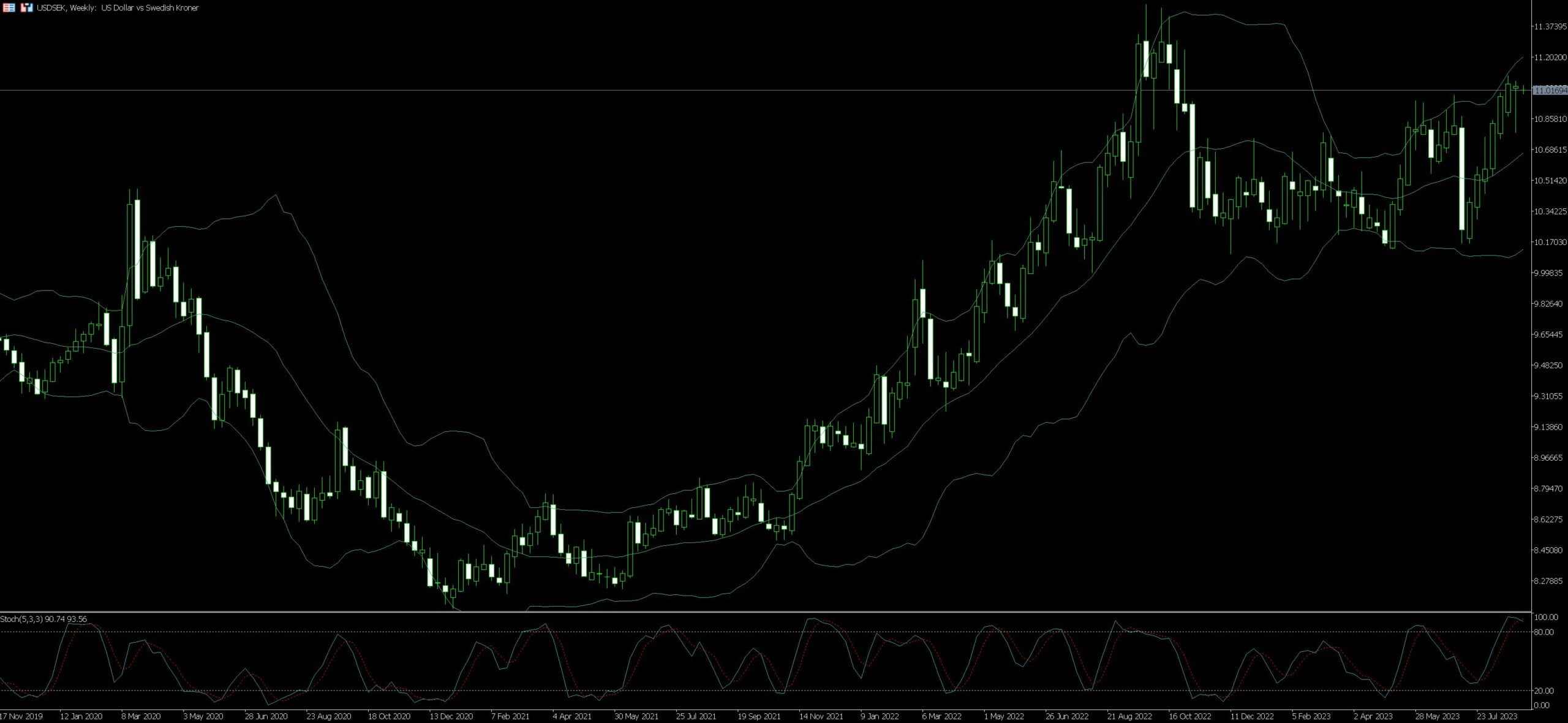

Live Chart Of USD/SEK

1. Understanding USD/SEK Forex Trading

Trading the USD/SEK pair in the forex market requires a profound understanding of both the United States and Swedish economies. Macro-economic factors and monetary policies from both countries play critical roles in shaping the USD/SEK exchange rate.

One key consideration when trading USD/SEK pair is the stability of the US dollar. As the world’s primary reserve currency, the dollar’s strength or weakness can have a considerable impact on the USD/SEK rate. In periods of economic uncertainty, traders often flock to safe-haven currencies like the USD, which tends to increase its value.

Simultaneously, understanding the Swedish economy’s nuances is equally crucial. Sweden, being an export-driven economy, is heavily dependent on the global trade cycle. Hence, global economic slowdowns may devalue the SEK and vice versa. Interest rate decisions made by Sweden’s central bank, the Riksbank, can also dramatically influence SEK value.

Integrating a deep understanding of these factors with technical analysis enables a more informed trading decision. It’s also critical to note the pair’s volatility. USD/SEK can see significant price fluctuations, providing both opportunities for profit and potential risks of substantial losses.

Tackling these risks requires a well-crafted risk management strategy. Position sizing, setting appropriate stop and limit levels, and maintaining an adequate margin can help protect your investment.

