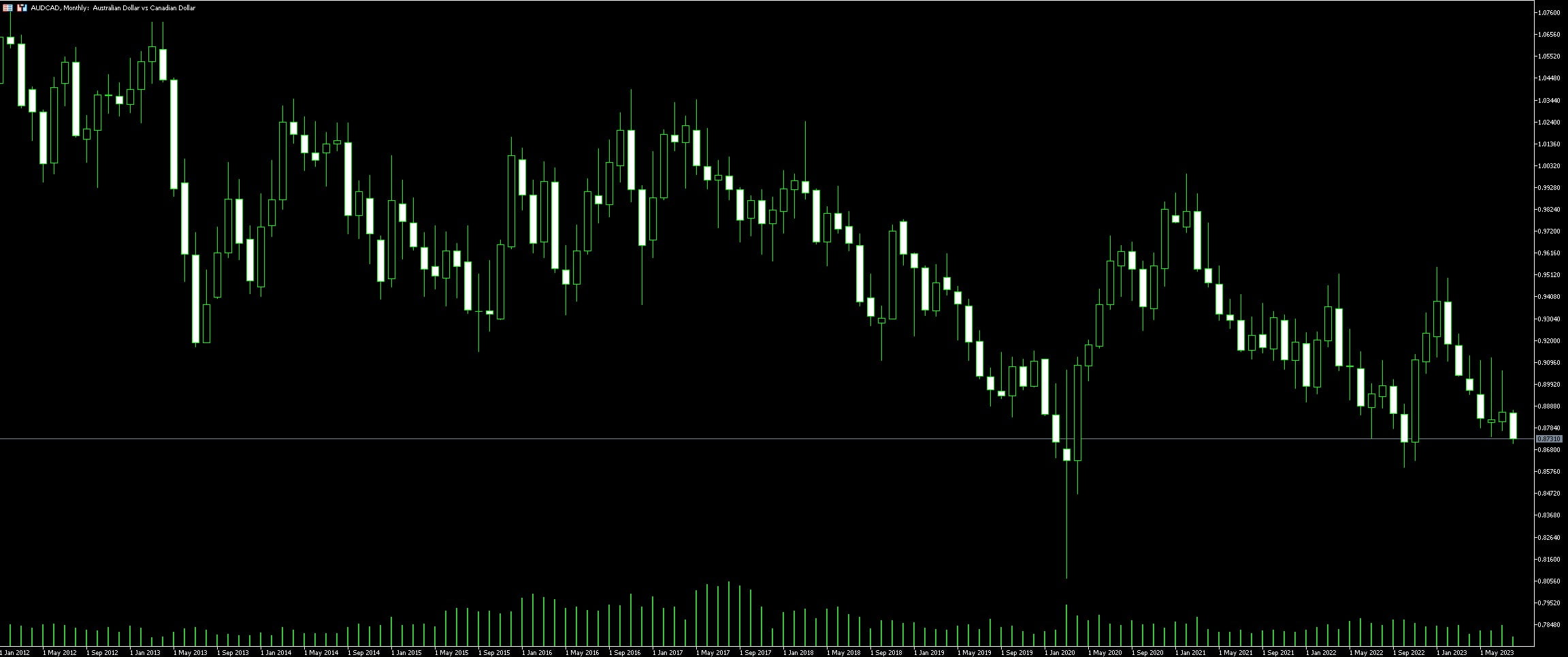

Live Chart Of AUD/CAD

1. Understanding AUD/CAD Forex Pair

Trading the AUD/CAD forex pair requires a clear understanding of the factors that influence the value of these two currencies. Relying heavily on commodity prices, the Australian Dollar (AUD) is often seen as a commodity currency. Australia’s economy is significantly impacted by its natural resources, including iron ore, coal, and gold. Any fluctuations in these commodities can affect the strength of the AUD.

On the other hand, the Canadian Dollar (CAD) is largely influenced by oil prices, due to Canada being one of the world’s leading oil producers. As such, movements in oil prices can have a significant effect on the CAD.

