1. Overview Of cTrader

cTrader is renowned for its clean interface, efficient ECN (Electronic Communication Network) trading, and advanced features, making it a popular choice among forex traders. Its modern interface and transparent pricing model provide a seamless trading experience. However, despite its strengths, there are reasons traders might look for alternatives.

The cost of using cTrader can be a deterrent for some, especially those looking for more cost-effective solutions. Additionally, while cTrader offers a range of features, they might not fully meet the specific trading needs of every investor. Some traders might seek platforms with different functionalities or a broader asset coverage beyond forex.

| Key Point | Details |

|---|---|

| Interface | Clean and user-friendly |

| Trading Type | ECN trading |

| Advanced Features | Highly advanced, suitable for experienced traders |

| Reasons for Alternatives | Cost considerations, feature limitations, need for different functionalities |

2. Top 5 Alternatives Of cTrader

2.1. MetaTrader 5 (MT5)

Overview: MetaTrader 5 (MT5) is a robust and multifunctional platform widely recognized as a leader in trading software, particularly for Forex and stock trading. It stands out for its comprehensive features that support advanced trading operations, including algorithmic and web trading. MT5 is designed to cater to both beginner and advanced traders with its user-friendly interface and extensive customization options.

2.1.1. Key Features:

- Algorithmic Trading: Utilizes trading robots and provides a full development environment for creating and testing these automated strategies.

- Technical and Fundamental Analysis Tools: Offers an extensive range of analytical tools, both technical and fundamental, enhancing traders’ ability to predict market movements.

- Multi-Asset Platform: Supports trading across various asset classes including Forex, stocks, and futures.

- Advanced Charting Tools: Provides multiple timeframes and detailed technical analysis capabilities.

- Web and Mobile Trading: Ensures accessibility through web-based platforms and mobile apps, facilitating trading on the go.

2.1.2. Pros:

- Versatility and Flexibility: Supports numerous financial instruments and trading strategies.

- Community and Support: Backed by a massive community where traders can exchange tools, indicators, and expert advisors.

- Global Broker Support: Widely supported by a vast range of brokers globally.

2.1.3. Cons:

- Complexity for Beginners: While it offers advanced features, the complexity might be overwhelming for new traders.

- Subscription Cost: Starting from $2000 per month, which can be a significant investment for individual traders or small businesses.

Ideal For: MetaTrader 5 is best suited for experienced traders who need robust analytical tools and the ability to use or develop automated trading systems. It’s also ideal for traders who operate across multiple markets and require a platform that supports extensive multi-asset trading.

Comparison Table Against cTrader:

| Feature | MetaTrader 5 | cTrader |

|---|---|---|

| Interface | User-friendly but complex for beginners | Very clean and straightforward |

| Trading Type | Supports all trading types, including ECN | Primarily ECN |

| Advanced Features | Extensive: Robots, multiple asset classes, advanced analysis | Advanced but less extensive than MT5 |

| Customization | Highly customizable interface and tools | Less customizable |

| Cost | Starts at $2000 per month | Generally lower cost |

| Broker Compatibility | Supported by a vast range of global brokers | Limited to fewer brokers |

| Ideal User | Advanced traders needing comprehensive tools | Traders seeking simplicity and ECN |

