1. Understanding US Dollar Futures

Trading in the world of foreign exchange always comes with significant risk and reward, which is particularly true when it comes to the US Dollar Futures. These futures are a financial contract allowing the buyer to purchase dollars at a specific price, locking in the FX rate for a future date.

To enhance the understanding, the decentralized nature of the forex market, where the US Dollar is a part, should be considered. As a global entity, this market operates around the clock, allowing trading opportunities at any hour. However, the pricing of US Dollar futures is heavily influenced by interest rates, geopolitical events, and macroeconomic data. Trading, therefore, requires a comprehensive understanding of these factors.

Bold speculation is also part of the game, as future prices can change based on traders’ expectations of where the US Dollar will stand at the contract’s maturity. This speculation sees traders buying futures contracts when they believe the dollar will rise, or selling if they predict a drop.

In terms of strategy, one effective approach is the utilization of technical analysis. Traders may employ a range of indicators, patterns and sell/buy signals to make informed trading decisions. High probable trading opportunities often arise from the confluence of multiple positive technical signals.

Another important aspect of the strategy lies in performing a fundamental analysis, which includes tracking economic indicators like inflation, trade balance, and employment data. Also, closely monitoring statements from the Federal Reserve, as their decisions on monetary policy directly impact the U.S. dollar.

Navigating through the volatile landscape of US Dollar futures can be a daunting task. With a balanced mix of thorough understanding, technical analysis, fundamental analysis and market speculation, however, traders can strive to make informed decisions, effectively managing risk and potentially reaping sizable rewards.

1.1. Concept of Futures

Futures represent legal agreements to buy or sell a particular commodity or financial instrument at a predetermined price at a specific time in the future. They are standardized to facilitate trading on a futures exchange. Some futures contracts may call for physical delivery of the asset, while others are settled in cash. Traders leverage futures in attempts to magnify returns and hedge risk.

US Dollar futures, offered by organizations such as the Chicago Mercantile Exchange (CME), enable traders to hedge against currency risk. By using these contracts traders can secure a certain exchange rate for a set date in the future, protecting their financial positions from adverse currency movements. Traders may even use futures for speculative purposes, making bets on the direction of the currency.

The trading strategy for US Dollar futures depends largely on the trader’s perception of where the dollar is headed. Bullish traders, believing the dollar will appreciate, may buy futures, whereas bearish traders, expecting the dollar to depreciate, may sell. Yet, it is critical to evaluate economic indicators, interest rate trends, political climate, and other market-moving factors when formulating a trading strategy.

Another key element in a winning futures trading strategy is planning. Prior to entering a trade, setting profit goals and stop-loss levels can increase the chances of success by predefining when to exit a trade, whether it’s for a profit or to limit losses. Consequently, risk management is another corner stone in futures trading. Leveraging brings with it the potential for higher profits but also the risk of greater losses. Traders need to gauge their risk tolerance and adjust their positions accordingly.

In the arena of US Dollar futures trading, having an overriding strategy, clear goals, and an effective risk management plan coupled with staying informed about key market developments, can be the difference between success and failure.

1.2. Evolution of US Dollar Futures

US Dollar Futures trace their origins back to the 1970s, a period marked by global economic upheaval and the end of the Bretton Woods system of fixed exchange rates. With the world economy transitioning to flexible exchange rates, there was a surge in market volatility and a heightened need for advanced financial instruments. In this context, the Chicago Mercantile Exchange launched a groundbreaking financial product: the International Monetary Market (IMM).

US Dollar Futures, as we know them today, were introduced as one of the first products on the IMM. The aim was simple yet revolutionary: to provide an efficient way to hedge against fluctuations in the value of the US Dollar, the world’s primary reserve currency. Over time, this new market became exceedingly popular among traders and institutions worldwide, providing a structured method for managing currency risk while simultaneously opening up lucrative speculative opportunities.

The promise of the US Dollar Futures market is rooted in its design, which permitted contracts to be purchased and sold in a standardized format—bringing a level of predictability to a volatile exchange rate environment. Over the course of several decades, this market has evolved further, incorporating enhanced trading technologies, extended trading hours, and more subtle contract specifications.

One of the most significant milestones in the history of US Dollar Futures was the introduction of electronically traded futures in the late 1990s. This not only increased market accessibility for traders globally, but also resulted in increased trading volumes, leading to greater market depth and tighter bid/ask spreads. This transition to electronic trading transformed the US Dollar Futures market into a 24-hour marketplace and expanded the global reach of this essential financial instrument.

