1. Understanding VWAP and Its Significance in Trading

Incorporating VWAP into a trading strategy often involves several tactical approaches:

- Trade Execution: For institutional traders, VWAP is used as a benchmark to execute large orders without disrupting the market. Executing trades near the VWAP can help in minimizing the market impact.

- Trend Confirmation: By comparing the current price to the VWAP, traders can confirm if the current market trend aligns with the broader market sentiment. Prices consistently above VWAP may confirm an uptrend, while prices below may confirm a downtrend.

- Breakouts and Reversals: A breakout above or a breakdown below the VWAP can signal a potential change in market direction. Traders might look for these signals to enter new positions or close existing ones.

VWAP also plays a pivotal role in algorithmic trading, where trading algorithms use this indicator to slice up large orders into smaller trades to minimize market impact and to execute at prices better than or equal to the VWAP.

| VWAP Uses | Description |

|---|---|

| Trade Execution | Helps in executing large orders near the VWAP to minimize market impact. |

| Trend Confirmation | Confirms if the price action aligns with the broader market sentiment. |

| Breakouts/Reversals | Identifies potential changes in market direction for timely entry or exit. |

| Algorithmic Trading | Utilized in algorithms for optimal trade execution and minimizing market impact. |

VWAP Limitations should also be acknowledged. It is primarily a day trading indicator and loses its effectiveness overnight when the market is closed. Additionally, VWAP may not be as useful in highly volatile markets where price movements can deviate significantly from the average.

More Information about the VWAP Auto Anchor can be found on Tradingview.

Traders should also be aware of the cumulative nature of VWAP, as it is based on intraday data and becomes more reliable as the day progresses. Early in the trading day, VWAP can be more volatile due to the smaller volume of data points.

Combining VWAP with other indicators can provide a more robust analysis. For example, using VWAP in conjunction with moving averages or price oscillators can help in confirming trends and identifying potential reversals.

By understanding and applying VWAP effectively, traders can enhance their trading decisions and potentially improve their performance in the markets. It remains a popular tool among traders for its simplicity and effectiveness in providing a real-time snapshot of market sentiment and price levels.

1.1. What is VWAP?

Utilizing VWAP in Trading Strategies

Traders incorporate VWAP into various trading strategies to enhance decision-making. Here are common ways traders might use VWAP:

- Trend Confirmation: A price above VWAP may indicate an uptrend, while a price below could suggest a downtrend.

- Price Entry and Exit Points: VWAP can serve as a potential support or resistance level. Traders might buy near the VWAP when the price is in an uptrend and sell when the price is below VWAP in a downtrend.

- Benchmarking Trade Execution: Institutional traders compare their transaction prices to VWAP values to assess their trading performance.

VWAP Breakouts and Breakdowns:

- Breakouts occur when the price moves above the VWAP with significant volume, which can signal a buying opportunity.

- Breakdowns happen when the price falls below the VWAP on substantial volume, potentially indicating a selling point.

VWAP Crosses:

- A bullish signal is generated when the price crosses above the VWAP.

- A bearish signal is indicated when the price crosses below the VWAP.

| Trading Action | VWAP Relation | Signal Type |

|---|---|---|

| Buying | Below VWAP | Bullish |

| Selling | Above VWAP | Bearish |

| Confirming Trend | Price consistently above/below | Trend Strength |

| Benchmarking | Close to VWAP | Efficient Execution |

VWAP Limitations

Despite its widespread use, VWAP has limitations that traders must consider:

- Timeframe Restriction: VWAP is predominantly useful for intraday trading. Its relevance diminishes over longer periods as it resets daily.

- Lagging Indicator: Being based on past data, VWAP can lag real-time price movements, which may lead to delayed signals.

- Volume Spikes: Sudden spikes in trading volume can skew VWAP calculations, potentially misleading traders.

- Reduced Effectiveness in Less Liquid Markets: In markets with lower trading volumes, VWAP may be less reliable due to the reduced amount of data.

