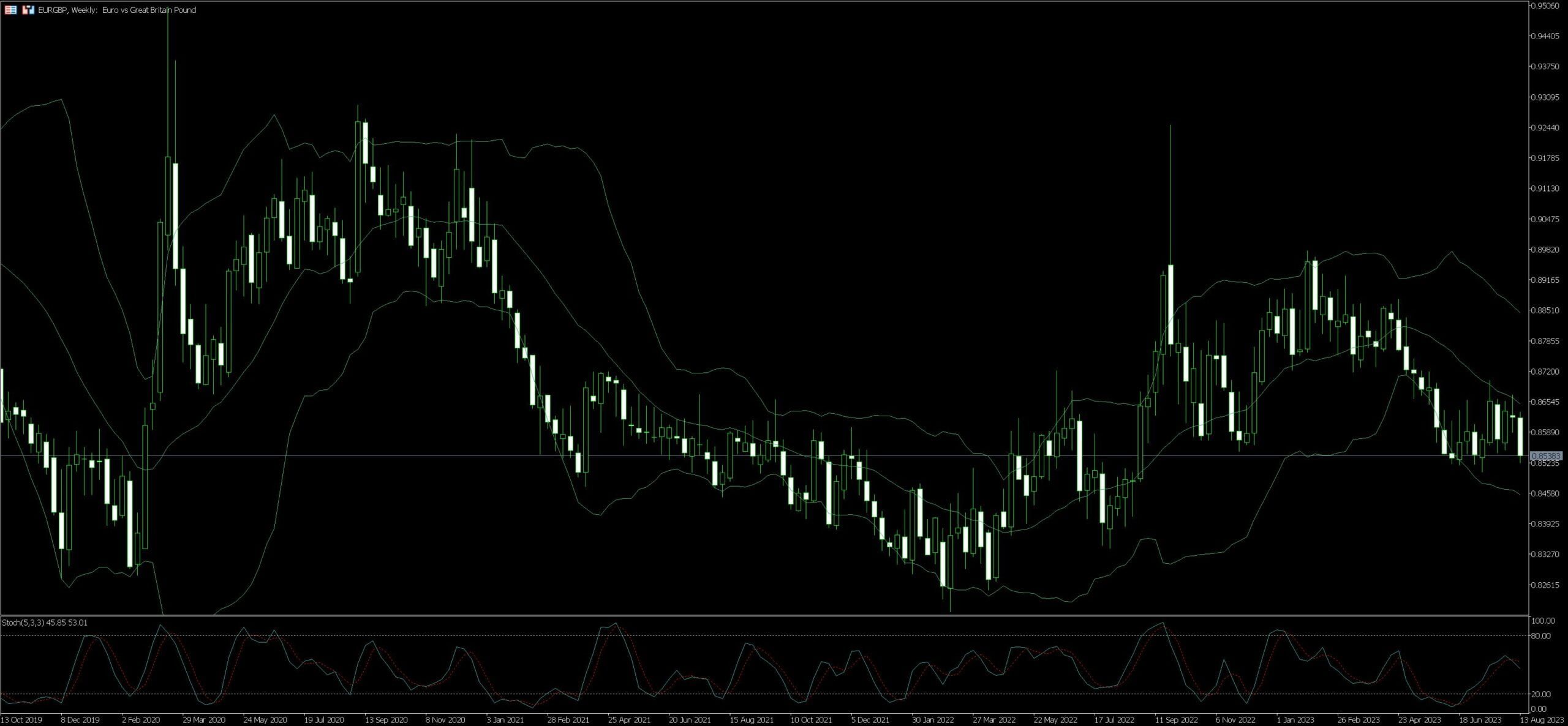

Live Chart Of EUR/GBP

1. Understanding EUR/GBP Currency Pair

The EUR/GBP currency pair, refers to the comparison of the Euro against the British Pound in foreign exchange markets. This forex pair is among the most traded, with fluctuating currency values consistently offering ample potential for profit. With both currencies originating from two of the globe’s biggest economies, each country’s economic health strongly impacts this forex pair’s movements.

