1. Overview Of eToro

Despite its strengths, such as social trading capabilities and a vast range of markets, there are several reasons why traders might seek alternatives. These include the desire for lower fees, different user interface, or more specialized trading tools. Recognizing eToro‘s popularity, it’s crucial to explore other platforms that might better align with individual trading strategies and preferences.

This article promises an in-depth look at the top alternatives to eToro, providing insights into their features, strengths, and limitations. Whether you are a beginner seeking simplicity and educational resources, or an experienced trader in need of advanced tools, understanding these alternatives will guide you to make an informed decision that best suits your trading needs.

| Feature | Importance |

|---|---|

| User Needs | Tailored platform choices |

| eToro Strengths | Social trading, diverse markets |

| Alternatives | Based on fees, UI, tools |

2. Top 5 Alternatives to eToro

2.1. TradingView

TradingView is renowned for its sophisticated charting tools and technical analysis capabilities, making it a favorite among traders who prioritize in-depth market analysis. It provides a wide array of features including real-time data, customizable charts, technical indicators, and a social trading environment. The platform supports a community-driven approach where users can share insights and trading strategies.

2.1.1. Key Features

- Comprehensive Charting: Hundreds of indicators and tools for detailed market analysis.

- Community & Social Trading: Engage with other traders and share strategies.

- Customizable Interface: Tailor the workspace to suit your trading needs.

2.1.2. Pros

- Advanced charting tools superior to many competitors.

- Large, active community for sharing and learning.

- Flexibility in customization and tool use.

2.1.3. Cons

- May be overwhelming for beginners due to its complex features.

- No integration with popular third-party platforms like MetaTrader.

2.1.4. Ideal for

Technical traders who need detailed charting and analysis tools and those who enjoy a community-driven trading approach.

Comparison with eToro

| Feature | TradingView | eToro |

|---|---|---|

| Charting Tools | Extensive and customizable | Basic with some integration |

| Social Trading | Community-driven insights | Copy trading focused |

| User Interface | Highly customizable | More streamlined |

| Fees | Variable based on subscription | Spread-based pricing |

| Regulation | Less regulatory oversight | Strong global regulation |

| Market Access | Extensive market instruments | Broad range including NFTs |

| Mobile App | Highly rated apps | Also highly rated |

| Demo Account | Available | Available |

| Minimum Deposit | None required for basic access | $50 |

TradingView offers more sophisticated analytical tools and a more customizable interface, which might appeal to experienced traders who find eToro’s options too basic or constrained. However, eToro provides stronger regulatory backing and a more social trading-focused experience.

