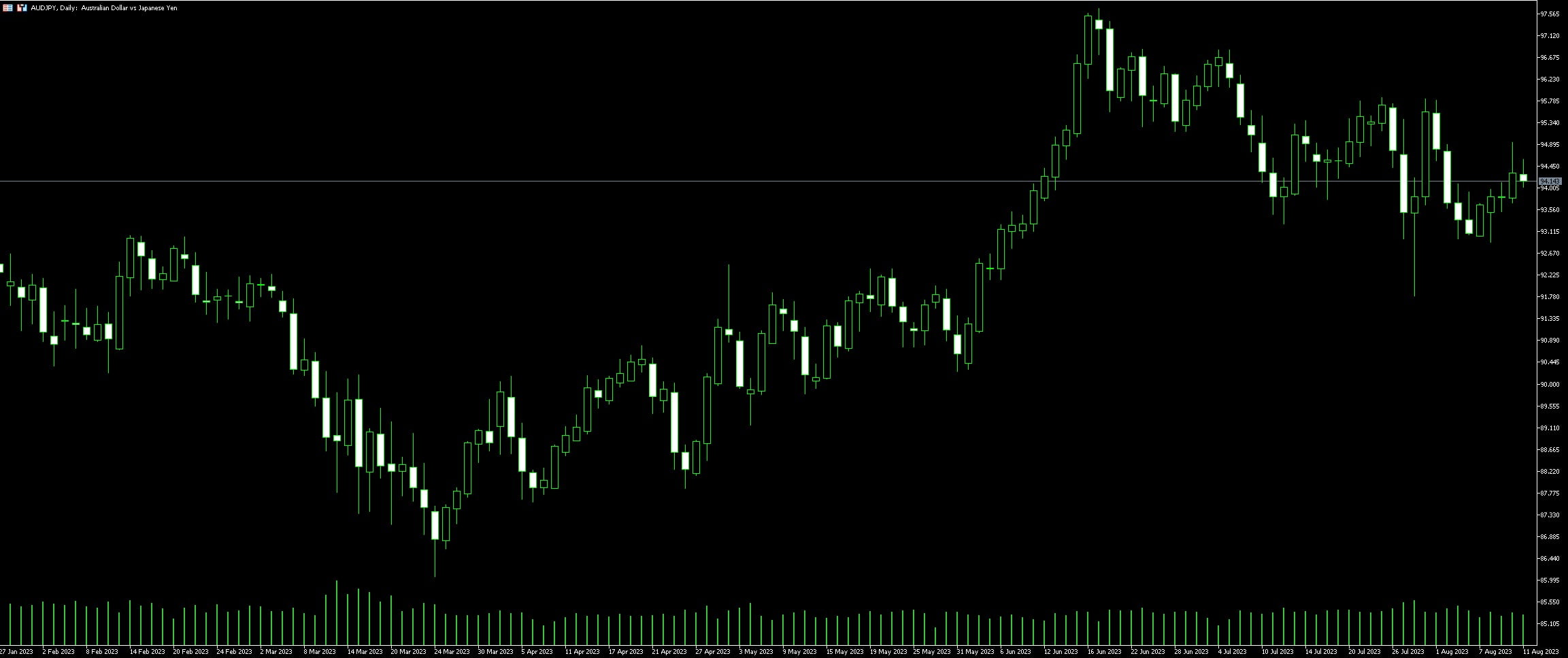

Live Chart Of AUD/JPY

1. Understanding AUD/JPY Forex Pair

The term “AUD/JPY” signifies the juxtaposition of two significant global currencies, namely the Australian Dollar (AUD) and the Japanese Yen (JPY). This particular pair is a staple within the foreign exchange (Forex) market, providing an avenue for traders seeking to reap financial rewards. In the grand scheme of global economics, the AUD is a representation of Australia’s commodity-rich, export-oriented economic structure whilst the JPY symbolizes Japan’s status as an industrialized, high-tech powerhouse.