These economic impacts can include shifts in interest rates, changes in gross domestic product (GDP), or political events such as Brexit. If, for example, the Euro-Zone announces a hike in interest rates, this could strengthen the Euro against the Pound. Traders would then look at purchasing EUR/GBP, expecting the pair to increase in value.

Technical analysis often plays a pivotal role in trading the EUR/GBP pair. Traders analyze various graphs, charts, and historical price movements to predict future fluctuations. These technical indicators include momentum indicators like the moving average convergence divergence (MACD), and volatility indicators like Bollinger bands.

Understanding the major fundamental factors that influence this currency pair is just as vital. Things such as changes in monetary policies, economic reports, and geopolitical events can all affect the EUR/GBP significantly. By seamlessly combining technical and fundamental analysis, traders can better make informed and strategic trading decisions.

While risks are inherently present in forex trading, strategies can help mitigate them. Traders set stop-loss points to limit potential losses, and take-profit points to ensure they get the most out of their winning trades. Thus, successful trading of EUR/GBP lies in a blend of thorough analysis, risk management, and continuous learning.

1.1. Basics of Forex Trading

Trading the EUR/GBP pair effectively necessitates a solid understanding of forex trading’s fundamental principles. The foreign exchange, or forex, market operates on the concept of selling one currency to purchase another, with the primary goal of making a profit from the exchange rate fluctuations. Forex trading is a highly competitive, high-risk, and high-reward industry, making it of profound interest to traders worldwide.

In the forex market, currencies are paired against one another, such as EUR (Euro) against GBP (Great British Pound). The currency on the left is known as the base currency, while the one on the right is the quote currency. An increase in the EUR/GBP rate signifies that the Euro is strengthening against the Pound, signaling a good time to buy. Conversely, a decrease indicates the Pound growing stronger, which could be an excellent opportunity to sell.

The trade process is surprisingly straightforward. A trader initially opens an account with a forex broker, deposits funds, and uses a trading platform to make trades. Risk management should always be prioritized in forex trading—this usually involves setting stop-loss orders beyond which a trader doesn’t want to endure a loss.

Understanding economic factors impacting the EUR/GBP is invaluable for forex trading. Both these currencies are influenced by different economic indicators such as Gross Domestic Product (GDP), interest rates, inflation, and political stability. For example, if the European Central Bank (ECB) raises interest rates, the Euro would typically gain strength against other currencies—leading to a potential rise in the EUR/GBP quote.

Finally, successful EUR/GBP trading also involves technical analysis, a forecasting method based on the study of past market data, primarily price and volume. Traders use graphs, charts, and various mathematical calculations to predict future price movements. Fibonacci retracement, moving averages, and trend lines are some popular technical analysis tools that forex traders might use.

Forex trading presents endless possibilities, but it requires a keen understanding of the underpinning principles for a trader to operate successfully. Always be cognizant of the prevailing economic conditions and use a robust risk management strategy. After all, the path to sustained success in forex trading is typically a marathon, not a sprint.

1.2. Why Trade EUR/GBP

Trading the EUR/GBP currency pair boasts a number of compelling advantages. First, with its consistently high liquidity, traders can expect minimal slippage and tight bid-ask spreads. This means transactions can be conducted with both ease and precision, thereby offering greater control over trading decisions.

Furthermore, this pairing utilises two of the world’s most powerful currencies, offering not only stability but also exposure to two major economies: the Eurozone and the UK. Factors that influence the economies of the Eurozone and the UK often create financial market volatility. Savvy traders can use this volatility to predict potential currency movements, offering ample opportunities for significant returns.

EUR/GBP, as a major currency pair, also typically enjoys extensive coverage from the global financial press. Traders can leverage this plethora of information to gain a depth of market insight that is just not available with some of the more obscure currency pairs. This unparalleled access to quality analysis and forecasting tools helps traders make informed decisions, optimising their strategies in a dynamic financial landscape.

