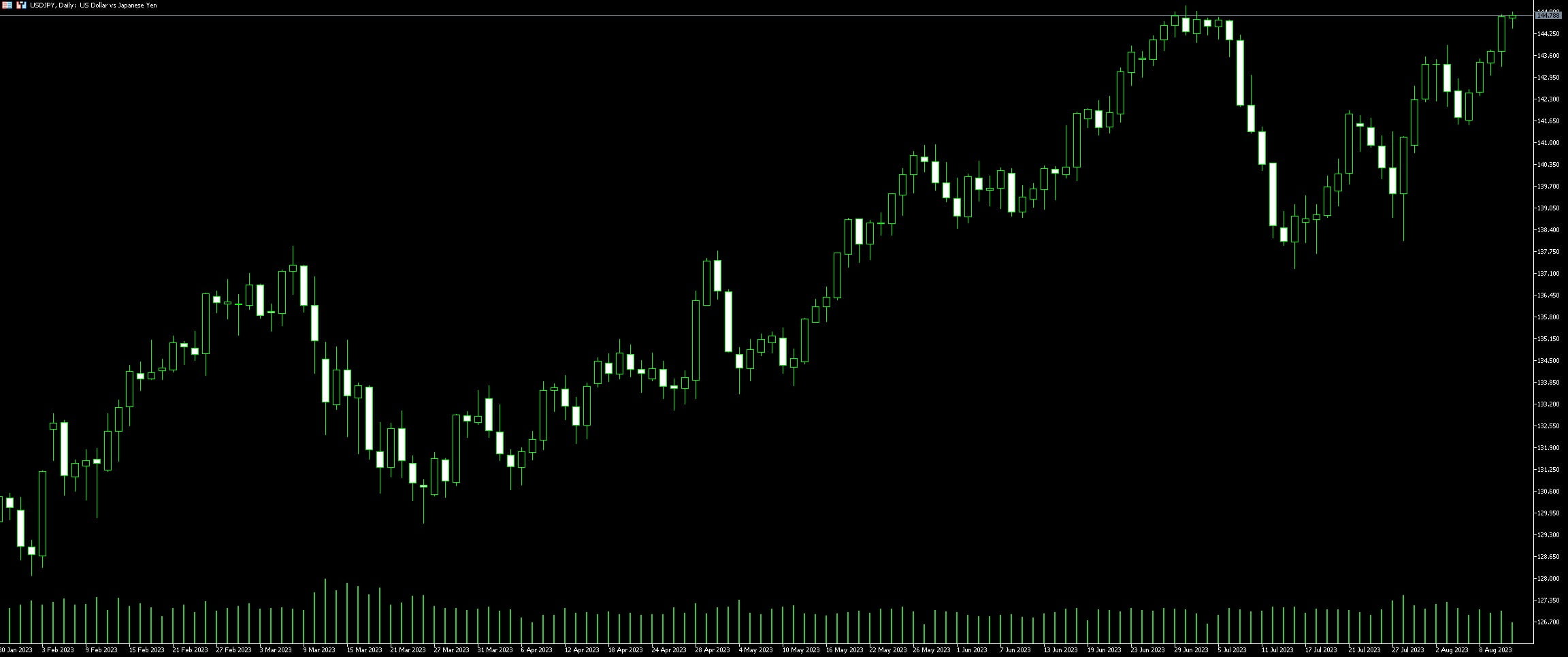

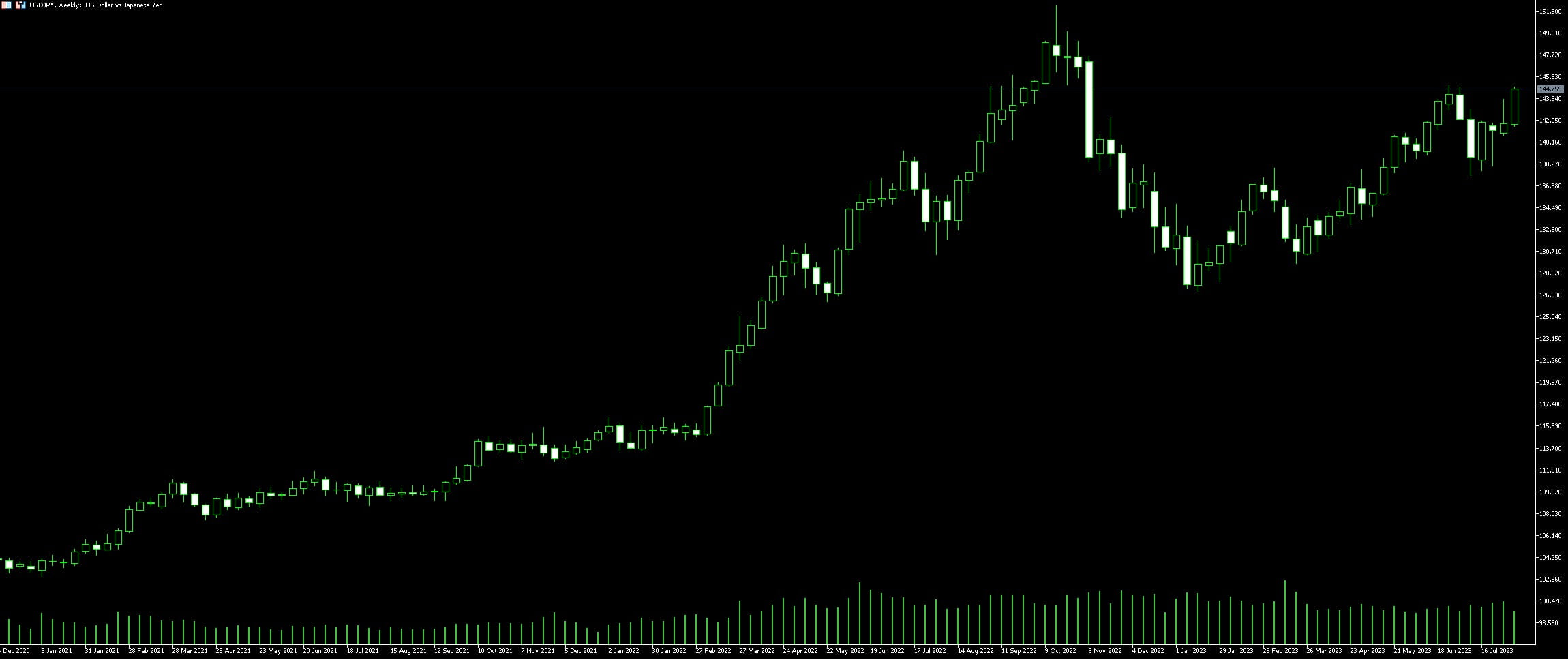

Live Chart Of USD/JPY

1. Understanding USD/JPY

Trading USD/JPY involves engaging with the largest and third largest national economies in the world – the United States and Japan. Knowing the fundamentals can greatly enhance trading strategies and yield significant profits.

USD/JPY is the currency pair that represents the exchange rate between the U.S. dollar (USD) and the Japanese yen (JPY). The rate shows how many yen are required to purchase one U.S. dollar. It’s essential to comprehend that currency pair trading involves buying one currency while simultaneously selling the other.

In the Forex market, this pair is among the most heavily traded, usually favoring more experienced traders due to its potential volatility. A striking characteristic of the USD/JPY pair is its sensitivity to swings in market sentiment. Usually, when market participants are more risk-averse, they tend to divert capital away from their riskier assets and into the safety of the U.S. dollar, providing the typical safe-haven flows.

To thoroughly grasp the nuance of trading USD/JPY, a trader must account for various economic indicators, including Gross Domestic Product (GDP), inflation rates, and the interest rates set by the Federal Reserve and the Central Bank of Japan. Additionally, geopolitical events can create opportunities to profit or, if not managed carefully, loss.

