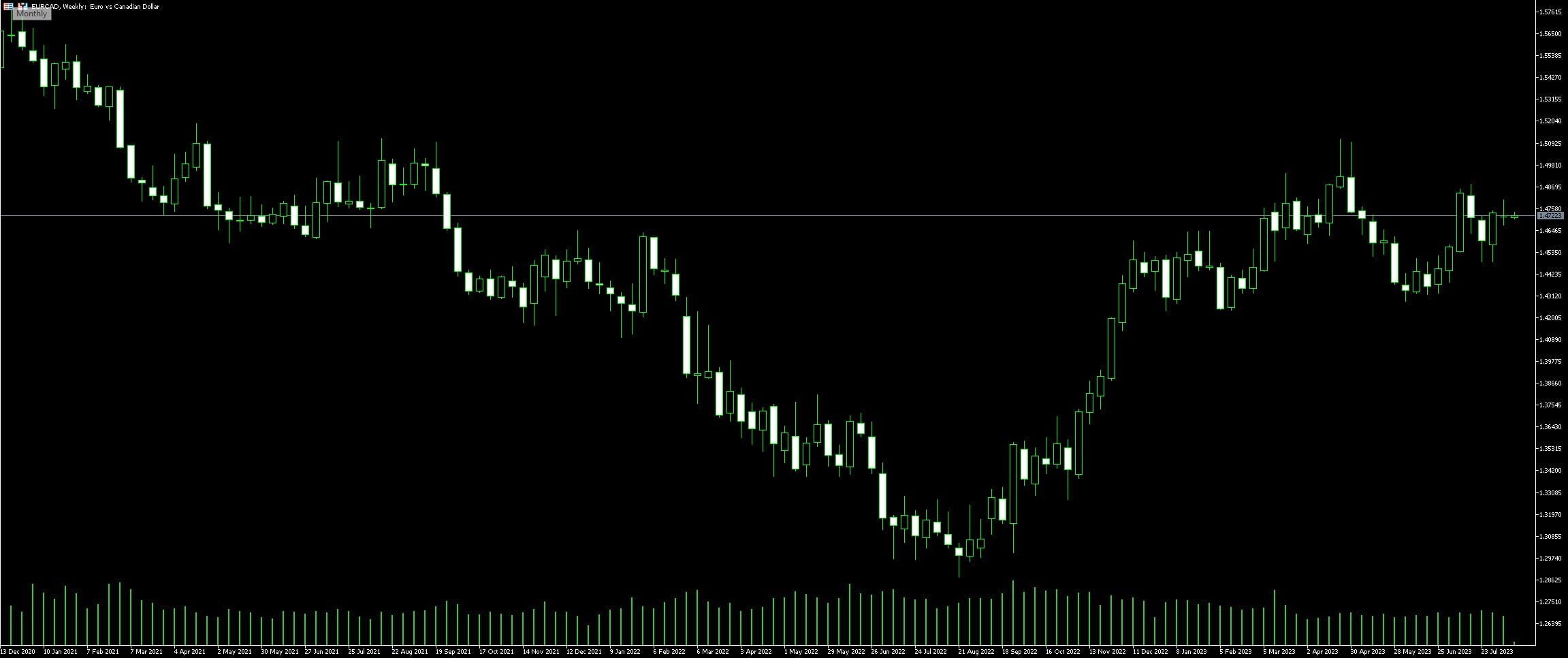

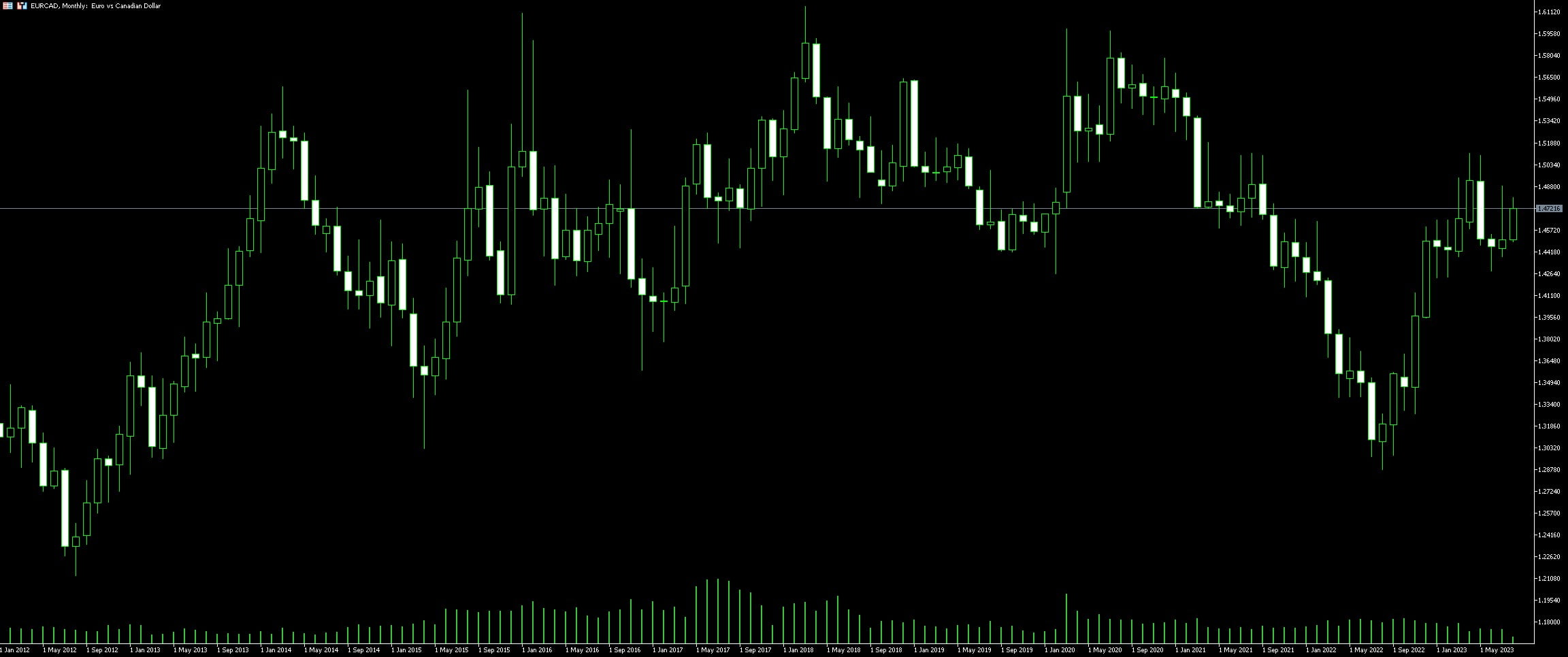

Live Chart Of EUR/CAD

1. Understanding the EUR/CAD Currency Pair

The EUR/CAD currency pair signifies a cross between two contrasting economies: the Eurozone and Canada. The Euro (EUR) constitutes a collective economic framework made up of 19 European Union countries, while the Canadian Dollar (CAD) underscores Canada’s robust economy tied primarily to North America. Drawing together these two distinct monetary realms, trading EUR/CAD engenders its unique set of dynamics.

To gain a good handle on the EUR/CAD pair, it is pivotal to understand the key factors that influence the values of EUR and CAD. This includes political influence, economic performance, and financial policy within the Eurozone and Canada. The European Central Bank (ECB) dictates the monetary policy for the Eurozone, whereas the Bank of Canada (BoC) is responsible for the CAD’s monetary policy. Changes in interest rates, economic health, and overall stability in these regions can provoke substantial fluctuation in the EUR/CAD pair’s exchange rate.

Understanding the correlation of EUR/CAD to commodity prices is another crucial facet. Notably, since Canada is a prime exporter of oil, CAD often ties closely to global oil prices. Any marked shifts in the oil market can radiate pronounced effects on the CAD, and in turn, the EUR/CAD pair.

Seasoned traders often resort to various technical indicators and price charts to assess potential trading opportunities involving the EUR/CAD pair. Tools such as Moving Average, Relative Strength Index (RSI), and Bollinger Bands can provide invaluable insights into market trends and possible price reversal points.

The EUR/CAD pair, therefore, poses an intriguing option for diligent traders capable of scrutinizing and interpreting global economic factors, monetary policies, and commodity price fluctuations. With comprehensive knowledge and careful strategy, traders can turn the inherent volatility of this pair to their advantage, capitalizing on potentially lucrative opportunities.