2. Successful Trading Strategies for EUR/GBP

Understanding the dynamics of the market is essential when trading the EUR/GBP pair. The cross pair of two powerful currencies demands a strategic approach. One reliable method is practicing Technical Analysis. This approach involves analyzing past market data, primarily price and volume, to forecast future price movements. Traders often use indicators like Moving Averages, RSI, and MACD to identify trend direction and potential reversal points.

On the other hand, some traders prefer using Fundamental Analysis, considering factors that affect the economies of the European Union and the United Kingdom. Key economic data such as GDP reports, inflation rates, and political developments significantly impact the cross pair.

Moreover, the Carry Trade Strategy can also be employed in EUR/GBP trading. This strategy involves borrowing in a low-interest-rate currency (in this case, the EUR) and investing in a high-interest-rate currency (the GBP). The aim is the interest rate differential between the two currencies, which can provide substantial returns.

Utilizing the Pair Trading Strategy can be a viable approach too. Here, traders simultaneously go long and short on two highly correlated currencies like the EUR and GBP. The idea behind this strategy is to net off the positive and negative movements, with the overall profit being the difference between the two.

Regardless of the chosen strategy, risk management is paramount. Using tools like stop-loss orders and take profit orders, can help limit losses and secure profits. Additionally, it is important to keep an eye on the economic calendar to stay abreast of major market events that could cause extreme volatility. Even though these strategies have been observed to succeed, past performance does not guarantee future results.

2.1. Fundamental Analysis

Fundamental analysis is a potent tool that enables traders to gauge the intrinsic value of an asset, such as EUR/GBP, by examining related economic and financial factors. This method considers variables such as interest rates, employment reports, and political events that can impact exchange rates.

Consider the correlation of interest rates between the European Central Bank and the Bank of England. If the ECB raises interest rates while the Bank of England keeps theirs steady, this will likely strengthen the Euro against the British Pound. Conversely, if the Bank of England hikes rates while the ECB remains unmoved, this might bolster the British Pound against the Euro.

Employment reports are another significant factor. Strong employment numbers generally strengthen a currency as they signify economic stability and growth prospects. For instance, if the unemployment rate falls in the European Union but rises in the UK, this could potentially lead to an appreciation of the Euro against the British Pound.

On the political front, situations like Brexit can cause significant volatility. The uncertainty leading up to the UK’s withdrawal from the EU caused the Euro to strengthen against the Pound. However, once the withdrawal agreement was confirmed and the uncertainty diminished, the Pound regained strength.

Fundamental analysis requires a significant understanding of economic concepts and the ability to interpret complex data. Nevertheless, by understanding these concepts and leveraging this knowledge, traders can make more informed decisions when trading EUR/GBP.

2.2. Technical Analysis

Technical analysis is an essential tool when planning to trade EUR/GBP. The ability to read and understand charts, indicators, and patterns can make the difference between a successful trade and an unsuccessful one. This form of analysis primarily involves the study of past and current price action for predicting future market behaviour.

For instance, traders can leverage trend lines to understand the direction of the pair’s movement. A downward trend may imply selling opportunities, where an upward trend represents buying prospects. Meanwhile, support and resistance levels give insights into the price levels which the asset has trouble moving beyond.

A prominent concept used in technical analysis is candlestick patterns. Candlestick patterns represent price movement in a specified timeframe and can signal potential market reversals or continuations. Having a grip on these can assist traders in making decisions on when to enter or exit a trade.

Through indicators like moving averages, traders can smooth the price data to form a line that negates the daily price fluctuations and shows only the underlying trend. Another widely used tool is the Relative Strength Index (RSI), which identifies overbought or oversold conditions in the market.

Additionally, Fibonacci retracement is a tool that allows traders to highlight potential support and resistance levels. These levels are mathematical levels based on the ratios from the Fibonacci sequence and can help in predicting future price movements.

The power of technical analysis cannot be understated in trading EUR/GBP. It can offer substantial trading signals and opportunities when combined with an understanding of the broader economic picture. Sharpening skills in these areas can be highly beneficial for traders intent on navigating the intricacies of the forex market effectively.

