1. Overview of Trader WorkStation

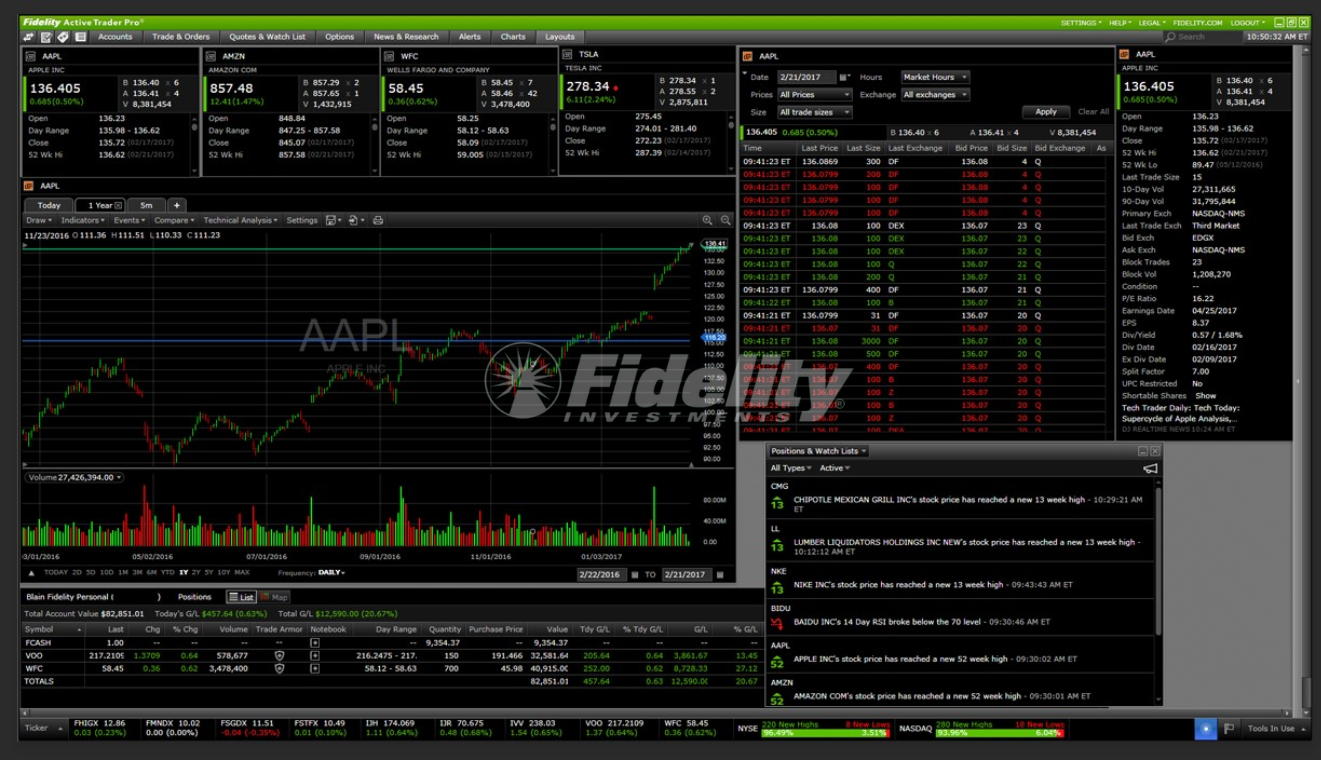

Choosing the right trading platform is crucial for every trader, whether novice or experienced. A popular option is Trade Work Station (TWS), known for its robust functionality and comprehensive tools. However, despite its strengths, some traders may find its features overwhelming or not tailored to their specific trading style. This underscores the importance of selecting a platform that not only offers powerful tools but also aligns with individual trading needs and preferences.

Key Highlights:

- Trade Work Station (TWS) is celebrated for its advanced trading tools and comprehensive market access.

- Traders may seek alternatives due to complexity or specific needs that TWS does not meet.

- Personalization and suitability are paramount in choosing a trading platform that fits one’s trading strategy and comfort level.

| Feature | Details |

| Platform Name | Trader WorkStation (TWS) |

| Strengths | Advanced tools, comprehensive access |

| Potential Lacks | May be overwhelming, might not meet specific trader needs |

| Importance | High for alignment with personal trading preferences |

2. Top 5 Trader WorkStation Alternatives

2.1. TradingView Overview

TradingView is widely regarded for its user-friendly interface and powerful charting capabilities. This platform offers an array of tools designed for both novice and seasoned traders, making it an ideal choice for those focused on technical analysis and community interaction within the trading sphere.

