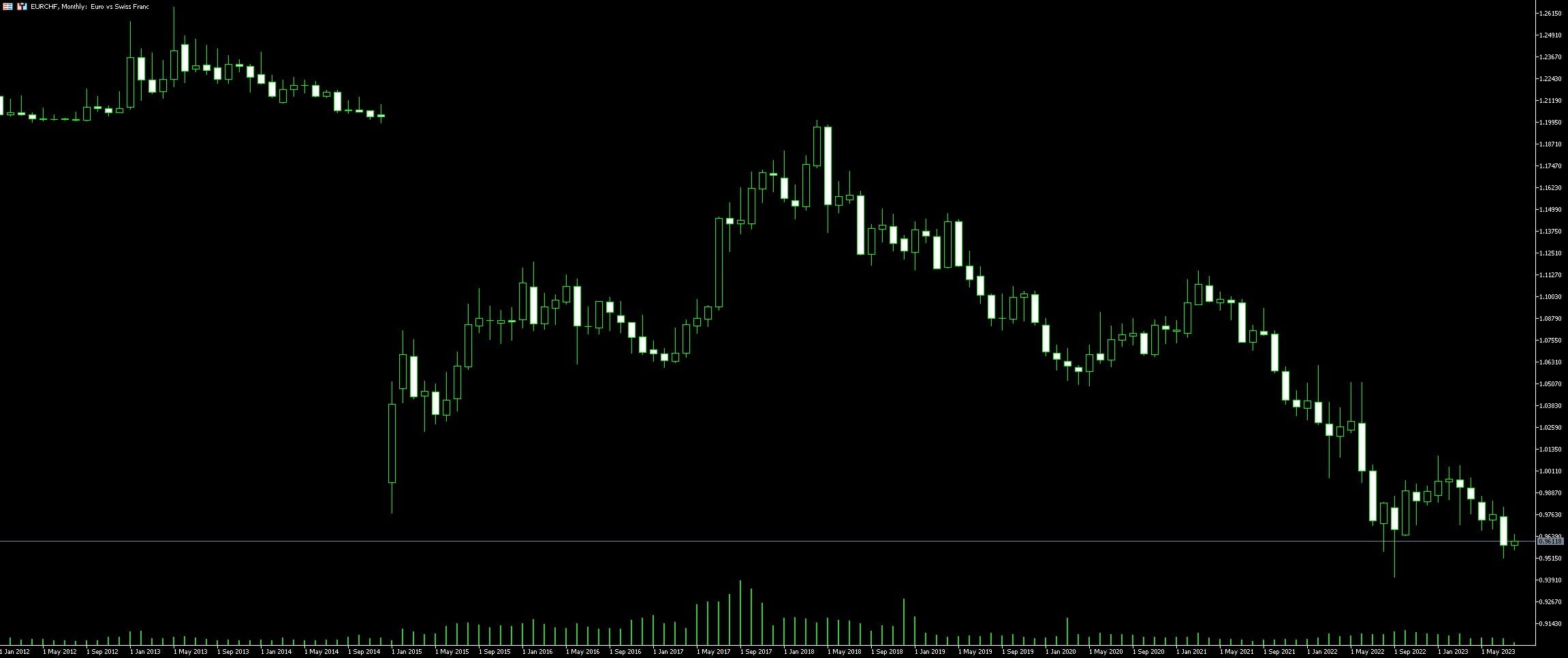

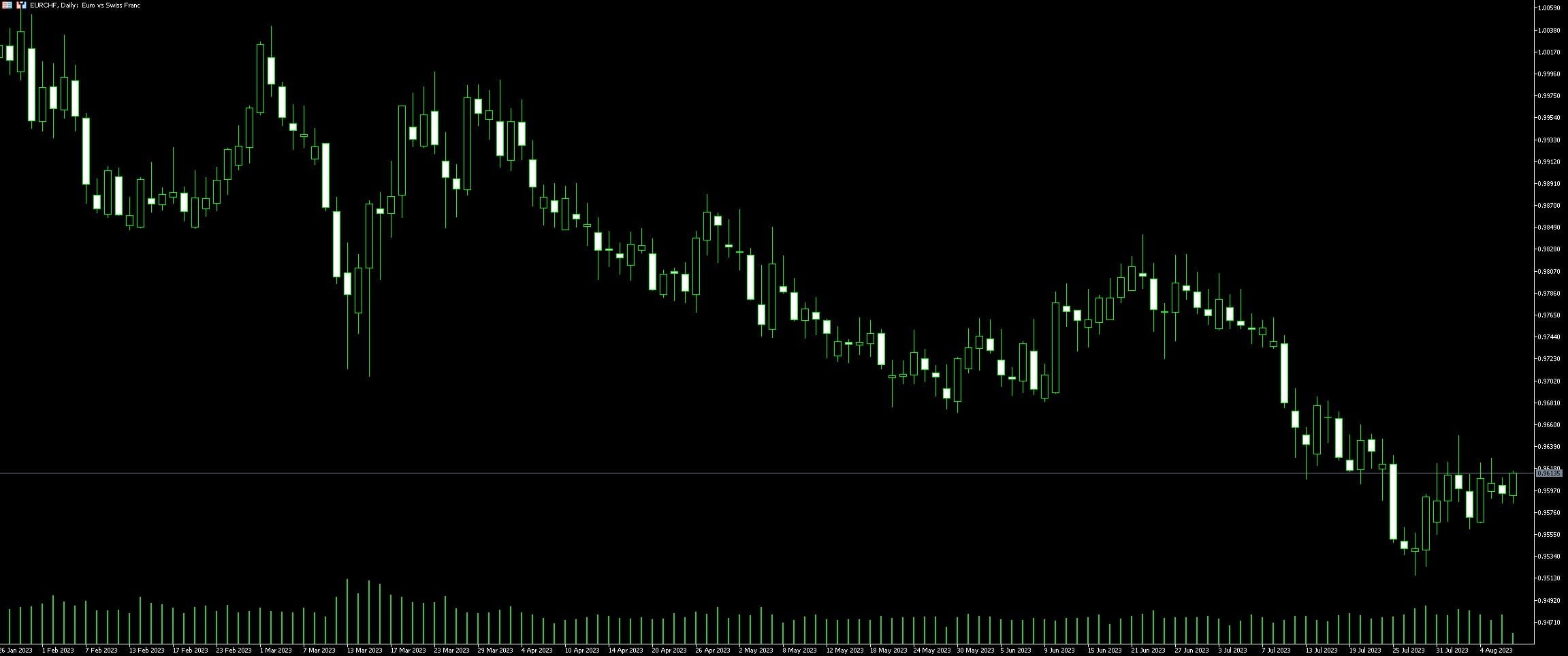

Live Chart Of EUR/CHF

1. Understanding EUR/CHF Trading

EUR/CHF trading signifies the exchange of the Euro (EUR) and the Swiss Franc (CHF) in the Forex market, which holds incredible potential for experienced and novice traders alike. Given as the value of one Euro in terms of Swiss Francs, the EUR/CHF rate is sensitive to a wide array of economic and political factors.

For achieving success in EUR/CHF trading, it necessitates a thorough comprehension of both the European and Swiss economies. Even minute fluctuations in interest rates, employment statistics, gross domestic product (GDP) data, and political stability can cause significant shifts in the EUR/CHF rate. Hence, keeping an eye on economic calendars for scheduled announcements and events becomes paramount.

Technical analysis, the practice of predicting future price movements based on past trends, is another vital aspect of EUR/CHF trading. The focus lies on price charts and indicators to identify potential opportunities for profit. Moreover, trading strategies – such as scalping, swing trading, and position trading – each offer distinct approaches to the market, warranting a firm grasp on their application.

Risk management is as crucial as the aforementioned factors and can often be the distinguishing factor between success and failure in EUR/CHF trading. Setting stop-losses, determining the proper leverage, and profiting from small price swings all play a part in minimizing potential losses and maximizing profits.