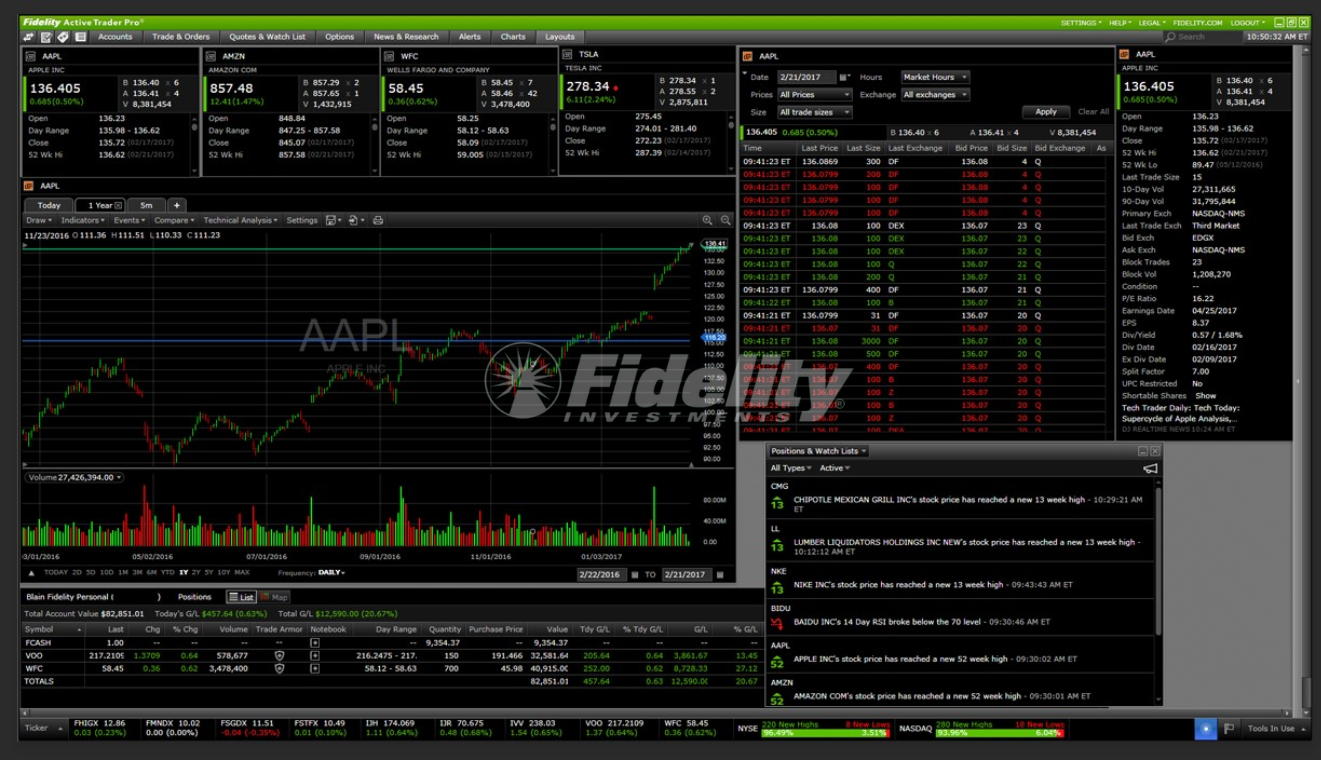

2.2. Active Trader Pro

Active Trader Pro, developed by Fidelity, is designed to cater to the needs of active traders seeking advanced trading tools and a customizable trading experience. It offers a robust set of features including real-time analytics, dynamic visual analytics, and options trading capabilities.

2.2.1. Key Features

- Advanced Trading Tools: Includes over 45 market filters, options probability calculators, and advanced charting.

- Customization: Users can personalize layouts, set trade defaults, and utilize hotkeys for efficient navigation.

- Directed Trading: Offers capabilities for directed trading, allowing greater control over trade execution.

2.2.2. Pros

- Highly customizable interface suitable for tailoring to individual trading needs.

- Comprehensive tools for options trading, including strategy builders and detailed options chains.

- No commission on U.S. stock, ETF, and option trades, competitive margin rates.

2.2.3. Cons

- Steeper learning curve due to advanced features, which may be challenging for beginners.

- Some users find the platform complex to navigate initially.

- Customer service experiences can vary, with some reports of difficulties in navigation and support.

2.2.4. Ideal for

Active traders who need extensive tools and customization options to execute a variety of trading strategies, especially those involved in options trading.

Comparison with eToro

| Feature | Active Trader Pro | eToro |

|---|---|---|

| User Interface | Highly customizable, complex | User-friendly, simpler interface |

| Trading Tools | Extensive tools for advanced trading | Basic tools, with strong social trading |

| Options Trading | Comprehensive options trading suite | Limited options trading capabilities |

| Commission Fees | No commission on U.S. stocks and options | Spread-based fees and other charges |

| Customer Service | Variable, can be challenging | Generally accessible but varies by region |

| Learning Resources | Extensive, including tutorials and webinars | Rich educational content via eToro Academy |

| Market Access | Strong focus on U.S. markets | Broad international market access |

| Mobile App | Efficient and functional | Highly rated, intuitive app |

Active Trader Pro offers a highly customizable platform with sophisticated trading tools, making it better suited for traders who engage frequently in complex trades, particularly with options. It contrasts with eToro’s more accessible but less customizable interface, which is geared more towards social and copy trading.

