1. Overview Of MotiveWave

MotiveWave is a comprehensive trading platform known for its advanced charting and market analysis capabilities. It caters particularly to professional traders who require in-depth technical analysis and a robust suite of trading tools. However, despite its strengths, MotiveWave may not suit everyone due to reasons such as its cost, its focus on niche features, or simply because different traders have different needs based on their trading styles.

If you find that MotiveWave doesn’t quite meet your trading demands or seems financially steep, you’re in luck. This article promises to explore the top alternatives to MotiveWave, each with its own unique features and strengths. Whether you’re a beginner looking for ease of use or a seasoned trader needing specific analytical tools, our guide will help you select the right trading platform.

| Key Points | Details |

|---|---|

| MotiveWave Strengths | Advanced charting, market analysis |

| Reasons to Seek Alternatives | Cost, niche features, suitability for different styles |

| Promise | Breakdown of top alternatives, guide to selecting right one |

2. Top 5 MotiveWave Alternatives

2.1. TradingView

Overview: TradingView is widely recognized as a leading platform in the realm of financial charting and market analysis, particularly appreciated for its responsive, user-friendly interface across devices, including desktop and mobile apps. It caters to a broad spectrum of traders, from novices to experts, by providing tools that are both powerful and easy to use.

2.1.1. Key Features:

- Pine Script: Allows users to write their own indicators and strategies with minimal coding.

- Advanced Charting: Multiple chart types and over 100,000 community-published indicators and strategies.

- Social Trading: Large community of traders sharing insights and strategies.

- Broker Integration: Supports direct trading through various brokers.

- Mobile and Desktop Apps: Seamless experience across all devices with synchronicity of charts and watchlists.

- Custom Alerts: Real-time alerts on any device, based on user-defined conditions.

2.1.2. Pros:

- Community Aspect: Extensive social network for traders.

- Breadth of Tools: Wide array of analytical tools and integration options.

- Ease of Use: Highly intuitive interface suitable for beginners and professionals alike.

- Flexibility: Offers a free version with considerable functionality, alongside more advanced paid options.

2.1.3. Cons:

- Cost: While it offers a free version, advanced features can be expensive with premium plans.

- Information Overload: The vast array of tools and data can be overwhelming for new users.

Ideal For: TradingView is ideal for both new and experienced traders who value community-driven insights and robust technical analysis tools. It’s particularly beneficial for those who engage in day trading and swing trading due to its real-time data and extensive charting capabilities.

Comparison against MotiveWave: While MotiveWave excels in in-depth technical analysis and market simulations, TradingView offers a more accessible platform with a strong community aspect and better device integration. Its user-friendly nature and lower cost structure make it a strong alternative for those who find MotiveWave too complex or expensive.

TradingView vs. MotiveWave

| Feature | TradingView | MotiveWave |

|---|---|---|

| User Base | 60 million traders and investors | Professional traders primarily |

| Key Features | Pine Script, social trading, broker integration | Advanced charting, market simulations |

| Device Compatibility | High (including mobile apps) | Desktop primarily |

| Price | Free basic plan, up to $59.95/month for Premium | Typically higher, professional-grade pricing |

