1. Overview of MetaStock

MetaStock is a renowned trading platform that offers an extensive array of tools designed for technical analysis and stock trading. Widely used by both novice and experienced traders, MetaStock provides a robust suite of features including real-time data, advanced charting capabilities, and over 300 technical indicators and tools.

1.1. Pros of MetaStock:

- Comprehensive Tools: Offers a variety of charting tools, indicators, and data options that cater to different trading strategies.

- Customization: Allows users to customize indicators and systems according to their trading preferences.

- Scanning and Backtesting: Strong capabilities in scanning the market for opportunities and backtesting strategies to ensure their effectiveness.

1.2. Cons of MetaStock:

- Complexity: Its wide range of features can be overwhelming for beginners.

- Cost: MetaStock might be more expensive compared to some of its competitors, which can be a deterrent for individual traders on a budget.

- Platform Dependency: Primarily a desktop-based application, which may limit accessibility compared to web-based platforms.

| Feature | Detail |

|---|---|

| Real-Time Data | Yes |

| Charting Tools | Advanced, over 300 technical indicators |

| Customization | High |

| User-Friendliness | Moderate; steep learning curve |

| Cost | Higher than many competitors |

| Platform Type | Desktop-based |

2. Alternatives Of MetaStock

2.1. TradingView: A Comprehensive Overview

TradingView is a highly popular online platform known for its robust charting and social networking features, catering to both novice and experienced traders. Established in 2012, TradingView has grown into a vibrant community of over 30 million users. It stands out for its user-friendly interface, making it an ideal choice for those new to trading, yet it also provides powerful tools for seasoned market analysts.

2.1.1. Unique Features

- Paper Trading: Allows users to simulate trading without financial risk, which is perfect for strategy testing and practice.

- Pine Script: A proprietary scripting language that enables users to create custom indicators and automate trading strategies.

- Social Networking: TradingView integrates a social media aspect where users can share insights and discuss strategies, enhancing the learning experience through community engagement.

2.1.2. Strengths

- User-Friendly Interface: Known for its intuitive design, making it accessible to beginners.

- Extensive Toolset: Offers over 100,000 indicators and tools for comprehensive market analysis.

- Community and Collaboration: Active community for exchanging trading ideas and strategies.

2.1.3. Weaknesses

- Broker Integration: Limited direct trading capabilities as it integrates with only about 30 brokers.

- Advanced Features: While it offers advanced tools, some professional traders might find certain functionalities lacking compared to more specialized software.

Ideal For

TradingView is ideal for traders who prioritize a balance of powerful analytical tools, educational content, and a collaborative environment. It suits both beginners due to its ease of use and experienced traders looking for depth in market analysis.

Comparison Table Against MetaStock

| Feature | TradingView | MetaStock |

|---|---|---|

| User Interface | Intuitive and user-friendly | Complex, with a steeper learning curve |

| Customization | High customization with Pine Script | Extensive customization options |

| Social Features | Strong social networking component | Limited social features |

| Trading Capabilities | Paper trading available, limited broker integration | Direct trading supported, more broker integrations |

| Pricing | Freemium model with affordable premium options | Generally more expensive, no free tier |

