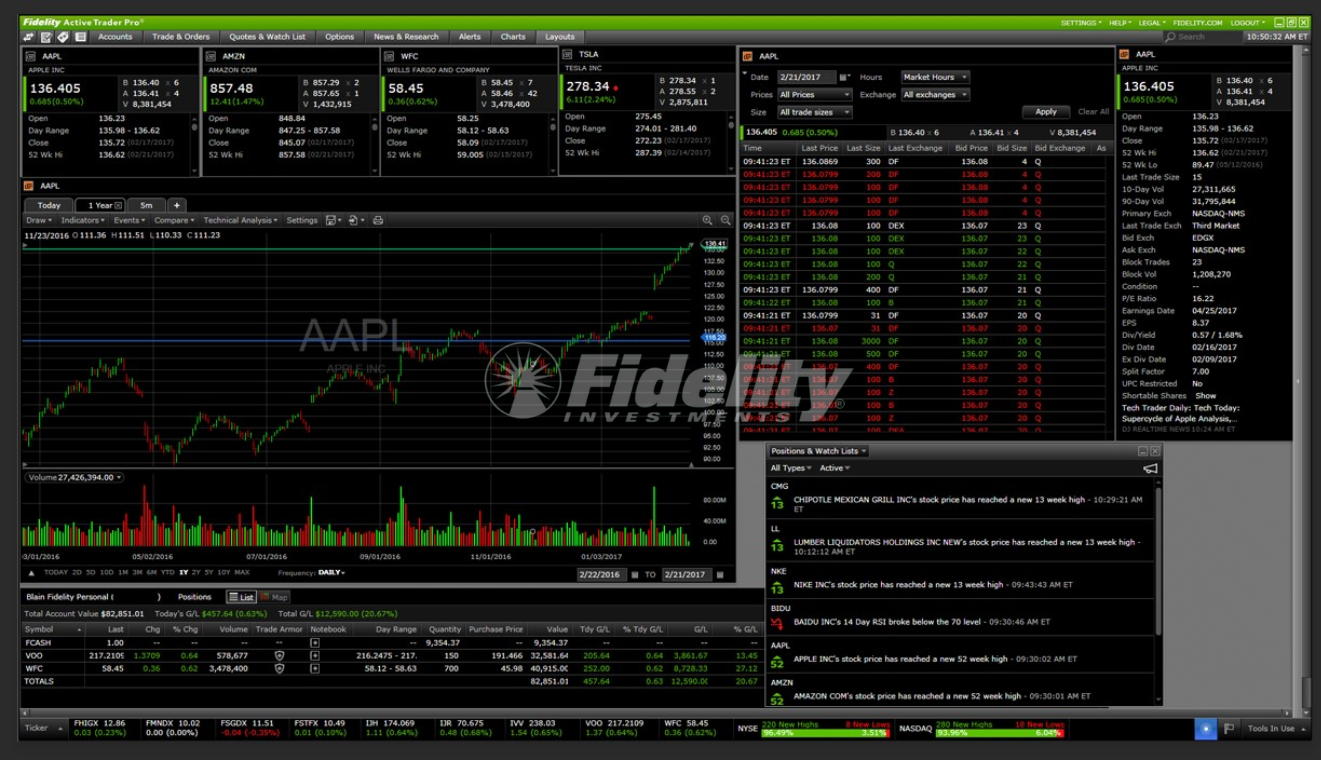

1. Overview of Active Trader Pro

Active Trader Pro is a trading platform developed by Fidelity, tailored primarily for active traders who require powerful tools and data to inform their trading decisions. Known for its robust functionality, Active Trader Pro offers a suite of features that includes real-time analytics, integrated trading tools, and customizable dashboard options that cater to the needs of seasoned traders.

Despite its strengths, some users may find the platform lacking in certain aspects. Key shortcomings include limited accessibility on multiple devices, as the platform is primarily desktop-based, and a somewhat steep learning curve that may deter newer traders. Additionally, while it offers extensive tools for equity trading, it might not be as comprehensive for other types of trading such as forex or cryptocurrencies.

