1. Overview of NinjaTrader and the Need for Alternatives

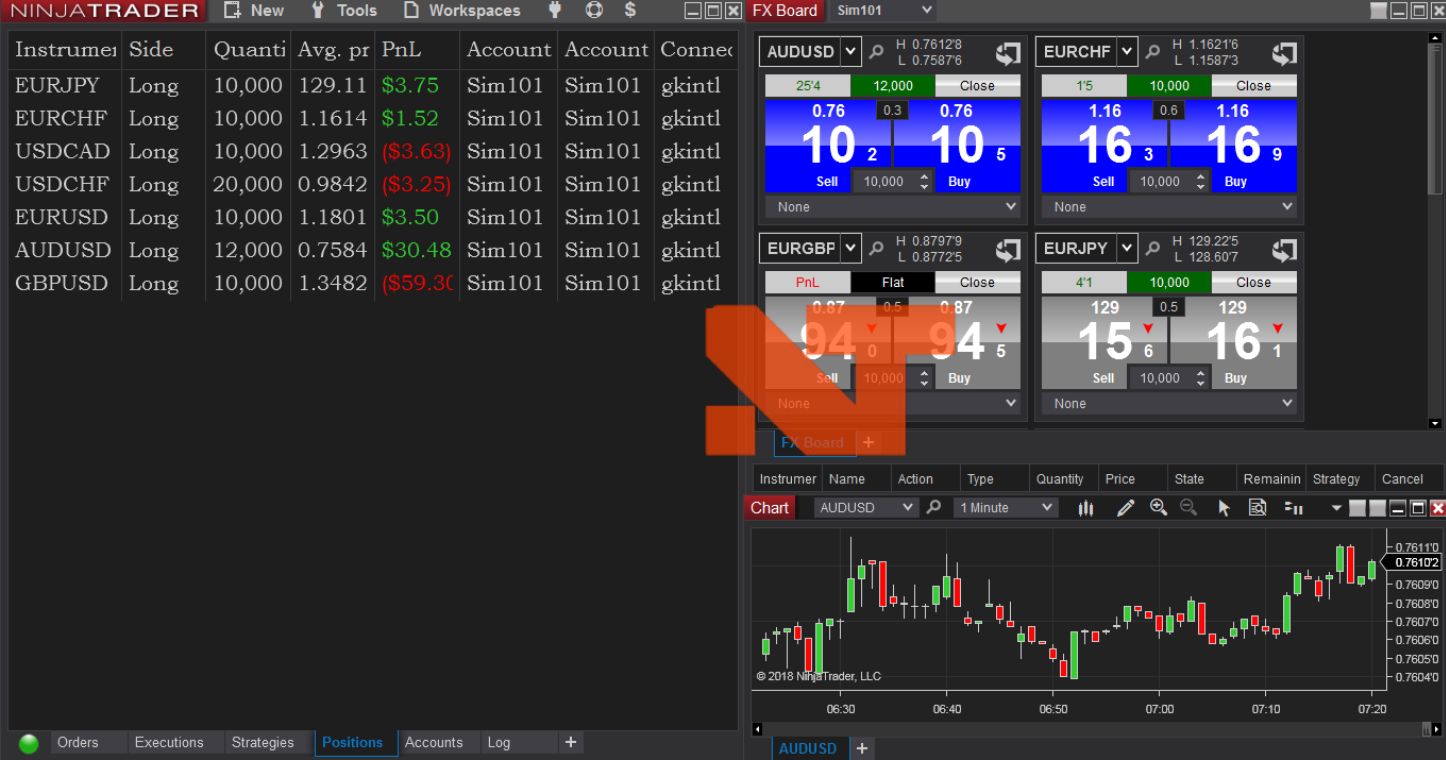

NinjaTrader is a renowned trading platform known for its advanced charting capabilities, comprehensive market analysis tools, and robust futures and forex trading support. However, despite its strengths, certain aspects of NinjaTrader may prompt traders to explore alternatives. Some common reasons include the cost of its premium features, the complexity of its tools which may be overwhelming for beginners, and perhaps a focus on features that might not align with every trader’s needs.