| Ease of Use | High | Moderate, with a learning curve |

| Community | Extensive social features | Limited community interaction |

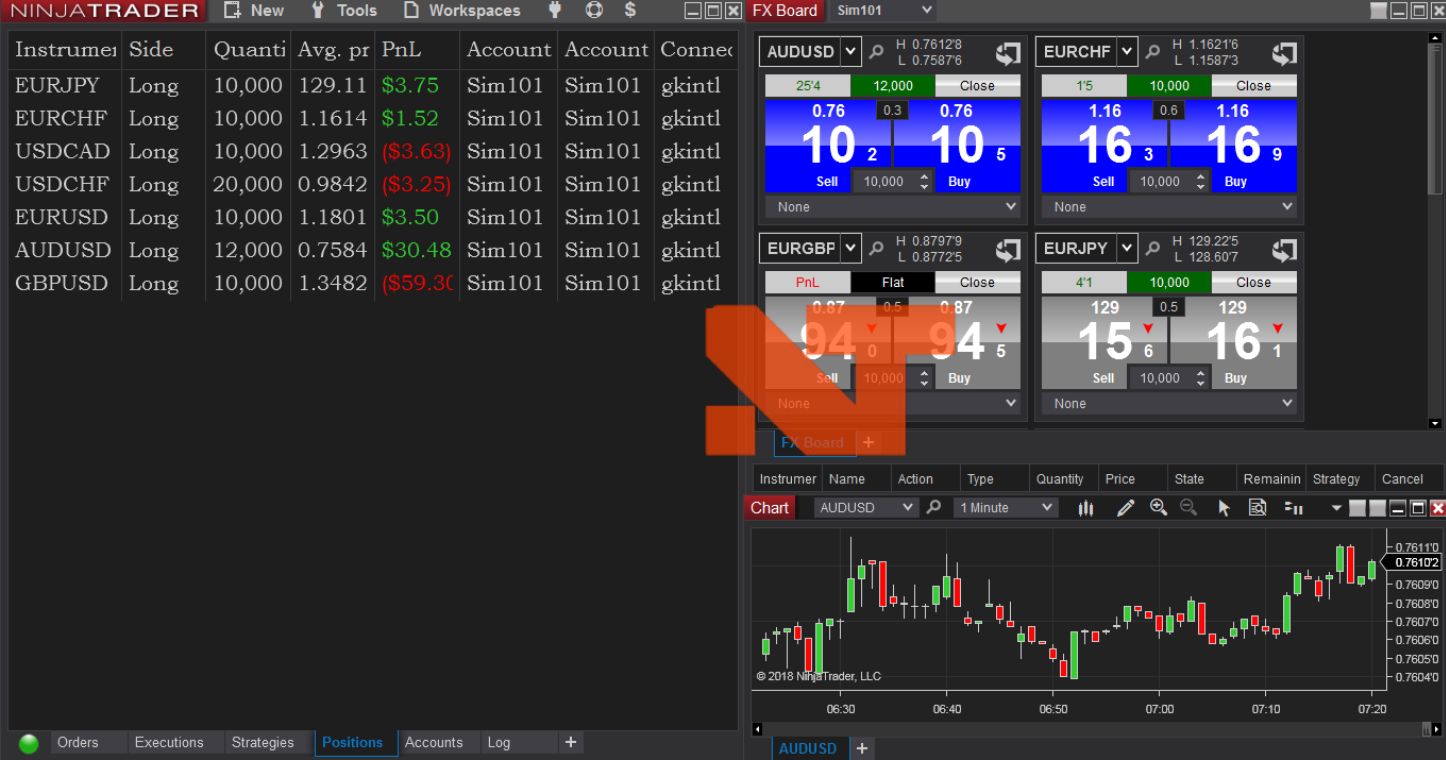

2.2. NinjaTrader

Overview: NinjaTrader is renowned for its specialized capabilities in futures and forex trading, presenting a robust platform that appeals to both new and seasoned traders. Known for its sophisticated technical analysis tools and extensive customization options, NinjaTrader caters to traders who require detailed and dynamic trading strategies.

2.2.1. Key Features:

- Advanced Charting and Trading Tools: Includes features like the SuperDOM, advanced charting, and automated trade management strategies.

- Customization: Highly customizable with options for creating or importing indicators, as well as designing complex trading strategies.

- Market Simulation: Offers an advanced market replay feature to practice trading or test strategies with historical data.

- Multi-Broker Compatibility: Can integrate with multiple brokers, allowing users to manage various brokerage accounts simultaneously.

2.2.2. Pros:

- Depth for Advanced Traders: Provides deep analytical tools and a flexible, programmable interface.

- Customization Flexibility: Extensive options to tailor the platform according to individual trading needs.

- Strong Backtesting: Robust features for backtesting strategies using historical market data.

2.2.3. Cons:

- Steeper Learning Curve: Can be challenging for beginners due to its complex features and detailed customization options.

- Costs Add Up: While the basic features are free, accessing more advanced features and data feeds involves additional costs.

Ideal For: NinjaTrader is best suited for experienced traders who focus on futures and forex markets, particularly those who value detailed analysis and the ability to execute advanced trading strategies.

Comparison against MotiveWave: NinjaTrader provides a highly customizable trading experience with strong emphasis on technical analysis and automated trading, which contrasts with MotiveWave’s broader focus on comprehensive market analysis tools. While MotiveWave is preferred for its thorough market simulation features, NinjaTrader excels in real-time trading efficiency and integration with multiple data feeds and brokerage accounts.