Traders should use VWAP in conjunction with other indicators and market analysis techniques to confirm signals and develop a robust trading strategy. It’s important to consider market context, volume patterns, and price action when interpreting VWAP to avoid relying on potentially misleading signals.

1.2. The Role of VWAP in Trade Analysis

Understanding VWAP Breakouts and Breakdowns

Traders often monitor VWAP for potential breakouts or breakdowns. A breakout above VWAP can signal that buyers are gaining control and that there may be upward momentum. This can be a cue for traders to consider long positions. On the other hand, a breakdown below VWAP might indicate sellers overpowering buyers, potentially leading to a downward trend. Such a scenario could be an opportunity to initiate short positions.

Key VWAP Strategies for Traders:

- Trend confirmation: A price maintaining above VWAP can confirm an uptrend, while consistently below can signal a downtrend.

- Entry and exit points: VWAP can be used to fine-tune the timing of market entry and exits. Entering a trade near VWAP may provide a favorable risk-reward ratio.

- Price reversals: Sharp moves towards or away from VWAP can indicate possible price reversals.

- Stop-loss orders: Setting stop-loss orders around VWAP levels can help manage risk.

Traders should be aware that VWAP is predominantly a day-trading indicator. Since it is reset at the beginning of each trading day, its relevance is limited to intraday price action. For longer-term trade analysis, traders might consider the moving VWAP, which extends over multiple sessions.

VWAP Limitations and Considerations

While VWAP is a powerful tool, it is not without limitations. It does not account for macroeconomic factors or news events that can significantly influence stock prices. Additionally, during periods of low volume, VWAP may be less reliable due to the reduced market participation.

- Volume spikes: Sudden increases in volume, often due to news or events, can skew VWAP calculations.

- Opening and closing periods: VWAP may be more volatile during market open and close, where volume and price movements are more erratic.

- Consolidation periods: In sideways markets, VWAP might offer less insight into price direction.

In conclusion, while VWAP is a valuable indicator for understanding market dynamics and making informed trading decisions, it should be used in conjunction with other analysis tools and market knowledge for the best results.

1.3. Benefits of Using VWAP for Traders

VWAP as a Trend Indicator

For traders who incorporate trend analysis into their strategies, VWAP can act as a trend indicator. If the price is above the VWAP, it might indicate an uptrend, and if it’s below, a downtrend could be suggested. This simple heuristic allows traders to align their trades with the prevailing market momentum, potentially increasing their chances of success.

Combining VWAP with Other Indicators

To enhance their trading strategies, traders often combine VWAP with other technical indicators such as moving averages, RSI, or MACD. This multi-faceted approach can help in confirming signals and refining trade setups. For instance, a trader might look for a stock trading above both the VWAP and a 50-day moving average as a bullish signal.

VWAP for Different Time Frames

While VWAP is traditionally used on an intraday basis, its principles can be applied to longer time frames using anchored VWAP (aVWAP). By anchoring the VWAP to a specific event or date, traders can obtain a volume-weighted price average from that point, offering insights into longer-term trends and levels of interest.

VWAP Limitations

Despite its advantages, traders should be aware of VWAP’s limitations. It is less effective in highly volatile markets where price swings can distort the average. Additionally, VWAP is a lagging indicator, meaning it relies on past data and may not predict future market movements.

VWAP Strategies Table

| Strategy | Description | Consideration |

|---|---|---|

| Mean Reversion | Buying below VWAP or selling above it, assuming price will return to the average. | Works best in range-bound markets. |

| Momentum Trading | Trading in the direction of the VWAP trend; buying above or selling below. | Requires confirmation to avoid false signals. |

| Breakouts/Breakdowns | Entering trades when price breaks through VWAP with high volume. | Needs to ensure breakout isn’t a false move. |

By integrating VWAP into their trading arsenal, traders can leverage these strategies to potentially enhance their market edge. However, it’s important to combine VWAP with a robust risk management plan and to test strategies thoroughly before applying them to live trading scenarios.

