Home » Broker » CFD Broker » Mitrade

Mitrade Review, Test & Rating in 2026

Autor: Florian Fendt — Updated in Feb 2026

Mitrade Trader Rating

Summary about Mitrade

The vast majority of traders will have positive experiences with Mitrade. Due to the modern trading platform, both beginners and advanced traders are in good hands with Mitrade. Once the trading academy launches, beginner traders will be able to improve their trading results dramatically.

| 💰 Minimum deposit in USD | $200 |

| 💰 Trade commission in USD | $0 |

| 💰 Withdrawal fee amount in USD | $0 |

| 💰 Available trading instruments | 420 |

What are the pros & cons of Mitrade?

What we like about Mitrade

Most traders will have positive experiences with Mitrade due to its solid trading infrastructure. Trades are executed instantly in less than 0.1 seconds. With more than 420 available trading instruments and low spreads without commissions, Mitrade excels at offering outstanding trading conditions for new and pro traders alike. After counting some numbers, we found that their webtrader offers more than 80 indicators as well as crucial data like forecasts, economic calendars, market data or sentiments, and risk management tools. Beginners will find plenty of learning materials ready to use, and an exclusive trading academy will launch in Q4 2022. Mitrade offers STP and negative balance protection. Overall, Mitrade is a trustworthy broker and highly regulated. Conveniently, traders can choose their desired leverage for each trade and even trade without any leverage.

- Low spreads with zero commissions

- Fast execution with instant execution

- Outstanding learning materials

- Modern proprietary trading platforms

What we dislike about Mitrade

Like every time, we try to highlight negative aspects about every broker that we review as well. For Mitrade, it is probably that they do not offer thousands of trading instruments. You will not find every possible exotic stock at Mitrade. Similarly, if you are an advanced trader, who already trades with several brokers, you will maybe miss MetaTrader as an available trading platform. Traders that want to hold positions for quite a while, will miss CFD-futures without swap fees. US traders can’t trade with Mitrade.

- “Only” +420 trading instruments

- MetaTrader 4 & 5 unavailable

- No CFD futures

- US traders not allowed

Available trading instruments at Mitrade

Mitrade offers over 420 different trading instruments. Traders can choose from popular FX pairs like GBP/USD or USD/CAD, or even more exotic options like GBP/DKK or EUR/TRY. US & Australian stocks are available as well.

Among the available instruments are:

- +58 forex/currency pairs

- +12 commodities

- +11 Indices

- +319 shares

- +28 cryptocurrencies

Mitrade regularly adds new markets and expands its available trading assets.

