1. Overview Of Thinkorswim

Thinkorswim is a popular trading platform known for its powerful tools and advanced features, making it a top choice for many traders. However, despite its strengths, some users may find Thinkorswim too complex or expensive for their trading needs. Additionally, traders with very specific requirements might find that Thinkorswim doesn’t fully meet their expectations.

Different types of traders, ranging from beginners to seasoned investors, might seek alternatives that better align with their individual trading styles and preferences. This article aims to guide you through finding the right trading platform by understanding the unique features, costs, and usability of each option, ensuring that you select a tool that complements your trading strategy effectively.

| Feature | Details |

|---|---|

| Platform | Thinkorswim |

| Known For | Advanced tools, powerful features |

| Common Concerns | Complexity, cost |

| Users Seeking Alternatives | Beginners, intermediate traders, experts |

2. Finding the Right Alternative: Understanding Your Trading Style

Choosing the right trading platform is crucial and depends heavily on your personal trading style and needs. Here are several factors to consider when selecting a platform:

- Ease of Use: Not every trader requires complex tools and interfaces. Some may prefer a more user-friendly platform that simplifies their trading activities.

- Cost Structure: It’s important to understand the fees and commissions associated with a platform. This can significantly affect your overall trading costs, especially for those who trade frequently.

- Features Needed: Identify the specific features you need, such as advanced charting tools, order types, or access to international markets. This ensures that the platform can support your trading strategies.

Understanding search intent is also critical when creating content or searching for platforms online. It refers to the purpose behind online searches. By aligning your content with the right keywords, you can attract readers or users who are actively looking for the trading solutions you discuss. This concept is vital for traders seeking platforms and for marketers aiming to connect with their audience effectively.

| Criteria | Importance |

|---|---|

| Ease of Use | High for beginners; variable for advanced traders |

| Cost Structure | Critical for frequent traders |

| Features Needed | Must align with trading strategy |

| Search Intent | Essential for targeting the right audience |

3. Top 5 Alternatives Of Thinkorswim

3.1. E*TRADE Web Platform

The ETRADE Web Platform caters primarily to beginner to intermediate traders who are looking for a user-friendly interface that simplifies the trading experience. It’s also well-suited for frequent traders due to its efficient handling of transactions and its competitive pricing structure, which includes *commission-free trades for stocks, options, mutual funds, and ETFs.

Key features of E*TRADE include:

- No minimum deposit requirements, making it accessible for new investors.

- Commission-free trading on most stocks, options, and ETFs, with a competitive fee of $0.65 per options contract, which can be reduced for high-volume traders.

- A robust mobile app experience that allows trading on the go, along with access to streaming market data, real-time quotes, and advanced mobile features like multi-leg options trades.

- Comprehensive research and data offerings that include free access to several external research providers, enhancing decision-making for traders.

- Paper trading capabilities, which allow traders to practice their strategies without financial risk.

- Educational resources that help users from beginner to advanced levels expand their trading knowledge and skills.

E*TRADE’s interface is less complex compared to Thinkorswim, potentially making it a better fit for traders who prioritize ease of use over the availability of ultra-advanced tools.

Comparison Table: E*TRADE vs. Thinkorswim

| Feature | E*TRADE | Thinkorswim |

|---|---|---|

| Interface Complexity | User-friendly, simpler interface | Highly detailed, complex interface |

| Commission Costs | $0 for stocks, ETFs; $0.65 per options contract | Variable, generally higher without discounts |

| Minimum Deposit | $0 | $0, but more focused on advanced traders |

| Research and Data | Extensive, with free access to external providers | Extremely comprehensive, more advanced tools |

| Mobile Trading | Highly rated apps for iOS and Android | Advanced features, slightly less user-friendly |

| Paper Trading | Available | Available |

| Educational Resources | Abundant, covers a range of topics | Extensive, more technical focus |

