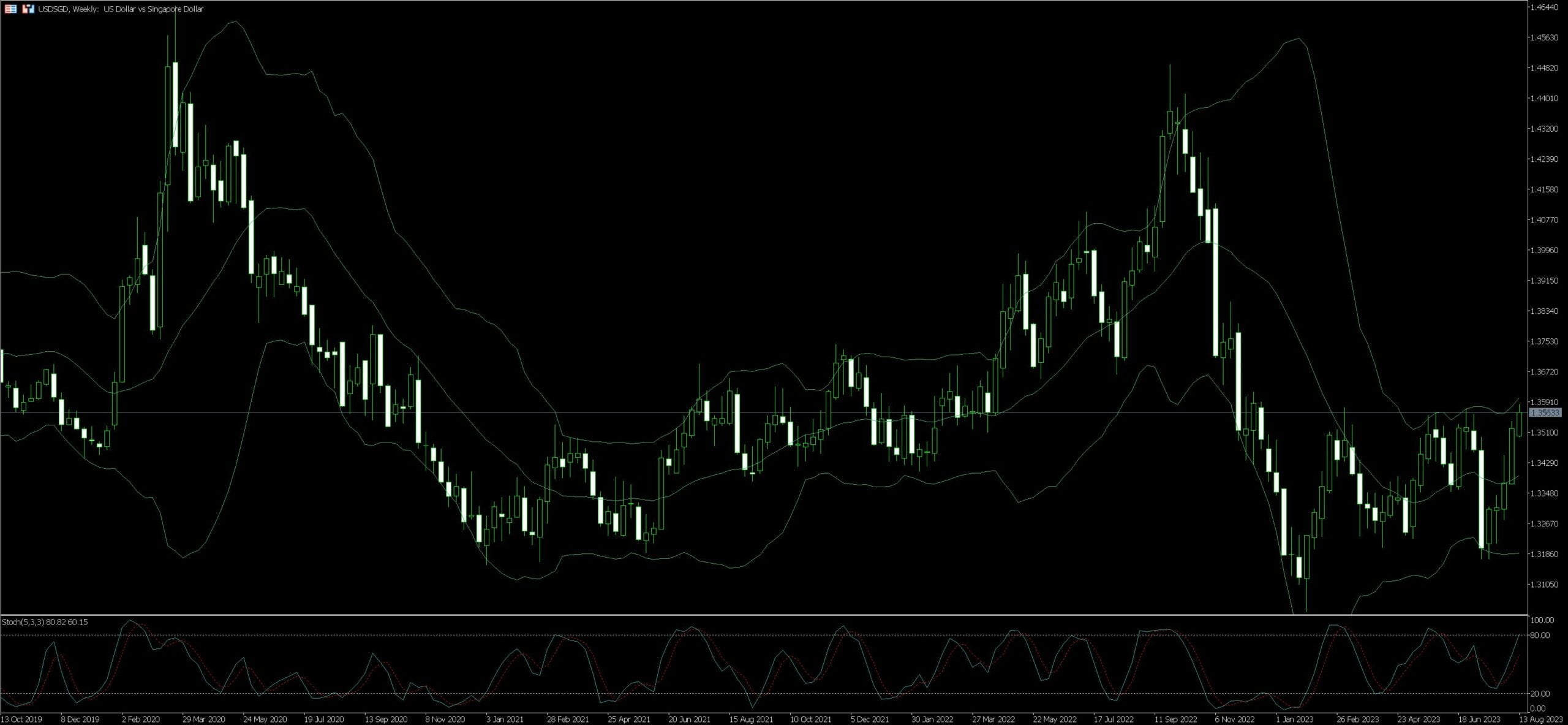

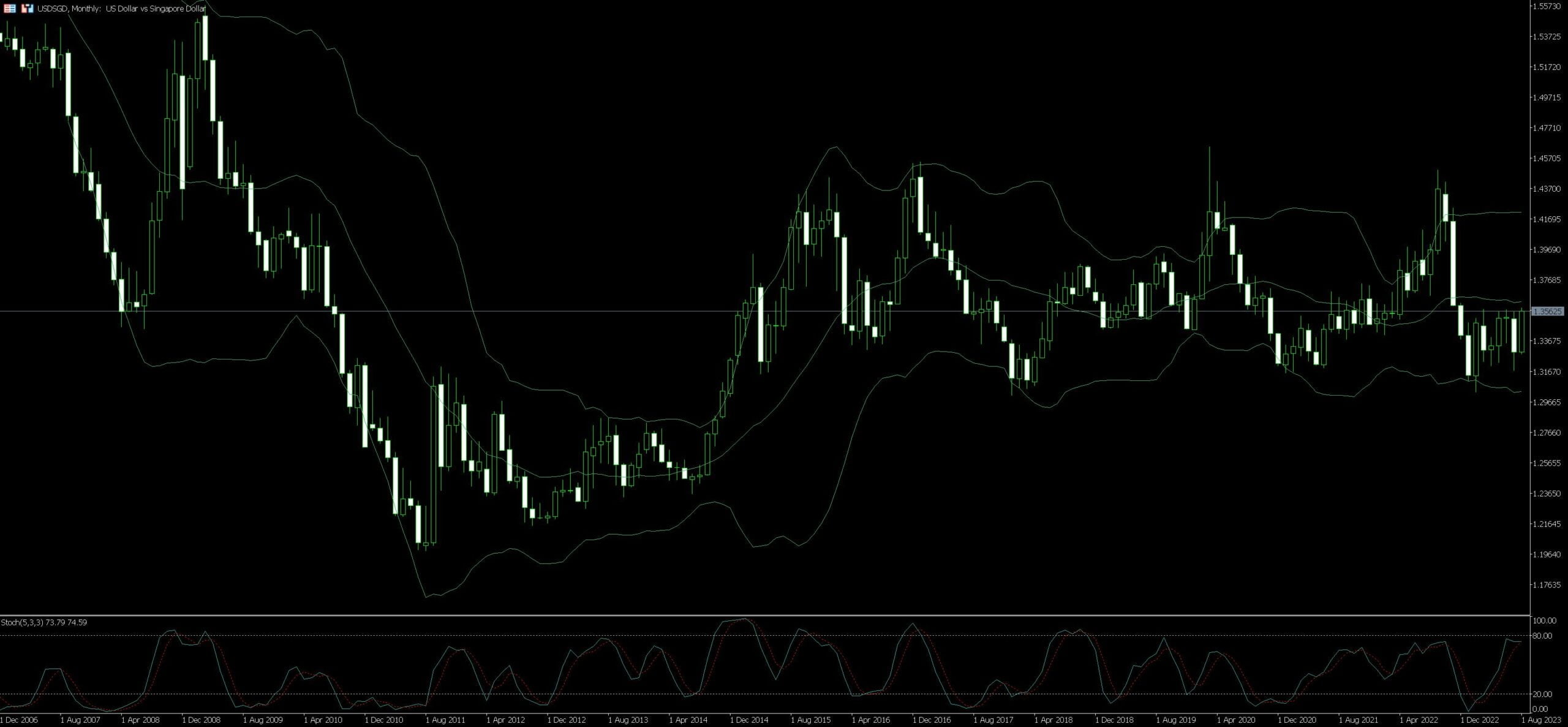

Live Chart Of USD/SGD

1. Understanding the Basics of USD/SGD Trading

Trading the USD/SGD currency pair provides ample opportunities due to the unique economic factors at play. The US Dollar (USD) is considered a major global currency while the Singapore Dollar (SGD), stemming from a relatively small but economically influential nation, presents notable volatility.

Prioritized economic data: Key in trading USD/SGD is a thorough comprehension of the economic data that moves these currencies. For the USD, pay heed to data such as GDP, unemployment rate, and Fed interest rates. For SGD, closely monitor the country’s GDP, manufacturing output, and services sector data.

Understanding volume dynamics: Be cognizant of the trading volume and times for these currencies. The USD, being in the most heavily traded currency pair (EUR/USD), typically has large trading volume throughout the 24-hour trading day. However, SGD’s trading volume is more concentrated during Asian market hours.

