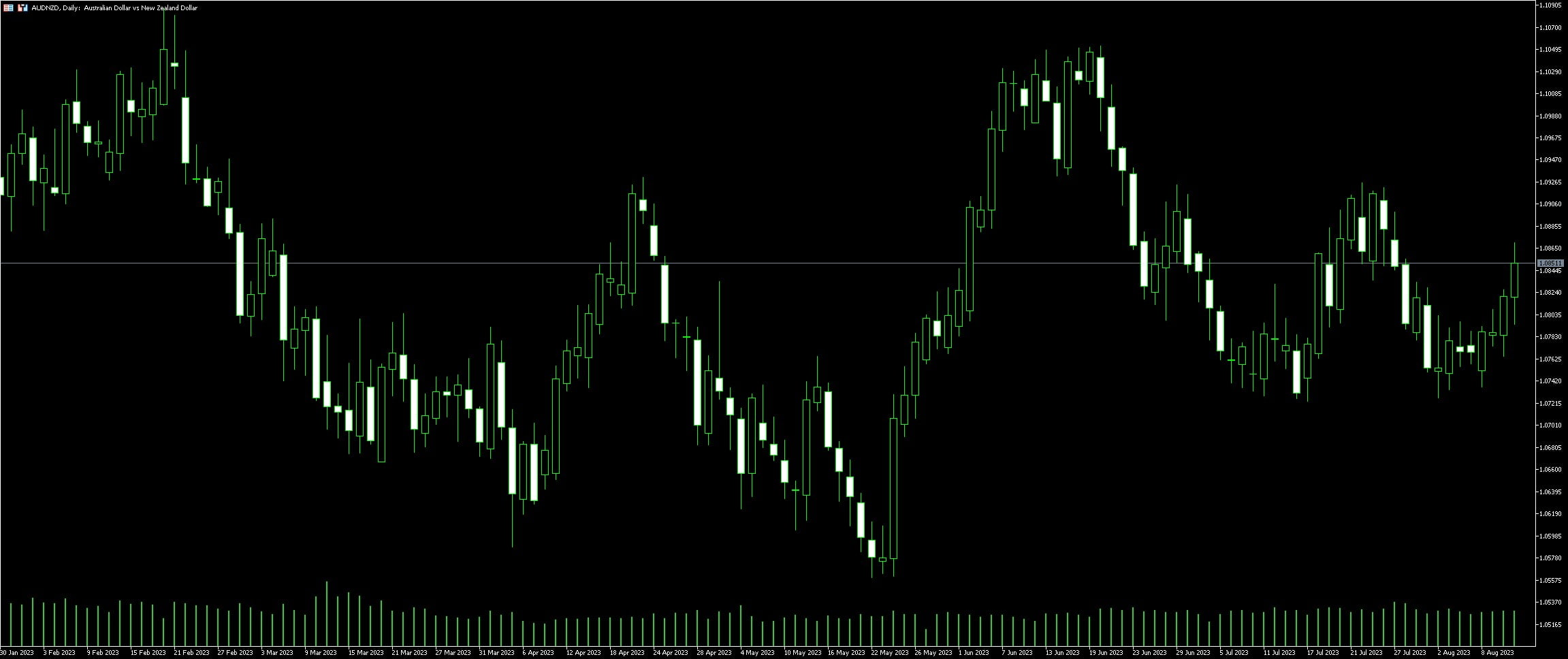

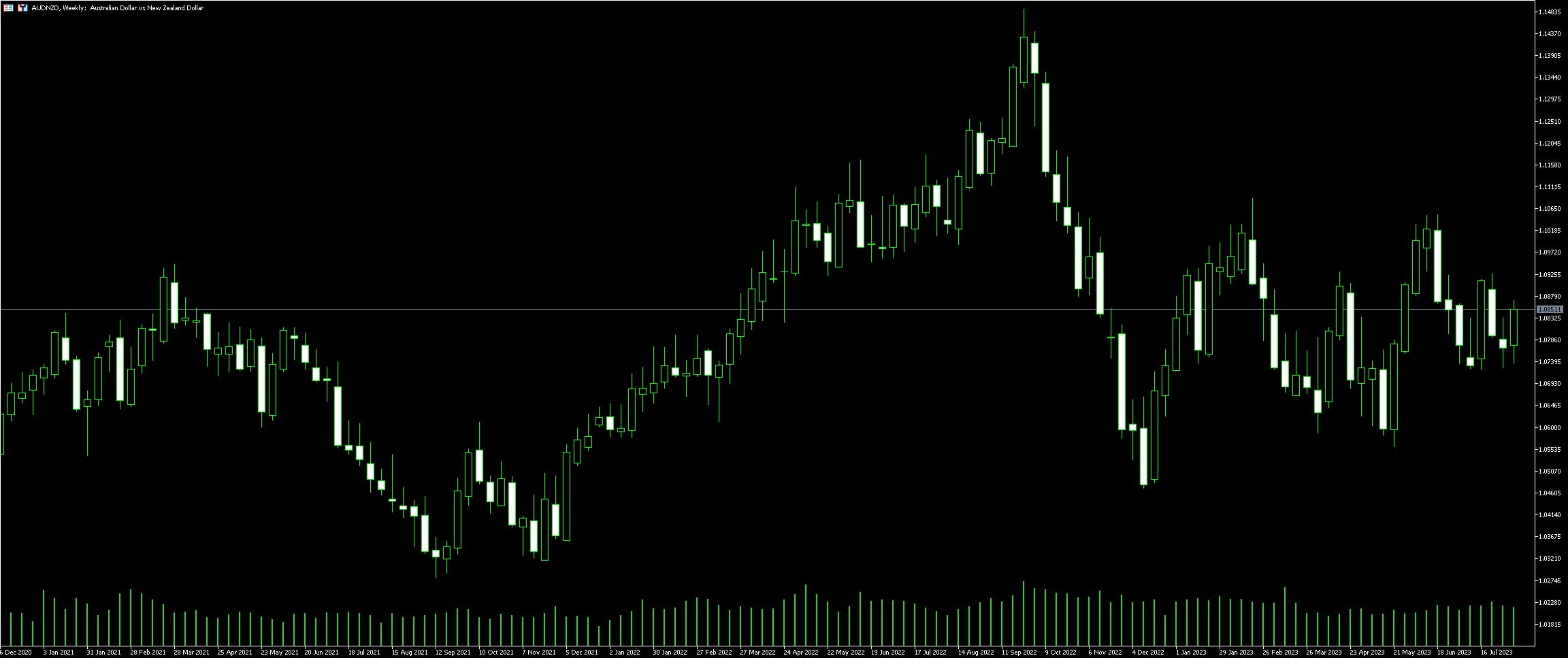

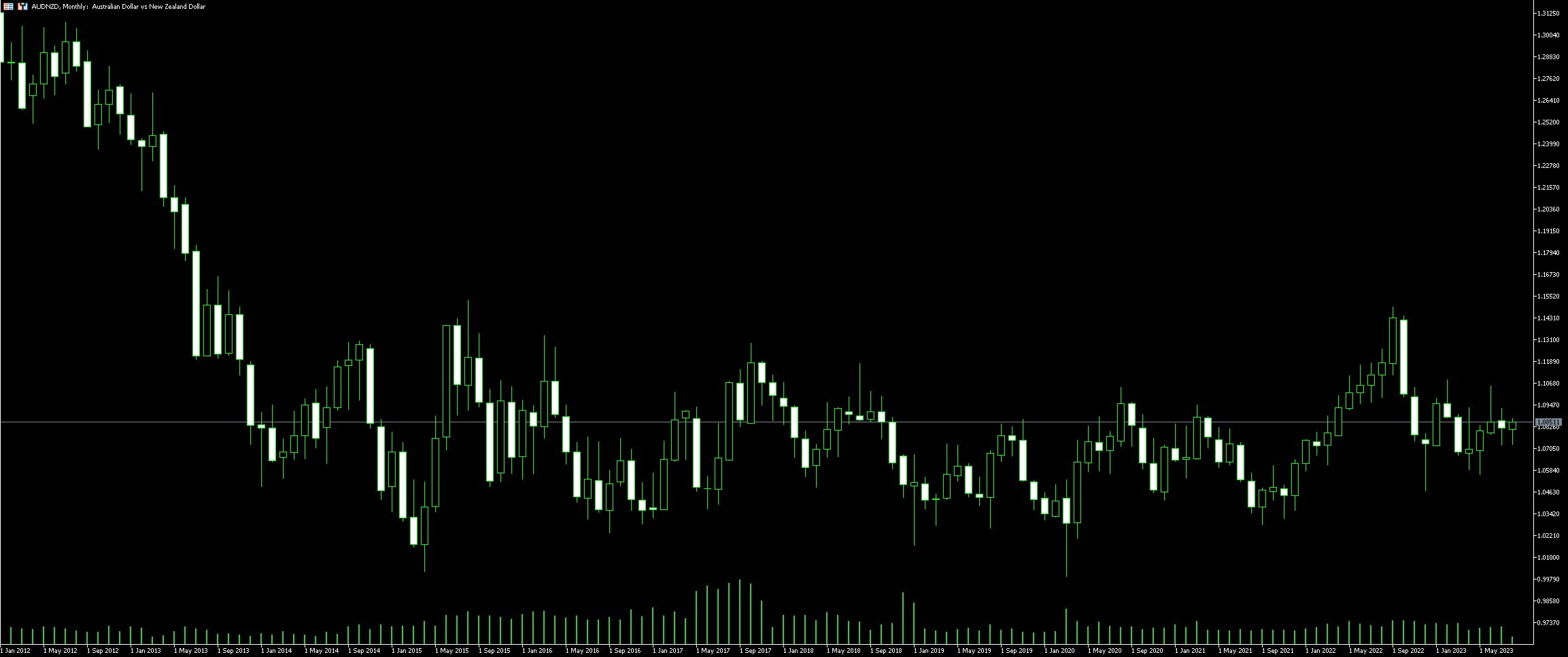

Live Chart Of AUD/NZD

1. Understanding the AUD/NZD Currency Pair

The AUD/NZD currency pair signifies how many New Zealand Dollars (NZD) are needed to purchase one Australian Dollar (AUD). Traders thrive with this pair due to the inherent volatility spawned from the economic interactions between two neighboring countries, Australia and New Zealand. The AUD/NZD exchange rate fluctuates in response to changes in the economic landscape, such as export levels, commodity prices, and interest rate differentials.

When trading AUD/NZD, an astute observation of both countries’ economic indicators is pivotal. The Australian economy is heavily dependent on commodity exports, particularly iron ore, coal, and gold, meaning shifts in commodity prices can drive the value of AUD. Consequently, significant changes in the global demand and pricing for these commodities can make huge impacts on AUD/NZD trading.