The importance of choosing the right trading platform cannot be overstated. Each trader has unique needs based on their trading style, preferred assets, and experience level. Aligning the platform’s features with these needs is crucial to ensure effective trading and to leverage opportunities in the financial markets effectively.

| Key Aspects | Details |

|---|---|

| Platform | Active Trader Pro by Fidelity |

| Strengths | Real-time analytics, customizable interface |

| Shortcomings | Limited mobile support, steep learning curve |

| Ideal for | Seasoned equity traders |

| Needs Alignment | Essential for effective use and trading success |

2. Top 5 Active Trader Pro Alternatives

2.1. TradingView

TradingView stands out as a comprehensive and versatile charting platform that caters to both novice and experienced traders. It is especially recognized for its strong community engagement and advanced charting capabilities.

TradingView operates as a cloud-based platform, ensuring a secure and accessible trading environment from any device with internet connectivity. It integrates a wide range of markets, including stocks, forex, and cryptocurrencies, offering extensive data feeds from over 50 exchanges.

2.1.1. Key Features:

- Advanced Charting Tools: Offers over 160 technical indicators and various chart types like LineBreak, Renko, and Heikin Ashi, which are complemented by powerful drawing tools

- Community Features: Features a robust social network where traders can share insights, publish analysis, and interact through a fully integrated chat system. This community aspect is one of its strongest selling points, providing a platform for collaborative learning and trading.

- Customizability and Scripting: Allows for extensive customization through Pine Script, enabling users to create and share their own indicators and strategies.

- Cross-Platform Accessibility: Being web-based, it offers flexibility to access the platform from various devices, enhancing usability for traders who need to stay connected across different locations.

2.1.2. Pros:

- Comprehensive charting capabilities and a large selection of technical indicators.

- Strong community engagement for sharing and learning from other traders.

- Cloud-based with high accessibility and security.

- Supports a broad range of markets and data integration.

2.1.3. Cons:

- Limited direct trading capabilities as trades often have to be executed outside the platform due to limited broker integrations.

- While it has a strong community, the quality of interactions can vary, with a mix of highly beneficial insights and some less reliable content.

2.1.4. Best For:

Traders who prioritize advanced charting, a community aspect, and technical analysis, making it suitable for those who seek a blend of robust tools and collaborative trading insights.

Comparison Table Against Active Trader Pro

| Feature | TradingView | Active Trader Pro |

|---|---|---|

| Charting Capabilities | Extensive with over 160 indicators | Robust, but less extensive |

| Community Interaction | Strong, integrated community | Limited to no community features |

| Accessibility | Cloud-based, accessible on any device | Desktop-based, limited mobility |

| Broker Integration | Limited direct trading capabilities | Strong integration with Fidelity |

| Market Coverage | Stocks, Forex, Cryptocurrencies, etc. | Primarily equities focused |

| Customization | High, with Pine Script | Moderate customization options |

2.2.Thinkorswim (TD Ameritrade)

Thinkorswim, developed by TD Ameritrade, is a highly sophisticated trading platform known for its comprehensive toolset that caters to active and options traders. This platform is particularly celebrated for its advanced charting capabilities, extensive range of technical indicators, and integration with real-time market data.

Thinkorswim offers a robust trading experience with features like customizable charting, over 300 technical indicators, and a variety of order types. It’s known for its detailed approach to options trading, including advanced strategies and tools. The platform supports trading across multiple assets including stocks, options, futures, and FOREX.

2.2.1. Key Features:

- Advanced Charting and Analysis Tools: Over 300 technical indicators and tools for comprehensive market analysis.

- Customizable Interface: Users can set up their workspace according to their trading preferences and strategies.

- Robust Options Trading: Detailed options analysis and strategy development tools.

- Educational Resources: Provides a wide range of educational materials to support traders at all levels.

2.2.2. Pros:

- Exceptionally strong in options and futures trading.

- Highly customizable interface and workflow.

- Integrated paper trading for strategy testing.

- Extensive educational resources to help users leverage the platform’s capabilities.

2.2.3. Cons:

- Can be overwhelming for beginners due to its complexity.

- The user interface, while functional, is considered less modern in appearance.

- Some features may be too advanced for casual traders.

2.2.4. Best For:

Thinkorswim is best suited for options traders, those wanting deep broker integration, and individuals who value educational resources to enhance their trading skills. It’s also well-regarded by those who require a platform that supports complex trading strategies and multi-faceted analysis.