USD/JPY can provide a fascinating exploration and, potentially, profitable opportunities in Forex trading. Its dynamism and links to two economic powerhouses offer traders a broad range of opportunities. However, it’s essential to stay updated on the economic climates in both countries and worldwide events affecting market sentiment. For instance, the pair is known for its susceptibility to alter with shifts in broad market inclination shaped by geopolitical and economic news.

The art of trading does not depend purely on knowledge. Patience, discipline, risk management, and a sense of timing are all critical components. Therefore, a successful USD/JPY strategy must be comprehensive, capitalizing on technical analysis, understanding fundamental economic indicators, and considering market sentiment. For successful navigation of the Forex market, an in-depth comprehension of these aspects, along with a bulletproof trading plan, is crucial for any trader venturing into the USD/JPY currency pair.

1.1. Understanding the Pair: USD/JPY

USD/JPY, the currency pair that denotes how many Japanese yen—it’s possible to purchase with one US dollar, can be an appealing option for forex traders. Irrespective of the fact that this pair operates within the system of two of the world’s biggest economies, understanding its nuances couldn’t be more critical.

The USD/JPY exchange rate formulates a vital facet of the global forex market. One important characteristic to keep in mind with this pair is that, uniquely, Japan is an extensively export-based economy. Thus, Japanese corporations regularly exchange their yen for dollars—which can have an impact on this currency pair’s price.

