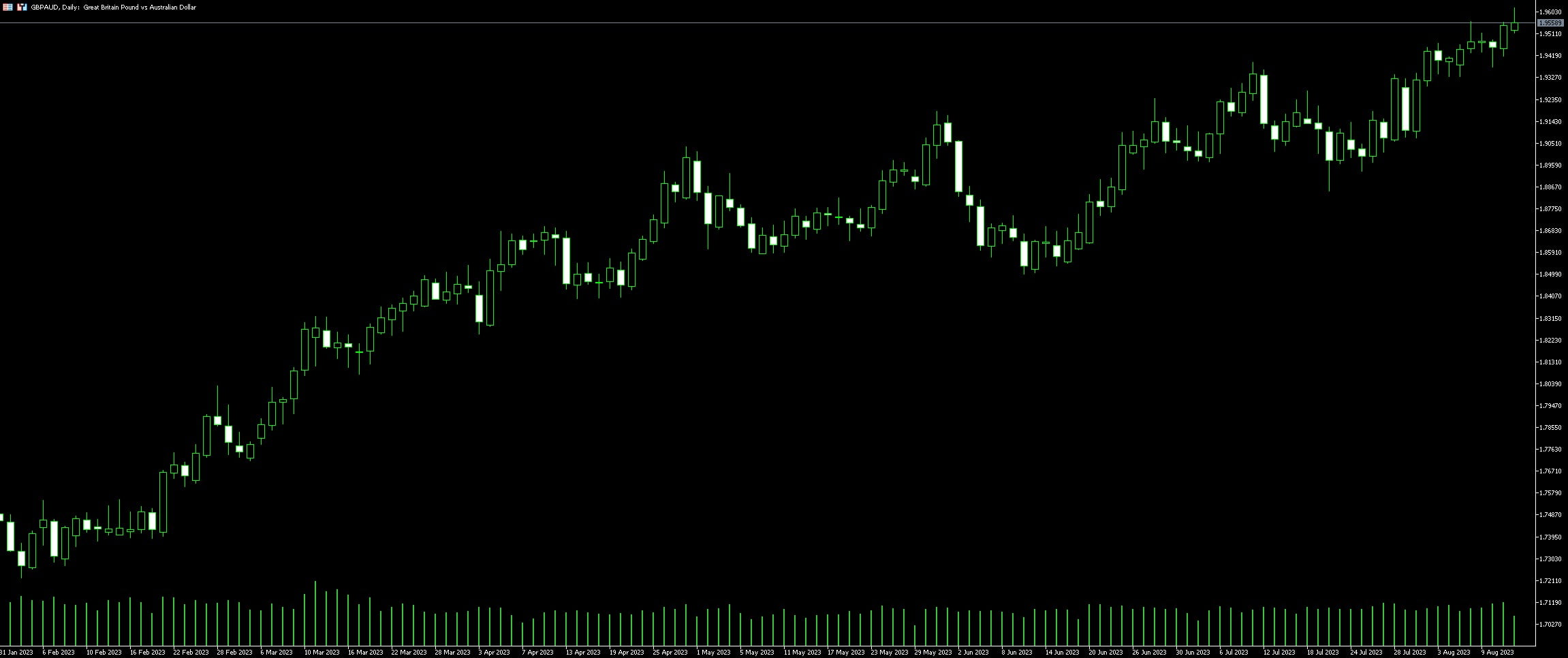

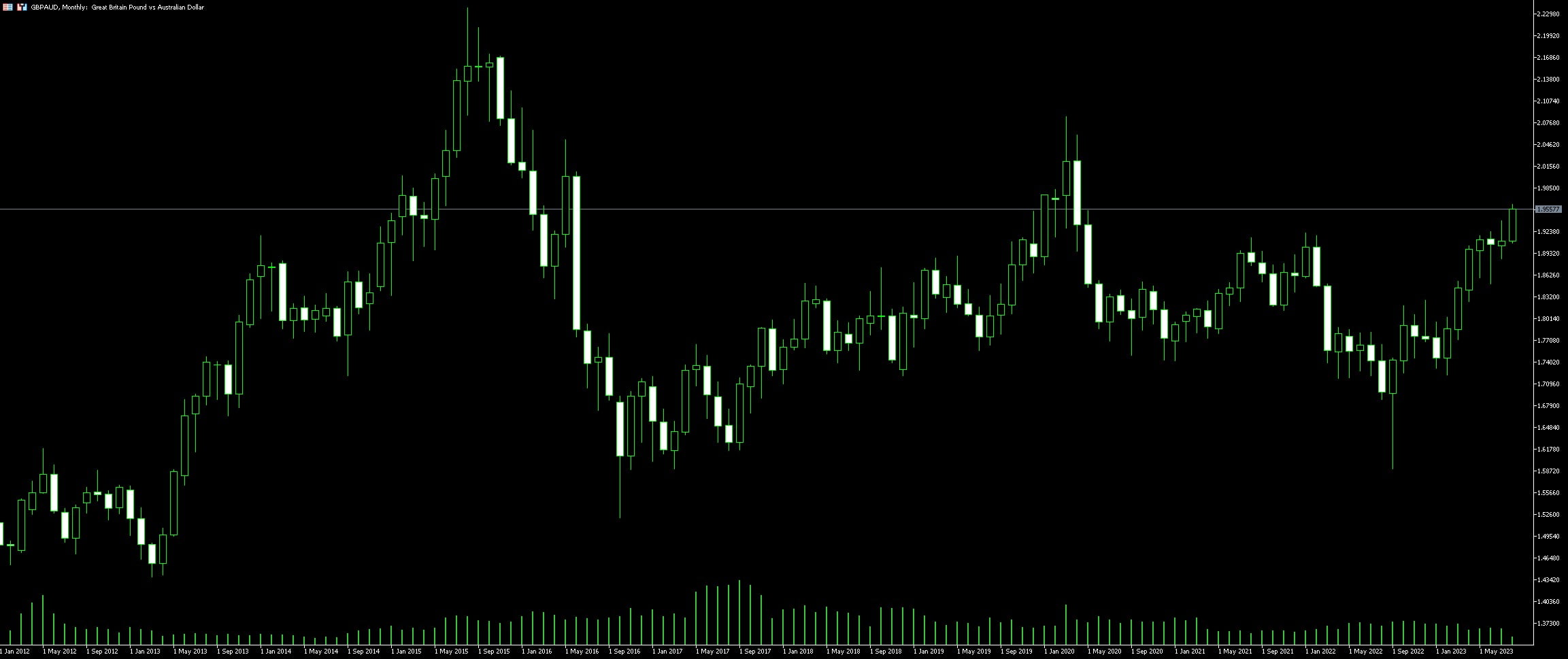

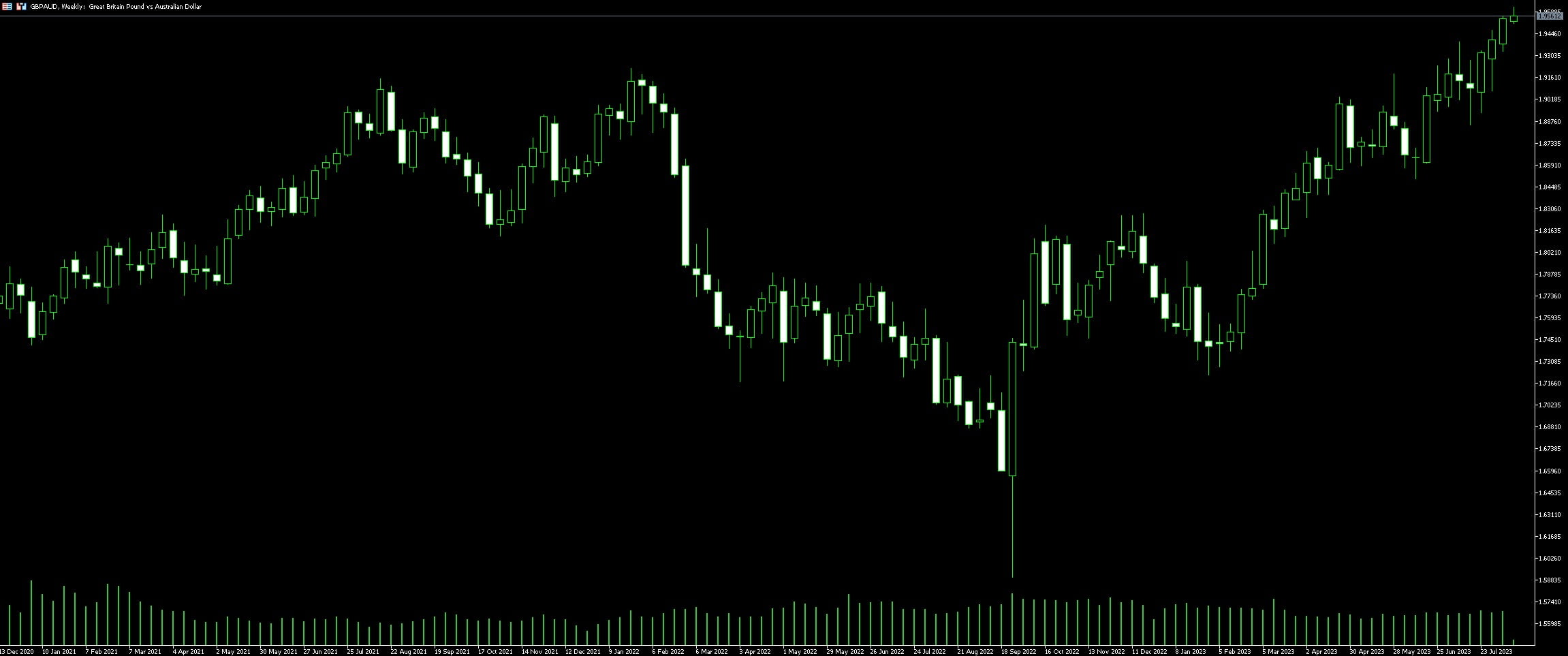

Live Chart Of GBP/AUD

1. Understanding GBP/AUD Currency Pair

GBP/AUD, a fascinating currency pair, reflects the value of one British Pound in terms of Australian Dollars. Diverse factors unite to impact this pair’s volatility and provide traders with numerous opportunities. Indeed, economic indicators from both the United Kingdom and Australia, such as Gross Domestic Product (GDP), interest rates, and unemployment rates, steer the GBP/AUD pairing’s movements.

Particularly agile are the shifts dictated by interest rate differentials. For instance, if the Bank of England (BoE) hikes interest rates while the Reserve Bank of Australia (RBA) leaves rates on hold, the GBP could appreciate against the AUD. Market participants swayed by the higher returns on the Pound would spur this ascent.

In addition, the GBP/AUD currency pair demonstrates a strong correlation with commodity prices. Australia, rich in minerals, natural gas, and coal exports, often sees its currency sway with fluctuations in commodity prices. Therefore, traders should incorporate global commodity trends into their analysis of the GBP/AUD pair.