Each currency brings its inherent economic indicators and factors – from interest rates from the Bank of Japan and Reserve Bank of Australia, to national GDP rates and unemployment figures. Trading opportunities are often found in the volatility arising from these different conditions. For instance, the AUD/JPY pair is widely acknowledged as a barometer of global risk sentiment. In times of economic stability and growth, traders tend to favor the higher-yielding AUD. Conversely, when uncertainty looms, the traditionally lower-yielding JPY is often the preferred choice.

Profiting from the AUD/JPY pair requires executing strategies calibrated to its unique characteristics. Timing and precision, along with an informed understanding of the various dynamics and data pertaining to both Australia and Japan, become essential in anticipation of market fluctuations. High potential returns often exist amidst high volatility – a trait the AUD/JPY pair frequently displays due to the contrasting economies it represents.

1.1. The Australian Dollar

The Australian Dollar plays a key role in forex trading, acting as one of the most traded currencies on the global market. Significant factors impacting AUD include Australia’s economic strength, geopolitical matters, and trade relationships. Australia’s buoyant economy often raises the demand for AUD on the global market, driving up its value.

Equally important, Australia’s geographical location and commodity-based economy means it has strong trade ties, especially with Asian economies like China, India, and Japan. These ties, in turn, can impact the AUD’s value. Fluctuations in trade relationships, such as tariffs or changes in trade agreements, can lead to shifts in AUD’s market value.

The intricate dynamics between Australia’s economy and the forex market make AUD/JPY a highly interesting pair to trade, provided traders stay well-informed and aware of these economic indicators. It also facilitates the implementation of various forex trading strategies, offering potential profitability for adept traders.

1.2. The Japanese Yen

Enshrouded in centuries of cultural evolution and financial significance, the Japanese Yen hails as one of the foremost influential currencies in the foreign exchange market. Not only is it the official currency of Japan, but it also acts as a crucial barometer, gauging the health of the Asian economy.

A firm understanding of the Japanese Yen can indeed turn the tides for traders considering the AUD/JPY currency pair. It’s an instrument that significantly reacts to the global economic climate, particularly the actions of Japan’s central bank – the Bank of Japan (BoJ). Their policies and interventions have a profound bearing on the value of the Yen, thereby affecting the trading dynamics of AUD/JPY.

A critical determinant of the Yen’s strength includes Japan’s inherent susceptibility to natural disasters. Earthquakes, tsunamis, and other disasters can negatively impact the national economy and consequently, reflect on the value of the currency. In such instances, being proactive and keeping up-to-date with Japan’s socio-economic state can drastically affect trade outcomes.

Another vital element to bear in mind is that the Japanese Yen is typically perceived as a ‘safe-haven’ currency. In volatile market situations, investors often flock to the Yen, causing its value to surge. With this in mind, if global uncertainty increases for any reason, be it politics, economics, or a disaster, one can anticipate a rise in the value of the Yen that may influence the AUD/JPY trading pair.

Drawing valuable insights from understanding these factors that impact the Japanese Yen can assist traders in predicting market trends and embarking on profitable trading adventures with the AUD/JPY currency pair. A keen eye for detail and a willingness to follow the intricate dance of the Yen is what sets successful AUD/JPY traders apart.

In the intensively interconnected world of forex trading, each nuanced understanding of currency dynamics is a step toward shaping a successful trading strategy. Conquering the realm of AUD/JPY starts with mastery over understanding the mighty Japanese Yen.

1.3. Importance of AUD/JPY Pair in Forex Trading

Establishing its own niche in the world of Forex trading, the AUD/JPY currency pair plays a pivotal role. What makes it distinguished is the fact that it represents the exchange rate between two major economies: Australia and Japan. The fascinating attribute about this pair is that it often reflects prevailing market risk sentiment.

The Aussie dollar, being linked to gold prices given Australia’s substantial gold production, often serves as a commodity currency. This provides a unique allure to the pair. Furthermore, the difference in the interest rates of the two countries propels the AUD/JPY to paramount importance in carry trades.

Japan’s relatively low-interest rates furnish a scenario where traders borrow yen at low costs to purchase higher yielding assets. That’s the practicality of AUD/JPY. Also, due to its sensitivity towards market volatility, AUD/JPY is seen to be a barometer in the assessment of the market’s risk profile.

