Overview of TradingView

TradingView is a popular online platform that offers a range of tools and resources for traders and investors alike. It is designed to help users make informed decisions by providing access to real-time data, advanced charting tools, and a vibrant community of traders to share ideas and strategies.

One of the most notable features of TradingView is its intuitive charting system, which allows users to easily analyze financial markets and make predictions based on historical data. The platform offers a wide range of chart types, including candlestick, bar, line, and area charts. Additionally, users can customize their charts with various timeframes, indicators, and drawing tools to better understand market trends and identify potential trading opportunities.

TradingView also boasts a comprehensive library of technical indicators that users can apply to their charts. These indicators cover a range of categories, such as trend, oscillators, volatility, and volume. Some popular indicators available on the platform include:

- Moving Averages (Simple, Exponential, and Weighted)

- Relative Strength Index (RSI)

- Stochastic Oscillator

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

- Fibonacci Retracements and Extensions

Besides the vast array of technical indicators, TradingView also offers a powerful scripting language called Pine Script. This feature enables users to create their own custom indicators and strategies, which can then be applied to their charts or even shared with the TradingView community. The Pine Script language is designed to be easy to learn and use, even for those without prior programming experience.

Another key aspect of TradingView is its social trading community. The platform encourages users to share their trading ideas, strategies, and market analyses with others. Users can publish their ideas, complete with annotated charts and explanations, and receive feedback from other members of the community. This fosters a collaborative environment where traders can learn from one another and improve their skills.

TradingView also offers a range of market screening tools that help users identify potential trading opportunities based on specific criteria. Users can filter assets based on various factors such as price, market cap, dividend yield, and more. This feature is particularly useful for those looking to diversify their portfolios or find new investment opportunities.

In addition to its charting and community features, TradingView provides access to real-time market data for a wide range of assets, including stocks, cryptocurrencies, commodities, and Forex pairs. Users can view live quotes, historical data, and even create custom watchlists to keep track of their favorite assets.

For those looking to take their trading to the next level, TradingView offers a paper trading feature that allows users to practice their strategies without risking real money. This virtual trading environment is an excellent way to test new ideas and refine trading techniques before implementing them in the live market.

Finally, TradingView offers a variety of subscription plans to cater to different users’ needs. The platform offers a free plan with limited features, as well as paid plans that provide access to additional tools, data, and resources. Some benefits of upgrading to a paid plan include:

- Access to premium charting tools and indicators

- Increased number of alerts and watchlists

- Real-time data for additional exchanges

- Priority customer support

- Ad-free browsing experience

Overall, TradingView is a comprehensive and versatile platform that offers a wealth of resources for traders and investors of all levels. With its advanced charting tools, extensive library of indicators, and active trading community, users can gain valuable insights into the financial markets and make more informed decisions.

Why consider alternatives to TradingView?

TradingView has gained immense popularity among traders and investors for its comprehensive charting tools, social networking features, and a user-friendly interface. However, there are several reasons why one might consider exploring alternatives to TradingView.

Diverse Trading Needs: Every trader has unique requirements, depending on their trading style, strategies, and instruments they trade. While TradingView caters to a broad audience, it may not be the perfect fit for everyone. Some traders might prefer a platform that offers more specialized tools or caters to their specific needs. For example, options traders may require a platform that focuses on options analytics, while forex traders might need a platform with advanced currency analysis tools.

Costs: TradingView offers a free plan, but it comes with limitations on the number of indicators, alerts, and chart layouts. To access the full suite of features, users need to subscribe to one of the paid plans. Some traders may find the cost of these plans prohibitive, especially if they need only a few advanced features. In such cases, they might prefer a more cost-effective alternative that provides the features they need without breaking the bank.

Broker Integrations: One of the key aspects of a trading platform is its ability to integrate with brokers for seamless execution of trades. While TradingView has integrations with several brokers, it may not support the specific broker a trader uses. In this case, traders might look for a platform that offers better integration with their preferred broker.

Customization and Extensibility: TradingView offers a wide range of built-in tools and indicators, but some traders may require more customization or the ability to create their own custom tools. Although TradingView provides the Pine Script language for creating custom indicators, it may not be suitable for everyone. Traders who need more advanced customization options or prefer a different scripting language might consider an alternative platform.

Performance: TradingView is a web-based platform, which means it runs in a browser and relies on an internet connection. While this provides the advantage of accessibility from any device, it can also lead to performance issues, especially for users with slow or unreliable internet connections. Traders who require a high-performance platform might consider a desktop-based alternative that offers better performance and stability.

Privacy and Security: As a cloud-based platform, TradingView stores user data on its servers. While this offers the convenience of accessing your data from any device, some traders may have concerns about the privacy and security of their data. In such cases, they might prefer an alternative platform that stores data locally on their own device.

Community and Support: One of the main attractions of TradingView is its active community of traders who share ideas, strategies, and insights. However, some traders might prefer a platform with a smaller, more focused community, or one that offers more personalized support and educational resources.

When considering an alternative to TradingView, it’s essential to evaluate the features and benefits of each platform in relation to your specific trading needs.

Ultimately, the choice of a trading platform comes down to personal preferences, trading style, and the specific needs of the individual trader. Taking the time to explore and compare various alternatives can help you find the platform that best suits your requirements and enhances your trading experience.