On the other hand, New Zealand’s economy relies on dairy, meat, and wood product exports. Bear in mind the impact of climate change on agriculture, which can influence export levels and the NZD’s value. Also, the Reserve Bank of New Zealand’s interest rates play a significant role.

Leveraging a comprehensive forex trading strategy, technical analysis can offer well-timed entry and exit points for AUD/NZD. Emphasis on daily charts for mid to long term trades, checking for trend lines, support and resistance levels; studying moving averages and observing oscillators or indicators for potential reversals hold the key.

AUD/NZD pair suits both swing trading and day trading due to its aforementioned volatility. Harnessing leverage and understanding margin requirements ably adds an extra dimension to the trading strategy, granting capacity to optimize larger trades.

Forewarned is forearmed when it comes to trading. Always stay updated with economic news and events through an economic calendar, specifically those affecting Australia and New Zealand. Regularly monitor trade policy changes, GDP reports, labor market conditions, and any geo-political tension that might tip the scales in the AUD/NZD forex market.

1.1. Basic Framework of AUD/NZD

In the foreign exchange market, the pairing of the Australian dollar (AUD) with the New Zealand dollar (NZD) may not be the most renowned, but it is certainly one full of potential for traders. Often overlooked in favour of giants like EUR/USD or GBP/USD, the AUD/NZD can offer unique insights and yield unexpected profits for those who take the time to understand its workings.

A fundamental pillar for trading AUD/NZD is the economic interrelation between both countries. Australia and New Zealand are closely linked economically, geographically, and politically. This interconnectedness results in the pair’s strong correlation with gold prices, commodity indices, and regional economic news. Trader should also grasp that the AUD/NZD exchange rate isn’t as volatile as some major currency pairs, making it a potentially safer option for beginners or risk-averse traders.

Both Australia and New Zealand’s economies heavily rely on exporting goods. Australia majorly exports iron ore, coal, and gold, while New Zealand’s key exports are dairy products, meat, and wood. Commodity price fluctuations, therefore, can vastly impact the value of both currencies, and subsequently influence the AUD/NZD currency pair.