Sensitivity to the wider market sentiment is another attribute of the USD/JPY pair. Factors like global political instability or shifts in commodity prices can cause significant movements in its price.

It’s also interesting to note that this pair has a tendency to correlate with US Treasury notes. Since Treasury notes are perceived as a safe haven in times of market uncertainty, any surge in their value often leads to a corresponding rise in the value of the yen, due to Japan’s considerable holdings of US debt.

Given these variables, strategic forex traders develop a sturdy comprehension of economic indicators and market conditions to predict probable shifts in the USD/JPY pair. Therefore, understanding in-depth about this pair is vital for traders while deciding whether to ‘buy’ or ‘sell’. So, currency trading fundamentally revolves around making informed decisions based on thorough comprehension and careful analysis of the pair’s behaviour.

2. Effective Trading Strategies

Trading different currencies require different strategies and this rings particularly true when trading the USD/JPY pair. This pair is heavily influenced by geopolitical developments and market sentiment. In order to effectively trade this pair, traders must employ a variety of strategies including technical analysis and fundamental analysis.

Technical analysis focuses on price patterns and market trends. Tools such as trend lines, support and resistance levels, Fibonacci retracements, and Bollinger Bands can be beneficial. Trend lines help identify the direction of the market, whether it’s an uptrend, downtrend, or sideways trend. Support and resistance levels indicate price levels where the market has historically shown some level of support or resistance. Traders define these levels to create straddle trades, breakout trades, or trades based on bounces.

Fundamental analysis on the other hand, considers economic data and geopolitical events. For example, changes in interest rates by the Federal Reserve or the Bank of Japan can greatly impact the USD/JPY pair. Global economic events and domestic economic indicators such as GDP, unemployment rates, and trade balances can all influence a currency’s value.

Understanding sentiment analysis is another key player when trading USD/JPY. Often times, the Japanese yen is seen as a safe haven currency, so in times of global economic uncertainty or instability, the yen tends to gain while the USD might weaken.

Embracing these strategies – technical analysis, fundamental analysis, and sentiment analysis – can help traders navigate the unique characteristics of the USD/JPY pair. Monitoring these factors and applying comprehensive strategies can lead to successful trades. Remember, every strategy takes time and practice to implement effectively.

2.1. Day Trading Strategy

In the world of Forex, day trading is a compelling strategy, particularly effective for trading pairs like USD/JPY. Day trading can offer handsome profits if decisions are well-informed and calculated. Understanding the market forms the bedrock of this strategy; traders need to keenly follow global news, looking for triggers that can influence currency exchange rates. Economic data reports, political events and financial news can all significantly sway USD/JPY rates.

When planning a day trading strategy for USD/JPY, consider the timeframe. A typical day trade lasts less than one day to cash on swift market fluctuations. Choose a timeframe that reflects your comfort level. Fast-paced momentum traders, for example, might go for five-minute charts, while trend traders may opt for hourly, four-hourly, or daily charts.

Technical analysis is a pivotal component of a well-rounded day trading strategy. It highlights price patterns, providing entry and exit points to optimize profitability. Tools like candlestick patterns, support and resistance levels, and technical indicators such as Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) can bolster decision-making.

Finally, maintaining a balanced risk-reward ratio and strict stop-loss orders – automated orders that close trading positions when the price hits a specified level – shields from excessive losses. This ensures a trader continues to trade another day, even if things turn sour.

It’s worth noting that while this approach can be profitable, its fast pace and potential for significant losses can make it unsuitable for everyone. As such, tirelessly working on a robust, personalized day trading strategy is key for operational resilience and sustained success.

2.2. Swing Trading Strategy

Swing trading operates under the premise that fluctuations in financial markets are cyclic, and namely, that these cycles are predictable. Although shorter on the timeline than long-term investment strategies, a swing trading strategy still requires a degree of patience, discipline, and sound analytics. The USD/JPY currency pair, with its increased liquidity and low spread, is a favourable field for implementing a swing trading strategy.

Utilizing multiple analytical tools to detect trends in price movement is critical in this trading approach. Tools like Fibonacci Retracement and Moving Average Convergence Divergence (MACD) serve to identify possible entry and exit points, resulting in optimized trading opportunities. A glance at a long term USD/JPY chart reveals cyclic trends which swing traders take advantage of.

By placing a buy order at a low point in the trend and a sell order at a high point, traders aim to maximize profit and minimize loss. However, the significant characteristic of a swing trading strategy is knowing when to exit the market. Without pre-emptive measures in place, one can easily be taken by a swift market swing in the opposite direction.