In the volatile landscape of EUR/CHF trading, one cannot undermine the importance of proper broker selection. Opting for a broker offering low spreads, efficient customer service, and advanced trading platforms can pave the way for a smoother and more profitable trading journey. Therefore, executing due diligence on this front is crucial for every trader.

These guidelines form an integral part of the basic toolkit for traders aiming to venture into EUR/CHF trading. The complexity and diversity of this form of trading necessitate a focused and disciplined approach, with equal emphasis on knowledge accumulation and practical application.

1.1. Basics of EUR/CHF Currency Pair

Understanding the fundamentals of the EUR/CHF currency pair begins with a breakdown of the individual currencies involved. The EUR or Euro, is the standard monetary unit used by the Eurozone — a group of 19 European Union member states. It’s one of the world’s leading currencies and heavily influences global economic conditions.

The CHF, on the other hand, is the abbreviation for the Swiss Franc, the official currency and legal tender of Switzerland and Liechtenstein. Widely considered as a reliable ‘safe haven’ currency, the CHF holds a strong influence in foreign exchange (forex) markets due to Switzerland’s robust and stable economy.

In the world of forex trading, a ‘currency pair’ like EUR/CHF signifies the price relation of these two currencies. The base currency (EUR) is always quoted against the quote or counter currency (CHF). For instance, if the EUR/CHF pair exhibits a rate of 1.10, this translates to the requirement of 1.10 Swiss Francs to buy one Euro.

Trading the EUR/CHF pair involves the forecasting of this exchange rate, either increasing (long position) or decreasing (short position) in the future. Factors impacting this pair include divergences in interest rates set by the European Central Bank and the Swiss National Bank, geopolitical events, economic indicators, and risk sentiment. Doing a thorough analysis of these variables is pivotal when making informed trading decisions and minimizing potential losses.

1.2. Dynamics of the EUR/CHF Forex Market

The EUR/CHF market, favored by many Forex traders, boasts of a dynamic landscape set by two of the world’s most powerful currencies. At the heart of this movement stands the Euro (EUR), the official currency of the European Union, and the Swiss Franc (CHF), Switzerland’s official legal tender. Ebb and flow in their respective economies, including factors such as interest rates, political stability, and GDP, play a key part in shaping the EUR/CHF foreign exchange rate.

The Swiss National Bank’s (SNB) monetary policy, renowned for its interventions into the currency market, makes the CHF an intriguing currency to trade. Quite often, these interventions cause unexpected moves in the EUR/CHF currency pair, offering opportunities to traders. On the other hand, the EUR movement hinges greatly on factors such as European Central Bank’s (ECB) interest rates and the overall economic health of the Eurozone countries.

Technical analysis remains a key strategy for predicting price movements in this currency pair. Traders look for chart patterns, price levels, and technical indicators for hints on future price direction. Nonetheless, given the economic might of the EU and Switzerland, fundamental analysis, which accounts for economic indicators and macroeconomic events, also plays a substantial part in shaping the trading strategy for this pair.

Understanding the intricacies of both currencies is key when taking a position in EUR/CHF. Traders need to stay alert to breaking news related to both economies, as the pair can display high volatility during such times. To successfully navigate this market, traders must manage risk effectively and adjust their strategies in accordance with changing market conditions. While trading the EUR/CHF does carry risks, it also offers significant opportunities for substantial gains thanks to its dynamism.

2. Mastering the Trade: Critical Strategies for EUR/CHF Trading

Understanding the dynamics of the EUR/CHF pair is key to gain a strategic edge in forex trading. Recognizing market patterns and studying these can provide invaluable assistance to accurately speculate the pair’s future movements. This becomes increasingly vital during periods of political instability or significant changes on the macroeconomic scale, both in the Eurozone and Switzerland.

Trading with technical analysis instruments can also significantly improve the success rate. Indicators such as Relative Strength Index (RSI), Bollinger Bands, and Moving Averages can provide insight into potential market shifts. It’s important to accurately read these signals as they offer a precision tool to determine the best entry and exit points.

Another highly effective strategy in EUR/CHF trading is practicing risk management. Implementing a stop-loss order, which automatically closes your position at a certain price level to limit your loss, can guard your capital against steep market movements. Pairing this with a take-profit order ensures gains are secured when the market moves in your favor.

