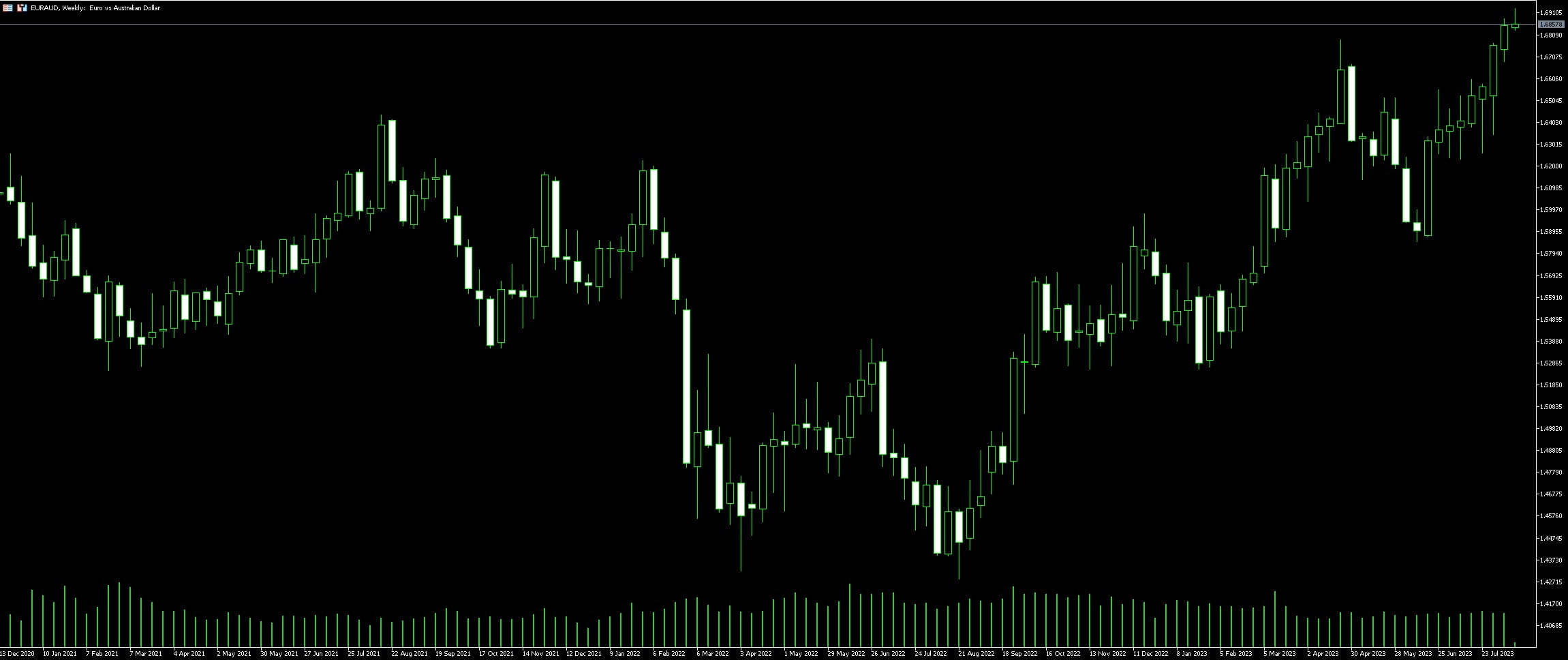

Live Chart Of EUR/AUD

1. Understanding EUR/AUD Trading

Trading the EUR/AUD currency pair requires a robust understanding of the socioeconomic and geopolitical factors impacting Europe and Australia. Key events such as policy announcements by the European Central Bank (ECB) or the Reserve Bank of Australia (RBA) may significantly sway the EUR/AUD FX rate.

The Euro, as the primary currency of the Eurozone, is influenced by diverse factors. From large-scale political events like Brexit to general economic indicators such as GDP & inflation rates, all generate shifts in the EUR value.

Simultaneously, the Australian dollar’s movements often hinge on commodity price fluctuations. As a resource-rich nation, Australia’s revenue from commodity exports heavily impacts the AUD. Strong demand for commodities like iron ore or coal globally can thus elevate the AUD’s value.