Conditions & detailed review of Mitrade

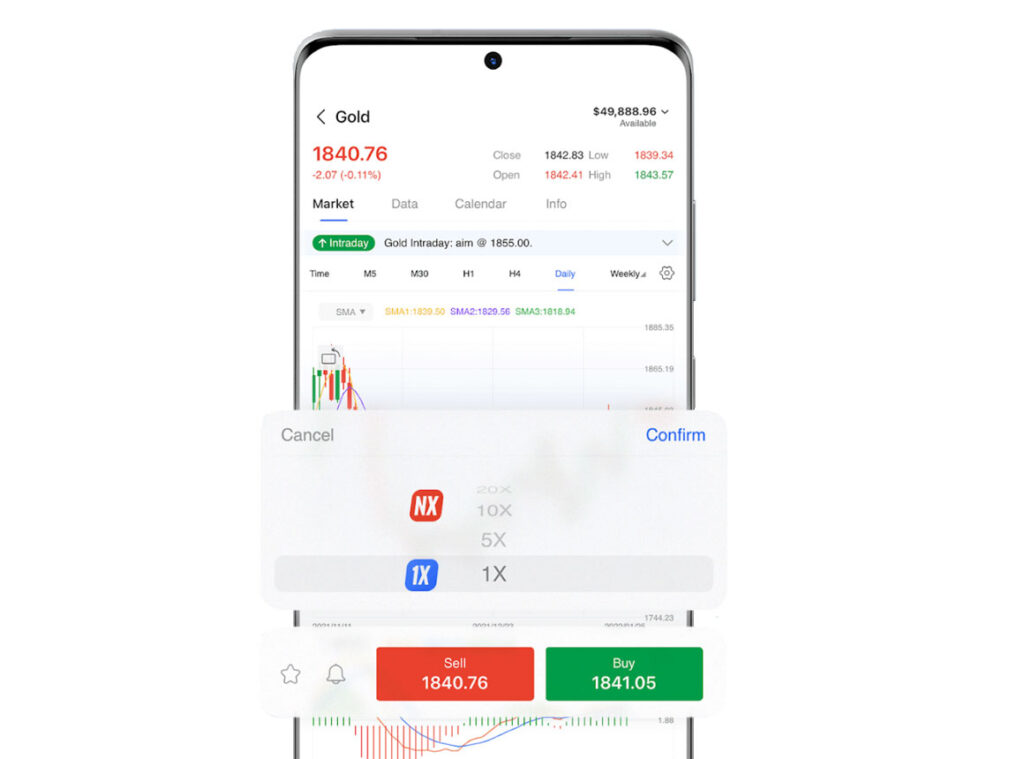

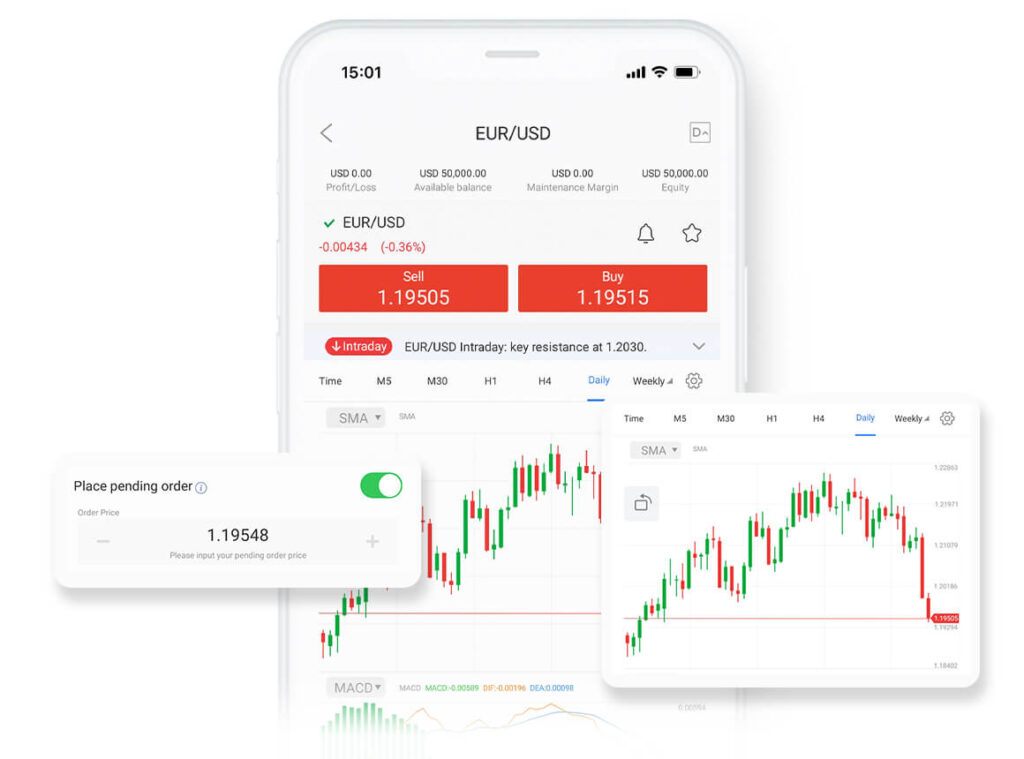

Overall, our Mitrade experiences are positive. Their top-notch proprietary trading platform offers everything every beginner or advanced trader desires. Before placing any trade, you can choose the leverage, including the option to trade without any leverage at all.