Key Features:

- 400+ built-in indicators and strategies, allowing for comprehensive market analysis.

- Customizable chart types including Renko, Kagi, and Point & Figure.

- Cloud-based platform for secure and flexible trading.

- Pine Script®, enabling traders to create custom indicators and strategies.

- Social trading features with a vibrant community of traders.

Pros:

- Advanced charting tools that are highly customizable.

- Robust security measures provide a secure trading environment.

- Strong community engagement, fostering a space for knowledge exchange and support among traders.

- Cross-platform accessibility, ensuring that users can trade from any device, anywhere.

Cons:

- Limited direct trading through linked accounts, requiring most trades to be executed outside the platform.

- Pricing model, while flexible, can become costly for access to more advanced features.

Ideal User:

TradingView is best suited for chart-focused traders and those who value community interaction. Its tools cater to those who engage heavily in technical analysis and benefit from a social environment to exchange trading ideas.

Comparison Table Against Active Trader Pro:

| Feature | TradingView | Active Trader Pro |

| Interface | User-friendly and highly customizable | Streamlined but less customizable |

| Charting Tools | Extensive, with 400+ indicators | Adequate for most needs, fewer options |

| Community | Vibrant, integrated community | Limited community features |

| Accessibility | Cloud-based, accessible anywhere | Desktop-based, limited mobility |

| Trading Execution | Mostly external | Direct trading capabilities |

| Customization | High, with Pine Script® | Moderate, less flexible |

| Security | Strong cloud-based security | Standard brokerage security |

2.2. MetaTrader 4/5 Overview

MetaTrader 4 and MetaTrader 5 (MT4/5) are dominant platforms in the forex market, renowned for their extensive algorithmic trading capabilities and comprehensive technical analysis tools. These platforms, developed by MetaQuotes, are particularly favored for their support of Expert Advisors (EAs) which automate trading by following programmed strategies.

Key Features:

- Enhanced algorithmic trading: MT5 includes a more advanced MQL5 development environment for writing sophisticated automated trading strategies.

- Comprehensive technical and fundamental analysis tools: Both platforms provide a plethora of analytical tools, including 30 built-in indicators and 24 analytical objects.

- Virtual Hosting (VPS): Traders can rent a virtual server directly from the platform to ensure low latency trades around the clock.

- Marketplace access: Direct access to the MetaTrader marketplace where users can buy or rent trading robots and technical indicators.

Pros:

- Robust for algorithmic trading: Both platforms are highly acclaimed for their algorithmic trading capabilities through the use of EAs.

- Global community and marketplace: There’s a large global community and an extensive marketplace for trading strategies, indicators, and scripts.

- Multi-asset support: MT5 in particular offers extensive capabilities for trading not just forex, but also stocks, futures, and options.

Cons:

- Complexity for beginners: The platforms can be intimidating for beginners due to their complex features and advanced trading capabilities.

- Limited advancements in MT4: While MT4 remains popular, it has not seen significant updates in comparison to MT5, which continues to evolve with new features.

Ideal User:

MetaTrader is ideal for forex traders, automated strategy developers, and those involved in markets requiring extensive algorithmic trading and technical analysis.

Comparison Table Against Active Trader Pro:

| Feature | MetaTrader 4/5 | Active Trader Pro |

| Algorithmic Trading | Extensive support with EAs | Basic automated trading features |

| Technical Analysis Tools | Advanced, with 30+ indicators | More limited compared to MT4/5 |

| Marketplace | Large marketplace for EAs and indicators | Does not have a comparable marketplace |

| Asset Types Supported | Forex, stocks, futures, options | Primarily stocks and options |

| User Community | Large global community | Smaller, more focused community |

| Complexity | High, suitable for experienced traders | More user-friendly for beginners |

2.3. cTrader Overview

cTrader is a highly versatile trading platform known for its sleek user interface, advanced order types, and strong support for algorithmic trading. Developed by Spotware, cTrader is particularly favored by users who require deep market analysis and quick execution times.

Key Features:

- Advanced charting tools: cTrader offers a variety of chart types and technical indicators, enhancing the analytical capabilities of traders.