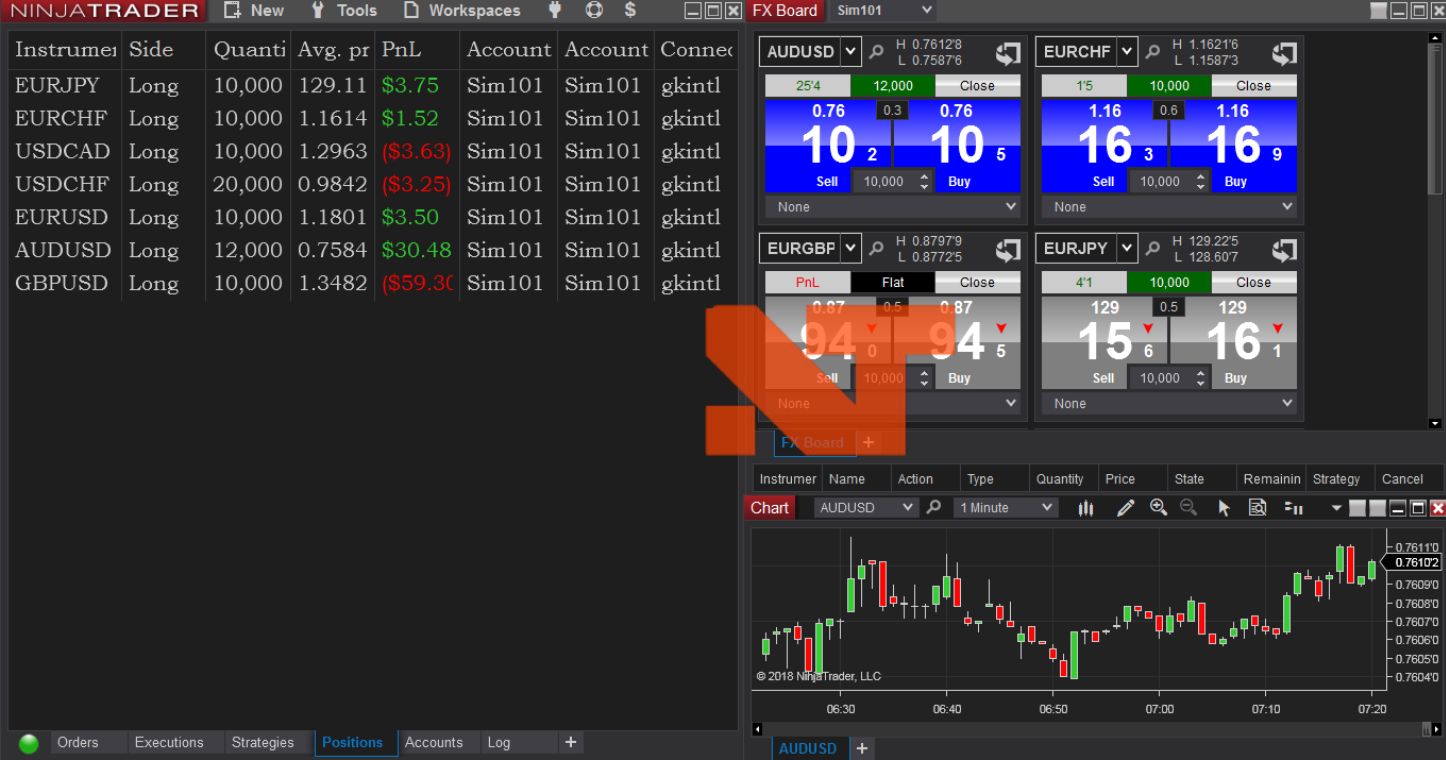

2.2. NinjaTrader: In-Depth Overview

NinjaTrader is renowned for its comprehensive features aimed at active futures and options traders. Established as a robust trading platform, it offers advanced charting, market analysis tools, and automated trading capabilities. Its strength lies in the versatility and depth of its trading tools, making it a top choice for traders who need detailed technical analysis and the ability to execute complex trading strategies.

2.2.1. Unique Features

- Advanced Order Types: NinjaTrader provides a myriad of order types, including automated stop and target orders which help in managing risk and locking in profits.

- Customization: Users can enhance their trading experience by utilizing NinjaTrader’s C# based development framework to create or integrate thousands of third-party trading apps and add-ons.

- Market Analysis: The platform includes over 100 built-in indicators and provides access to high-quality market data and analysis tools.

2.2.2. Strengths

- High Customizability: Offers extensive options to customize and automate trading strategies.

- Low Trading Costs: Competitive commission rates, especially for futures trading.

- Robust Technical Tools: Advanced charting features and a plethora of technical analysis tools.