1. StockCharts

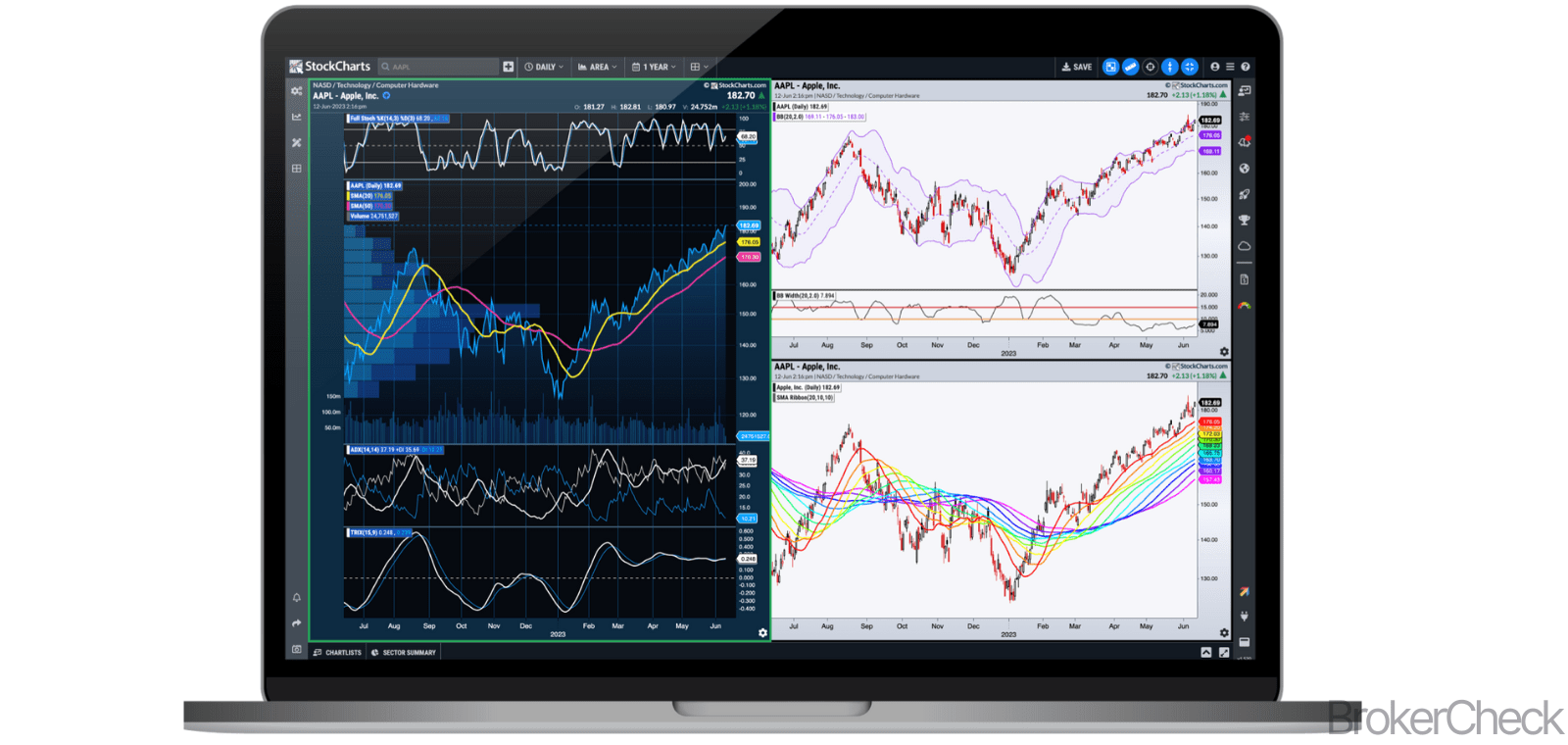

StockCharts is a popular and powerful tradingview alternative that provides traders and investors with a comprehensive suite of tools for technical analysis, charting, and market data. It offers a user-friendly interface and a wide range of features that cater to both novice and experienced traders.

One of the key strengths of StockCharts is its extensive collection of chart types, which includes line charts, bar charts, candlestick charts, and many more. This allows traders to analyze the market from various angles and perspectives, enabling them to make well-informed decisions. In addition to the traditional chart types, StockCharts also supports Point & Figure, Renko, and Kagi charts, which are less commonly found in other charting platforms.

Another notable feature of StockCharts is its advanced scanning and filtering capabilities. Users can create custom scans based on a wide variety of technical indicators, chart patterns, and other criteria. This makes it easy for traders to identify potential trading opportunities and monitor their watchlists more efficiently. The platform also provides a predefined set of scans that covers popular technical analysis concepts, such as moving averages, RSI, and MACD.

StockCharts also excels in the area of technical indicator support. The platform offers over 50 built-in technical indicators, including trendlines, moving averages, oscillators, and volume-based indicators. Users can easily customize the parameters of these indicators to suit their personal trading preferences. Moreover, StockCharts allows users to overlay multiple indicators on a single chart, enabling them to perform in-depth technical analysis.

Another useful feature of StockCharts is its annotation tools, which allow users to add various shapes, text, and other graphical elements to their charts. This can be particularly helpful for traders who want to highlight specific areas of interest, such as support and resistance levels, trendlines, or chart patterns. The annotation tools are easy to use and can be customized to match the user’s preferred colors, styles, and sizes.

For traders who prefer to use custom technical indicators and studies, StockCharts offers the Advanced Custom Studies (ACS) feature. This allows users to create their own custom indicators and studies using the platform’s built-in scripting language, which is based on JavaScript. This feature is especially useful for advanced traders who want to implement their own unique trading strategies and methodologies.

In terms of market data, StockCharts provides real-time and historical data for stocks, ETFs, mutual funds, and indexes from major exchanges around the world. Users can access intraday data as well as daily, weekly, and monthly timeframes. The platform also offers a Market Summary page that provides an overview of the current market conditions, including top gainers and losers, sector performance, and market breadth indicators.

StockCharts offers several subscription plans to cater to different user needs and budgets. The Basic plan is free and provides access to a limited set of features, while the Extra and Pro plans offer more advanced features and additional data. Some of the premium features available in the paid plans include:

- Real-time data

- Advanced charting and scanning tools

- Custom technical indicators and studies

- Historical data for up to 20 years

- Ad-free experience

Overall, StockCharts is a versatile and feature-rich platform that offers a wide array of tools and resources for technical analysis and charting. Its user-friendly interface, extensive chart types, advanced scanning capabilities, and customizability make it an excellent choice for traders and investors seeking a powerful tradingview alternative.

2. MetaTrader 4 (MT4)

Developed by MetaQuotes Software, MetaTrader 4 (MT4) is a widely popular trading platform among forex traders, offering a comprehensive suite of tools and features to help them execute trades and manage their accounts. With its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators, MT4 has become a go-to choice for traders looking for a powerful yet easy-to-use platform.

One of the key strengths of MT4 is its customizability. Users can easily modify the platform’s appearance, create custom chart templates, and even develop their own technical indicators and trading algorithms using the built-in MetaEditor and MetaQuotes Language 4 (MQL4). This flexibility allows traders to tailor the platform to their specific needs and trading strategies, making it a versatile option for both beginners and experienced traders alike.

MT4’s advanced charting capabilities are another major selling point. The platform supports multiple chart types, including line, bar, and candlestick charts, as well as nine timeframes ranging from one minute to one month. Users can overlay various technical indicators on the charts, such as moving averages, Bollinger Bands, and Fibonacci retracements, to help identify trends and potential entry and exit points. The platform also allows for multiple charts to be open simultaneously, enabling traders to monitor multiple currency pairs or timeframes at once.

