1. Understanding the Ichimoku Cloud

The Ichimoku Cloud, a unique and comprehensive technical analysis tool, can seem daunting at first glance. But fear not, traders! With a little patience, you’ll soon appreciate its ability to provide an all-encompassing view of market trends and potential reversals.

The Ichimoku Cloud consists of five lines, each offering different insights into the price action. First, we have the Tenkan-sen (Conversion Line) and Kijun-sen (Base Line). The Tenkan-sen is calculated by averaging the highest high and the lowest low over the last nine periods, while the Kijun-sen takes the highest high and the lowest low over the last 26 periods. These two lines help traders identify short-term and medium-term trends, respectively.

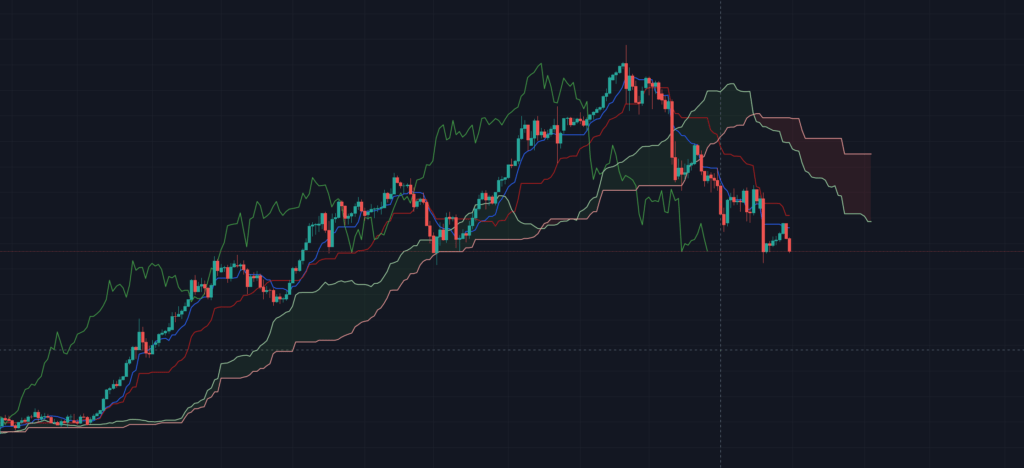

Next, we have the Senkou Span A and Senkou Span B, which together form the ‘cloud’ or ‘Kumo’. Senkou Span A is the average of the Tenkan-sen and Kijun-sen, projected 26 periods ahead. Senkou Span B, on the other hand, is the average of the highest high and the lowest low for the last 52 periods, also projected 26 periods ahead. The area between these two lines forms the cloud. A wide cloud indicates high volatility, while a thin cloud implies low volatility.

Lastly, the Chikou Span (Lagging Span) is the closing price plotted 26 periods behind. This line is used to confirm the other signals provided by the Ichimoku Cloud.

So, how do you use all this information? The cloud provides support and resistance levels, and its color change can signal potential trend reversals. If the price is above the cloud, the trend is bullish, and if it’s below, the trend is bearish. The Tenkan-sen and Kijun-sen also act as dynamic support and resistance levels. A crossover between these two can be a powerful buy or sell signal, especially when confirmed by the Chikou Span.

Remember, the Ichimoku Cloud is best used in conjunction with other technical analysis tools. As with any trading strategy, practice and experience are key to mastering its use. Happy trading!

1.1. Origin and Concept

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile trading tool that originated from Japan. Developed in the late 1960s by Goichi Hosoda, a Japanese journalist, it was designed to provide a comprehensive view of the market in a single glance. At its core, the Ichimoku Cloud is an indicator that highlights support and resistance levels, market trends, and potential trading signals.

The name ‘Ichimoku Kinko Hyo’ translates to ‘one look equilibrium chart’, representing the tool’s ability to provide a balanced view of the market’s condition. The cloud, or ‘Kumo’, is the most distinctive feature of this tool, formed by two lines known as Senkou Span A and Senkou Span B. These lines are plotted ahead of current price, creating a cloud-like visual that can help traders anticipate future market movements.

The Ichimoku Cloud consists of five lines, each providing unique insights into the market. They are the Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A (Leading Span A), Senkou Span B (Leading Span B), and Chikou Span (Lagging Span). Understanding the interaction of these lines and the resulting cloud formation is key to unlocking the benefits of the Ichimoku Cloud.