- Algorithmic Trading: Supported by a native development environment, cTrader allows traders to build, test, and apply trading bots and custom indicators using C#.

- Depth of Market (DOM): Real-time order book visibility and Level II pricing are available, offering insights into market depth.

- Risk Management Tools: Comprehensive tools including stop-loss, take-profit, and trailing stops to manage and mitigate trading risks effectively.

- Copy Trading: cTrader Copy enables users to replicate the strategies of experienced traders, making it accessible for beginners or those looking to diversify their trading strategies.

Pros:

- Highly Customizable: Extensive customizability for charts and algorithmic trading scripts.

- Intuitive User Interface: Known for its clean, responsive design which is easy to navigate.

- Robust Order Execution: Fast trade execution speeds, which is crucial for scalping and high-frequency trading.

Cons:

- Complex Features for Beginners: The range of advanced features might be overwhelming for new traders.

- Broker Availability: While popular, it might not be offered by all brokers, potentially limiting access for some traders.

Ideal User:

cTrader is best suited for active traders and those who prioritize technical analysis and algorithmic trading. It’s also a great choice for traders who rely on fast execution and detailed market analysis.

Comparison Table Against Active Trader Pro:

| Feature | cTrader | Active Trader Pro |

| User Interface | Sleek, modern, highly customizable | More traditional, less flexible |

| Algorithmic Trading | Extensive support with native IDE | Limited automated trading options |

| Charting Tools | Advanced with multiple types and indicators | Basic to moderate charting capabilities |

| Execution Speed | Very fast, suitable for scalping | Adequate for general trading |

| Market Depth | Depth of Market (DOM) and Level II pricing | Limited market depth visibility |