Utilizing technical analysis techniques can also optimize EUR/AUD trading strategies. Support and resistance levels, for instance, often provide key entry/exit points in trading. Recognising these levels helps predict potential price reversals, thereby informing strategic decisions.

Furthermore, the EUR/AUD trading hours overlap with trading sessions in both regions. This overlap often results in increased market liquidity, creating opportunities for traders to benefit from tighter spreads. Being alert to these timing dynamics can prove beneficial in executing successful trades.

Monitoring economic calendars featuring scheduled events and indicator releases can help anticipate potential market movements. Such calendars offer insights into expected volatility and may help traders manage risks effectively in the EUR/AUD market. Adopting these strategies can serve as a comprehensive guide for navigating the complexities of trading the EUR/AUD.

Beyond this, staying updated with global market trends and developing a disciplined trading regimen is vital. This includes setting appropriate stop-loss orders, maintaining a balanced portfolio, and not overindulging in leveraged trading. Adhering to these best practices can help foster a sustainable and potentially profitable EUR/AUD trading experience.

Expert assistance via seasoned brokers and utilizing modern trading platforms equipped with advanced tools can further enhance the trading capacity. Availing a Demo account, often offered by brokers, can familiarize traders with the market dynamics before diving into live trading. Trading EUR/AUD relies on a balanced blend of market awareness, strategic planning, and disciplined implementation and not just mere luck.

1.1. Definition of EUR/AUD

EUR/AUD is a major currency pair introduced in forex trading, representing the relationship between the Euro and the Australian Dollar. It is a speculative asset traded in the global forex market where the Euro is the base currency, and the Australian Dollar is the quoted currency. The pair portrays how many Australian dollars are needed to purchase a single Euro. With the fluctuating exchange rates of both currencies, the potential for profit or loss arises, thus creating an exciting platform for astute traders. The Euro is influenced by economic conditions within the Eurozone, particularly Germany and France’s economies. Contrarily, the Australian dollar is heavily reliant on commodity prices, namely gold, iron ore, and coal, which significantly impact its strength and therefore, the EUR/AUD market. Trading EUR/AUD requires factual understanding of these economies’ strategies, including interest rates, inflation data, and political stability, as they are instrumental in currency pair predictions. The pair is highly liquid and typically displays long trend patterns, making it well suited for long-term trend following on trading strategies.

1.2. Factors Influencing EUR/AUD Pair

Diving headlong into the dynamics of the EUR/AUD currency pair, it becomes apparent that various factors shape its movement and volatility. Understanding these forces is critical for any trader looking to profit from this unique pair.

Geopolitical Events play an integral role in defining the exchange rate of the EUR/AUD pair. Whenever political disturbances arise within the eurozone or Australia, the pair experiences significant shifts. For instance, decisions tied to the European Union’s Brexit negotiations influence EUR’s value, which inevitably impacts the EUR/AUD pair.

Interest Rate Differentials between the European Central Bank (ECB) and the Reserve Bank of Australia (RBA) also sway the EUR/AUD pair. An increase in ECB’s interest rate might strengthen the euro against the Australian dollar, whereas a hike in RBA’s interest rate could result in the Australian dollar’s appreciation.

The Economic Health of both the eurozone and Australia is another powerful factor. Economic indicators like GDP, employment reports, and consumer sentiment surveys all provide insight into the regions’ financial well-being. A stronger economy usually boosts the strength of its currency.

Taking into account the Commodity Prices, it’s noteworthy that the Australian economy is heavily reliant on commodity exports, including iron ore, coal, and gold. So, any substantial changes in these commodity prices affect the AUD, subsequently altering the EUR/AUD pair.

Lastly, Market Sentiment, guided by traders’ perceptions and reactions to market news and data, inevitably impacts the EUR/AUD pair. For instance, a perceived riskier environment could lead to the sell-off of AUD, as traders seek out the ‘safe-haven’ euro.

1.3. Benefits of Trading EUR/AUD

In the highly dynamic world of forex trading, a pair often overlooked but with substantial potential is EUR/AUD. Diving into the benefits of trading this pair, the primary advantage lies in its relative stability. The Eurozone and Australia have robust economies, bringing a sense of reliability to the pair’s market activity.

Volatility also becomes an asset with EUR/AUD. Keen traders can exploit the pair’s high intraday volatility through day-trading strategies. The right move can yield substantial profits.