Contrary to popular belief, emotional management is just as critical as understanding technical analysis. The ability to maintain a clear head in a volatile market can be the thin line between success and failure. Traders who act on impulse, instead of following their meticulously crafted trading plan, are likely to suffer significant losses.

Keeping up with economic announcements and global events, notably those pertaining to the European Central Bank (ECB) and the Swiss National Bank (SNB), is paramount. The ECB’s monetary policy has a direct impact on the EUR, whereas SNB decisions are pivotal to the CHF value. Having the ability to anticipate and capitalize on these influences are key attributes of a successful EUR/CHF trader.

Understanding advanced trading concepts like leverage and margin is essential, especially in a market as liquid as the forex. Used wisely, leverage can exponentially increase your capital gains. However, it is a double-edged sword and can equally intensify your losses. Reckless use of leverage is a fast track to financial ruin. Traders should carefully consider all aspects before entering a leveraged position.

Cultivating these skills and strategies will provide confidence in trading the EUR/CHF pair. However, it is essential to consistently review and adjust your strategies in response to changing market conditions. Achieving proficiency in EUR/CHF trading demands patience, dedication, and an inherent understanding of the foreign exchange market.

2.1. Fundamental Analysis in EUR/CHF Trading

Fundamental Analysis, a key strategy in the trading world of EUR/CHF, plays an important role in forecasting the currency pair’s future direction. It takes into consideration a myriad of economic data, geopolitical risks, Central bank decisions, and the prevailing market sentiment.

Economic data such as GDP growth, inflation rates, unemployment figures, and retail sales can significantly affect the EUR/CHF pair’s trajectory. For instance, if releases indicate positive economic growth in the Eurozone, but negative or stagnant growth in Switzerland, the Euro is expected to rise against the Swiss franc.

Interest rates decisions taken by the European Central Bank (ECB) and the Swiss National Bank (SNB) also have a profound impact. Generally, a hike in interest rates strengthens the currency, whilst a cut weakens it. So, if the ECB hikes rates while SNB maintains or reduces theirs, the Euro would typically appreciate against the Swiss franc.

Moreover, the geopolitical climate in the region affects the EUR/CHF trading. Potentially volatile or destabilizing events like conflicts, elections, or referendums can create uncertainty. The Swiss franc, known as a “safe-haven currency,” often strengthens during such times due to its perceived stability.

Lastly, the market sentiment can influence the EUR/CHF pair. Optimistic tones can foster risk-taking and weaken the Swiss franc, while pessimistic tones can trigger risk-aversion, raising the franc’s value.

Embracing fundamental analysis in EUR/CHF trading is vital. It provides the trader with a holistic view of the various factors at play, setting a solid groundwork for informed trading decisions. Be aware of the data releases, keep abreast with central bank decisions, consider the geopolitical risks and always gauge the market sentiment for successful EUR/CHF trading.

2.2. Technical Analysis of EUR/CHF Trades

Technical analysis is a paramount trading tool when trading the EUR/CHF currency pair. It employs historical data to envisage future price movements. One leading manifestation of this technique is the use of charts to determine potential price patterns. For instance, a typical bull or bear flag pattern may offer signals indicative for a future breakout.

EUR/CHF traders may find trend lines, which trace the price highs and lows, particularly advantageous. These lines are instrumental in ascertaining the direction of the current price trend as well as potential reversal zones. A break below a bullish (upward) trend line may indicate the potential initiation of a bearish (downward) trend.

Indicators, such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands provide further insight. Moving Averages can highlight a long-term trend and the RSI is an overbought or oversold signal. Bollinger Bands help traders to apprehend volatility and price levels that are overextended.

Candlestick patterns, such as engulfing patterns, pin bars or dojis can offer additional entry or exit signals. Profound knowledge of technical analysis aids traders in making more informed decisions, which may subsequently lead to more lucrative trade outcomes. Important to note, though, technical analysis is not infallible, it should be amalgamated with other analytical methods like fundamental and sentiment analysis for a more holistic market outlook.