1.1. Economic Factors Influencing EUR/CAD

Economic factors serve as fundamental driving forces dictating EUR/CAD behavior in the financial markets. The health of the Eurozone’s economy, denoted by economic indicators such as Gross Domestic Product (GDP), unemployment rate, and inflation rate, cause substantial currency fluctuations. Strength in these aspects certainly bolsters the EUR against other currencies. Simultaneously, Canadian economic health plays an equally pivotal role. Economic enhancements, substantial commodities exports, notably oil and strengthening of GDP, typically contribute towards a robust CAD.

Furthermore, the monetary policies implemented by the European Central Bank (ECB) and the Bank of Canada (BoC) also hold implications for EUR/CAD trading. For instance, an increase in the ECB’s interest rates usually fuels the EUR, whereas, an interest rate hike by the BoC generally strengthens the CAD.

Being interdependent, global events such as changes in the geopolitical landscape and economic crises are capable of impacting EUR/CAD as well. An acute understanding of these forces can lead to successful EUR/CAD trading. This drives the relevance of devoting sufficient time to learn about these factors and monitor their evolution. Going beyond the limitations of technical analysis, acknowledging these economically derived market influences may greatly enhance trading performance and strategy efficiency in the EUR/CAD market.

1.2. Historical Price Action of EUR/CAD

The EUR/CAD pair possesses a distinct historical pattern that traders can unearth through meticulous examination of past movements. Significant fluctuations have been a noticeable characteristic of this forex pair, often driven by shifts in the political or economic landscapes of Europe and Canada. Delving into the depths of the history of EUR/CAD, traders can note the influence of crucial events such as the European sovereign debt crisis and changes in Canada’s oil industry. These occurrences have often spurred volatility, creating numerous opportunities for profit or, conversely, unanticipated loss, cementing the importance of understanding the EURO/CAN history.

Historically, the EUR/CAD has shown a strong relationship with commodity prices, particularly oil. As Canada is a significant oil exporter, any drastic changes in global oil prices can also incite substantial price action in the pair. Meanwhile, the EURO is swayed by a myriad of factors, including the monetary policy of the European Central Bank and the economic health of the Eurozone.

One remarkable period was the unprecedented plunge of the EURO against the Canadian Dollar during the 2008 global financial crisis. Following this, the EURO embarked on a swift recovery in 2009, only to face a crushing blow from the sovereign debt crisis in 2010-2012. This tumultuous era played a significant role in driving the EUR/CAD pair’s price action, setting the scene for some of the most volatile trading periods for this pair.

Undoubtedly, the historical price action of the EUR/CAD is an essential guide for both aspiring and seasoned traders. Comprehending its past performance can pave the way for more informed decision-making and risk management in trading this unique forex pair.

2. Developing a Profitable Trading Strategy for EUR/CAD

Spotting entry and exit points proves crucial when trading the EUR/CAD pair. Profit wisdom lies in understanding the pair’s volatility, closely monitoring economic data released by the European Central Bank and Bank of Canada. Movements in the oil market hugely affect the CAD, hence the need to stay updated on global oil price trends. Successful traders focus on creating comprehensive trading plans including clear-cut entry, stop, and exit levels while accommodating market volatility.

Identify indicators that best portray price action for this pair. Traders often look at technical indicators like Moving Averages or the Relative Strength Index (RSI) to spot potential trends or reversal points. While these indicators offer useful insight, they should be used alongside other tools for robust market analysis.

Understanding the correlation between the EUR/CAD and other pairs such as EUR/USD or USD/CAD can also provide valuable direction. If EUR and CAD are moving in the same direction against USD, the EUR/CAD pair may not move as much. Therefore, this correlation insight lays foundation for further strategy refinement.

Trading during the optimal time escalates chances of increased profit. During the European trading session, the EUR/CAD pair experiences increased volatility. Experienced traders leverage this market movement to their advantage, thereby boosting their bottom line.

Continuous refinement of your trading strategy ensures its enduring profitability. Market conditions constantly evolve, reflecting factors such as geopolitical events, changes in monetary policy, and economic reports. Staying informed on these issues and adjusting your strategy accordingly not only positions you strategically in the market, but also garners long-term success.

Practice makes perfect; demo accounts allow traders to test their strategies in real-time market conditions without risking real money. Using a demo account also promotes experience and confidence growth, better preparing traders for their real-time trading journey. No strategy guarantees 100% success, but a well-researched, tested and refined strategy significantly raises the odds of profitable EUR/CAD trades.