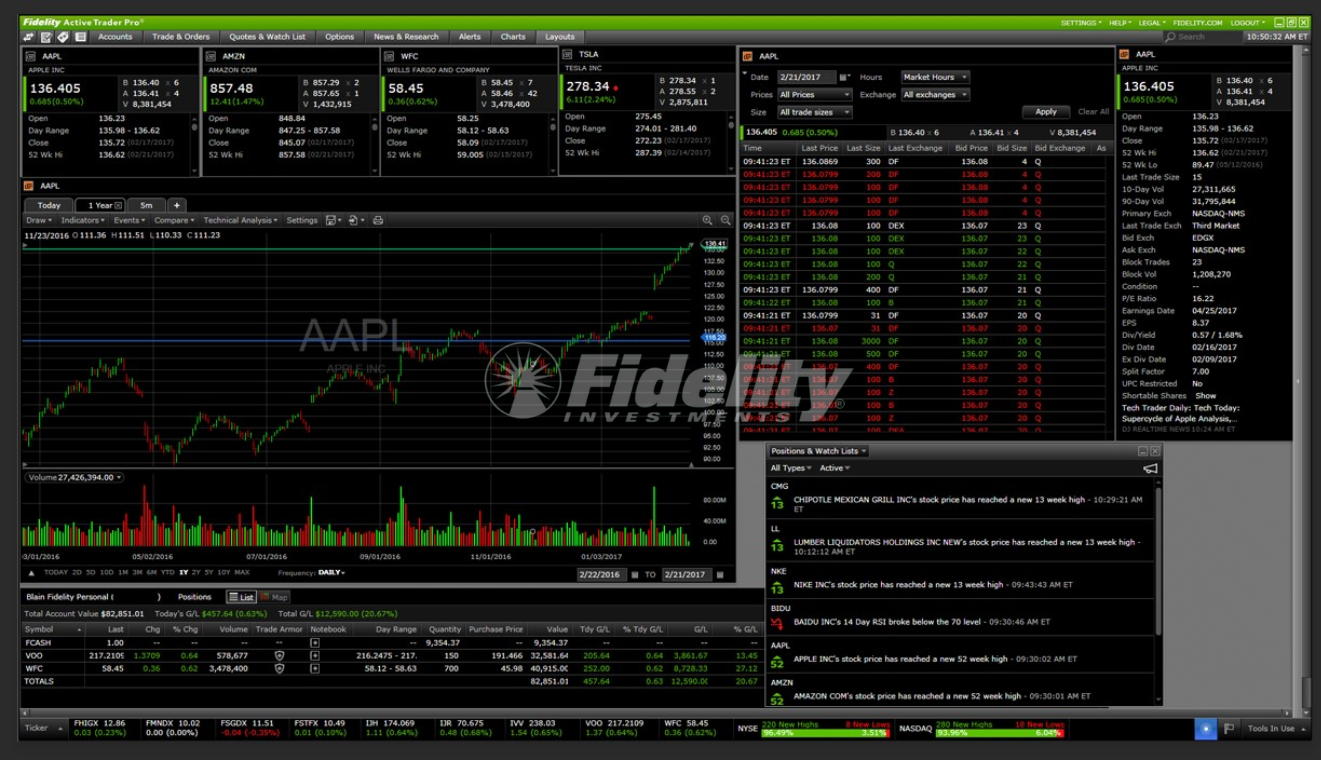

3.2. Fidelity Active Trader Pro

Fidelity Active Trader Pro is designed for active traders comfortable with a platform that includes both basic and some advanced functionalities. It is especially well-suited for those who prioritize a blend of sophisticated charting tools and direct market access but may find Thinkorswim’s advanced features excessive.

Key Features of Fidelity Active Trader Pro include:

- Advanced Charting: The platform offers over 100 technical indicators and a variety of charting options, making it suitable for detailed technical analysis.

- Options Trading: Features a unique proprietary tool that generates trade ideas based on user input about market sentiments and assists in setting up trades.

- Real-Time Analytics: Alerts users about technical signals on equities and ETFs like unusual volume and market divergences, enhancing decision-making during trading.

- Customization: Users can customize their trading experience extensively, including layout adjustments and the creation of shortcuts for more efficient navigation.

- Directed Trading: Gives users control over where their trades are routed, potentially improving execution speeds and prices.

However, it’s important to note that Active Trader Pro has limitations, particularly in mobile accessibility. The platform is primarily designed for desktop use, and lacks a mobile or web version, which may deter traders who prefer to operate on the go.