2.2. NinjaTrader

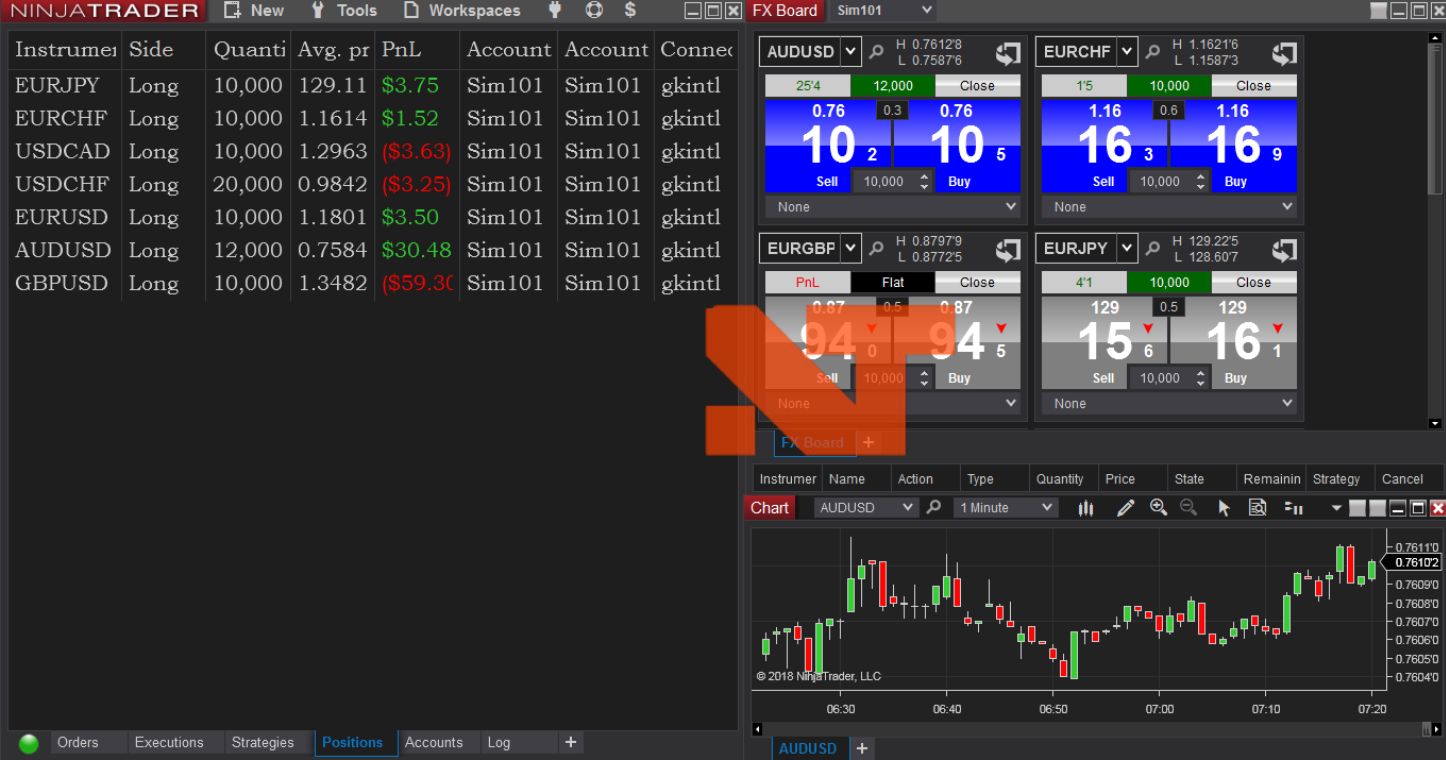

Overview: NinjaTrader is a specialized trading platform known for its advanced charting capabilities, market analysis tools, and strong support for automated trading. It caters to active traders who require detailed technical analysis and a platform that supports sophisticated trading strategies. NinjaTrader is particularly popular among futures traders but also supports forex and stock trading through connectivity with various brokerage accounts.

2.2.1. Key Features:

- Advanced Charting and Analysis Tools: Offers over 100 pre-built indicators and supports extensive customization with third-party add-ons.

- Trade Management: Includes features like the SuperDOM and Advanced Trade Management (ATM) module for sophisticated order handling.

- Automation: Supports both partial and fully automated trading strategies, accessible through a point-and-click interface or a C# based trading framework.

- Market Replay: Allows traders to download historical data and replay market movements for backtesting strategies.

- Educational and Support Resources: Provides extensive educational materials, including daily webinars, training videos, and a responsive user forum.

2.2.2. Pros:

- Comprehensive Trading Tools: Offers powerful tools for technical analysis and trade execution.

- Customization and Automation: Highly customizable platform with support for a wide range of automated trading functions.

- Educational Resources: Provides robust educational support to help traders maximize their use of the platform.

2.2.3. Cons:

- Complexity for New Traders: The platform’s sophistication might be overwhelming for beginners.

