Live Chart Of USD/CNH

1. Understanding the USD/CNH Pair

Navigating the ebbs and flows of financial markets calls for a thorough grasp of the USD/CNH pair. At the heart of this pair lies the exchange rate between two of the world’s most powerful economies — the United States and China. The USD/CNH pair reflects the value of the US dollar against the Chinese yuan (also known as the Renminbi) outside of mainland China. Trading this pair requires special attention to economic indicators in both countries.

The U.S Economy plays a pivotal role in the price movement of the USD/CNH pair. Economic factors like the Federal Reserve’s monetary policy, inflation rates, GDP growth, and political stability can significantly impact the US dollar’s strength. Regularly monitoring these economic indicators will place traders in a strong position to make accurate predictions about the USD/CNH pair.

However, it is no one-sided affair, as the trajectory of China’s economy likewise heavily influences the USD/CNH pair. China Central Bank’s policy decisions, its economic growth pace, inflation, and the health of its manufacturing and export sectors, necessitate careful monitoring. China’s strict capital control policies can sometimes lead to a disparity in the CNH and CNY (the onshore version of the yuan) rates, making it crucial for traders to understand these nuances.

Moreover, the USD/CNH pair is particularly sensitive to geopolitical events and economic relations between the U.S. and China. The pair often exhibits increased volatility during trade negotiations, tariffs disputes, and similar events that stir the waters between the two giants. Traders keeping an ear to the ground about these international affairs stand to gain from the arising trading opportunities.

Please bear in mind, trading the USD/CNH pair, like any other trading pair, inherently carries risks. Efficient risk management techniques, alongside diligent and continuous analysis, are hence integral parts of trading this pair successfully.Striking a balance between potential risks and rewards is a key aspect of successful USD/CNH trading.

1.1. The Definition of USD/CNH Pair

The USD/CNH pair refers to the foreign exchange rate between the US Dollar (USD) and the off-shore Chinese Yuan (CNH). When trading, USD is considered as the base currency and CNH is the quote one. This pair informs traders on the amount of CNH needed to purchase one USD. Off-shore Chinese Yuan (CNH) represents a variant of Chinese Yuan introduced in 2010 to allow foreign investors access to China’s economy. Unlike the on-shore Yuan (CNY), CNH is not controlled by the People’s Bank of China and fluctuates freely against the US Dollar and other currencies. Trading USD/CNH therefore provides an alternative, unrestricted means of investing in and speculating on Chinese economic performance. The pair also serves as a crucial instrument for understanding currency tensions between two of the world’s largest economies. While fluctuations in this unique forex pair occurs due to a variety of reasons, some key influencing factors include China’s economic indicators, interest rate decisions by the Federal Reserve and the People’s Bank of China, and the ongoing and constantly evolving economic and trade policies between the United States and China.

1.2. Characteristics of USD/CNH Trading

USD/CNH trading boasts a unique set of characteristics, making it an appealing choice for savvy traders. Market Volatility is an inherent trait of the Forex market and USD/CNH is no exception. This paired currency brings with it higher than average market volatility, offering lucrative opportunities to traders willing to navigate the possible hurdles.

Another characteristic of USD/CNH is its Heavily Decentralized Nature. Since CNH trades outside China, it is less influenced by domestic Chinese policies and interventions that the CNY (on-shore Renminbi) often falls under. This provides the trader some insulation from abrupt policy shifts that might drastically impact trading strategies.

Leverage stands tall among other traits, offering traders the chance to potentially enlarge their profits. Be wise when using leverage, though. It is a double-edged sword that can inflate profits or amplify losses depending on market performance.

Lastly, bear in mind the Trade Timing. USD/CNH follows the Hong Kong trading timetable, incorporating extended hours. This allows traders to engage almost 24/7, paving the way for increased flexibility and round-the-clock trading opportunities.

One should understand that despite these promising characteristics, trading USD/CNH comes with its share of challenges. Market volatility, while rewarding, may lead to substantial losses for the unprepared trader. Hence, one must commit time, efforts, and conduct thorough research before diving into the USD/CNH trading arena. Familiarize yourself with Forex fundamentals, employing meticulous risk management strategies, and staying abreast of global and regional economic news is paramount to success in the USD/CNH trading landscape.

