Live Chart Of GBP/NZD

1. Understanding GBP/NZD Pair

In the world of forex trading, each currency pair has its unique characteristics and the GBP/NZD pair is no exception. This pair represents the British Pound against the New Zealand Dollar, two economies with diverse economic activity, making it an intriguing prospect for forex traders. The value of this pair fluctuates based on the difference in interest rates set by the Reserve Bank of New Zealand (RBNZ) and the Bank of England (BoE), creating numerous trading opportunities.

The GBP/NZD pair is notoriously known for its volatility. The inherent risk means potential for higher rewards, whereas experienced traders take advantage of studying market indicators to formulate trading strategies. Key elements to monitor include economic news and data releases from both countries, such as GDP, employment figures, and political events amongst others.

Striking a balance between risk and reward, hedging is often implemented in trading GBP/NZD. This technique helps in mitigating potential losses associated with the volatility of the currency pair. It involves opening multiple positions that are likely to move in opposite directions. Alongside, take into account the time difference between the UK and New Zealand, as it can lead to significant price movements during the overlap of trading hours in both zones.

GBP/NZD trading might demand high attention due to the inherent volatility and economic variables influencing its movement. Yet, the potential for significant returns makes it an attractive choice for forex traders.

1.1. Characteristics of GBP/NZD Pair

Trading the GBP/NZD pair as a forex trader is an opportunity filled with the promise of substantial gains or losses due to its unique characteristics. The GBP/NZD currency pair is known for its high volatility, influenced by factors such as economic changes, monetary policy adjustments and geopolitical news. Displaying major price fluctuations on a daily basis, this currency pair may offer traders a robust set of profitable strategies, but also requires a high level of risk management.

Another notable characteristic is the GBP/NZD’s liquidity. As the pair involves two of the world’s most traded currencies, liquidity is relatively high, meaning traders can enter and exit positions with ease without fearing significant price slippage. However, like all forex pairs, liquidity can wane during off-market hours or periods of low volatility.

Additionally, the interest rate differential between the Bank of England (BoE) and the Reserve Bank of New Zealand (RBNZ) offers opportunities for carry trading. A strategy commonly used in forex, where traders aim to profit from the difference in interest rates between two currencies.

Finally, the economic health and stability of the UK and New Zealand directly influence the GBP/NZD pair. Indicators such as GDP growth, trade balance, employment rates and inflation are closely monitored by traders for potential trading signals. During periods of economic uncertainty or instability, the GBP/NZD pair can experience increased volatility and dramatic price swings. Thus, staying abreast of market news and economic developments is key to succeeding in GBP/NZD trading.

1.2. Importance of Economic Indicators

Prospering in the Forex market entails a deeper understanding of market dynamics. One key tool that traders utilize to gauge these dynamics is economic indicators. The economic indicators act like a compass, providing traders with invaluable insights on the performance and direction of economies worldwide.

When it comes to trading currency pairs like GBP/NZD, being privy to such indicators could mean the difference between a successful trade and a disastrous one. Economic indicators like GDP, interest rates, and employment statistics, amongst others, drive the valuations of currencies. For instance, if New Zealand’s economic indicators point towards substantial growth, the NZD will likely appreciate against the GBP. Conversely, if the UK’s economic indicators portray a healthy economy, the GBP might strengthen against the NZD.

Employment statistics, for example, are a crucial economic indicator. A low unemployment rate signifies a robust economy, which could strengthen the respective currency. Once a trader grasps the connection between economic indicators and the strength of a currency, they have taken the essential first step towards profitable trading.

Moreover, it is equally crucial for traders to understand how interest rates govern currency valuation. When a country’s central bank raises interest rates, it typically attracts foreign investors, leading to an appreciation of the domestic currency.

Likewise, traders need to understand that the GDP drives the value of a currency. Higher GDP indicates a healthy economy, and consequently, a stronger currency.

By accurately analysing these economic indicators, Forex traders can devise effective trading strategies. The trader equipped with a deep understanding of economic indicators is the trader best positioned to succeed in the tumultuous world of Forex trading.

Note that these indicators are not crystal balls; they merely offer a probable glimpse of the future. There is always a degree of risk involved in Forex trading. So, while economic indicators serve as a reliable guide, they do not provide a guaranteed forecast of currency movements. However, utilizing them correctly can offer traders a substantial advantage in their trading endeavours.

2. Strategies for GBP/NZD Trading

As an agile market participant, understand that currency pairs can be volatile, and the GBP/NZD pair is no exception. When trading GBP/NZD, the economic health of the United Kingdom and New Zealand is essential to consider. Economic indicators like GDP growth, employment rates, interest rates, and political stability can influence the currency pair’s direction.