1.1. Definition and Fundamentals

Creating an effective trading strategy for USD/SEK calls for a comprehensive understanding of these elements. This includes assessing economic indicators, recognizing market trends, and interpreting Forex charts to anticipate future price movements. This detailed analysis forms the backbone of successful USD/SEK trading. Leverage is another fundamental concept in forex trading, allowing you to initiate bigger trades than your original investment. However, while it can magnify gains, it can also amplify losses. Therefore, prudent management of leverage forms a critical part of USD/SEK trading.

1.2. Timing and Market Hours

Hence, striking an optimal balance in the timing of trades, aligned with the understanding of both Scandinavian and American market hours, could be a key step towards enhancing profitability in USD/SEK trading.

To succeed in USD/SEK trading, you need to consider timing and market hours. The Forex market operates 24 hours a day from Monday to Friday, starting in Sydney, then moving to Tokyo, London, and ending in New York.

For USD/SEK, keep in mind that the Stockholm Stock Exchange (OMX Stockholm) is active from 9:00 AM to 5:30 PM local time. This is when you may see higher volatility due to economic news related to Sweden.

Also, monitor the New York Stock Exchange (NYSE), open from 9:30 AM to 4:00 PM Eastern Time. Important U.S. economic events can impact the USD, affecting the USD/SEK pair during NYSE hours.

Balancing your trades to align with both Scandinavian and American market hours can help boost profitability in USD/SEK trading.

1.3. Volatility and Risk Management

The trading of USD/SEK often involves high degrees of volatility due to economic, political, and market factors. These ever-changing conditions can result in significant fluctuations in currency pair values. Trading in hyperactive market conditions requires a solid understanding of volatility and how it impacts forex trading.

Strategically navigating these high-risk conditions requires complex risk management strategies. Traders often employ stop-loss orders to limit potential losses. By setting a predetermined selling point, traders can exit the trade if the market moves against them, thereby controlling the amount they’re willing to lose on a trade.

To tackle volatility head-on, traders commonly use set limits to automate trades at specified price points. This strategy, known as limit orders, allows traders to set a desired price for buying or selling a currency pair. The trade will only execute when these specified conditions are met, providing a level of control even in the most volatile markets.

Additionally, the use of hedging strategies can prove beneficial. It involves making trades that offset each other to minimise potential losses. For instance, you could open a long position on USD/SEK while simultaneously opening a short position on another pair that’s correlated with it, to reduce the total potential risk.

Automated trading systems can track larger volumes of markets than a human, and can respond instantaneously to changing market conditions, often making them a handy tool for navigating volatile, high-risk market conditions.

Being able to accept losses is a necessary part of trading USD/SEK. No trading strategy is successful 100% of the time, and even the best traders experience losses. The key to profitability over the long term is to minimize losses when they occur, maximise gains when they are available, and to keep learning and adapting to the ever-changing forex market.

2. Strategies for Successful USD/SEK Forex Trading

Trading USD/SEK can be both rewarding and risky, but you can improve your chances of success by following these steps:

- Understand the Market: Start by gaining a deep understanding of the foreign exchange (FX) market. This market involves trading currencies from different countries. For USD/SEK trading, focus on economic conditions and policies in the USA and Sweden. Pay attention to factors like inflation rates, GDP growth, interest rates, and employment numbers. Changes in these indicators can impact the USD/SEK exchange rate. Use both fundamental analysis (economic data) and technical analysis (charts and patterns) to make informed decisions.

- Create a Trading Plan: To succeed, you need a trading plan. This plan should outline your objectives, how much risk you’re willing to take, your trading strategy, and criteria for evaluating your performance. A well-thought-out plan helps you maintain discipline and avoid impulsive decisions driven by fear or greed.

- Choose a Reliable Trading Platform: Your trading platform is the interface between you and the market. Look for a platform that offers real-time charts, quick order execution, economic news updates, and analytical tools. A good platform enhances your trading experience, so avoid ones that slow you down or lack essential features.

- Keep Learning: Forex trading, including USD/SEK trading, requires ongoing learning. Take advantage of educational resources such as webinars, workshops, and trusted trading blogs. Continually improving your knowledge and skills will make you a better trader.

- Think Long-Term: Approach USD/SEK trading with a long-term perspective. Success in trading often comes from consistent and well-thought-out strategies. Don’t expect to get rich quickly; instead, focus on steady, recurring success.

2.1. Technical Analysis

- What is Technical Analysis?: Technical analysis is a way to make informed trading decisions for the USD/SEK currency pair. It’s based on historical data and statistical trends, helping traders understand how the pair has performed in the past and predict its future movements.

- Tools Used: Traders use charting tools and indicators to analyze the currency pair. These tools turn numbers into visual charts, such as lines, bars, or candlesticks. They reveal patterns that suggest when to buy or sell. Common tools include Bollinger Bands (showing price volatility) and Relative Strength Index (identifying overbought or oversold conditions).

- Holistic Approach: Successful trading doesn’t rely on just one indicator. Technical analysis combines different tools to zoom out from the details and analyze overall trends. This helps create a flexible trading strategy. Traders look for trends like uptrends, downtrends, or when the market is moving in a range. These trends help in deciding when to enter or exit a trade.