- Limited Mobile Support: Lacks a dedicated mobile app, which could be a limitation for traders who need to manage trades on the go.

- Narrow Asset Coverage: Primarily focused on futures, with more limited capabilities for other asset classes unless connected with an external brokerage account.

Ideal For: NinjaTrader is ideal for experienced and technically-savvy traders who prioritize detailed market analysis and customization. It’s particularly suited for those focusing on futures trading but can also be adapted for forex and stock trading with the right brokerage connections.

Comparison Table Against cTrader:

| Feature | NinjaTrader | cTrader |

|---|---|---|

| Interface | Highly customizable, complex for beginners | Clean, user-friendly, less complex |

| Trading Type | Strong in futures, capable in forex and stocks | Primarily ECN for forex |

| Advanced Features | Extensive technical tools, automation, third-party add-ons | Advanced but fewer customization options |

| Customization | Highly customizable with a focus on technical analysis | Less customizable but more streamlined |

| Cost | Free core features, paid upgrades for advanced tools | Generally lower cost, fewer paid barriers |

| Broker Compatibility | Requires external brokerage for non-futures trading | Limited to fewer brokers |

| Ideal User | Experienced traders needing depth and customization | Traders seeking simplicity and ECN access |

2.3. TradingView

Overview: TradingView is highly regarded as a versatile and robust charting platform that caters to traders and investors of all levels. Known for its comprehensive suite of tools, TradingView combines technical analysis with a vibrant social networking component, allowing users to share insights and strategies. Its cloud-based nature ensures it is accessible from any device, making it a favorite among those who prefer flexibility and extensive market data.

2.3.1. Key Features:

- Pine Script: Allows users to write and share custom scripts and indicators, enhancing the platform’s versatility.

- Advanced Charting Tools: Offers over 50 drawing tools and numerous chart types to cater to various trading styles.

- Social Trading Features: Facilitates interaction with a global community of traders, providing access to shared trading ideas and strategies.

- Screeners and Alerts: Powerful screeners and customizable alerts help traders stay informed of market movements and opportunities.

2.3.2. Pros:

- Community and Collaboration: Strong social features for sharing and learning from other traders.

- Customizability: Extensive tools for personalization and automation of trading strategies.

- Accessibility: Available on multiple devices, enhancing its usability for traders who are on-the-go.

2.3.3. Cons:

- Complexity for New Traders: The array of tools and options can be overwhelming for beginners.

- Limited Broker Integration: While it supports various brokers, some popular ones may not be directly integrated, which could limit execution capabilities directly from the platform.

Ideal For: TradingView is perfect for traders who value a combination of powerful analytical tools with a community aspect. It suits both beginners and experienced traders, though the latter will likely benefit more from its advanced features and customization options.

Comparison Table Against cTrader:

| Feature | TradingView | cTrader |

|---|---|---|

| Interface | Extensive customization, can be complex | Cleaner, more straightforward |

| Trading Type | Supports multiple asset types, not just forex | Primarily focused on forex ECN trading |

| Advanced Features | Custom scripting, community sharing, advanced charting | Standard technical analysis tools |

| Customization | High degree of tool customization | Less customizable, more user-friendly |

| Cost | Free basic plan, premium features at a cost | Generally lower cost, fewer premium barriers |

| Broker Compatibility | Supports 30+ brokers, but not all | Limited broker integration |

| Ideal User | Traders who value community insights and detailed analysis | Traders looking for straightforward, direct trading |

2.4. TradeStation

Overview: TradeStation is a well-established trading platform known for its powerful and versatile trading tools tailored for active traders. It provides robust technical analysis capabilities, high-quality research, and is particularly noted for its comprehensive desktop trading platform. TradeStation is suitable for trading a variety of securities including stocks, options, futures, and cryptocurrencies.

2.4.1. Key Features:

- Extensive Trading Tools: Offers advanced charting capabilities, customizable trading environments, and a plethora of built-in trading apps.

- Multiple Platform Options: Available on desktop, web, and mobile, providing flexibility depending on the trader’s needs.

- Simulation and Backtesting: Allows traders to test strategies using historical data before applying them in real market conditions.

- Educational Resources: Provides a wealth of learning materials and support to help both new and experienced traders.