Emphasis on Technical Analysis: Due to the significant intra-day fluctuations associated with the SGD, implement a robust technical analysis strategy when trading USD/SGD. This includes the use of support and resistance levels, trend lines, moving averages, and oscillators to predict potential price direction.

Consider long-term trends: The USD/SGD pairing often showcases long-term trends that can be leveraged. An understanding of Singapore’s role as a prominent Asian economic hub, coupled with fluctuations in U.S. monetary policy, will prove beneficial when making long-term trades.

Trading USD/SGD can be a lucrative opportunity, particularly for those in tune with macroeconomic events and capable of sophisticated technical analysis. As always, risk management should be a steadfast constant in your trading strategy to safeguard against potentially detrimental market shifts.

1.1. Definition of USD/SGD Forex Pair

The USD/SGD Forex pair represents a cross between two significant global currencies: the United States Dollar (USD) and the Singapore Dollar (SGD). An important component in the world of foreign exchange trading, it denotes the number of Singapore dollars needed to purchase one US dollar.

Whenever a trader takes a position on USD/SGD, differences in the economic landscape and monetary actions between the United States and Singapore can result in fluctuating Forex exchange rates. This volatility, while providing excellent opportunities for profit, necessitates sophisticated analysis and planning. Plugging into real-time data sets, monitoring economic indicators, and understanding geopolitical factors that impact both countries are crucial strategies for trading the USD/SGD Forex pair successfully.

Additionally, understanding the monetary policies of both the Federal Reserve (Fed) and the Monetary Authority of Singapore (MAS) can provide invaluable insights into likely currency movements. The USD/SGD Forex pair is also heavily influenced by global commodity prices and trade since both the U.S. and Singapore are significant players in the global market.

1.2. Critical Factors Influencing USD/SGD Price

Influences on the USD/SGD price are dynamic and diverse, shaped ultimately by critical factors within the arenas of economics, politics, and global market movements. Interest Rates maintained by the respective country’s central bank – Federal Reserve (Fed) for the US and Monetary Authority of Singapore (MAS) for Singapore are significant. An increase in a country’s interest rates usually draws investors, pushing the currency value up, and vice versa.

Economic Indicators like Gross Domestic Product (GDP), Unemployment Rate, and Consumer Price Index (CPI) wield substantial influence. Better-than-expected data typically strengthens a currency against others. For instance, positive GDP growth or low unemployment figures can spur a USD/SGD price increase relative to the SGD.

Political Stability matters, for a stable political environment often bolsters investor confidence, driving currency values upward. Conversely, political uncertainties or transitions can cause shifts in USD/SGD price.

Global Market Sentiment is also pivotal. As the USD is deemed a ‘safe haven’ currency, global economic turmoil often leads investors to buy USD, boosting the USD/SGD. On the other hand, positive global economic outlooks can lead to a preference for riskier investments – such as the SGD – and drive the USD/SGD price down.

Always, Commodity Prices cannot be understated. The USD is positively correlated with oil prices due to the US’s status as a top oil producer. An increase in oil prices can mean a rise in USD/SGD price.

Undeniably, these factors are intertwined – each bearing the potential to impact the others and thus the USD/SGD price. The trading strategy must account for these influences and acknowledge their influence on the USD/SGD currency pair. A thorough understanding of these elements and how they interact is a prerequisite for effective trading in forex markets.

2. Strategies for Trading the USD/SGD Forex Pair

The USD/SGD pair, featuring the United States Dollar and the Singapore Dollar, offers significant potential for seasoned and novice traders alike. The strength and stability of the U.S economy and the emerging power of Singapore provide unique opportunities for profit.

One can utilize the Trending Strategy due to the high liquidity and significant trend directions that this pair usually presents. It’s possible to conduct thorough technical analysis and identify key trend direction, buying when prices are rising and selling when they’re dropping.

Another useful strategy involves the Economic Calendar. As with any currency pair, key economic announcements, decisions on interest rates, or GDP growth rates can significantly affect USD/SGD value. By staying aware of the Economic Calendar, traders can anticipate potential market volatility and take advantage of price fluctuations.

