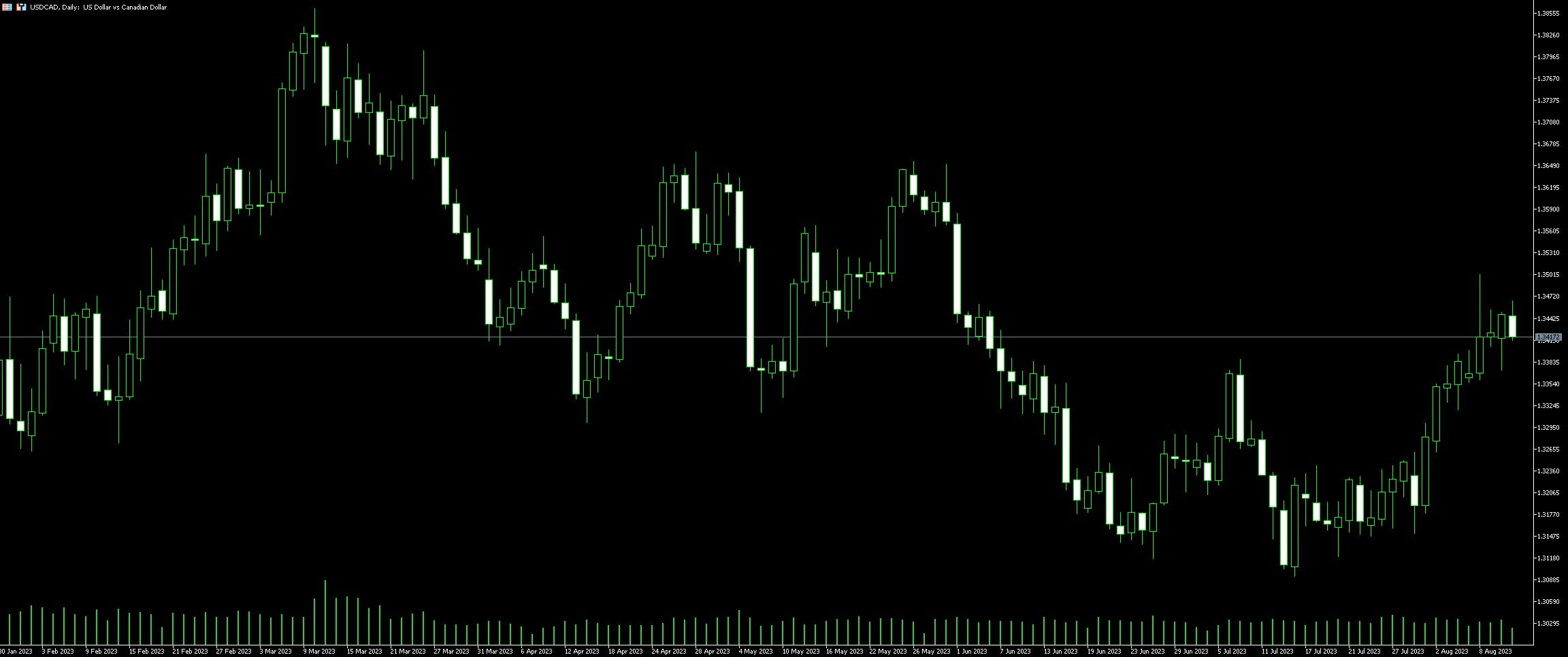

Live Chart Of USD/CAD

1. Understanding USD/CAD Currency Trading

Currency trading can often pose a challenge, especially when dealing with a pair like USD/CAD. This currency pair consists of the United States Dollar (USD) and the Canadian Dollar (CAD). Familiarity with both nations’ economic factors is critical in understanding its valuation and trends. The economic health of the United States and Canada, significant global political events, and changes in oil prices are integral factors that can greatly influence the direction of the USD/CAD currency pair.

Yet, unlike trading with a stock, where one simply decides to buy or sell based on its perceived value, currency trading requires a comparative approach. A trader is late to anticipate that the USD will strengthen against the CAD, or vice versa. To predict this dynamic, a deep understanding of the relative outlook of each country’s economy is mandatory. For instance, as Canada is one of the world’s largest oil exporters, any significant change in oil prices can directly impact the value of CAD.

