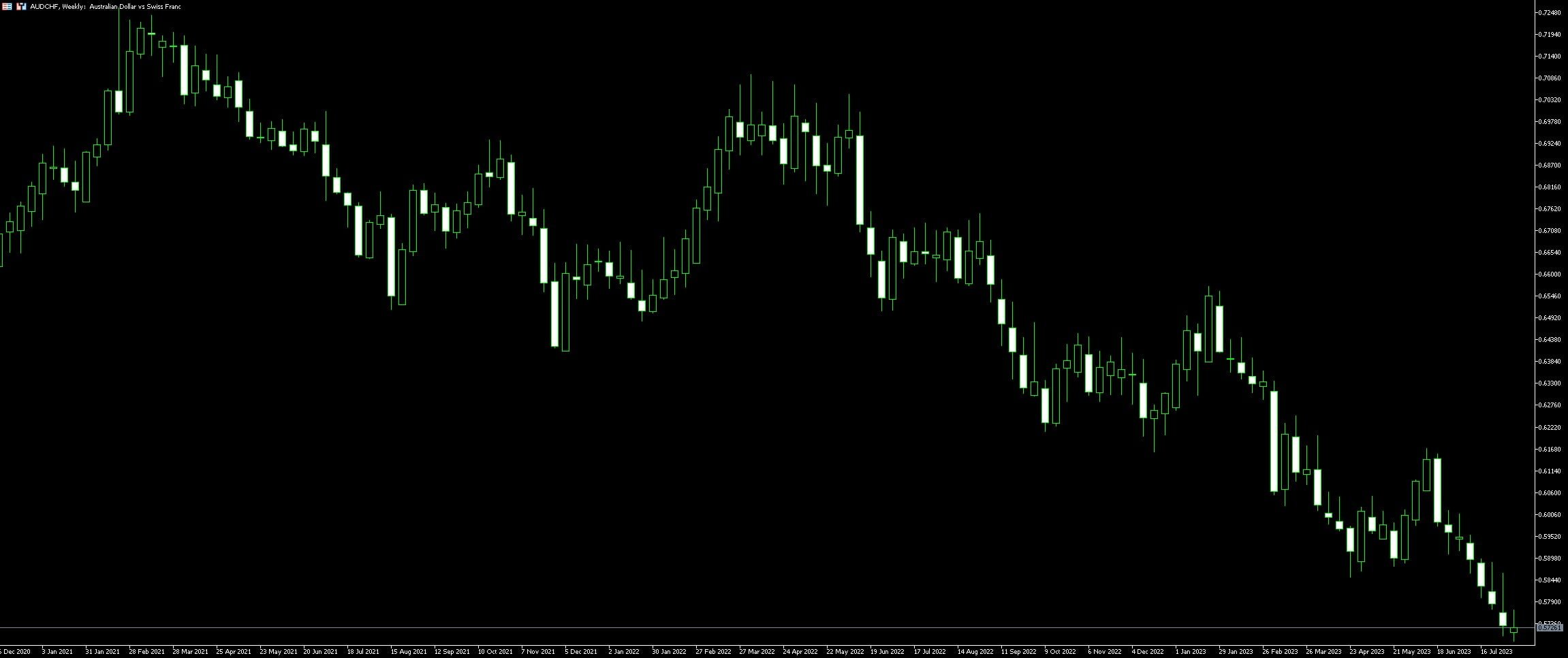

Live Chart Of AUD/CHF

1. Understanding AUD/CHF Currency Pair

Trading the AUD/CHF currency pair is a unique opportunity to fully engage the differences between the Australian and Swiss economies. This pair combines the Australian Dollar (AUD) and the Swiss Franc (CHF), two currencies governed by very distinct financial dynamics. AUD, referred to as the ‘Aussie,’ is influenced primarily by Australia’s position as a commodities-based economy, with raw materials exports playing a huge role in its value. Consider the influence of gold, iron ore, and coal exports, among other key commodities.

On the other hand, the Swiss Franc is viewed as a ‘safe haven’ currency, often sought by investors in times of economic instability. Switzerland’s renowned banking system, political stability, and substantial gold reserves all contribute to CHF’s steady value. Speculation on the global market, interest rates, and geopolitical issues can impact the value of this pair.