Moreover, the EUR/AUD pair is less susceptible to sudden market shocks compared to pairs tied to the U.S dollar. Hence, traders have a cushion against unpredictable events impacting the American economy.

Not to overlook, one of the unique perks of trading the EUR/AUD pair is the opportunity to take advantage of the time zone difference. The overlapping trading hours between European and Australian sessions allow continuous trading, ensuring the availability of liquidity.

A lesser-known benefit is the potential to earn from the interest rate differential between the European Central Bank and the Reserve Bank of Australia. If handled strategically, traders can turn the interest rate differential in their favour, leading to potential profit from swap fees.

It must be brought into attention that despite the attractiveness of trading EUR/AUD, it requires a concrete understanding of both economies and external factors that might influence them. A meticulous approach paired with comprehensive market analysis is the key to cherry-picking the benefits EUR/AUD trading has to offer.

2. Mastering EUR/AUD Trading Strategies

The intricacies involved in successfully trading the EUR/AUD pair lie within the ability to accurately analyze key economic factors and to progressively develop practices honed through market experience. Trading this currency pair involves navigating the economic trends of both the European and Australian markets, making understanding their distinct facets crucial. This involves a keen watch on the eurozone economic indicators such as inflation rates, interest rates and gross domestic product (GDP) growth.

Simultaneously, staying updated about vital Australian economic indicators like the Reserve Bank of Australia (RBA) interest rates, commodity prices, especially of iron ore and gold, is also pivotal. A detail-oriented approach to changes in these relative economic landscapes can bring about more calculated, informed decisions determining profitability.

A good grasp of the Technical Analysis is another significant element. Prevalence of chart patterns provides discernible trends that can be capitalized upon. Tools such as Moving Averages, Fibonacci Retracement, and Relative Strength Index (RSI) expose potential points of entry or exit, market volatility, and price movements trends. This further assists in crafting informed trading strategies.

Avoiding emotional trading decisions and implementing a disciplined approach to risk management is also invariably paramount. Establishing a risk/reward ratio and adhering to it, is essential for Long-term trading sustainability. This emphasis on risk management goes beyond just preserving capital but also maintains a level headspace for incomparable decision making in future trades.

Continuously learning and adjusting trading strategies based on market dynamics is another crucial factor in successful EUR/AUD trading. Recognizing when to stick to a plan or when to deviate based on market changes is a skill developed over time and via consistent market participation.

Finally, the utilization of stops and limit orders can ensure a trader does not suffer acute losses during unpredictable market surges. This, together with a comprehensive use of leverages, can be hugely beneficial in enhancing profitability while limiting exposure to risk.

2.1. Fundamental Analysis Approach

Built on the foundation of economics, fundamental analysis stands as a pillar of successful trading strategy. It seeks to evaluate a currency’s inherent value through economic indicators and geopolitical events, acting as a compass to understand the pairings current performance and potential future movement.

One cannot ignore the power of governmental decisions on EUR/AUD trading. For instance, changes in fiscal policy such as tax rates, budget, and public spending, invariably influence the value of a currency. Moreover, monetary policy—how central banks manage liquidity to stimulate growth—can significantly impact currency values, making interest rates and inflation key elements of any fundamental analysis.

As the name suggests, Economic indicators are potent tools that can predict a shift in the economic environment. From GDP growth rates, employment figures, to manufacturing information, each indicator alerts traders to potential opportunities or potholes along the trading pathway.

Then there are geopolitical events, the silent players that can instantly transform the trading landscape. Trends revolving around political stability, elections, conflicts, and international relations hold the power to swiftly alter the currency value, thereby affecting the EUR/AUD trading landscape.

Utilizing a fundamental analysis approach, therefore, equips traders with the knowledge they need to time their entry and exit points in the EUR/AUD market. This strategic forecasting allows traders to capitalize on fluctuations and potentially reap substantial benefits.

2.2. Technical Analysis Approach

The principle of technical analysis circles around understanding and predicting future price movements based on past trends and patterns. In the world of trading EUR/AUD, this strategy is often king. When it comes to the tactical utilization of technical analysis, traders employ a plethora of charting tools and indicators.

Notably, common tools include trend lines – inferencing the course of current price momentums, and moving averages – providing insight on the general direction of the market over a set timeframe. Oscillators like the Relative Strength Index (RSI) and the Stochastic, are equally indispensable. These tools help to identify overbought and oversold situations, potentially heralding a price reversal.