2. Auto-Anchoring VWAP for Enhanced Trading Precision

Auto-Anchoring VWAP has become a staple for traders who demand cutting-edge analytical tools. By automatically finding the most relevant starting point for VWAP calculations, this dynamic feature streamlines the analytical process, saving time and enhancing the quality of trading signals.

Key Advantages of Auto-Anchoring VWAP:

- Adaptability: Adjusts to market changes, providing up-to-date analysis.

- Precision: Offers a more accurate reflection of market price and sentiment.

- Efficiency: Reduces manual effort in recalculating VWAP for different sessions or events.

- Consistency: Ensures a uniform approach to analyzing price movements across various instruments.

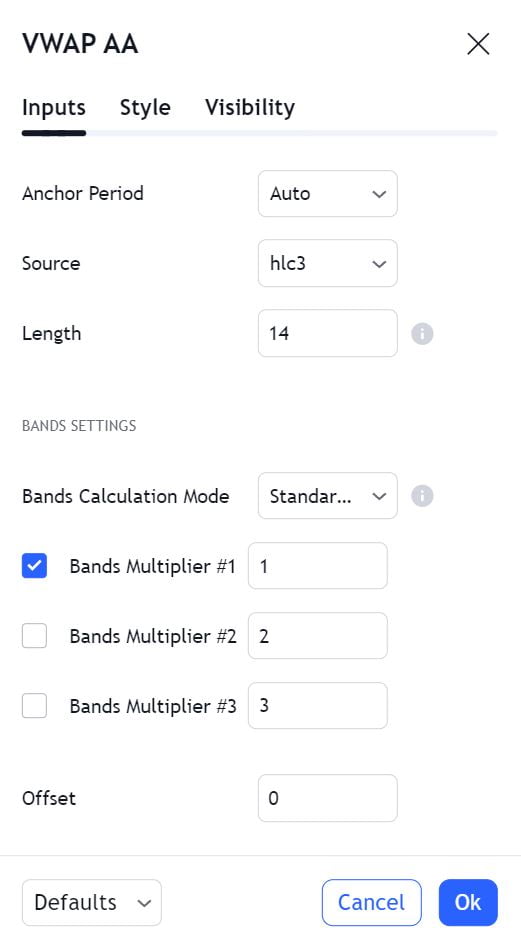

Traders should be mindful that the effectiveness of auto-anchoring VWAP can be influenced by the specific settings chosen. Parameters such as the look-back period, the criteria for re-anchoring, and the sensitivity to market events can all impact the performance of this tool. Therefore, customization to fit individual trading styles and market conditions is crucial.

Best Practices for Utilizing Auto-Anchoring VWAP:

- Understand the Mechanism: Grasp how VWAP is calculated and how auto-anchoring modifies this calculation.

- Set Clear Parameters: Define the rules for when and how the VWAP should auto-anchor.

- Backtest Strategies: Evaluate the tool’s performance historically to fine-tune its application.

- Monitor Market Conditions: Stay alert to events that may warrant a re-anchoring of the VWAP.

By incorporating auto-anchored VWAP, traders can leverage a data-driven approach to capture market trends and make trades that are aligned with the underlying volume-weighted price action. This tool is particularly useful in markets where volume patterns are indicative of future price movements.

Integrating Auto-Anchoring VWAP into Trading Systems:

- Combine with Other Indicators: Use in conjunction with other technical analysis tools for comprehensive insights.

- Apply to Multiple Timeframes: Analyze short-term and long-term trends for a holistic view.

- Adjust for Asset Specifics: Customize settings based on the liquidity and volatility of the asset being traded.

- Use as a Benchmark: Compare the current price to the auto-anchored VWAP to assess overbought or oversold conditions.

Traders who effectively harness the power of auto-anchoring VWAP position themselves to capitalize on market inefficiencies and execute trades with increased confidence. By aligning their strategies with the true market narrative that auto-anchored VWAP provides, they can navigate the complexities of the financial markets with greater clarity and conviction.