Understanding the intricate connection between commodity prices and the AUD/CAD forex pair is key to implementing successful trading strategies. Observing fluctuations in commodity prices can provide an indication of potential movements in AUD/CAD exchange rates.

Global economic conditions and central bank policies are other influential factors. True to its commodity currency status, the AUD is often sensitive to changes in global growth outlook. Conversely, the CAD can be influenced by domestic economic indicators, such as employment data and inflation reports. Additionally, the trading strategies must cater to the monetary policies set by the Reserve Bank of Australia and the Bank of Canada, as these policies can impact the strength of the respective currencies.

Trading AUD/CAD also requires awareness of the time zone differences between Australia and Canada, which can impact trading hours and market volatility. Overall, successful AUD/CAD trading hinges on a multifaceted approach taking into account commodity prices, economic indicators, central bank policies, and time zone differences.

1.1. Fundamental Basics of AUD/CAD

Trading the AUD/CAD presents some unique opportunities and challenges due to the intrinsic dynamics of this pair. AUD, the Australian Dollar, is recognized as a commodity currency due to Australia’s vast natural resource exports, such as coal and iron ore. The fluctuating global commodity prices, in addition to Australia’s monetary policy and economic health, greatly impact the value of the AUD.

On the other hand, CAD, the Canadian Dollar, is strongly influenced by Canada’s oil exports. As one of the world’s biggest oil exporters, any shift in oil prices has a significant impact on the CAD’s value. Understanding these factors is key to formulating a successful AUD/CAD trade strategy.

The AUD/CAD pair also interacts with the USD, the global reserve currency. Events affecting the USD can cause ripples in AUD/CAD dynamics, such as changes in U.S. monetary policy or significant shifts in the U.S. economy.

Furthermore, the correlation between the AUD and CAD is noteworthy. When the AUD strengthens or weakens against major currencies like the USD or EUR, the CAD often follows. However, it is not a perfect correlation, and disparities can create profitable trading opportunities. Also, be aware of economic indicators from both countries like GDP, inflation, unemployment rates, or commodity price indexes, as they can provide valuable cues about potential currency movements.

1.2. Examination of AUD/CAD Trading History

Scrutiny of historical data, when it comes to AUD/CAD trading, can give key insights into market behavior and help form effective trading strategies. An understanding of the finer details, like peak trading periods or major dips, can often provide the edge traders seek. So, let’s delve deeper into the historical aspects of AUD/CAD trading.

Trade records reveal that AUD/CAD is influenced heavily by economic indicators from both Australia and Canada. Take note of how the Australian Dollar reacts to changes in gold prices, as Australia is known to be one of the world’s largest gold producers. On the flip side, the Canadian Dollar often oscillates based on fluctuations in oil prices, considering Canada’s significant role in the global oil markets.

Seasonal trends are another noteworthy aspect when looking at the historical behaviour of AUD/CAD. A clear example being the Canadian Winter, often leading to a surge in energy demand, thereby impacting CAD value positively.

Another beneficial analysis tool is the study of macroeconomic data from both countries, which might include GDP, unemployment rates, or inflation. Trends observed in these areas can have a significant impact on how AUD/CAD pair behaves.

Historical charts also present a rich source of information in terms of price movements. Technical analysis of past data can help identify potential entry and exit points, reliable support and resistance levels, and even provide predictive readings of future price movements.

By examining AUD/CAD trading history, it is evident that strategies formed on thorough research and deep understanding of market dynamics hold a better chance of yielding successful trades. Therefore, traders are always encouraged to meticulously analyse past data, and not solely rely on current trends or instinctual judgment.

2. Effective Strategies for AUD/CAD Trading

Trend Tracking is undeniably a potent technique when speculating AUD/CAD pairings. Traders proficiently deploy this strategy by tracing the trendline, which essentially embodies the currency pair’s historical trajectory. This is considered a proactive approach, as it helps keep up with market fluctuations and capitalize on imminent trend reversals.

Fundamental Analysis, another notable mechanism, entails extensive scrutiny of socio-economic policies, geopolitical scenarios, and significant events impacting the Australian and Canadian economies. This strategy aids in discerning potential long-term market trends, providing an edge to traders entrenched in long-term trading.