When trading AUD/CHF, monitoring the commodities market is vital due to the direct influence on the AUD. Additionally, a keen eye on global economic trends can hint at potential changes in CHF value. This enables an investor to make strategic decisions, leveraging the strengths and weaknesses of each economy to profit in both rising and falling markets.

Diverse economic indicators that traders need to consider while trading AUD/CHF include interest rates set by the Reserve Bank of Australia (RBA) and the Swiss National Bank (SNB), the gross domestic product (GDP), and employment/unemployment data from both countries. Technical analysis tools, chart patterns, and candlestick patterns can also provide valuable insights into the trend direction and potential reversals in the AUD/CHF pair. The interesting interplay between the AUD and CHF offers numerous trading possibilities but demands a comprehensive understanding and a consistent trading strategy.

1.1. Significance of AUD/CHF in Forex Trading

With a keen understanding of the comprehensive outlook on the AUD/CHF pair, optimal trading strategies can be formed. The currencies represent two diverse and distinctive economies, Australia (AUD) and Switzerland (CHF), providing an interesting blend of both commodity and safe haven traits. Examination of how the Australian economy, reliant on exports such as commodities like iron ore, coal, and gold, impacts AUD becomes crucial. The currency often shows a strong relation to the global economic health, with prices ascending when the global economy performs well due to the high demand for Australian exports.

The Swiss Franc, on the other hand, doesn’t rely on exports but rather on its reputation as a safe haven currency, with CHF appreciating during times of economic uncertainty. This makes the AUD/CHF pair particularly interesting for traders who want to capitalize on distinct economic indicators and factors that affect these two economies. With proper knowledge and strategies, a trader can exploit the strengths and vulnerabilities of this currency pair to yield profits.

Certain economic indicators like GDP growth rates, interest rates, employment data, and trade balance data of both countries should be followed meticulously by traders. One particular driver of this pair is the interest rate differential set by the Reserve Bank of Australia and Swiss National Bank, which can lead to carry trade opportunities if handled correctly. By recognizing the fundamental factors influencing this pair along with technical analysis, traders can leverage the inherent volatility in this pair for potential profit. The ability to understand and act upon these factors marks the initiation into effective AUD/CHF trading.

1.2. Historical Analysis of AUD/CHF

With a keen eye on historical trends, it becomes evident that the AUD/CHF pair behaves differently to other well-known forex pairs. Primarily driven by geopolitical events, changes in trade relationships, and economic health of Australia and Switzerland, the fluctuation of AUD/CHF carries unique characteristics that savvy traders exploit.

Prior to the Global Financial Crisis (GFC), the pairing was marked by the strength of the Australian economy, elevated by the demand for the country’s resources. This factor saw a favourable tilt towards AUD. Post-2008, however, there was a pronounced shift. AUD/CHF reflected the effects of the GFC with the Australian dollar plummeting against the Swiss franc, a safe-haven currency.

A significant game-changer was the Swiss National Bank’s (SNB) decision in 2011 to place a floor under the currency pair EUR/CHF, which indirectly impacted AUD/CHF. This move stabilized AUD/CHF for a short period. However, the abrupt removal of the floor in 2015 saw volatility surge and triggered steep declines for the AUD against the CHF.

The historical path of AUD/CHF continues to mould its current and future behaviour. Keeping an eye on the past can allow traders to make informed predictions on the pair’s movements, a vital part of trading AUD/CHF. This is inherently useful to those who wish to leverage the unique volatility and patterns of this pair. By understanding the key periods of immense change – both globally and specifically within the two nations – traders can gain insights into potential market responses to similar events in the future.

2. Key Trading Strategies for AUD/CHF

The AUD/CHF currency pair provides a dynamic market for traders, dictated by various internal and external factors. One of the primary trading strategies for this currency pair revolves around understanding the economic indicators of both Australia and Switzerland. As Australia is the larger economy, it often has a significant influence on AUD/CHF prices. One key economic indicator to keep an eye on is the Reserve Bank of Australia’s (RBA) interest rate decisions. High interest rates tend to attract investors, which can push the AUD/CHF price upwards. Swiss interest rates, set by the Swiss National Bank, can also have an impact, although it’s usually less potent than the RBA’s rate decisions.