NinjaTrader vs. MotiveWave

| Feature | NinjaTrader | MotiveWave |

|---|---|---|

| Focus | Futures, forex, and options trading | Broad market analysis including stocks and futures |

| Key Strengths | Customization, depth in technical tools | Comprehensive charting, strategy testing |

| Ease of Use | Moderate, with a learning curve | Moderate, with extensive features |

| Cost | Free basic use, fees for advanced features | Generally higher pricing for advanced features |

| Ideal User | Experienced technical traders | Traders seeking in-depth market analysis |

| Community and Support | Active community, extensive educational resources | Limited community features |

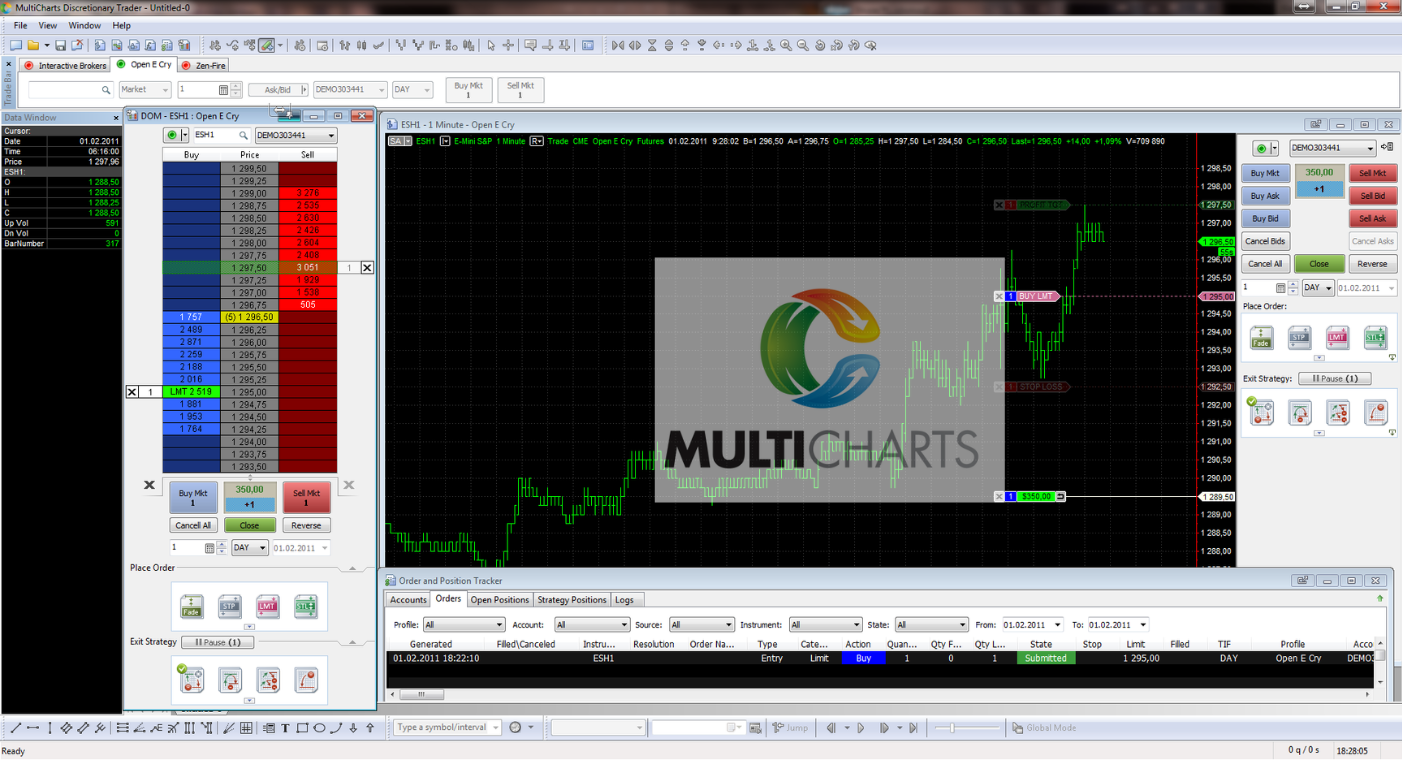

2.3. MultiCharts

Overview: MultiCharts is a comprehensive trading platform recognized for its powerful charting and analytical capabilities. It caters to traders who require robust tools for technical analysis, including day traders and those interested in longer-term investment strategies. The platform supports extensive backtesting and automated trading, making it a favorite among traders who utilize detailed strategies.