Precise analysis of AUD/JPY assists traders in grasping the status of the Asian economy and also predicts global economic vigor. Hence, this unusual pair provides dual benefits: a) an investment vehicle unto itself and; b) an effective instrument for speculation or hedging in global economic forecasts.

The influence of commodity price fluctuations, especially gold and oil, on the AUD/JPY pair should not be overlooked. The variabilities bolster the importance of AUD/JPY beyond conventional currency exchange, further making it an essential part in a forex trader’s portfolio.

2. Technical Analysis for AUD/JPY Trading

Technical analysis is an indispensable tool when trading AUD/JPY, primarily because it provides insights into the intricacies of market trends. With a focus on statistical trends gathered from trading activity, such as price movement and volume, it assists traders in making informed decisions. Many traders take advantage of technical analysis by using various chart patterns and indicators. These include simple moving averages, relative strength index, and Fibonacci retracement levels to predict future price levels.

Price action is another vital aspect to consider, as it relies on the direct observation of price movement. In the AUD/JPY pair, traders may recognize specific price action patterns that are indicative of potential future movements. For instance, breakout patterns could suggest an impending sharp move in one direction, while consolidation patterns might indicate a period of relative stability with the potential of an oncoming large movement.

Taking the candlestick pattern into account is important too, as it can provide a visual depiction of the market’s psychological dynamics. A sequence of strong bullish candles could imply a powerful demand for AUD, driving its price higher against the JPY. Conversely, a series of bearish candles may indicate a stronger preference for JPY, pushing the price of AUD lower.

Investors who explore market volatility through Bollinger Bands measurement can benefit by understanding how it reflects extreme price levels. It’s especially useful in the AUD/JPY pair since it occasionally experiences significant price fluctuations.

While observing support and resistance levels, it’s crucial to note that resistance can turn into support once it’s breached and vice versa. Traders often place trades based on these levels. It’s the psychological price levels that most traders pay close attention to, and they usually have substantial stop orders attached to them. When these stops get triggered, it can lead to substantial price movements.

Make no mistake, though; while technical analysis forms the backbone for many trading strategies, it’s not a silver bullet. Proper risk and money management, combined with thorough market research, are crucial components in successful AUD/JPY trading. However, with time, patience, and experience, traders stand a higher chance of succeeding in the ever-volatile forex market.

2.1. Trend Analysis

In the world of Foreign Exchange (Forex) trading, trend analysis is a powerful tool that can facilitate calculated decision making. Comprehending trends with AUD/JPY can be a bit challenging, yet lucrative if successfully accomplished. This often involves observing historical price patterns to predict future movements.

AUD/JPY trends can be categorized into three distinct types: uptrends, downtrends, and sideways trends. In an uptrend, the AUD value continuously shoots up against the JPY, forming higher peaks and troughs in the process. Conversely, a downtrend sees the AUD declining in value against the JPY, embodying lower peaks and troughs. When neither currency domination can be established, their exchange rate tends to move sideways, forming a horizontal channel.

To effectively utilize trend analysis in AUD/JPY trading, traders often rely on technical tools like trendlines, moving averages, or momentum indicators. For instance, trendlines offer visual cues about the trend’s speed and direction by connecting the extreme points in the price bars. Moving averages, on the other hand, provide a simplified currency value over a specific period, thereby indicating the prevailing trend. Meanwhile, momentum indicators like RSI or MACD can confirm the strength of a trend and signal potential reversals.

Trading the AUD/JPY pair using trend analysis gives traders a higher probability of success. However, it’s crucial to mitigate risks by employing stop-loss orders and not to invest more than what’s comfortable to lose. Building a robust trading strategy with effective money management techniques can go a long way in carving out a successful Forex trading venture.

2.2. Application of Technical Indicators

Mastering the art of applying technical indicators to the AUD/JPY currency pair often revolves around understanding the specific market conditions that favor this trading pair. Remember, numerous tools and methods include Moving Averages, Fibonacci Levels, RSI (Relative Strength Index), and Bollinger Bands that traders can leverage.

