Live Chart Of EUR/TRY

1. Understanding EUR/TRY Currency Pair

EUR/TRY is a currency pair denoting the exchange rate between the Euro (EUR) and the Turkish Lira (TRY). This pairing reflects how many liras one euro can purchase. The Euro, being one of the world’s major currencies, is representative of Europe’s economic strength. The Turkish Lira, on the other hand, mirrors the financial health of Turkey.

Trading the EUR/TRY appeals to both long-term investors and short-term traders due to its volatility. Volatility is an attractive feature because it presents greater opportunities for profit. It’s worth noting, however, that with increased potential for rewards comes greater risk.

Movements in the EUR/TRY exchange rate are predominantly influenced by economic indicators, including inflation rates, GDP figures, and interest rate decisions from the European Central Bank (ECB) and the Central Bank of the Republic of Turkey (CBRT). For instance, if the ECB raises interest rates while the CBRT holds steady, the EUR would typically appreciate against the TRY.

Market sentiment and geopolitical events also play a crucial role in shaping the EUR/TRY. Take conversely, if political instability in Turkey was causing concern among investors, there might be a ‘flight to safety’ – with traders selling off the TRY in favor of the more stable EUR.

Trading the EUR/TRY effectively requires a solid grasp of fundamental analysis, keen observation of economic indicators, and an understanding of how geopolitical events can influence market sentiment and behavior. Further, it’s crucial to employ risk management strategies like stop-loss and take-profit orders to protect against adverse movements in the EUR/TRY. A balanced combination of knowledge, skill, and strategy is essential for successful trading in this currency pair.

1.1. The Basics of EUR/TRY

When stepping into the fascinating world of currency exchange, EUR/TRY demands attention from traders. Both novice and experienced individuals find value in this pair due to its unique characteristics. The pair comprises the Euro (EUR), the official currency for 19 countries within the European Union, and the Turkish Lira (TRY), the currency of Turkey.

The driving forces for EUR/TRY are often grounded in economic events and announcements formulating in Europe and Turkey. Understanding the impact of inflation rates, GDP growth, unemployment figures, and political instability is fundamental for potential success in EUR/TRY trading.

Turkey is marked as an emerging economy in the world scene. Its role as one of the leading producers of agricultural products, automobiles, and textile sends a ripple effect across the value of its currency. As such, trade balance fluctuations and industrial growth in Turkey are key ingredients stirring variation in the EUR/TRY pair.

On the European side, the European Central Bank’s interest rate decisions influence the value of EUR substantially. Furthermore, economic indicators like manufacturing PMIs, consumer confidence data, or any changes in the Eurozone’s economic health can lead to shifts in the EUR/TRY.