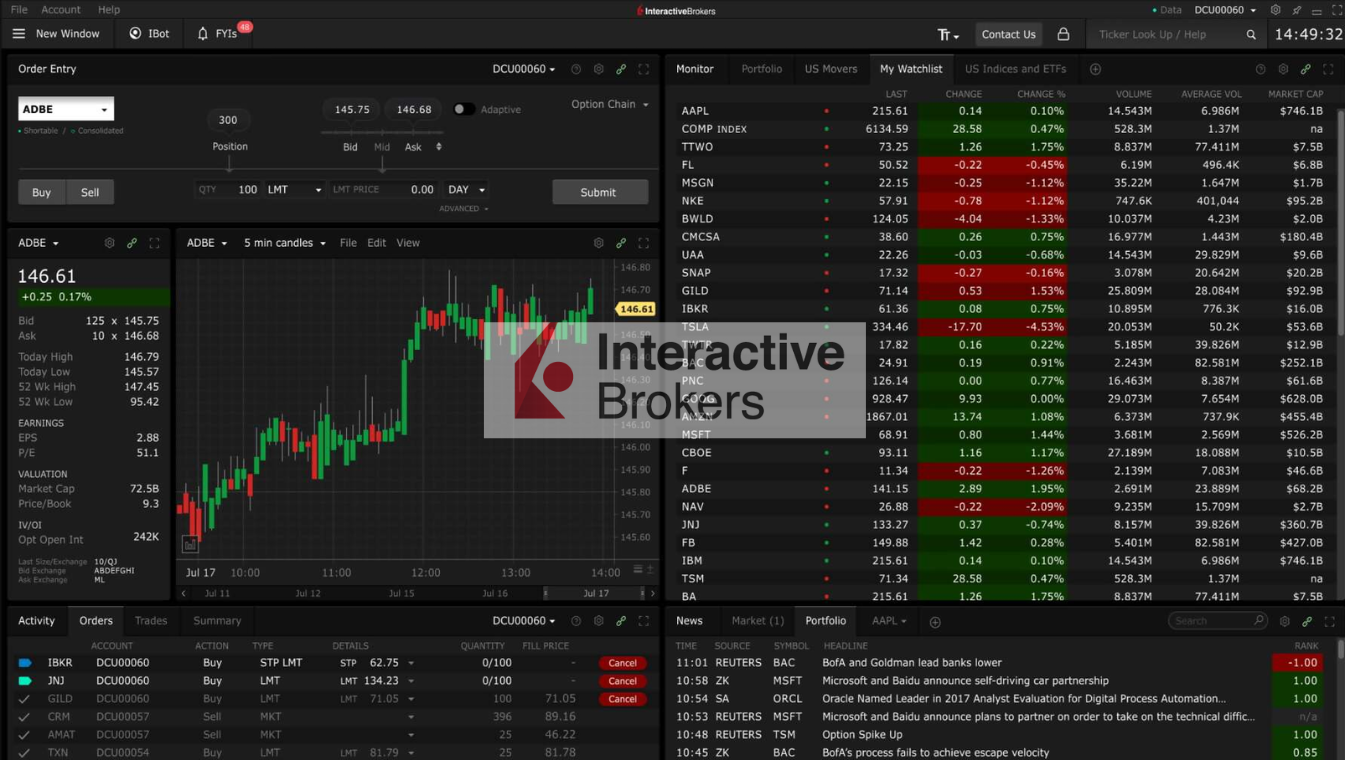

2.3. Trader Workstation (TWS)

Trader Workstation (TWS), offered by Interactive Brokers, is a powerful trading platform designed for experienced traders who demand a high level of control and flexibility over their trading activities. TWS is known for its broad range of tools and functionalities that cater to complex trading strategies.

2.3.1. Key Features

- Comprehensive Market Access: TWS users can trade stocks, options, futures, forex, bonds, and funds across over 150 markets worldwide.

- Advanced Trading Tools: The platform offers over 100 different order types and algorithms to help traders manage their trading strategies effectively.

- Robust Risk Management: Features like real-time monitoring and what-if scenario analysis help traders stay on top of their potential risk exposures.

- Customizable Interface: TWS allows for highly customizable layouts, enabling traders to tailor the interface according to their specific needs.

2.3.2. Pros

- Extensive customization options for dashboard and trading environment.

- Access to a wide array of assets and markets not always available on other platforms.

- Powerful tools for both technical analysis and order management.

2.3.3. Cons

- The interface can be overwhelming for beginners due to its complexity.

- Requires installation on a desktop, limiting access compared to web-based platforms.

- The learning curve is steep, demanding significant time investment to become proficient.

2.3.4. Ideal for

Advanced traders who require detailed control over their trading operations and those involved in multi-product trading needing a robust platform with global market access.