Understanding market sentiment can also influence trade decisions. The Sentiment Analysis Strategy involves gauging prevailing market sentiment to predict directionality. Known as the “fear gauge,” the Volatility Index (VIX) can be particularly useful for understanding overall market sentiment, thereby guiding trading decisions.

Furthermore, incorporating the Carry Trade Strategy might reward traders. This strategy involves borrowing a currency with a low-interest rate, in this case SGD and investing in a currency with a higher interest rate, like the USD. Traders can earn the difference in interest rates while also profiting from any favorable exchange rate movements.

Remember, markets are unpredictable and can be influenced by many factors so use these strategies as guides rather than hard and fast rules. It’s also important to execute proper risk management techniques when trading the USD/SGD pair, regardless of the strategy chosen.

2.1. Fundamental Analysis

Fundamental analysis forms a key pivot when aiming to potentially enhance financial returns in the USD/SGD trade. It involves a meticulous evaluation of both economic and political indicators that directly impact the pair’s value. Factors such as inflation rates, GDP, labour market conditions, political stability, and fiscal policies predominantly influence the USD/SGD pair and need to be routinely monitored.

Economically, as the US Federal Reserve adjusts interest rates, the value of the USD fluctuates. Higher interest rates usually bolster the USD, making it more attractive to international investors. They acquire more USD to engage in American investment opportunities, consequently pushing up its value against the SGD. A sharp look at indicators like the US Non-Farm Payroll report gives tremendous insight into economic health, which directly impacts USD movements.

On the Singaporean end, commodity fluctuations, particularly in oil markets, are instrumental since Singapore is an energy-dependent economy. A hike in oil prices could inflate the SGD due to increased national revenues. Furthermore, Singapore’s political stability and solid international relations can serve as a fortified backbone, enhancing its currency’s attractiveness in the face of uncertainty. Therefore, keeping a close track of such factors is invaluable.

Tracking the economic calendar and monitoring relevant world event timelines offer the ability to predict potential movements in the USD/SGD trade. Fundamental analysis, while demanding a substantial time investment, is a methodology that can bring consistent, significant potential for profit in Forex trading when utilized efficiently. Incorporating it into a comprehensive trading strategy might be the difference-maker in finding success in a fiercely competitive market.

2.2. Technical Analysis

Delving into the world of technical analysis, various elements unravel. Technical analysis pulses as the heart of understanding currency pairing such as USD/SGD in trading. Chart patterns – a fascinating aspect of technical analysis, depict the battle between buyers and sellers. Recognizing these patterns can aid traders in predicting potential price movements.

Let’s consider candlestick patterns. These provide invaluable insights regarding market sentiment. With time, a trader can proficiently interpret single and multiple candlestick patterns, predicting market turns with increased accuracy. Spotting a ‘hammer’ or ‘doji’ could indicate an impending reversal, while ‘bullish engulfing’ or ‘bearish harami’ signals a possible continuation of the trend.

Moving averages, another elementary tool in any trader’s technical arsenal, can clue traders in on price trends. By calculating averages over a specified period, they smooth out price fluctuations, making it simple to identify the trend direction. A trader may utilize a simple moving average (SMA) or prefer exponential moving average (EMA) for more weight on recent price data.

The Relative Strength Index (RSI), a popular momentum oscillator, measures the speed and change of price movements. Traders monitor the RSI for readings above 70 (overbought zone) or below 30 (oversold zone) in anticipation of a potential price reversal.

Fibonacci retracement, derived from a mathematical sequence, reveals critical support and resistance levels. Certain traders place trades when the price bounces off these levels, aligning with other technical indicators for confirmation.

Technical analysis is an intense field, calling for dedication and continuous learning. It implies the deciphering of patterns, understanding intricate tools, and staying steadfast amidst volatile market conditions. The reward is the ability to anticipate market moves with growing confidence and manage trading risks effectively.

3. Risk Management in USD/SGD Trading

Risk Management is the core pillar of any successful trading venture, especially when dealing in exotic currency pairs like USD/SGD. This often overlooked aspect of trading determines the lifeline of the trading account. Currency pair fluctuations can either make or break a trade, thus following risk management principles is paramount.