Embracing the concept of Support and Resistance Levels is fervently advised with AUD/CAD pair trading. The identification of these key levels assists in understanding critical points where the price has made considerable adjustments historically. Accurately distinguishing these levels can expedite trade entries and exits to maximize profits while mitigating risks.

Lastly, the usage of Technical Indicators, such as Moving Averages or Bollinger Bands, provides insight into market psychology and momentum. These indicators, when used in combination with other strategies, can amplify chances of netting profitable trades.

2.1. Analysis Techniques for Trading AUD/CAD

In trading AUD/CAD, one size does not fit all approach infers to diverse techniques and strategies an investor can implement. Fundamental analysis serves as a powerful tool in predicting the market movements by understanding the economic indicators and relevant news like interest rate decisions, employment statistics and GDP growth rates from both Australia and Canada.

On the other hand, technical analysis is a fortitude that draws from interpreting historical data and price patterns. Multiple charting tools, such as moving averages and Fibonacci levels, improve the precision of this approach. Besides, the reliance on indicators like Bollinger Bands, RSI, and MACD ensures the timely entry and exit points in trades.

Another prominent technique is sentiment analysis. Since financial markets are strongly influenced by the traders’ sentiments, this approach helps gauge the market mood. Indicators like Commitments of Traders (COT) reports provide an insight into the buying and selling pressures among large speculators.

Lastly, combining these approaches in developing a ‘triage’ strategy bolsters accurate predictions. It involves using fundamental analysis to identify long-term trends, technical analysis for timing entry and exit, and sentiment analysis to understand the market mood, making the trading process of AUD/CAD a seamless affair. Remember, however, that the market is unpredictable and these techniques merely improve the chances of successful trades.

2.2. Creating a Robust Trading Plan

Strategic planning is a fundamental pillar in the world of AUD/CAD trading. Without it, traders are akin to a ship without a compass, veering aimlessly onto treacherous waters. In this regard, a robust trading plan is nothing short of a necessity.

A sturdy trading plan embodies several key elements, namely defining objectives, setting risk parameters, and developing a detailed action plan. Objectives should be clear, measurable, and realistic. They serve as the tactical ‘north star’, guiding all subsequent actions. Similarly, risk parameters set the boundaries beyond which traders will not venture. Risk management is paramount, acting as a protective shield against exorbitant losses. It is not merely about understanding what to invest, but knowing when to cut losses and exit the market.

Finally, an action plan – a roadmap of execution steps – bridges the chasm between strategy and actual execution. Traders are advised to specify ahead of time criteria for order entry and exit, stop losses, order types, and sizes. Precise, quantifiable indicators can form the basis of these. The use of tools such as ‘stop loss’ and ‘take profit’ can automate these decisions, leading to increased precision and efficiency.

To ensure a plan’s resilience, it must be backtested using historical data. This will evaluate its effectiveness and pinpoint potential areas for improvement. Regular reviews, tweaks, and adaptation based on market dynamics are also an integral part of maintaining a robust trading plan. It is prudent to adjust the plan according to fluctuating market situations, as trading is a dynamic process and flexibility paves the way to success.

The creation of a powerful trading plan requires time, effort, and diligent preparation. However, it’s an investment that undoubtedly pays dividends when it comes to the tumultuous world of AUD/CAD trading.

3. Using Trading Platforms for AUD/CAD

Trading platforms are an essential tool when investing in forex markets, especially when trading AUD/CAD. A diverse range of platforms are available, designed to facilitate the varied needs of traders. Robust, user-friendly platforms such as MetaTrader 4 and MetaTrader 5 are among the top choices of seasoned traders. The platforms offer a broad range of tools and features to enhance the trading experience.

There is value in utilizing a platform’s demo account before starting real investing. This enables traders to familiarize themselves with the platform and its functionalities, seeking a better understanding of market conditions without risking any real capital. Proficiency in using these demo accounts often translates to confidences when executing real trades.