Comparison Table: Fidelity Active Trader Pro vs. Thinkorswim

| Feature | Fidelity Active Trader Pro | Thinkorswim |

|---|---|---|

| Charting Tools | Over 100 technical indicators, user-friendly | Over 300 technical indicators, highly advanced |

| Options Trading Tools | Options trade builder, options statistics | Extensive options trading capabilities |

| User Interface | Streamlined, somewhat outdated but functional | Highly sophisticated, customizable |

| Mobile Trading | Limited to desktop only | Available on desktop, web, and mobile |

| Access to Trading Types | Stocks, ETFs, options, and mutual funds | Stocks, ETFs, options, mutual funds, bonds, FOREX |

| Real-Time Analytics | Real-time technical signals on equities and ETFs | Extensive real-time data and analytics |

| Customization | High degree of customization available | Highly customizable across all platforms |

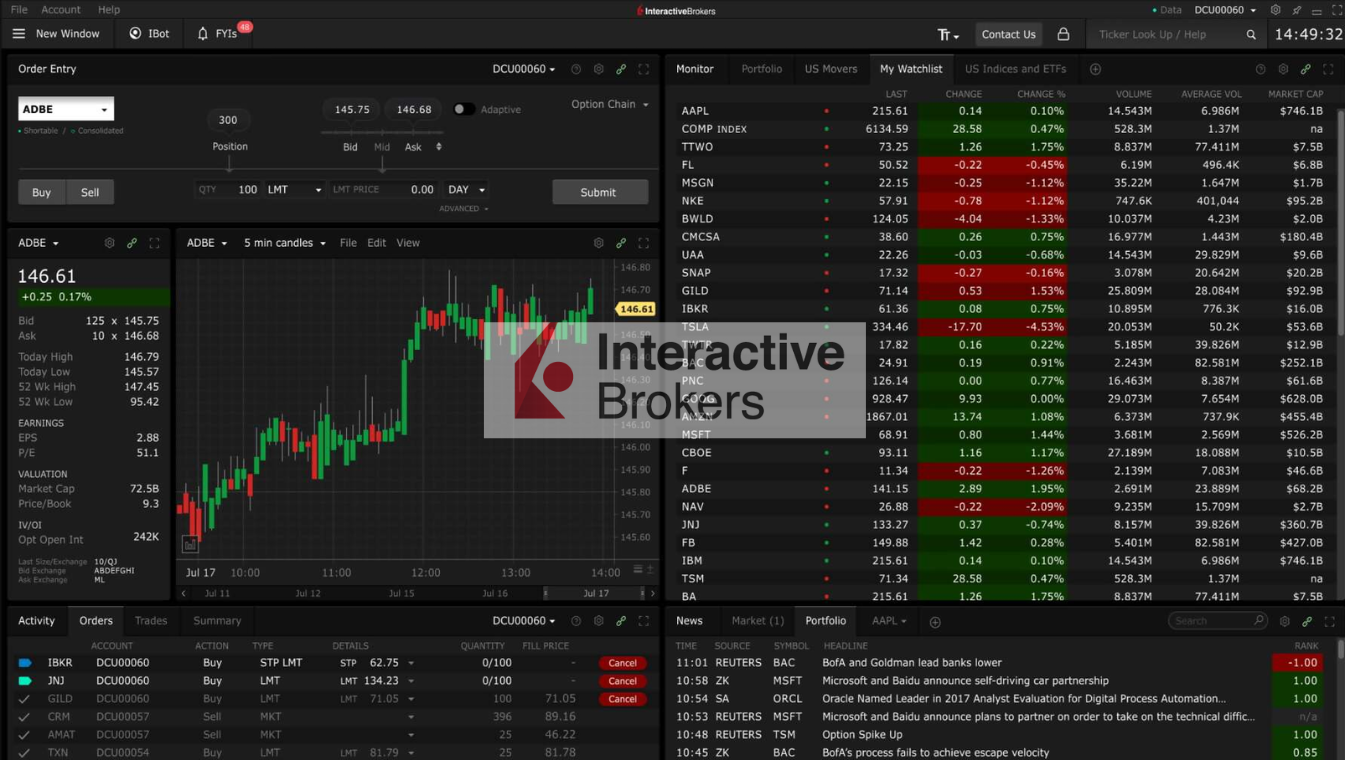

3.3. Interactive Brokers Trader Workstation (TWS)

Interactive Brokers’ Trader Workstation (TWS) is tailored for experienced traders who require a robust, feature-rich platform that allows for trading across a global network of exchanges. Known for its highly customizable interface and sophisticated trading tools, TWS is ideal for those who need extensive control over their trading environment.

Key Features of Interactive Brokers TWS include:

- Global Market Access: TWS provides access to over 135 markets worldwide, allowing trading in stocks, options, futures, forex, bonds, and funds.

- Advanced Trading Tools: Offers more than 100 order types and algorithms that can help enhance trading strategies by minimizing risk and improving price execution.