Choosing the right trading platform is crucial as it can significantly influence trading efficiency, decision-making, and overall success. The ideal platform varies widely among traders, depending on their specific needs, trading style, and the markets they are focusing on. Thus, exploring alternatives that might better align with individual preferences or offer different strengths is essential.

| Key Points | Details |

|---|---|

| Platform Strengths | Advanced charting, market analysis, futures and forex trading |

| Reasons for Seeking Alternatives | Cost, complexity, feature focus |

| Importance of Choice | To align with individual trading preferences and needs |

2. Factors to Consider Before Choosing the Right Trading Platform

When selecting a trading platform, it’s vital to consider various factors that align with your specific needs as a trader. Here’s a detailed breakdown of the key aspects you should evaluate:

- Market and Asset Accessibility: Ensure the platform supports the markets and asset types you’re interested in, such as stocks, forex, cryptocurrencies, or futures.

- User Interface and Usability: A platform’s interface should be intuitive and user-friendly, especially for beginners. An overly complex interface can hinder efficient trading.

- Tools and Features: Look for essential tools like advanced charting options, technical indicators, and economic calendars. Specific features like algorithmic trading or customizable dashboards might be crucial for advanced traders.

- Costs and Fees: Analyze all associated costs, including trading fees, subscription charges, and any other hidden costs. Some platforms offer free basic services with optional premium features for a fee.

- Mobility and Accessibility: Check if the platform provides mobile and tablet support for trading on the go. This is increasingly important in a connected, mobile-first world.

- Order Execution Speed: Fast and reliable order execution is critical, especially for day traders and those who trade volatile markets.

- Customer Support and Community: Good customer support can be invaluable, especially when technical issues or uncertainties arise. Also, a vibrant community can provide support, share strategies, and offer insights.

- Security Measures: Robust security features are non-negotiable to protect your investments from unauthorized access and cyber threats.

- Educational Resources: Especially for new traders, having access to educational materials and training tools can help enhance their trading skills and knowledge.

- Regulatory Compliance: Ensure that the platform is compliant with relevant financial regulations to avoid legal issues and ensure a secure trading environment.

These factors are crucial for all types of traders, whether novices or professionals, each emphasizing different aspects according to their strategies and experience level.

| Factor | Description |

|---|---|

| Market Accessibility | Supports various assets like stocks, forex, or crypto |

| User Interface | Should be intuitive and straightforward |

| Tools and Features | Essential tools like charting, technical indicators, and algorithmic trading capabilities |

| Costs and Fees | Transparent fee structure, considering all potential costs |

| Mobility | Mobile support for trading on the go |

| Order Execution | Fast and reliable for efficient trading |

| Customer Support | Accessible and helpful support, with a strong community |

| Security | Strong measures to protect user data and funds |

| Educational Resources | Availability of learning materials to improve trading skills |

| Regulatory Compliance | Compliance with financial laws to ensure safe trading environments |

3. Top 5 NinjaTrader Alternatives

3.1. MetaTrader 5 (MT5)

3.1.1. Overview of MetaTrader 5

MetaTrader 5 (MT5) is a versatile trading platform designed primarily for forex and futures trading but also supports a wide array of other assets. It is recognized for its advanced trading and analytical technologies and offers a powerful trading system with market depth and a system of separate accounting of orders and trades. MT5 caters to a global audience, providing tools for comprehensive price analysis, algorithmic trading applications (through trading robots or expert advisors), and copy trading.

3.1.2. Key Features of MetaTrader 5

- Algorithmic Trading: MT5 uses the MQL5 programming language, allowing traders to create, test, and apply Expert Advisors (EAs) and trading robots.

- Advanced Charting and Analysis Tools: Offers over 80 technical indicators and 21 timeframes, facilitating detailed market analysis.

- Multi-Asset Platform: Supports trading in forex, stocks, futures, and CFDs, with capabilities to handle exchange-traded securities and commodities.