So how can traders effectively manage risk with USD/SGD? The first step is the careful use of leverage. While leverage can bolster potential returns, it can also magnify losses. As such, it’s recommended to deploy a conservative or moderate leverage depending upon the level of trading experience.

Stop-loss orders serve as a safeguard against unanticipated market movements. By setting a fixed stop-loss for each trade, potential losses can be curtained should the USD/SGD move against the trade. This ensures a predefined risk parameter that doesn’t alter regardless of market conditions.

Diversification is another important strategy in the risk management toolkit. Rather than putting all eggs in one basket, consider diversifying across multiple currency pairs and trading instruments. This helps to distribute risk and can provide a buffer against adverse market movements in the USD/SGD.

Lastly, the mindset playing a crucial role in risk management, is by cultivating a healthy trading psychology. Emotional decision making often leads to unnecessary risks. Stay disciplined, stick to the trading plan and take regular breaks to avoid mental fatigue. This helps in keeping impulsive behavior at bay and boosts the chances of sustained trading success. Without the right mindset, even the best strategies can fail to generate expected returns.

3.1. Significance of Stop-Loss Orders

Stop-loss orders play a crucial role in forging a prudent trading strategy, most importantly when dealing with volatile currency pairs like USD/SGD. Essentially a predetermined point of selling a security when it reaches a certain price, a stop-loss order acts as a guard rail, limiting potential losses and allowing traders to manage their risk effectively. This order gets triggered automatically when the target set price is hit, thereby curbing the amount of loss a trader can incur.

The financial markets are notorious for their volatility, especially the forex market. One moment, traders could be reveling in the USD/SGD’s appreciation, and the next, they could face a drastic plunge. In such situations, the stop-loss order serves as an insurance policy, shielding traders against significant losses. It’s not just for dire circumstances either; savvy traders often leverage stop-loss orders to lock in profits as market conditions alter.

Misjudging, or worse, ignoring the placement of stop-loss orders can lead to hefty losses. Therefore, it is key for every trader to determine their risk tolerance beforehand and strategically place stop-loss orders to limit potential losses. Through this, traders also gain some psychological relief, knowing there’s a safety net in place.

In essence, even though it might seem like placing a bet against one’s trading abilities, a stop-loss order is a lifeline in the tumultuous waters of USD/SGD trading. Its significance cannot be overstated, as it provides risk management, psychological comfort, and offers an additional tool to enhance profits.

3.2. The Role of Take-Profit Orders

Take-profit orders play a pivotal role in shaping an effective trading strategy, particularly when dealing with USD/SGD. Traders widely use this type of order as a protecting mechanism against abrupt market movements. Essentially, a take-profit order sets a predefined limit for a trade, securing lucrative profits when the market price reaches the specified level. This significantly reduces the risk of potential losses and prevents the emotional rollercoaster of constant market monitoring.

Furthermore, it’s crucial to calibrate the take-profit orders carefully to make the most of the trading activities. Determining appropriate exit points for trades holds as much significance as selecting the entry points. A properly placed take-profit order can optimize the victory rate by grabbing profits at highs before the market swings in the other direction. One should note that a take-profit order, once triggered, closes the trade, thus helping protect earned profits.

It calls for considerable experience and knowledge to set the precise levels for take-profit orders. As the market conditions for USD/SGD are subject to fluctuations, it’s important to remain adaptable and adjust the trading approach as required. Using advanced tools and indicators can facilitate making accurate predictions and setting reasonable take-profit orders, thus maximizing profits in the long run.

Notably, the usefulness of take-profit orders is not restricted to going long on trades. They’re just as effective when shorting the market. Adjusting the take-profit levels in short trades can help derive profits when the price plunges to the set level. Therefore, traders should capitalize on the versatility of the take-profit orders while dealing with USD/SGD, without overlooking its core essence of risk management.

