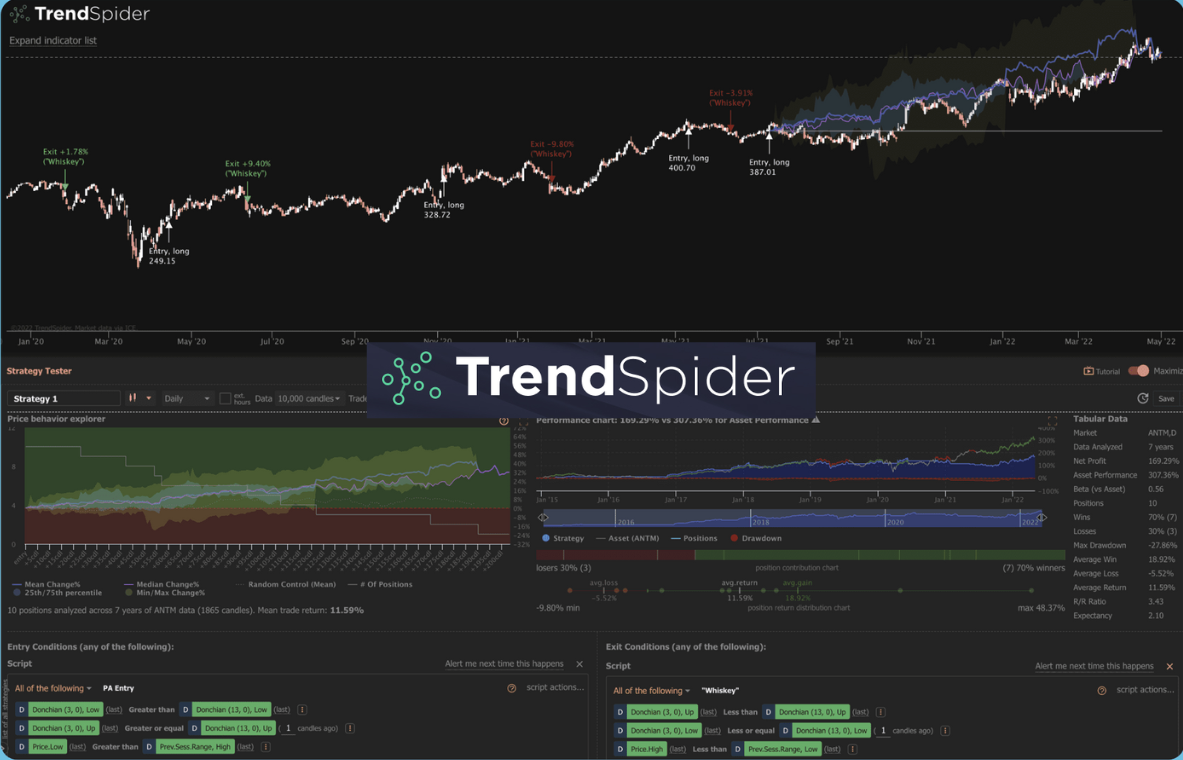

1. Overview Of TrendSpider

In the complex landscape of financial trading, the right analytical tools can significantly enhance decision-making processes. TrendSpider is a notable platform that leverages automated technical analysis tools to simplify and enhance the trading experience. Its innovative approach to automating tedious aspects of chart analysis has positioned it as one of the best charting software solutions available today.

Despite its robust features, traders often seek alternatives to TrendSpider to suit different trading needs or preferences. Exploring other platforms can offer tailored solutions that might better meet individual trading strategies, whether due to a desire for different functionalities, a more diverse asset selection, or unique user interface features.

| Aspect | Details |

|---|---|

| Key Focus | Automated technical analysis |

| Strengths | High automation, user-friendly charting, diverse market tools |

| Reasons for Seeking Alternatives | Preferences for asset variety, interface features, or additional functionalities |

2. Top 5 TrendSpider Alternatives

2.1. TradingView

TradingView stands out as a comprehensive platform that seamlessly integrates charting, social features, and trading tools, making it one of the most popular choices among traders. It offers a user-friendly interface that appeals to both novice and experienced traders alike, emphasizing community-driven insights and collaboration.