In addition to its charting tools, MT4 offers a range of order management features to help traders execute their trades efficiently and manage their risk. These include:

- Market orders: Instantly buy or sell a financial instrument at the current market price.

- Limit orders: Place an order to buy or sell a financial instrument at a specified price or better.

- Stop orders: Place an order to buy or sell a financial instrument once a certain price level is reached.

- Trailing stops: Automatically adjust the stop loss level as the market moves in the trader’s favor, helping to lock in profits and limit downside risk.

Another notable feature of MT4 is its support for automated trading. Using the platform’s Expert Advisors (EAs) functionality, traders can develop, test, and implement trading algorithms that automatically execute trades based on predefined criteria. This can be particularly useful for traders looking to capitalize on specific market conditions or implement a more disciplined approach to their trading.

MT4 also offers a range of analytical tools to help users monitor their trading performance and identify areas for improvement. The platform’s built-in Account History tab provides a detailed record of all executed trades, while the Reports feature allows users to generate customizable performance reports for specific time periods or trading strategies. Additionally, the Strategy Tester tool enables traders to backtest their EAs against historical market data, helping to refine their algorithms and optimize their performance.

As a trading platform, MT4 is compatible with a wide range of brokers, making it easy for users to switch between providers without having to learn a new platform. Furthermore, MT4 is available on various devices, including desktop computers, smartphones, and tablets, allowing traders to access their accounts and execute trades from anywhere, at any time.

While MT4 is primarily known for its forex trading capabilities, the platform also supports trading in other financial instruments, such as commodities, indices, and cryptocurrencies, depending on the broker. This versatility makes it a suitable option for traders looking to diversify their portfolios and explore new markets.

Overall, MetaTrader 4 stands out as a powerful, customizable, and user-friendly trading platform that offers a wide range of features to help traders succeed in the financial markets. With its advanced charting tools, flexible order management options, and support for automated trading, MT4 provides a solid alternative to TradingView for those looking to expand their trading toolkit and enhance their trading performance.

3. NinjaTrader

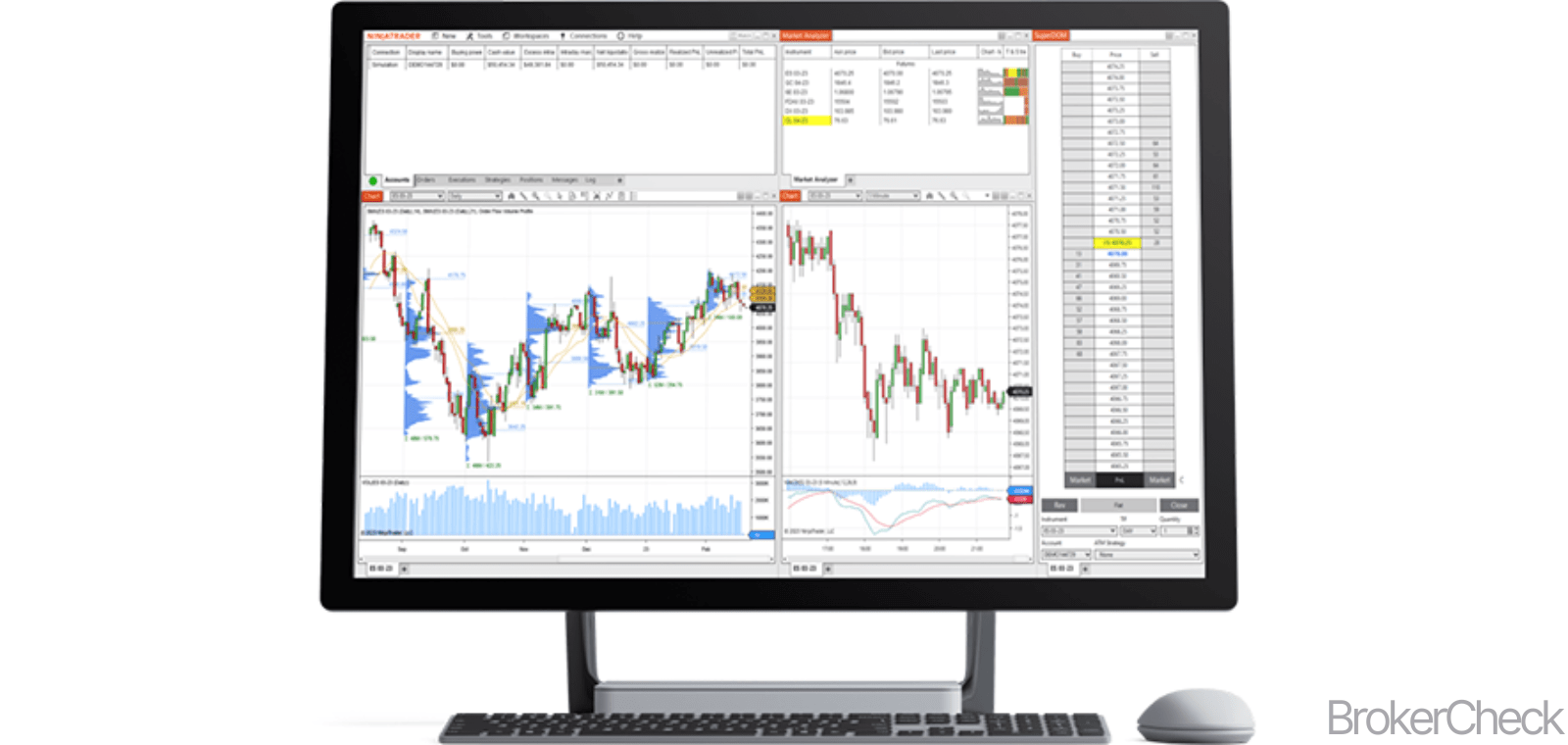

NinjaTrader is a powerful trading platform that offers a wide range of features to help traders analyze the market and execute trades. As a TradingView alternative, it provides users with advanced charting capabilities, market analytics, and trade simulation tools.

One of the key features of NinjaTrader is its customizable charting system. Users can choose from various chart styles, including candlestick, bar, and line charts. They can also apply numerous technical indicators, such as moving averages, RSI, and MACD, to help them identify potential trading opportunities. Additionally, traders can create custom indicators and strategies using NinjaScript, a C#-based programming language.

Another advantage of using NinjaTrader is its market replay feature. This allows users to replay historical market data at different speeds, enabling them to practice their trading strategies and refine their skills in a simulated environment. This can be particularly useful for new traders who want to gain experience without risking real money.