- Comprehensive Research and Data: Includes real-time news, research, and market data from leading services like Reuters and Morningstar, providing essential information directly through the platform.

- Risk Management Tools: Features like the Risk Navigator help traders monitor and manage their market risk across various asset classes globally.

- Paper Trading: TWS includes a paper trading function that lets traders practice strategies in a simulated environment without financial risk.

- Mobile Access: Alongside its desktop and web platforms, TWS is also accessible via a mobile app, offering consistent functionality across devices.

The platform is available for free to Interactive Brokers clients and supports extensive API integration, enabling traders to tailor their trading environment extensively. Despite its capabilities, TWS has a learning curve due to its complexity, which might be challenging for less experienced traders.

Comparison Table: Interactive Brokers TWS vs. Thinkorswim

| Feature | Interactive Brokers TWS | Thinkorswim |

|---|---|---|

| Market Access | Over 135 international markets | Primarily U.S. markets, with some international |

| Order Types and Algos | More than 100 types, with sophisticated algorithms | Extensive order types, strong on algorithms |

| User Interface | Highly customizable, steep learning curve | User-friendly, customizable but complex |

| Research and Data Tools | Extensive, with access to multiple premium services | Comprehensive, slightly more intuitive |

| Mobile Trading | Fully functional mobile app | Comprehensive mobile app |

| Simulation Trading | Advanced paper trading capabilities | Robust paper trading options |

| Pricing | Free platform access, competitive trading fees | Free platform access, variable trading fees |

3.4. TradingView

TradingView is highly regarded among traders of all levels for its exceptional charting capabilities and social networking features. It offers a wide array of tools that cater to both novice and advanced traders, making it a versatile platform for technical analysis across various global markets.

Key Features of TradingView:

- Advanced Charting Tools: Over 100 pre-built indicators and tools for comprehensive market analysis, with extensive customization options.

- Pine Script: Allows the creation of custom indicators and strategies via its user-friendly scripting language, enhancing the platform’s flexibility.

- Social Trading Features: A vibrant community of traders shares insights and trading ideas, facilitating collaborative learning and trading strategies.

- Broker Integration: Users can execute trades directly through connected brokerage accounts, streamlining the trading process.

- Paper Trading: Simulated trading environment where users can practice strategies without financial risk, perfect for beginners and testing new strategies.

- Comprehensive Market Coverage: Supports a wide range of asset classes including stocks, forex, and cryptocurrencies, with tools to analyze and screen these markets effectively.

TradingView is not just a charting tool but a comprehensive platform that combines advanced technical analysis with an interactive trading community. This makes it ideal for those who not only want to conduct in-depth market analysis but also engage with other traders.

Comparison Table: TradingView vs. Thinkorswim

| Feature | TradingView | Thinkorswim |

|---|---|---|

| Charting Tools | Extensive with over 100 indicators and custom scripting | Extensive with professional-grade options |

| User Community | Large active community with shared trading ideas | Community features available but less prominent |

| Paper Trading | Integrated paper trading to test strategies | Paper trading available with advanced features |

| Broker Integration | Direct trading through connected brokers | Seamless integration with TD Ameritrade |

| Mobile Trading | Highly functional mobile app | Comprehensive mobile app |

| Market Access | Global market access with a variety of asset classes | Strong focus on US markets with global access |

| Educational Resources | Rich educational content and community insights | Extensive educational resources and webinars |

| Subscription Model | Freemium model with optional premium subscriptions | Mostly free but some features require TD account |