2.3. Risk Management Strategies

Risk management is an inherited part of any trading activity, including trading EUR/GBP. It is pivotal to the success and sustainability of a trading venture. Traders have to comprehend, when venturing into the world of foreign exchange markets, no trade is devoid of risk. This is why a vigilant attitude towards risk management can be the backbone of a robust trading strategy.

It is apt to emphasise that ‘stop-loss’ orders are an essential tool for risk management. These automated orders serve the purpose of limiting a trader’s loss on a position. The stop-loss order is executed when the market price reaches a pre-defined level. It is a way to keep losses to a minimum and save the trader’s capital for future undertakings.

In light of this, another significant measure to be considered under risk management is the ‘take-profit’ order . This tool allows traders to automatically close a trade when the market reaches the desired level of profit. Thus, by utilizing take-profit orders, traders secure profits and eliminate emotional decision-making.

Such risk management strategies also include diversification . It stands as a core tenet of risk management, involving an appropriate mix of investment types within a portfolio. This is crucial to diminish exposure to risk and increase the potential for returns amidst volatile market conditions.

Lastly, it is imperative to keep track of leverage usage . While leverage can magnify profits, it could dramatically augment losses. Ensuring consistent monitoring of leverage ratios and adapting them based on market conditions is a factor of grave importance.

Aforementioned measures heed attention to the prudent observation that risk management is an ongoing process and not a one-time checklist to skim through. Mismanaging risks could turn profitable strategies into losing ones. Therefore, effective risk management strategies are not optional; they are indispensable to the success of trading in any foreign exchange market.

3. Maximize Profit from EUR/GBP Trading

Delving into the realm of EUR/GBP trading requires a comprehensive understanding of market principles. The unique volatility of this trading pair demands attention to specific strategies, designed to bolster the profit potential while minimizing risk exposure. One pivotal tool in the arsenal of EUR/GBP trader is the pivot point strategy. It pivots on the philosophy of capitalizing on the currency pair’s volatility, through accurate prediction of market reversal points.

Leveraging the fundamental and technical analysis aids a trader to decipher market trends, thus functioning as the backbone of the pivot point strategy. With a keen observance of the EUR/GBP market, sustained by quantitative analysis, traders can distinguish market reversals swiftly. As markets fluctuate, understanding these highs and lows can point to lucrative trading opportunities.

Another pivotal strategy revolves around the precise timing of trades. A trader must be adept at observing vital economic indicators. Factors such as interest rates, inflation rates, gross domestic product quantities and unemployment rates significantly influence the currency pair prices. Any competitive edge derived from these indicators can be harnessed for maximized profits.

An essential part of EUR/GBP trading lies with leveraging stop-loss orders. Stop-loss orders act as a safety net, limiting potential losses, and act as a buffer against unpredictable market variability. When the market moves against a trade, the stop-loss order minimizes the damage, making it a crucial asset in profitable EUR/GBP trading. Thus, integrating stop-loss orders imbues the trading strategy with a level of financial security.

Yet another aspect that demands trader attention is the practice of ‘scaling in’ and ‘scaling out’. Increasing trade size during profitable periods and reducing it during less prosperous ones is a pragmatic approach to managing risk. This adaptive trading method impacts the trading strategy positively, creating a balance between risk and reward.

Consider the use of leverage carefully while trading EUR/GBP. While it can significantly magnify profits, it also amplifies potential losses. Therefore, deploying leverage should be approached with cautious optimism and a clear understanding of the associated risks.

Finally, the most potent advantage in trading is acquired through continuous education. Staying updated with market trends, economic news, and refining trading tactics offers an edge over others. A trader’s perceptions, ability to adapt and intuitive proficiency shape the trading strategy and the subsequent profitability from EUR/GBP trading.

3.1. Picking the Right Trading Time

Trading Time signifies periods during which financial markets are open for trading and can greatly impact the outcomes. The EUR/GBP currency pair ties to both the European and UK markets; therefore, it is pivotal to consider when these markets are at their most dynamic. Conventional wisdom tells us that the busiest, and often most volatile, trading times are when market hours overlap. For the EUR/GBP pair, this would be between 7 am – 10 am GMT when the London and Frankfurt markets are both open, and again at 12 pm – 4 pm GMT when the London and New York markets overlap.