NinjaTrader also offers a comprehensive market analyzer tool, which helps traders identify potential trading opportunities by scanning the market for specific conditions. Users can customize the market analyzer by adding their own custom columns and filters, allowing them to focus on the information that is most relevant to their trading style.

Some of the other notable features of NinjaTrader include:

- Automated trading: Users can create, test, and deploy automated trading strategies using NinjaScript.

- Trade management: NinjaTrader offers advanced trade management tools, such as trailing stops and profit targets, to help users manage their trades more effectively.

- Alerts: Traders can set up custom alerts based on price, time, or technical indicator conditions, ensuring they never miss a potential trading opportunity.

- DOM (Depth of Market): The platform provides a visual representation of the order book, allowing users to see the depth of market liquidity and place trades directly from the DOM.

- Third-party add-ons: NinjaTrader supports a wide range of third-party add-ons, including custom indicators, strategies, and educational resources.

It’s worth noting that while NinjaTrader offers a free version of its platform, some features are limited or unavailable. For example, the free version does not support live trading, and users can only access a limited number of historical market data. To unlock the full functionality of the platform, traders can purchase a lifetime license or opt for a monthly subscription.

In terms of brokerage support, NinjaTrader is compatible with several popular brokers, including Interactive Brokers, TD Ameritrade, and FuturesOnline. This makes it easy for traders to connect their existing brokerage accounts to the platform and start trading.

One potential downside of NinjaTrader is its learning curve. The platform offers a wealth of features and customization options, which can be overwhelming for new users. However, there are numerous resources available to help users get started, such as video tutorials, webinars, and an active user community.

Overall, NinjaTrader is a versatile and powerful trading platform that offers a wide range of features and tools to help traders analyze the market and execute trades. Its advanced charting capabilities, market analytics, and trade simulation tools make it an excellent TradingView alternative for those looking to take their trading to the next level.

4. Thinkorswim

When it comes to trading platforms, thinkorswim stands out as an excellent alternative to TradingView. Developed by TD Ameritrade, this powerful and versatile platform offers a wide range of advanced tools and features that cater to both novice and experienced traders. With its customizable interface, extensive research capabilities, and real-time data, Thinkorswim has become a popular choice for those looking to elevate their trading experience.

One of the most notable features of Thinkorswim is its comprehensive charting capabilities. Users can access over 400 technical studies and indicators, making it easy to analyze market trends and make informed decisions. Additionally, the platform allows traders to create custom studies and alerts, ensuring that they stay up-to-date with the latest market movements.

Another significant advantage of Thinkorswim is its paper trading functionality. This feature enables users to practice their trading strategies in a risk-free environment, using virtual money. By simulating real trading conditions, paper trading helps traders gain valuable experience and confidence before diving into live trading with real funds.

Thinkorswim also boasts an impressive range of educational resources. Users can access a vast library of articles, videos, and webinars covering various trading topics, from basic concepts to advanced strategies. Furthermore, the platform offers live, in-person workshops and events, allowing traders to network with like-minded individuals and expand their knowledge.

For those interested in options trading, Thinkorswim provides a powerful options analytics tool called the Analyze tab. This feature allows traders to evaluate potential strategies and visualize their risk-reward profiles. With the ability to model various scenarios and assess the impact of different market conditions, the Analyze tab is an invaluable resource for options traders.

In addition to its robust trading tools, Thinkorswim offers a user-friendly mobile app for both iOS and Android devices. The app provides access to many of the platform’s features, including charting, watchlists, and trade execution. With the convenience of mobile trading, users can monitor their positions and execute trades on the go.

Another noteworthy aspect of Thinkorswim is its community-driven approach. The platform features a built-in chat room, where traders can share ideas, discuss strategies, and learn from one another. This collaborative environment fosters a sense of camaraderie among users and promotes continuous learning and growth.

It’s worth mentioning that Thinkorswim is available to TD Ameritrade customers at no additional cost. This means that traders can take advantage of the platform’s advanced tools and features without incurring any extra fees. However, non-TD Ameritrade customers can still access Thinkorswim by opening a brokerage account with the firm.

Overall, Thinkorswim is an excellent alternative to TradingView for traders seeking a comprehensive and versatile trading platform. With its advanced charting capabilities, extensive educational resources, and user-friendly mobile app, Thinkorswim caters to a wide range of trading styles and experience levels.