Uniquely characterized by transparency, liquidity, and resilience, the US Dollar Futures market continues to evolve in response to changing global economic circumstances. Whether used for hedging currency risk, speculating on future exchange rate movements, or making investment decisions based on expected shifts in macroeconomic policy, US Dollar Futures remain an indispensable tool in the financial trader’s arsenal.

1.3. Significance of US Dollar Futures

The US Dollar Futures market holds an integral position in the global financial ecosystem. Futures markets are founded on the principles of speculation and hedging, offering the functionality to secure future exchange rates. The significance of US Dollar Futures expands further than just American borders. With the US Dollar being the de facto global reserve currency, dollar futures take on a broader international importance.

The sheer volume and liquidity of US Dollar Futures markets render them attractive for traders. With a constantly fluctuating market driven by geopolitical, economic and even social factors, traders have numerous opportunities to profit from these price movements. The ability to short sell futures also allows traders to capitalise on declining markets, adding another dimension to their trading strategy.

The institution of margin trading within futures markets presents its own unique allure. By enabling traders to control large contracts with a relatively small capital, high returns in smaller time frames make US Dollar Futures an enticing venture. But prospective traders should remain cautious: while this leveraged trading amplifies potential profits, it simultaneously magnifies potential losses.

With round-the-clock access to the market, traders can react swiftly to changes in international economic indicators and breaking news events. This total access, combined with the US Dollar’s status as a ‘safe-haven’ currency during times of economic turbulence, underpins the immense significance of US Dollar futures in the sphere of global finance and trading.

2. Trading US Dollar Futures

Futures trading presents a unique opportunity to hedge against risk while leveraging market volatility. One instrument gaining traction among forward-thinking traders is US dollar futures. These contracts enable trading based on future valuations of the US dollar against other currencies. Think of it as a strategic bargaining chip, allowing traders to both protect and expand their investment portfolio.

The trading environment for US dollar futures is rooted in comprehensive market analysis. Traders need an in-depth understanding of the global economic climate, interest rates, and geopolitical events – all of which can dramatically impact the valuation of the US dollar. Technical analysis is the method commonly used to predict future trends based on past data, and involves identifying patterns in price changes and volume traded. Employing this analysis can lead to informed predictions about potential price fluctuations.

Expressed in terms of trading strategy, the goal is to purchase futures contracts when the US dollar is predicted to strengthen, and sell when it’s expected to weaken. The effective use of stop loss orders can manage potential losses by automatically closing a position if the market price drops below the level pre-set by the trader. Risk and reward are core metrics that require constant monitoring. Hedging strategies, including options or spread trading, may also be employed for further protection against unfavorable trade outcomes.

However, it’s essential that the trader maintains momentum even during unpredictable market conditions. Profit opportunities may emerge during periods of volatility, but these also carry a greater risk. The key is for the trader to stay vigilant, assessing minute-to-minute price changes while always poised to capitalize on a profitable move. Betting on the future value of the US dollar requires a heady mix of skill, intuition, and resilience, but for those who master the trade, the rewards can be significant.

Remember, while trading US dollar futures can bring about generous profits, it is also fraught with potential risks. Adequate education and careful strategy formation are key to becoming a successful futures trader. Always seek expert advice and consider all aspects of trading before diving into the often turbulent waters of US dollar futures.

2.1. Fundamental Analysis

Examining the relational mechanics of the fundamental elements that directly influence the US Dollar is paramount. When performing a fundamental analysis, traders scrutinize a compilation of essential economic indicators like inflation rates, unemployment rates, GDP growth rates, and interest rates established by central banks—specifically, the US Federal Reserve in this case. Attention must be paid to political climates as geopolitical situations can initiate drastic fluctuations in currency values.

Understanding macroeconomic indicators can inform trading decisions on the US Dollar. For instance, substantial change in employment rates might suggest economic stability or instability, playing a pivotal role in currency valuation, while turbulence in international diplomatic relations can produce unanticipated market volatility.

Perceptive traders intricately correlate these aspects of fundamental analysis, appraising possible outcomes and discerning the possible impact on the US Dollar in the forex market. It is the astute comprehension of these various components, and the intersectionality between them, where investors find the keys to minimize their exposure to market risks while capitalizing on prospective market opportunities.