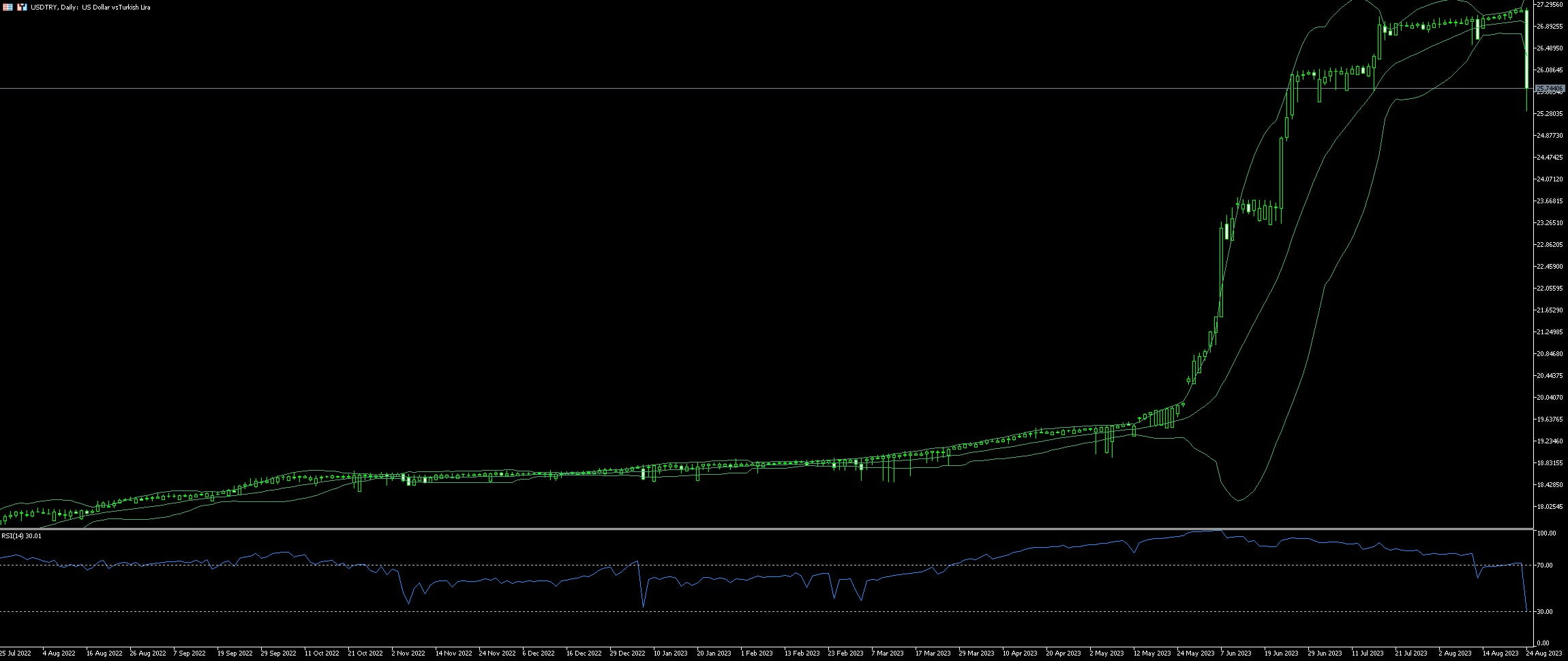

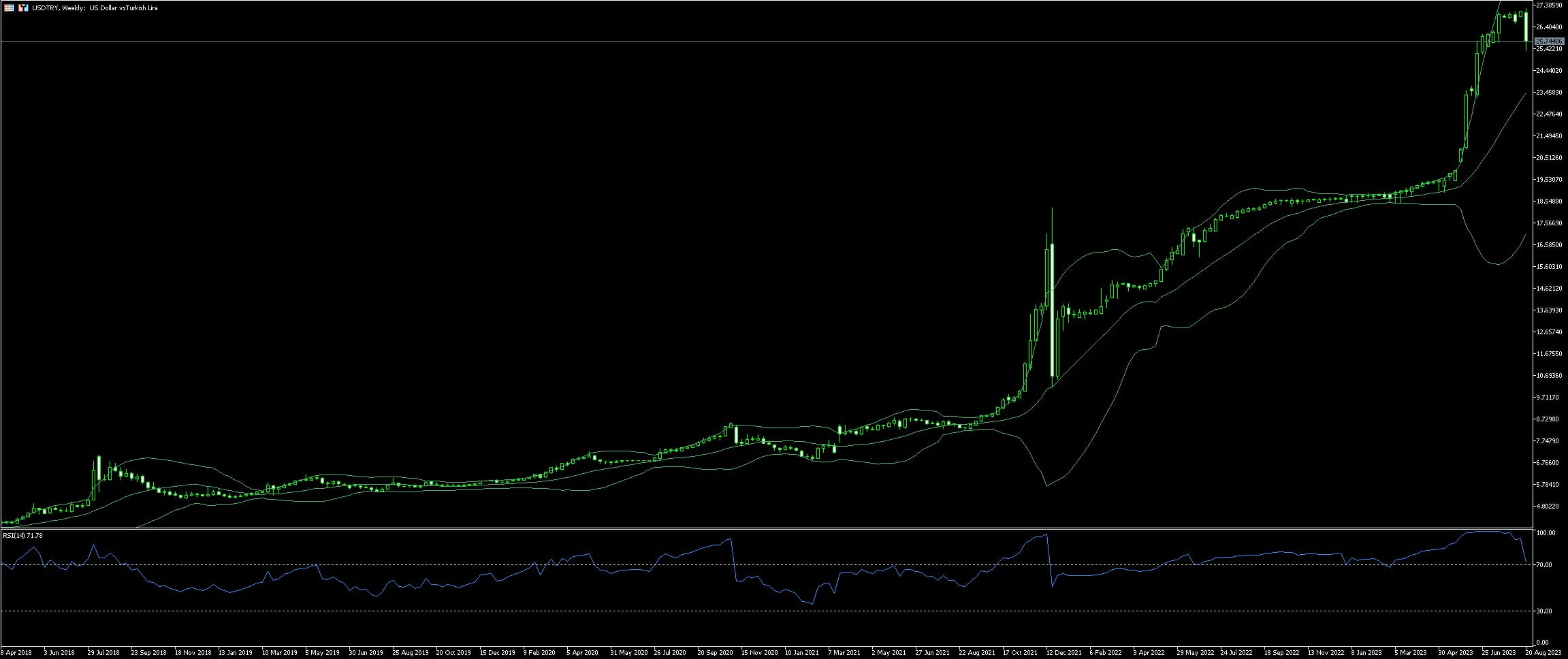

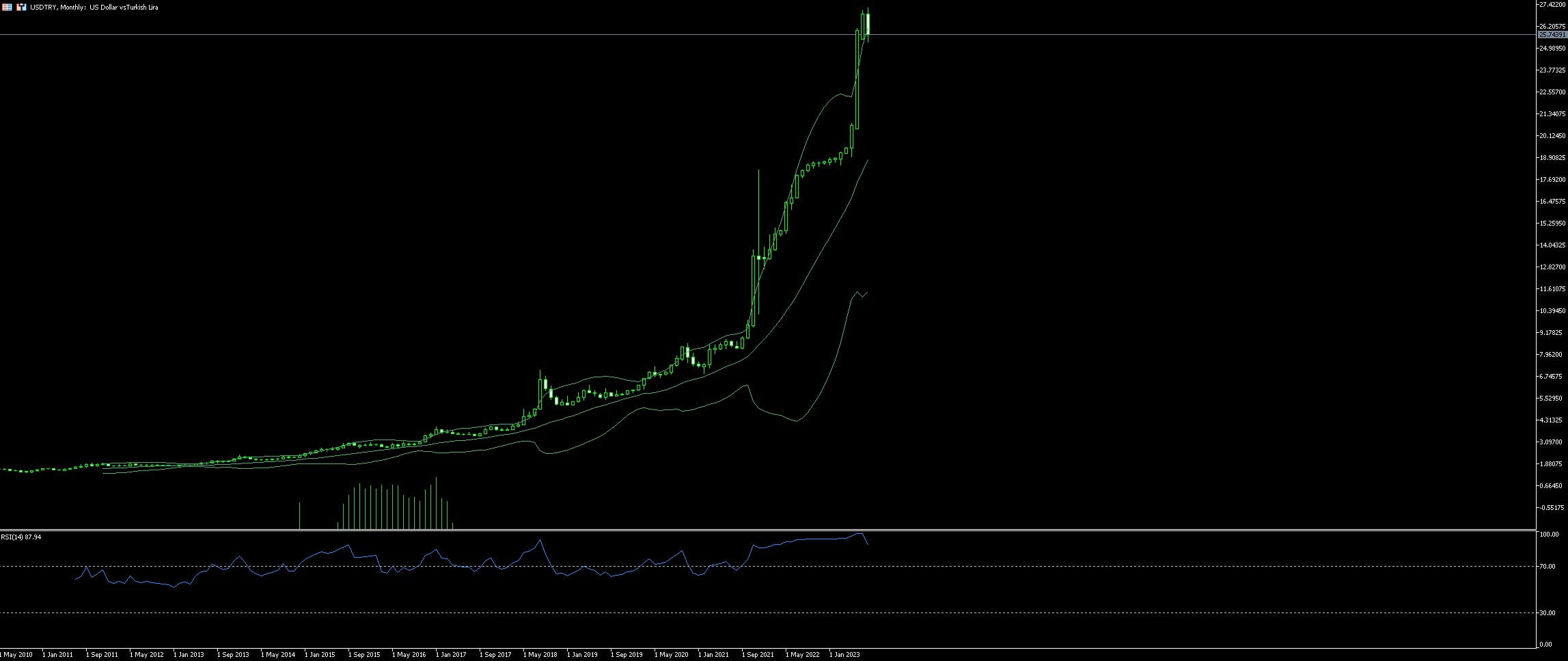

Armed with the understanding of these fundamentals, technic-oriented traders add another layer of prospect by analyzing historical price charts, patterns, and technical indicators. These may include moving averages, relative strength index (RSI), and Fibonacci retracement levels, offering insightful trading signals for the EUR/TRY pair.