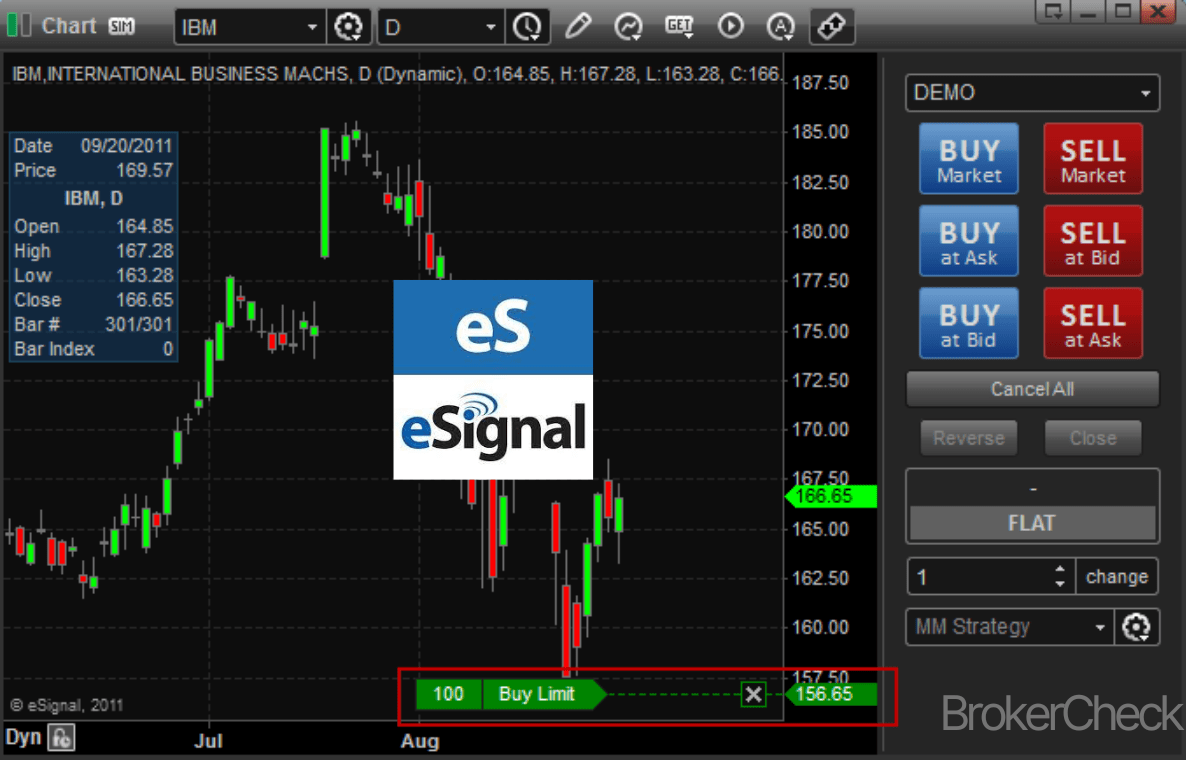

5. eSignal

When it comes to finding a reliable tradingview alternative, eSignal stands out as a powerful and versatile trading platform for both beginners and experienced traders alike. This platform offers a wide range of features and tools that can help investors make informed decisions and execute trades efficiently. In this blog post, we will explore the various aspects of eSignal that make it an excellent choice for those looking to enhance their trading experience.

Feature-rich charting and analysis tools

One of the main strengths of eSignal is its comprehensive suite of charting and analysis tools. With over 100 technical indicators and drawing tools, users can customize their charts to suit their trading style and preferences. Additionally, eSignal supports multiple chart types, including candlestick, bar, line, and more, allowing traders to view market data in a way that best suits their needs.

Advanced scanning capabilities

eSignal’s advanced scanning capabilities enable traders to quickly and easily identify potential trading opportunities. The platform’s Formula Wizard allows users to create custom scans using a combination of technical and fundamental criteria. This feature is particularly useful for those who want to focus on specific market conditions or trading strategies.

Extensive market data coverage

With eSignal, traders can access an extensive range of market data, including stocks, options, futures, and Forex from major global exchanges. This comprehensive market coverage ensures that users have all the information they need to make informed trading decisions.

Integration with popular brokerages

To facilitate seamless trading, eSignal integrates with several popular brokerages, including Interactive Brokers, FXCM, and Infinity Futures. This integration allows users to execute trades directly from the eSignal platform, streamlining the trading process and reducing the need for multiple applications.

Customizable workspace

eSignal’s customizable workspace allows traders to create a personalized trading environment tailored to their specific needs. Users can arrange charts, watchlists, and other tools in a way that best suits their workflow. Furthermore, the platform supports multiple monitors, enabling traders to keep an eye on multiple markets simultaneously.

Backtesting capabilities

For traders who rely on algorithmic or systematic trading strategies, eSignal’s backtesting capabilities are an invaluable resource. The platform enables users to test their strategies against historical market data, helping them to refine and optimize their approach before deploying it in live markets.

Education and support

eSignal offers a wealth of educational resources to help users get the most out of the platform. These resources include webinars, video tutorials, and a comprehensive knowledge base. Additionally, the platform provides dedicated customer support to assist with any technical issues or questions users may have.

Pricing and plans

eSignal offers several pricing plans to suit the needs of different traders. The Classic plan starts at $64 per month and includes basic charting and scanning features. The Signature plan, priced at $216 per month, includes advanced features such as backtesting, market screener, and integration with popular brokerages. Finally, the Elite plan, at $440 per month, offers additional benefits such as real-time market scanning and premium support.

Overall, eSignal’s comprehensive suite of tools, extensive market coverage, and customizable workspace make it a strong contender for those seeking a tradingview alternative. With its advanced charting and analysis capabilities, eSignal can help traders of all experience levels make more informed decisions and improve their overall trading performance.

6. Finviz

As a trader, having access to a wide array of tools and resources is essential for making informed decisions. One such platform that offers valuable insights and analytics is Finviz. Designed as a comprehensive financial visualization tool, Finviz provides users with a wealth of information to help them stay ahead of the market and make better trading choices. Here, we’ll delve into the various features and benefits that make Finviz a worthy alternative to TradingView.

1. User-friendly Interface: Finviz is known for its clean, easy-to-navigate interface that allows users to quickly find the information they need. Whether you’re a beginner or an experienced trader, you’ll appreciate the platform’s intuitive design, which makes it simple to access various tools and resources.

2. Stock Screener: One of the standout features of Finviz is its powerful stock screener. With over 60 filters available, users can narrow down their search for stocks based on criteria such as market capitalization, dividend yield, price-to-earnings ratio, and more. This makes it easy to find potential investment opportunities that align with your specific trading strategy.

3. Market Maps: Finviz’s market maps offer a visually appealing way to view the performance of various market sectors. By displaying stocks in a heatmap format, users can quickly identify which industries are outperforming or underperforming at a glance. This can be particularly helpful when looking for potential sector-specific investment opportunities.

4. Technical Analysis: For traders who rely on technical analysis, Finviz offers a range of tools to help you identify trends and patterns. The platform provides various charting options, including candlestick, line, and bar charts, as well as overlays and indicators such as moving averages, Bollinger Bands, and RSI. This makes it easy to perform a detailed analysis of a stock’s price movement and make more informed trading decisions.

5. News and Data: Staying up-to-date with the latest market news and data is crucial for making informed trading decisions. Finviz offers a news aggregator that compiles headlines from various sources, allowing users to stay informed about the latest developments in the market. Additionally, the platform provides key financial data for individual stocks, such as earnings, dividends, and financial ratios, as well as aggregated data for market indices and sectors.

6. Portfolio Tracking: Finviz allows users to create and track their own custom portfolios, making it easy to monitor the performance of your investments over time. You can also view the aggregate performance of your portfolio, as well as individual stock performances, helping you make better-informed decisions about your holdings.

7. Elite Membership: While Finviz offers a wealth of information and tools for free, users can also opt for an Elite membership to gain access to additional features. These include real-time data, advanced charting tools, backtesting capabilities, and more. For serious traders looking for a more comprehensive platform, the Elite membership could be a valuable investment.

Overall, Finviz is a versatile and powerful platform that offers a range of features to help traders make more informed decisions. With its user-friendly interface, powerful stock screener, and wealth of market data and news, Finviz is an excellent alternative to TradingView for traders seeking a comprehensive financial visualization tool.

7. ProRealTime

As a trader, having access to a powerful and feature-rich charting and trading platform is essential. One such platform, which is often considered as a viable alternative to TradingView, is ProRealTime. Established in 2001, ProRealTime has been providing traders with advanced charting and trading tools for almost two decades. Catering to both novice and experienced traders, the platform offers a wide range of functionalities that can help you make informed trading decisions.