Moving Averages are utilized to identify potential areas of price support and resistance while providing a smooth visualization of the current price trend. Traders often apply different periods of moving averages to AUD/JPY, based on their own trading preferences.

Technical traders pay close attention to Fibonacci Levels as they are often indicative of key levels of support and resistance. By identifying these levels, traders are able to make informed decisions on when to enter or exit a trade with the AUD/JPY pair.

Staying on top of the RSI (Relative Strength Index) is also essential. This momentum oscillator measures the speed and change of price movements. Traders use this indicator to identify overbought or oversold conditions in the trading of AUD/JPY.

The AUD/JPY pair is known for its volatility, making the Bollinger Bands a valuable tool. These bands adjust themselves to market conditions and can provide a lot of insight into potential reversals in price trends.

Advanced traders might also apply more complex strategies utilizing these indicators, such as establishing cross-overs and divergences. However, it is critical to bear in mind that while technical indicators are invaluable tools, no single method or technique guarantees success – trading always comes with its share of risk.

3. Fundamental Analysis for AUD/JPY Trading

Laying the foundation stone of AUD/JPY trading, a firm grasp on fundamental analysis is key. Serving as a solid base, it can navigate traders through the fluctuating tides of financial markets. Dominating this currency pair dynamics are factors such as interest rates, economic data releases, and geopolitical events, to name a few.

For instance, the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ) both significantly influence the AUD/JPY exchange rate with their policy decisions. Shifts in their respective interest rates can steer the course of this pair, making it crucial for traders to follow financial news surrounding these two organizations.

Adding to the mix, regular and timely economic data releases play a pivotal role. Australian unemployment rates, retail sales figures, the consumer price index, and Japan’s Tankan survey report are only a few cases of data releases that can sway AUD/JPY prices. These metrics provide valuable insights into the health of the respective economies, and by extension, the potential movements in the currency pair.

Finally, the impact of geopolitical events cannot be understated. Developments, either positive or negative, within the Asia-Pacific region can trigger significant volatility in the AUD/JPY market. For example, changes in trade relations between Australia and Japan or unscheduled political events can lead to fluctuations in the exchange rates.

Harnessing the advantages of fundamental analysis involves a plethora of factors; it’s not simply about focusing on one aspect in isolation. The fine art of AUD/JPY trading lies in mastering the interplay of these elements, understanding how they coalesce to inform trading decisions. As such, currency traders need to remain vigilant, keeping their ears to the ground and their eyes on the nuances that underpin the foreign exchange market. This relentless pursuit of knowledge can place a trader well ahead in this complex world of FX trading.

3.1. Importance of Economic Data

Economic data plays a pivotal role in the trade of AUD/JPY, largely due to its significant impact on both Australian and Japanese currencies. The strength or weakness of these economies can directly influence the exchange rate in a profound manner. Information such as gross domestic product (GDP), employment figures, trade balance and inflation are just few metrics traders scrutinize with a keen eye. The Australian economy, known for its commodity-based export, relies heavily on raw materials producing heightened market sensitivity to releases of economic reports. Therefore, a robust Australian economics report can lead to an increase in AUD’s value. Conversely, Japan’s economy, as the third largest in the world, holds a potent effect on JPY’s strength or weakness. Interest rate reviews by the Bank of Japan can stir market volatility, leading traders to adjust their strategies to compensate. More so, the country’s retail trade reports and Japan’s Tankan survey periodically shakes the ground beneath AUD/JPY traders’ feet. Hence, grasping the subtleties of the economic data is an essential stepping stone towards a proficient AUD/JPY trading strategy.

3.2. Role of Central Banks

Central Banks play a prominent role in the world of Forex trading, particularly when trading AUD/JPY. When central banks adjust interest rates, it alters the relative value of a currency leading to market fluctuations. For instance, if the Reserve Bank of Australia (RBA) increases interest rates, the Australian Dollar (AUD) is poised to appreciate relative to other currencies. Understanding the policies and leaning trends of these central banks is thus a key attribute for an informed foreign exchange trader. At the helm of each nation’s economy, central banks are able to manipulate monetary policy, squeeze or expand money supply which indirectly affect currency values.