Key Features

- Comprehensive Charting: TradingView provides extensive charting options that allow traders to customize and analyse market data in real-time.

- Social Networking Features: The platform incorporates a strong social aspect where traders can share strategies, insights, and charts.

- Multi-Device Compatibility: Users can access TradingView on various devices, ensuring flexibility in trading.

- Broad Market Coverage: TradingView supports a wide range of asset classes including stocks, forex, cryptocurrencies, and more.

Pros

- Excellent Charting and Customization: Offers some of the most powerful and versatile charting capabilities in the market.

- Huge Community and Resources: Traders gain access to a vast pool of shared knowledge and trading strategies.

- Wide Range of Asset Classes Supported: Suitable for trading a diverse array of markets.

Cons

- Can Be Overwhelming for Beginners: The wealth of features and data might be daunting for new traders.

- Free Plan Limitations: Essential features might be restricted on the free plan, necessitating an upgrade for full functionality.

Who’s It Best For

TradingView is ideal for traders who are seeking a highly customizable, all-in-one solution with a strong community aspect, making it a superb platform for those who appreciate collaboration and extensive tools.

Comparison Table Against TrendSpider

| Feature | TradingView | TrendSpider |

|---|---|---|

| Charting Capabilities | Extensive and customizable | Automated with less customization |

| Community Features | Strong social networking capabilities | Limited social features |

| Ease of Use | Moderate, can be overwhelming | User-friendly, straightforward |

| Asset Classes | Supports a wide variety, including crypto | Mainly stocks and forex |

| Ideal for | Advanced traders and those who value community interaction | Traders focusing on automated technical analysis |

2.2. TC2000

TC2000 is renowned for its speed, advanced scanning capabilities, and access to extensive historical data. This platform caters especially to data-driven traders who rely on detailed analysis and fast execution to make informed trading decisions.

Key Features

- Powerful Scanning Tools: TC2000’s software excels in scanning the market for stocks that meet predefined criteria, providing real-time alerts.

- Extensive Historical Data: Access to vast historical datasets helps traders perform thorough backtesting to validate their trading strategies.

- Customizable Interface: Traders can tailor the workspace to fit their needs, enhancing the overall user experience.

- Technical Analysis Tools: Offers a wide range of technical indicators and drawing tools for in-depth market analysis.

Pros

- Powerful Real-Time Scanning: Allows for quick identification of trading opportunities based on set parameters.

- Extensive Historical Data for Backtesting: Traders can rigorously test their strategies against historical market data.

- Highly Customizable: Enables a personalized trading experience through extensive customization options.

Cons

- Can Have a Steeper Learning Curve: The wealth of features and tools might be challenging for beginners.

- Less Focus on Automated Trend Drawing: Does not prioritize automated analysis as much as some other platforms, like TrendSpider.

Who’s It Best For

TC2000 is best suited for data-driven traders who prioritize scanning, backtesting, and in-depth technical analysis, making it a powerful tool for those who delve deeply into market data.

Comparison Table Against TrendSpider

| Feature | TC2000 | TrendSpider |

|---|---|---|

| Scanning Tools | Advanced, real-time scanning capabilities | Automated but less detailed |

| Historical Data | Extensive access for backtesting | Limited historical data access |

| Customization | Highly customizable interface | More automated, less customizable |

| Learning Curve | Steeper, due to complex features | Easier for beginners |

| Ideal for | Traders focusing on detailed technical analysis and backtesting | Traders looking for automated trend analysis |

3.3. MetaStock

MetaStock focuses on providing powerful tools for backtesting and system development, making it an excellent choice for traders who want to rigorously test and develop their own trading systems. It stands out for its robust analytical capabilities and the ability to code custom indicators and strategies.

Key Features

- Robust Backtesting Capabilities: Allows traders to test trading strategies against historical data to gauge their effectiveness.

