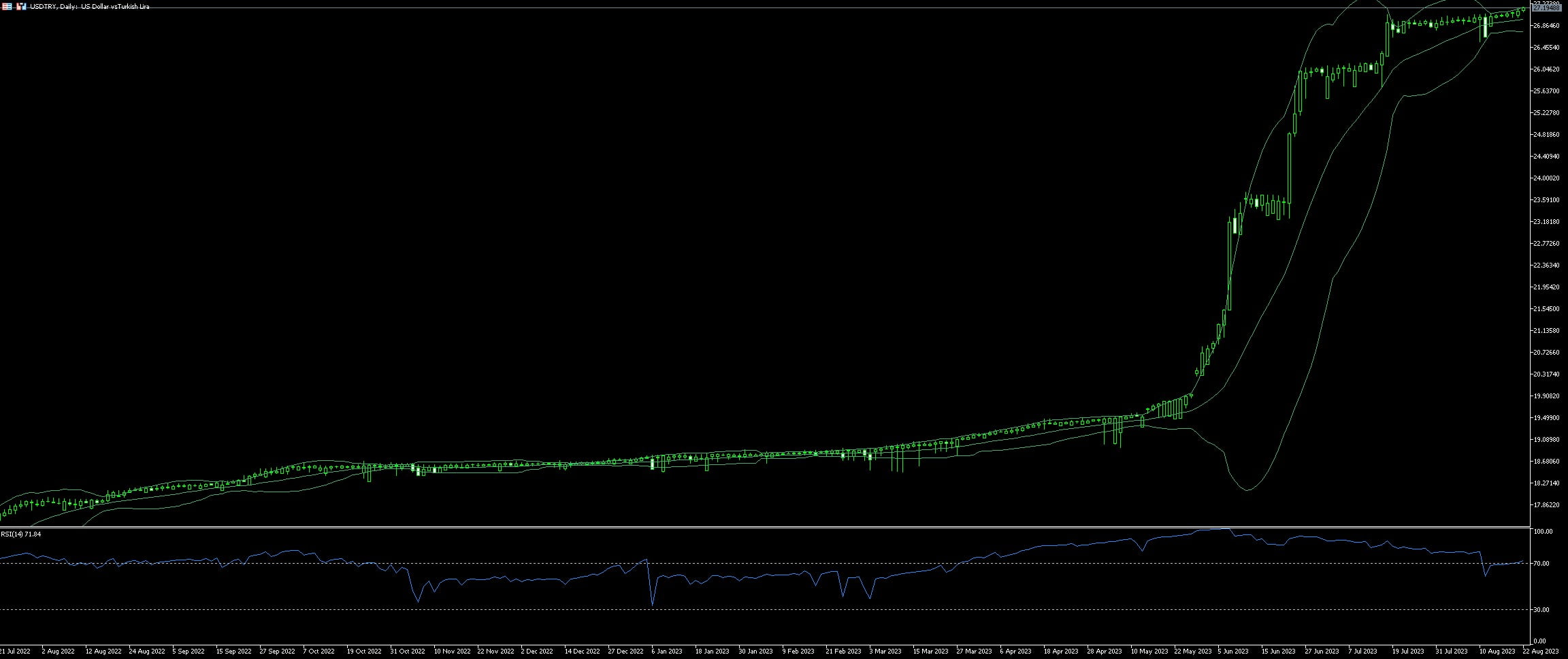

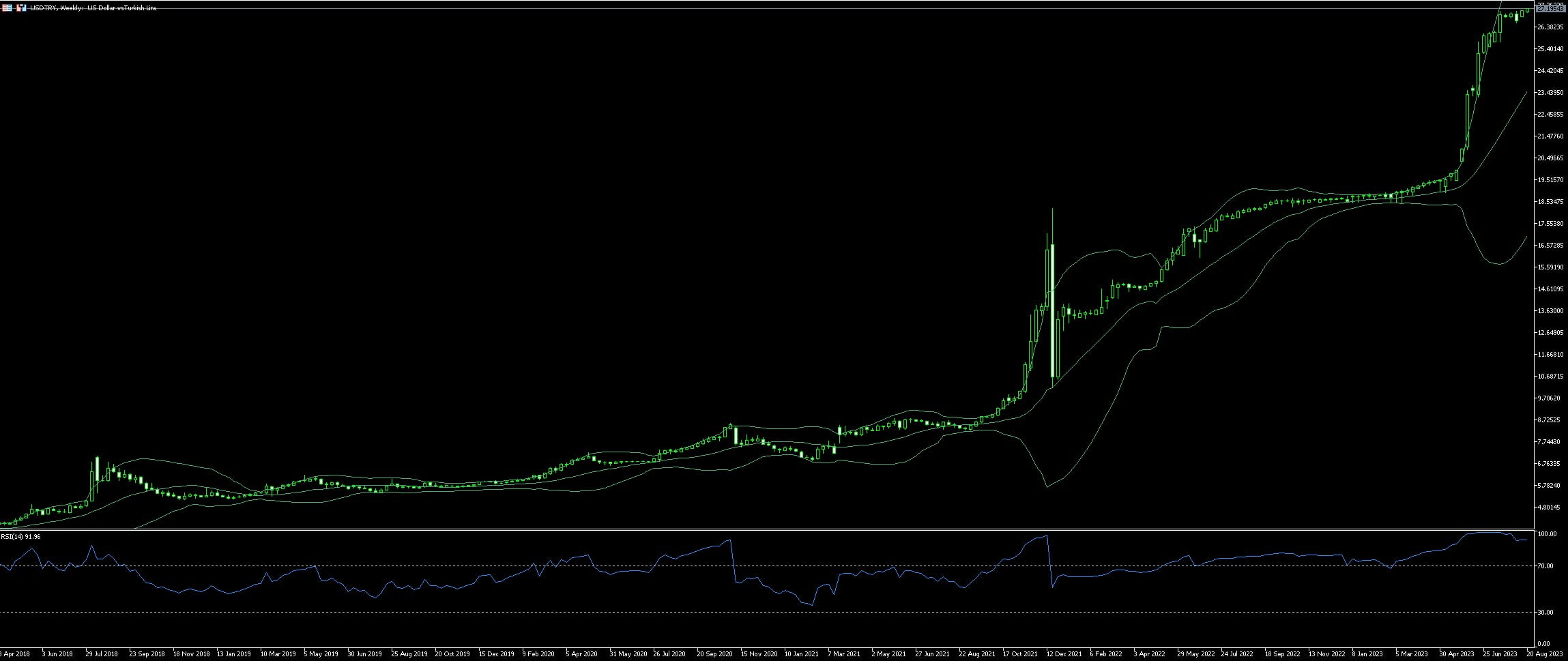

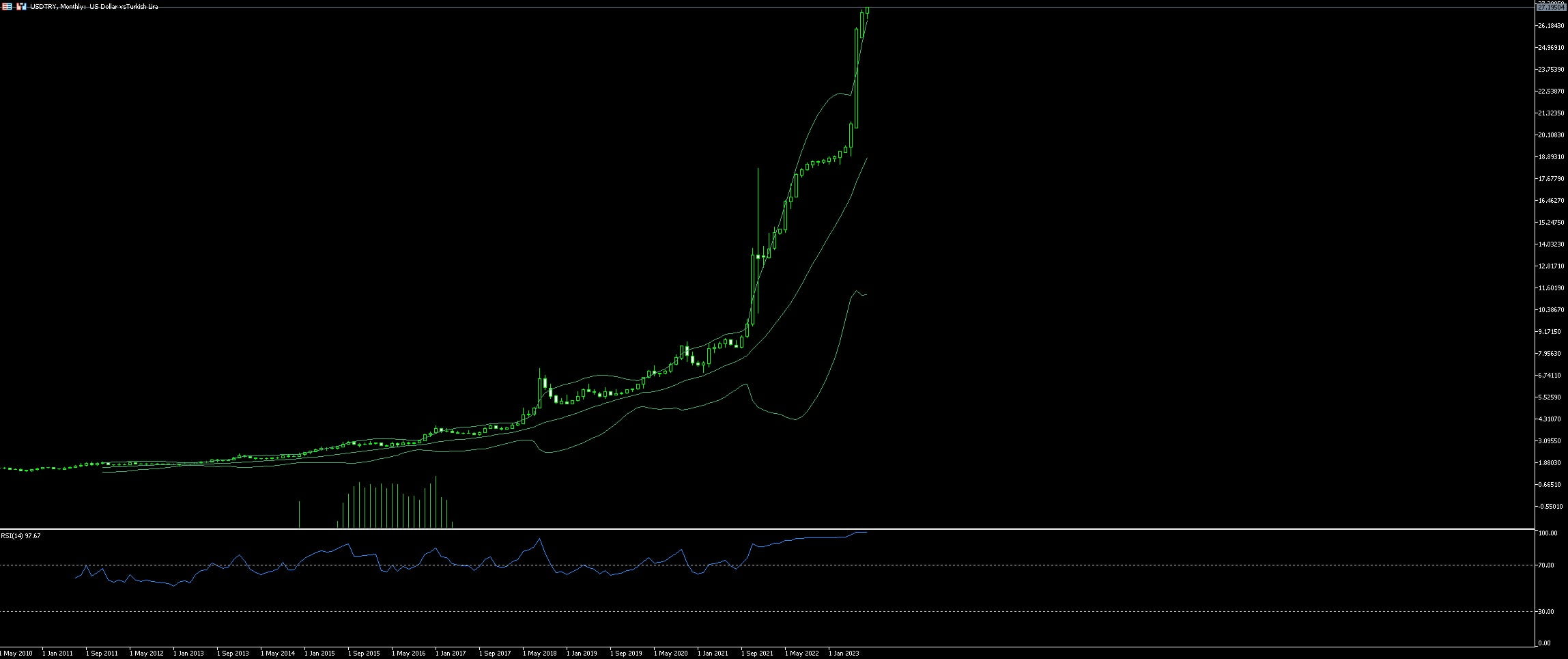

Live Chart Of USD/TRY

1. Understanding USD/TRY Trading Basics

The USD/TRY currency pair depicts the ratio between the US Dollar and the Turkish Lira, being referred to as how many lira are needed to purchase one dollar. Forex market participants often use this pair to speculate on the economic developments in both the United States and Turkey. It’s crucial for the trader to monitor economic indicator announcements such as interest rate changes, inflation rates, and political events that affect the value of both currencies.

Analyzing market trends, historical data charts, and executing sound risk management strategies plays a significant role in successful USD/TRY trading. The influence of other regional currencies, especially the Euro, should also be kept under scrupulous observation as it affects the volatility of this pair.

A common strategy used by traders, known as ‘day trading’, involves buying or selling the USD/TRY pair within a single trading day to profit from small price fluctuations. Patient traders might opt for a ‘swing trading’ approach, holding positions for several days or weeks, anticipating larger market moves.