Furthermore, it is crucial to pay close attention to the interest rate disparity between the two countries. The central banks of both nations are remarkably transparent about their monetary policies, so changes in interest rate differentials are typically known in advance and can be taken into account in AUD/NZD strategies.

Trading hours can shape the market behaviour plot as well as liquidity for AUD/NZD. The fact that both countries are located in roughly the same time zone can lead to increased volatility during the Australasian trading session. Conversely, during the North American and European sessions, this pair might be the quietest.

All these components constitute the basic framework for understanding and effectively trading AUD/NZD. By mastering this comprehension, traders could enhance their trading opportunities and potentially make impressive profits from this unique currency pair.

1.2. Indicators Important for AUD/NZD Trading

Entering into the competitive realm of AUD/NZD trading requires an astute understanding of various indicators. Having a solid grounding in these indicators is half the battle won, when determining the direction of this pair. An essential checkpoint to consider is Economic Data. Economic announcements, especially those regarding interest rate decisions or employment levels in Australia and New Zealand can significantly swing the AUD/NZD pair.

Interplay with the Commodity Prices is another crucial aspect as both nations are heavily reliant on commodity exports. Specifically, the Australian dollar often correlates inversely with gold prices, while the New Zealand dollar shows a direct relationship with dairy product prices. Also, the Geopolitical Dynamics provide valuable insights into AUD/NZD trading. The pair’s volatilities tend to increase during the Asian trading session, and the pair is known to be sensitive to economic and political developments in Asia, specifically China.

Lastly, it’s difficult to ignore the role of Technical Indicators such as moving averages, relative strength index (RSI), and Fibonacci retracements that can provide traders with signals to enter or exit trades, and offer an overview of trends or potential reversals. Working with these signals can drastically augment the success rates in making profitable trades. Utilizing these indicators to their optimal advantage gives traders a potent edge in navigating the challenging yet rewarding AUD/NZD market.

1.3. Timing AUD/NZD Trades

Markets are heavily influenced by macroeconomic data releases, and the AUD/NZD pair is no different. Trading around these data releases can provide lucrative opportunities. Key announcements like interest rates decisions, unemployment reports or GDP growth figures from the Reserve Bank of Australia (RBA) and Reserve Bank of New Zealand (RBNZ) play a significant role in determining the direction of this pair. The AUD/NZD exchange rate exhibits volatile price movements during these times.

Strategic entry and exit points are crucial in timing AUD/NZD trades. Traders extensively use technical indicators such as moving averages, RSI, and MACD to identify potential points of reversal or breakout in the market. These tools do not guarantee a winning trade but can provide vital insights into the market’s behavior.

Paying attention to the market hours is equally important possibly as important as the economic data releases. Both the Australian and New Zealand markets operate in similar time zones. High liquidity is observed during the opening hours of these markets. Trading during these peak liquidity times presents traders with more opportunities as compared to off-hours when the market is relatively calm.

Consideration of risk management strategies is another significant part of timing trades. Well-planned risk management can protect a trader’s capital from potential heavy losses. Utilizing stop-loss and take-profit levels ensures that traders are not overly exposed to risk, even during high market volatility. A comprehension elucidation of the relationship between risk and reward in the context of personal trading goals is essential.

In addition, observing the correlation between AUD/NZD and other pairs can also provide insight into potential future movements. For instance, both AUD and NZD have a high correlation with gold prices and can be influenced by its fluctuations.

2. Developing Robust AUD/NZD Trading Strategies

Harnessing a dynamic approach to robust AUD/NZD trading strategy formulation is integral to manoeuvring the choppy waters of currency trading. This strategy building procedure, typically divided into four stages – Analysis, Design, Testing and Execution – is extremely effective. Starting with the Analysis phase, it’s critical to conduct a comprehensive examination of both the Australian and New Zealand economies. This includes surveying pertinent influences such as interest rates, national commodities, and fiscal policy.

Harnessing a dynamic approach to robust AUD/NZD trading strategy formulation is integral to manoeuvring the choppy waters of currency trading. This strategy building procedure, typically divided into four stages – Analysis, Design, Testing and Execution – is extremely effective. Starting with the Analysis phase, it’s critical to conduct a comprehensive examination of both the Australian and New Zealand economies. This includes surveying pertinent influences such as interest rates, national commodities, and fiscal policy.