Technical analysis likewise embraces the application of Fibonacci retracement levels. This concept hails from the mathematics of an Italian mathematician, which traders adopted as a tool for predicting potential support and resistance levels. Candlestick patterns, telltale symbolizations of market sentiments, equally bear weight in the analysis.

However, a critical factor in technical analysis is timeframe selection. Short-term traders typically analyze chart patterns within periods as short as 1-minute to 1-hour, while long-term traders would assess charts from daily to monthly time frames. Knowing how to tailor the analysis to individual trading styles and goals is key. The selection influences the relevance and reliability of signals, and hence, traders must use the right indicators and tools corresponding to their chosen timeframe.

While the arsenal of technical analysis tools appears overwhelming, leveraging them for EUR/AUD trading does not imply usage of all tools simultaneously. Utilizing a combination of tools that compliment each other enhances the accuracy of the predictions, and hence a successful trading outcome. Selecting the right toolset depends heavily on personal preferences, trading objectives, and risk tolerance.

2.3. Risk Management in EUR/AUD Trading

Risk management in EUR/AUD trading is a pivotal component of trading strategies. Traders must have a thorough understanding of the volatility associated with EUR/AUD. This currency pair is notorious for its rapid fluctuations, which could pose considerable risks. It’s integral for traders to set stop-loss orders at a reasonable level to cap potential losses.

Currency strength fluctuates owing to a variety of factors, including geopolitical events, economic indicators, and market sentiment. As such, keeping track of specific economic calendars, news events, and market analyst predictions pertaining to both the Eurozone and Australia is crucial for maintaining a successful trading strategy.

Also, leverage acts as a double-edged sword in forex trading. While it provides the potential for increased profits, it also amplifies potential losses. Therefore, it’s crucial for traders to employ leverage judiciously when trading EUR/AUD.

The implementation of a comprehensive risk management plan is inextricably linked to successful trading. This plan should balance potential profits against risks, assess probability, and prudently manage capital to ensure the longevity and profitability of trading. Take frequent breaks from trading EUR/AUD. Continuous trading increases the probability of making emotionally guided decisions, which often lead to substantial financial loss.

Prepossessing a risk management strategy is not sufficient. Adherence to it in all market conditions is crucial. Traders who stick to their plans without getting swept away by market emotions tend to achieve consistent outcomes. At its core, successful trading is accomplished with discipline, perseverance, continual learning, and most importantly, effective management of risks.

3. Utilizing Trading Platforms for EUR/AUD

Trading platforms offer a host of tools and resources that elevate the experience of trading pairs such as EUR/AUD. One of the distinguishing features of these platforms are the all-encompassing charts that visualize a myriad of data in real-time, providing the traders with up-to-the-minute information.

Technical analysis is a crucial component of Forex trading, especially when trading EUR/AUD. This involves analyzing historical price patterns and market trends in order to forecast the future movements. Most platforms deliver a range of tools to facilitate this analysis, such as trend lines, oscillators, and moving averages, thereby helping traders make informed decisions.

Risk management tools, such as stop loss and take profit orders, have been in-built into modern trading platforms. These tools allow traders to set predefined levels at which trades will automatically close, hence preventing significant losses and locking in gains when the target price levels are reached.

Additionally, trading platforms offer demo accounts where traders can practice their trading expertise, try out new strategies without the fear of losing capital. This is particularly important for novice traders who need to gain a fair understanding of the trading dynamics before risking real capital.

The economics calendar, another useful feature offered by the trading platforms, outlines all the significant economic events and news releases that could influence the EUR/AUD pair. This way, traders can prepare themselves for any potential rate spikes and make the most of the market volatility.

The combination of these features helps traders navigate the dynamic Forex market while trading the EUR/AUD pair. The trader’s journey, however, is not only about using the right tools; it also entails constantly updating their knowledge base, testing strategies, and adapting to market changes. Trading platforms, with their diverse functionalities and dedicated resources, aid in transforming these trading aspirations into achievable outcomes.

3.1. MetaTrader 4 and 5 for EUR/AUD Trading

MetaTrader 4 and 5 stand as premier platforms favored by numerous traders worldwide, particularly those dealing with the unique pairings such as EUR/AUD. Uniquely structured, these platforms deliver advanced tech functionalities that enable efficient trading processes. With an accessible, user-friendly interface, they allow precise & swift execution of trades.