Traders receive up-to-date market insights, trade analytics, sentiment data and risk management tools to improve their trading results. The minimum deposit to start trading with a live account is quite low. Depending on the country, you only need about $50 to $200 to start trading.

The order execution of Mitrade is extremely fast, and most orders are executed under 0.1 seconds. As info for experienced traders, scalping is not allowed, but hedging is. There is no guaranteed stop loss feature, but all accounts are negative balance protected. Spreads are usually below average, which is good for heavy traders. But like with every broker, you should pay attention to the spreads because in volatile markets or at times when liquidity is thin, spreads could get bigger.

The proprietary trading platform is very modern and clear and offers especially for trading beginners an easy entry into the world of trading. Advanced traders will also quickly become familiar with the platform. Only professionals, with their own automated trading software, will not be able to use it if it's running on MetaTrader, as neither MT4 nor MT5 is currently available at Mitrade.

Mitrade won the BrokerCheck 'Best Trading Platform' Award

Due to the exceptional proprietary trading platform of Mitrade, we decided to give Mitrade an award. If you never tried the platform yourself, we can only invite you to test it on a free and risk-free demo account.

Software & trading platform of Mitrade

Mitrade has developed a standalone trading platform for web, desktop and mobile. In our experience, it is intuitive for most advanced traders and yet beginner-friendly. Mitrade has gathered more than 1.2million users for its platforms and thus ironed out problems. You can download the android app or apple version for free, or check out their webtrader.

In addition, the Webtrader sorts in categories such as stocks, Forex, indices, cryptocurrencies and commodities. Mitrade’s trading software provides a broad variety of technical indicators despite its simplicity, allowing traders to utilize the platform for advanced technical analysis. The chart is fully customizable.

Open positions or orders can be easily managed. Both the Stop Loss (close on loss) and the Take Profit (close on profit) can be adjusted to manage your risks.

Traders who are looking for new trading ideas or markets can use the provided analysis from trading central. You will find trading ideas or strategies for stocks, currencies and commodities. Especially with stocks, highly volatile trading opportunities can be discovered quickly.

Your account at Mitrade

Mitrade only offers a single live account type. There are no tiers for higher deposits, which is a huge plus in our opinion. The Order Execution is instant and your account type is STP. Mitrade does not charge any inactivity fees or similar hidden fees. Traders who wish to try Mitrade first can do so in a free demo account. If you do not verify your account information, your trial account will run out after 30 days.

Client funds are safe with Mitrade.

- Retail client deposits are kept in a segregated trust account when required under regulation and law

- Mitrade does not use any client funds for their own operational activities

- Mitrade does not conduct any speculative trading activities

- Audits are conducted by an external independent accounting firm

Although Mitrade offers the same trading conditions for each account size, additional services may be available for clients with large trading volumes.

How are the fees at Mitrade?

The fees are simple at Mitrade. There are generally no commissions or any other charges

- 0% commission: Forex, stocks, crypto, indices, commodities

- 0% commission: deposits, withdrawals, real-time quotes, opening/closing trades, educational material, dynamic charts and indicators

Mitrade is financed exclusively through spreads, which usually have only a small premium over market prices. Therefore, the fee structure is quite lean. The spreads of most products are cheaper than those of other brokers. In particular, equity traders will be satisfied with the fees, since no minimum commissions are due.

The overnight interest rates at Mitrade are favourable, as the calculation of the swap fee is only based on the leverage provided and not the entire value of the position.

How can I open an account with Mitrade?

By regulation, every new client must go through some basic compliance checks to ensure that you understand the risks of trading and are admitted to trading. When you open an account, you will probably be asked for the following items, so it is good to have them handy: A scanned colour copy of your passport or national ID A utility bill or bank statement from the last six months with your address You will also need to answer a few basic compliance questions to confirm how much trading experience you have. It is therefore best to take at least 10 minutes to complete the account opening process. Although you can explore the demo account immediately, it is important to note that you cannot make any real trading transactions until you have passed compliance, which can take up to several days depending on your situation.