Moreover, the course of trading AUD/CAD can be largely affected by leveraging trading strategies. The Economic Calendar feature provided by most platforms is a traders’ must-have. This tool enables traders to keep track of vital events that may impact the AUD/CAD pair. It helps to predict directional moves, which can be beneficial in making informed trading decisions.

Automated trading is another key feature to make use of. By applying pre-defined rules and letting the platform do the trading, traders can potentially capitalize on market opportunities they might miss due to time constraints or lack of presence.

To keep a clear overview of all activities, regular use of trade journaling capabilities can prove effective. This tool helps to document trades, strategies used, and their outcomes, promoting a comprehensive review and improvement for future trades.

Having a solid grasp of the platform’s features and tools undoubtedly contributes to maximizing the potential profits when trading the AUD/CAD currency pair. Leveraging these tools effectively can set the stage for successful strategy execution and sound trading decisions.

3.1. Understanding Trading Platforms

Every trader, from a rookie to a veteran, will agree that a seamless trading platform is a non-negotiable aspect in the realm of trading. A trading platform is more than just a marketplace; it’s a complete toolkit for charting, executing trades, and managing the overall journey of traders. These platforms come with a wide array of features including access to real-time market data, tools for technical analysis, trade execution speed and flexibility.

MetaTrader 4 and MetaTrader 5 rule the roost when it comes to popular platforms for currency trading like AUD/CAD. Offering a user-friendly interface, these platforms support a multitude of languages and provide a variety of charts and technical indicators. Undoubtedly, MetaTrader platforms are a powerful ally when tackling the volatile waves in the AUD/CAD currency pair.

However, it’s not just about the features. The reliability of these platforms is worth mentioning. No worries of downtime or server crashes ruining the moment in a volatile trading scenario. AUD/CAD traders appreciate this, as it allows them to make swift decisions without any lag.

NinjaTrader is another commendable platform that is often under the radar but does splendidly well for AUD/CAD trading. Recognised for its advanced charting abilities, it allows for customizable indicators – a feature highly valued by experienced traders. NinjaTrader is a robust toolkit for the trader who needs an edge.

cTrader can also be deemed as the dark horse amidst trading platforms. Featuring a sleek interface, it caters to the sophisticated tastes of modern traders. While offering exceptional order routing and charting capabilities, it also has an in-built copy trading feature – a godsend tools for new entrants in AUD/CAD trading.

Selecting a trading platform is akin to selecting your trading companion. It requires careful consideration of both current and future needs. The decision process goes beyond “just another software selection,” and dives deep into what would enhance the capacity for larger profit margins in trading AUD/CAD. The key is to understand the feature-set each brings to table, investigate their reliability, and align it to individual trading style. It goes without a saying – a well-chosen platform empowers traders while dealing with AUD/CAD or any other currency pair!

3.2. Choosing the Best Trading Platform for AUD/CAD

When starting out with AUD/CAD trading, picking the best trading platform can be a challenging task. A thorough comparison of many platforms is vital. The process should involve investigating the fees and commissions charged by each platform, as well as the trading tools it offers. Some platforms may offer lower transaction costs, which can save a substantial amount of money in the long run.

On the other hand, others may provide powerful research and analytics tools. These tools can help traders gain deeper insights into the market and its trends. The data provided can also facilitate making informed, data-driven trading decisions. Hence, a balance between costs and trading tools must be established.

Another critical factor to consider is the platform’s usability. The interface should be intuitive and easy to navigate. This ensures that traders can conduct their trading activities efficiently without unnecessary disruptions. Most top-tier platforms offer demo trials. Prospective users are advised to make the most out of these trials to assess the platform’s functionality and ease of use.

Evaluating the platform’s customer support is crucial too. There should be timely and professional assistance available round the clock to help traders solve any problems they may encounter.

Finally, the platform’s security measures are essential to protect the trader’s investment and personal information. The best platforms go the extra mile to ensure that their systems are secure from cyber threats. The platform should also be well-regulated and licensed by the appropriate financial authorities.

By carefully considering each of these aspects, traders can increase their chances of selecting the best platform for their needs. They can then confidently trade in the AUD/CAD pair, equipped with the right tools and services.