Developing a risk management plan is a critical part of any swing trading strategy. Establishing a ‘stop loss’ and ‘take profit’ margins helps to limit potential losses and protect profits. Combining these strategies will ensure a robust swing trading strategy for USD/JPY.

Utilizing the market fundamentals alongside technical analysis enables traders to predict possible trend swings. Economic indicators such as Gross Domestic Product (GDP) figures, interest rates, and political events significantly impact the USD/JPY pair. Awareness of upcoming economic events can prove advantageous, helping to predict possible market movements. The inclusion of these principles in your swing trading strategy will bolster potential profits and protect against untimely losses.

3. Enhancing Trading Skills

Implementing a successful trading strategy is vital when it comes to trading USD/JPY. A comprehensive understanding of the market, coupled with an analytical approach significantly enhances trading skills. Key indicators to watch include GDP numbers, interest rate decisions, and employment statistics. This data, available in the economic calendar, aids in forecasting potential movements in the pair.

Analysing past performance also helps to predict future trends. Historical charts provide indispensable insight to seasoned traders, allowing a glimpse into the pair’s behavior under various economic conditions. Developing the ability to interpret these charts presents an advantageous leap in the trading journey.

Furthermore, leveraging the use of technical analysis tools, such as market sentiment, moving averages, and oscillators, sharpens trading instincts. These instruments assist in pinpointing potential entry and exit points, effectively steering trading decisions.

It is also prudent to tap into the knowledge of more experienced traders. Discussion forums and social trading platforms are excellent venues for acquiring wisdom from those who have honed their skills over time. The experiences shared here serve as supplementary education, enriching novice traders with first-hand knowledge.

Lastly, constant practice cements these skills and strategies. Most brokers offer demo accounts that simulate real trading conditions, providing an ideal environment for practice without risking actual capital. Through consistent practice, traders develop a robust strategy, attaining proficiency in negotiating the caprices of the USD/JPY market.

3.1. Practice Through Demo Accounts

Experience the trading dynamics of USD/JPY by immersing yourself in a simulated trading environment. Demo trading accounts offer a platform where first-time traders can hone their skills, develop a strategy, and familiarize themselves with market fluctuations—all without risking real capital.

Bear in mind the characteristics of USD/JPY pair trading. Make your move during the Asian market hours, when it tends to be most volatile. Being one of the most traded currency pairs in the Forex market, a demo account presents an exceptional opportunity to understand how the USD/JPY pair reacts to economic news coming from the world’s largest economies, amongst other factors.

Market analysis techniques are crucial skills that every trader should grasp. Demo accounts invite you to discover and master both fundamental and technical analysis techniques. Fundamental analysis priori addresses factors like economic data releases and political events, while technical analysis is all about studying past market patterns to foreshadow future price behaviour.

The power to action trades using virtual money in real-time market conditions is especially beneficial for understanding leverage and other forex-specific concepts. Leverage pertains to a loan provided by the broker to the trader, enabling you to open positions that are larger than the capital in your account. Responsible use of leverage is key as it can amplify both profits and losses.

Make a note that patience and consistency are significant when trading USD/JPY even in a demo setting. The objective is not to rush and make profits, but to develop a trading rhythm and strategy that consistently yield results.

3.2. Keeping Abreast of Market News

In the realm of currency pair trading, a keen awareness of market news bears immense importance. Particularly, while dealing with a highly active pair like USD/JPY, both USD (United States Dollar) and JPY (Japanese Yen) relate deeply to their respective countries’ economic events. The performance of these economies often directly influences the pair’s price fluctuations.

Trading the USD/JPY demonstrates something like reading a tale of two cities. Traders have to consistently monitor the economic pulse of two of the world’s major economies—the United States and Japan. Release of major data such as employment statistics, inflation figures, gross domestic product (GDP), or central bank’s interest rate decision could instigate significant movements in the USD/JPY exchange rate. Each of these data forms an integral part of the market news, requiring traders’ attention.

Staying ahead with real-time news updates provides traders with advantageous cues. Trends, sudden reversals, or breaks in patterns become easily understandable with this cognizance. It’s like keeping an ear to the ground in the vast landscape of Forex trading.

Apart from this, the political climate also adds to the market news playing a decisive role in the USD/JPY trading. Elections, political unrest, policy changes, or unexpected political events might cause volatility in the exchange rate. Therefore, keeping abreast becomes an essential habit for traders desiring a successful career in trading the USD/JPY.