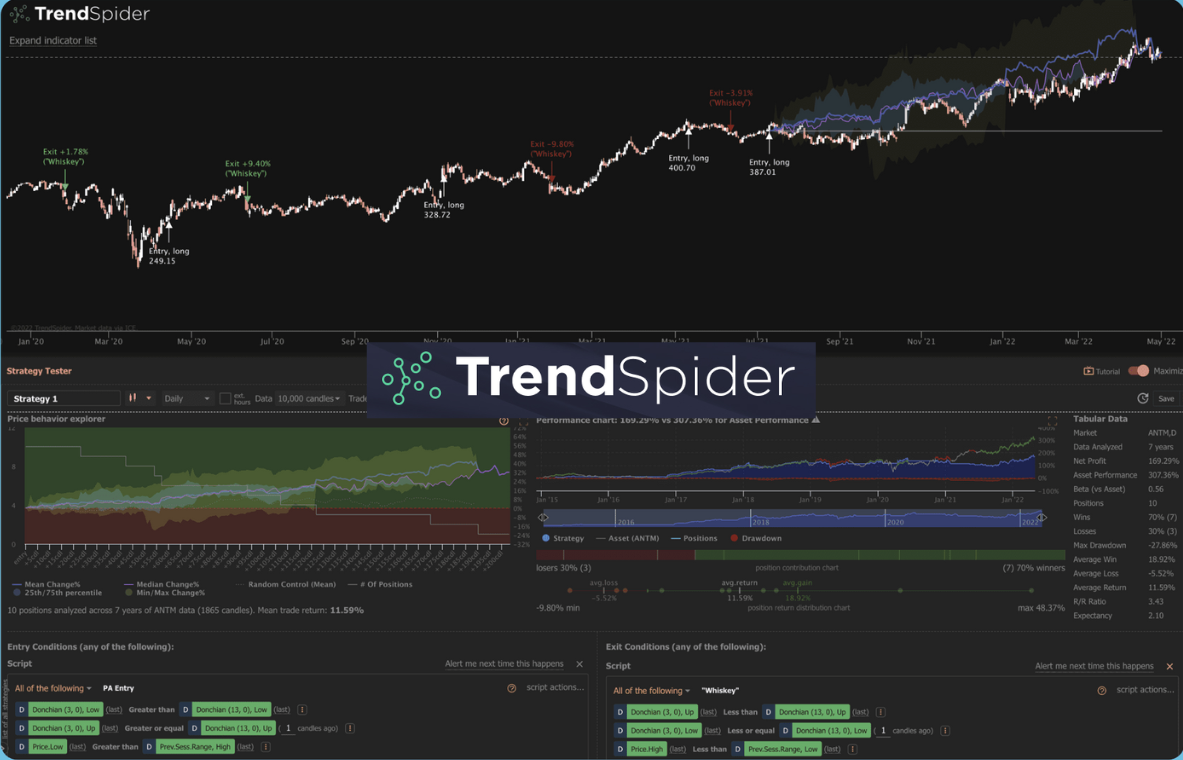

3.5. TrendSpider

TrendSpider is emerging as a compelling alternative to Thinkorswim for traders looking for innovative technical analysis tools and automated trading features. This platform is especially geared towards technical traders who benefit from advanced charting and automated analysis to reduce the time and effort spent on routine tasks.

Key Features of TrendSpider:

- Automated Technical Analysis: TrendSpider offers unique features like automated trendline detection, Fibonacci retracements, and pattern recognition which help streamline the analysis process.

- Dynamic Price Alerts: The platform allows users to set multi-factor alerts based on price action, indicators, and pattern recognition, ensuring traders do not miss significant market movements.

- Market Scanner: A powerful scanner helps users filter through stocks, forex, and crypto markets based on customizable criteria, making it easier to spot opportunities.

- Backtesting Tools: Traders can test their trading strategies against historical data with an intuitive backtesting suite, which is crucial for refining and validating strategies before applying them in live markets.

- Cloud-Based Platform: As a fully cloud-based solution, TrendSpider provides accessibility from any device, enhancing the flexibility for traders to monitor and analyze the market on the go.

TrendSpider is particularly suited for traders who rely heavily on technical analysis and would benefit from automation features to enhance their trading decisions. Its interface is user-friendly, yet packed with powerful tools that can be customized to fit any trading style.

Comparison Table: TrendSpider vs. Thinkorswim

| Feature | TrendSpider | Thinkorswim |

|---|---|---|

| Technical Analysis Tools | Extensive with automation for trendlines and patterns | Comprehensive with manual setup for analysis |

| User Interface | Modern and intuitive, suitable for all levels | Complex, ideal for experienced traders |

| Accessibility | Cloud-based, accessible on any device | Desktop-based with mobile and web versions |

| Price Alerts | Advanced multi-factor alerts | Standard price alerts |

| Market Scanning | Powerful scanner with customizable filters | Extensive scanning but less automation |

| Backtesting | Integrated backtesting for strategy validation | Advanced backtesting capabilities |

| Community and Support | Growing community and responsive support | Large established community with extensive support |

Conclusion

In exploring alternatives to Thinkorswim, we’ve highlighted platforms that cater to various trading needs, from beginners seeking simplicity to experienced traders needing advanced tools. Remember, the right platform should align with your trading strategies and comfort level. Consider experimenting with demos or trials to find your best fit and utilize their educational resources to enhance your trading skills. Ultimately, choosing the platform that feels right for your trading style is crucial for your trading success.