Forex trading in general, and especially USD/TRY, can offer potentially high rewards but also carries a significant risk of loss. So, it’s strongly advised to utilize a proper understanding of leverage and margin requirements, stop-loss orders, and to never invest more than what can be affording to lose. By practicing disciplined trading and making educated decisions, traders can take advantage of the opportunities offered by the USD/TRY pair.

This currency pair experiences considerable volatility because the economies of the US and Turkey often respond differently to global economic events. Turkey is an emerging market economy and, thus, faces more economic instability than the mature US market. This increased volatility makes USD/TRY a potentially more profitable pair to trade, but it also significantly raises the risk level.

It’s crucial to remember that successful USD/TRY trading usually combines technical analysis, market research, and a deep understanding of the economic factors affecting both countries. This will allow traders to make well-informed decisions, thereby increasing the likelihood of successful trades.

1.1. Identifying the Key Factors Affecting USD/TRY Values

In the realm of Forex trading, certain dynamic elements play an influential role in shifting the value of USD/TRY. One such crucial factor is the monetary policies enforced by the Federal Reserve and the Turkish Central Bank. There is frequently a domino effect observed when either of these institutions alters interest rates or initiates quantitative easing. The subsequent ripples can significantly sway the USD/TRY currency pair.

Another equally pivotal factor is the economic strength of the US and Turkey, particularly the comparative robustness of their financial markets. For instance, if the dollar strengthens because the US economy is thriving, the value of USD/TRY generally rises, and vice versa.

Political stability in both countries also significantly affects the currency pair’s value. Any significant political rift or uncertainty in either the US or Turkey can generate investor unease, leading to fluctuations in trading values.

