1. Platform Overview

In this section, we will provide an overview of TradingView and cTrader. Both are popular trading platforms that offer traders different features and functionalities.

1.1. TradingView

TradingView is a cloud-based platform that provides advanced charting, technical analysis, and social networking for traders and investors. TradingView was founded in 2011 by Stan Bokov, Denis Globa, and Constantin Ivanov. They wanted to create a platform allowing anyone to access the financial markets and share their ideas with other traders.

TradingView has several key features and strengths that make it a popular choice among traders, such as:

- Charting: TradingView offers over 15+ chart types, including candlestick, bar, line, Renko, Heikin-Ashi, and more. Users can customize their charts with various drawing tools, annotations, and indicators. TradingView also supports multiple timeframes, ranging from 1 second to 1 month.

- Indicators: TradingView has over 100 built-in indicators, such as moving averages, oscillators, trend lines, Fibonacci retracements, and more. Users can also create their own custom indicators using the Pine Script language or use indicators created by other users in the public library.

- Technical Analysis Tools: TradingView provides various tools for technical analysis, such as pattern recognition, alerts, trading signals, screeners, and scanners. Using historical data, users can also use the TradingView platform to backtest and optimize their trading strategies.

- Social Networking: TradingView has a large and active community of traders and investors who share their ideas, opinions, and insights on the platform. TradingView also allows users to publish and subscribe to trading ideas, which are visual and interactive representations of trading strategies.

TradingView has different pricing and subscription plans for different levels of users, ranging from free to premium. The free plan allows users to access most of the features and functionalities of the platform but with some limitations. The paid plans offer more features and functionalities, such as unlimited indicators, multiple chart layouts, more alerts, and more data and exchanges. The paid plans are as follows:

- Essential: $12.95 per month or $155.40 per year.

- Plus: $24.95 per month or $299.40 per year.

- Premium: $49.95 per month or $599.40 per year.

TradingView’s target audience and user base are mainly traders and investors who are interested in technical analysis, charting, and social networking. It supports trading in various asset classes, such as forex, stocks, commodities, cryptocurrencies, futures, and options. The platform has over 3 million monthly active users from over 180 countries and is one of the most visited financial websites in the world.

| Feature | Free | Essential | Plus | Premium |

| Indicators per chart | 3 | 5 | 10 | 25 |

| Alerts | 1 | 20 | 100 | 400 |

| Chart connections | 1 | 10 | 20 | 50 |

| Data and exchanges | Limited | Extended | Extended | All |

1.2. cTrader

cTrader is a desktop, web, and mobile platform that provides fast and reliable order execution, platform stability, and algorithmic trading for traders. cTrader was launched in 2010 by Spotware Systems, who wanted to create a platform offering a transparent and fair trading environment for traders.

cTrader has several key features and strengths that make it a popular choice among traders, such as:

- Order Execution: cTrader offers fast and reliable order execution with low latency and minimal slippage. Users can choose from various order types, such as market, limit, stop, stop limit, and more. cTrader also supports partial fills, market depth, and level II pricing.

- Platform Stability: cTrader is a stable and robust platform that can handle high volumes of trading activity and data. Users can enjoy a smooth and seamless trading experience with minimal downtime and errors. cTrader also has a high level of security and encryption, as well as backup and recovery systems.

- Algorithmic Trading: cTrader supports algorithmic trading, which allows users to automate their trading strategies using the cTrader Automate feature. Users can create, test, and optimize their trading robots and indicators using the C# language or use the ones created by other users in the cTrader community.

cTrader has a different pricing and commission structure than TradingView, as it is mainly a platform for forex and CFD trading. cTrader does not charge subscription fees or monthly payments for using the platform but instead charges commissions for each trade executed on the platform. The commissions vary depending on the broker, the account type, and the asset class.

cTrader’s target audience and user base are mainly traders who are interested in order execution, platform stability, and algorithmic trading. cTrader supports trading in various asset classes, such as forex, CFDs, metals, indices, commodities, and more. cTrader has millions of users from over 100 countries and is one of the most widely used platforms for forex and CFD trading.

| Feature | cTrader |

| Order types | Market, limit, stop, stop limit, and more |

| Order execution | Fast and reliable, with low latency and minimal slippage |

| Platform stability | Stable and robust, with minimal downtime and errors |

| Algorithmic trading | Supported with cTrader Automate feature |

| Pricing and commission | No subscription fees, but commissions per trade |

2. Head-to-Head Comparison

This section will compare and contrast TradingView and cTrader in three main aspects: charting and technical analysis, order execution and trading tools, and community and resources.