Knowledge of technical analysis tools is also crucial in USD/CAD trading. Tools such as chart patterns, trend lines, support and resistance levels, and technical indicators can shed light on potential future price movements. The combination of both fundamental and technical analysis creates a holistic approach that can form the basis of a systematic trading strategy with discipline and consistency.

Finally, a note on the risks involved in currency trading. It should be acknowledged that all forms of trading, including USD/CAD, carry a significant amount of risk. However, reputable brokers offer risk management tools to help tackle these to an extent. Thus, choosing the right broker marks a critical step in the currency trading journey. This will be someone who can offer a secure trading platform, timely market insights, and support with risk-management strategies.

Trading the USD/CAD currency pair is a combination of well-applied knowledge of macroeconomic factors, adeptness in technical analysis, and wise broker selection. Yet, it’s equally imperative to remember that even with the best strategies, success isn’t guaranteed, and all traders should be prepared for potential loss.

1.1. Key Features of USD/CAD Pair

The USD/CAD pair, colloquially known as the ‘Loonie’, is one of the seven major currency pairs on the Forex market and holds a distinct profile of key features. Liquidity tops this impressive list, due mostly to the vast amount of trading activity between the United States and Canada. As such, the USD/CAD pair can often offer relatively tight spreads and excellent opportunities for both short and long-term trading strategies.

Next, one can’t ignore the importance of commodity prices. The Canadian economy is heavily reliant on the export of natural resources, particularly oil. So when oil prices fluctuate, expect to see comparable changes in the value of CAD – a key detail for traders.

Also vital to consider is the impact of economic indicators. Both the Federal Reserve (Fed) in the US and the Bank of Canada (BoC) regularly release data that can violently shift the direction of the USD/CAD pair. Figures like employment stats, Gross Domestic Product (GDP) and inflation are just a few examples that traders should closely monitor.

Finally, the political climate in both nations can significantly influence the value of the pair. Political instability, changes in policies or shifts in the general public sentiment could trigger sudden spikes or dips in the pair’s value – offering both risk and reward to the discerning trader. Whether leveraging these opportunities for gain or mitigating potential losses, understanding these nuances forms the bedrock of a successful USD/CAD trading strategy.

1.2. Comparative Analysis of USD/CAD with Other Major Currency Pairs

The USD/CAD trade, also known as trading the “loonie”, stands as a key player in the currency exchange market. This currency pair has unique characteristics, unlike other major pairs, given the close geographical and trade relationship between the United States and Canada.

In contrast to USD/EUR and USD/GBP, which are often influenced by various international geopolitical events or major economic developments, the USD/CAD pair is significantly impacted by the commodities market, especially oil prices, due to Canada being a major exporter. With the shift in oil prices, CAD experiences corresponding shifts, creating lucrative trading opportunities.

The USD/JPY pair, known for its low spread and high sensitivity to global economic conditions, is less volatile than USD/CAD. However, a careful observation of U.S. aspects affecting both pairs can often lead to beneficial trading decisions. The USD/CAD duo is naturally coupled to the U.S. economy, and fluctuations generate a ripple effect that impacts this trade pair more directly.

Furthermore, Australian and New Zealand dollars, being commodity currencies like CAD, also show similarities in trading patterns with the USD/CAD pair. Yet, their geographical location and economic structures suggest a different range of influential factors.

Undeniably, having an understanding of these comparisons deepens one’s ability to predict market movement, using it to formulate effective trading strategies. A key focus on commodity prices, particularly oil, economic news from the U.S and Canada, and a comprehensive comparative analysis of USD/CAD with other major currency pairs certainly contributes to success in trading the “loonie”.

Word of caution, however, risks abound in any form of trading. Thorough research, risk management regulations, and an equipped understanding of the forex market can translate to lowered risk and higher profits.

2. Strategies for Successful USD/CAD Trading

Traders keen to venture into the thrilling USD/CAD forex trading world should arm themselves with effective strategies. A smart move for traders is to meticulously study the intricate relationship between the US dollar (USD) and the Canadian dollar (CAD). This pair, often known as the ‘Loonie’, is significantly impacted by commodity prices, particularly oil.