Technical analysis constitutes another invaluable trading strategy for AUD/CHF. This involves examining previous price movements to predict potential future trends. Traders often utilize technical tools like trend lines, support and resistance levels, and Fibonacci retracements, among others, to identify entry and exit points in the market. Trading AUD/CHF effectively requires a comprehensive understanding of both these fundamental and technical strategies, coupled with the ability to adapt quickly to market changes.

Next, a lucrative trading strategy for AUD/CHF is exploiting the carry trade. This strategy involves borrowing in a currency with a low-interest rate (like the Swiss Franc), and investing in a currency with a high-interest rate (like the Australian Dollar). The trader pockets the difference in interest rates, leading to profits even without movement in currency prices. Keep in mind that this strategy comes with its risk factors, especially in volatile markets.

Finally, it’s worth noting that geopolitical events in either Australia or Switzerland can cause abrupt price fluctuations in AUD/CHF. This implies that being aware of major political events and understanding their potential impact on the currency market is another significant trading strategy.

The above-mentioned strategies serve as guiding lights in the dynamic world of AUD/CHF trading. They require perpetual learning and adaptation according to market conditions. The skill lies not only in understanding these strategies but also in their effective utilization while considering market turbulence and economic indicators.

2.1. Technical Analysis Strategies

Understanding the dynamics of AUD/CHF trading requires a robust comprehension of technical analysis strategies. Delving into currency pair behaviour through charts and indicators, enables the prediction of future price actions.

Candlestick patterns, a popular chart interpretation method, delivers an easily identifiable representation of price activities. Each candle provides four key points of data: the opening and closing prices plus the high and low of a certain period. Identifying recurring patterns might hint to possible price motivations and can be a reliable forecast tool.

When accounting for the longer-term price movements, the use of trend lines becomes crucial. By linking high points during a down trend or low points during an upward trajectory, the identification of potential resistance and support levels is possible. It also provides an insight on when a trend might reverse, a key information for timing market entries and exits.

Critical points of price stabilization or reversal, also known as support and resistance levels, are amongst the fundamental aspects of technical analysis. Analyzing previous points where the price had difficulty moving beyond allows traders to estimate potential obstacles to the current price action.

An integral part of technical trading is the use of technical indicators. These mathematical calculations, usually displayed as overlays on price charts, can predict potential market trends and volatility. Moving averages, relative strength index (RSI), and moving average convergence divergence (MACD) are among the most commonly used indicators.

Employing these technical analysis strategies can offer more confident decision-making while trading AUD/CHF. However, blending them with a profound understanding of fundamental analysis might bring about the most comprehensive market appraisal. Proper application and interpretation of these techniques pave the way towards more successful forex trading strategy.

2.2. Fundamental Analysis Strategies

Delving deep into the realm of Fundamental Analysis Strategies, these methodologies pivot around macroeconomic forces that steer AUD/CHF prices on the forex markets. Forex traders using these strategies scrutinise key economic indicators, such as GDP growth rates, inflation, interest rates, and political stability. These indicators can offer vibrant insights into potential price movements of the AUD/CHF pair.

Central Banks and Interest Rates – Central banks utilise interest rate changes as a tool to control inflation. Hence, a rise in the Australian interest rates might attract investors to the AUD for higher returns, driving up its value against the CHF. A shrewd trader keeps abreast of the monetary policy meetings by the Reserve Bank of Australia and the Swiss National Bank, ready to leverage the impact of their decisions on the AUD/CHF pair.

Geopolitical Stability – The CHF is regarded as a safe-haven currency, meaning that it gains strength in times of global economic uncertainty. Thus, traders need to keep a close eye on international political and economic news. Tensions and crisis, especially in the key economic zones, could fuel a surge in demand for the CHF, pressing down the AUD/CHF pair.

Equipped with a strong understanding of Fundamental Analysis Strategies, forex traders can anticipate market movements and time their AUD/CHF trades for maximum profitability. It’s vital to keep in mind that these strategies don’t predict future movements definitively but enrich traders with a comprehensive perspective of market dynamics. A holistic approach often involves using Fundamental Analysis in tandem with Technical Analysis to validate trading signals and manage risk better.