2.1. The Concept of Auto-Anchoring in VWAP

Traders often seek tools that can enhance their decision-making process by offering precise and timely market insights. Auto-anchoring VWAP stands out by providing a dynamic perspective on the market s average price, factoring in volume at each point. This approach differs from traditional VWAP calculations, which typically start at the beginning of the trading day and continue cumulatively.

Benefits of Auto-Anchoring VWAP:

- Adaptability: Automatically adjusts to the most significant points, such as market openings, earnings reports, or economic data releases.

- Efficiency: Reduces the manual effort required to recalibrate the VWAP for different trading scenarios.

- Objectivity: Minimizes the potential for human error or bias in selecting the anchoring point for VWAP calculations.

How Auto-Anchoring VWAP Works:

- Event Recognition: The system identifies key events that warrant a reset of the VWAP calculation.

- Automatic Reset: The VWAP calculation begins anew from the identified event, providing a fresh average that incorporates the latest volume data.

- Continuous Update: As new data comes in, the VWAP is recalculated, ensuring that the average price is always relevant and up-to-date.

For traders, the ability to see a volume-weighted price that is constantly realigned means having a pulse on market sentiment immediately following impactful events. This can be especially useful in volatile markets where price movements are rapid and information is continuously evolving.

Practical Application of Auto-Anchoring VWAP:

- Day Trading: Day traders can leverage auto-anchored VWAP to make informed decisions on entry and exit points throughout the trading day.

- Event-Driven Strategies: Traders focusing on event-driven strategies can use the auto-anchoring feature to assess the market’s reaction to news or events.

- Risk Management: By providing a more accurate price average, auto-anchoring VWAP can help in setting tighter stop-loss orders or more strategic take-profit levels.

Incorporating auto-anchoring VWAP into a trading strategy can offer a significant edge, as it aligns the trader’s tools with the ever-changing landscape of the market. By leveraging real-time data and automatic adjustments, traders can maintain a consistently accurate view of market value as it pertains to their specific trading approach.

2.2. How Auto-Anchoring VWAP Improves Trade Entry and Exit Points

When integrating auto-anchored VWAP into a trading strategy, it’s crucial to consider the tool in the context of other technical indicators and market conditions. Here’s how traders can leverage auto-anchored VWAP for trade entry and exit points:

Identifying Trend Direction:

- Bullish Signal: Price above VWAP may indicate an uptrend.

- Bearish Signal: Price below VWAP could suggest a downtrend.

Trade Entry Points:

- Long Position: Enter when the price crosses above the VWAP line, suggesting upward momentum.

- Short Position: Enter when the price falls below the VWAP, indicating downward pressure.

Trade Exit Points:

- Taking Profit: Exit a long position when the price starts to fall below the VWAP, signaling a potential reversal.

- Cutting Losses: Exit a short position when the price rises above the VWAP, hinting at a shift in momentum.

- Support: The VWAP can act as a dynamic support level in an uptrend.

- Resistance: In a downtrend, the VWAP may serve as a dynamic resistance level.

Breakouts and Breakdowns:

- Breakout: A price move above VWAP with high volume could indicate a breakout.

- Breakdown: A price move below VWAP on significant volume may signal a breakdown.

Combining with Other Indicators:

- Confirmatory Signals: Use VWAP in conjunction with indicators like Moving Averages, RSI, or MACD for confirmation.

- Volume Analysis: Look at volume patterns alongside VWAP to gauge the strength of the price move.

Practical Considerations:

- Slippage Reduction: Aim to execute trades near the VWAP to reduce slippage.

- Avoid Overreliance: Don’t solely rely on VWAP; consider the broader market context.

- Adaptability: Be ready to adapt to new VWAP levels as they auto-anchor to recent events.

| VWAP Condition | Long Trade Action | Short Trade Action |

|---|---|---|

| Above VWAP | Possible entry or hold | Possible exit or short |

| Below VWAP | Possible exit or wait | Possible entry or hold |

| Price Crossing VWAP | Assess for entry signal | Assess for entry signal |

| Price Bouncing off VWAP | Confirm as support | Confirm as resistance |

Risk Management:

- Stop-Loss Orders: Place stop-loss orders at strategic levels around the VWAP to manage risk.