MetaTrader 4, equipped with advanced analytical technologies, provides automated trading scripts, facilitating calculated & time-efficient trading decisions. It offers multiple charts and a customizable interface, making it an optimal choice for both novice and veteran traders.

MetaTrader 5, the evolution to its predecessor, spurs trading to a novel level with its high-speed performance and advanced set of trading tools. Epic features such as in-depth analysis tools, economic event alerts, and integration of key financial indicators aide traders in making meticulously informed decisions.

Trading the EUR/AUD pair on these platforms facilitates a seamless experience. Both MT4 and MT5 provide various types of orders, historical data for backtesting strategies, and automated trading options, such as Expert Advisors and a range of indicators. With market accessibility 24/5, traders can respond swiftly to currency market fluctuations.

Forex trading pairs like EUR/AUD are highly sought after due to their volatility & potential for high returns. With MetaTrader 4 and 5, the trading practice becomes streamlined. The robust functionality, coupled with a plethora of tools at traders’ disposal, makes these platforms a preferred choice for EUR/AUD trading.

3.2. Analyzing EUR/AUD with TradingView

With its array of advanced features and sleek functionality, TradingView stands as a predominant tool for conducting intensive EUR/AUD analysis. An essential part of trading is gathering vital market information, which TradingView conveniently provides. With this platform, traders can visualize live EUR/AUD data, observe market dynamics and track price changes in real-time.

Technical analysis is made simpler with the diverse range of technical indicators offered by TradingView. RSI, MACD, Bollinger Bands – these are only a few of the treasured tools within a trader’s disposal to gauge market trends. Whether interested in identifying overbought or oversold conditions or detecting price volatility, these indicators lay the groundwork for informed trading decisions.

Implementing an effective strategy also demands a careful assessment of historical data. TradingView allows traders to delve deep into EUR/AUD past performance. Detailed bar or candlestick charts that capture previous market oscillations can unveil potent patterns, which may inform possible future price movements.

Another remarkable facet of TradingView is its social trading aspect. Traders can freely share their views, get feedback and follow success-proven trading strategies from the global TradingView community. Stronger decision-making becomes accessible through collective market insight, empowering traders to trade EUR/AUD with increased confidence and precision.

4. Step by Step Guide on Trading EUR/AUD

Understanding the Market Environment plays a crucial role in trading EUR/AUD. Grasp the economic factors influencing both the European and Australian markets. This includes but is not limited to inflation rates, political stability, and natural disaster incidence. For a sturdy foundation, familiarize yourself with market hours and the best times to trade.

Selecting the Right Trading Platform follows after understanding the market environment. A reliable, user-friendly platform with extensive features and tools maximizes trading efficiency. Good customer service, swift execution of trades, and security should also be paramount while choosing a platform.

Next in line is Analysing the Market. Before you make any trading decision, it’s vital to predict the future direction of the pair. This includes technical analysis, where you examine past market data primarily via use of charts, and fundamental analysis, where you scrutinize economic indicators and geopolitical events.

The final step involves Setting Stop Losses and Take Profits. Effective risk management is imperative for sustained profitability in forex trading. Stop losses limit any potential losses if the market moves opposite to your prediction, while take profits automatically close your trade once your predetermined profit level is hit.

The approach to trading EUR/AUD should encompass a mix of all these strategies. This includes understanding the market, choosing the right trading platform, conducting effective market analysis, and advocating for strong risk management via setting stop losses and take profits. All these aspects married together can lead to a potentially successful EUR/AUD trading strategy.

4.1. Choosing the Right Broker for EUR/AUD Trading

Selection of an appropriate broker can act as a catalyst in the success of EUR/AUD trading. Essentially, traders should consider multiple factors before settling on any specific broker. Licensing and Regulation remain fundamental considerations when seeking broker services. Brokers licensed under notable regulatory bodies such as FCA, ASIC, or CySEC offer a protective umbrella for a trader’s investment, simultaneously ensuring transparency and fairness in trade.