Moreover, a vigilant observer stays updated with global events and international policy amendments as unexpected fluctuations can often be traced back to these tangible real-world occurrences. Capitalizing on these disruptions with adept timing is an advanced strategy employed by experienced traders. Nevertheless, it’s crucial to remember that fundamental analysis offers perspectives on long-term trends rather than immediate, short-term reactions.

2.2. Technical Analysis

Technical analysis plays an instrumental role in successful forex trading, and when focused on the US Dollar, it’s equally paramount. It involves inspecting and interpreting historical prices and volumes of this fiat currency to predict future market trends. It’s not just about forecasting, it also encompasses spotting high-probability trade setups and managing market risks effectively.

Its application kicks off with identifying and tracking patterns. Trend lines, support and resistance levels, and Fibonacci retracements are common tools used. Notably, these tools help in determining directional dominance, key trading levels, and potential reversal zones.

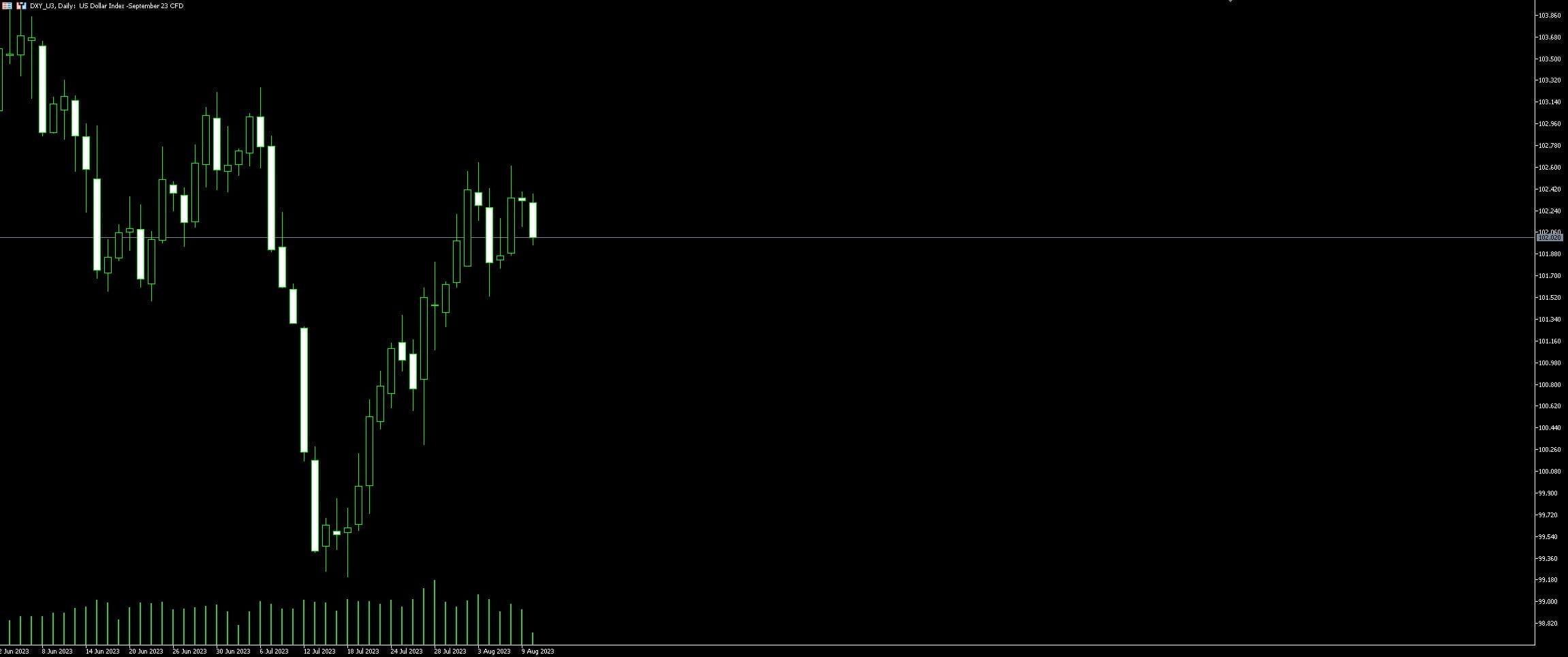

When it comes to the US Dollar, one key element to look out for is its correlation with other currencies. The US Dollar Index (DXY) gives an overview of its average value against a basket of significant foreign currencies. A rise in DXY represents a strong US Dollar, while a drop signals weakness. Many traders use this index as a proxy for the overall health of the US Dollar.