Comprehensive Charting Tools

ProRealTime boasts an impressive array of charting tools, with over 100 different indicators and drawing tools available. These tools can help you analyze market trends, identify potential entry and exit points, and develop your own trading strategies. Some of the key charting features include:

- Multiple chart types, such as candlesticks, Heikin-Ashi, and Renko charts

- Custom timeframes, allowing you to view charts in any time interval

- Flexible layout options, enabling you to create your own personalized workspace

- Comparative charting, which lets you overlay multiple instruments on a single chart

- Advanced drawing tools, including Fibonacci retracements, Gann lines, and trend channels

Automated Trading and Backtesting

One of the standout features of ProRealTime is its support for automated trading. The platform provides a built-in programming language called ProBuilder, which allows you to create custom trading algorithms and indicators. Additionally, you can use the ProBacktest module to test your strategies on historical data, helping you fine-tune your trading rules before deploying them in the live markets.

Integration with Leading Brokers

ProRealTime seamlessly integrates with several leading brokers, including Interactive Brokers and IG. This integration allows you to execute trades directly from the platform, without the need to switch between different applications. Furthermore, the platform provides real-time market data and Level 2 data, ensuring that you have access to the most up-to-date information when making your trading decisions.

Customizable Alerts and Notifications

To help you stay on top of market movements, ProRealTime offers a comprehensive alert system. You can set up custom alerts based on various criteria, such as price levels, technical indicators, and economic events. These alerts can be delivered via email, SMS, or directly within the platform, ensuring that you never miss a trading opportunity.

Community and Support

ProRealTime has a strong user community, with an active forum where traders can share ideas, strategies, and custom indicators. The platform also offers extensive educational resources, including video tutorials, webinars, and a comprehensive help center. Additionally, ProRealTime provides dedicated customer support via email, phone, and live chat, ensuring that you can get the assistance you need when you need it.

While ProRealTime might not be as well-known as TradingView, it offers a robust and feature-rich platform that can cater to the needs of both novice and experienced traders. With its advanced charting tools, automated trading capabilities, and seamless broker integration, ProRealTime is a worthy alternative for those looking to enhance their trading experience.

8. MotiveWave

MotiveWave is a powerful and user-friendly trading platform that offers a wide range of features to help traders make informed decisions. As a tradingview alternative, it provides a comprehensive suite of tools for technical analysis, strategy development, and trade management.

One of the key features of MotiveWave is its advanced charting capabilities. The platform offers over 250 built-in studies and indicators, as well as support for custom studies and indicators using Java SDK. This allows traders to create their own unique analysis tools and strategies, tailored to their specific needs. Some of the popular chart types available in MotiveWave include:

- Candlestick

- Bar

- Line

- Area

- Heikin-Ashi

- Renko

- Point and Figure

- Kagi

Another notable feature of MotiveWave is its extensive support for Elliott Wave analysis. Elliott Wave Theory is a popular method of technical analysis that involves identifying recurring price patterns and trends. MotiveWave offers a comprehensive suite of tools for identifying and analyzing these patterns, including automatic wave counting, manual wave labeling, and wave pattern recognition.

In addition to its advanced charting and analysis tools, MotiveWave also includes a strategy development and backtesting module. This allows traders to develop, test, and optimize trading strategies using historical data. The platform supports various order types, including market, limit, stop, and conditional orders, as well as advanced order management features such as OCO (one cancels other) and bracket orders.

MotiveWave also offers integrated trading with multiple brokers, allowing traders to execute trades directly from the platform. This can help streamline the trading process and improve efficiency. Some of the supported brokers include:

- Interactive Brokers

- OANDA

- TD Ameritrade

- FXCM

- Berkeley Futures

Furthermore, MotiveWave provides extensive customization options to suit individual trader preferences. Users can customize the appearance of charts, toolbars, and workspaces, as well as create custom layouts to optimize their workflow. The platform also supports multiple monitors, allowing traders to set up a more efficient trading environment.

One of the drawbacks of MotiveWave, however, is its pricing structure. The platform offers several different pricing tiers, with the most basic version starting at $24 for a month. More advanced features, such as Elliott Wave tools and strategy development, are available at higher pricing tiers, which can be a significant investment for some traders.

Despite its higher price point, MotiveWave’s comprehensive suite of tools and advanced features make it a compelling alternative to TradingView for traders seeking a more powerful and customizable trading platform. With its user-friendly interface and extensive support for technical analysis, strategy development, and trade management, MotiveWave can be a valuable asset for both novice and experienced traders alike.