- Copy Trading: Enables traders to subscribe to professional traders’ signals and automatically replicate their trades in their trading accounts.

- Market Access: Provides both netting and hedging mode options, along with four order execution modes: Instant, Request, Market, and Exchange.

3.1.3. MT5 vs. NinjaTrader: Key Feature Comparison

- Charting Tools: Both platforms offer advanced charting capabilities, but MT5 provides more timeframes and technical indicators.

- Algorithmic Trading: MT5 has a built-in environment for developing and testing EAs, making it superior in this aspect compared to NinjaTrader’s more manual approach.

- User Interface: MT5 offers a more modern interface and is available in web, desktop, and mobile versions, enhancing accessibility compared to NinjaTrader.

- Market Reach: NinjaTrader is often preferred for futures and options trading, while MT5 has a stronger presence in forex trading.

3.1.4. Best Suited For

MetaTrader 5 is best suited for traders who prioritize forex trading, need automated trading strategies, and value a large community for sharing and accessing trading strategies and tools.

Comparison Table: NinjaTrader vs. MetaTrader 5

| Feature | NinjaTrader | MetaTrader 5 |

|---|---|---|

| Asset Coverage | Futures, Options | Forex, Stocks, Futures, CFDs |

| Trading Tools | Advanced charting, market analysis | Advanced charting, 80+ indicators, market depth |

| User Interface | Customizable, complex | Modern, user-friendly, multi-platform |

| Algorithmic Trading | Supported, less integrated | Fully integrated with MQL5 |

| Market Access | Direct market access | Broad access with netting and hedging options |

3.2. TradeStation

3.2.1. Overview of TradeStation

TradeStation is a robust and well-established trading platform known for its powerful tools and features tailored to advanced and active traders. It offers a wide array of tradable securities including stocks, ETFs, options, futures, and cryptocurrencies. Recognized for its comprehensive trading and analysis tools, TradeStation is particularly strong in options trading and technical analysis.

3.2.2. Key Features of TradeStation

- Multiple Trading Platforms: TradeStation offers desktop, web, and mobile platforms, each rich in features like customizable charting, advanced order management, and real-time data streaming.

- Advanced Tools: The platform is known for its RadarScreen tool, EasyLanguage programming for strategy development, and advanced back-testing capabilities.

- Educational Resources: Provides substantial educational support including tutorials and webinars to help traders of all levels improve their trading skills.

- Crypto Trading: TradeStation has expanded to offer trading in major cryptocurrencies, although it has a more limited selection compared to dedicated crypto exchanges.

3.3.3. TradeStation vs. NinjaTrader: Key Feature Comparison

- User Interface: TradeStation offers a complex but highly customizable interface suitable for experienced traders, while NinjaTrader is also known for its powerful tools but may have a steeper learning curve.

- Trading Tools: Both platforms provide extensive tools for technical analysis and trading, but TradeStation offers its unique EasyLanguage feature for traders who want to program their own indicators and strategies.

- Asset Coverage: TradeStation offers a broader range of tradable assets including cryptocurrencies, whereas NinjaTrader focuses more on futures and forex.

- Accessibility: TradeStation provides robust mobile and web platforms, making it easier for traders to operate on-the-go compared to NinjaTrader.

3.3.4. Best Suited For

TradeStation is best suited for experienced traders who need a powerful and customizable platform. It supports a broad range of asset classes and is particularly strong in options trading and technical analysis. It is less suited for beginners due to the complexity of its tools and interface.