- Custom Indicator and Strategy Development: Traders can create and customize their own indicators and strategies using MetaStock’s coding environment.

- Real-Time Data and News: Provides up-to-the-minute data and news to keep traders informed of market conditions.

- Wide Range of Pre-built Systems: Offers a variety of ready-to-use trading systems and templates.

Pros

- Robust Backtesting Capabilities: Exceptionally strong in enabling detailed testing of trading strategies.

- Coding Environment for Custom Indicators/Strategies: Supports advanced users who want to implement proprietary trading techniques.

- Wide Range of Pre-built Systems: Offers numerous built-in systems to help traders start quickly.

Cons

- Charting Can Feel Slightly Dated: Some users might find the visual aspects of charting tools less modern compared to newer platforms.

- Less Intuitive for Purely Visual Traders: The platform’s focus on technical and quantitative analysis may not suit traders who prefer a more visual and less technical approach.

Who’s It Best For

MetaStock is particularly well-suited for traders who are serious about developing and testing their own trading systems. Its strength in backtesting and customization makes it ideal for technical analysts and system developers.

Comparison Table Against TrendSpider

| Feature | MetaStock | TrendSpider |

|---|---|---|

| Backtesting Capabilities | Extremely robust, with advanced options | Basic automated analysis |

| Customization | High customization with coding environment | Automated with limited customization |

| User Interface | More complex, less modern | More modern and user-friendly |

| Target User | System developers and technical analysts | Casual traders seeking automation |

| Ideal for | Developing and testing complex strategies | Simplified technical analysis |

2.4. MotiveWave

MotiveWave is a feature-rich platform tailored for traders who rely heavily on specific technical analysis methods like Elliott Wave, Fibonacci, and more. It’s known for its advanced tools and options analysis capabilities, appealing to those who need detailed and specialized technical insights.

Key Features

- Advanced Technical Analysis Tools: Specialized in Elliott Wave, Fibonacci, Gann, and other forms of technical analysis.

- Options Analysis Capabilities: Provides tools and features specifically designed for options trading.

- Active User Community: Engages a community of users who focus on advanced technical analysis, providing a platform for knowledge sharing.

- Highly Customizable Interface: Allows users to tailor almost every aspect of their trading experience.

Pros

- Specialized Technical Analysis Tools: Offers some of the most sophisticated tools for traders focused on advanced technical methods.

- Options Analysis Capabilities: Robust support for options traders with specific tools and analytics.

- Active User Community: Benefits from a knowledgeable community that shares advanced trading strategies and insights.

Cons

- Pricing on the Higher End: MotiveWave tends to be more expensive, reflecting its advanced capabilities.

- Some Advanced Features Can Have a Learning Curve: The depth of features may require a steeper learning curve.

Who’s It Best For

MotiveWave is ideal for traders who need advanced technical analysis tools and are particularly focused on methods like Elliott Wave and Fibonacci. Its comprehensive features make it suitable for those who are willing to invest in mastering these complex techniques.

Comparison Table Against TrendSpider

| Feature | MotiveWave | TrendSpider |

|---|---|---|

| Technical Analysis Tools | Advanced, with specific methodologies | Standard, automated |

| Options Trading Support | Extensive options analysis tools | Limited or no specific options tools |

| User Community | Active, with a focus on advanced techniques | Less focused on advanced techniques |

| Price | Higher due to advanced capabilities | More accessible pricing |

| Ideal for | Advanced technical traders | Casual traders seeking ease of us |

2.5. Trade Ideas

Trade Ideas excels with its AI-powered idea generation and scanning capabilities, positioning itself as a powerful tool for traders looking for inspiration and automation, especially in active day trading scenarios. Its strength lies in quickly uncovering potential trade setups and offering extensive backtesting functionality.

Key Features

- AI-Powered Trade Scanning: Uses artificial intelligence to scan markets and suggest potential trades based on real-time data.