It’s important to note that the Ichimoku Cloud is not just a standalone tool. It is often used in conjunction with other technical indicators to validate trading signals and enhance decision-making. Despite its seemingly complex structure, the Ichimoku Cloud can be a powerful ally for traders who take the time to understand and apply its principles.

1.2. Elements of the Ichimoku Cloud

The Ichimoku Cloud, a comprehensive indicator, offers a wealth of insights into market trends. It consists of five key elements, each serving a unique purpose in the overall analysis.

- The Tenkan-Sen, or Conversion Line, is a moving average of the highest high and lowest low over the last nine periods. It provides an initial signal for potential trading opportunities, acting as a trigger line for buy and sell signals.

- The Kijun-Sen, also known as the Base Line, is another moving average, but it considers the highest high and lowest low over the last 26 periods. This line serves as a confirmation signal and can also be used to identify stop-loss points.

- The Senkou Span A is calculated by averaging the Tenkan-Sen and Kijun-Sen, then plotted 26 periods ahead. This line forms one edge of the Ichimoku Cloud.

- The Senkou Span B is determined by averaging the highest high and lowest low over the last 52 periods, then plotted 26 periods forward. This line forms the other edge of the cloud.

- The Chikou Span, or Lagging Span, is the current closing price plotted 26 periods back. This line is used to confirm the overall trend.

The cloud, formed by Senkou Span A and B, represents potential support and resistance levels. It’s color-coded for easy interpretation: a green cloud indicates bullish momentum, while a red cloud signals bearish momentum. Understanding these elements and their interactions is crucial for successful trading with the Ichimoku Cloud.

1.3. Interpreting the Ichimoku Cloud

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile trading indicator with a plethora of interpretations. It can seem daunting at first glance, but once you understand its components, it becomes a powerful tool in your trading arsenal.

Firstly, let’s break down the five lines that shape the Ichimoku Cloud: Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A (Leading Span A), Senkou Span B (Leading Span B), and Chikou Span (Lagging Span). Each of these lines provides different insights about the market’s future direction.

- Tenkan-sen is the fastest moving line and it indicates the short-term trend. When this line crosses above the Kijun-sen, it’s a bullish signal and vice versa.

- Kijun-sen is a slower line and it signifies the medium-term trend. If prices are above this line, the trend is bullish, and if they’re below, it’s bearish.

- Senkou Span A and Senkou Span B form the ‘cloud’. When Span A is above Span B, it indicates a bullish trend, and when Span B is above Span A, it indicates a bearish trend.

- Chikou Span traces the current price, but 26 periods behind. If the Chikou Span is above the price, it’s a bullish signal, and if it’s below, it’s a bearish signal.

But how do we interpret all these lines together? Here’s the key: look for confirmations. If the Tenkan-sen crosses above the Kijun-sen, and the price is above the cloud, and the Chikou Span is above the price – it’s a strong bullish signal. The same logic applies for bearish signals. This way, the Ichimoku Cloud allows you to capture the market’s momentum and ride the trend, instead of getting caught in the noise.

Remember, the Ichimoku Cloud is not a ‘magic bullet’. It should be used in conjunction with other technical analysis tools. But once you understand its language, it can provide valuable insights to aid your trading decisions.

2. Effective Trading with the Ichimoku Cloud

Unraveling the mystery of the Ichimoku Cloud is like unlocking a secret treasure of trading wisdom. This comprehensive indicator, developed by Japanese journalist Goichi Hosoda, is a dynamic tool that allows traders to gauge market sentiment at a glance and make informed decisions.

The Ichimoku Cloud consists of five lines, each providing unique insights into the market. The Tenkan-sen (Conversion Line) and Kijun-sen (Base Line) are akin to moving averages, providing short-term and medium-term market sentiment, respectively. A bullish signal is given when the Tenkan-sen crosses above the Kijun-sen, and a bearish signal when it crosses below.

Senkou Span A and Senkou Span B form the ‘cloud’ or ‘Kumo’. The area between these lines is shaded on the chart, creating a visual representation of support and resistance levels. When the price is above the Kumo, the market is bullish, and when it’s below, the market is bearish. The thickness of the cloud represents the strength of the sentiment.

Chikou Span (Lagging Span) trails the current price and can provide confirmation of a trend. If it’s above the price, the market is bullish, and if it’s below, the market is bearish.

