1. Head-to-Head Comparison

MetaTrader 4 and MetaTrader 5 are more similar than different from each other. Below is a head-to-head comparison of these two platforms.

1.1. Platform Fundamentals

The platform fundamentals are the basic features and functions that every trader needs to execute and manage their trades. They include trading tools, asset classes, user interfaces, and ease of use. Let’s see how MT4 and MT5 compare in these aspects.

1.1.1. Trading Tools

One of the most important aspects of any trading platform is the trading tools it offers. These include order types, technical indicators, charting tools, and backtesting capabilities. These tools help traders analyze the market, enter and exit trades, and test and optimize their trading strategies.

Order types:

Order types are the instructions that traders give to their brokers on how to execute their trades. They include market orders, limit orders, stop orders, and more.

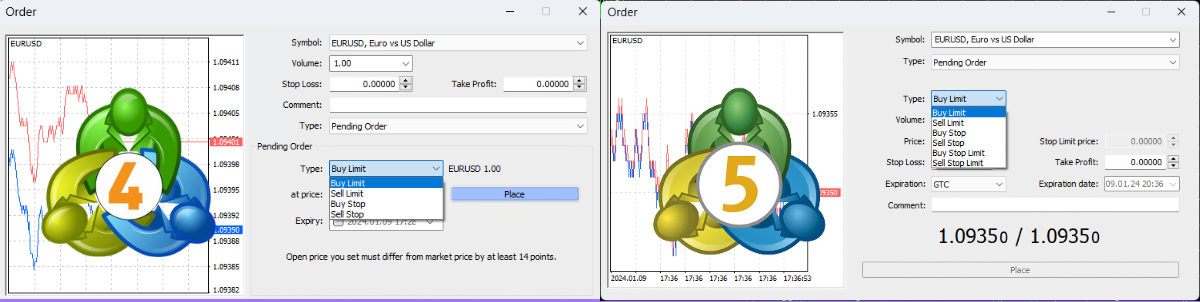

MT4 and MT5 both offer the same basic order types, such as market, limit, stop loss, take profit. However, MT5 also offers some additional order types, such as buy stop limit and sell stop limit, which are a combination of stop and limit orders. These order types allow traders to have more control and flexibility over their trade execution.

Technical indicators:

Technical indicators are mathematical calculations based on price and volume data that help traders identify trends, patterns, and signals in the market. They include popular indicators such as relative strength index (RSI), moving average convergence divergence (MACD), stochastic oscillator, and more.