Comparison Table: NinjaTrader vs. TradeStation

| Feature | NinjaTrader | TradeStation |

|---|---|---|

| Asset Classes | Forex, Futures | Stocks, ETFs, Options, Futures, Crypto |

| User Interface | Complex, customizable | Highly customizable, multiple platforms |

| Trading Tools | Advanced charting, strategy development | EasyLanguage, RadarScreen, advanced charting |

| Mobile Trading | Basic mobile support | Full-featured mobile app available |

| Crypto Trading | Not available | Available, with multiple cryptocurrencies supported |

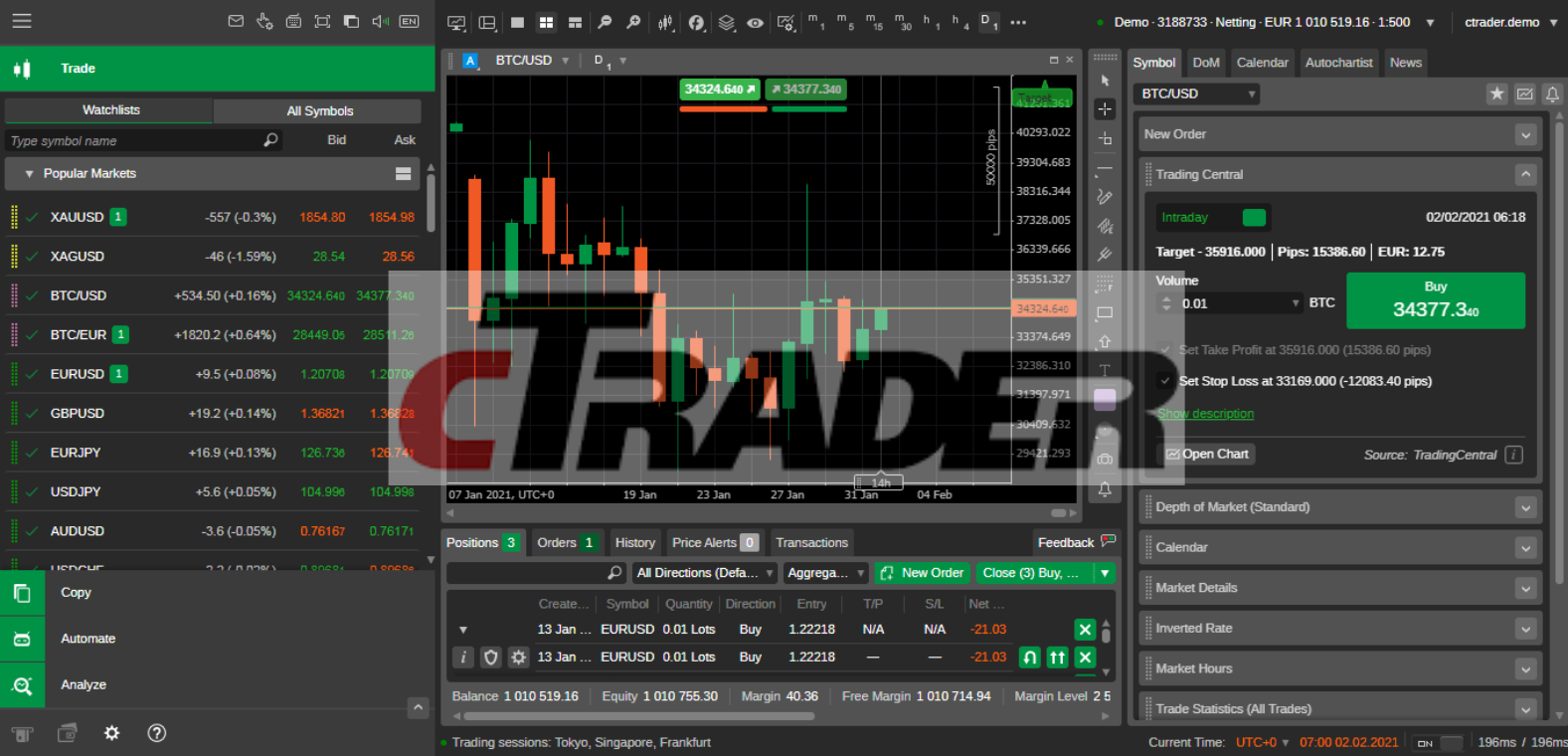

3.3. cTrader

3.3.1 Overview of cTrader

cTrader is a comprehensive trading platform favored for its intuitive user interface and advanced trading capabilities, making it suitable for both novice and experienced traders. Developed by Spotware, cTrader is particularly strong in forex and CFD trading, providing direct market access and advanced order execution capabilities which are appealing to scalpers and day traders.