Risk management remains the cornerstone of any trading strategy irrespective of the traded pair. Maximizing gains while limiting losses requires a well-defined investment plan. Applying stop-loss orders, limiting leverage, and diversifying the portfolio can mitigate the risk while trading the volatile EUR/TRY pair.

Remember, past performance is not indicative of future results, and trading forex involves significant risk of loss. Always trade responsibly.

1.2 Key Factors Influencing EUR/TRY

Trading the EUR/TRY pair may be influenced by a multitude of factors. Economic indicators from both the European Union and Turkey can move this forex pair significantly. Releases such as GDP growth figures, inflation, and unemployment rates in both regions often cause substantial shifts in the EUR/TRY exchange rate.

Central bank policies are another crucial aspect to consider. The European Central Bank (ECB) and the Central Bank of Turkey set the interest rates for their respective currencies. Any changes in these rates impact the EUR/TRY pair. For instance, if the ECB increases rates, the Euro might appreciate against the Lira while a rate hike in Turkey would have the opposite effect.

Also, the political climate within the European Union and Turkey plays a significant role. Political instability or changes in leadership could influence investors’ confidence, leading to increases or decreases in need for one of the currencies.

Lastly, global trends and events affect all currencies, including the Euro and the Turkish Lira. Occurrences such as changes in oil prices or significant shifts in the US dollar’s value can cause variations in the EUR/TRY pair. Baring all these factors in mind is crucial when navigating the volatile waters of forex trading.

2. Strategies for Trading EUR/TRY

2.1. Technical Analysis

Technical Analysis forms an integral part of decision making in trading EUR/TRY. It comprises studying the price movement and market activity extensively. Indicators like moving averages, trend lines, and oscillators serve as valuable tools, enabling traders to forecast future price movements. Traders utilize these indicators to ascertain the onset of a trend or to predict when it might reverse or continue. A strong upward trend signifies an opportune time to buy EUR/TRY, whereas a decisive downward trend indicates that it may be the right moment to sell.

In using technical indicators, it’s crucial to remain cognizant of false signals. Technical analysis is not foolproof, as many factors, beyond merely price and market activity, influence the behaviour of currency pairs. For instance, political instability, changes in economic policy, or dramatic events can drastically impact the EUR/TRY, irrespective of what technical indicators might suggest.

Consider incorporating chart patterns in your technical analysis arsenal. They’re commonly used to forecast future price movement. Patterns such as head and shoulders, double tops and bottoms, and triangles are among the favourites among traders. It’s important to comprehend that while these patterns can be incredibly useful, they too are not immune to false signals or unpredictable market shifts.

Finally, establishing a comprehensive trading strategy is essential. This strategy doesn’t only revolve around technical analysis, but also considers risk management and emotional control. Combine different elements of technical analysis to ensure a more rounded and effective trading plan.

2.2. Fundamental Analysis

Diving into Fundamental Analysis, it’s an evaluation method that allows traders to estimate the intrinsic value of an asset in the financial market. This technique relies on current events and macroeconomic indicators to determine a currency’s real worth. In the context of the EUR/TRY, various factors play a role when using fundamental analysis to make informed trading decisions.

Interest Rates of the Eurozone and Turkey significantly influence the EUR/TRY price. The disparity in interest rates is a major drive for currency pair fluctuations. Higher interest rates tend to attract foreign investors, increasing demand for that currency and vice versa.

Political and Economic Stability is another vital aspect. Currency rates are sensitive to instability or major changes in a respective country’s political scene or economy. For instance, a political turmoil or economic recession in Turkey could depreciate the TRY against the EUR.

Geopolitical Events and Global Economic Indicators also impact currency exchange rates. A critical episode like Brexit can affect the EUR’s health. Alternatively, global events such as economy data releases from giants like the U.S. or China could sway the EUR/TRY.

Finally, understanding Import and Export trends and their respective influence on the trade balance is crucial. For example, Turkey’s export-dependent economy means an increase in exports could result in a stronger TRY.

Forex traders must be vigilant and continuously update their knowledge, considering myriad variables that influence EUR/TRY. Emphasizing on fundamental analysis, specific awareness of socio-political events, financial news, and economic indices is pivotal to successful trading.

3. Managing Risks in EUR/TRY Trading

Every trade involves a certain level of risk, and the EUR/TRY pair is no exception to this rule. Risk management is an essential aspect of this trade, as effective strategising can protect against substantial losses and enhance profitability.