Comparison Table Against Active Trader Pro

| Feature | Thinkorswim | Active Trader Pro |

|---|---|---|

| User Interface | Functional but complex | More streamlined and user-friendly |

| Technical Indicators | Over 300 available | Less extensive than Thinkorswim |

| Customization | Highly customizable | Moderate customization options |

| Educational Resources | Extensive educational offerings | Limited compared to Thinkorswim |

| Asset Types Covered | Stocks, options, futures, FOREX | Primarily equities focused |

2.3. MetaTrader 5

MetaTrader 5 is a highly versatile trading platform that caters especially to forex and futures traders, offering advanced capabilities for trading across multiple financial markets. Known for its algorithmic trading features, it is widely used for automated trading through its robust trading system.

MetaTrader 5 supports a comprehensive range of trading functions, enhanced by its multi-asset platform which allows trading Forex, stocks, futures, and options. It is equipped with advanced technical and fundamental analysis tools, which are essential for predicting market movements and making informed trading decisions. The platform offers both desktop and mobile versions, ensuring traders can operate across various devices with seamless integration.

2.3.1. Key Features:

- Advanced Technical Analysis: Over 80 built-in technical indicators and over 40 analytical objects.

- Algorithmic Trading: Utilizes the MQL5 language for developing custom trading robots and indicators.

- Fundamental Analysis Tools: Features an economic calendar and financial news integrated directly into the platform.

- Multi-Asset Trading: Enables trading across forex, stocks, futures, and options from a single platform.

2.3.2. Pros:

- Extensive tools for both technical and fundamental analysis.

- Robust support for algorithmic trading with a large marketplace for trading robots and technical indicators.

- Strong mobile integration, allowing traders to manage their accounts and trade from anywhere.

- Supports multiple order types and execution modes, accommodating a variety of trading strategies.

2.3.3. Cons:

- The complexity of features might be overwhelming for beginners.

- Custom tools and advanced features require familiarity with the MQL5 programming language, which has a learning curve.

2.3.4. Best For:

MetaTrader 5 is best suited for traders who need strong algorithmic trading capabilities, extensive technical analysis tools, and the flexibility to trade across multiple asset types, particularly in forex and futures markets.

Comparison Table Against Active Trader Pro

| Feature | MetaTrader 5 | Active Trader Pro |

|---|---|---|

| Technical Analysis | Extensive with over 80 indicators | Moderate, fewer indicators |

| Algorithmic Trading | Full support with custom options | Limited to no native support |

| Asset Types | Forex, stocks, futures, options | Mainly equities focused |

| Mobile Trading | Strong mobile platform integration | Limited mobile features |