2.3.1. Key Features:

- High-Definition Charting: Provides clear and detailed charts, which can support multiple timeframes and data series simultaneously.

- Built-In Indicators and Strategies: Offers a vast array of pre-built technical indicators and the flexibility to develop personalized trading strategies.

- Automated Trading: Capable of running trading robots or automated strategies directly linked to broker servers for execution.

- Portfolio Backtesting: Allows traders to apply strategies across various instruments simultaneously to evaluate performance and robustness.

- Dynamic Portfolio-Level Strategy Testing: Supports advanced testing and optimization techniques, including genetic optimization and walk-forward testing.

2.3.2. Pros:

- Strategy-Building Focus: Strong capabilities in strategy development and testing, with support for EasyLanguage.

- Portfolio Backtesting: Ideal for traders who manage diversified portfolios and need to test strategies across multiple assets.

- Data Compatibility: Supports numerous data feeds and broker integration, enhancing its versatility.

- Visual Trading Tools: Simplifies the trading process with tools like drag-and-drop order management on charts.

2.3.3. Cons:

- Less Beginner-Friendly: The depth of features may overwhelm new traders.

- Interface Can Feel Dated: Some users may find the interface less modern compared to newer platforms.

Ideal For: MultiCharts is best suited for advanced traders who need powerful analytical tools, automated trading capabilities, and the ability to perform detailed backtests on a variety of trading strategies and instruments.

Comparison against MotiveWave: MultiCharts shares several advanced features with MotiveWave, like high-level market analysis and strategy testing. However, MultiCharts distinguishes itself with its superior portfolio backtesting tools and broader compatibility with multiple data feeds and brokers, making it more adaptable for traders who use diverse sources of market data.

MultiCharts vs. MotiveWave

| Feature | MultiCharts | MotiveWave |

|---|---|---|

| Focus | Advanced technical analysis, strategy testing | Comprehensive market analysis, simulation |

| Key Strengths | Portfolio backtesting, automated trading | Detailed charting, real-time simulation |

| Interface | Functional but can feel outdated | More modern, intuitive |

| Data Feed and Broker Support | Extensive support for multiple feeds and brokers | Limited to specific integrations |

| Ideal User | Advanced traders focusing on automation | Traders who prefer manual strategy testing |

2.4. MetaStock

Overview: MetaStock stands out as a powerful technical analysis platform that caters to traders looking for detailed charting, analysis, and trading strategy development. Known for its sophisticated analytical tools, MetaStock is a favorite among traders who require robust data and insight generation capabilities.

2.4.1. Key Features:

- Advanced Charting and Analysis Tools: Offers over 300 chart types and indicators, designed to cater to the various needs of technical traders.

- Expert Advisor: Provides trading signals, trends, and commentary on market conditions, making it easier for traders to make informed decisions.

- Powerful Backtesting: MetaStock’s “System Tester” allows traders to simulate trading strategies over historical data to assess potential outcomes.

- Real-Time Data and News: Integrates with Refinitiv and Xenith for real-time global financial news and data, providing traders with up-to-the-minute market insights.

- Flexible Layouts and Workflow Enhancements: MetaStock 19 introduces new features like customizable multi-chart and multi-frame views to optimize the trading experience.

2.4.2. Pros:

- Unique Pattern Focus: Specialized in identifying and leveraging unique market patterns through its advanced charting capabilities.

- Add-Ons for Specialized Needs: Offers numerous third-party add-ons that enhance its core capabilities, tailored for various trading strategies.

- Comprehensive Data Access: Provides extensive historical and real-time data across global markets, which is crucial for detailed market analysis.

2.4.3. Cons:

- Complexity for Beginners: The depth and breadth of features can be overwhelming for new traders.

- Cost: Accessing the full suite of features, especially real-time data, can be expensive.

Ideal For: MetaStock is particularly well-suited for experienced traders who focus on technical analysis and require detailed data to make trading decisions. It’s also beneficial for those who rely on backtesting and pattern recognition to form trading strategies.