1.3. Timing for USD/CNH Trading

When trading USD/CNH, understanding the markets’ cycle and the optimal times to trade is crucial. The USD/CNH currency pair is not as widely traded as other major pairs; hence, timing plays a considerable role. It is predominantly traded during the Asian trading session, which runs from 01:00 to 10:00 GMT. This period usually corresponds with the opening hours of financial institutions in China and Hong Kong.

The largest price movements tend to happen during this session when liquidity is at its peak. However, it should be noted that important economic data from the United States, released between 12:30 and 15:30 GMT, also significantly influence this pair’s activity. This includes data such as Non-Farm Payrolls and Gross Domestic Product (GDP) announcements, which tend to have a significant influence on USD/CNH movements.

Placing trades outside these peak activity periods, when liquidity is lower, may result in wider spreads and greater slippage. As such, being prepared and understanding these timings can significantly impact a trader’s success when trading the USD/CNH currency pair.

2. Key USD/CNH Trading Strategies

Engaging in Forex trading necessitates grasping the intricacies of the market and crafting effective trading strategies. The USD/CNH, otherwise known as the US Dollar against the Chinese Yuan Offshore, is one pair that demands a clear understanding of these strategies.

When dealing with the USD/CNH, one should account for the influence of economic indicators. Monitor critical reports coming from both the U.S. and China as they can provoke substantial price swings. Key indicators include GDP growth rates, inflation data, and political developments. Comprehension of these factors enhances a trader’s ability to predict possible market movements.

Another pivotal strategy indulges in what is known as the ‘Carry Trade’. This approach aims for profit from the difference in interest rates between the US and China. A trader, in this case, borrows a currency with a low-interest rate and uses it to purchase another with a higher one. The transaction is profitable if the currency with the high-interest rate appreciates against the low-interest rate one.

Technical analysis, employing tools like charts and indicators to forecast price movements, is a crucial consideration for successful USD/CNH trading. Traders rely on trend lines, moving averages, and oscillators to comprehend the cyclic nuances of this pair.

Considering the influence of the USD/CNH on the global economy, building effective strategies becomes even more fundamental. A blend of all these strategies along with a rigorous study of market conditions play pivotal roles in ensuring successful USD/CNH trades.

2.1. Scalping Strategy

Scalping is a popular and fast-paced trading strategy that involves making a large number of trades within a short time frame. The key idea behind scalping is to earn small profits while limiting exposure to the market. In fact, a typical scalping strategy may involve making anywhere from 10 to hundreds of trades in a single day.

In the context of trading USD/CNH, scalping can be effectually employed. The strategy begins with a trader setting up a chart of the USD/CNH in a time frame anywhere from one minute to five minutes. Traders need to watch the charts closely for any emerging patterns or trends. This involves a keen eye and a quick propensity to act on subtle market shifts.

With scalping strategy, traders might set relatively tight stop-loss orders. This is primarily done to limit the potential loss on a trade if the market makes an abrupt move against the trader’s position. Conversely, traders may also set a take-profit order, ensuring they lock in profits when the market moves in their favor.

The nature of scalping means traders must be willing to commit a significant amount of time to their trading efforts. It is not uncommon for scalpers to be glued to their screens for several hours a day. Scalping is certainly not for the faint-hearted, demanding high-stress tolerance and quick decision-making skills. Nonetheless, when utilized correctly, scalping can be a highly profitable strategy in trading USD/CNH.

2.2. Trend Following Strategy

Harnessing the potency of the Trend Following Strategy in the USD/CNH trading spectrum holds immense potential. The basis lies in identifying, and adhering to, the trajectories of price movements. Popularity of this approach stems from its overarching essence of simplicity and effectiveness.

Phenomenal results are obtainable through diligent application of this technique, providing traders an edge in the volatile atmosphere of the forex market. It endorses a holistic comprehension where the focus is on the ‘big picture’ of overall market trends as opposed to the daily fluctuations and variations.