Equally important, putting the spotlight on economic indicators is rewarding. The US economy largely impacts the USD/CAD trading. Therefore, keeping a pulse on the Federal Reserve’s decisions can greatly sway the value of the USD. On the other hand, Canada’s economic health also paints this currency pair’s prospects. Looking into the Bank of Canada’s moves, as well as Canada’s employment data, GDP, and retail sales gives a well-rounded overview of the bearish or bullish turns that the CAD may take.

The ups and downs of the global economy should never be underestimated. How global trade behaves significantly determines how USD/CAD pairs navigate in the volatile forex market. Therefore, traders should always track global events and economic news from power economies.

A powerful tool for traders is technical analysis. Monitor patterns and price movements— these pieces of information help predict how the USD/CAD might behave. With indicators such as moving averages, Relative Strength Index (RSI) and Bollinger Bands, traders may be able to chart a course through the unpredictable waves of forex trading.

Yet at the heart of successful trading practices is a robust risk management strategy. The thrill of the market should never hypnotize one into straying from a well-crafted plan. Experts recommend that trades never exceed more than 1% of the trader’s capital. Implementing stop-loss orders is also a safety measure that safeguards traders’ capital against adverse market movements. This strategy limits losses sanely and prevents emotional trading.

USD/CAD trading can be challenging, but a thorough understanding of market dynamics, economic indicators coupled with strong technical analysis and risk management, can guide traders to the island of profitability.

2.1. Fundamental Analysis

Fundamental analysis serves as the bedrock to smart trading decisions, particularly when dealing in pairs such as USD/CAD. It’s essential to delve into both countries’ economic health – primarily their interest rates and GDP growth, as these factors heavily influence the currency rates. A keen eye should be kept on the US Federal Reserve and Bank of Canada’s action, as any alteration in the fiscal policy can lead to significant volatilities in the USD/CAD exchange rates.

In terms of GDP, a growing economy fortifies the currency, making it a tempting buy for traders. When the US economy is excelling and Canada’s is lagging, it potentially stimulates investor interest in selling CAD to buy USD, and vice versa.

Unemployment rates also deserve scrutiny. High unemployment devalues a currency while low unemployment does the opposite. Keeping tabs on the monthly unemployment reports of both countries can help predict fluctuations in the USD/CAD pair.

Trade balance reports, indicating the difference between a country’s import and export value, is another arrow in the trader’s quiver. A high trade deficit (more imports than exports) can weaken a currency, while a favourable trade balance (more exports than imports) can strengthen it.

Lastly, political stability is of paramount importance as currency values can fluctuate wildly due to political turbulence or uncertainties. Therefore, staying informed about the political climate in both countries is advised when trading USD/CAD.

Combined, these elements create a comprehensive understanding of both countries’ economic landscape, enabling traders to make more informed speculations about the future direction of the USD/CAD pair. It’s important not to view these variables in isolation, though. Understanding the relationships between these economic indicators can prove invaluable in anticipating market movements and trading wisely.

2.2. Technical Analysis

Technical analysis is a critical strategy in forex trading, and in USD/CAD pair trading, it is no exception. Technical analysts use past price movement patterns to predict the future direction of price using various instruments such as charts graphs and indicators. Candlestick charts, bar charts, and line charts are among various ways that traders identify patterns, resistance levels, and support levels.

For instance, when trading the USD/CAD using candlestick charts, clear identification of Bullish and Bearish candle patterns can signal possible trend reversals. Recognizing popular patterns such as Doji, Hammer, or Hanging Man formations can be a valuable strategy to anticipate a market turn.

Beyond these charting methods, technical analysis also emphasizes indicators. Moving averages are widespread, with the 50-day and 200-day averages frequently used. When the 50-day moving average crosses above the 200-day one, it potentially signals a buying opportunity; when it crosses beneath, it indicates a selling opportunity.

Fibonacci retracements are another powerful tool within technical analysis that allows traders to anticipate potential price levels. Derived from mathematical patterns, these retracement levels can be used to identify possible departure points in the market.

Oscillators such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) are other beneficial tools for traders. They are applied to discover potential trend reversals in the market by identifying overbought or oversold conditions.