Comparison against MotiveWave: While both platforms offer robust analytical tools, MetaStock excels with its integrated real-time news provided by Xenith and its global market data access. Unlike MotiveWave, which is also strong in technical analysis, MetaStock provides more direct integration with data services like Refinitiv, offering a more comprehensive suite of news and data analytics.

MetaStock vs. MotiveWave

| Feature | MetaStock | MotiveWave |

|---|---|---|

| Data Integration | Refinitiv and Xenith for comprehensive data access | Limited to specific integrations |

| Charting Capabilities | Over 300 chart types and indicators | Advanced charting, less variety than MetaStock |

| User Base | Suited for experienced technical traders | Appeals to both new and experienced traders |

| Cost | Higher cost for full features | Generally lower cost, depends on the features |

| Unique Offering | Expert Advisor for trading signals and market trends | Strong market simulation features |

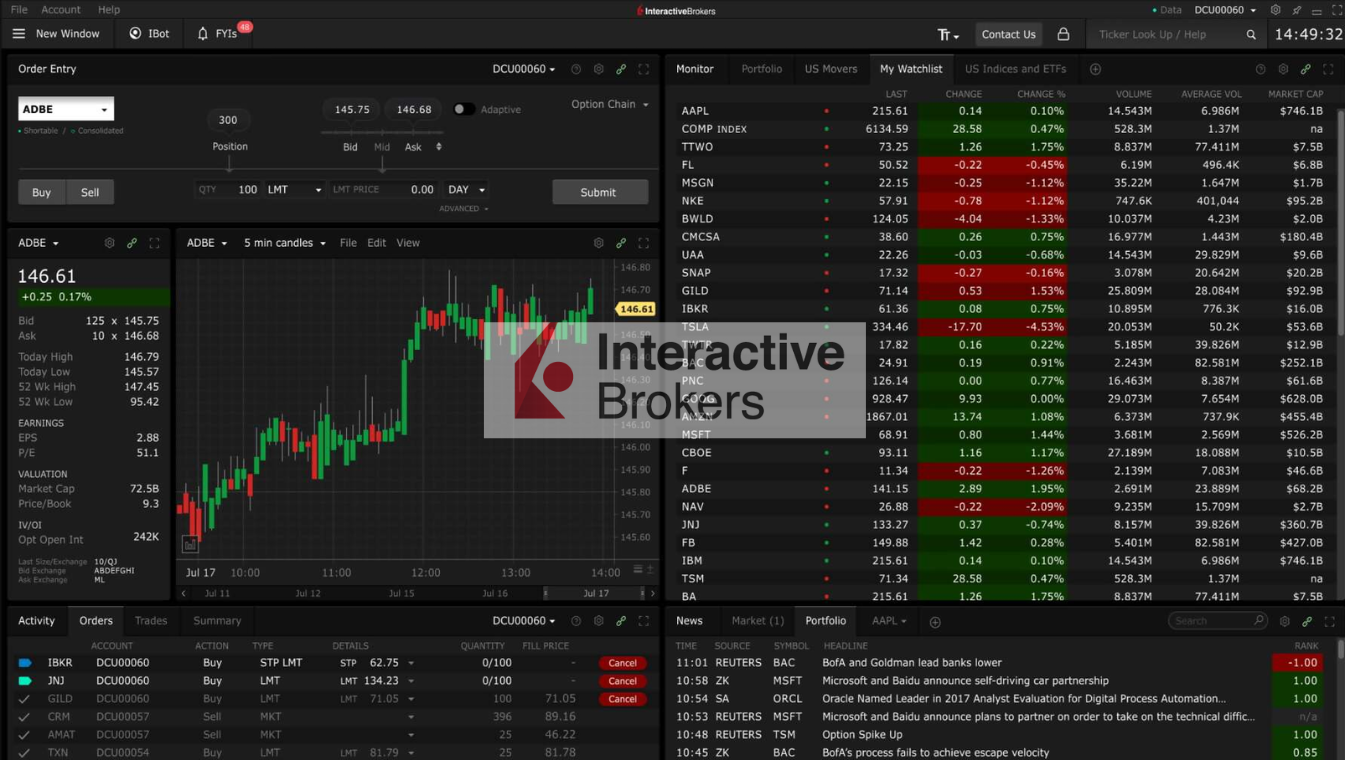

2.5. Interactive Brokers Trader Workstation (TWS)

Overview: Trader Workstation (TWS), developed by Interactive Brokers, is a sophisticated trading platform known for its robust functionality and flexibility. TWS is designed to cater to the needs of active traders and institutions, providing a comprehensive range of tools for trading across multiple asset classes globally.