2.1. Utilising Technical Analysis

No trading strategy is complete without the inclusion of Technical Analysis. This powerful tool, when combined with astute understanding and tactical application, can provide insightful predictions on the EUR/CAD price fluctuations.

Technical Analysis is a method that digs into past market data, mainly focusing on price and volume information. To a keen trader dealing in the EUR/CAD currency pair, this analysis offers valuable pointers on potential reversal points and future price direction.

Developing a thorough grasp of technical analysis enhances the identification of trends and patterns that have proven relevance over time. The EUR/CAD price chart is not random. It reveals patterns and trends that are indicative of the market’s sentiment.

Looking at the historical price data, levels of support and resistance become conspicuous. These critical points can aid in decision-making about when to enter or exit trades.

Indicators such as the Moving Average and Bollinger Bands have pivotal roles in technical analysis. The Moving Average provides a smoothed line chart which is an amalgamation of past prices. Bollinger Bands, on the other hand, indicate volatility in the market, providing both upper and lower price boundaries.

While understanding and implementing technical analysis is an integral part of trading the EUR/CAD pair, it is of utmost importance to remember its complimentary nature with fundamental analysis for a holistic view of market dynamics. Combining both analytical methods enhances the chances of placing successful trades, thus elevating profitability in the FX market.

2.2. Leveraging Fundamental Analysis

Fundamental analysis is often sidelined when traders focus on EUR/CAD currency pair, but its importance cannot be overstated. Observing the undercurrents of the global economy has a significant effect on this pair’s movement. Everyday occurrences such as trade balances, interest rate changes, GDP reports and employment status are some of the myriad factors that have a gravitational pull on the exchange rate.

It’s a common misconception that fundamentals of the economy only influence long-term trading strategies, but seasoned traders utilise these for short-term strategies too. Even a simple news report can lead to drastic volatility in the forex market. Consider studying important economic indicators released by Europe and Canada on a regular basis. The metrics provide guidance on both the currency’s future direction and the health of the country’s economy.

International politics also plays a potent role. As a trader, it is beneficial to keep an eye on political discourse, trade negotiations, or any global happenings affecting the countries involved. One well-documented incident of extreme volatility in the EUR/CAD was during the Brexit uncertainty. The influence political events have over currency pairs is tangible.

It’s not just about staying updated with the news but understanding the implications of these events over your preferred currency pair. Being abreast of developments and keeping a balanced view of both the microscopic technical analysis and the macroscopic fundamental analysis will prove to be a game-changing approach in your EUR/CAD trading strategy.

2.3. Incorporating Risk Management in EUR/CAD Trading

When trading the EUR/CAD currency pair, integrating risk management strategies can prove indispensable. The first step in this direction would be to understand the volatility of this pair adequately. Realising that the EUR/CAD pair may experience significant price swings during certain economic events can help in better position sizing and stop-loss placement.

Beyond understanding volatility, use forex analysis tools to predict potential market trends. Powerful indicators like Relative Strength Index (RSI), Bollinger bands, and Moving Averages can identify market oversold or overbought conditions, signal potential reversals or confirm a trend, contributing essentially to more informed trade decisions.

Always remember, excessive leverage boosts the potential for higher profit but also inflates the risk of substantial losses. It’s imperative, therefore, to apply appropriate leverage levels based on your risk tolerance and trading objectives. Even the most experienced traders often practice not to risk more than 1-2% of their trading account on any single trade.

Moreover, having a sound risk/reward ratio can serve as a fail-safe against any potential market downturns. As the aim is to earn more when one is correct than what is lost when wrong, focusing on trades with a risk/reward ratio of 1:2 or higher can be beneficial. A trader’s ultimate goal should be to keep losses to a minimum and make sure that winning trades outperform the losing ones.

Furthermore, keeping emotions in check and sticking to a predefined trading plan becomes crucial during market volatility. The key here is to not let fear or greed drive the trading decisions. Implementing set entry and exit strategies and sticking to the predefined rules could fortify the trading approach and mitigate risks effectively.

Embracing these time-tested risk management techniques while trading EUR/CAD can lead to an improvement in overall performance. However, it’s worth noting that no strategy guarantees success, and each individual’s experience with these practices may vary. It is ultimately about finding what works best in your specific scenario.

3. Ideal Conditions for EUR/CAD Trading

Varying conditions can influence the landscape of EUR/CAD currency pair trading. A distinct factor that traders heavily consider is the economic performance of the European and Canadian economies. Unpredictable and strong economic indicators from the European Central Bank (ECB) or the Bank of Canada (BoC) can spur high volatility, presenting opportunities for traders to potentially profit from swift moves in the market.