4. Choosing the Right Trading Platform For USD/SGD

Selection of an appropriate trading platform is a principal prerequisite in your journey to trade USD/SGD. It’s akin to choosing the right vehicle on the complex forex trading highway. The platform chosen should have an interactive, user-friendly interface that simplifies the understanding of complicated market trends and eases navigation.

Additionally, security is paramount when selecting a trading platform. The platform must adhere to strict regulatory standards to guarantee the safety of your investments. The chosen service must put in place robust safeguarding mechanisms to deter potential cyber threats that could jeopardize your investment.

One of the more overlooked facets when choosing a platform is customer support. Trading platforms should offer reliable customer service easily accessible during trading hours, capable of handling any issues quickly and efficiently. There is nothing quite as frustrating as facing a hurdle while trading and not being able to resolve it swiftly.

Accurate and real-time data feed is another crucial requirement. Currency rates fluctuate within seconds, and the platform needs to reflect these changes instantaneously. Delayed information can be the difference between achieving a profit or not.

Lastly, consider if the platform offers valuable extras like education resources and handy tools. These are particularly useful for new traders. They not only help hone trading skills but also enable traders to make more informed decisions based on the most recent market trends and predictions.

In the pursuit of trading USD/SGD successfully, the above-mentioned conditions should be met when selecting a trading platform. Your magnifying glass should focus on usability, security, customer support, data accuracy, and additional resources. With these five necessities in place, you’re better prepared to navigate the busy world of forex trading.

4.1. Evaluating Platform Features

Evaluating the features of your trading platform is a significant cog in the wheel of achieving trading success. Armed with a proficient platform, forex traders can execute trades efficiently and securely. Choosing a platform with advanced charting tools is invaluable. Traders can observe historical data of USD/SGD and visualise market trends, thereby informing their trading decisions. Consider platforms offering customisable indicators, enhancing tailored trading strategies.

On the other hand, platforms with an intuitive user interface simplify trading—enabling quick navigation through various features without the hassle of unnecessary complexities. Also, consider availability and quality of a demo account. This allows one to practice trading USD/SGD without risking real capital, enabling skill development and strategy testing.

Security measures are equally paramount in a platform selection. A reliable platform has industry-standard encryption protocols to safeguard your financial and personal information. Customer support is another critical factor—readily available assistance is crucial for effective resolution of technical problems and enquiries.

Additionally, a top-tier platform will provide educational resources, from market news updates, economic calendars to webinars, aiding traders in making informed decisions. Capitalize on these resources to stay abreast with market changes affecting USD/SGD currency pair. Thus, evaluating a trading platform is more than mere aesthetic appeal; it’s about matching a platform with your trading needs and aspirations.

4.2. Comparing Broker Policies

Delving into the various broker policies in place for trading USD/SGD can often feel formidable. However, this process proves critical for the informed trader looking to maximize potential profits and mitigate possible risks. Consider, for instance, the variances in spread fees. Some brokers may charge higher spreads on this currency pair, significantly impacting the profitability of each trade.

Similarly, not all brokers offer the same leverage options. Leverage can quickly amplify profits, but it can also lead to large losses. Therefore, it’s crucial to understand each broker’s leverage policy and choose one that aligns with your risk threshold.

In addition, the order execution policies differ from one broker to another. High-speed execution can mean the difference between a profitable trade and a loss, especially in volatile currency pairs like USD/SGD.

Lastly, withdrawal policies should not be overlooked. Hidden fees and lengthy waiting period on withdrawals may turn your profitable trade into an unpleasant surprise. Hence, a thorough examination of these policies is of utmost importance.

The user interface is another element to factor in when comparing brokers. A difficult-to-use platform can create unnecessary hurdles in the trading process, potentially leading to untimely and costly mistakes.

Warrant special attention to each broker’s customer service as well. In the often-unpredictable world of forex trading, having reliable support standby can make all the difference. Hence, the availability, responsiveness, and competence of each broker’s customer service team should form an integral part of your broker comparison.

Bearing in mind that while all these policies are paramount when selecting a broker to trade USD/SGD, individual preferences and trading styles should also be at the forefront of your decision-making process. An approach tailored to your unique trading style and risk preference is often the most successful.