3.3.2. Key Features of cTrader

- Advanced Charting Tools: cTrader offers extensive charting capabilities with multiple chart types, customizable timeframes, and over 50 technical indicators, which facilitate detailed market analysis.

- Algorithmic Trading: Supports automated trading through its cAlgo platform, allowing users to write and implement their own trading bots using C# programming.

- Direct Market Access (DMA): Offers tight spreads and faster execution speeds by connecting directly with liquidity providers.

- Copy Trading: cTrader Copy allows users to replicate the strategies of successful traders, which is beneficial for beginners or those looking to trade passively.

- Risk Management Tools: Includes sophisticated risk management features like stop-loss orders, trailing stops, and margin call alerts to help traders manage their exposures effectively.

3.3.3. cTrader vs. NinjaTrader: Key Feature Comparison

- User Interface: cTrader is known for its sleek, modern interface that is highly customizable, making it more accessible for beginners compared to NinjaTrader’s more complex interface.

- Market Access and Pricing: cTrader provides direct market access which can result in tighter spreads and more transparent pricing, while NinjaTrader is typically favored for futures and options trading.

- Algorithmic Trading: Both platforms support automated trading, but cTrader offers a more integrated development environment with cAlgo for users familiar with C#.

- Copy Trading: cTrader has a robust copy trading function, which NinjaTrader does not inherently support.

3.3.4. Best Suited For

cTrader is best suited for forex traders who need fast order execution, advanced charting tools, and direct market access. It is also a good choice for traders who are interested in algorithmic and copy trading.

Comparison Table: NinjaTrader vs. cTrader

| Feature | NinjaTrader | cTrader |

|---|---|---|

| User Interface | Complex | User-friendly, modern |

| Algorithmic Trading | Supported, manual integration | Fully integrated, supports C# |

| Market Access | Futures, Options | Forex, CFDs, direct market access |

| Copy Trading | Not supported | Supported |

| Risk Management | Advanced tools available | Comprehensive risk management features |

3.4. Sierra Chart

3.4.1. Overview of Sierra Chart

Sierra Chart is a highly customizable and powerful desktop trading and charting platform known for its robust technical analysis tools and efficiency in handling complex analyses. This platform is primarily designed for experienced traders who require advanced functionalities like custom studies, detailed charting, and comprehensive market depth analysis. Sierra Chart supports trading in stocks, forex, cryptos, and more.

3.4.2. Key Features of Sierra Chart

- Advanced Charting: Offers over 300 technical studies and a wide range of chart types including Renko, Kagi, and Heikin Ashi, catering to sophisticated analytical needs.

- Customization and Automation: Features the Advanced Custom Study Interface and Language (ACSIL), allowing users to create custom technical studies and automate trading strategies using C++.

- Market Depth and Historical Data: Includes historical depth of market data and tools for analyzing market liquidity and order flows.

- Support for Multiple Data Sources: While it provides comprehensive historical data and real-time forex and crypto data, users may need to subscribe to external services for some types of real-time data.

3.4.3. Sierra Chart vs. NinjaTrader: Key Feature Comparison

- User Interface: Sierra Chart offers a complex interface that can be fully customized, which may present a steep learning curve compared to the more straightforward NinjaTrader interface.

- Technical Tools: Both platforms provide advanced charting and technical analysis tools, but Sierra Chart’s integration of C++ for custom studies may offer deeper functionality for those with programming skills.

- Data Integration: Sierra Chart may require additional subscriptions for real-time data, whereas NinjaTrader offers more integrated data solutions.

3.4.4. Best Suited For

Sierra Chart is best suited for technical traders who require deep customization, extensive technical studies, and the ability to code their own indicators and strategies. It is particularly favored by those who trade futures and forex, but its capabilities extend to other instruments like stocks and cryptocurrencies.