Among several other technical analysis strategies exist, each providing different insights about possible market directions. Considering these tools is crucial for traders looking to take advantage of fluctuations in the USD/CAD currency pair. Mastery of these techniques may ultimately lead to more informed trading decisions.

3. Risk Management in USD/CAD Trading

In the volatile field of currency trading, understanding risk management is crucial. With currency pairs like the USD/CAD, the Canadian dollar and the U.S dollar, the importance of this aspect becomes even more prominent. Its influence within the exchange rate can impact potential profits significantly, and as such, it is a parameter that should not be overlooked.

Ensuring that risk is managed effectively can be assisted by utilizing a stop-loss order. This order is a crucial protection mechanism that limits the extent of potential losses by automatically closing a position when a certain loss level is reached. It can offset the volatility often associated with the USD/CAD currency pair and minimize risk.

Additionally, the leverage ratio also plays a substantial role in USD/CAD risk management. While a high leverage can amplify potential gains, it equally magnifies the potential losses. Therefore, it is advisable to maintain a sensible leverage ratio, taking into consideration the potential risks and benefits associated with the market situation.

Furthermore, a deep understanding of market analysis serves as a fundamental tool in risk management. Keeping abreast of global economic events, the performance of the U.S and Canadian economies, and the oil market is beneficial. The USD/CAD is commonly known as a ‘commodity currency’ due to Canada’s large oil reserves. Thus, oil prices can heavily influence the pair’s exchange rate.

Finally, risk management isn’t solely about controlling losses; it’s also about optimizing profits. Traders should consider applying a take-profit order. This order allows traders to set a pre-determined profit level at which the trade will close, ensuring profits are secured when market conditions are favourable.

Fundamentally, risk management in USD/CAD trading is about mitigating potential losses and enhancing profits by exploiting market opportunities. With good market knowledge, discipline, and effective use of trading tools, managing trading risks effectively becomes achievable.

3.1. Importance of Stop-Loss Orders

Within the tumultuous realm of currency trading, navigating the USD/CAD pair efficiently requires an absolute understanding of strategic tools, with stop-loss orders reigning supreme. When dealing with this volatile pair, setting a stop-loss order can safeguard your capital. Stop-loss orders are pre-determined market orders that close a trade when the market price reaches a specified level, preventing any further losses.

Primarily, stop-loss orders curb potential losses, strategically closing your positions if the market goes against your expected movement. No one can predict with 100% certainty the direction that market prices will take. Market volatility, economic news, and geopolitical events are some dynamic elements influencing the USD/CAD pair. Therefore, utilizing stop-loss orders is an essential safety net for your investments. It protects you from the unexpected market swings that can threaten your trading capital.

Additionally, stop losses bring discipline into your trading strategy. Setting a stop-loss order forces you to decide the acceptable loss level before entering a trade. Defining the risk beforehand encourages a more rational approach towards trading, fostering discipline and enabling traders to avoid emotional and impulsive trading decisions.

Moreover, stop-loss orders ensure traders maximize the bang for their buck. Rather than continuously monitor your positions, a stop loss automates the process. It ensures you can focus on analyzing charts and planning trades, instead of stressing about potential losses.

Regardless of the tools used for success, healthy trading habits such as setting stop-loss orders are key to navigating the USD/CAD pair safely. These orders not only protect your capital from undesirable declines but add a coat of calculation, forethought and discipline to your trading approach. Equip yourself with this vital tool and trade with confidence.

3.2. Leverage Control

Leverage control is a powerful tool for forex trading, and its strategic use can enhance returns significantly. Taking the USD/CAD pair as an example, understanding its dynamic can play a pivotal role in improving trading results. Using leverage effectively involves maintaining a cautious balance, as excessive use can amplify both profits and losses. Important aspects such as market volatility, economic conditions, and risk appetite are all integral parts of determining appropriate leverage.

One crucial aspect of leveraging is to manage it according to a trader’s comfort level. For instance, a risk-averse trader may opt to trade USD/CAD with lower leverage – like 1:10, minimizing exposure while a risk-friendly trader might choose higher leverage, say 1:50 or even 1:100. This move increases the potential for lucrative returns but simultaneously elevates the risk of substantial losses.