- Position Sizing: Adjust position size based on the distance to VWAP to control potential losses.

By understanding and applying auto-anchored VWAP within a comprehensive trading plan, traders can better navigate the markets and make decisions that are aligned with the latest price and volume data. The key is to use VWAP as a guide, not a standalone solution, and to always remain aware of its dynamic nature in relation to market events.

2.3. Integrating Auto-Anchored VWAP into Your Trading Strategy

Integrating the auto-anchored VWAP into your trading strategy can be a game-changer, especially when you’re aiming for precision and adaptability in your market analysis. The Volume Weighted Average Price (VWAP) serves as a benchmark that traders use to gauge the market’s trend and to make informed decisions about entry and exit points.

Key Steps for Integration:

- Identify Significant Market Events:

- Earnings reports

- Economic news

- Market open/close

- Start of the week/month/quarter

- Configure Your Trading Platform:

- Ensure VWAP resets automatically

- Customize settings for your specific trading needs

- Set Up Alerts:

- Price crossing above VWAP (potential bullish signal)

- Price crossing below VWAP (potential bearish signal)

- Assess Trend Direction:

- Price above VWAP: consider long positions

- Price below VWAP: consider short positions

- Combine with Other Indicators:

- Moving averages

- Support and resistance levels

- Fibonacci retracements

- Oscillators (RSI, MACD)

Benefits of Using Auto-Anchored VWAP:

- Reflects Current Market Sentiment: Automatically adjusts to encapsulate recent price action and volume.

- Enhanced Precision: Offers a more accurate average price based on the latest market activity.

- Improved Decision-Making: Assists in identifying potential trade entry and exit points.

- Adaptability: Adjusts to market changes, maintaining relevance across different trading sessions.

By employing the auto-anchored VWAP, you’re not just relying on a static average price; instead, you’re engaging with a dynamic tool that reflects the latest market conditions. This approach can help you stay ahead of the curve, making decisions that are informed by real-time data and market movements.

Remember to monitor the performance of the auto-anchored VWAP in your trading strategy regularly. Markets evolve, and so should your methods. By doing so, you can fine-tune your approach, making the necessary adjustments to maintain an edge in your trading endeavors.

2.4. Best Practices for Utilizing Auto-Anchored VWAP

Auto-Anchored VWAP serves as a dynamic benchmark that adjusts to market conditions, reflecting the true average price based on both volume and price. It is essential for traders to identify the trend direction with the VWAP. When the price is consistently above the VWAP, it signals strength, and when below, it indicates weakness.

Anchor selection is pivotal for the VWAP’s relevance. Key dates, such as earnings releases or product launches, can serve as meaningful anchor points. This temporal anchoring can offer insights into investor sentiment and price trends following such events.

Volume analysis complements the VWAP. High volume levels can validate the VWAP as a stronger level of support or resistance. Traders should watch for volume spikes as they may precede significant price movements, with the VWAP acting as a magnet or a hurdle for prices.

Timeframe integration is another layer of analysis. A VWAP on a 15-minute chart may offer short-term trade setups, while a daily VWAP provides a lens for the longer-term trend. By analyzing multiple timeframes, traders gain a multi-dimensional view of market dynamics.

Technical confluence enhances the VWAP’s utility. By combining VWAP with indicators like MACD or Bollinger Bands, traders can corroborate their trade theses. This multi-indicator approach helps in filtering noise and pinpointing high-probability trades.

Backtesting is indispensable for strategy validation. By analyzing how the Auto-Anchored VWAP would have behaved during past market scenarios, traders can fine-tune their approach. Historical performance, while not a guarantee of future results, can guide expectations and strategy adjustments.

Risk management is the safeguard of trading. Establishing stop-loss levels based on VWAP deviations can help in mitigating losses when the market moves against a position. A disciplined approach to stop-loss placement ensures that traders can survive to trade another day, even after unexpected market moves.