Comparison with eToro

| Feature | Trader Workstation | eToro |

|---|---|---|

| User Interface | Complex, highly customizable | Simpler, user-friendly |

| Market Access | Extensive global markets | More limited market variety |

| Tools and Features | Advanced technical tools | Basic tools, strong in social trading |

| Order Types | Over 100 types, including algos | Standard types prevalent in retail trading |

| Mobile Trading | Available but less intuitive | Highly intuitive mobile platform |

| Demo Account | Advanced simulation features | Standard demo features |

| Educational Resources | Extensive resources for professionals | More beginner-focused resources |

| Commission Structure | Competitive rates for active traders | Spread-based with other fees |

Trader Workstation excels in offering a sophisticated trading environment with extensive tools and market access, catering well to professionals. In contrast, eToro provides a more accessible platform focusing on social trading and ease of use, which may appeal more to beginners or those who prefer a simpler trading experience.

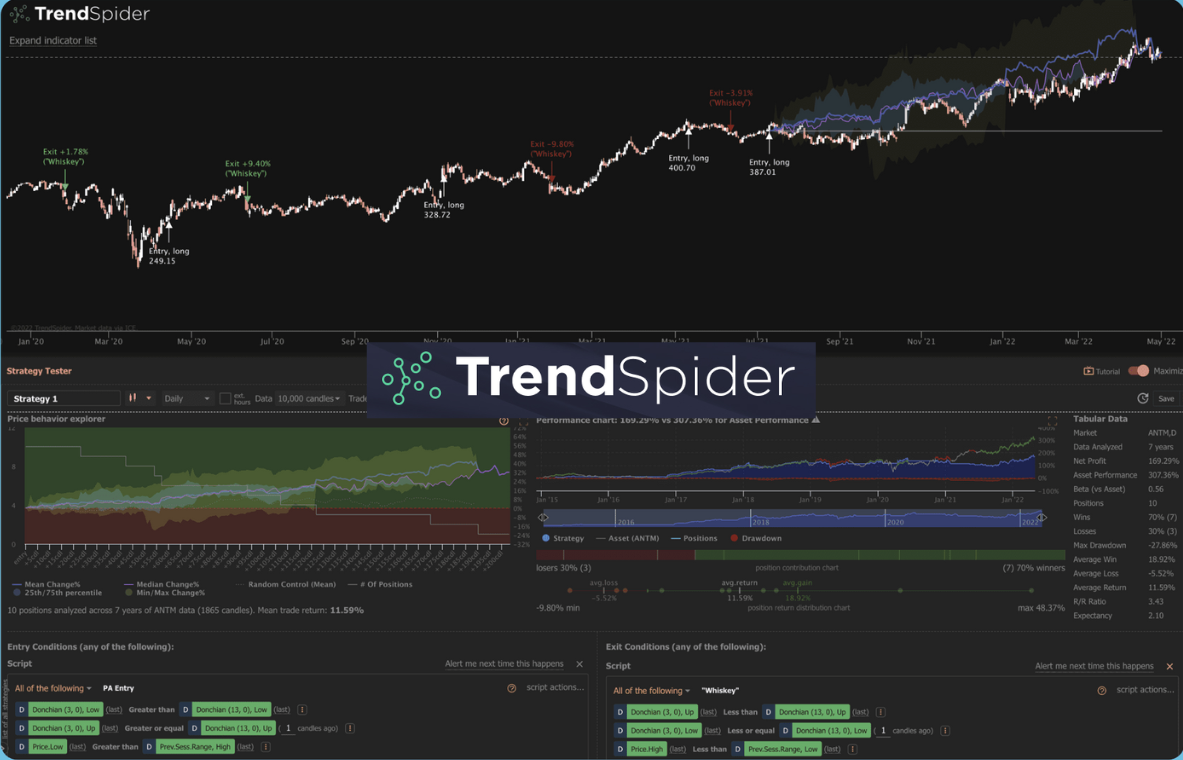

2.4. TrendSpider

TrendSpider is an advanced charting tool that leverages artificial intelligence to enhance technical analysis for traders. It’s designed for those who require precision and speed in their trading decisions, using automated tools to streamline processes.

2.4.1. Key Features

- Automated Technical Analysis: Utilizes AI to automatically detect and draw trend lines, chart patterns, and Fibonacci levels.

- Multi-Timeframe Analysis: Enables viewing multiple timeframes on a single chart for comprehensive analysis.

- Advanced Alert System: Customizable alerts based on specific trading indicators and movements.

- Backtesting Capabilities: Allows traders to test trading strategies against historical data.

2.4.2. Pros

- Offers a wide array of automated analysis tools that reduce the need for manual input and increase efficiency.

- Supports detailed customization options for charts and alerts, accommodating the needs of advanced traders.