Market sentiment, perhaps one of the most subtle and yet significant influences, can also drive shifts in USD/TRY. Whether driven by hard data or emotional reactions, market sentiment can lead to large-scale buying or selling, thus impacting prices.

Lastly, global events or disasters can greatly influence the currency pair. Such happenings often lead to a ‘flight to safety’ among investors, meaning they move their investments to perceived safe-haven currencies like the USD, affecting the value of USD/TRY.

Geopolitical tensions can often cause Forex markets to react. These can include trade wars, diplomatic disputes, or wide-scale military conflicts. The potential for impact on imports, exports, or international relations can lead to swift changes in USD/TRY values.

Inflation and deflation rates in the two nations present another key aspect. These rates can trigger changes in interest, affecting the USD/TRY trade values.

Armed with knowledge about these key factors, traders can make informed decisions on when to buy or sell USD/TRY, increasing their chances of profitable trades.

1.2. Grasping the Trading Hours for USD/TRY

Trading hours for USD/TRY is an essential component of a successful strategy as it grants insights into the most viable periods to execute trades. The Turkish lira (TRY) operates under the Eastern European Time (EET), and trades from Monday to Friday, from 9:00 AM through to 5:00 PM.

Being aware of this time frame presents an edge in navigating the market. For the American dollar (USD), which is governed by the Eastern Standard Time (EST), trades are conducted between Sunday 22:00 to Friday 22:00.

Understanding the overlap between both currency hours is crucial to optimizing investment decisions and leveraging volatility. That is because the intersect of USD and TRY trading hours holds the potential of increased liquidity, more substantial price movements, and amplified market volatility.

Therefore, timing trades within the peak hours of both markets can enhance trading profitability. Investors also need to consider notable news releases and economic events. These happenings often occur at the beginning of trading sessions and can stir exceptional market movement in the USD/TRY currency pair, offering substantial opportunities for traders well-versed in timing their trades aptly.

In the same vein, being cautious of low liquidity periods can help avoid greater exposure to risk. These periods often follow the close of a market or during off-peak hours and might present unexpected price fluctuations. Detecting these changes and adjusting strategies accordingly can significantly impact the trading success with the USD/TRY pair.

2. Developing Effective Trading Strategies for USD/TRY

Trading USD/TRY demands a deep understanding of both currencies: the U.S. Dollar (USD) and the Turkish Lira (TRY). Monitoring the relationship between these currencies promotes more strategic decisions, improving the likelihood of trading successes. The impact of political, economic, and global events must also be considered for optimal results. Analysing the currency pair in real-time often reveals trends helping traders to make calculated decisions.

Developing an effective strategy for trading USD/TRY involves encompassing three key cornerstones: fundamental analysis, technical analysis, and risk management. Fundamental analysis involves evaluating Turkish and U.S. economic indicators and the global economy’s overall health. Essential factors include GDP growth rates, inflation and interest rates, and geopolitical changes.

Technical analysis, meanwhile, includes studying past patterns of the USD/TRY currency pair to predict future behaviour. Traders lean heavily on charts for this aspect, identifying trends and patterns to forecast probable price trajectories. Key tools and concepts such as Candlestick charts, trend lines, resistance and support levels, Fibonacci retracement, and Moving averages are indispensable for a well-rounded technical analysis.

Risk management is paramount to surviving and thriving in today’s volatile and unpredictable financial markets. Implementing diligent risk management strategies involves determining the appropriate position size before making a trade and employing stop-loss orders to limit potential losses. In addition, many successful traders do not risk more than a small percentage of their trading capital on a single trade.

Tools like economic calendars could further enhance the trading experience. They track economic news, which could significantly influence the USD/TRY exchange rate.

Conducting regular backtesting of the adopted strategies is another crucial aspect to monitor their efficiency consistently. Backtesting involves applying trading rules to historical market data to determine how well the strategy would have done in the past. While not a perfect predictor of future performance, consistent backtesting can provide an indication of the potential effectiveness of a trading strategy.

Also, implementing a robust trading plan provides a roadmap for trading activities and decision-making. Well-structured plans typically include clear objectives, risk tolerance levels, evaluation criteria, and defined exit strategies. A solid plan provides a guiding beacon, fostering discipline and helping to alleviate rash and impulsive decisions.

Incorporating all these principles helps establish solid, full-proof trading strategies for USD/TRY. This holistic approach allows for better navigation of the complex and often unpredictable landscape of financial markets, increasing the probability of trading success.