2.5.1. Key Features:

- Comprehensive Asset Access: Supports trading in stocks, options, futures, forex, bonds, and funds on over 135 exchanges worldwide.

- Advanced Trading Tools: Offers over 100 order types and algorithms, allowing for complex strategy execution and risk management.

- Customizable Interface: Features the Mosaic interface for personalized workspace arrangements, enhancing trading efficiency and effectiveness.

- Cross-Platform Availability: Available on desktop (Windows, Mac, Linux), as well as mobile devices through apps for iOS and Android, and also as a web application.

2.5.2. Pros:

- Unparalleled Depth for Serious Traders: Extensive tools for order management, risk management, and market analysis.

- API Access: Allows coding of custom tools and integration with other software.

- Global Reach: Direct market access to international exchanges and a wide array of tradable instruments.

2.5.3. Cons:

- Overkill for Casual Traders: The complexity and scale of tools may overwhelm non-professional traders.

- Learning Curve: New users may find the interface and array of options challenging to navigate initially.

Ideal For: TWS is ideal for professional traders who need a powerful, highly customizable platform that supports a broad range of trading activities across multiple markets and asset classes.

Comparison against MotiveWave: While MotiveWave offers comprehensive charting and analysis tools particularly suited for technical traders, TWS stands out for its depth of features designed for professional trading. TWS provides extensive market access, a vast array of order types, and advanced risk management tools that are essential for serious trading operations, making it a more suitable choice for those engaging in high-volume or algorithmic trading.

TWS vs. MotiveWave

| Feature | Trader Workstation (TWS) | MotiveWave |

|---|---|---|

| User Base | Professional and institutional traders | Technical traders focusing on charting and analysis |

| Trading Tools | Extensive order types, real-time data, API access | Advanced charting, technical analysis tools |

| Market Access | Over 135 global exchanges | Limited compared to TWS |

| Customizability | Highly customizable interface and trading experience | Customizable, but more focused on analysis |

| Platform Availability | Desktop, mobile, and web | Desktop mainly |

| Ideal Usage | High-volume, algorithmic, multi-asset trading | Detailed technical analysis and trading |

3. Factors to Consider When Choosing a Trading Platform

Choosing the right trading platform is crucial for effective trading. Several key factors influence this decision, each tailored to individual trading styles and needs. Here’s a detailed breakdown of the main aspects to consider:

3.1. Trading Style:

- Day Trading vs. Swing Trading vs. Long-Term Investing: Day traders need platforms with fast execution and real-time data, swing traders require intermediate-term data and analysis tools, and long-term investors benefit from comprehensive research and portfolio management tools.

- Technical vs. Fundamental Analysis: If your focus is on technical analysis, look for platforms with advanced charting and analytical tools. For fundamental analysis, platforms that provide in-depth financial data, news feeds, and research reports are preferable.

- Manual vs. Automated Trading: Manual traders need a user-friendly interface with efficient manual order processing. Automated traders should look for platforms that support algorithmic trading and offer robust API access.

3.2. Asset Classes:

- Platforms vary in the types of assets they support—stocks, forex, futures, options, cryptocurrencies. Ensure the platform supports all the asset classes you intend to trade.

3. 3. Technical Analysis Tools:

- Charting Types: Does the platform offer advanced charting options like candlestick, line, and point-and-figure charts?

- Indicators and Drawing Tools: The availability of technical indicators and customizable drawing tools is crucial for detailed market analysis.

- Backtesting Capabilities: Essential for testing strategies against historical data.

3.4. User Experience:

- Ease of Use: A straightforward, intuitive interface can significantly enhance trading efficiency.

- Learning Curve: Some platforms are more complex and require a significant investment in learning.

- Customizability: Ability to customize the interface can make the platform more aligned with personal trading habits.

3.5. Costs:

- Platform Fees: Monthly or annual subscription costs.

- Data Subscriptions: Costs for real-time or specialized data feeds.

- Commissions and Spreads: Fees per trade or spreads on forex and other asset classes.

- Additional Costs: Fees for access to premium features or higher-tier services.

3.6. Additional Factors:

- Community and Support Resources: Good customer support, active user forums, and learning resources can enhance your trading experience.