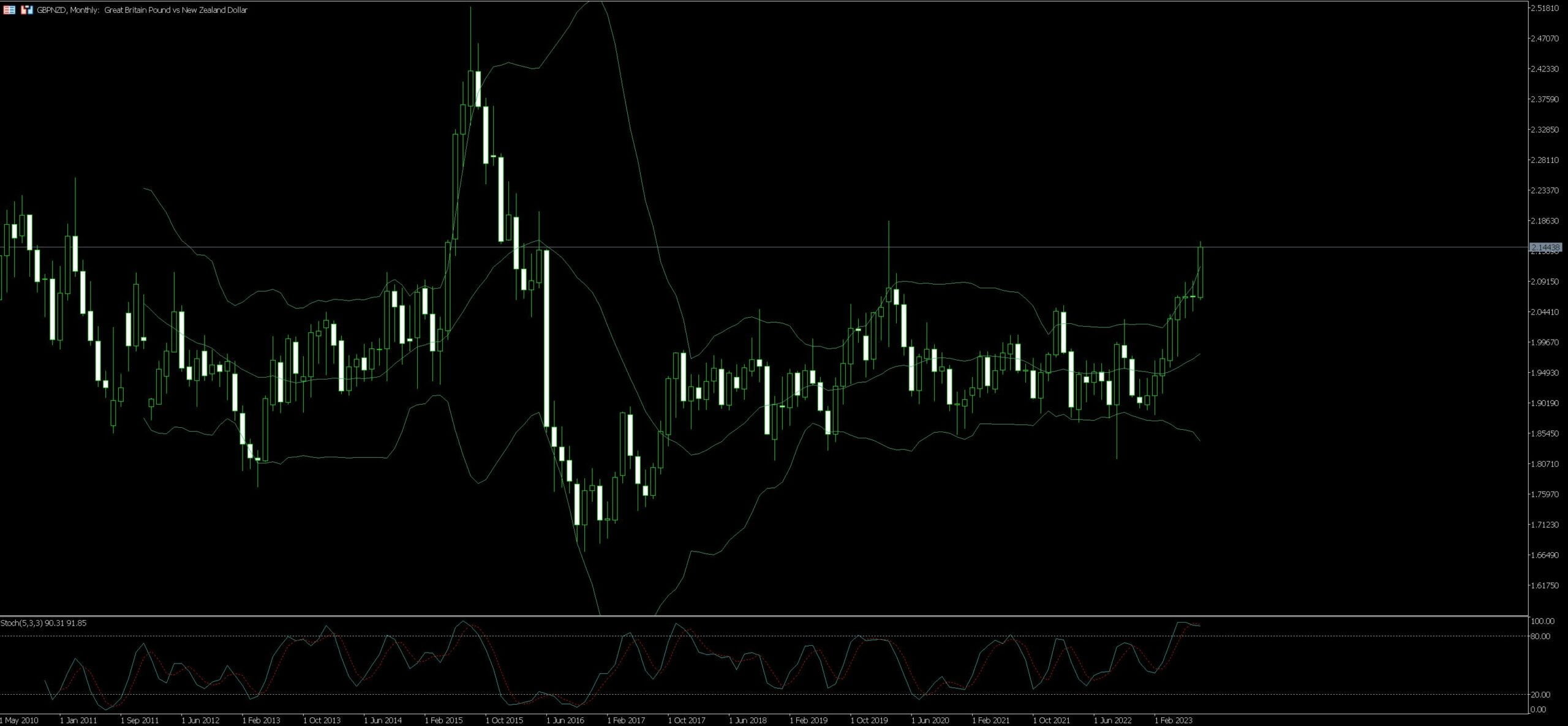

One advantageous strategy includes technical analysis. Traders turn to chart patterns, trend lines, and indicators, such as moving averages or stochastic oscillators, to detect potential trading opportunities. These tools can reveal patterns not easily seen in a market’s price action, giving the trader an edge. For instance, ‘support’ and ‘resistance’ levels become apparent when applying technical analysis, enabling you to predict price turnaround points.

Another strategy focuses on macroeconomic data releases – fundamental analysis. The Bank of England and the Reserve Bank of New Zealand play pivotal roles in shaping the GBP/NZD exchange rate through their monetary policies. Keeping tabs on central bank announcements regarding interest rates could provide early signals of potential market movements.

Scalping may be a viable strategy for GBP/NZD due to its volatility. This strategy involves making a large number of trades within the day, capitalizing on minor price fluctuations. The important aspect here is precision, timing, and quick decision-making.

Lastly, GBP/NZD trading can be influenced profoundly by geopolitical events. Brexit discussions have previously impacted this currency pair due to their implications on the UK’s economic future. Therefore, keeping informed about significant geopolitical events is essential.