2.4.2. Pros:

- High Customizability: Users can tailor almost every aspect of their trading environment.

- Advanced Order Management: Features like direct-market access and automatic trade execution enhance trading efficiency.

- Strong Regulatory Framework: Regulated by multiple Tier-1 authorities ensuring a high level of trust and security.

2.4.3. Cons:

- Complexity: May be overwhelming for beginners due to the complexity of its features.

- Additional Costs: Certain advanced features require a subscription, and there are fees associated with some account activities like inactivity or account transfers.

Ideal For: TradeStation is best suited for advanced and active traders who need a comprehensive set of tools to support frequent and sophisticated trading strategies. It’s also a good choice for those interested in trading across multiple asset classes, including cryptocurrencies.

Comparison Table Against cTrader:

| Feature | TradeStation | cTrader |

|---|---|---|

| Interface | Highly customizable, complex for beginners | Clean, more user-friendly |

| Trading Type | Stocks, options, futures, cryptocurrencies | Primarily forex ECN trading |

| Advanced Features | Extensive tools for analysis and trading automation | Less extensive, more focused on forex |

| Customization | High customization of trading environment | Limited customization options |

| Cost | No commission for basic services, fees for advanced features | Generally lower cost with fewer fees |

| Broker Compatibility | Supports various asset classes, complex setup required | Limited to forex markets |

| Ideal User | Advanced traders needing extensive tools and customization | Traders seeking straightforward forex trading |

2.5. MotiveWave

Overview: MotiveWave is a comprehensive trading software designed for advanced traders who need detailed analytical tools. It excels in areas like Elliott Wave analysis, Fibonacci tools, and Gann analysis. Established in 2010, MotiveWave has developed a strong reputation for its robust feature set, catering to those who require depth in their technical analysis and trading strategies.

2.5.1. Key Features:

- Elliott Wave Analysis: Offers advanced tools for this sophisticated technical analysis technique.

- Customizable Charting and Indicators: Over 300 technical indicators and customizable chart options.

- Broker Integration: Compatible with multiple brokers, allowing trading directly from the platform.

- Advanced Trading Tools: Includes features like strategy backtesting, walk-forward testing, and a paper trading simulator to test strategies risk-free.

2.5.2. Pros:

- Extensive Analysis Tools: Packed with advanced tools that cater to detailed technical analysis needs.

- User-Friendly Interface: Despite its advanced capabilities, it is designed to be accessible for users with varying levels of experience.

- Cross-Platform Support: Runs on Windows, macOS, and Linux, making it versatile for all traders.

2.5.3. Cons:

- Cost: Pricing might be a barrier for some traders, with several tiers that escalate in cost depending on the features required.

- Complexity: The range of features and detailed analysis tools can be overwhelming for new traders.

Ideal For: MotiveWave is ideal for professional traders who need detailed analytical tools and the ability to execute complex trading strategies. It’s particularly suited for those who utilize Elliott Wave, Gann, and Fibonacci analyses in their trading.

Comparison Table Against cTrader:

| Feature | MotiveWave | cTrader |

|---|---|---|

| Interface | Highly customizable, complex for beginners | Cleaner, more user-friendly |

| Trading Type | Supports advanced technical analysis | Primarily forex ECN trading |

| Advanced Features | Elliott Wave, Fibonacci, Gann analysis | Standard technical analysis tools |

| Customization | High degree of customization | Limited customization options |

| Cost | Multiple pricing tiers, potentially high cost | Generally lower cost |

| Broker Compatibility | Supports multiple brokers for direct trading | Limited to fewer brokers |

| Ideal User | Advanced traders focusing on technical analysis | Traders seeking straightforward ECN access |

3. Factors To Consider For Different Trader Types

In this section, we will explore the factors that traders of various experience levels should consider when choosing a trading platform. Different types of traders—beginners, experienced or active traders, and algorithmic traders or developers—each have unique needs that can influence their choice of platform.

3.1. Beginners

For those new to trading, the key considerations include:

- Ease of Use: Beginners should prioritize platforms that offer a simple, intuitive interface. This can help reduce the learning curve and improve the overall trading experience.