3. Risk Management While Trading AUD/CHF

3.1. Importance of Risk Management in Forex Trading

Risk Management is a paramount aspect not only in Forex trading but also in all financial trading spheres. It can’t be overstressed that risk management is the cornerstone of successful trading. Every trader must understand that irrespective of their understanding of the AUD/CHF, the market will always hold certain unpredictable elements.

Carefully planned risk management strategies enable traders to cope with these unforeseeable market risks. A relevant strategy minimizes the potential losses whilst maximising profit potentials. In the context of Forex trading and the AUD/CHF pair, this could mean setting stop losses and take-profit limits that shield against drastic devaluations of the AUD relative to the CHF.

Establishing stop losses is an undeniable element of risk management. This involves setting a predetermined level in the trading platform where one’s position will automatically close if the price moves against their expectations. Trading the AUD/CHF pair without stop loss orders can be likened to driving on a high-speed lane without seatbelts – extremely risky.

The other side of the coin in risk management is to establish a take-profit limit. This automatic order closes one’s position if the price moves favourably to a predetermined level. It ensures a trader capitalizes on winning trades before the market conditions shift and potentially erode their profits.

Appropriate leverage use is another fundamental principle of risk management. While high leverage can amplify profits, it also raises loss potential. Hence, responsible leverage use involves finding a balanced ground where profits are maximised relative to one’s risk acceptance level.

Hence, without an effective risk management strategy, trading AUD/CHF could be as unpredictable as tossing a coin in the air. Despite lucrative opportunities that this pair presents, always remember that no reward exists without its corresponding risks.

3.2. Practical Risk Management Strategies for AUD/CHF

Establish clear stop losses and set realistic profit targets: Before you engage in AUD/CHF trades, it’s crucial you decide your trading limits. Stop losses safeguard your investment from dramatic market swings, ensuring your risk remains within control. By predetermining a point of maximum loss, you prevent chasing losses, thereby conserving account balance. On the flip side, defining realistic profit targets sets an optimal exit point for your trades.

Understand the market hours: An often-overlooked element when trading AUD/CHF is the influence of Forex market hours. The Australian and Swiss markets open at different times, affecting their currency’s liquidity and volatility. Trading when one market is open but the other is not can influence your trade outcomes. Determining the synchronization of these market hours can proffer insights towards greater odds for a successful trade.

Keep an eye on economic data releases: Economic indicators often dictate the direction of AUD/CHF trends. Key factors include the Australian employment rate, GDP, retail sales, housing market data, and the Swiss National Bank’s decisions, amongst others. Tracking these economic data releases and understanding their potential impact could underpin your risk management strategy.

Implementing technical analysis: No risk management strategy is complete without technical analysis. It helps traders identify potential entry and exit points, figure out trend directions, and ascertain market sentiment. Popular indicators for the AUD/CHF pair include Bollinger Bands, Moving Averages, and Relative Strength Index (RSI). A solid grasp of these tools helps to enhance your risk management proficiency.

Diversification: Concentrating your portfolio solely on one pair is like putting all the eggs in a single basket. It heightens your exposure to risk. Diversifying your portfolio with different currency pairs distributes your risk and might improve the resistance capacity of your portfolio against market volatility. Furthermore, it encompasses the philosophy of not putting all hopes on a single trade, thus steering a wise trading journey.

4. Tools and Resources for Successful Trading

Understanding various trading tools and resources is crucial in walking the treacherous paths of AUD/CHF trading. There are numerous tools that can equip you with the skills necessary to navigate these often unpredictable markets. One of these invaluable tools is the trading platform. Preferably one that offers a broad range of charts and indicators, which can portray price action and market trends accurately.

Economic calendars also play a pivotal role. These calendars provide an update on potential market-moving events, allowing you to strategize and make well-informed trading decisions. Economic data, coming from either Australia or Switzerland, can cause significant fluctuations in the AUD/CHF pair. Being aware of such releases can help manage risks and exploit trending opportunities.