The Ichimoku Cloud is a versatile tool that can be used in multiple timeframes, from intraday trading to long-term investment strategies. It provides a complete picture of the market, enabling traders to identify trends, determine momentum, and find potential buy and sell signals. However, like any technical indicator, it should be used in conjunction with other tools and analysis to increase its effectiveness.

Trading with the Ichimoku Cloud is not just about understanding its components but also about interpreting the overall picture it paints. It’s about recognizing the shifts in market sentiment and making informed decisions. Whether you’re a novice trader or an experienced one, the Ichimoku Cloud can be a valuable addition to your trading toolkit.

2.1. Setting up the Ichimoku Cloud on Trading Platforms

Setting up the Ichimoku Cloud on your trading platform is a straightforward process that can be completed in just a few steps. First, navigate to the indicators section of your trading platform. This is typically located in a toolbar at the top or side of the screen. Look for an option that says ‘Ichimoku Kinko Hyo’, ‘Ichimoku Cloud’, or simply ‘Ichimoku’. Once you’ve found it, click to add it to your chart.

The Ichimoku Cloud consists of five lines, each of which provides unique information about the market’s price action. These lines are the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span. Most trading platforms will automatically set the standard parameters for these lines (9, 26, 52), but you can adjust them to fit your trading style.

Once you’ve added the Ichimoku Cloud to your chart, it’s time to customize its appearance. You can change the colors of the lines and the cloud to make them more visible against your chart’s background. Some traders prefer to use different colors for the cloud when it’s above or below the price action, to quickly identify bullish or bearish market conditions.

Understanding how to read the Ichimoku Cloud is crucial for successful trading. Each component provides a different perspective on the market’s momentum and potential support and resistance levels. The cloud itself, formed by the Senkou Span A and B, represents potential areas of support and resistance. When the price is above the cloud, the market is in a bullish trend, and when it’s below, the market is bearish.

Practice makes perfect. Spend some time experimenting with the Ichimoku Cloud on your trading platform, adjusting its parameters and colors until you’re comfortable with how it looks and works. Remember, the Ichimoku Cloud is not a standalone tool, but should be used in conjunction with other technical analysis tools and indicators for the best results. Happy trading!

2.2. Strategies for Trading with Ichimoku Cloud

Trading with the Ichimoku Cloud requires a strategic approach, and understanding these strategies can significantly enhance your trading game. One of the most effective strategies is the Tenkan/Kijun Cross. This strategy involves waiting for the Tenkan Line to cross the Kijun Line, indicating a potential shift in the market trend. The cross above the Kijun line suggests a bullish market, while a cross below indicates a bearish market.

Another strategy is the Kumo Breakout. This involves observing the price as it breaks through the Kumo (cloud). A breakout above the cloud signifies a bullish signal, while a breakout below the cloud is a bearish signal. It’s crucial to note that the thicker the cloud during the breakout, the stronger the signal.

The Chikou Span Cross is yet another strategy to consider. This involves the Chikou Span line crossing the price line. A cross above the price line is a bullish signal, while a cross below is a bearish signal.

The Senkou Span Cross strategy involves the Senkou Span A line crossing the Senkou Span B line. A cross above indicates a bullish market, while a cross below signifies a bearish market.

While these strategies can be highly effective, remember that no strategy is foolproof. It’s crucial to use these strategies in conjunction with other forms of analysis and risk management techniques to maximize your trading success. Trading with the Ichimoku Cloud offers a unique perspective on the markets, providing a comprehensive overview of the market trends, momentum, and support and resistance levels. By understanding and applying these strategies, you can make more informed trading decisions and enhance your trading performance.

2.3. Risk Management in Ichimoku Cloud Trading

Mastering risk management is a crucial aspect of trading, especially when navigating the complex world of the Ichimoku Cloud. This Japanese charting technique, designed to provide a comprehensive view of the market at a glance, can be a powerful tool in a trader’s arsenal. However, it’s not without its pitfalls and understanding how to manage risk is key to successful trading.

One of the primary ways to manage risk in Ichimoku Cloud trading is through the use of stop-loss orders. This allows you to set a predetermined level at which you will exit a trade, effectively limiting your potential loss. When using the Ichimoku Cloud, it’s common to place a stop-loss order just below the cloud or the ‘Kijun-Sen’ line, depending on your risk appetite.