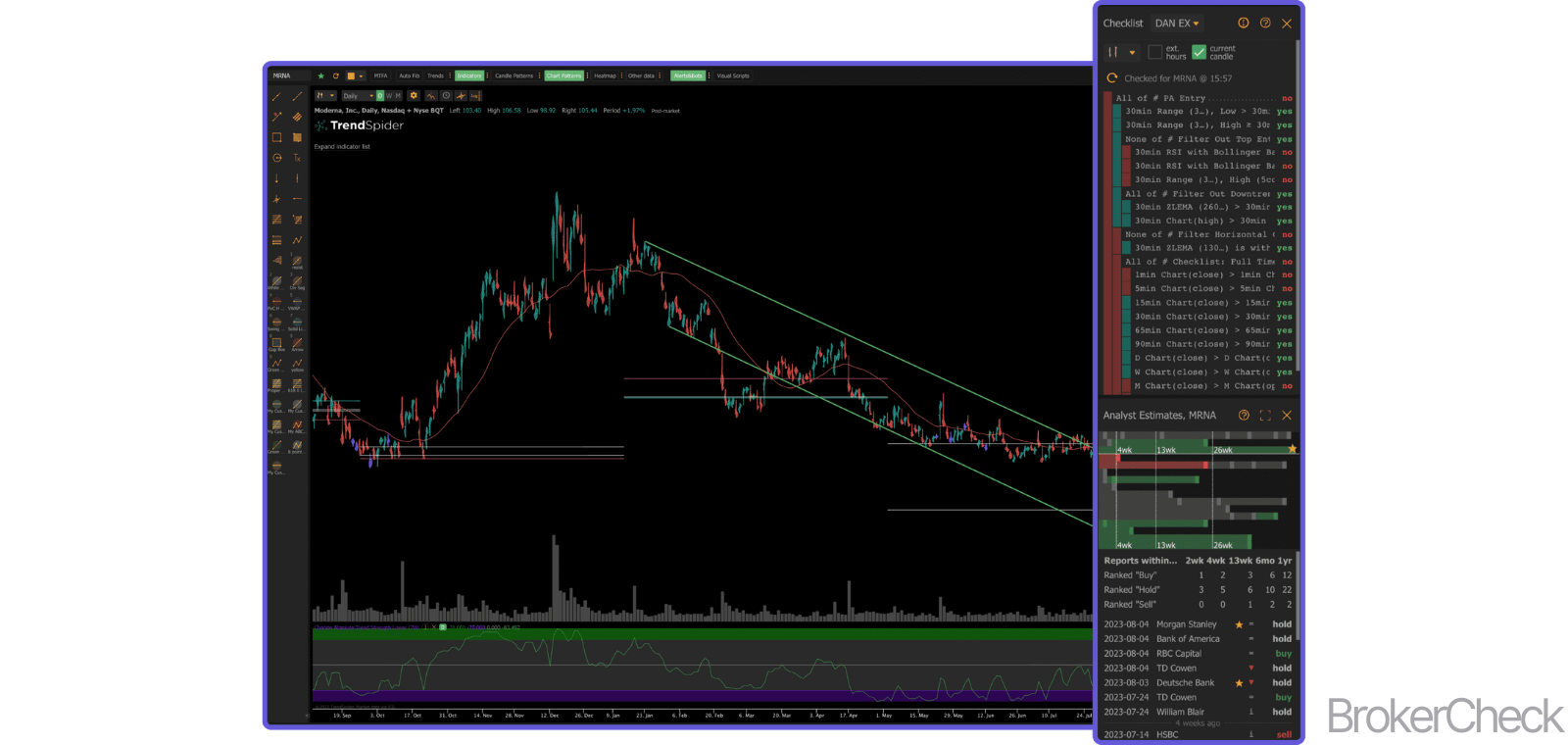

9. TrendSpider

As a trader, you might be on the lookout for a powerful and user-friendly alternative to TradingView. Look no further, as TrendSpider is an excellent choice that offers a wide range of features to help you make informed decisions in the world of trading.

Designed to automate the technical analysis process, TrendSpider is a platform that caters to both beginner and advanced traders. With its cutting-edge technology, it provides an array of tools and resources to enhance your trading experience. Some of the key features include:

- Automated Charting: TrendSpider automatically identifies and draws trendlines, support and resistance levels, Fibonacci retracements, and more on your charts. This saves you time and ensures that your analysis is consistent and accurate.

- Multi-Timeframe Analysis: With this feature, you can easily overlay multiple timeframes on a single chart, allowing you to spot trends and patterns that may not be visible on a single timeframe. This is particularly useful for traders who use multiple timeframes to make decisions.

- Dynamic Price Alerts: TrendSpider’s dynamic price alerts enable you to set alerts based on specific technical indicators, trendlines, or patterns. This way, you can stay informed about important market movements and act accordingly.

- Backtesting: Test your trading strategies with historical data to evaluate their effectiveness and refine them as needed. This feature allows you to gain insights into how your strategy would have performed in the past, helping you make better decisions moving forward.

- Market Scanner: Scan the market for stocks, ETFs, and cryptocurrencies that meet your specific criteria. This powerful tool helps you identify potential trading opportunities and stay ahead of the game.

In addition to these impressive features, TrendSpider offers a user-friendly interface that makes it easy for traders to navigate and customize their charts. The platform also supports over 150 technical indicators, giving you the flexibility to create a comprehensive and personalized analysis.

One of the standout aspects of TrendSpider is its commitment to continuous improvement. The team behind the platform is constantly working on updates and enhancements to ensure that users have access to the best tools and resources available. This dedication to innovation makes TrendSpider a top contender among trading platforms.

TrendSpider also offers a variety of educational resources to help traders improve their skills. From webinars and video tutorials to blog posts and a comprehensive knowledge base, users have access to a wealth of information that can help them become more successful traders.

When it comes to pricing, TrendSpider offers a single subscription plan. The plan is tailored for advanced traders and offers premium features like extended historical data, white-label chart sharing, and additional user accounts.

Overall, TrendSpider is a powerful and versatile trading platform that can greatly enhance your trading experience. With its automation capabilities, advanced features, and user-friendly interface, it is an excellent alternative to TradingView for traders of all levels.