Another pivotal aspect revolves around interest rates; the ECB and BoC policy decisions can drastically impact the value of the EUR/CAD. For instance, an increase in interest rates typically raises the appeal of a currency, potentially generating profitable scenarios for traders who can predict these changes before they transpire.

Furthermore, the price of oil is intrinsically tied to the Canadian dollar due to Canada’s substantial oil exports. Any significant price fluctuation in oil can impact the EUR/CAD, offering traders another avenue to explore when exploiting optimal trading conditions. Intriguingly, this relationship often defies the usual correlation seen in other currency pairs, providing a unique perspective to apply in strategy formulation.

Ultimately, a keen understanding of these conditions – the economic performance of the associated countries, interest rates, and the price of oil – are paramount in navigating the often unpredictable waters of EUR/CAD trading. Harnessing this knowledge effectively can enable traders to identify key trading opportunities, mitigate potential risks, and potentially reap significant rewards.

3.1. Trading During Optimal Market Hours

Trading during optimal market hours is an essential aspect for yielding potential profits. With EUR/CAD, it’s the overlapping trading hours between European and Canadian financial markets that give rise to lucrative opportunities. Typically, the most volatile sessions occur when the worldwide economic data is released. These are the moments when the trading volume spikes, presenting traders with the opportunity to make significant gains. A keen eye on Forex market hours combined with solid strategies can greatly enhance the chances for success.

Determining the best timeframe to trade involves understanding the intricacies of market liquidity and volatility. Market liquidity, simply put, measures the ease and speed at which a financial instrument can be bought or sold without altering its market price too much. High liquidity conditions offer traders tighter spreads, which subsequently lowers transaction costs. Thus, during optimal trading hours, when the markets are inundated with traders, the liquidity is typically high.

Market volatility signifies the degree of variation in a trading price series over a specific period. High market volatility indicates rapid changes in market prices, which could potentially lead to larger profits or losses. Therefore, for EUR/CAD traders, it is palpable to acknowledge that volatility and liquidity usually peak during the overlapping hours between European and Canadian trading sessions.

Defining a quality trading plan fuses technical analysis, fundamental analysis, and a comprehensive risk management strategy. Given the unique attributes of EUR/CAD, aligning trades with optimal market hours could further leverages the potential for sustainable profits. It’s paramount not to rely solely on this factor, but to utilize it in conjunction with other pertinent elements of a balanced trading system. Keep in mind, a thorough understanding and application of strategic planning within these optimal market hours could help mitigate trading risks, making for a smoother trading journey.

3.2. Trading in Different Market Conditions

In the realm of trading, adaptability is essential. Successful traders understand that different market conditions require specific trading strategies, with the market conditions largely dictating whether a trader should take a long or short position. An awareness of prevailing economic indicators, such as interest rates and GDP growth, is crucial when trading the EUR/CAD currency pair.

Volatility is an undeniable force in any market, and the EUR/CAD pair is no exception. Significant shifts in volatility often indicate potential trading opportunities. When the market is highly volatile, aggressive strategies, like breakout trades, have the potential to produce considerable returns. On the other hand, during periods of low volatility, range strategies, which involve buying at support and selling at resistance, tend to be more effective.

Trends are another decisive factor. Trend trading strategies, where traders aim to profit from a security moving in a particular direction, can lead to significant gains when trading the EUR/CAD pair. An uptrend communicates strength in Euro or weakness in Canadian Dollar and open opportunities for long trades, while a downtrend indicates opportunities for short trades.

The Economic Calendar tool is a trader’s lifesaver. It provides crucial insights into upcoming economic events that can impact the EUR/CAD rate. For instance, the release of Eurozone CPI or Canadian employment rate shifts the market dynamics significantly. By leveraging this tool, traders can predict market movements and make informed decisions accordingly.

Then there are market sessions. The overlap of European and Canadian trading sessions can bring an amplified level of market activity. These sessions might carry increased volatility, providing possible trading opportunities. Conversely, times outside these active sessions often witness reduced price movements, favoring more conservative trading strategies.

Trading the EUR/CAD pair successfully involves a keen understanding of these market conditions, and the flexibility to adjust to sudden shifts. The ability to adapt trading strategies and respond promptly to market changes is central to sustainable success.