- Pre-built Scans and Strategies: Offers a variety of ready-to-use scans and strategies to help traders identify opportunities quickly.

- Backtesting Functionality: Allows traders to test their strategies against historical data to assess effectiveness.

- Holistic View of Market Trends: Provides a comprehensive overview of market trends, helping traders make informed decisions.

Pros

- Uncovers Potential Trade Setups Quickly: AI tools help identify opportunities faster than manual analysis could.

- Pre-built Scans and Strategies: Saves time and effort with ready-made trading solutions.

- Backtesting Functionality: Enables robust evaluation of trading strategies before application in live markets.

Cons

- Focus is on Idea Generation, Less on In-depth Charting: While excellent for generating trade ideas, it may not offer the depth of charting tools that some traders require.

- Can Be Overwhelming for Those Who Want Full Manual Control: The automation and AI-driven features might not appeal to traders who prefer to control every aspect of their trading strategy.

Who’s It Best For

Trade Ideas is best for traders who are looking for a dynamic, AI-driven approach to trading, particularly suited to active day traders who value speed and efficiency over manual controls.

Comparison Table Against TrendSpider

| Feature | Trade Ideas | TrendSpider |

|---|---|---|

| AI and Automation | Advanced AI for scanning and suggestions | Basic automation in analysis |

| Trade Idea Generation | Powerful, with quick identification of opportunities | Less focused on idea generation |

| Backtesting | Robust backtesting capabilities | Limited backtesting features |

| Charting Tools | Less focus on in-depth charting | More comprehensive charting options |

| Ideal for | Active day traders, AI-driven strategies | Traders seeking automated technical analysis |

3. Finding The Best Alternative That Suits You

Choosing the right trading platform is essential but varies greatly depending on individual trading styles, goals, and experience levels. While platforms like TradingView, TC2000, MetaStock, MotiveWave, and Trade Ideas offer a range of specialized tools, the best choice for you will hinge on several key factors:

Factors to Consider When Selecting a Trading Platform

- Feature Set: Assess whether the platform offers the specific tools and functionalities you need for your trading strategies, such as advanced charting, AI-driven insights, or extensive backtesting capabilities.

- Ease of Use: Determine how user-friendly the platform is. A more intuitive interface can significantly enhance your trading efficiency, especially if you are a beginner.

- Cost: Consider the cost-effectiveness of each platform. Evaluate whether the benefits and features provided justify the price, and check if there are any hidden fees or required add-ons.

- Community and Support: The strength and activity of a platform’s user community can be a valuable resource. Also, consider the quality and availability of customer support, which can be crucial for resolving technical issues or during market crises.

- Customization and Scalability: Some traders may require highly customizable platforms that can scale with growing needs, including the ability to integrate third-party tools or data feeds.

- Speed and Reliability: For day traders and those who trade on very short time frames, the speed of data and execution reliability can be critical factors.

Making an informed decision involves more than just comparing features; it requires a thorough understanding of how each platform aligns with your specific needs and trading style.

| Consideration | Description |

|---|---|

| Feature Set | Ensure the platform has the tools you need, like AI analytics, live data feeds, or specific charting capabilities. |

| Ease of Use | Look for an intuitive interface suitable for your skill level and trading style. |

| Cost | Assess overall value considering both upfront costs and ongoing fees. |

| Community and Support | Evaluate the strength of the user community and the responsiveness of customer support. |

| Customization and Scalability | Consider if the platform allows customization and can adapt to your growing needs. |

| Speed and Reliability | Ensure the platform performs well during high-volume periods, particularly for strategies that rely on real-time data. |

Conclusion

Exploring alternatives to Thinkorswim showcases a variety of platforms, each with unique features suited to different trading needs. From TradingView’s comprehensive charting and community-driven insights to Trade Ideas’ AI-enhanced scanning, the choices cater to a range of trading styles and preferences.

To find the most suitable platform, consider each option’s features, ease of use, and cost-effectiveness. By actively researching and testing demos, traders can select a platform that not only meets their needs but also enhances their market performance and trading success.