| User Interface | Complex, feature-rich | More streamlined and user-friendly |

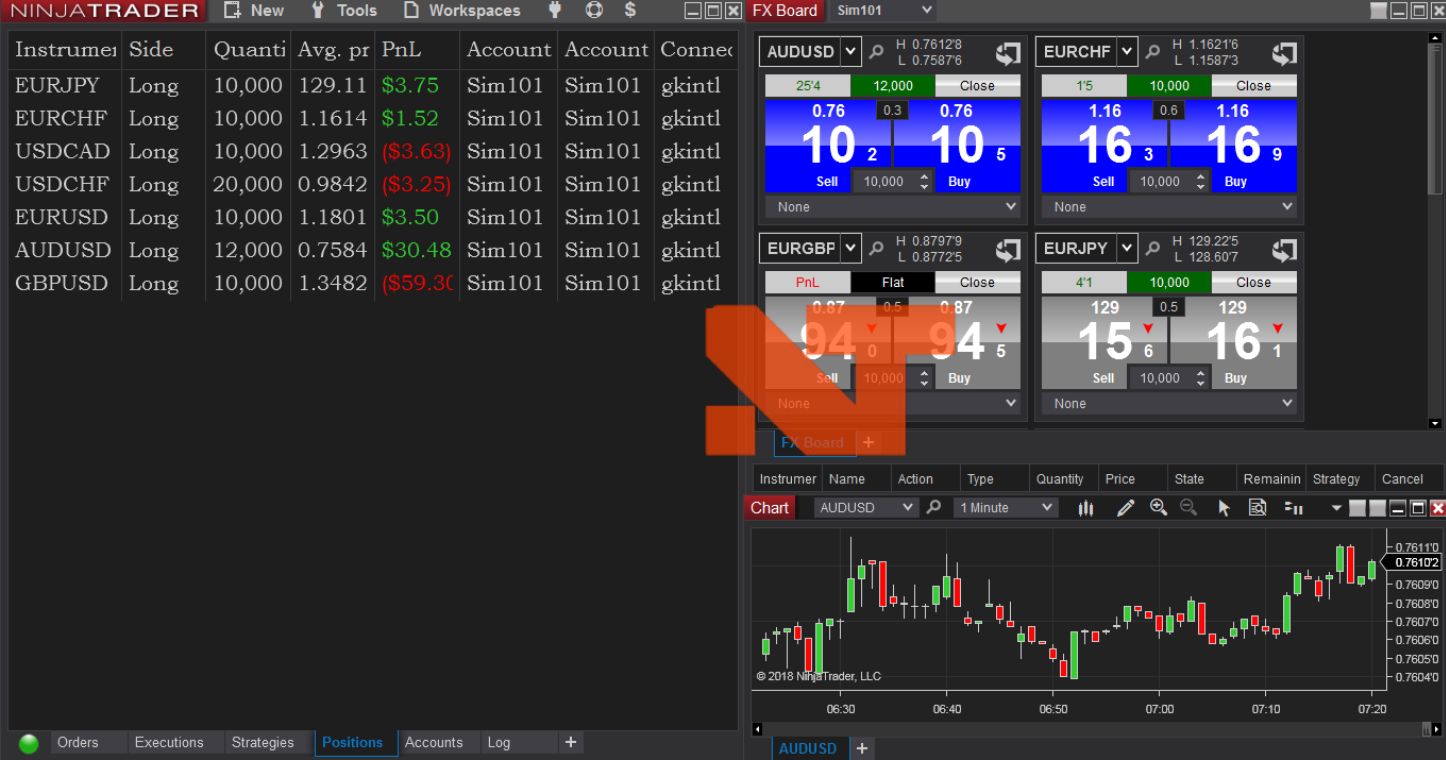

2.4. NinjaTrader

NinjaTrader is a robust trading platform known for its advanced charting, analysis capabilities, and strong emphasis on futures trading. It caters especially to experienced traders who require detailed technical analysis and the ability to use automated trading strategies.

NinjaTrader offers a powerful trading environment with a focus on futures trading, though it also supports stocks, forex, and options trading. The platform is popular for its deep discount commissions, low margin requirements, and comprehensive market data. Notably, NinjaTrader provides a rich ecosystem for developing and applying trading strategies with extensive support for custom indicators and automated trading through the use of NinjaScript, a C#-based programming language.

2.4.1. Key Features:

- Advanced Charting Tools: Offers over 100 technical indicators and an array of charting options.

- Customization and Automation: Supports extensive customization with a wide range of third-party applications and add-ons available. Users can also develop their own trading strategies and indicators using NinjaScript.

- Simulated Trading: Provides an advanced trade simulation tool to practice trading strategies without financial risk.

- Education and Support: Offers a variety of educational resources, including daily webinars, video guides, and a comprehensive support forum.

2.4.2. Pros:

- Advanced technical analysis and charting capabilities.

- Low trading costs and flexible account management.

- Strong support for automated trading and strategy development.

- Access to a vast library of add-ons and integrations for customization.

2.4.3. Cons:

- Can be complex and intimidating for beginners.

- Lacks a native mobile trading app, limiting on-the-go trading options.

- The platform’s focus is primarily on futures trading, which may not appeal to traders interested in other types of assets.

2.4.4. Best For:

NinjaTrader is best suited for experienced traders who prioritize futures trading and seek a platform that supports extensive customization and automated trading strategies. It’s particularly valuable for those who wish to engage in high-level market analysis and develop their own trading tools.