2.2.3. Weaknesses

- Complexity: Can be overwhelming for beginners due to its advanced features.

- Limited Asset Coverage: Primarily supports futures and options, with less support for other asset classes unless through integrated brokers.

Ideal For

NinjaTrader is particularly suited for experienced traders who require advanced analytical tools and the ability to execute complex trades. It is also well-suited for those who prefer to trade futures and options.

Comparison Table Against MetaStock

| Feature | NinjaTrader | MetaStock |

|---|---|---|

| Asset Coverage | Focuses on futures and options | Broad coverage including stocks, forex, etc. |

| User Interface | Complex and customizable | Complex, suitable for experienced traders |

| Customization | Extensive with C# development framework | Extensive with built-in programming language |

| Technical Tools | Advanced charting, 100+ indicators | Advanced charting, 300+ indicators |

| Pricing | Competitive for futures, options | Generally higher, subscription-based |

2.3. eSignal: Comprehensive Overview

eSignal is a versatile trading platform known for its detailed charting capabilities, extensive market data, and robust analytical tools. It caters to both novice and professional traders, offering various features designed to enhance trading efficiency and accuracy.

2.3.1. Unique Features

- Advanced Charting: eSignal provides a wide range of chart types, including candlestick, bar charts, and more, all highly customizable.

- Market Screener Plus: A powerful tool for scanning based on technical, fundamental, or value-based criteria.

- Broker Integration: Supports over 50 online brokers, facilitating direct trades from the platform.

2.3.2. Strengths

- Real-Time Data: Offers real-time market data and news feeds, crucial for making informed trading decisions.

- Technical Indicators: Features a comprehensive set of technical indicators for detailed market analysis.

- Customization: Users can personalize their trading experience with various add-ons and integration options.

2.3.3. Weaknesses

- Complexity: The platform’s extensive features can be overwhelming for beginners.

- Cost: eSignal is considered expensive compared to some competitors, with costs that can add up for active traders.

- Geographic Limitations: Some services and broker integrations are not available in regions like Africa, Europe, and the Middle East.

Ideal For

eSignal is best suited for active traders who require real-time data and comprehensive analytical tools. It is particularly valuable for those who engage in technical trading and require robust charting and scanning capabilities.

Comparison Table Against MetaStock

| Feature | eSignal | MetaStock |

|---|---|---|

| Real-Time Data | Available across all plans | Available but dependent on subscription level |

| Charting Capabilities | Extensive with multiple chart types and indicators | Advanced with 300+ technical indicators |

| Customization | High with add-ons and broker integration | High with scripting and indicator customization |

| Cost | Generally higher, starting at $54 for basic access | Starts higher but varies by data package |

| Geographic Availability | Limited in Africa, Europe, and the Middle East | Broadly available globally |