Lastly, geopolitical events and economic news can swing this currency pair dramatically. Brexit, for example, greatly impacted the GBP’s standing against other currencies, including the AUD. Traders should always remain informed of such events to anticipate GBP/AUD pair volatility accurately.

GBP/AUD trading requires an in-depth understanding of the macroeconomic factors of both the UK and Australia. Diligent tracking of interest rates, commodity prices, and significant geopolitical happenings equip traders with the necessary foresight for successful trading. Be prepared to adapt and respond to the ever-evolving economic landscape to effectively navigate the GBP/AUD currency pair market.

1.1. Understanding GBP (British Pound Sterling)

The British Pound Sterling (GBP) represents the economy of the United Kingdom, encompassing England, Scotland, Wales, and Northern Ireland. Renowned as one of the oldest currencies still in use today, GBP significantly influences global financial markets. Possessing a deep understanding of the GBP, its value, and the factors affecting its fluctuation is crucial for thriving in the trading market.

Investors and traders globally view the GBP as a relatively stable and reliable currency. The strength and stability of the GBP often hinge on several key indicators which include political stability, interest rates, inflation, economic growth rates, and the Bank of England’s policies governing monetary issues.

However, trading the GBP can be notably volatile, given the heavy impact of the UK’s political scene. Key political events such as general elections, Brexit and policy changes, can result in drastic fluctuations in the value of the GBP.

When trading GBP/AUD, understanding the behavioural pattern of GBP assists in predicting potential changes that may occur in the currency pair value. For example, investors closely observe economic indicators like the Gross Domestic Product (GDP) and inflation rates to gauge the GBP’s projected performance. These insights into the British economy are invaluable in aiding investors in making informed trading decisions.

Equally important is observing the actions and decisions of the Bank of England (BoE). The BoE’s role in governing monetary policies directly impacts GBP’s value. Any alterations to interest rates or changes in quantitative easing measures can lead to significant shifts in the GBP’s value, echoing into the GBP/AUD pair.

To add another layer of complexity, international relations and the UK’s trade agreements influence the strength of the GBP. Trade agreements with crucial partners, such as the European Union, invoke direct impacts on the UK’s economy and consequently, the GBP.