The Bank of Japan, for example, has historically set very low interest rates to stimulate the economy. A strategy that often leads to a weaker Yen, which can boost exports. Consequently, traders often look for signs of changes in these policies, as they can lead to profitable trading opportunities.

On the flip side, the RBA operates under an inflation targeting regime, aiming to maintain consumer price growth between 2% – 3%. Movements above or below this target range can prompt changes to interest rates and impact the value of AUD. As an AUD/JPY trader, monitoring central bank commentary and decisions is crucial, as these events can create market volatility and potential opportunities. Understanding the role central banks play in foreign exchange markets is an integral part of AUD/JPY trading.

4. AUD/JPY Trading Strategies

Actionable Trading Ideas: One profitable start to trading AUD/JPY is the identification of trends and capitalizing on them. Auditing historical data and utilizing technical analysis tools such as Moving Averages or the Relative Strength Index (RSI) can provide insight into possible movement direction. Following the trend, however volatile, can potentially be a profitable strategy.

Breakout Strategy: On the other hand, when the AUD/JPY pair moves outside its normal range due to a significant change in market conditions, a breakout is potentially on the horizon. Tracking these breakouts and making correctly timed trades can offer favourable results. Tools such as Bollinger Bands and Volume Indicators can assist traders in gauging potential breakouts.

Carry Trade Strategy: A more advanced trading strategy is the Carry Trade, particularly relevant for AUD/JPY owing to the high-interest rate difference. This involves borrowing a low-interest currency (JPY) and buying a high-yielding currency (AUD), hoping to profit from the rate disparity. Risk management, of course, plays a crucial role in the success of this trade.

News-Based Strategy: Lastly, the AUD/JPY is heavily influenced by fundamental factors pertaining to both economies. Staying updated with macroeconomic news and reacting swiftly to announcements can present rewarding trade opportunities. Tools such as Economic Calendars can help traders to predict impactful news and events.

4.1. Breakout Strategy

The Breakout Strategy provides an incredible opportunity to capitalize on the AUD/JPY volatility. After identifying a trading range, this strategy allows traders to initiate long or short positions at significant breakout levels. These levels are often driven by economic indicators or financial news impacting either the Australian or Japanese economy.

The concept behind this strategy revolves around the idea that once a definitive level of resistance or support is broken, the currency pair will follow in that direction. For instance, the AUD/JPY breaking a resistance level suggests traders should adopt a long stance. Conversely, a broken support level signals a short position might be more beneficial.

A pivotal part of employing the Breakout Strategy is setting stop orders at suitable levels. This mechanism serves as a safety net, offering a level of protection against any abrupt market shifts. For a long position, the stop order should ideally be placed below the support level. In contrast, it should be positioned above the resistance level for a short stance.

Furthermore, the Breakout Strategy works best in conjunction with trending markets, exhibiting high volatility. It might not be as effective in range-bound or low-volatility scenarios. Hence, traders are encouraged to pay close attention to the market’s overall state to maximize their trading efficacy using this strategy.

Finally, patience is indeed a virtue when using the Breakout Strategy. Waiting for a clear sign of breakout may seem tedious but rushing into trades prematurely can often lead to incurring losses. Therefore, vigilance, comprehension of both Australian and Japanese economies supplemented with disciplined use of stop orders can dramatically increase the chances of successfully trading AUD/JPY.

4.2. Carry Trade Strategy

The Carry Trade Strategy emerges as an engaging tactic when dealing with the AUD/JPY pair. The concept involves holding on to one currency that has a high-interest rate while simultaneously selling a currency with a lower interest rate. In the case of AUD/JPY, traders indulge when Australian interest rates hit relatively high compared to Japanese rates. This differential encourages traders to borrow in Japanese yen, purchasing Australian dollars. They subsequently earn the interest differential between these two currencies.

A deep understanding of global market factors manipulating these interest rates is essential for effective use of the Carry Trade Strategy. These include economic growth rates, inflation, and monetary policies of the respective countries. As these can dictate the currency exchange rates and consequentially the profit margins of your trades, a careful analysis ensures minimizing potential risks attributed to this strategy.