| Copy Trading | Supported through cTrader Copy | Not typically supported |

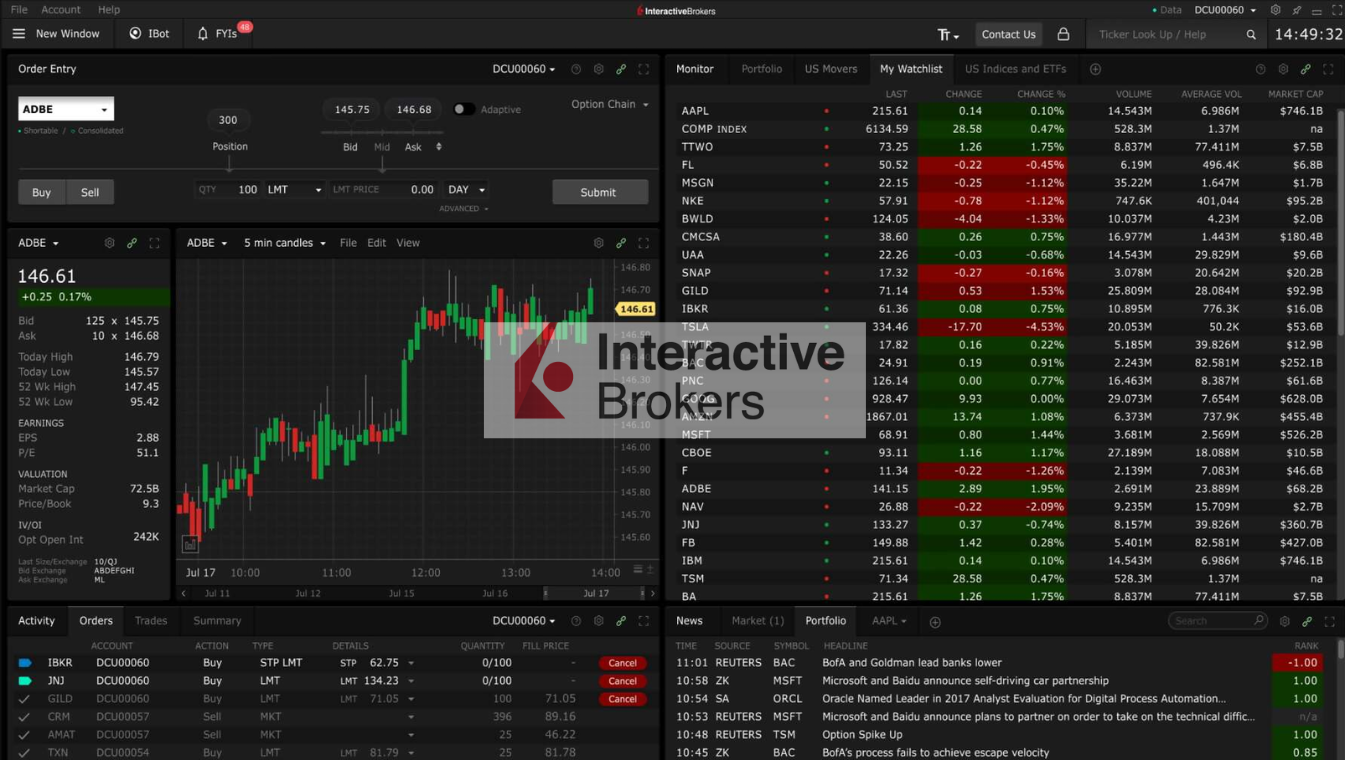

2.4. NinjaTrader Overview

NinjaTrader is recognized for its powerful trading tools and advanced functionalities, primarily catering to active traders who need robust technical analysis and advanced trade management capabilities.

Key Features:

- Advanced Charting: Offers a range of chart styles and over 100 built-in indicators, supporting extensive customization to suit various trading styles.

- Trade Management: Integrates with Advanced Trade Management (ATM) technology to automate complex order types and strategies.

- Algorithmic Trading: Supports both semi and fully automated trading strategies, with options for those who prefer coding and those who don’t.

- Comprehensive Market Data: Includes features like market replay, which allows traders to practice with historical data as if it were live.

Pros:

- Extensive Customization: Highly customizable interfaces and charting capabilities.

- Rich Analytical Tools: Offers powerful analytical tools including a variety of charting options and technical indicators.

- Robust Trade Execution and Management: Features like single-click order entry, modification, and cancellation streamline the trading process.

Cons:

- Complexity for Beginners: The wealth of features and customization options might overwhelm new traders.

- Limited Access to Mobile Trading: Lacks a native mobile trading application, which could be a significant drawback for traders who need to manage their positions on the go.

Ideal User:

NinjaTrader is best suited for experienced traders who need detailed analytical tools, advanced charting, and robust trade management features.

Comparison Table Against Active Trader Pro:

| Feature | NinjaTrader | Active Trader Pro |

| User Interface | Highly customizable, complex | More straightforward, easier to navigate |

| Charting Tools | Advanced with 100+ indicators | Basic to moderate, fewer indicators |

| Trade Execution | Fast, with advanced order types | Standard execution with basic order types |

| Automated Trading | Extensive support with detailed control | Limited automated trading features |

| Mobile Trading | No native mobile app | Mobile app available |

| Market Data | Market replay and real-time data | Basic real-time market data |

2.5. ProRealTime Overview

ProRealTime is acclaimed for its comprehensive charting and technical analysis tools, making it a preferred choice for experienced traders who prioritize detailed market analysis and algorithmic trading.

Key Features:

- Advanced Charting and Technical Analysis: ProRealTime offers over 100 technical indicators and allows for extensive customization of charts. Traders can utilize a variety of chart styles including candlesticks, Renko, and Point & Figure.

- Algorithmic Trading: The platform supports the creation of automated trading strategies through ProBuilder, its proprietary programming language, and offers extensive backtesting capabilities.

- Real-Time Market Scanning: ProRealTime includes advanced scanning tools like ProScreener to help traders identify investment opportunities by setting multiple criteria across different markets and timeframes.

- Enhanced Order Execution: Traders can execute orders directly from the charts using a variety of order types like OCO, stop, and trailing stops.

Pros:

- Highly Customizable Tools: Provides numerous options for charting, analysis, and automated trading setups.

- Comprehensive Data Access: Offers extensive historical data and real-time market scanning capabilities.

- Robust Programming Features: Allows for detailed algorithmic strategy development and customization with ProBuilder.

Cons:

- Complex Interface for Beginners: The platform’s vast array of features and detailed customization options can be overwhelming for new traders.

- Limited Mobile Support: While ProRealTime is comprehensive, its mobile platform might not offer the same depth of features as the desktop version.

Ideal User:

ProRealTime is ideally suited for serious technical analysts, futures traders, and those who require detailed charting and technical analysis alongside strong backtesting and automated trading capabilities.