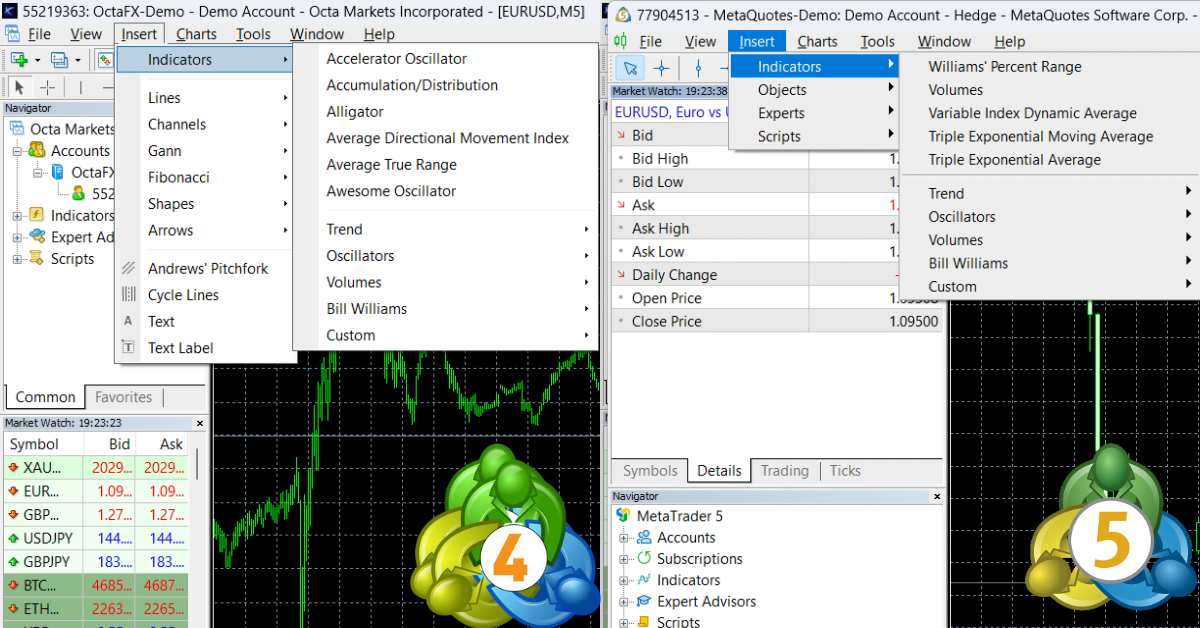

MT4 and MT5 both offer a wide range of technical indicators, with MT4 having 30 and MT5 having 38 built-in indicators. Moreover, they also allow traders to create and import their own custom indicators, which can enhance their technical analysis.

Charting tools:

Charting tools are graphical representations of price movements and indicators that help traders visualize the market and identify trading opportunities. They include different types of charts, such as line, bar, candlestick, and more, as well as various customization options, such as colors, styles, and timeframes.

MT4 and MT5 both offer advanced charting tools, with MT4 having 31 and MT5 having 44 built-in graphical objects. However, MT5 also offers more timeframes, with 21 compared to MT4’s 9, which can help traders analyze the market from different perspectives.

Backtesting:

Backtesting capabilities are the ability to test and optimize trading strategies using historical data and simulated market conditions. They help traders evaluate the performance and profitability of their trading systems and fine-tune their parameters and settings.

MT4 and MT5 offer backtesting capabilities, with MT4 having a single-threaded strategy tester and MT5 having a multi-threaded strategy tester. However, MT5 also offers some additional features, such as multi-currency and real tick testing, which can improve the accuracy and reliability of the backtesting results.

| Feature | MT4 | MT5 |

| Order types | Market, limit, stop loss, take profit | Market, limit, stop loss, take profit, buy stop limit, sell stop limit |

| Technical indicators | 30 built-in, over 2000+ free custom, 700+ paid custom¹ | 38 built-in, custom indicators supported |

| Charting tools | 31 graphical objects, 9 timeframes¹ | 44 graphical objects, 21 timeframes² |

| Backtesting capabilities | Single-threaded, single-currency, real spread¹ | Multi-threaded, multi-currency, real tick, optimization² |

1.1.2. Asset Classes

Another important aspect of any trading platform is the asset classes it offers. These are the types of financial instruments that traders can trade on the platform, such as forex, CFDs, stocks, futures, and more. They determine the diversity and availability of trading opportunities for traders.

Forex and CFDs:

MT4 and MT5 both offer access to various asset classes, with MT4 being more focused on forex and CFDs and MT5 being more versatile and multi-market. MT4 supports trading on forex, CFDs on indices, commodities, metals, and cryptocurrencies, while MT5 supports a broad range of trading on forex, CFDs on stocks, futures, options, bonds, and cryptocurrencies. MT5 also offers exchange trading, which allows traders to trade directly on stock and futures exchanges, such as NYSE, NASDAQ, and CME.

| Asset Class | MT4 | MT5 |

| Forex | Yes | Yes |

| CFDs | Indices, commodities, metals, cryptocurrencies | Stocks, futures, options, bonds, cryptocurrencies |

| Stocks | No | Yes (exchange trading supported) |

| Futures | No | Yes (exchange trading supported) |

| Options | No | Yes |

| Bonds | No | Yes |

1.1.3. User Interface and Ease of Use

The user interface and ease of use of any trading platform are the factors that affect the user experience and satisfaction of traders. They include the learning curve for each platform, the customization options and layout flexibility, and the mobile trading app functionality and integration.

Learning curve:

MT4 and MT5 both have a user-friendly and intuitive user interface, with MT4 being simpler and familiar and MT5 being more modern and sophisticated. MT4 has a lower learning curve for beginners, as it has fewer features and functions than MT5 and is more widely used and supported by the trading community. MT5 has a higher learning curve for advanced traders, as it has more features and functions than MT4 and requires more technical knowledge and skills.