Chart analysis forms the core of this strategy, where traders use technical indicators to pinpoint noticeable trends. When applied to USD/CNH trading, this involves keeping an eagle eye on market momentum and determining its direction.

Delve deeper into understanding the currency pair trends and act upon definitive price movements. Be it bullish or bearish – adjusting your trading position cynosures with the identified trend. This ensures traders do not end up swimming against the current of the market stream.

The keystone of trend following is captured in the phrase – ‘Let your profits run.’ By sticking to a trend till it reverses, traders empower themselves to maximize gains from substantial price movements within the market. Valuable insights drawn from historical data combined with an analytical approach can transform the USD/CNH trading landscape for the discerning trader by leveraging the Trend Following Strategy. For continuous trading success, execute trades with mindfulness, resilience, and above all, patience.

2.3. Breakout Trading Strategy

Breakout trading strategy plays a crucial role in anticipating potential profits when trading USD/CNH. Primarily, this strategy involves entering the market when the price escapes beyond a defined support or resistance level with a surge in volume. The primary expectation is the start of a new trend that upshots from the change in traders’ sentiment after the breakout.

A key feature of breakout trading lies in volatility. It is especially favorable for USD/CNH trading during market hours where the American and Chinese financial markets overlap, given the inherent currency pair volatility. Traders need to maintain a vigilant approach to market movements, identifying possible breakouts either upwards or downwards.

Particularly in the context of USD/CNH, breakout trading has its rewards when leveraged effectively. Traders can use trend lines, channels, or even moving averages to detect possible breakouts. A common tactic is setting buy orders above the resistance level or sell orders below support when these lines hint at a breakout.

It’s important to consider that breakout trades may entail larger stop losses than other strategies owing to market volatility. However, the potential for significant profits balances the scales by over-riding the risk, especially when breakouts are corroborated by strong volume and momentum.

Tools like charts and candlestick patterns can bring invaluable help in identifying breakouts. For instance, patterns such as ascending triangles, rectangles, or head & shoulders can often indicate impending breakouts. Optimizing stop loss and take profit strategies by the use of these can steer the trader towards profiting from price breakouts.

It is worth mentioning the significance of news and macroeconomic indicators. They often catalyze spikes in volatility leading to breakouts. Therefore, being up-to-date with economical news updates and keeping an eye on significant financial announcements, releases, and events can critically assist in identifying high-probability breakout trading opportunities.

3. Mental Preparation for USD/CNH Trading

Mental fortitude is paramount in any form of trading, including USD/CNH trading. Effective trading strategies aren’t simply about understanding market trends, financial reports, and economic indicators. They’re also about knowing how to manage emotions and prepare the mind for the task at hand.

Active trading is mentally demanding. Emotional highs and lows can run parallel to the fluctuating USD/CNH rates. Profitable moments can skyrocket confidence and losses can send traders spiraling into doubt. This volatility can induce stress, fear, and greed – all potent distractors in decision-making processes.

It’s essential to acknowledge these emotional signals and realize they exist outside of market mechanics. Proficient traders aren’t impervious to these emotions, but they’ve developed tools to manage them effectively. Strategies include setting clear profit targets, sticking to stop losses, and practicing consistent risk management. Staying disciplined to these principles helps moderate volatile emotions, ensuring they don’t override sound judgement.

Furthermore, constructing a positive trading environment can promote a calm and focused mind. This might encompass a tidy, distraction-free workspace, regular exercise, and a healthy diet.

It’s crucial too, to practice patience. Rushing trades can lead to costly errors. Conversely, waiting for the right opportunities and not forcing trades are characteristics of seasoned traders. Patience is not just about waiting; it’s about waiting wisely. This can be a challenge particularly in the Forex market, where volatility can strike any moment, but it’s a critical skill to hone.

In conclusion, the ancillary aspects of trading, such as mental preparation and emotional management, should be given as much attention as developing technical and analytical skills. Both are equally vital in a trader’s journey towards success. Trading isn’t a battle against the markets, but a contest within oneself.