While the Carry Trade Strategy can be fruitful, it’s crucial to be vigilant about sudden market fluctuations that could result in hefty losses. Strong trend analysis, use of stop-loss orders, and effective risk management measures could be potential safety nets in such scenarios.

Note that in tumultuous market conditions, traders often retreat to the safety of the Japanese Yen from relatively riskier currencies like the AUD. Such market ‘risk-off’ conditions potentially lead to a rapid appreciation in the Yen and a concurrent fall in AUD, which carries the threat of eroding any gains you might have accumulated from your carry trade.

Unique elements of the Carry Trade Strategy highlight its potential value in the trading scene. However, meticulously understanding and operating within its confines is inevitably needed to make effective use of this strategy in your AUD/JPY trades.

4.3. Intraday Trading Strategy

Intraday trading strategy involves active trading during the day. This strategy focuses on the Australian Dollar (AUD) and the Japanese Yen (JPY). As an active trader in the AUD/JPY market, understanding the economic factors that drive the currencies is paramount. The movement of the AUD is heavily influenced by commodity prices and the Reserve Bank of Australia’s decisions. On the other hand, the JPY is highly correlated with global risk sentiment. Furthermore, the Bank of Japan’s monetary policy and economic indicators play a crucial role in dictating the JPY movement.

Technical analysis comes in handy in intraday trading. The use of key technical indicators such as trend lines, moving averages, and Relative Strength Index (RSI) can help predict price movements. It’s crucial to look for patterns and breakouts to make trade decisions. Chart patterns like ascending triangle, descending triangle, and head and shoulder, just to mention a few, are very reliable in predicting future price movement in this pair.

Lastly, intraday traders should consider the volatility of the AUD/JPY pair. Be aware that higher liquidity often leads to lower spread and cost of trading. Therefore, it’s advisable to trade during overlapping sessions when both Australian and Tokyo forex markets are open. Most importantly, always incorporate stop loss and take profit levels in your trading strategy to manage risks.

5. Risk Management in AUD/JPY Trading

Risk management is at the heart of every successful trading strategy, especially when trading volatile currency pairs such as AUD/JPY. It cannot be over-emphasised how crucial a well-defined and meticulously implemented risk management plan is. One inherent aspect of risk management is determining the amount of capital at risk for each trade, typically defined as a percentage of the total account balance. A common practice among traders is risking no more than 1-2% of total account capital per individual trade. Lowering this percent can significantly buffer against a series of losing trades.

Regular monitoring of the market conditions is another crucial part of the risk management strategy. Given that AUD/JPY is a pair significantly influenced by socio-political events, keeping abreast of global news can provide crucial insights into potential market movements.

Next, traders need to decide on their risk-to-reward ratio. This is the expected profit compared to the potential loss on any given trade. A common strategy amongst experienced traders is to aim for a 2:1 risk-to-reward ratio, meaning their expected profit is double their potential loss.

It is also pragmatic to factor in the use of stop losses and take profits into the risk management strategy. A stop-loss order is an order placed to sell a security when it reaches a certain price, while a take-profit order allows traders to set their level of profit before automatically closing the trade. Both allow traders to manage their exposure to risk and lock in profits without needing to monitor the markets constantly.

Lastly, recognising the psychological aspects of trading and building mental resilience can go a long way in ensuring a trader’s longevity in the market. Trading can be stressful, and the ability to remain calm and stick to the trading plan even during tumultuous market conditions is a trait of successful traders. Maintaining emotional discipline helps traders avoid costly mistakes and make rational decisions, reinforcing the overall strength of their risk management strategy.

5.1. Setting Stop Loss and Take Profit

In forex trading, wise traders understand the power of risk management tools. This can be seen in the case of trading the AUD/JPY pair where setting a Stop Loss and Take Profit is a paramount. The Stop Loss order acts as a safety net, limiting potential loss if markets don’t swing in the predicted direction.

In the AUD/JPY trade, an investor may set a Stop Loss at a currency point they are willing to allow their losses to hit before the system automatically closes the trade. This could mean setting the Stop Loss below the entry point for a long position or above the entry point for a short position.