Moving forward into the Design stage, the creation of a trading plan that targets appropriate entry and exit points begins. Here, the role of technical indicators, like Moving Averages, and Bollinger Bands, can be indispensable in formulating a savvy trading blueprint. The next step is the Testing. Deploying a meticulous testing approach, such as utilizing a demo account to validate your strategy, provides invaluable insights and tangible evidence of potential success or failure.

Lastly, the Execution stage comes into play, as an informed strategy gets actioned. Adherence to the trading plan, resistance to emotional decision making, and reflection on outcomes for future improvement are non-negotiable elements of this phase. Rigorously manage risks by setting stop-losses, and always stick to the planned strategy. This comprehensive approach to developing robust AUD/NZD trading strategies is pivotal to making lucrative currency trades.

2.1. Fundamental Analysis Approach

Fundamental analysis forms a key part of any successful trading approach, including the AUD/NZD pair. This method of analysis involves the heavy scrutiny of economic indicators, policy announcements, and critical global events that may impact the economic health of Australia and New Zealand.

The unemployment rate, for instance, acts as a definite barometer of economic health. A lower rate often indicates an economically thriving nation which, in turn, may strengthen its currency. Likewise, interest rate announcements from the Reserve Bank of Australia or the Reserve Bank of New Zealand hold immense weight. Higher rates often serve as a magnet for foreign investors, causing a bullish trend in the respective currency.

Trade balance reports too, act as key catalytic events. A greater export value than import results in a trade surplus thus implying a high demand for the country’s goods and therefore, its currency. In contrast, a trade deficit possibly leads to a bearish trend in the market.

Policy shifts regarding key industries prove instrumental in shaping currency trends. For instance, the performance of the dairy industry, a significant sector in New Zealand’s economy, or mining, which holds a substantial share in Australia’s GDP, can impact AUD/NZD.

Continuous tracking of factors like the Consumer Price Index (CPI) gives traders an insight into inflationary trends, while the Gross Domestic Product (GDP) reports help perceive economic performance.

In the dynamic landscape of FOREX trading, the winning edge often belongs to those who stay informed and act swiftly in response to changing economic fundamentals. The fundamental analysis process necessitates time, diligence, and true comprehension of economic indicators. No strategy is complete without it in the pursuit of long-term prosperity in the AUD/NZD trading space.

2.2. Technical Analysis Approach

Delving into the realm of Technical Analysis brings to light the importance of charts, patterns, indicators, and statistical analysis in trading AUD/NZD. Arming a trader with patterns such as head and shoulders, double tops, and wedges, technical analysis paves the way for informed decision-making.

Technical indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD) or Bollinger Bands often form the backbone of technical trades. These are not magic wands for success but tools that can provide insights into market movements and potentially profitable trades. Specifically, they assist in determining whether the AUD/NZD pair is under-or-overbought, if there are any divergences, and the potential volatility of price movements.

Charting and pattern recognition in technical analysis serve as a roadmap for traders, offering insights into where the market may go. They identify key levels where the market reacted previously and are likely to do so again. Consider them as the ‘markers’ on the trading highway.

Another essential element in technical analysis is trend identification. Trends can indicate if the AUD/NZD pair is predominantly moving upward (uptrend), downward (downtrend) or sideways (range-bound). Understanding trends aids in aligning trades with the market move, which makes a significant difference in a trade’s success.

Lastly, applying statistical analysis, such as moving averages and standard deviation calculations, can help smoothen out price movements and provide a clearer, cleaner look at the overall direction of the AUD/NZD trend. They can mute the ‘noise’ of the markets, to enable traders to view the ‘music’ of price movements. Understanding and applying these tools correctly, while remaining aware of their limitations, can be instrumental in a trader’s success with the AUD/NZD pair.

2.3. Risk Management in AUD/NZD Trading

In the realm of Forex trading, one would be remiss to ignore the importance of risk management. Specifically, when trading AUD/NZD, it is vitally important to monitor and adjust trading strategies appropriately. Aligning strategies to risk tolerance levels is paramount, as it helps sustain long-term profit.