In the realm of EUR/TRY trading, understanding Economic Events forms a significant part of risk management. Both the Eurozone and Turkey are influenced by distinct factors like political developments, changes in interest rates, and shifts in economic policies. Staying updated with these events can provide cues on potential currency value oscillations.

To minimize exposure, Stop-Loss Orders and Take-Profit Orders come into play. Stop-loss orders are designed to limit an investor’s loss on a position in a security, while take-profit orders allow traders to lock in a specific amount of profit. Implementing these orders provides a safety net, shield the portfolio from extreme volatility.

Lastly, incorporating Diversification as a risk management strategy is highly advisable. Diversification doesn’t necessarily mean trading in multiple currency pairs; it can involve trading within different time frames or adopting various trading strategies.

Furthermore, partnering with a Reliable Broker minimizes operational risks associated with the trading process. Traders should opt for brokers regulated by reputed financial authorities, offering transparency and security in all transactions.

The importance of maintaining a healthy Risk-to-Reward Ratio cannot be overstated. It is always wise to risk a smaller percentage of the portfolio on any particular trade to safeguard the bulk of the investment, even during a string of losses.

Risk in EUR/TRY trading can be intimidating, and yet, with these risk management strategies, traders can manage potential threats and optimize their trading experience.

3.1. Importance of Risk Management

Trading in the foreign exchange market can be a challenging endeavor. Taking into consideration the high levels of risk involved, prudent traders emphasize risk management. In the context of the EUR/TRY pair, risk management becomes even more paramount. The volatile nature of these currencies, influenced by an array of economic, political and regional factors, heightens the need for traders to exercise caution and discipline.

Risk Management when trading EUR/TRY does not merely mean preventing losses, but rather managing them in a manner that would allow for sustainable profitability in the long run. Barring uncontrolled losses, mitigating short term losses is possible through a number of strategies. A balanced portfolio, spreading the risk over numerous trades and adhering to the principle of not risking more than a small percentage of total investing capital on a single trade, can contribute significantly to effective risk management.

Leveraging hedging strategies is another practical approach. A trader could, in anticipation of economic volatility affecting the EUR/TRY pair, enter into a secondary trade that is expected to move in the opposite direction. Should the primary trade face losses, they will ideally be offset by profits from the hedging trade.

Moreover, in an effort to maintain a disciplined strategy, traders can utilize stop-loss orders. These orders, designed to limit an investor’s loss on a position, are set to execute the sale of securities when they reach a predetermined price point.

The use of technical analysis can also provide empirical trading advantages. Identifying trends, recognising overbought and oversold conditions, monitoring key support and resistance levels could play a substantial role in risk mitigation.

In conclusion, the ability to manage risk effectively can significantly increase a trader’s chances of success. Efforts should therefore be driven towards learning and implementing risk management strategies, especially when dealing with highly volatile pairs such as the EUR/TRY.

3.2. Controlling Emotions in Trading

Trading EUR/TRY represents a compelling opportunity for traders. Yet it poses its fair share of challenges too. One of the crucial pitfalls often overlooked: the emotional turmoil that comes with the thrill and risks of this currency pair trading. Keeping a check on emotions often stands as the difference between a successful trade and a failure.

Taking impulsive decisions driven by panic or euphoria often leads to disastrous outcomes. Traders should avoid making decisions when they are emotional as this is a recipe for disaster. Every move should be based on logical analysis rather than emotional reactions.

In the highly volatile world of EUR/TRY trading, overconfidence is a trader’s worst enemy. Convictions like ‘this trade can’t go wrong’ or ‘I can’t lose this time’ based on a few successful trades can lead to illogical and unreasonable decisions.

The principle rule is: do not let fear guide trading decisions. If a trade doesn’t go as planned, traders must learn to accept losses. Continuous fear of loss only leads to stress and can force a trader to exit from a potentially profitable position prematurely.

Moreover, greed drives traders to overtrade, due to the allure of making ‘easy money’. These traders end up taking high-risk trades with huge volumes, which could potentially wipe out all their gains.

To witness success in the EUR/TRY trading market, a trader must master the art of controlling emotions, and learning to make logical decisions based on careful analysis and risk management strategies. Knowing when to enter or exit a trade, and when to stay put are crucial elements that are made clearer with emotional discipline.