- Provides integration with multiple data streams, including stocks, ETFs, forex, and cryptocurrencies.

2.4.3. Cons

- The high level of complexity and multitude of features can be overwhelming for beginners.

- Limited social trading features compared to platforms like eToro.

2.4.4. Ideal for

Experienced technical traders who benefit from using advanced charting tools and appreciate the integration of automated technologies to aid in decision-making.

Comparison with eToro

| Feature | TrendSpider | eToro |

|---|---|---|

| Technical Analysis | Extensive with automated AI features | Basic, more focused on social trading aspects |

| User Interface | Highly customizable, complex | Simpler, more intuitive for beginners |

| Trading Tools | Advanced tools for technical analysis | Basic tools, strong social and copy trading |

| Asset Coverage | Stocks, ETFs, forex, crypto, indices, futures | Primarily stocks, crypto, ETFs |

| Pricing | Starts at $97/month, with discounts available for annual plans | Free basic account, various fees for trading activities |

| Learning Resources | Limited compared to eToro | Extensive resources suitable for beginners |

TrendSpider excels in providing a technical analysis platform that automates many of the functions needed by advanced traders, which contrasts with eToro’s focus on accessibility and social trading features. It offers a robust solution for those who need detailed and automated analysis tools not typically found in more beginner-friendly platforms like eToro.

2.5. Sierra Chart

Sierra Chart is a professional trading and charting platform that has been in the market since 1996, offering a robust and customizable interface that caters to advanced traders. It is known for its comprehensive data integration and wide array of technical tools.

2.5.1. Key Features

- Comprehensive Charting Tools: Offers over 300 technical studies and indicators and supports a variety of charting types including TPO, Volume, and Market Depth profiles.

- Advanced Trading Capabilities: Includes features like automated trading, a functional Trading DOM fully integrated with charts, and direct connectivity to a multitude of data and trading services.

- High Customizability: Users can tailor almost every aspect of their interface and features to suit their trading styles and preferences.

2.5.2. Pros

- High-performance software that is suitable for detailed and complex analysis.

- Extensive customization and programmability, including support for C++ and various scripting for custom indicators and automated strategies.

- Offers both historical and real-time data directly, without the need for third-party services.

2.5.3. Cons

- Has a steep learning curve due to its comprehensive and complex features.

- User interface may appear dated compared to more modern platforms.

- Lacks built-in social trading features which are popular on platforms like eToro.

2.5.4. Ideal for

Professional traders and those who require detailed analytical tools for trading futures, stocks, and forex markets. It is especially suited for users who value deep data integration and high customizability in their trading platform.

Comparison with eToro

| Feature | Sierra Chart | eToro |

|---|---|---|

| User Interface | Highly customizable, complex | User-friendly, simpler for beginners |

| Technical Tools | Extensive and advanced | More basic, with an emphasis on social trading |

| Data Accessibility | Direct and extensive market data access | Limited to data provided through the platform |

| Trading Capabilities | Advanced trading options, including automated trading | More focused on manual and social trading |

| Market Focus | Comprehensive coverage including futures and options | Primarily stocks, forex, and crypto |

| Pricing | Competitive pricing with multiple service levels | Free entry level, various fees for advanced services |

Sierra Chart offers a powerful trading environment with high technical capability and extensive market data integration, making it a strong alternative to eToro for advanced traders who need more than basic charting and social trading features.

3. Factors to Consider When Choosing a Trading Platform

When selecting a trading platform, it’s crucial to consider various factors to ensure that the platform aligns with your trading needs and preferences. Here are the key aspects you should evaluate:

- User Interface and Usability: Choose a platform with an intuitive and user-friendly interface. It should be easy to navigate and allow for customization to fit your trading style, making it simpler to manage trades, analyze markets, and access necessary tools.

- Range of Instruments: Look for a platform that offers a wide variety of trading instruments. This flexibility is crucial as your trading interests might evolve over time.

- Security: Ensure the platform has robust security measures like data encryption and two-factor authentication. It should also comply with regulatory standards to protect your investments.

- Trading Costs: Understand the fee structure, including spreads, commissions, and any potential inactivity fees. Choose a platform that offers transparency in their pricing to avoid any hidden costs that could eat into your profits.

- Educational Resources: If you’re keen on improving your trading skills, opt for platforms that provide comprehensive educational materials like tutorials, webinars, and real-time market analysis.