2.1. Charting and Technical Analysis

Charting and technical analysis are essential skills for traders who want to analyze the price movements and trends of the financial markets. Both TradingView and cTrader offer advanced charting and technical analysis tools, but they have some differences.

- Charting Tools and Customization Options: TradingView has more chart types and customization options than cTrader. TradingView offers over 15+ chart types. Users can also customize their charts with various drawing tools, annotations, and indicators. cTrader offers only 8 chart types. Users can also use some drawing tools and indicators but with less variety and flexibility than TradingView.

- Indicator Selection and Library: TradingView has a more diverse indicator selection and library than cTrader. TradingView has over 100 built-in indicators. Users can also create their own custom indicators using the Pine Script language or use indicators created by other users in the public library. cTrader has only 28 built-in indicators. Users can also create their own custom indicators using the C# language or use indicators created by other users in the cTrader community.

- Backtesting and Strategy Optimization Capabilities: TradingView has more backtesting and strategy optimization capabilities than cTrader. TradingView allows users to backtest and optimize their trading strategies using historical data and provides various statistics and metrics. Users can also use the TradingView platform to publish and subscribe to trading ideas, which are visual and interactive representations of trading strategies. cTrader allows users to backtest and optimize their trading strategies using historical data but with fewer statistics and metrics than TradingView.

- Ease of Use and Learning Curve for Technical Analysis: TradingView is easier to use and learn for technical analysis than cTrader. TradingView has a user-friendly and intuitive interface with clear and simple menus and buttons. Users can easily access and adjust the charting and technical analysis tools and switch between different timeframes, asset classes, and indicators. TradingView also has a lot of tutorials, guides, and educational resources for users to learn and improve their technical analysis skills. cTrader has a more complex and sophisticated interface with more menus and buttons. Users may need more time and effort to access and adjust the charting and technical analysis tools and switch between different timeframes, asset classes, and indicators.

| Aspect | TradingView | cTrader |

| Charting tools and customization options | More | Less |

| Indicator selection and library | Larger and more diverse | Smaller and less diverse |

| Backtesting and strategy optimization capabilities | More | Less |

| Ease of use and learning curve for technical analysis | Easier | Harder |

2.2. Order Execution and Trading Tools

Order execution and trading tools are important factors for traders who want to execute their trades efficiently and effectively. Both TradingView and cTrader offer fast and reliable order execution and trading tools, but they have some differences.

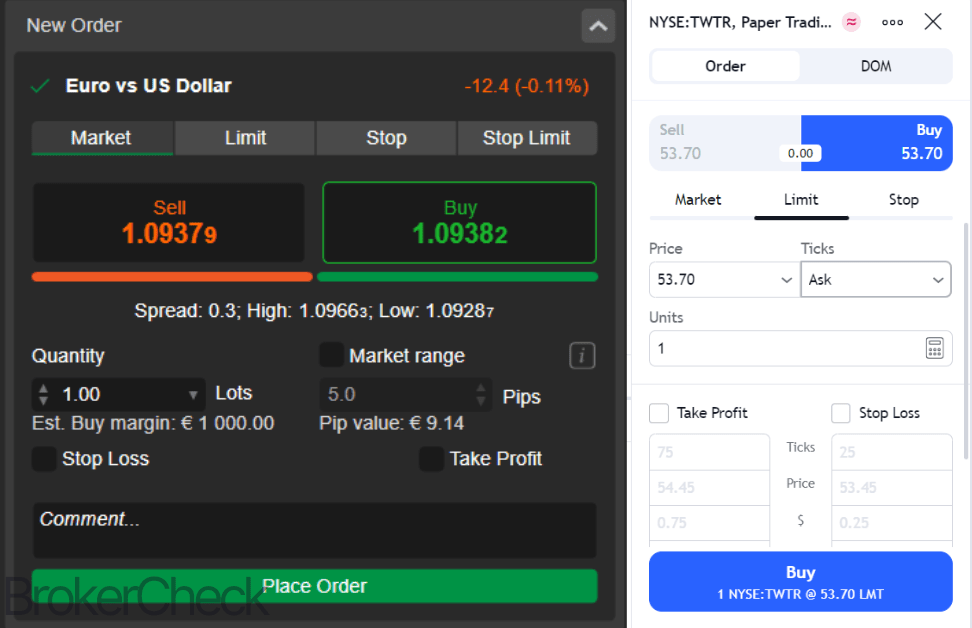

- Order Types and Execution Speed Comparison: cTrader has more order types and faster execution speed than TradingView. cTrader offers various order types, such as market, limit, stop, stop limit, and more. Users can also use advanced order features, such as one cancels the other (OCO), fill or kill (FOK), and immediate or cancel (IOC). cTrader also supports partial fills, market depth, and level II pricing. cTrader has a fast and reliable order execution, with low latency and minimal slippage. TradingView offers only market and limit orders and does not support advanced order features, partial fills, market depth, or level II pricing.