Additionally, global crises or events triggering risk-off sentiments may lead traders to invest in safe-haven currencies like the Japanese Yen. During these times, being well-aware of market news aids in making timely decisions, thus maximizing the probability of potential gains in USD/JPY trading.

In a nutshell, whether a participant on Wall Street or an average retail trader, understanding, analyzing, and deploying market news in USD/JPY trading is not just preferred but paramount, shaping trading strategies and decisions.

4. Mastering Advanced Concepts

Entering the arena of USD/JPY trading requires a strong understanding of advanced concepts. While technical analysis and fundamental analysis lay the groundwork, the application of advanced theories affords the trader an edge in this highly competitive market.

Intermarket Analysis is exceedingly helpful when dealing with currency pairs like USD/JPY. The ripple effects of shifts between different sectors such as bonds, commodities and equities can influence currency value. For instance, changes in the U.S. bond yields routinely sway USD/JPY’s direction.

Another powerful weapon in a trader’s arsenal is the understanding of Economic Indicators. Both Japan and USA’s policies can significantly influence the currency pair. An attentive eye to employment rate, GDP, interest rates, and other economic indicators helps to predict trends and movements.

Geopolitical Events also wield substantial power over the USD/JPY pair. The impact of a political event is often immediate and drastic. Trade wars, territorial disputes or political transitions, these events can sometimes cause sharp fluctuations in the currency market.

Lastly, the key to successful trading is the Psychology of Trading. It is critical to maintain an objective standpoint, managing emotions to make sound trading decisions. A clear head is a trade’s best friend, providing calm amidst market turmoil.

Each advanced concept is a tool, that when applied smartly, aids in predicting the USD/JPY pair’s movement. The mastery of these theories optimise a trader’s operations, paving the way to success.

4.1. Understanding Volatility in USD/JPY

In the frenetic world of forex trading, one pair has a reputation for being particularly unpredictable: USD/JPY. The pairing of the United States Dollar and Japanese Yen is known for its volatility, owing largely to the economic dynamics of the two nations. As the world’s first and third largest economies, fluctuations in this pair can be driven by a wide variety of factors.

Volatility refers to the degree of variation in a financial instrument’s trading price. High levels indicate that prices can change drastically in a very short time span, potentially representing a great opportunity for forex traders. However, greater volatility also means higher risk. The USD/JPY pair exhibits an intriguing characteristic where its volatility varies depending on the time of day.

Akin to other forex pairs, USD/JPY trading is most volatile during the crossover of the Asian and London sessions. This is the period when both the economies come together in the trading world leading to rapid price movements. In contrast, the pair tends to stabilise during the Asian session due to Japan’s status as a major hub for forex trading system.

Moreover, USD/JPY’s volatility is influenced by key economic data releases such as interest rates, unemployment, and GDP figures from both Japan and the US. Understanding this relationship between economic data and volatility is crucial for every trader looking to venture into trading this pair.

One peculiar trait about USD/JPY is its sensitivity to global geopolitical events, which can increase volatility. For instance, the pair is often seen as a “safe-haven” during times of global economic uncertainty, which means it might attract greater trading interest and hence, volatility.

Almost paradoxically, these factors that make USD/JPY a highly volatile pair also provide unique trading opportunities. An adept forex trader, armed with thorough research, the right tools, and a good understanding of these variables, can harness these price swings to their benefit.

4.2. High Frequency Trading (HFT)

When delving deeper into the nuances of trading USD/JPY, the concept of High Frequency Trading (HFT) becomes paramount. HFT employs advanced algorithms and computing power to trade quickly, often involving numerous trades in fractions of a second. Typically, these trades aim to capture minimal gains but occur at such high volumes that they can lead to substantial profit overall.

For the execution of HFT strategies, traders also rely on data centres situated as geographically close to their exchanges as possible. This cuts down on lag time and permits faster trading. For example, a USD/JPY trader might utilise HFT strategies to exploit temporary discrepancies in the pair’s value between exchanges, executing trades in near-real time.

Another aspect of HFT in USD/JPY trading involves the use of predictive algorithms. These algorithms intelligently analyse historical and real-time market data, predicting currency pair value fluctuations before they occur. Traders implementing HFT with predictive algorithms seize upon these opportunities, rapidly buying or selling the USD/JPY pair for incremental gains that can accumulate over time.

Despite these advantages, it’s noteworthy that HFT is not a risk-free trading strategy. HFT can lead to flash crashes—abrupt, steep declines in currency values due to intense selling activity. This could be particularly pertinent while trading volatile currency pairs like USD/JPY. Traders must, therefore, utilise risk management tools and strategies, including stop-loss orders and limit orders, to safeguard against potential losses during rapid market shifts.