Stop-loss orders are quite the reliable shield for traders, limiting potential losses by automatically closing a trade when the market swings unfavorably. The winning recipe entails setting stop-loss orders at appropriate level, a place where the trader feels comfortable absorbing a loss but won’t derail the overall trading strategy.

Just as crucial are take-profit orders, which are designed to secure profits at a certain level before the market has a chance to turn. Cutting one’s losses and letting profits run is a cliché, but wise advice when dealing with volatile pairs like AUD/NZD.

Further, applying advanced risk management techniques such as hedging can provide a safety net against unfavorable market fluctuations. Hedging involves opening positions in both directions – both long and short – to potentially offset losses in one direction with gains in the other.

Moreover, effective risk management in AUD/NZD trading includes diversifying one’s portfolio. Diversification, or the practice of spreading investments across various assets and asset classes, can minimize risks and ensure a stable return on investment.

This same principle applies to the amount of leverage used. An optimal leverage ratio protects margin and prevents account balance from being wiped out due to a single bad trade.

Leverage, while a powerful profit multiplier, can also amplify losses. To avoid such traps, traders should set reasonable leverage levels and not exceed them, no matter how appealing a trade may seem at first sight.

Lastly, risk management revolves around emotional discipline and detached decision-making. Succumbing to emotions like fear or greed can often result in poor decisions, jeopardizing an otherwise sound trading strategy. Frequent review and evaluation of one’s strategies and trading performance ensure traders stay on top of their game and adapt to changing market conditions and trends.

In conclusion, solid risk management contributes significantly to the success of AUD/NZD trading. Traders should always have an effective risk management strategy in place and adhere to it, regardless of market twists and turns.

3. Tools and Platforms for Successful AUD/NZD Trading

An array of tools and platforms imbued with advanced features and functionalities have emerged as lucrative choices for successful AUD/NZD trading. One such prominent tool is MetaTrader 4. Renowned for its user-friendly interface, MetaTrader 4 allows easy access to real-time, easily comprehensible data charts and an assortment of other trading indicators to assist in making well-informed decisions.

Another highly beneficial tool for AUD/NZD trading is the Economic Calendar. With a global perspective, this tool provides important reports, forecasts, and announcements that have potential impact on the currency pair. This includes economic data releases, political events, and monetary policy changes from Australia and New Zealand.

The Forex Volatility Calculator, another noteworthy tool, is a repository of data demonstrating the volatility of different currency pairs over various timeframes. This tool proves to be an essential aid, especially in forming strategies for high volatility trading scenarios.

Trading Platforms like eToro and Plus500 are other core components for successful AUD/NZD trading. These platforms boast real-time interactive charts, social trading features, and a variety of technical analysis tools, making them an all-round solution for traders.

Charting Softwares like NinjaTrader and TradingView grant traders the ability to analyze detailed and accurate AUD/NZD price charts. These can further aid in identifying trends, defining stop-loss levels, and deciphering price patterns.

In the realm of trading, the Artificial Intelligence-based trading systems are emerging as another powerful tool. Utilizing algorithmic execution capabilities, they allow enhanced speed, efficiency, and precision in the trading process.

Therefore, the adventurous journey of AUD/NZD trading can be navigated with more confidence, leveraging these tools and platforms. Basing decisions on tangible, analytical data rather than gambling on plain luck can unlock the potential for more profitable outcomes in the AUD/NZD trading arena.

3.1. Choosing the Right Trading Platform

Selecting a suitable trading platform to engage in AUD/NZD trading requires careful consideration of several key factors. Primarily, evaluate the platform’s credibility by inspecting its regulations, licenses, and its financial stability. A worthy platform possesses the oversight of renowned regulatory authorities, guaranteeing safety and credibility. Remember the phrase, “safety over returns,” and prioritise a platform with a solid security framework.

Trade execution speed is a pivotal factor, especially for day traders. The pace at which the platform relay orders to the market often spells the difference between profits and losses. A top-tier platform provides swift trade execution, mitigating market lag and slippage. Similarly, pay attention to the spread and commission, as these factors affect profit margin. Platforms charging exorbitant spreads or commissions consume more of your earnings, impacting profitability in the long term.

Lastly, assess the platform’s functionality and user-interface. Trading AUD/NZD necessitates precise analysis, which is best achieved on an intuitive, smooth-running platform. The finest trading platforms offer advanced charting tools, real-time news feed, customisable features and 24/7 customer support. Associating with such a platform enriches your trading experience and fosters decision-making accuracy.