3.1. Maintaining Emotional Stability

Maintaining emotional stability is a paramount skill in trading USD/CNH. The potential volatility of the pair imposes an atmosphere prone to quick changes – either losses or gains. A turbulent trading session can surge a torrent of emotions, disrupting your ability to make calculated, disciplined decisions. But how does one combat the emotional storm that seems inevitable?

Emotional stability is nurtured through a medley of techniques. Trading plans are an unsung hero in this battle. This systematic approach instills routine and rules into your trading activities, leaving little room for emotional interference. You know what you’re going to do, and by surges of emotion, you’re less likely to deviate.

Stop loss orders are another effective buffer against emotional seesaws. They ensure you don’t hold onto a losing trade motif by a false hope that market conditions might reverse. They are a preset indicator that you’ve reached your risk tolerance limit, enforcing discipline where your emotional side might have convinced you to bend the rules.

Tools aside, an internal focus on emotional regulation is imperative. Engaging in mindfulness and stress management techniques aids you in maintaining a calm, balanced mindset. You must bear in mind that trading is inherently risk-filled and losses are a part of the process, but so are winnings. By accepting this, you foster a consistent focus, preventing emotionally-charged decisions that could detriment your portfolio.

Emotional stability is not a lofty goal; it is a tangible skill. A journey nurtured through trading plans, stop-loss orders, and a focus on emotional regulation. It’s not about muting emotions but harmonizing them with your strategic, rational trading decisions. Maintaining an even keel while trading the USD/CNH transforms the turbulent financial ocean into a manageable, navigable sea.

3.2. Cultivating Patience as a Trader

Patience separates successful traders from those who fail – it’s the ability to hold a winning position and the courage to wait for the opportune moment. This is particularly true while trading the USD/CNH currency pair, where volatility and dramatic shifts keep the market interesting.

Success evolves from a patient perspective. Flashy, quick-win strategies may appear enticing but often lead to substantial financial risk. Instead, focus on in-depth market analysis, which tends to yield consistent results. Interpretation of economic indicators from the US and China, alongside geopolitical outlooks and macroeconomic settings, are essential markers to observe.

Cultivating patience is not a passive pursuit. It is an active and conscious decision to abstain from impulsive trades based on transient market trends. Instead, it’s advisable to establish a robust trading plan exploiting fundamental and technical analysis, which anchors your decision-making process. These plans help mitigate emotional trading, which often clouds clear and objective judgment.

The practice of patience guides us to smarter trading. Gradual accrual of profits over time proving more effective than sporadic high-risk trades. Profitable opportunities exist in more extended market trends which can be capitalized on with a patient mindset.

Deliberate patience in trading the USD/CHN pair allows time to analyze the influences of different market variables. Emphasis on understanding trade inflows, fiscal policies, or economic indicators such as the Purchasing Managers Index (PMI) has the potential to yield substantial advantages.

Incorporating this mindset demands discipline, practice and, at times, resisting the urge to react to every market swing. Patience may well imply the difference between fleeting success and long-term profitability. Embrace the rhythm of slow, steady, and strategic trading to navigate the intriguing terrain of USD/CNH trading.

4. Essential Tools for USD/CNH Trading Analysis

In the realm of forex trading, the USD/CNH pair is notorious for its volatility. This level of unpredictability necessitates the use of robust, multifaceted trading tools.

Designed to chart trends and anticipate market movements, Technical Analysis Tools top the list of indispensable implements. They analyze past market activity, employing diverse chart types or mathematical calculations to project future price trends.

Second to none is the Economic Calendar, a crucial resource documenting significant economic events influencing the USD/CNH pair. Central bank announcements, GDP reports, and unemployment data; all these can trigger drastic pair fluctuations. Judicious use of this calendar allows traders to forecast market movements and strategically position trades.

Equally vital is the Financial News that provides real-time updates on all events impacting global financial markets. By staying current with this tool, traders can buttress their trading decisions with up-to-the-minute information.

Finally, Trading Indicators offer indispensable quantitative data by converging diverse market measurements. By interpreting this data, traders can identify beneficial entry and exit points, fundamentally improving their profit margins.