Stop loss and take profit orders are some of the risk management tools that traders simply can’t ignore. Stop loss orders aim to limit the potential loss on a trade, whereas take profit orders are used to secure profits when the price moves in a favorable direction. Precise execution of these tools, dependent on thorough analysis, can drastically increase the potential for profitable trades.

Additionally, trading education and webinars can significantly improve your trading skills. From learning about technical analysis and understanding fundamental influences to the psychological aspects of trading, knowledge is indeed power in the world of foreign exchange trading.

Furthermore, it is often beneficial to automate some of your trading using tools like Expert Advisors (EAs). These can run complex strategies without any intervention, alleviating the burden of making trading decisions under pressure or losing out on potential opportunities due to inactivity.

Advanced charting tools serve traders by storing historic price data, providing trend lines, and supplying a variety of technical indicators. These tools can give traders insights into market trends, enabling them to make strategic decisions based on historical data and real-time market movement.

Lastly, in the realm of trading AUD/CHF, having a reliable source of market news and analysis is essential. Real-time data regarding economic, political, and disaster-related events can profoundly impact the trading environment. Being capable of quickly responding to such changes is a characteristic of successful traders. It promotes proactive trading and provides traders with the opportunity to seize profitable movements in the market.

4.1. Choosing the Right Trading Platform

Delving into the world of financial trading takes more than just understanding exchange rates or currency pairs like AUD/CHF. The trading platform chosen plays an instrumental role in a trader’s success. Nothing short of a mean between flexibility and efficacy will suffice for serious traders. A good trading platform should accommodate the unique trading needs of every individual, offering a variety of features, tools, and resources.

High-quality charting tools are fundamental in any worthwhile trading platform. They provide intricate details about market trends and currency dynamics. Combined with historical data, such tools make for informed trading decisions, hence, minimizing risks for AUD/CHF traders.

Moreover, transparency is another vital benchmark to consider. Platforms that provide transparent pricing, such as real-time spreads and commissions, usually stand out from the crowd. These details should be readily available, right at your fingertips, to aid in making quick and effective trading decisions.

In an era of digital mobility, having platform accessibility on multiple devices is an advantage that cannot be understated. Being able to trade AUD/CHF from the convenience of your smartphone or tablet can receive market updates, execute orders, and manage your account anytime, anywhere.

Customer support is yet another crucial factor not to ignore. A platform with prompt, reliable, and compassionate support ensures you’re never left stranded in case of any technical glitches or uncertainties.

Finally, and possibly most importantly, one must consider a platform’s security features. Given the sensitive nature of financial transactions, you want to be sure that your personal and financial information is thoroughly protected. Strong encryption systems, two-factor authentication, and regular system updates are essentials to look for.

Therefore, it emerges quite clearly that the choice of a trading platform can make or break a trader’s success. It calls for a meaningful consideration of features, transparency, accessibility, customer support, and security.

4.2. Leveraging Educational Resources

Harnessing the power of educational resources becomes a fundamental aspect while trading AUD/CHF. This includes a breadth of knowledge, extending from understanding basic trading concepts to comprehensive understanding of economic indicators of Australia and Switzerland. These indicators may include GDP growth rates, unemployment rates, inflation rates and interest rates of both the countries.

Forex trading webinars are one such educational resource that can provide real-time insights into this currency pair’s movements. Webinars include experienced traders who share their strategies and provide tips and tricks that can be adapted to trading scenarios. Moreover, they also provide the opportunity to ask questions, giving a rounded learning experience.

Next, utilising the economic calendar provided by brokerage platforms can aid in forecasting future market movements of AUD/CHF. These calendars offer significant news events and economic data releases that can potentially impact this currency pair’s value. By staying updated on these events, traders can strategise their moves effectively.

Finally, the power of trading journals can not be overlooked. In providing an opportunity to track and assess one’s own trading patterns and decisions, journals can provide clarity and insight into what’s working and where adjustments need to be made. Such reflections can then be used to refine one’s trading strategy for AUD/CHF.

These resources, when effectively used and appropriately integrated within a trader’s routine, can lead to a better understanding of the market dynamics of AUD/CHF and hence, can provide an edge in reaping profits.