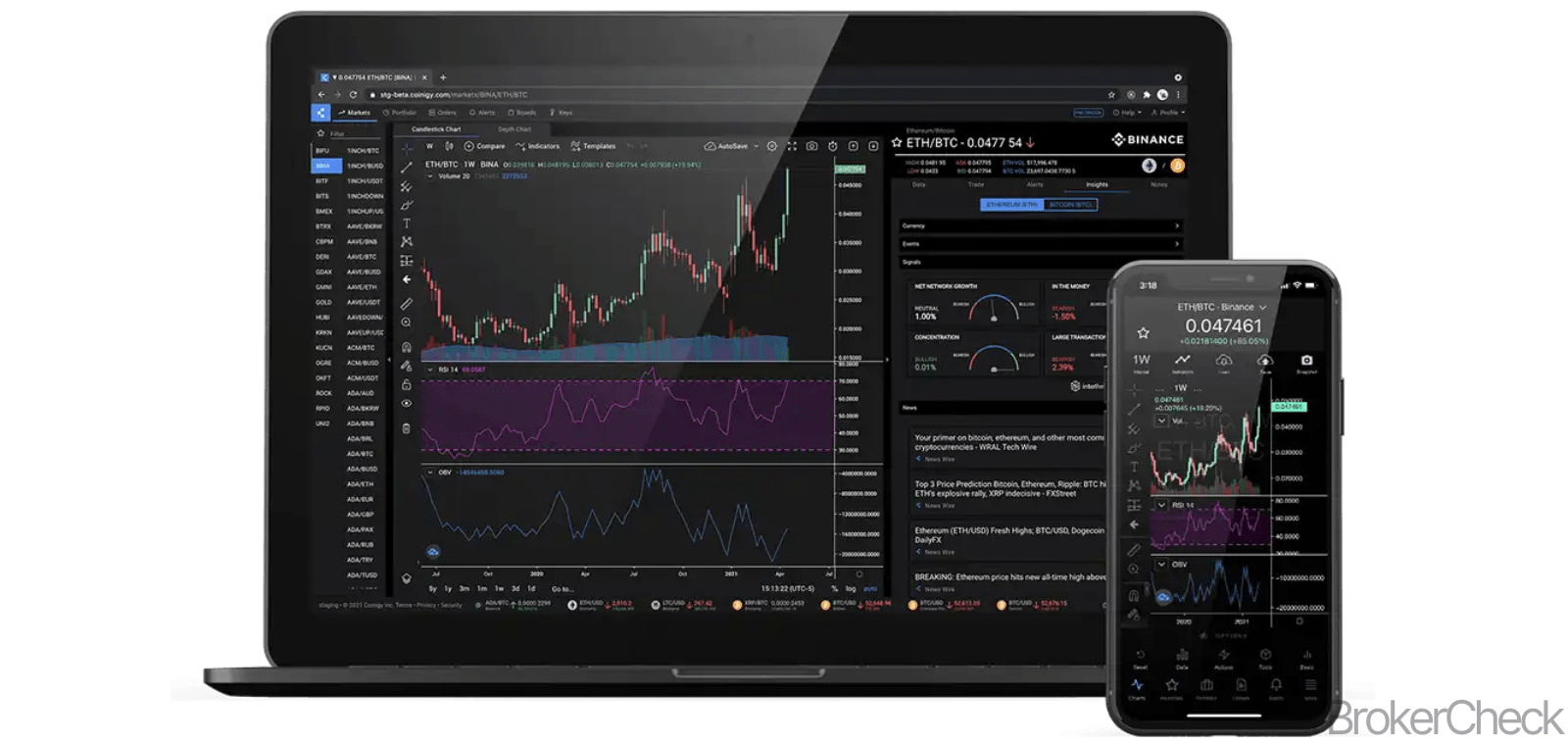

10. Coinigy

As a trading platform, Coinigy stands out for its extensive range of features, making it a viable alternative to TradingView for cryptocurrency traders and investors. With support for over 45 exchanges, Coinigy offers a comprehensive suite of tools and services that cater to different types of users, from beginners to advanced traders. This platform is designed to simplify the trading process and provide users with a seamless experience.

One of the key features of Coinigy is its unified trading interface. This allows users to manage their trades across multiple exchanges from a single platform. This is particularly useful for those who trade on multiple exchanges, as it eliminates the need to constantly switch between different platforms. Additionally, users can also view their portfolio balances and trade history in one place.

Coinigy’s charting tools are also noteworthy. The platform offers a wide range of technical indicators, drawing tools, and chart types to help users analyze market trends and make informed trading decisions. Coinigy’s charting tools also support custom scripts, allowing users to create their own indicators and strategies.

Another standout feature of Coinigy is its API integration. This allows users to connect their exchange accounts to the platform, enabling them to trade directly from Coinigy’s interface. This integration also allows for automated trading, as users can create custom trading bots using Coinigy’s API.

Security is a crucial aspect of any trading platform, and Coinigy takes this seriously. The platform employs advanced security measures to protect user data and funds, including two-factor authentication (2FA), SSL encryption, and regular security audits. Additionally, Coinigy does not store users’ funds on their platform, ensuring that users retain control over their assets.

Coinigy also offers a mobile app for both iOS and Android devices, enabling users to monitor their portfolio and execute trades on the go. The app includes many of the same features as the web-based platform, including charting tools, portfolio management, and price alerts.

For those who require assistance or have questions about the platform, Coinigy offers a comprehensive support system. This includes a help center with detailed articles and guides, as well as a responsive support team that can be reached via email or live chat.

In terms of pricing, Coinigy offers a free 7-day trial for users to test out the platform’s features. After the trial period, users can choose between two subscription plans: Pro Trader and API Developer Pro. The Pro Trader plan costs $18.66 per month and includes access to all of Coinigy’s features, while the API Developer Pro plan is designed for users who require advanced API access and costs $99.99 per month.

- Unified trading interface: Manage trades across multiple exchanges from a single platform.

- Charting tools: Access a wide range of technical indicators, drawing tools, and chart types.

- API integration: Connect exchange accounts to the platform and create custom trading bots.

- Advanced security measures: Protect user data and funds with 2FA, SSL encryption, and regular security audits.

- Mobile app: Monitor your portfolio and execute trades on the go.

- Comprehensive support system: Access a help center with detailed articles and guides, as well as a responsive support team.

- Free 30-day trial: Test out the platform’s features before committing to a subscription plan.

Overall, Coinigy is a versatile and feature-rich platform that offers a compelling alternative to TradingView for cryptocurrency traders and investors. With its unified trading interface, advanced charting tools, and robust security measures, Coinigy is well-equipped to meet the needs of users at all levels of expertise.

Closing Thoughts

As we reach the final section of this blog post, it’s essential to take a moment and reflect on the various aspects of tradingview alternatives that have been discussed throughout. This will enable readers to make informed decisions when selecting a suitable platform for their trading and investment needs.

First and foremost, it’s vital to consider the features and tools offered by each alternative. These platforms should provide a comprehensive suite of tools, such as charting capabilities, technical indicators, and fundamental analysis options. Some of the alternatives may also offer additional features like social trading or copy trading, which can be beneficial for novice traders seeking guidance from more experienced peers.

- Charting capabilities

- Technical indicators

- Fundamental analysis options

- Social trading

- Copy trading

Another critical factor to consider is the ease of use of the platform. A user-friendly interface can significantly enhance the trading experience, making it easier for traders to navigate the platform and execute trades efficiently. This is particularly important for beginners who may not be familiar with the intricacies of trading platforms.

Moreover, the cost structure of the tradingview alternative should be evaluated. This includes any subscription fees, commissions, and spreads that may be applicable. Traders must ensure that the platform they choose aligns with their budget and trading style, as excessive fees can erode profits over time.

- Subscription fees

- Commissions

- Spreads

Furthermore, the availability of educational resources is an essential aspect to consider. A platform that offers comprehensive educational materials, such as webinars, articles, and video tutorials, can help traders improve their skills and stay updated on market trends. This is especially beneficial for those who are new to trading or looking to expand their knowledge base.

In addition to the aforementioned factors, the customer support offered by the tradingview alternative is crucial. A responsive and knowledgeable support team can address any issues or concerns that may arise, ensuring a smooth and hassle-free trading experience. This can be particularly important during times of high market volatility when prompt assistance may be required.

Lastly, it’s essential to evaluate the reputation and credibility of the tradingview alternative. This can be done by researching online reviews, testimonials, and industry awards. A platform with a solid reputation will provide greater peace of mind and confidence in its services.

By carefully considering each of these factors, traders can make an informed decision when selecting a tradingview alternative that best suits their needs and preferences. This will ultimately contribute to a more successful and enjoyable trading experience, allowing individuals to achieve their financial goals.