In essence, a successful forex trading strategy is incomplete without these tools. Their insightful data, allowing traders to predict price movements with a higher degree of accuracy, are integral to optimizing USD/CNH trading outcomes. Notice that these tools should be exploited to the fullest to grasp the USD/CNH pair’s intricacies and devise an effective trading strategy.

4.1. Currency Strength Indicator

The Currency Strength Indicator is crucial when trading USD/CNH, harnessing its robust functionality to check the strength of individual currencies in the forex market. A valuable tool, it assesses pairs like USD/CNH, enabling clear sighting of currency pair trends and providing a detailed analysis of each currency’s comparative strength.

Compared to traditional methods, the Currency Strength Indicator minimizes risk by highlighting the strongest and weakest currencies, leading traders toward profitable trading patterns. Look for a divergence in strength between the USD and CNH, indicating potential trading opportunities. Seeing a strongly performing USD and a weak CNH might suggest the time to buy, creating a favourable trading position.

USD/CNH traders should take note of fluctuating strength in these currencies, using their findings to inform their trading decisions and maximise profits. Exploit the Currency Strength Indicator’s capacity to predict forecast changes in prices—strengthening your forex trading strategy. The key to successful USD/CNH trading lies hidden in this essential tool’s usage, poised to reveal attractive trading opportunities.

Knowledge of the Currency Strength Indicator is non-negotiable for any serious trader. It’s a comprehensive trading partner that could prove invaluable in the pulsating world of USD/CNH trading.