Customization:

MT4 and MT5 both offer customization options and layout flexibility, with MT4 being more limited and rigid and MT5 being more flexible and adaptable. MT4 allows traders to customize the colors, styles, and indicators of their charts, as well as the position and size of their windows and panels. MT5 also allows traders to customize the same aspects as MT4, as well as the position and size of their toolbars and menus. Moreover, MT5 allows traders to detach and move their charts to different monitors, which can enhance their trading efficiency and convenience.

Mobile Application:

MT4 and MT5 both offer mobile trading app functionality and integration, with MT4 being more basic and compatible and MT5 being more advanced and comprehensive. MT4 has a mobile trading app for iOS and Android devices, which allows traders to access their accounts, place and manage orders, view charts and indicators, and receive notifications and alerts. However, MT4’s mobile app has fewer features and functions than its desktop version and does not support algorithmic trading or copy trading. MT5 has a mobile trading app for iOS and Android devices, which allows traders to access their accounts, place and manage orders, view charts and indicators, and receive notifications and alerts. Moreover, MT5’s mobile app has more features and functions than its desktop version and supports algorithmic trading and copy trading.

| Feature | MT4 | MT5 |

| Learning curve | Low | High |

| Customization options | Colors, styles, indicators, windows, panels | Colors, styles, indicators, windows, panels, toolbars, menus |

| Mobile trading app | iOS, Android | iOS, Android |

| Mobile app features | Account access, order placement, charting, notifications | Account access, order placement, charting, notifications, algorithmic trading, copy trading |

1.2. Advanced Features

The advanced features are the additional features and functions that enhance the trading capabilities and opportunities of traders. They include algorithmic trading and expert advisors (EAs), copy trading and social features, and mobile trading. Let’s see how MT4 and MT5 compare in these aspects.

1.2.1. Algorithmic Trading and Expert Advisors (EAs)

Algorithmic trading is the use of computer programs and algorithms to automate trading decisions and actions. Expert advisors (EAs) are the specific type of algorithmic trading programs that run on the MetaTrader platforms. They allow traders to create, test, and execute their own trading strategies or use the ones developed by other traders and programmers.

MT4 and MT5 both support algorithmic trading and EAs, with MT4 being more popular and established and MT5 being more powerful and versatile. MT4 uses the MetaQuotes Language 4 (MQL4) to create and code EAs, while MT5 uses the MetaQuotes Language 5 (MQL5) to create and code EAs. MQL4 and MQL5 are both based on the C++ programming language, but they have different capabilities, compatibility, and coding complexity.

MT4 and MT5 both have a large and active community of developers and users who create, share, and sell EAs and indicators on the MetaTrader Market and the MQL5.community website. However, MT4 has a bigger and more established community, as it has been around for longer and has more popularity and support. MT5 has a smaller and more emerging community, as it is relatively newer and has less adoption and recognition.

| Feature | MT4 | MT5 |

| Programming language | MQL4 | MQL5 |

| Language complexity | Simple, easy to learn | Powerful, difficult to learn |

| Language compatibility | Compatible with existing EAs and indicators | Not fully compatible with existing EAs and indicators |

| Community resources | Large and active | Smaller and emerging |

| MetaTrader Market | Available | Available |

1.2.2. Copy Trading and Social Features

Copy trading is the practice of copying the trades and strategies of other traders, usually through a social trading network or a signal service. It allows traders to benefit from successful traders’ experience and expertise and diversify their trading portfolio and risk. Social features are the functions and tools that enable traders to interact, communicate, and share information with other traders, such as chat, forums, blogs, and news.

Finding and copying successful traders:

MT4 and MT5 both support copy trading and social features, with MT4 being more limited and basic and MT5 being more comprehensive and advanced. Both platforms allow traders to subscribe to signals from other traders and automatically copy their trades to their accounts. Moreover, MT5 also allows traders to use the MetaTrader Signals service, which is a more professional and reliable signal platform that offers more features and options, such as performance statistics, risk management, and broker compatibility.

| Feature | MT4 | MT5 |

| Signal subscription | Yes | Yes |

| Signal provision | No | Yes |

| MQL5.community access | No | Yes |

| MetaTrader Signals service | No | Yes |

1.3. Performance and Security

The performance and security of any trading platform are the factors that affect the reliability and safety of trading. They include speed and stability, regulation, and broker compatibility. Let’s see how MT4 and MT5 compare in these aspects.