How To Close Your Mitrade account?

Deposits and withdrawals at Mitrade

Mitrade does not charge any fees for deposits or withdrawals. All fees incurred by you when transferring money to and from your account are charged by your bank or payment provider.

The following payment methods are available at Mitrade.

- Credit cards (Visa, Mastercard)

- Bank transfer

- Wire transfer

- worldpay

- Poli

The payout of funds is governed by the refund payout policy, which is available on the website.

For this purpose, the customer must submit an official withdrawal request in his/her account. The following conditions, among others, must be met:

- The full name (including first and last name) on the beneficiary account matches the name on the trading account.

- A free margin of at least 100% is available.

- The withdrawal amount is less than or equal to the account balance.

- Full details of the method of deposit, including supporting documents required to support the withdrawal in accordance with the method used for the deposit.

- Full details of the method of withdrawal.

How is the service at Mitrade

The service of Mitrade is solid. Support is available 24/5. So, you can also reach someone at 4 am, which is critical for some traders.

Among the contact possibilities are:

- E-Mail: [email protected]

- Phone: +61 3 9606 0033

- Contact Form

Regulation & Safety at Mitrade

Mitrade is a reputable broker that is being regulated by multiple official entities. These include CIMA, ASIC, FSC

Mitrade is a brand jointly used by multiple companies, and it operates through the following companies:

- Mitrade Holding Ltd is the issuer of the financial products that are described or available on this website. Mitrade Holding is authorised and regulated by Cayman Islands Monetary Authority (CIMA) and the SIB licence number is 1612446. The registered office address is 215-245 N Church Street, 2nd Floor, White Hall House, George Town, Grand Cayman, Cayman Islands

- Mitrade Global Pty Ltd with ABN 90 149 011 361 holds an Australian Financial Services Licence (AFSL 398528).

- Mitrade International Ltd is authorised and regulated by Mauritius Financial Services Commission (FSC) and the licence number is GB20025791.

Highlights of Mitrade

Finding the right broker for you is not easy, but hopefully you now know if Mitrade is the best choice for you. If you are still unsure, you can use our forex broker comparison to get a quick overview.

- ✔️ Free Demo Account

- ✔️ Guaranteed Stop Loss

- ✔️ Flexible Leverage

- ✔️ +420 Available Trading Assets

Frequently asked questions about Mitrade

Is Mitrade a good broker?

XXX is a legit broker operating under CySEC oversight. No scam warning has been issued on the CySEC website.

Is Mitrade a scam broker?

XXX is a legit broker operating under CySEC oversight. No scam warning has been issued on the CySEC website.

Is Mitrade regulated and trustworthy?

XXX remains fully compliant with CySEC rules and regulations. Traders should view it as a safe and trusted broker.

What is the minimum deposit at Mitrade?

The minimum deposit at XXX to open a live account is $250.

Which trading platform is available at Mitrade?

XXX offers the core MT4 trading platform and a proprietary WebTrader.

Does Mitrade offer a free demo account?

Yes. XXX offers an unlimited demo account for trading beginners or testing purposes.

At BrokerCheck, we pride ourselves on providing our readers with the most accurate and unbiased information available. Thanks to our team’s years of experience in the financial sector and feedback from our readers, we have created a comprehensive resource of reliable data. You can therefore confidently trust the expertise and rigor of our research at BrokerCheck.

What is your rating of Mitrade?

1 comment

Rei

Put hundreds in, use brain, take thousands out. Just remember, use brain lol 🤪 Great app, yeah, they have their issues here and there, but it still maintains a rather streamlined performance, syncing between mobile and PC. Clock switching is useful too. Glad to have chosen this app for my main investing plays.

Anyways glhf to the newcomers!! ✌