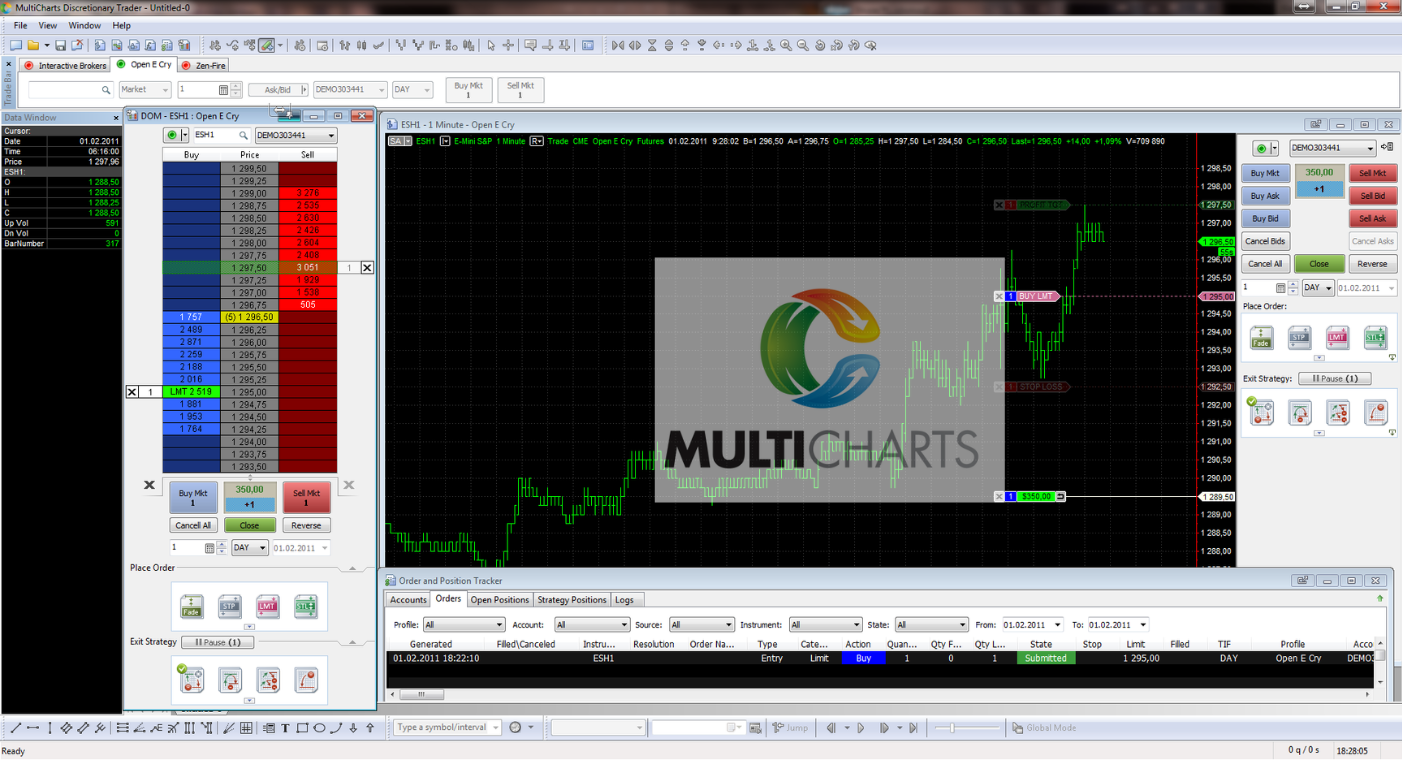

2.4. MultiCharts: Detailed Overview

MultiCharts is an advanced trading platform recognized for its extensive array of analytical tools and capabilities suited for serious traders. The platform is renowned for its high-definition charting, comprehensive backtesting options, and robust support for automated trading through EasyLanguage scripting.

2.4.1. Unique Features

- Automated Trading: MultiCharts supports automated trading, allowing traders to implement strategies without manual intervention, using EasyLanguage or Visual Builder for algorithmic trading.

- Market Scanner and Strategy Backtesting: The platform provides a powerful market scanner and sophisticated backtesting tools that are faster and more efficient compared to many competitors.

- Multi-Broker Support: Traders can execute trades across various brokers and data feeds, enhancing trading flexibility.

2.4.2. Strengths

- Customization: Extensive customization options are available for charts, indicators, and the trading workspace itself, making it adaptable to specific trader needs.

- Comprehensive Technical Analysis Tools: Over 250 built-in studies and indicators, alongside innovative features like chart trading and a depth of market (DOM) view.

- Support for PowerLanguage: This feature allows the creation of custom indicators and strategies, akin to TradeStation’s EasyLanguage.

2.4.3. Weaknesses

- Complexity: Its array of features and depth of customization can be overwhelming for beginners.

- Cost: While offering powerful tools, the platform can be expensive, particularly for traders who require advanced features and real-time data.

Ideal For

MultiCharts is best suited for experienced traders who need deep analytical capabilities and the ability to automate their trading strategies extensively. It is particularly appealing to those who benefit from detailed backtesting and strategy optimization.