When trading GBP/AUD, it’s essential to stay updated with all these influencing components surrounding the GBP. This knowledge, paired with strategic insight, assists in deciphering the market’s volatility and making profitable decisions in the dynamic world of forex trading.

1.2. Understanding AUD (Australian Dollar)

Trading with an understanding of AUD (Australian Dollar) represents a significant aspect of global FX activities. Dominated by a robust economy, the Australian Dollar is highly favored in the Asian region due to its geographical proximity.

AUD happens to be one of the highest yield currencies and is typically correlated with gold prices. With Australia being the third-largest gold-digger worldwide, there is a symbiotic relationship between gold prices, the strength of the AUD, and it’s consequent pairings.

Monetary policy, set by the Reserve Bank of Australia, also impacts the value of the AUD. Interest rates maneuvers influence the allure of the currency to foreign investors. High interest rates could lure investors looking for the best return on their money, which could potentially reinforce the AUD. Conversely, lower interest rates can deter investors, possibly weakening the AUD.

Vigilance is vital while trading GBP/AUD as certain economic indicators, such as unemployment rates, GDP, interest rates, and commodity prices, can impact the exchange rate volatility. Adopting a strategic approach and understanding the undercurrent trends can help in navigating profitably in this challenging yet potentially lucrative currency pair.

1.3. Analysis of GBP/AUD Cross Currency Pair

In the financial markets, the GBP/AUD cross currency pair is peering through numerous windows of opportunities for astute traders. Known for its robust levels of liquidity, this pair demonstrates significant price movements which can be meticulously exploited with an effective trading strategy. Generally, the value of the GBP/AUD pair is particularly influenced by a wide range of economic factors, including interest rates, inflation figures, and geopolitical events.

Appreciating the underlying intricacies, the GBP/AUD cross pair is heavily influenced by the performance of two potent economies, i.e., the United Kingdom and Australia. Therefore, a trading strategy for this pair necessitates a firm grasp of the economic health and policies of these nations. For instance, any shifts in the United Kingdom’s monetary policy can have a substantial impact on the value of the GBP/AUD pair. Simultaneously, fluctuations in commodities market, where Australia is a major global player, is also a pivotal determinant for the pair’s value.

Furthermore, another essential component to consider while trading GBP/AUD is the time difference and corresponding market hours of the UK and Australia. It is during the overlapping hours of these two markets that the pair experiences heightened levels of liquidity and volatility, paving the way for potentially profitable trading opportunities.

On the technical analysis front, GBP/AUD exhibits certain recurrent patterns and trends that can be leveraged to predict future price movements. Employing various indicators such as Fibonacci retracements, moving averages, or Bollinger bands can assist in identifying potential entry and exit points. However, it is imperative to couple technical analysis with fundamental analysis for a more accurate market forecast.

Indeed, GBP/AUD trading can be rewarding but not without its share of risk. Utilising a judicious blend of technical and fundamental analysis and keeping tabs on the economic indicators of the UK and Australia can help in carving out a successful trading path. However, one must always be prepared for unforeseen market turbulences and manage risk meticulously.

Importantly, practicing trading strategies on a demo account before applying them to a live trading environment can assist in refining your approach and building confidence. Consideration of all these aspects will enable a meticulous trading process in the GBP/AUD market. Be aware that understanding this pair demands dedication and patience, but the potentials it offers makes it a rewarding endeavour for shrewd traders.

2. Leveraging Fundamental Analysis for GBP/AUD Trading

Fundamental analysis is a powerful tool for trading, but it requires an understanding of economic indicators and their impact on the markets. It comes with its unique set of challenges such as interpreting complicated economic reports and staying updated with geopolitical events. News about economic growth, inflation, political stability, monetary policy, and other pertinent data can have a direct effect on the currency pair, GBP/AUD.

Generically, economic growth indicators tend to strengthen a nation’s currency. So, good news regarding the UK economy generally boosts the strength of the GBP, while positive news for Australia typically enhances the AUD. Inflation is another crucial factor in establishing a currency’s value. An increased inflation rate within the UK can devalue the GBP, which may result in a weaker GBP/AUD exchange rate.

Political stability is vital as it impacts investment decisions. If Australia, for example, is experiencing a political crisis, this could result in a pullback on investment, and subsequently, negatively, affect the value of AUD against GBP. Tracking these fundamental factors can enable traders to make more informed decisions, potentially capitalizing on market trends caused by these fluctuations.