Constant monitoring of leverage levels is essential. Regularly adjusting leverage according to market conditions and your risk profile can ensure optimal control over trading outcomes. For instance, during high market instability, reducing leverage can help hedge against excessive losses.

Another essential part of leverage control involves setting a stop-loss order. This tool ensures that trades are automatically closed once they reach a predefined unfavorable price level. Using a stop-loss when trading USD/CAD can prevent significant losses and secure profits, providing a safety net for leveraged trades.

In conclusion, balance and constant monitoring are keys to taking advantage of leverage while minimizing potential risks. Whether you’re trading USD/CAD or any other currency pair, incorporating these principles into your trading strategy can lead to more profitable outcomes.

4. Advanced USD/CAD Trading

Advanced USD/CAD trading guides traders to build strategies that consider both the US and Canadian economies’ influencing factors. A nuanced approach peels back the surface to understand the elements that increase or decrease the Currency Pair’s value. One primary factor to note is interest rates. Rate changes by the Federal Reserve in the United States or the Bank of Canada can greatly swing trading in favor or against the USD/CAD. Another crucial consideration revolves around commodities, specifically crude oil, as Canada is one of the world’s leading oil exporters.

Technical analysis also holds considerable weight in any smart trading strategy. Understanding when the US Dollar is bullish or bearish against the Canadian Dollar using moving averages, stochastic oscillators or relative strength work to add more depth to a trader’s acumen. Additionally, the effectiveness of powerful trading platforms is hard to underestimate. Fast, reliable trading instruments with a wealth of features can open up more dynamic trading possibilities.

In diversifying a trader’s toolkit, news and event trading can provide additional insights into market trends shaping the USD/CAD pair. Both economic and geopolitical news from US and Canada can sway the currency pair’s value since currency markets often react strongly to news events. These strategies combined, contribute to advanced USD/CAD trading by ensuring traders sufficiently equip themselves with essential knowledge and tools, as well as a multidimensional perspective of this popular currency pair.

4.1. Correlation with Oil Prices

A degree of correlation exists between the USD/CAD currency pair and the prices of oil, triggering crucial trading decisions. The rise and fall of oil prices often have a profound impact on the value of the Canadian dollar (CAD), given Canada’s substantial oil reserves. The reason stems from Canada’s economy that heavily relies on its oil exports. Thus, when oil prices climb, the CAD often strengthens due to increased global demand for Canadian oil, yielding more revenue for the economy. Simultaneously, the United States Dollar (USD) may weaken, especially if higher oil prices fuel inflation concerns within the US. As a result, the USD/CAD currency pair may decline in such a scenario. On the contrary, low oil prices can cause the CAD to weaken and the USD to strengthen, causing an incline in the USD/CAD currency pair. Exploiting this relationship between oil prices and the USD/CAD is crucial for traders wanting to make informed decisions on their trading activities.

4.2. Cognitive and Psychological Aspects of USD/CAD Trading

Trading the USD/CAD currency pair demands a strategic blend of cognitive prowess and psychological acumen. Developing a clear understanding of the political, economic, and social dynamics of both the United States and Canada is one such cognitive aspect. This requires incessant learning and flexibility to adapt as the economic landscapes of these nations evolve. At the core of this approach is the ability to process large volumes of information and make fast yet precise decisions.

On the psychological front, trading USD/CAD involves navigating through emotional peaks and valleys. Emotional discipline is paramount when dealing with volatility, as currencies can drastically swing due to sudden market disruptions. Maintaining a level head and sticking to the established trading plan helps mitigate reckless actions.

Therefore, an indivisible mix of diligent analysis and emotional stability is crucial for successful USD/CAD trading. Effective risk management and understanding one’s individual psychological strengths and weaknesses will aid in making more informed trading decisions.

In devising a trading strategy, the grasp of both nations’ policy shifts is invaluable. Intricate knowledge on how factors such as interest rates, GDP and employment numbers affect the USD/CAD exchange rate is indispensable in predicting market movements.

Finally, the performance of USD/CAD is quite sensitive to oil prices, given Canada’s status as a leading oil exporter. As a Forex trader, closely tracking the global oil markets to foresee potential shifts that could impact the USD/CAD value cannot be overstated.