- Spreads and Commissions for Different Asset Classes: cTrader does not charge any subscription fees or monthly payments for using the platform but instead charges commissions for each trade executed on the platform. The commissions vary depending on the broker, the account type, and the asset class. TradingView charges subscription fees or monthly payments for using the platform, ranging from free to premium. The paid plans offer more features and functionalities but also higher spreads and commissions for different asset classes.

- Order Book Analysis and Market Depth Tools: cTrader has more order book analysis and market depth tools than TradingView. cTrader supports market depth and level II pricing, which allows users to see the supply and demand of the market and the best available prices for buying and selling. Users can also use the cTrader platform to analyze the order book and the market sentiment and identify potential trading opportunities and risks. TradingView also supports market depth or level II pricing but provides no order book analysis or market depth tools.

- Algorithmic Trading Support and API Access: cTrader has more algorithmic trading support and API access than TradingView. cTrader supports algorithmic trading, which allows users to automate their trading strategies using the cTrader Automate feature. Users can create, test, and optimize their trading robots and indicators using the C# language or use the ones created by other users in the cTrader community. cTrader also provides API access, which allows users to connect their platform to third-party applications and services, such as data providers, signal providers, and liquidity providers. TradingView supports algorithmic trading and does provide API access nut the usage is limited according to the subscription level you are using.

| Aspect | TradingView | cTrader |

| Order types and execution speed comparison | Fewer and slower | More and faster |

| Spreads and commissions for different asset classes | Higher | Lower |

| Order book analysis and market depth tools | Limted | More |

| Algorithmic trading support and API access | Limted | More |

2.3. Community and Resources

Community and resources are valuable aspects for traders who want to learn from others, share their ideas, and access more information and education. Both TradingView and cTrader have large and active communities and resources, but they have some differences.

- Availability of Tutorials, Guides, and Educational Resources: TradingView has more tutorials, guides, and educational resources than cTrader. TradingView has a lot of tutorials, guides, and educational resources for users to learn and improve their trading skills, such as articles, videos, webinars, courses, and more. Users can also access the TradingView blog, which provides news, updates, and tips on the platform and the markets. cTrader has some tutorials, guides, and educational resources but fewer than TradingView. cTrader has some articles, videos, webinars, and courses, but not as many or as diverse as TradingView. Users can also access the cTrader blog, which provides news, updates, and tips on the platform and the markets.

- User Forums and Community Support for Troubleshooting: TradingView has more user forums and community support for troubleshooting than cTrader. TradingView has a large and active community of traders and investors who share their ideas, opinions, and insights on the platform. It also has a dedicated support team that provides customer service and technical support for users. Users can also access the TradingView help center, which provides answers to frequently asked questions and issues. cTrader has a smaller and less active community of traders and investors who share their ideas, opinions, and insights on the platform. Users can follow, comment, like, and chat with others, but with less engagement and interaction than TradingView. cTrader also has a support team that provides customer service and technical support for users but with less responsiveness and availability than TradingView. Users can also access the cTrader help center, which provides answers to frequently asked questions and issues.

- Cost-Effectiveness and Value for Money: TradingView and cTrader have different cost-effectiveness and value for money, depending on the user’s needs and preferences. TradingView charges subscription fees or monthly payments for using the platform, ranging from free to premium. The paid plans offer more features and functionalities and higher spreads and commissions for different asset classes depending on brokers. TradingView may be more cost-effective and valuable for users who want more charting and technical analysis tools, social networking, and trading ideas. cTrader does not charge any subscription fees or monthly payments for using the platform but instead charges commissions for each trade executed on the platform. The commissions vary depending on the broker, the account type, and the asset class. cTrader may

| Aspect | TradingView | cTrader |

| Availability of tutorials, guides, and educational resources | More | Less |

| User forums and community support for troubleshooting | More | Less |

| Cost-effectiveness and value for money | Depends on user’s needs and preferences | Depends on user’s needs and preferences |