Comparison Table: NinjaTrader vs. Sierra Chart

| Feature | NinjaTrader | Sierra Chart |

|---|---|---|

| User Interface | More intuitive | Highly customizable, complex |

| Technical Analysis | Extensive tools | Over 300 technical studies, deeper customization |

| Data Integration | Integrated options | Requires external data subscriptions for full functionality |

| Programming | Basic scripting | Advanced C++ customization |

| Asset Coverage | Futures, Forex, Stocks | Stocks, Forex, Crypto, and more |

3.5. MotiveWave

3.5.1. Overview of MotiveWave

MotiveWave is a versatile and comprehensive trading platform renowned for its advanced technical analysis capabilities, particularly strong in Elliott Wave analysis and Fibonacci tools. It’s designed for traders who appreciate a rich feature set and deep customization options. MotiveWave supports various trading activities, including stock and forex trading, through an intuitive yet robust platform suitable for both Windows and Mac users.

3.5.2. Key Features of MotiveWave

- Elliott Wave Analysis: MotiveWave provides sophisticated tools for Elliott Wave analysis, allowing traders to automatically or manually identify wave counts, which is crucial for predicting market movements based on wave patterns.

- Advanced Charting and Technical Tools: The platform offers over 300 technical indicators and a variety of charting options that cater to extensive analytical needs. Users can customize and save their chart templates for different analysis scenarios.

- Algorithmic Trading: MotiveWave facilitates the design, testing, and implementation of automated trading strategies with its comprehensive backtesting tools, enhancing trade execution and strategy development.

- Customization: It provides a highly customizable interface that includes drag-and-drop functionality, enabling users to tailor their trading environment to their preferences and strategies.

3.5.3. MotiveWave vs. NinjaTrader: Key Feature Comparison

- User Interface: MotiveWave boasts a user-friendly interface with extensive customization capabilities, making it easier to navigate and personalize compared to NinjaTrader’s more technical-oriented setup.

- Technical Analysis and Tools: Both platforms offer advanced technical analysis tools, but MotiveWave excels with its specialized Elliott Wave and Fibonacci tools, which are highly valued by traders focusing on these analytical techniques.

- Algorithmic Trading: While both platforms support algorithmic trading, MotiveWave provides a more integrated environment for developing and testing trading strategies with its advanced tools.

3.5.4. Best Suited For

MotiveWave is ideally suited for technical traders who rely heavily on Elliott Wave theory, Fibonacci analysis, and want a platform that supports extensive customization and sophisticated algorithmic trading. It’s also great for traders who value having a wide range of technical indicators and tools at their disposal.

Comparison Table: NinjaTrader vs. MotiveWave

| Feature | NinjaTrader | MotiveWave |

|---|---|---|

| User Interface | Complex | User-friendly, highly customizable |

| Technical Analysis | Advanced tools | Specializes in Elliott Wave, Fibonacci, over 300 indicators |

| Algorithmic Trading | Supported | More advanced support with robust backtesting |

| Customization | High | Extremely high, with intuitive drag-and-drop interface |

4. Conclusion: Evaluating NinjaTrader Alternatives

When considering alternatives to NinjaTrader, each platform presents unique strengths that cater to different trading styles and preferences:

- MetaTrader 5 (MT5): Ideal for forex traders and those interested in automated trading strategies. It offers a broad range of analytical tools and algorithmic trading support through its MQL5 programming language.

- TradeStation: Suitable for experienced traders looking for powerful analytics and customization options, particularly strong in options trading and technical analysis.

- cTrader: Favored for its user-friendly interface and strong support for algorithmic trading. It excels with its direct market access and advanced charting tools.

- Sierra Chart: Best for technical traders who require deep customization and extensive charting capabilities, especially popular among futures traders.

- MotiveWave: Perfect for traders who utilize Elliott Wave analysis and Fibonacci tools, providing a highly customizable platform with robust technical analysis tools.

Each platform has its own merits and choosing the right one depends on your specific needs, trading style, and the complexity of strategies you wish to implement. It’s important to thoroughly research and, if possible, utilize trial versions before committing to ensure the platform meets all your trading requirements.