Comparison Table Against Active Trader Pro

| Feature | NinjaTrader | Active Trader Pro |

|---|---|---|

| Focus | Futures, options, forex, stocks | Primarily equities focused |

| User Interface | Highly customizable, complex | User-friendly, less customizable |

| Mobile Trading | No native app, web access via CQG | Limited mobile features |

| Automated Trading | Extensive support with NinjaScript | Limited automated trading features |

| Educational Resources | Comprehensive, includes webinars | Limited to basic platform guides |

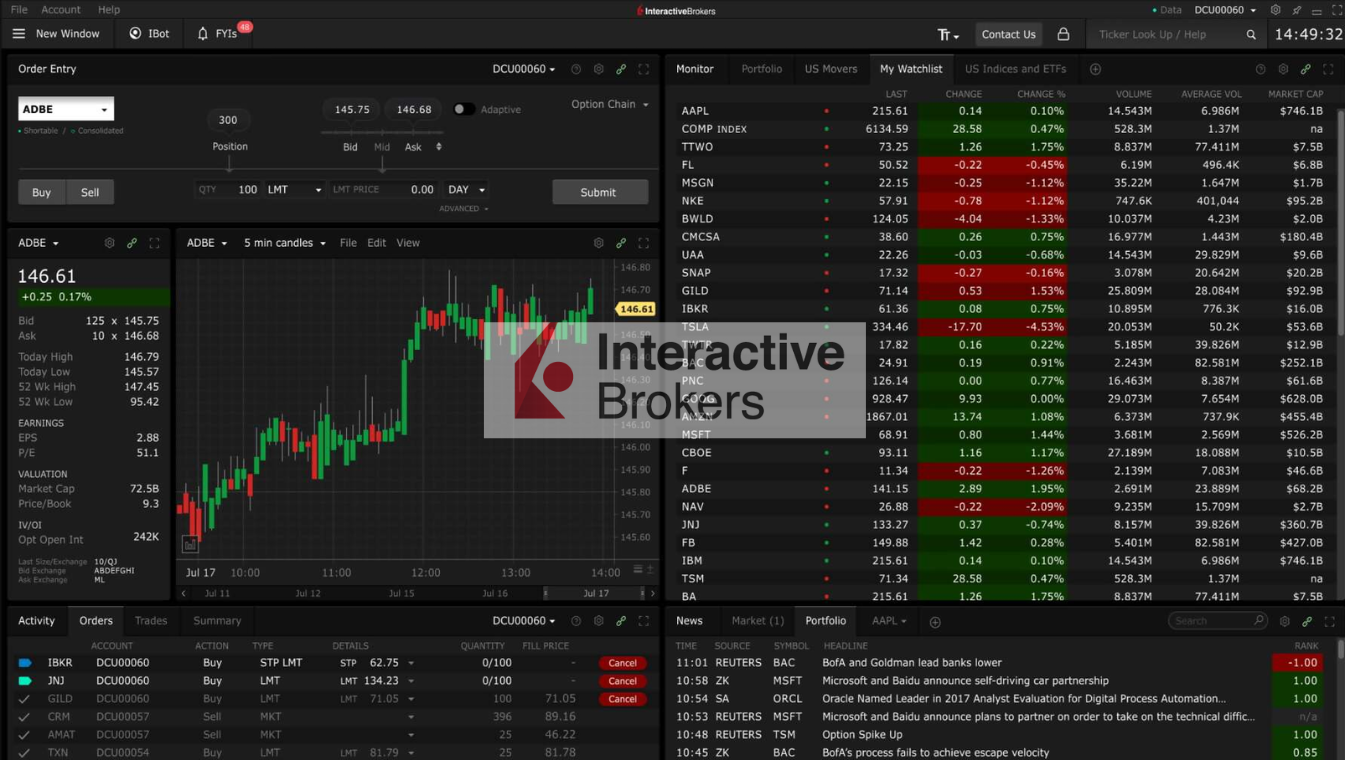

2.5. Interactive Brokers TWS (Trader Workstation)

Interactive Brokers TWS is a highly sophisticated trading platform designed for seasoned traders and investors who require a broad array of tools for comprehensive market analysis and trading. It is known for its depth in features and the flexibility it offers across various markets and instruments.

Interactive Brokers TWS (Trader Workstation) provides access to over 100 markets worldwide, allowing users to trade stocks, options, futures, forex, bonds, and funds from a single integrated account. The platform is renowned for its robust trading tools and advanced features, including algorithmic trading, extensive risk management tools, and market scanners that help identify trading opportunities.

2.5.1. Key Features:

- Advanced Trading Tools: Real-time monitoring, alerts, watchlists, and a customizable account dashboard.

- Algorithmic Trading: Supports the development and deployment of automated trading strategies.

- Comprehensive Market Data: Offers access to real-time news, research, and a wide range of data analytics.