Comparison Table Against MetaStock

| Feature | MultiCharts | MetaStock |

|---|---|---|

| Automated Trading | Extensive support with EasyLanguage | Limited to built-in systems |

| Charting Capabilities | High-definition with extensive customizability | Advanced with 300+ indicators |

| Backtesting | Advanced multi-threaded backtesting | Comprehensive but less customizable |

| Broker Integration | Supports multiple brokers and data feeds | Supports fewer brokers directly |

| Cost | Generally higher for full features | Variable, can be lower depending on the plan |

2.5. TC2000: Comprehensive Overview

TC2000 is recognized for its robust stock charting and scanning capabilities, primarily catering to US traders focusing on stocks and options. The platform combines advanced technical analysis tools with practical trading features, making it a favored choice for both new and experienced traders.

2.5.1. Unique Features

- EasyScan: Allows for rapid scanning of the markets, enabling traders to quickly identify trading opportunities based on a wide array of customizable criteria.

- Personal Criteria Formulas: Provides tools to create custom indicators and conditions, enhancing the platform’s scanning and alerting capabilities.

2.5.2. Strengths

- Integrated Trading: Direct trading from charts and the ability to manage trades, including complex options strategies, directly within the platform.

- Highly Customizable Charts: Offers a wide range of chart types and drawing tools, alongside the ability to adjust chart settings extensively to suit individual trading needs.

2.5.3. Weaknesses

- Limited Asset Classes: Focuses predominantly on stocks and options, with no support for forex, futures, or cryptocurrencies.

- Lacks Some Advanced Features: Does not support backtesting or social trading features, which may be a drawback for traders relying on these functionalities.

Ideal For

TC2000 is ideal for traders who need powerful scanning and charting tools specifically for stocks and options within the U.S. markets. Its user-friendly interface and efficient setup make it accessible to beginners, while its advanced features satisfy the needs of more experienced traders.

Comparison Table Against MetaStock

| Feature | TC2000 | MetaStock |

|---|---|---|

| Focus | Stocks and Options | Broad market coverage including international stocks |

| User Interface | Highly customizable, user-friendly | Complex, suitable for experienced traders |

| Trading Capabilities | Direct trading from charts, options strategies | Powerful system testing, forecasting, and alerts |

| Asset Classes | Stocks, Options | Stocks, Forex, Futures, Options |

| Pricing | More cost-effective, with several tiered options | Subscription-based, generally higher priced |

3. Choosing the Right Trading Platform: Essential Factors

3.1. Ease of Use and Accessibility:

A user-friendly and intuitive interface is crucial. It should be easy to navigate and responsive, making trading more efficient and reducing the likelihood of errors.

3.2. Security:

Opt for platforms with robust security measures like two-factor authentication and data encryption to protect your financial and personal information.

3.3. Range of Instruments and Market Accessibility:

Ensure the platform offers a wide variety of financial instruments and markets. This flexibility is vital as your trading strategies and interests may evolve over time.

3.4. Costs and Fees:

Understand the fee structure clearly, including spreads, commissions, and potential hidden charges like inactivity fees. This will help in managing trading costs effectively.

3.5. Reliability:

The platform should be stable and reliable, especially during high market volatility, to prevent disruptions that could lead to missed trading opportunities【60†source】.

3.6. Educational and Analytical Tools:

Access to comprehensive educational resources and advanced analytical tools can enhance your trading decisions. Features like customizable charts, technical indicators, and backtesting capabilities are beneficial.

3.7. Customer Support:

Look for platforms with strong customer support that is accessible 24/7. Quick and helpful support can be invaluable, especially when you encounter issues.

3.8. Demo Accounts:

Platforms offering demo accounts allow you to practice and familiarize yourself with the platform features without risking real money. This is particularly useful for beginners.