The use of charts and indicators is another crucial aspect of technical analysis. Different types of charts such as line, bar, and candlestick charts provide visual insights into market movements. Indicators like moving averages, stochastic oscillators, and relative strength index (RSI), among others, aid in providing an in-depth understanding of the possible market trends.

Moreover, economic events significantly impact currency movements. This includes important news releases, monetary policies, and changes in the economic environment. Keeping an eye on an economic calendar and staying updated with major news around the globe is essential.

For effective trading strategies, it’s necessary to augment technical analysis with a good understanding of market sentiment and fundamental analysis. Market sentiment refers to the overall attitude of investors toward a particular security or financial market and can sway the trends in the market. On the other hand, fundamental analysis delves deep into factors influencing the economic stability and growth perspectives of the country, thereby impacting the strength of the US Dollar.

Undertaking the diligent interpretation of these technical tools, patterns, indices, charts and indicators, in conjunction with a keen awareness of global economic events, leads the way towards crafting an effective trading strategy for the US Dollar. It’s a journey of continuous learning, experience, and adaptability, to keep up with the dynamic nature of forex markets.

2.3. Risk Management in Trading US Dollar Futures

Risk management plays a vital role when it comes to trading US Dollar futures. Identifying potential risks and finding methods to mitigate them is at the core of this practice. There are several components worth understanding to maintain a balance between risks and rewards in the futures market. Positions in this market may engender substantial financial losses if left uncontrolled so the necessity to incorporate risk management tools should never be underestimated.

One of the most basic forms of risk management in futures trading is the use of a stop-loss order. This tool enables traders to limit their losses by setting a predetermined point to exit a losing position. Therefore, significant losses can be evaded by predetermining a level where the trade will be closed if the market takes an unfavorable turn.

Bond traders often rely on US Dollar futures to hedge against potential currency fluctuations. These futures contracts allow the trader to lock in a price for the US Dollar against other currencies, which can be helpful when expectations are for the currency to depreciate.

Furthermore, diversification of the portfolio can also be an effective risk management strategy. By spreading investments across diverse financial instruments and markets, traders can minimize the impact of individual market fluctuations on their overall portfolio.

To summarize, traders cannot afford to neglect the domain of risk management. The application of stop-loss orders, hedging strategies, and portfolio diversification are critical to plotting a careful course through the treacherous waters of US Dollar futures trading.

2.4. Step by Step Guide to Trading US Dollar Futures

- Understanding US Dollar futures trading requires delving into the core of the process that involves buying and selling contracts on a specific date in the future at a predetermined price. As these actions correlate with the expected value of the US Dollar, an in-depth market analysis is essential.

- Begin with market analysis. Use technical indicators, economic data and news events to predict how the US Dollar might move. Following the basic principle of trading, purchase futures when you anticipate the US Dollar to gain strength and sell when you foresee a weakening.

- Develop your trading plan. A well-thought-out plan should outline your goals, risk tolerance, and methodology. Decide the type and number of futures contracts to trade based on your analysis and the capital you are willing to risk.

- Choosing a futures broker is crucial. Ensure they provide access to futures exchanges where US Dollar futures are traded – like the Chicago Mercantile Exchange. Research brokers’ commission rates, financial stability, and customer service quality.

- Navigating the trading platform effectively is essential. Familiarize yourself with order types, how to read charts, and use technical analysis tools. Paper trading, a way of practicing trades without using real money, can be helpful.

- After becoming comfortable with the platform, execute your first trade. Remember, the key lies in purchasing futures contracts when anticipating the US Dollar to rise and selling when forecasting a drop.

- Monitoring and adjusting your positions is an ongoing requirement. Review changes in the futures price and the margin requirements. Continually reassess your market analysis with any significant news events or economic releases.

- Thorough documentation keeps track of trading decisions and emotional factors influencing those decisions. This learning tool helps refine your trading strategy and identify any patterns which might result in losses.

- Sound Risk Management is integral, and setting stop-loss orders can prevent significant losses beyond your risk tolerance level.

US Dollar futures trading offers opportunities to profit from price fluctuations, but it demands a comprehensive strategy, thorough analysis, and prudent risk management.