2.1. Utilizing Fundamental Analysis

Fundamental analysis plays a vital role in forex trading, particularly for pairs like USD/TRY, where economic and geopolitical factors can significantly impact the currency exchange rate. Traders harness the power of fundamental analysis by delving deep into a country’s economic indicators, from Gross Domestic Product (GDP) to inflation rates, interest rates, and unemployment figures.

A robust understanding of Turkey’s economic and political conditions is paramount when aiming for success in USD/TRY trading. For example, tracking inflation rates within Turkey can offer traders an unparalleled advantage. A surge in inflation often leads to a swifter interest rate increase by the country’s central bank, which can cause the Lira (TRY) to appreciate against the Dollar (USD).

Moreover, monitoring the U.S Federal Reserve’s (Fed) monetary policies can provide crucial insights into USD performance. When the Fed increases interest rates, the USD often strengthens, negatively impacting the USD/TRY pair. On the other hand, a decline in the U.S. interest rates can bolster the USD/TRY pair due to the relative weakness of the USD.

Understanding geopolitical events is another essential element of fundamental analysis. Political instability or changes in the diplomatic relations between the two countries can influence the currency pair’s movement. For instance, strained U.S.-Turkey relations or domestic political upheaval in either country may weaken their respective currencies, affecting the USD/TRY trading dynamics.

Ultimately, a solid grasp of fundamental analysis equips traders with a comprehensive view of the market’s possible directions, helping them make informed trading decisions in the USD/TRY forex market.

2.2. Leveraging Technical Analysis

Understanding the technical analysis is akin to unlocking the hidden repository of knowledge for trading currencies like USD/TRY. Essentially a method used by traders to evaluate investments and identify trading opportunities, technical analysis is based on statistical trends gathered from trading activity.

A key tool, Chart Patterns, represents price movements in a given timeframe, allowing traders to identify market trends and anticipate future price movements. Recognizing these patterns, be it a ‘head and shoulders’ or ‘double top’ can provide crucial insight into potentially profitable trading points.

Moreover, the importance of Technical Indicators should not be undervalued. They are mathematical calculations derived from price and volume data, which further simplifies the process of making decisions. Among these, indicators like Moving Averages, Relative Strength Index (RSI) and Bollinger Bands aid the USD/TRY trader in identifying potential trading opportunities.

Furthermore, Candlestick Patterns provide graphical representation of price movements in a specified period. This ancient Japanese method has proven its worth in predicting potential reversals, helping traders to time their entry and exit points in USD/TRY trades.

Nevertheless, bear in mind that while technical analysis is a powerful tool, its effectiveness is amplified when used in conjunction with other trading strategies, such as fundamental analysis. Combining the two can help create a more robust trading strategy catered to the volatile nature of the USD/TRY trading landscape. Finally, always exercise caution, ensuring your trading actions are suitably cautious given the high-risk nature of forex trading.

Remember that trading involves risk and is not suitable for everyone, so always make sure to trade responsibly.

2.3. Implementing Risk Management Techniques

Risk management is the shield that shields traders from unavoidable market fluctuations that could potentially bring losses. When trading the USD/TRY, certain risk management techniques should be implemented. These techniques could include setting a stop-loss limit and a take-profit level. These levels are beneficial because they permit traders to automatically close a trade when it reaches a level where the trader is content with the profits or a level where the trader can tolerate the loss.

Diversifying the trading portfolio is an additional technique that can help. By trading different currency pairs, traders reduce the risk of losing all investments if the USD/TRY pair does not perform as predicted. Not only does portfolio diversification spread the risk, but it also enhances potential gains, as positive movements in one currency pair can offset negative ones in another.

Another crucial point is not to invest more than what can be lost. Avoiding high leverage is imperative, since high leverage, though drastically inflating potential returns, can equally amplify potential losses.

In the same vein, traders should build an understanding of economic and geopolitical events to assess their possible impacts on the USD/TRY pair. Awareness of key economic indicators, like unemployment rates, inflation reports, central bank policy decisions, political incidents, or military conflicts, can be instrumental in predicting changes in the currency pair’s exchange rate.