- Chart Patterns: Traders also pay attention to chart patterns like Double Tops and Head and Shoulders. These patterns can indicate potential market reversals. Recognizing the significance of resistance (a level prices struggle to go above) and support (a level prices tend not to fall below) is also important. These levels help traders make informed decisions.

- Structured Approach: Technical analysis provides a structured approach in the often unpredictable currency markets. By mastering this technique, traders can make well-thought-out trading decisions.

2.2. Fundamental Analysis

In trading USD/SEK (US Dollar to Swedish Krona), Fundamental Analysis is a vital concept that helps traders make informed decisions. Here’s a simplified explanation:

- Fundamental Analysis: This is a way of studying the fundamental factors that influence the value of a currency pair, like USD/SEK.

- Economic Indicators: Traders focus on various economic indicators, which are essentially statistics that tell us how well an economy is doing. These include things like economic growth rates, inflation levels, interest rates, and other big-picture economic figures.

- Impact on Currency Values: These economic indicators directly affect the value of a currency. Think of them as the “fundamentals” of a currency’s strength or weakness.

- Interest Rates: When the central bank of a country raises its interest rates, it makes that country’s currency more appealing to investors. So, if the Swedish central bank raises interest rates, the Swedish Krona (SEK) may become more attractive, leading to its increased value against the US Dollar (USD).

- Inflation: If the United States experiences higher inflation than Sweden, it means the US Dollar’s purchasing power is decreasing compared to the Swedish Krona. This can lead to a weaker exchange rate for USD/SEK.

- Political and Economic Health: The political stability and overall economic condition of both countries can also impact the USD/SEK exchange rate. Political turmoil or economic instability can create uncertainty and potentially cause a country’s currency to lose value.

2.3. Trading Psychology

Trading USD/SEK successfully isn’t just about knowing market trends and economic data; it also involves handling your emotions wisely. Emotions like fear and greed can cause impulsive actions that lead to losses. Here’s a simpler breakdown:

Emotional Control: Traders must learn to control their emotions, especially fear and greed. Fear can make you sell too quickly, missing potential profits, while greed can make you hold onto an investment too long, even when it’s time to sell.

Practice and Experience: To manage emotions, practice is crucial. Beginners can use paper trading, where they trade with fake money in a simulated market. This helps gain experience without real financial risk.

Discipline: Successful traders stick to their plans, even when the market is unpredictable. They set predetermined levels to stop losses and take profits and don’t deviate from them, despite any pressures.

Self-Reflection: Regularly reviewing past trades helps identify patterns and habits. This lets traders repeat successful strategies and avoid previous mistakes.

Stress Management: Trading can be very stressful. Techniques like meditation, exercise, and a healthy diet can help manage stress, preventing it from affecting trading decisions.

Continuous Learning: Developing good trading psychology is an ongoing process. It evolves with every trade, both wins and losses. While it can be challenging, mastering it can lead to better decisions and more profits.

In short, controlling emotions, sticking to a plan, and managing stress are crucial for success in USD/SEK trading. Practice, reflection, and ongoing learning are key to improving your trading psychology over time.

2.4. Selecting a Forex Broker

Embarking on the journey of Forex trading is an exciting venture where you delve into the intricate dynamics of the ever-evolving global marketplace. An initial decision that carries significant weight in this journey is the choice of a Forex broker. The right broker should not merely facilitate transactions but also offer valuable market analysis, comprehensive educational resources, and dependable customer support.

Prioritize selecting a Forex broker with a deep understanding of the intricacies of the USD/SEK currency pair. This is essential because traders benefit immensely from collaborating with a broker who possesses profound insights and experience concerning these currencies, enabling them to provide valuable guidance.

Additionally, consider the reputation of the broker. In today’s market, numerous emerging brokers are vying for attention. Hence, it is crucial to partner with a reputable broker that complies with regulatory standards. This serves as a robust safeguard against financial fraud, which often tempts traders with promises of high profits and minimal risks. Investigating the broker’s past performance and reading customer reviews can be highly advantageous in this regard.

The significance of dedicated and reliable customer support cannot be overstated. Whether you encounter a technical issue, require assistance with transactions, or need guidance during volatile market phases, a broker’s prompt response and effective resolution can be the difference between success and failure.

The trading platform provided by the broker for trading the USD/SEK pair should be user-friendly, equipped with advanced tools, secure, and compatible with various devices. This ensures uninterrupted trading, even when you’re on the move, giving you an edge to react swiftly to market changes.

Educational resources offered by brokers serve as valuable aids for both novice and experienced traders. Regular seminars, webinars, eBooks, and industry reports can help sharpen the skills needed to trade the USD/SEK pair successfully.

However, it’s important to evaluate the fees and commissions charged by the broker. Understanding the fee structure and comparing it with other brokers will enable you to predict potential earnings and assess the costs associated with trading with a particular broker.

In summary, the choice of a broker is a pivotal decision for successful trading in the USD/SEK currency pair. It sets the foundation for what could potentially become one of the most thrilling and profitable endeavors in your trading career.