However, a busy market does not necessarily equate to a successful trading opportunity. High liquidity can lead to increased volatility, which requires sharp skills to navigate. Conversely, trading outside of these peak hours may present a more stable environment, albeit with potentially less opportunities.

Hence, there are a few crucial factors to consider: Your trading strategy, risk appetite, and personal schedule. High-frequency traders may thrive during peak hours, whilst those adopting a more conservative strategy may find it more suited to trade outside of such periods.

It’s important to highlight that while the ‘right’ trading time may increase the possibility of success, no time guarantees consistent profitability. The success of a trader depends on a blend of strategic planning, risk management, and perseverance. It’s also crucial not to underestimate the importance of a robust platform and an understanding broker in your trading journey.

While picking the right trading time is pivotal, traders must always remember that the foreign exchange market is highly unpredictable. Hence, securing the knowledge and awareness of a myriad of trading determinants is essential. This includes reading about and establishing the impact of economic events, political instability and myriad other factors that can all play into the day’s trade.

3.2. Leveraging your Trade

Leveraging your trade when it comes to the EUR/GBP pair holds immense potential. Generally, leverage is the use of borrowed capital to open or maintain a position in an investment market. By using leverage, you can increase your market exposure, allowing you to potentially make larger profits from smaller investments. However, it’s crucial to remember that while leverage can magnify gains, it also magnifies losses. Thus, precision and utmost caution is needed when leveraging your trades.

In the Forex market, traders use leverage to profit from the fluctuations in exchange rates between two countries. The leverage that is achievable in the forex market is one of the highest that traders can obtain. Therefore, the EUR/GBP pair can be an excellent choice for leveraging strategies due to its high liquidity and relatively stable prices as compared to other exotic forex pairs.

The EUR/GBP pair has its specifics and characteristics which make leveraging strategies work efficiently. It is influenced by many macroeconomic factors, such as interest rates, inflation, political events, and economic indicators, among others.

When trading the EUR/GBP pair with leverage, traders perform a careful analysis of these factors and how they may affect the exchange rate. They also need to consider their risk tolerance and adjust their leveraging strategy accordingly.

Applying leverage while trading EUR/GBP, or any other currency pair, involves certain risks. However, smart traders limit these risks by implementing some kind of stop-loss order and only investing money they can afford to lose. Trading platforms offer various tools to manage these risks and effectively leverage your trade.

Leveraged trading in the EUR/GBP pair can be a powerful part of a sophisticated trading strategy. With careful risk management, it offers the potential for significant returns. However, it’s crucial to understand the mechanics of leverage and the potential risks involved before diving in and implementing your trading strategy.

3.3. Ongoing Market Research and Learning

Immersing in ongoing market research along with continuous learning is the backbone of fruitful currency trading. Trends within the EUR/GBP market feature a never-static nature, evolving each day with global economic shifts, political developments, and other critical parameters. Therefore, a profound understanding of these fluctuations offers an upper hand in devising precise trading strategies.

Exploring valuable resources for market research includes scrutinizing financial news, updates from central banks, and economic data released by government agencies. It is beneficial to stay updated with events impacting the strength of the Euro or British Pound, affecting the EUR/GBP pair consequently.

Learning, as an ongoing effort, can govern the sustainability of earnings from currency trading. Multiple platforms provide insightful knowledge resources for novice or experienced traders. This may cover interactive webinars, insightful e-books, trading simulators, and comprehensive courses explaining intricate EUR/GBP market factors. Grasping these aspects can empower traders to analyze the EUR/GBP market meticulously.

In-depth technical analysis, incorporating chart patterns, indicators, and statistical data, can help to understand the possible future direction of EUR/GBP. Chart patterns can reveal trader psychology, while indicators can deliver signals to enter or exit trades.

Therefore, the integration of ongoing market research with steadfast learning can unfold stronger potentialities of the EUR/GBP trading market, shaping up the trader’s journey towards desired profit levels. Continuous refinement of trading strategies, based on an evolving understanding of the market and technical analysis, can facilitate remarkable trading experiences.