- Educational Resources: Access to comprehensive learning tools such as tutorials, webinars, and articles is crucial. These resources help beginners understand the basics of trading and the platform’s features.

- Community Support: A supportive community or forum can be invaluable. New traders can gain insights from more experienced users and find answers to common questions.

3.2. Experienced/Active Traders

Experienced traders typically need advanced tools:

- Charting and Technical Analysis Tools: Advanced charting tools, a variety of technical indicators, and customizable interfaces are crucial for detailed market analysis.

- Order Types: A range of order types, including stop losses, limit orders, and conditional orders, can help manage risk and improve trading strategies.

- Speed and Execution: For traders who deal with large volumes or require quick execution, a platform’s ability to handle these efficiently is vital.

3.3. Algorithmic Traders/Developers

Traders who use automated strategies or develop their own trading algorithms need specialized features:

- API Support: Robust APIs allow traders to connect their trading algorithms directly to the platform.

- Backtesting Tools: Platforms that offer advanced backtesting tools enable traders to test their strategies against historical data before risking real money.

- Programming Language Compatibility: Compatibility with popular programming languages like Python or C# is essential for those who write their own trading scripts.

| Trader Type | Key Considerations |

|---|---|

| Beginners | Ease of use, educational resources, community support |

| Experienced/Active Traders | Advanced charting tools, variety of order types, speed and execution |

| Algorithmic Traders/Developers | API support, backtesting tools, programming language compatibility |

4. Additional Considerations

When choosing a trading platform, several additional factors come into play that can affect a trader’s decision. These considerations include costs, asset classes, broker compatibility, and customer support. Each of these factors can significantly impact the trading experience and overall satisfaction with a platform.

4.1. Costs

Cost is a critical factor for most traders:

- Account Minimums: Some platforms require a minimum balance to open an account, which can be a barrier for new traders or those with limited capital.

- Commissions and Fees: Understanding the fee structure is essential as fees can cut into profits, especially for active traders. This includes trading fees, platform fees, and any additional charges for access to premium features.

- Data Fees: Traders who require real-time data or access to advanced analytical tools may need to pay additional fees for these services.

4.2. Asset Classes

The range of asset classes available can influence a trader’s choice:

- Market Coverage: Platforms vary in the types of markets they cover, such as stocks, forex, futures, and options. Traders should choose platforms that support the markets they are interested in trading.

- Asset Diversity: Having access to a diverse range of assets can be crucial for traders looking to diversify their portfolios or trade on multiple markets.

4.3. Broker Compatibility

Ensuring that a platform is compatible with a preferred broker is vital:

- Integration: Some platforms offer better integration with certain brokers, which can affect the efficiency of trading operations and the execution of trades.

- Accessibility: The ability to access a platform through various brokers can provide flexibility and choice for traders.

4.4. Customer Support

Quality customer support can greatly enhance the trading experience:

- Availability: Support should be available when the markets are open, and ideally 24/7.

- Responsiveness: Quick responses to inquiries or issues are crucial, especially in fast-moving markets.

- Quality of Support: Effective and knowledgeable support can resolve issues faster and help traders make the most of their platform.

| Factor | Details |

|---|---|

| Costs | Account minimums, commissions, fees, data fees |

| Asset Classes | Market coverage, asset diversity |

| Broker Compatibility | Integration with preferred brokers, accessibility |

| Customer Support | Availability, responsiveness, quality |

Conclusion

Choosing the right trading platform is not a one-size-fits-all decision; it depends on individual needs and trading styles. Beginners may prioritize user-friendly interfaces and educational resources, while experienced traders might seek advanced charting tools and fast execution speeds. Algorithmic traders require robust APIs and comprehensive backtesting capabilities.

Additional considerations such as cost, asset diversity, broker compatibility, and customer support quality are crucial in shaping the trading experience. Prospective users should assess platforms based on these criteria to find the most suitable match for their trading objectives.

It’s advisable for traders to take advantage of demos and trials offered by platforms to thoroughly evaluate their features and ensure they meet their specific trading needs before making a commitment. Upcoming trading platforms should also be monitored as they might offer innovative alternatives or improvements over existing ones.