Therefore, EUR/CHF traders should sufficiently equip themselves with substantial understanding of technical analysis’ intricacies to maximize the potential of their trading strategies.

2.3. Currency Risk Management

In the fast-paced world of forex trading, Currency Risk Management stands as a crucial pillar. This concept becomes exceptionally important especially when dealing with pairs like the EUR/CHF, due to the inherent volatility involved. Ensuring the implementation of correct risk management strategies significantly reduces the probability of substantial losses.

To begin, understanding the specific risk associated with the currency pair is paramount. This includes, amongst other factors, an understanding of the ongoing economic trends, geopolitical conditions and public sentiments in the economies associated with both currencies. A comprehensive pre-trade analysis should ideally aim to understand these dynamics and predict their effect on the currency pair.

Furthermore, various strategies such as hedging, diversification, and the use of stop-loss orders can come to your rescue, in terms of risk management. Hedging means taking multiple positions to minimize the loss if the market moves against one’s prediction. Diversification, on the other hand, involves trading multiple currency pairs to spread the risk. Stop-loss orders are also instrumental in limiting the extent of potential losses.

However, effective Currency Risk Management goes beyond implementing strategies. It demands a vigilant monitoring and subsequent adjusting of these strategies according to the fluctuations in market conditions. The liquidity of the EUR/CHF pair is relatively high, warranting constant tracking of your trading positions.

Equally essential is an understanding of risk tolerance as an individual trader. The measure of this varies from trader to trader and often dictates the maximum percentage of the trading capital risked on a single trade. Risk tolerance aids in deciding when to exit a trade and hence, is integral to risk management.

Trading the EUR/CHF can indeed be a rewarding experience, given the possible high returns. However, there is an equal chance that the opposite could happen. This is why mature Currency Risk Management stands pivotal. Although it doesn’t guarantee profits, it undeniably equips traders with a cushion against the inherent risks.

3. Advanced Tips for EUR/CHF Trading Success

Gaining an in-depth understanding of the forces that influence the EUR/CHF pair is the first of many golden nuggets of wisdom in successful forex trading. Grasping the interplay between the economies of Switzerland and the Eurozone countries forms the foundation for trading proficiency in this pair. Expanding on this macro-economic comprehension includes detailed study of international political events and global economics.

Increased leverage is a two-edged weapon of choice for traders. While it can provide potentials for making astounding profits, it also carries significant risks. Smart utilization of leverage in your EUR/CHF trades involves closely-monitored risk management techniques and a well-planned exit strategy. Without diligent adherence to these guidelines, leverage could lead to sizeable losses.

Critical analysis of the forex market should never be neglected. This means employing both technical analysis and fundamental analysis in making educated trade decisions. Technical analysis helps to visualize historical trading patterns and price movements through charts, while fundamental analysis involves interpreting economic data and news. Mingling these two approaches provides a comprehensive insight into the EUR/CHF market.

Finally, keep in mind that the forex market thrives on volatility. Swift market movements may sometimes engender retail investor fear, but can also present affluent trading opportunities within the EUR/CHF pair. Maintaining a proactive stance towards volatility, by staying informed and prepared for sudden market shifts, will greatly enhance your forex trading capabilities.

3.1. Timing Your Trades in the EUR/CHF Market

Understanding the nuances of currency pairs is vital; the EUR/CHF inherently presents distinct advantages and challenges. Crucial to success is capturing the optimal moment for trading. Grasping the intricacies of timing depends heavily on comprehending market shifts associated with the Euro (EUR) and Swiss Franc (CHF), each underpinned by its own economic indicators.

Central to successful trading is appreciating the role placed by interest rate announcements, especially those by the European Central Bank (ECB) and Swiss National Bank (SNB). Interest rates have a profound influence on currency value; an indicator not to be overlooked. Dealers await these announcements, promptly integrating impacts into their buy-sell decisions.

Economic reports are another vital consideration. Ranging from gross domestic product (GDP) numbers to employment rates, these revealing data points offer insight into the economic health of the countries in question. This fundamental analysis forms the basis of sound decision-making.