1.3.1. Speed and Stability

Speed and stability are measures of how fast and smoothly the trading platform operates and executes orders. They depend on the platform’s architecture, design, and technology, as well as the broker’s server and infrastructure. Speed and stability are crucial for traders, especially for those who use high-frequency trading, scalping, or arbitrage strategies or who trade during high-volatility market events.

MT4 and MT5 both offer high speed and stability, with MT4 being more lightweight and efficient and MT5 being more robust and advanced. MT4 has a simpler and faster architecture, which allows it to handle and process orders quickly and smoothly. However, MT4 also has some limitations, such as the lack of partial order-filling policies and the lack of advanced order types. MT5 has a more complex and powerful architecture, which allows it to handle and process orders more accurately and flexibly.

1.3.2. Regulation and Broker Compatibility:

Regulation and broker compatibility are the factors that determine the availability and legality of the trading platform in different regions and markets. They depend on the platform’s licensing and security features, as well as the broker’s regulation and authorization. Regulation and broker compatibility are important for traders, as they affect the trustworthiness and reputation of the platform and the broker, as well as the protection and compensation of the traders’ funds and rights.

MT4 and MT5 both offer high regulation and broker compatibility, with MT4 being more widespread and accessible and MT5 being more compliant and secure. MT4 is more popular and widely used by brokers and traders around the world, as it has been in the market for longer and has more recognition and support. However, MT4 also faces some challenges and restrictions, such as the ban on hedging by the US regulators and the lack of exchange trading by the Russian regulators.

MT5 is more regulated and compliant with the latest standards and requirements of the financial authorities, as it has been developed and updated to meet the changing needs and demands of the market. Moreover, MT5 also offers more security and protection features, such as advanced encryption and authentication systems and the built-in economic calendar and email system.

| Feature | MT4 | MT5 |

| Speed and stability | Lightweight and efficient, but limited and outdated | Robust and advanced but complex and powerful |

| Regulation and broker compatibility | Widespread and accessible but challenged and restricted | Compliant and secure, but difficult and emerging |

1.4. The Verdict

Now that we have compared MT4 and MT5 in terms of platform fundamentals, advanced features, performance, and security, it is time to draw the verdict. Which platform is better for traders, and who should use which platform? Choosing one platform depends on various factors, such as the trader’s style, experience, and preferences, as well as the broker’s offerings and conditions. However, we can provide some general guidelines and recommendations based on the strengths and weaknesses of each platform.

1.4.1. Who Should Use MT4?

MT4 is a great platform for traders who are looking for a simple, easy, and reliable platform that offers the basic and essential features and functions for trading Forex and CFDs. MT4 is especially suitable for traders who:

- Are beginners or intermediate traders who want to learn and practice trading with a user-friendly and intuitive platform.

- Are existing users who are familiar and comfortable with the platform and do not want to change or migrate to a new platform.

- Are mainly interested in trading Forex and CFDs on indices, commodities, metals, and cryptocurrencies, and do not need access to other markets or instruments.

- Are not concerned or affected by the regulatory or technical limitations of the platform, such as the hedging ban, the exchange trading ban, or the order processing time

1.4.2. Who Should Switch to MT5?

MT5 is a great platform for traders who are looking for a more advanced, versatile, and powerful platform that offers more features and functions for trading various markets and instruments. MT5 is especially suitable for traders who:

- Are advanced or professional traders who want to use and benefit from the latest and most sophisticated trading technologies and tools

- Are new users who are open and willing to try and learn a new platform that has more potential and opportunities for trading

- Are interested in trading multiple markets and instruments, such as Forex, CFDs, futures, options, and cryptocurrencies, and want to have access to exchange trading and depth of market

- Are interested or involved in algorithmic trading or copy trading and want to create, import, or use more complex and diverse EAs and signals on the platform

- Are concerned or affected by the regulatory or technical limitations of MT4 and want to have more flexibility and compliance with the platform, such as the hedging option, the exchange trading option, or the partial order filling policies.