Comparison Table Against Active Trader Pro:

| Feature | ProRealTime | Active Trader Pro |

| Charting Tools | Extensive with over 100 indicators | Basic to moderate |

| Automated Trading | Advanced with custom programming | Limited automated trading features |

| Market Data Access | Extensive historical and real-time data | Basic real-time market data |

| User Interface | Complex, customizable | More straightforward |

| Mobile Trading | Limited mobile support | Full mobile app available |

3. Factors to Consider When Choosing a Trading Platform

Selecting the right trading platform is a critical decision for traders of all types, as it affects not only the efficiency of trading operations but also impacts financial results. Here are the key factors to consider:

3.1. Asset Classes

Different platforms excel with specific asset classes. Whether you trade stocks, forex, futures, options, or cryptocurrencies, ensure the platform supports all the assets you intend to trade. For example, MetaTrader is renowned for forex, while NinjaTrader is preferred for futures.

3.2. Trading Style

Your trading style greatly influences the type of platform best suited to your needs:

- Scalping: Prioritize platforms with ultra-fast execution speeds and direct market access.

- Day Trading: Essential features include advanced charting tools and the ability to react to news swiftly.

- Swing Trading: Look for platforms with strong fundamental analysis tools and flexibility in chart timeframes.

- Long-term Investing: Platforms that focus more on portfolio management tools and long-term financial data are preferable.

3.3. Technical Analysis Tools

Adequate technical analysis tools are vital for most trading styles. The sophistication of charting options, the variety of technical indicators available, and the ability to customize and save chart templates all contribute to effective trading.

3.4. Algorithmic Trading

For those interested in algorithmic trading, platforms that support backtesting and offer a robust development environment for creating custom scripts (like MetaTrader and NinjaTrader) are essential.

3.5. Cost

Consider all costs associated with a platform, including account minimums, commissions, spread costs, platform fees, and data fees. Some platforms may offer lower costs but have fewer features, while others might be more expensive but offer significant advantages in tools and technology.

3.6. Ease of Use

The usability of a platform should not be overlooked. A steep learning curve might be acceptable for professional traders, but beginners might benefit from a more intuitive interface.

3.7. Customer Support

Reliable customer support is crucial, especially when technical difficulties or uncertainties arise. The availability of customer service, the quality of support offered, and the variety of languages supported can significantly impact user experience.

| Factor | Description |

| Asset Classes | Ensure the platform supports all types of assets you plan to trade. |

| Trading Style | Choose a platform that suits your specific trading techniques and strategies. |

| Technical Analysis | Look for advanced charting tools and a wide range of indicators. |

| Algorithmic Trading | Necessary for developing and testing trading strategies. |

| Cost | Consider all related fees and how they align with your trading volume. |

| Ease of Use | Preference for user-friendly interfaces especially for beginners. |

| Customer Support | Availability and quality of support can be a deciding factor. |

4. Additional Considerations When Choosing a Trading Platform

In addition to the primary factors discussed previously, there are several other considerations that can influence the decision when selecting a trading platform. These considerations can be crucial in determining how well a platform suits your specific needs and trading environment.

4.1. Platform Stability

Platform stability is critical, especially during periods of high market volatility. Platforms that can maintain performance without significant delays or downtime are preferable. This is particularly important for day traders and those trading on very short timeframes, where every second counts.

4.2. Mobile Trading

With the increasing need for mobility, a robust mobile trading app is essential. The app should offer functionality close to the desktop version, allowing traders to manage positions, view charts, and execute trades anytime and anywhere without facing significant limitations.

4.3. Broker Compatibility

Broker compatibility should not be overlooked. Ensure that the trading platform is compatible with your preferred broker’s technology and offers seamless integration. This will facilitate smoother trade execution and potentially better pricing through direct market access or lower latency.

| Consideration | Description |

| Platform Stability | Essential for maintaining functionality during high volatility, crucial for high-frequency and day traders. |

| Mobile Trading | An efficient mobile app allows for trading on the go, mirroring the capabilities of the desktop platform. |

| Broker Compatibility | Compatibility with preferred brokers ensures seamless integration and effective execution of trades. |

Conclusion

Selecting the appropriate trading platform is a nuanced decision that hinges on a variety of factors tailored to individual needs and trading styles. Throughout this guide, we’ve explored key elements such as asset class support, trading style compatibility, technical analysis tools, algorithmic trading capabilities, costs, ease of use, and customer support. Additional considerations like platform stability, mobile trading capabilities, and broker compatibility also play crucial roles.