The mentioned strategies are not exhaustive, but they can provide a good starting point. Each trader should choose strategies that are aligned with their trading style, risk appetite, and the amount of time they can commit to trading. Always remember, trading in the foreign exchange market involves risk. Thus, ensure to employ appropriate risk management measures to safeguard your trading capital.

2.1. Technical Analysis Strategies

Delving into the realm of Technical Analysis Strategies, one realises the dynamic impact they can have on your GBP/NZD trading. The GBP/NZD currency pair attributes its volatility to factors like geopolitical events, economic data releases, interest rate decisions, to name a few. Trend-following strategies reign supreme here.

Traders monitor trends and capitalise on them through Moving Averages, a crucial indicator manifesting the directional momentum of a given trade. Buy signals are generated when the short-term moving average crosses above the long-term moving average, and vice versa for sell signals. This is also known as a golden cross or death cross, respectively.

Moreover, Relative Strength Index (RSI) serves as an instrumental tool for momentum trading. When RSI exceeds 70, representing overbought conditions, it can be an indication to sell. Conversely, if RSI falls below 30, denoting oversold conditions, a buying opportunity is often signalled.

Additionally, Bollinger Bands can be adopted to discern standard deviations from a mean price level. The upper band signals an overbought market, thereby demonstrating the potential for profit by selling. On the flip side, the lower band indicates an oversold market, indicating the potential for profit via buying.

Lastly, the Fibonacci retracement tool assists in identifying potential reversal points. After identifying a major high and a major low, traders apply the Fibonacci tool and then watch for a price to retrace a portion of the initial move before resuming the initial trend.

Strategic and vigilant application of these technical analysis strategies can enhance the odds of success in GBP/NZD trading. It’s crucial, however, to blend them with a sound risk management system. Always remember that even the most robust strategy does not guarantee risk-free trading. Balancing risk and reward is a perennial component of successful trading.

2.2. Fundamental Analysis Strategies

In the realm of Forex trading, formulating a potent strategy is vital for achieving success and mitigating potential risks. Consider fundamental analysis strategies, which can be applied effectively when trading pairs such as GBP/NZD. This pair encompasses the British Pound (GBP) and the New Zealand Dollar (NZD), both of which are heavily influenced by different economic factors and events. These can include interest rate decisions, employment statistics, or geopolitical shocks, all of which can significantly fluctuate the value of GBP/NZD.

Through a fundamental analysis strategy, traders can scrutinize these raw, economic data to forecast future market trends and behaviours. For instance, if the New Zealand central bank decides to increase its interest rates, it could potentially drive the NZD value upwards, making it more expensive to trade for GBP. On the other hand, if the UK economy shows potent employment growth, it could spur an increase in the GBP value against NZD.

But as with any strategy, awareness and understanding of the global marketplace are critical for conducting accurate fundamental analysis. Regular perusing of economic calendars, for example, allows traders to anticipate potential market-moving events and adjust their trading approach accordingly. Moreover, it’s advisable to stay updated on geopolitical news, as any volatility (such as Brexit) could instigate drastic shifts in the GBP/NZD pair, providing trading opportunities for those who have done their diligence.

Finally, consider the role technology can play in enhancing fundamental analysis strategies. Automated trading systems can execute trades upon occurrence of pre-determined economic events, providing traders a competitive edge by minimizing human error and reaction time in volatile markets.

3. Risk Management in GBP/NZD Trading

Trading GBP/NZD, like any other trading pair, is hugely reliant on efficient and effective risk management. With fluctuations in the global economy affecting these currencies from opposite sides of the globe, traders must be diligent in their approach to fend off potential financial pitfalls.

Risk management isn’t just a suggestion; it’s a necessity when dealing with a trading pair renowned for volatility. Proper strategies protect your capital from adverse market conditions, utilizing both stop-loss orders and take-profit points that keep harmful swings at bay. Applying these measures wisely is crucial to preserving your overall trading account condition.

When it comes to the practical use of stop-loss orders in GBP/NZD trading, one must consider the risk-to-reward ratio. A standard rule is the “1:3 risk-to-reward ratio”, which means you should be targeting three times the amount you are risking in the market. For instance, if using a 70-pip stop loss order, aim for a take profit point of 210 pips. It’s advisable to stick to this ratio as it can yield better results in the long run.

Further, a trader should never risk more than a certain percentage of their trading account on any one trade. This amount varies between traders, but a common consensus is to never risk over 2% of your account balance for any single trade. By maintaining this ‘golden rule’, traders can significantly limit potential losses and keep the door open for future trading opportunities.

Situations arise in trading where leveraging your position seems tempting. This can skyrocket profits if you’re correct, but essentially is a gamble that could decimate your funds rapidly if you’re wrong. Therefore, practicing responsible leverage and maintaining a firm grip on your exposure levels should be a core part of your risk management approach when trading GBP/NZD.