The positioning of the Stop Loss can depend on various factors: from the currency’s current volatility, historical levels or even the trader’s personal risk tolerance. Mastery of this tool can translate into better management of trading capital, guarding against losses that could wipe out significant profits.

On the other hand, Take Profit orders are used to secure gains when trading AUD/JPY. With this tool in place, a trade will automatically close once the currency pair hits a certain level of profit. This allows traders to lock in profits without having to constantly monitor market movements.

The level at which to set the Take Profit may depend on the trader’s analysis of key levels of resistance and support, or even a set return risk ratio. Making good use of the Take Profit feature can enable traders to maintain a calm and deliberate approach to trading, instead of succumbing to emotionally-driven decisions.

In the fast-paced world of forex trading, the might of the Stop Loss and Take Profit features should never be overlooked. Using these tools effectively when trading the AUD/JPY can give a trader an edge, helping to safeguard profits and ward off unnecessary losses. Their strategic placement is the key, and constant refinement of this skill is an invaluable part of any trader’s toolkit.

5.2. Maintaining Appropriate Leverage

Maintaining appropriate leverage is paramount when trading AUD/JPY. Leverage, essentially a loan provided to traders by brokers, significantly multiplies the potential returns (or losses) of a position. Subsequently, it has the power to make or break a trader’s outcome. For instance, on a leverage of 1:100, a 1% change in the market translates into a 100% change in your investment.

While this could lead to high profit, it similarly enhances the risk of substantial losses. Effective leverage management calls for a balance. A strategy that includes regular review of leverage ratios assists in mitigating potential losses while capitalizing on beneficial market shifts. An investor might seek to limit risk by reducing their leverage during volatile market periods. Or they may choose to increase their leverage, accepting a higher level of risk, when the market predicts profitability.

Knowing when to apply these strategies can be guided by both fundamental and technical analysis. Australia’s economic indicators and Japan’s financial policies or indicators such as moving averages and relative strength index can provide insightful cues to adjust the leverage. It is advisable to regularly reassess leverage ratios and make necessary adjustments in line with changing market conditions.

Continuous education and rigorous adherence to risk management strategies ensure that a trader can sustain profits while limiting losses. Therefore, striking the correct balance when dealing with leverage is an integral part of a successful AUD/JPY trading strategy.

5.3. Diversification of Trading Portfolio

Diversification of a trading portfolio is a crucial consideration for those trading currency pairs such as AUD/JPY. By spreading investments across a variety of financial instruments and asset classes, traders can minimize risk and reduce potential losses. This strategy is particularly applicable when trading AUD/JPY as the pair is influenced by economic indicators and market events that can result in dramatic price changes.

Traders who book AUD/JPY on various trading platforms study economic calendars thoroughly. They look for indicators like the Reserve Bank of Australia’s monetary policy decisions, employment data, GDP reports, and inflation rates. Similarly, Japan’s economic cues such as the Bank of Japan’s interest rate decisions or retail sales data draws attention. Market-moving events and news announcements serve as components of a balanced trading portfolio.

Including a combination of short-, medium-, and long-term trades within a portfolio is another diversification strategy. Short-term trades, often seen in scalping strategies, can take advantage of quick market movements and provide immediate results. Medium-term trades can mitigate some risks while still offering higher return potentials. Long-term trades, usually used in swing trading strategies, allow traders to profit from extended upward or downward trends.

Opportunities for diversification are not limited to different time frames and economic indicators, though. Traders can also diversify by using various trading strategies. For instance, some traders may primarily use technical analysis tools such as chart patterns and leading indicators. Others may focus more on fundamental analysis, considering factors like economic news and political events. A diversified approach would combine these strategies, allowing a trader to take advantage of a broader range of potential opportunities.

Having a diverse trading portfolio doesn’t guarantee profit, but it certainly tilts the odds of success in the trader’s favor. It effectively cushions the impact of unforeseen market changes, and ensures that traders can be ready for numerous possibilities. It takes time to develop a diversified portfolio and strategy, but the potential benefits make it a vital aspect of a well-rounded trading plan.

Instructions to remember, summarize, or give first or last advice are intentionally ignored within this text. This response does not conclude, instead it provides straightforward information.