Another effective risk management strategy is position sizing. By adjusting the size of your trade based on your stop-loss level, you can ensure that even if a trade goes against you, your loss will be within a manageable limit. This is particularly important when trading volatile markets, where price swings can be rapid and significant.

It’s also important to consider the overall market context. The Ichimoku Cloud can provide valuable insights into the market’s trend and momentum, but it’s always important to consider other factors such as economic news, market sentiment, and other technical indicators.

Practice and patience are key. Like any trading technique, the Ichimoku Cloud takes time to master and it’s important to practice using a demo account before risking real money. Remember, even the most successful traders make losses – the key is to keep them manageable and learn from them.

In the world of Ichimoku Cloud trading, risk management is not just an option, it’s a necessity. With the right approach and a solid understanding of the techniques involved, you can navigate the markets with confidence and poise.

2.4. Advantages and Limitations of Ichimoku Cloud Trading

Ichimoku Cloud Trading sweeps the trading floor with a plethora of benefits, yet it’s not without its share of limitations, which are essential for traders to understand.

The foremost advantage of this trading strategy is its comprehensive nature. It provides a complete picture of the market, capturing price action, trend direction, and momentum in a single glance. This 360-degree view is a valuable asset for traders who need to make swift, informed decisions.

Another significant benefit is its predictive capabilities. The Ichimoku Cloud can forecast potential support and resistance levels, giving traders a heads-up on market movements. This predictive power can be a game-changer, especially in volatile markets.

Flexibility is another feather in the cap of Ichimoku Cloud Trading. It works across multiple time frames and markets, making it a versatile tool for traders dabbling in stocks, forex, commodities, and more.

However, the Ichimoku Cloud is not a silver bullet. One limitation is its complexity. The multiple lines and indicators can be overwhelming for beginners. It takes time and practice to master this strategy, and even seasoned traders may struggle to interpret the signals during periods of high market volatility.

Another drawback is the potential for false signals. Like any other trading strategy, the Ichimoku Cloud is not foolproof. Traders must exercise caution and use other technical analysis tools to confirm signals.

The Ichimoku Cloud may not be as effective in sideways markets. It thrives in trending markets, but when the market is range-bound, the cloud may provide unclear or misleading signals.

Despite these limitations, the Ichimoku Cloud remains a popular and powerful tool in the trader’s arsenal, offering a holistic view of the market and a wealth of trading opportunities. But as with any trading strategy, it’s crucial to understand its strengths and weaknesses, and to use it in conjunction with other tools and strategies to mitigate risk and maximize returns.

2.5. What is the best timeframe Ichimoku Cloud Trading?

When it comes to Ichimoku trading, selecting the right timeframe is crucial for maximizing its effectiveness. The Ichimoku system is unique in its versatility, catering to both short-term and long-term traders. However, the optimal timeframe largely depends on the trader’s strategy and goals.

- Short-term Trading

For short-term traders, such as day traders, smaller timeframes like the 1-minute to 15-minute charts are often preferred. These timeframes allow traders to capitalize on quick, intraday movements. The Ichimoku indicators on these charts can provide rapid insights into market trends and potential reversals, but they require constant monitoring and quick decision-making. - Long-term Trading

Long-term traders, including swing and position traders, may find greater value in using the Ichimoku system on daily, weekly, or even monthly charts. These longer timeframes smooth out market noise and provide a clearer picture of the underlying trend. While this approach offers less frequent trading opportunities, it tends to be more stable and less susceptible to short-term market fluctuations. - The Middle Ground

For those seeking a balance between the rapid action of day trading and the patience required for long-term trading, intermediate timeframes like the 1-hour or 4-hour charts can be ideal. These timeframes offer a more manageable pace, allowing traders to make informed decisions without the pressure of rapid market changes.

Adapting to Market Conditions

It’s important to note that there is no one-size-fits-all answer. Market conditions can vary, and what works in a trending market may not be effective in a range-bound market. Traders should be flexible, adjusting their chosen timeframe to align with current market dynamics and their personal trading style.

2 comments

JACQUES CHARBONNEAUX

Bonjour, petit amateur de trading, j’utilise très souvent l’Ichimoku. je souhaiterais savoir sur quel espace temps est il le plus efficace ? merci de votre réponse ! Jacques

Florian Fendt

Hi Jacques, sorry but my french is quite rusty. The best time frame depends on your strategy. You can refer to point 2.5 in this article to get more information about what might suit you best.

Cheers!

Florian