Factors external to the markets like global economic events, political climate changes, and unexpected global crises can directly or indirectly influence GBP/NZD volatility. Being informed about such events and adjusting your risk management based on these factors can lead to more robust protection of your trading assets.

Maintaining a diversified investment portfolio is another key aspect that contributes to managing risk. If a majority of your resources are tied to GBP/NZD, a sudden market change involving these currencies could lead to significant losses. diversification aids in spreading your risk across different assets, improving resilience against market volatility.

Overall, comprehensive risk management allows traders to mitigate the significant risks associated with GBP/NZD trading. The aforementioned practices aimed to guide traders towards better safeguarding their assets and ensuring a fruitful trading experience.

3.1. Importance of Stop-Loss Orders

In the high-speed world of Forex trading, risk management stands as an essential pillar for all participants. One of the most effective risk management tools that every Forex trader dealing with GBP/NZD pair should leverage is the stop-loss order. This strategic order allows traders to set a predetermined level at which their trade will automatically close, thus limiting potential losses if the market moves adversely.

The unpredictable characteristics of the GBP/NZD pair, marked by occasional extreme volatility, calls for the effective implementation of stop-loss orders. Their ability to guarantee exit from a losing position is particularly vital given the uncertainties associated with Brexit and changes in New Zealand’s economic outlook. The stop-loss order mitigates risks by ensuring only a percentage of capital is at stake in event of unfavorable market shifts.

While using stop-loss orders, do note to set a realistic stop point considering both the normal market volatility and personal risk-tolerance limit. Too close a stop loss may lead to an early exit, while one set too far could mean unnecessary risk. Consequently, identifying a balance is key for long term success in forex trading.

In volatile trading times, stop-loss orders gain immense significance. Both abrupt and massive declines can happen, often within short time frames in the GBP/NZD pair. Such situations may seem chaotic and unpredictable, but with a stop-loss order set suitably, traders can create a safety net around their potential losses.

Remember, consistency is key in forex trading, and stop-loss orders are instrumental tools to achieve this. A failed trade does not imply failure in trading; it’s about managing risks to survive such downfalls and promote long-term trading health. Trading GBP/NZD with stop-loss orders is an example of how strategy and discipline result in successful forex trading.

3.2. Utilizing Take-Profit Orders

Maximizing your investment in the GBP/NZD market entails a robust strategy, and one component that demands your full attention is the proper deployment of Take-Profit Orders. Amid the high volatility and uncertainties in this unique currency tandem, setting up a reliable Take-Profit Order is equivalent to erecting a hardy safety net. This critically reduces the chance of leaving profits on the table.

The mystical magnetism of the GBP/NZD market owes a lot to its capacity for large swings, however, seeing through these sudden price roller-coasters to ensure positive trade closure can be daunting. This is where Take-Profit Orders shine, enabling traders to lock in profits at desirable levels without the need for round-the-clock monitoring.

The application of Take-Profit Orders in GBP/NZD trading is straightforward. After entering a position, a trader sets an exit point for the trade, that is comfortably within their profit expectations. When the market hits this pre-set point, the Take-Profit Order is automatically triggered, securing gains and closing the trade.

Take-Profit Orders aren’t only for securing profits; they also serve as a psychological breakwater, deterring rash decisions that might be prompted by market swings. By having a firm exit plan, traders can trade with more confidence, knowing they’re insulated from sudden downturns.

A prudent trader never underestimates the importance of flow in the grand canvas of GBP/NZD trading. This is expertly represented through the nifty utilization of Take-Profit Orders. By maximizing their decisions and strategies through these orders, traders can confidently navigate this high-risk / high-reward landscape, coming out on top with well deserved profits tucked safely away.

3.3. Balancing Risk and Reward

Mastering the artful dance between risk and reward stands at the heart of a successful GBP/NZD trading strategy. When it comes to managing risk, one strategy often adopted involves setting stop loss limits. This ensures that a trader will automatically exit a position should the market turn unexpectedly, thus generating a safety net of sorts against unpredictable changes in currency value.

On the flip side, maximising reward requires a savvy understanding of market trends, economic indicators, and the wider geopolitical climate. An ever-evolving landscape, savvy traders keep a keen eye on political, economic, and societal shifts in both the UK and New Zealand.

Institutions like the Reserve Bank of New Zealand and the Bank of England play highly influential roles. Interest rates, inflation, and employment levels come under constant scrutiny as well. The more familiar a trader becomes with these external factors, the better chances they will have at predicting favorable trading scenarios.

Regardless of the precautionary measures put in place, trading in financial markets like the GBP/NZD invariably involves some degree of risk. This fact underscores the importance of a prudent and consistent approach in every single trade. Combining effective risk management with a well-informed trading strategy is key to achieving a profitable balance between risk and reward.