Finally, continuous learning and skills development are inherently linked to successful risk management. Regularly tracking market news, attending trading seminars, workshops, and webinars, and engaging with other traders, can greatly enhance one’s trading acumen and decision-making abilities, thus paving the path for mitigating risk in trading USD/TRY.

3. Navigating Through Trading Platforms

Understanding trading platforms is a non-negotiable skill all traders need to acquire. Heavily dominated by chart indicators, graphs, and a plethora of financial instruments, these platforms can be pretty overwhelming for a new trader interested in buying or selling USD/TRY pair.

Risk mitigation tools, such as stop loss and take profit levels, are essential to comprehend. These tools can safeguard traders from extreme losses while ensuring captured profits remain intact. It is equally crucial to become well-versed with leverage and margin, which can boost potential profits yet also result in substantial losses if not managed effectively.

Knowing how to execute orders can make all the difference in successful trading. Be it limit orders, market orders, or conditional orders such as OCO (One Cancels the Other), every trader ought to not only understand what each order type means but also when to apply them in their trading.

Monitoring market trends is another must-have skill. Nothing gives traders an edge more than the ability to correctly predict the market’s direction. The USD/TRY pair is famous for its volatility, hence the need for constant trend monitoring. Equipping oneself with technical analysis tools such as Fibonacci retracements, moving average indicators, and Bollinger Bands can indeed provide accurate trend predictions.

Finally, there’s no substitute for familiarity with trading pairs – in this case, understanding USD/TRY. The currency pair’s price movements get heavily influenced by geopolitical events, trade balances, and monetary policies of the United States and Turkey. Therefore, a good grasp of macroeconomic events concerning the two economies can grant traders with an extra advantage while trading the USD/TRY pair.

3.1. Selecting the Right Trading Platform

When it comes to trading USD/TRY, choosing the right platform can determine the success or failure of the trading experience. The platform is akin to a trader’s toolbox, offering various financial instruments to trade with, detailed information for informed decisions, and a user-friendly interface for easy operation. There is no exception for trading USD/TRY.

Researching is, indisputably, an important first step. The internet offers a myriad of trading platforms, each promising top-tier service. Sadly, not all live up to their promises. Identify reputable reviews and comparisons of platforms. Seek platforms that offer comprehensive coverage of USD/TRY, providing real-time quotes and relevant news updates.

Next, consider the features provided. There’s a reason why features such as charting tools, stop-loss orders, direct market access, and social trading are important. They not only offer flexibility but also control over trading strategies. Look for platforms that allow customization to accommodate individual trading styles.

Also, it’s worth considering the platform’s mobile functionality. Given the fast-paced nature of forex trading, having a mobile-friendly platform ensures traders can act quickly on market trends.

Lastly, customer service and support system speaks volumes about a platform’s credibility. Responsive, knowledgeable, and cordial support staff may prove indispensable during a crisis. In essence, when selecting a trading platform for USD/TRY, thorough research and personal trading needs assessment make all the difference. After all, a robust, reliable, and versatile platform creates the optimal environment for successful trading.

3.2. Efficient Order Placement

Efficiency is a central principle in order placement during forex trading. USD/TRY, as a volatile currency pair, requires that traders swiftly execute each order to seize the best possible market prices. The functionality and ease-of-use of your forex broker’s trading platform play a vital role in this aspect. MetaTrader 4 and 5, cTrader, and commodities-specific platforms like NinjaTrader, are some of the frontrunners in the forex trading world with intuitive interfaces that promote efficient order placement. Differentiated by their functionalities, each of these tools can offer one-click trading or algorithm-driven trading, further facilitating prompt order placement.

Streamlining order execution begins with the understanding of different order types, which can directly impact trading results. Orders such as instant executions, pending orders, stop orders, and limit orders should be chosen judiciously, keeping in mind the market conditions, trading style, and risk tolerance. Using stop orders and limit orders can help in securing potential profits or containing losses during high volatility.

Aside from order types, it is also crucial to evaluate the broker’s execution speed. Having a broker that executes orders with minimal slippage and without requotes will ensure that your trades are conducted with the maximum level of accuracy and speed. Lastly, an integral part of efficient order placement includes the use of automated trading functions and strategies. Applying automated strategies and trading signals can provide you with consistent market-insights in real-time, while also unloading some of your workload, touching upon the all-important aspect of efficiency in trading.