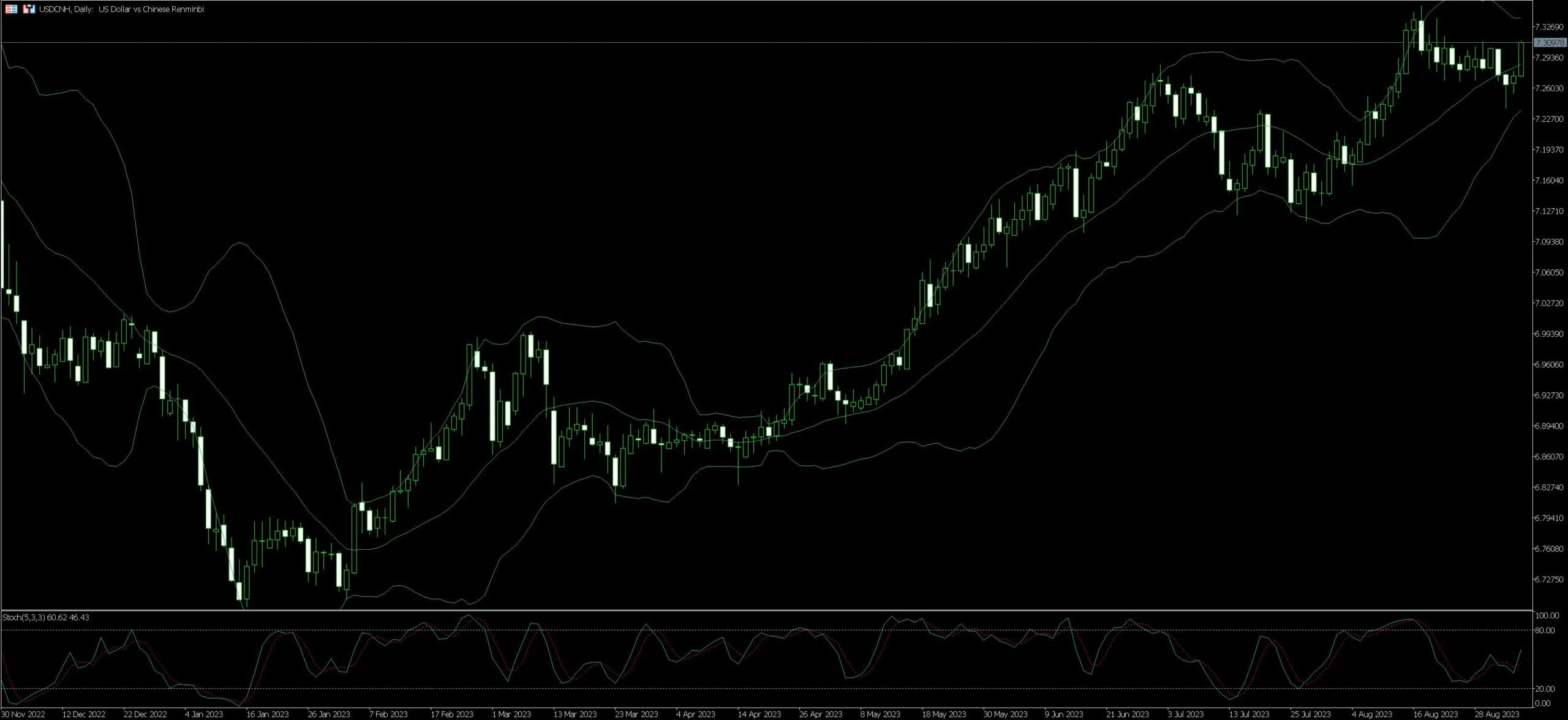

4.2. Use of Charts for Technical Analysis

Technical analysis of the USD/CNH begins with a thorough understanding of charts. Charts, vital to any trader, serve as the roadmap to navigating market trends, pinpointing potential reversals, and formulating trading strategies. An astute trader views charts not only as abstract graphical representations but as tools of insight into market dynamics.

Candlestick charts, the favoured choice among Forex traders, offer a much deeper level of detail in comparison to line charts. Besides displaying the opening, closing, high, and low prices during a particular period, they also deliver a snapshot of market sentiment. In the USD/CNH trading context, candlestick charts can prove highly informative, allowing traders to assess currency performance based on China’s market schedule, among other factors.

USD/CNH traders intensely scrutinise trends, a critical aspect of chart analysis. Distinguishing between an uptrend, downtrend, or range-bound trend equips the trader with valuable knowledge. With USD/CNH, factors like dollar strength and China’s economic status dictate the trend direction.

Support and resistance levels also hold a crucial role in technical analysis, derived from chart data. These price levels are regions where the currency pair often struggles to push through, shedding light on critical decision points in the market.

Likewise, enlist the aid of technical indicators, embedded within charting platforms. These mathematical calculations use past price and volume data to predict future activity, with many designed specifically for the Forex market. Be it moving averages, Bollinger bands, or relative strength index (RSI), each serves to augment your understanding of the USD/CNH pair’s behaviour.

Chart analysis involves the application of various elements, each interconnected. Hence, pursue a holistic approach to hammer down a well-informed USD/CNH trading strategy. Leave no stone unturned in assessing the multi-faceted dimensions that charts have to offer.

4.3. Importance of Economic Calendar

In the field of forex trading, the Economic Calendar is not just a mere tool—it’s a critical component that can greatly impact the flow of the USD/CNH currency pair. This Calendar provides updates on crucial economic events worldwide, unveiling essential data regarding employment rates, GDP, and business sentiment surveys. Through such essential figures, traders receive a clearer view of the economic health of both countries, therefore making more informed and accurate predictions.

Observing the Economic Calendar more closely delivers data-driven insights into China’s and the United States’ economic stability. When the US economy exhibits robust numbers while China’s veers towards a slowdown, the USD/CNH pair will likely ascend. Conversely, if China’s economy outperforms the US, traders could witness a slide in USD/CNH value.

Moreover, the Economic Calendar also enlightens traders on potential market volatility periods. Major economic announcements often lead to substantial swings in currency pairs, including USD/CNH. By staying mindful of these announcement times, traders can enact suitable strategies—either gearing themselves to capitalize on volatility or protecting their positions from potential shocks.

Using the Economic Calendar thus helps traders perceive where economic winds are blowing—to take advantage of the tailwind or steer clear of a developing storm. Therefore, it’s paramount for any traders dealing in USD/CNH to keep their eyes firmly on this essential tool.