Currencies are also heavily influenced by the nations’ central bank’s decision on interest rates. A higher interest rate in the UK would generally result in an increased value of GBP due to the higher return on investment it can provide to investors. Fluctuations in the monetary policy can spur significant market movement. By staying updated with these policy decisions, traders can take advantage of these market shifts.

However, a word of caution is needed here. While fundamental analysis gives the bigger picture of market movements, it should always be used in conjunction with technical analysis for precise entry and exit points in the market. A combination of both provides traders with a more reliable framework for trading the GBP/AUD.

2.1. Importance of Economic News and Events

Economic news and events have a crucial role in shaping the financial market. Trader’s attitudes toward specific currency pairs, like GBP/AUD, can be significantly affected by changing economic scenarios. Vital information is delivered through these economic announcements enabling traders to undertake informed decisions about upcoming trends and high probability trades.

The strength of the British Pound (GBP) against the Australian Dollar (AUD) is often directly linked to the economic health of both countries. Fluctuations in economic indicators, like inflation rates, unemployment rates, GDP growth rates, and other macroeconomic data heavily influence the conversion rates. A positive economic report on the UK can bolster GBP, while a downturn in Australian economic forecasts may weaken the AUD.

Economic calendars become an indispensable tool to keep track of the scheduled releases of these economic updates. It is vital for traders to monitor these events as elevated periods of volatility often follow their releases. For instance, the monthly unemployment report from Australia or the quarterly inflation report from the UK can cause significant price swings.

Traders also pay attention to various economic and political events, such as the Central Bank meetings, budget announcements, or trade policies. These events often hold potential clues about future changes in monetary policy, which can trigger either an uptrend or a downtrend in the GBP/AUD exchange rate.

Notably, the trade relationships between countries play a massive role in impacting currency pairs. Trade balance reports – revealing the difference between a nation’s export and import value – generate considerable market heat. For example, if Australia reports a higher trade surplus, it can strengthen the AUD against the GBP and could be a signal to sell GBP/AUD.

By integrating the understanding of economic news and events in their trading strategies, traders can better anticipate market movements and mitigate risks. Therefore, staying abreast with economic news and events becomes a critical part of mastering the trade of GBP/AUD.

2.2. Key Economic Indicators to Watch

Pay close attention to the health of each nation’s economy when trading GBP/AUD. This inevitably involves keeping track of key economic indicators. In the case of the United Kingdom, high on the list would be the country’s Gross Domestic Product (GDP) data, which measures economic output. Any significant increase or decrease can heavily influence the value of GBP.

Meanwhile, another crucial indicator to track is Unemployment Rates. High unemployment rates usually equate to a weaker economy and thus affect the GBP. Also, Interest Rates set by the Bank of England can significantly affect currency trading as they influence investment in the country. An increase might see GBP gaining against AUD, while any decrease is likely to have the opposite effect.

Focussing on Australia, one should consider the Commodity Prices Index. As a large exporter of commodities such as coal and iron ore, the AUD’s value often mirrors their prices. Similarly, Australia’s GDP Growth Rates and Unemployment Rates need to be watched due to their potential impact on market sentiment.

Finally, tracking the Australia’s Consumer Price Index (CPI), an inflationary marker, is also significant. A rise in the CPI can signal the Reserve Bank of Australia (RBA) to hike the interest rates leading to a potential AUD rise. Be sure to keep an eye on these indicators to better interpret how their dynamics might affect your trading decisions.

3. Strategies for Successful GBP/AUD Trading

Tune into Economic Indicators. Keeping an eye on critical economic indicators will provide integral insights into market movements. Data such as the GDP, unemployment rate, and inflation rate of both the United Kingdom and Australia can significantly sway the GBP/AUD exchange rate. Brokers who track these economic indicators are generally more likely to anticipate fluctuations and make more informed trades.

Observe Order Flow. GBP/AUD traders often use order flow analysis to predict future price movements. This strategy entails observing the volume and direction of trades to infer potential market trends. High volumes of selling orders may indicate a bearish market, while high buying volumes suggest bullish trends. Therefore, understanding order flow can bring about more credible trading decisions.

Deploy Support and Resistance Levels. GBP/AUD traders frequently employ support and resistance levels in their trading strategies. Essentially, these are levels at which the price tends to reverse or decelerate. When the price approaches a support level, it’s typically expected to bounce back upwards, while at a resistance level, the price is likely to decrease. These levels serve as excellent landmarks for setting take-profit and stop-loss orders.