However, don’t overlook the vitality of demo accounts. These accounts allow practice of trading strategies on AUD/NZD pairs without risking real money. A superior platform provides a feature-rich demo account, supporting the honing of trading skills. It’s crucial to remember: trading AUD/NZD, like any forex pair, demands consistent learning and experience. Therefore, continuous practice via demo accounts plays an indispensable role in eventual trading success.

Now, bear in mind, a single platform may not necessarily fulfil all your requirements. It’s pivotal to strike a balance and choose a platform that caters to most of your needs, ensuring a smooth trading journey on the AUD/NZD currency pair.

3.2. Using Technology to Boost Trading Performance

The advent of technology has catalyzed an immense transformation on the trading floor, making it easier and more efficient for traders to manage their transactions, especially when trading on popular currency pairs like AUD/NZD. Advanced trading platforms have been introduced that provide accurate, real-time market data, comprehensive charting and technical analysis tools, as well as automation capabilities that eliminate human error.

Algorithmic trading has revolutionised the approach to trading, allowing for pre-programmed trading instructions to execute trades at a speed and frequency that would be impossible for a human trader. These algorithms can consider a multitude of factors, such as timing, price, and volume, to realize potential profitable investment strategies with precision. They also facilitate high-frequency trading, which can provide the trader with a competitive edge, especially in volatile markets.

Crucial in technology application is the use of artificial intelligence in trading. AI technology includes machine learning, deep learning, and other cognitive computing technologies, which help create automated trading systems. These systems can analyze large volumes of data, learn from the market behavior, and execute trades, making the trading process more efficient and reliable.

Mobile trading is another technological advancement that has significantly impacted the trading landscape. It enables trading on-the-go, providing traders with the flexibility to monitor and manage their positions anywhere, anytime. Using apps designed for iOS, Android, or Windows, traders can enter or exit trades, stay updated on market news, and even perform technical analysis on their mobile devices.

Embracing technology to enhance trading performance requires an understanding and application of effective risk management tools. Technology aids in creating, back-testing, and applying various risk management strategies like Stop Loss and Take Profit orders, which protect the trader from excessive losses while also securing profits.

While technology has provided traders with countless tools and systems to optimize their trading, it’s essential to consistently update these systems and strategies. Traders need to understand that technology is ever-evolving and in order to maintain an edge in the competitive field of trading, they must stay informed and adapt to these changes.

3.3. Importance of Continuous Learning & Skill Improvement

Traders may find that the trading landscape is a rapidly evolving one, where new strategies and technologies emerge every so often. With AUD/NZD, a currency pair that’s extremely sensitive to changes in the economy and geopolitical environment, understanding the need for continuous learning and skill improvement is vital.

The subtleties of trading AUD/NZD demand regular skill polishing. It’s not just about garnering the basics and stopping there. The relentless pursuit of knowledge about this currency pair – like staying abreast of Australia and New Zealand’s economic conditions, the latest news shapes their respective economies, or learning new trading methodologies – can prove to be a trader’s strongest tool.

Indeed, updated skills can provide a trader with the agility to adapt to the ever-changing patterns of the AUD/NZD pair. The ability to read complex charts, use advanced trading software effectively, or confidently identify entry and exit points are all invaluable skills that can be perfected with continuous learning.

In addition, the constantly developing field of forex trading brings along fresh tools and resources that can help traders gain a competitive edge. For instance, those who learn to use new algorithmic software can execute trades with greater precision and less emotional involvement. Gaining knowledge and training in these areas can prevent traders from stagnating, keeping them on the cutting edge and competitive in the ever-evolving forex trading environment.

Equally important is the strengthening of fundamental analysis skills. As the AUD/NZD trade is guided largely by economic factors like inflation rates, interest rates or changes in employment figures, traders who keep learning about these issues can better predict currency movements. This, in turn, can potentially generate more profitable trades.

Thus, underlining the immense value of continuous learning and skill improvement in AUD/NZD trading is instrumental. It’s not just about sustaining in this trade, but also about thriving and outperforming. In an environment that is as dynamic as forex trading, staying stationary could be synonymous with moving backwards. Therefore, keep fueling the fire within for knowledge – it’s the most effective weapon a trader can possess.