Tracking such data through an economic calendar permits traders to anticipate market movements and plan trading strategies suitably. Empowered with this information, traders can engage the EUR/CHF market at opportune times, maximizing profitability.

The power of technical analysis is another asset in your trading toolbox. Deploying tools such as currency charts and trend lines, traders can forecast potential price movements, identifying profitable trade entry and exit points.

Trading times also matter. The overlap of the European and North American trading sessions, typically between 13:00 and 16:00 GMT, witnesses peak trading activity. Traders conversant with this ‘power hour’ know that it can offer high liquidity and tight spreads, yielding more trading opportunities.

Note that risk management is essential when timing trades. Implementing stop-loss orders and take-profit levels can safeguard against unforeseen market volatility, assuring that potential losses remain within acceptable thresholds. This stimulates long-term trading success, ensuring your survival in the unforgiving realm of foreign exchange trading.

Combining an understanding of market patterns, trading tools, and risk management, while agog to major economic events, equips traders with the firepower to tackle the mercurial nature of the EUR/CHF market, reaping substantial financial rewards in the process.

3.2. Utilizing Trading Tools and Platforms

Trading EUR/CHF effectively entails making full use of the available trading tools and platforms. Gaining efficiency and accuracy in your trades begins with understanding these tools. Embracing advanced trading platforms such as MetaTrader 4 and MetaTrader 5 can enhance your trading experience by offering a wealth of features and functionalities to simplify trading processes and allow quick trade executions.

Technical analysis tools are essential in making informed trade decisions. Tools such as Fibonacci retracement, moving averages, and oscillators provide in-depth market insights by deciphering past market trends. Familiarising yourself with these tools can empower you to anticipate potential market shifts and position your trades accordingly.

In addition, robust charting platforms are indispensable for any trader. They provide visual representation of price movements, enhancing your insight into market trends and potential trading opportunities. The influential candlestick charts, bar charts, and line charts can convey complex data in an uncomplicated manner, facilitating your ability to spot trading setups.

The benefit of automated trading systems should also not be underestimated. These systems let you design and implement your trading strategies with precision, leaving minimal room for error. They constantly monitor the market for set criteria and execute trades automatically when conditions are met, eradicating the impact of emotions on trading decisions.

Furthermore, integrate economic calendar into your trading routine as it details significant financial events that could impact the EUR/CHF pair. Keeping an eye on these events allows you to anticipate market volatility and strategically adjust your trades. Dive deep into harnessing the power of these trading tools and platforms to optimise your EUR/CHF trading activity.

3.3. Continuous Learning and Practice

In the realm of forex trading, currency pairings such as EUR/CHF present a landscape riddled with dynamic shifts and constant change. It’s an ecosystem where adaptability reigns supreme, particularly with its accompanying requirement for continual learning and practice.

One cannot deny the importance of building a strong foundation of knowledge in economic indicators and key market events that predominantly impact the EUR/CHF exchange rate. Our seemingly complex global financial system is embedded with patterns and trends. Recognizing these, combined with a solid grasp of fundamental and technical analysis, can significantly aid in reading the economic thermometer of the EUR/CHF market.

It’s crucial to build a strategy and remain consistent in its execution. Understanding the ins and outs of your chosen strategy, from its pros to its risk mitigation tactics, is paramount. Despite it being a common pitfall, one cannot afford to let emotions sway trading decisions. The power of backtesting your strategy on historical data can’t be overstated either, as it stands as a vital mechanism to measure its effectiveness.

Practice makes perfect rings true in the world of forex trading. The extensive use of demo accounts offer the perfect platform for testing strategies, honing trading skills, and cultivating a refined understanding of the EUR/CHF currency pair, all without the risk of losing real-world capital.

Henceforth, remain steadfast in the pursuit of knowledge, maintaining a consistent learning curve. Challenge your understanding, refresh your strategies, and regularly seek out evolving trends in an attempt to stay one step ahead in the forex trading game. This guiding principle of continuous learning and practice is, without doubt, the secret to mastering the formidable beast that is the EUR/CHF trading.