- Global Access: Enables trading in multiple currencies and across over 100 international markets.

2.5.2. Pros:

- Access to a wide range of instruments and global markets.

- Highly customizable interface and advanced trading tools.

- Competitive margin rates and low cost of trading.

- Robust research and data offerings, with many services available for free or via subscription.

2.5.3. Cons:

- Complex platform that may be challenging for beginners.

- No native cryptocurrency trading capabilities; crypto is accessible via external integrations.

- Limited mobile app functionality compared to the desktop version.

2.5.4. Best For:

Interactive Brokers TWS is ideal for advanced traders who need a powerful trading platform with access to a wide range of financial instruments and global markets. It suits those who require in-depth analysis, algorithmic trading capabilities, and who trade across multiple asset classes.

Comparison Table Against Active Trader Pro

| Feature | Interactive Brokers TWS | Active Trader Pro |

|---|---|---|

| Instruments Supported | Stocks, options, futures, forex, bonds, funds | Primarily equities focused |

| Trading Tools | Advanced charting, algos, market scanners | Basic to advanced tools, less extensive |

| User Interface | Highly customizable, complex | User-friendly but less customizable |

| Access to Global Markets | Yes, over 100 international markets | Limited to U.S. and selected international markets |

| Mobile Trading | Available but less feature-rich | Moderate mobile support |

3. Factors to Consider When Choosing a Trading Platform

Selecting the right trading platform is crucial for your trading success. Each trader has unique needs based on their trading style, preferred asset classes, and the level of analysis they require. Here are key factors to consider to ensure you choose a platform that best fits your trading strategy.

3.1. Trading Style

- Day Trading: Requires platforms with ultra-fast execution speeds, real-time data, direct market access, and hotkeys.

- Swing Trading: Look for strong charting tools, a variety of technical indicators, and fundamental analysis capabilities.

- Scalping: Essential features include very low latency, the ability to quickly enter and exit trades, and low commission costs.

- Long-term Investing: Fundamental research tools, historical data, and integration with long-term investment accounts are key.

3.2. Asset Classes

- Diversification Needs: Ensure the platform offers a broad range of asset classes like stocks, ETFs, options, futures, forex, and cryptocurrencies.

- Specialization: Some platforms specialize in specific asset classes, which could provide advantages like more tools or better pricing.

3.3. Technical Analysis

- Charting Tools: Platforms should offer customizable and comprehensive charting tools that allow for detailed technical analysis.

- Indicators and Studies: Availability of a wide range of technical indicators and the ability to add custom indicators.

3.4. Algorithmic Trading

- Automation Features: Look for platforms that support automated trading strategies, backtesting tools, and algorithmic trading capabilities.

3.5. Cost

- Fees Structure: Consider trading commissions, platform fees, inactivity fees, and any other associated costs.

- Transparency: Ensure that all fees are transparent and reasonable compared to the services provided.

3.6. Usability

- Interface: The platform should have an intuitive interface suitable for your level of expertise. Some platforms may offer more advanced features that require a learning curve.

3.7. Customer Support

- Availability: Good customer support should be readily available, either through live chat, phone, or email.

- Resources: Availability of educational resources and training can also be crucial, especially for new traders.

| Factor | Consideration |

|---|---|

| Trading Style | Match platform capabilities with your trading style. |

| Asset Classes | Ensure availability and specialization. |

| Technical Analysis | Comprehensive tools and indicators are crucial. |

| Algorithmic Trading | Support for automation and backtesting. |

| Cost | Consider all fees and their transparency. |

| Usability | Platform should align with your technical skills. |

| Customer Support | Accessibility and quality of support. |

Conclusion

In the world of trading, there is no “one-size-fits-all” solution when it comes to choosing the right trading platform. Each trader has unique needs based on their trading style, preferred asset classes, and desired tools for analysis and execution. It’s essential to assess platforms based on factors like technical capabilities, cost, user support, and the specific assets you intend to trade. As trading technologies continue to evolve, traders should also remain flexible and willing to adapt their tools and strategies to stay competitive in the market.

Before making a final decision, consider taking advantage of trial periods or demo accounts offered by many platforms. This approach allows you to test the functionalities without financial commitment, ensuring the platform you choose aligns well with your trading strategies and goals. Remember, the right platform is a crucial ally in maximizing your trading effectiveness and potential profitability.