Another vital point to remember is the platform’s user interface. An easy-to-use platform that offers smooth navigation aids traders in keeping abreast with fast-paced market changes, improving the overall decision-making process. Moreover, platforms that provide accessibility via multiple devices give traders the freedom to operate from anywhere at any time, proving advantageous in this dynamic currency trading market.

An often overlooked yet significant aspect is the broker’s customer service. As EUR/AUD trading happens 24/7, a broker offering round-the-clock customer support can help swiftly resolve any technical glitches or trading issues. This swift resolution ultimately helps in avoiding potential losses.

The factor of spreads and commissions should not be undervalued either. While a lower spread signifies a lesser cost of trading, it’s important to balance this with the quality of services provided. Therefore, conducting a thorough comparative study of different brokerage firms can help narrow down a broker that provides the best mix of competitive spreads and quality services. Additionally, keeping an eye on the availability of educational resources can offer a competitive edge, as these tools can enhance knowledge and subsequent performance in EUR/AUD trading.

It is essential to note that the perfect broker is a subjective choice, varying for every trader based on their individual trading strategy and risk tolerance. The trial and error method can prove beneficial in recognizing the most suitable broker for individual needs and preferences in trading EUR/AUD.

4.2. Setting Up a Trading Plan

A successful trading plan is the backbone of any strategic trading endeavor, particularly when trading the EUR/AUD currency pair. Before any trades are made, traders should ensure that they have a robust, well-thought-out trading plan in place. The importance of a trading plan arises from the need for clear guidelines while making critical trading decisions or during a high-paced, volatile market situation where hastiness can lead to substantial losses.

Understanding the Market: A complete understanding of both the Eurozone and Australian economies is critical in trading EUR/AUD. A well-informed trader is better equipped to make successful trades. Knowledge about key economic indicators, monetary policies, geopolitical events, and other influential variables is crucial.

Risk Management: Risk management forms an essential part of a trading plan with its primary focus being the preservation of capital. Implement an effective risk and money management system that includes setting stop loss and take profit levels prior to entering a trade.

Trading Strategy: A good trading plan also includes a well-tailored trading strategy. Incorporate both technical and fundamental analyses into your strategy. Consider indicators like price action, support and resistance levels, moving averages, and economic news events to make informed trading decisions.

Record Keeping: Keeping comprehensive trade records is a pivotal aspect of a trading plan. A meticulous log of all trading activities allows a trader to analyze previous trades, resulting in smarter trading decisions in the future.

Consistency: Consistency is key in trading. Stick to the well-researched rules within your trading plan – even in the face of losses. Frequent alterations in the plan can disrupt consistency, leading to irregular outcomes. A steadfast approach to the trading plan can yield better results in the long run.

Trading the EUR/AUD is much more than just making impromptu trades. A solid, well-structured trading plan increases the likelihood of favorable outcomes. Establish your plan before diving into this potentially lucrative yet unpredictable market.

4.3. Executing Trades

The act of executing trades in the EUR/AUD market is rooted in knowledge and strategic application. Ensuring a deep understanding of both the European and Australian financial markets, specifically how they interact with each other, is critical. Traders monitor economic indicators such as GDP growth rates, unemployment levels, and retail sales figures in both regions. Such data points can serve as a meaningful guide towards making informed trading decisions.

Identifying suitable entry and exit points in the market is pivotal when trading EUR/AUD. Entry points could be determined with the use of various technical analysis tools, such as trend lines, support and resistance levels, and Fibonacci retracements, among other mechanisms. Similarly, strategic exit points allow traders to cut losses and secure profits at desirable levels.

Adequate stop losses and take profit levels are integral elements in ensuring responsible risk management when trading EUR/AUD. This implies predetermining how much one is willing to lose on a trade (stop loss) and the point at which a profitable trade will be closed to secure gains (take profit). Predetermining these levels assists in avoiding emotional decision making, common in volatile markets.

Trade execution in the EUR/AUD market can be either manual or automated. Manual trading involves a trader independently making decisions and operative trade orders by themselves. In contrast, automated trading involves setting predefined rules for entering and exiting trades, which are then auto-executed through a trading algorithm or bot.

It is paramount to ensure that one is trading with a regulated broker. They must follow strict regulations set by financial authorities, providing a safety net to traders in adverse scenarios such as company insolvency. They also offer better trading conditions, advanced software, and sophisticated trading platforms, conducive for successful trade execution in the EUR/AUD currency pair.