3.9. Automatic Trading:

If interested in automating your trading strategies, check for platforms that support algorithmic trading options, allowing for automatic execution based on predefined conditions.

| Factor | Description |

|---|---|

| Ease of Use | Intuitive, user-friendly interface |

| Security | Robust measures like encryption and two-factor authentication |

| Instruments & Accessibility | Wide range of financial instruments and markets |

| Costs | Clear and competitive fee structure |

| Reliability | High stability and fast execution |

| Tools | Comprehensive educational and analytical tools |

| Support | Responsive 24/7 customer support |

| Demo Accounts | Availability of demo accounts for practice |

| Automatic Trading | Support for algorithmic trading strategies |

4. Considerations for Different Trader Types

When selecting a trading platform, traders must consider their specific trading styles and needs. Here’s how different types of traders might choose the best platform for their strategies:

4.1. Day Traders:

Key Needs: Fast execution speeds, real-time data, and robust charting tools.

Ideal Platforms: Platforms that offer advanced order types, low latency, and integration with multiple data sources are preferred. Examples include platforms like NinjaTrader and eSignal, which provide detailed charting and rapid execution to accommodate the fast-paced trading style of day traders.

4.2. Swing Traders:

Key Needs: Detailed technical analysis tools, and historical data analysis.

Ideal Platforms: Platforms like TradingView and MultiCharts offer extensive charting capabilities and a variety of technical indicators which are essential for identifying and analyzing trends over several days to weeks.

4.3. Long-Term Investors:

Key Needs: Portfolio management tools, fundamental analysis, and less emphasis on transaction speed.

Ideal Platforms: Platforms like TC2000 and MetaStock provide extensive tools for fundamental analysis and portfolio tracking, making them suitable for investors who hold positions for longer periods.

4.4. Options Traders:

Key Needs: Options strategy modeling tools, options-specific indicators.

Ideal Platforms: Thinkorswim from TD Ameritrade and Interactive Brokers offer comprehensive options trading tools that include probability analysis, risk graphs, and advanced option spread support.

4.5. Forex Traders:

Key Needs: Integration with forex markets, real-time currency data, and leverage options.

Ideal Platforms: Platforms like MetaTrader 4 or MetaTrader 5 are highly favored in the forex community for their automation capabilities, advanced charting tools, and access to real-time foreign exchange rates.

| Trader Type | Key Needs | Ideal Platforms |

|---|---|---|

| Day Traders | Fast execution, real-time data | NinjaTrader, eSignal |

| Swing Traders | Technical analysis, historical data | TradingView, MultiCharts |

| Long-Term Investors | Portfolio management, fundamental analysis | TC2000, MetaStock |

| Options Traders | Options strategies, specific tools | Thinkorswim, Interactive Brokers |

| Forex Traders | Forex market integration, real-time data | MetaTrader 4, MetaTrader 5 |

Conclusion

Throughout this article, we have explored various alternatives to MetaStock, each offering unique strengths that cater to different types of traders. From day traders to long-term investors, platforms like TradingView, NinjaTrader, eSignal, MultiCharts, and TC2000 provide tailored solutions that enhance trading strategies through their specialized tools and functionalities.

- TradingView is excellent for traders who seek a balance of technical analysis and a vibrant community for sharing insights.

- NinjaTrader offers powerful automation and customization options, ideal for advanced traders focusing on futures and options.

- eSignal excels in providing high-quality real-time data and advanced charting tools, suitable for experienced traders needing detailed market analysis.

- MultiCharts appeals to traders who require robust backtesting capabilities and technical analysis tools.

- TC2000 is preferred for U.S. stock and options traders, offering exceptional scanning tools and integration capabilities.

By considering your individual trading style and the specific features each platform offers, you can select a trading platform that not only meets your immediate needs but also supports your long-term trading goals. Each platform has its own set of advantages, so the choice depends largely on personal preferences and trading requirements.

For further exploration or to trial these platforms, visiting their respective websites and accessing demo versions where available is advisable. This approach will provide a hands-on experience to better understand how each platform aligns with your trading strategies.