- Platform Reputation and Longevity: Established platforms are often more reliable.

- Broker Compatibility: Ensure the platform integrates well with your broker for seamless trading.

| Factor | Description |

|---|---|

| Trading Style | Match platform capabilities with your trading style and needs. |

| Asset Classes | Ensure the platform supports the assets you trade. |

| Technical Analysis Tools | Advanced charting, indicators, and backtesting are key. |

| User Experience | Look for ease of use, learning resources, and customizability. |

| Costs | Consider all related fees, including data and transaction costs. |

| Additional Factors | Community support, platform stability, and broker integration are crucial. |

4. Matching the Right Platform to Your Needs

Finding the right trading platform depends on understanding your specific needs as a trader. Below, we’ve matched various trader profiles to the platforms discussed, helping you determine which might best suit your trading style and goals.

4.1. The Beginner Looking for Ease of Use

- Platform Recommendation: TradingView

- Why: TradingView is renowned for its intuitive interface and straightforward navigation, making it ideal for beginners. Its social community aspect also provides learning opportunities from other traders.

- Key Features: User-friendly interface, extensive educational resources, and interactive community.

4.2. The Technical Analyst Seeking Advanced Tools

- Platform Recommendation: MetaStock

- Why: MetaStock offers powerful technical analysis tools, including advanced charting, backtesting capabilities, and custom indicators for detailed market analysis.

- Key Features: Advanced charting options, real-time data, extensive backtesting tools.

4.3. The Algo-Trader Needing Automation

- Platform Recommendation: Trader Workstation (TWS)

- Why: TWS supports high-level automation and algorithmic trading, offering comprehensive API access for developing custom trading tools and strategies.

- Key Features: API access, support for numerous order types and algos, highly customizable.

4.4. The Budget-Conscious Day Trader

- Platform Recommendation: NinjaTrader

- Why: NinjaTrader provides a robust trading platform with lower cost options for advanced tools and data. It also offers a free version that’s quite capable for those on a budget.

- Key Features: Free access to essential tools, competitive pricing for advanced features, excellent simulation tools.

4.5. The Diverse Portfolio Manager

- Platform Recommendation: MultiCharts

- Why: MultiCharts supports extensive backtesting and automated trading across a diverse array of assets, ideal for traders managing varied portfolios.

- Key Features: Portfolio backtesting, strategy optimization, support for multiple data feeds and brokers.

| Trader Profile | Recommended Platform | Key Reasons for Recommendation | Notable Features |

|---|---|---|---|

| Beginner Looking for Ease of Use | TradingView | Intuitive interface, community learning | User-friendly, educational resources, active community |

| Technical Analyst Seeking Advanced Tools | MetaStock | Advanced technical analysis tools, superior charting | Advanced charting, backtesting, real-time data |

| Algo-Trader Needing Automation | Trader Workstation | Supports complex automation, comprehensive API access | API access, custom trading tools, algorithm support |

| Budget-Conscious Day Trader | NinjaTrader | Free core features, affordable upgrades | Low-cost advanced features, excellent simulation tools |

| Diverse Portfolio Manager | MultiCharts | Supports varied asset classes, advanced backtesting | Portfolio management, strategy optimization, multi-broker support |

Conclusion

Selecting the right trading platform is a crucial decision that hinges on individual trading style, needs, and financial goals. While there’s no single “best” platform for everyone, understanding your own requirements and comparing the strengths of each platform can guide you to the ideal choice.

Key Aspects:

- Understand Your Needs: Assess your trading style, preferred asset classes, and the level of technical analysis or automation you need.

- Cost vs. Features: Balance the costs associated with various platforms against the features and tools they offer. Remember, more expensive doesn’t always mean better suited for your needs.

- Trial and Adaptation: Most platforms offer demos or free trials. Utilize these to test how well a platform matches your trading workflow before committing financially.

- Continuous Learning: Trading platforms frequently update and add new features. Stay informed and adaptable to leverage the latest tools and data offerings.

Finally, while the digital tools at your disposal are powerful allies, successful trading also depends on continuous learning, market research, and strategic planning. Each platform has its merits and choosing the right one is about finding the best fit for your unique trading approach and goals. Whether you’re a beginner or a seasoned trader, the right platform can enhance your trading efficiency and potentially increase your profitability.