- Customer Support: Good customer service is essential. Verify that the platform offers responsive and accessible support, ideally 24/7, to handle any issues that may arise.

- Performance and Reliability: The platform should be reliable and perform well even during high market volatility, without crashing or freezing. Fast execution speeds are also crucial to avoid missed trading opportunities.

- Demo Accounts: Especially if you are new to trading, check if the platform offers demo accounts. This allows you to practice and get familiar with the platform’s features without risking real money.

- Regulatory Compliance: Verify that the platform adheres to local laws and regulations, which can vary depending on your location. This compliance ensures that the platform is legally authorized to operate and offers a layer of protection to your trading activities.

| Factor | Description | Importance |

|---|---|---|

| User Interface | Should be intuitive, customizable, and easy to navigate. | Essential for efficient trading and accessibility. |

| Range of Instruments | Platform should offer a diverse range of trading instruments. | Allows flexibility as trading interests evolve. |

| Security | Robust security measures are crucial, including data encryption and regulatory compliance. | Protects personal and financial information. |

| Trading Costs | Understanding all associated costs, such as spreads and commissions. Transparent pricing is crucial. | Direct impact on profitability and trading strategy. |

| Educational Resources | Platforms should offer materials like tutorials, webinars, and real-time market analysis to support learning. | Helps traders improve skills and make informed decisions. |

| Customer Support | Should be responsive and accessible, ideally 24/7. | Ensures support is available when issues arise. |

| Performance and Reliability | Platform should be reliable and perform well, especially during high market volatility. Fast execution speeds are crucial. | Prevents potential losses due to technical issues. |

| Demo Accounts | Allows new traders to practice without risk. | Provides a safe environment to learn the platform’s features. |

| Regulatory Compliance | Must comply with local laws and regulations, ensuring legal operation and additional security. | Ensures platform’s legality and operational integrity in your region. |

4. Matching Your Trading Style to the Platform

Choosing the right trading platform involves aligning the platform’s capabilities with your specific trading style. Each style has unique requirements in terms of platform features, tools, and overall trading environment.

4.1. Beginner Trader

If you’re just starting out, look for platforms that are known for their ease of use, comprehensive educational resources, and robust customer support. These features help beginners navigate through their early trading days, making the learning process smoother and more effective.

4.2. Social/Copy Trader

Social or copy trading platforms like eToro are ideal for traders who prefer to leverage the insights and strategies of other successful traders. These platforms allow users to replicate the trades of experienced traders automatically, thus they should offer a transparent view of trader performance and a strong social trading community.

4.3. Experienced/Active Trader

Active traders need platforms that can handle a high volume of trades quickly and efficiently. Key features include advanced charting tools, a wide range of technical indicators, and the ability to customize the trading interface. Platforms that offer low latency, high reliability, and real-time data are preferred.

4.4. Long-term Investor

For those who adopt a buy-and-hold strategy, platforms that offer a wide range of investment options and low transaction fees are crucial. Look for platforms that provide comprehensive research tools, fundamental analysis resources, and robust portfolio management features.

| Trading Style | Key Platform Features |

|---|---|

| Beginner Trader | User-friendly, educational resources, robust customer support |

| Social/Copy Trader | Strong social features, transparent trader profiles |

| Experienced/Active Trader | Advanced tools, high reliability, low latency |

| Long-term Investor | Low fees, broad investment options, strong research tools |

Matching your trading style to the right platform enhances your trading effectiveness and overall experience. Each style benefits from different features, so it’s crucial to choose a platform that best fits your specific trading needs and goals.

Conclusion

Selecting the ideal trading platform is not about finding the universally “best” platform, but rather the one that aligns perfectly with your specific trading needs and goals. Each trader’s choice will vary based on individual factors such as trading style, experience level, and the types of assets they intend to trade. Whether you are a beginner seeking educational resources and simplicity, a social trader looking for a robust community, or an experienced trader in need of advanced tools and fast execution, understanding the features and capabilities of different platforms is crucial.

As the trading world evolves, so might your needs, making it important to continually reassess your choice of platform. Always consider the platform’s security, user interface, toolset, and cost structure, ensuring they align with your trading strategies and budget. Remember, the superior choice is always the one that best supports your individual trading journey, helping you to trade confidently and effectively.

By carefully weighing these considerations, you can choose a trading platform that not only meets your immediate needs but also supports your growth as a trader, enhancing your potential for success in the dynamic world of trading.