A prudent mix of these can drive trading decisions towards profitable outcomes. Traders who adopt these strategies tend to tread more carefully in the trading environment, armed with data, analytically drawn inferences and trend expectation techniques.

3.1. Technical Analysis Tools for GBP/AUD Trading

The world of trading currency pairs, especially GBP/AUD, empowers traders with a robust array of technical analysis tools. These instruments harness the power of historical market data to anticipate the potential future direction of this particular pair.

Forex charting tools are invaluable when trading GBP/AUD, allowing for meticulous breakdown and comprehension of historical price patterns. Employing a variety of chart types, such as line, bar, and candlestick, helps to highlight important market movements and trends.

Market sentiment indicators also contribute pivotal input. Traders can access these tools via most online trading platforms, which report the proportion of traders buying a currency pair against those selling it, providing a graphical representation of market sentiment. This understanding allows you to tune into the ‘mood’ of the market, an all-important element in GBP/AUD trading.

Moving averages offer another effective strategy, assisting traders by smoothing out price fluctuations and creating a line on the chart that can indicate an upward or downward trend. By identifying these trends, you are equipped to make informed trades.

For the enthusiasts of statistical probabilities and standard distributions, the Bollinger Bands® technical analysis tool will be a trusted ally. This statistical chart characterizes the prices and volatility over time and provides relative definitions of high and low prices.

In conclusion, every trader owes it to themselves to blend into their strategy an assortment of these useful technical analysis tools, each equipped to offer precise insights into the infamously dynamic GBP/AUD currency pair market. Through gaining proficiency in these tools, you increase your chance of deciphering the complex world of currency trading.

3.2. Risk-Management Techniques

Trading GBP/AUD, either in forex markets or across other trading platforms, inherently carries a degree of risk. One cannot ignore the potential for market fluctuations impacting trade outcomes. However, by employing effective risk-management techniques, traders can mitigate this inherent risk.

One such technique commonly applied involves the use of stop-loss orders. This essentially limits the amount one can lose on a single trade by setting a predefined point where the trade will automatically close. Stop-loss orders are vital in preventing substantial losses, allowing traders to maintain control over their portfolios.

Another technique, known as diversification, seeks to spread risk across a range of different assets. Diversifying a portfolio with varied currency pairs and not exclusively investing in GBP/AUD can help to balance potential losses. As the saying goes – don’t put all your eggs in one basket. Diversification is indeed a sturdy protective shield against unpredictable market forces.

Position sizing, yet another crucial risk-management approach, involves controlling the amount of risk undertaken in a single trade relative to the total available capital. By never risking more than a small percentage of the trading account on a single trade, traders may avoid significant setbacks, achieving sustainable trading in the longer run. Calculated position sizing is key to maintaining healthy trading practices.

Certainly, these techniques can play a significant role in managing trading risk. These safeguards, when combined with ongoing market analysis and robust trading strategies, secure an environment where traders can exploit opportunities while adequately managing exposure to the unpredictability of the GBP/AUD currency pair trading.

3.3. Developing a GBP/AUD Trading Plan

An effective GBP/AUD trading plan is crucial for any serious trader to implement strategies, manage risks and achieve desired trading outcomes, while always keeping in mind the economic dynamics of both the United Kingdom and Australia. Possess a thorough understanding of the applicable forex market trends, their implications as well as the various economic factors that can influence GBP/AUD rates.

In the creation phase of a GBP/AUD trading plan, conducting extensive research forms a formidable foundation. Utilising reliable sources, explore the economic indicators such as GDP growth rates, employment figures, inflation rates, and central bank policies of both countries. Interpreting these economic indicators could lead to a better understanding of the potential directions and volatility of GBP/AUD rates.

A technical analysis is equally important in developing a GBP/AUD trading plan. This includes examining historical data, identifying trends, and applying relevant technical trading indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. Doing so can provide in-depth insights into possible future price trends and significant price levels.

Moreover, a trading plan should encompass comprehensive risk management tactics. Planned stop-loss and take-profit levels, as well as a proper risk to reward ratio, should be clearly defined. It is also advisable to set specific trading rules such as never risking a certain percentage of the trading capital on a single trade, thereby limiting potential losses.

In the realm of GBP/AUD trading, consistency remains key. The trading plan should be followed religiously as deviation might lead to unnecessary risk-taking. However, the plan isn’t unchangeable; regular reviews and modifications may be required according to market changes.

Always bear in mind that successful trading isn’t about always being right, it’s about managing risk effectively and following a well-crafted plan, especially when you’re wrong. As such, preparation via a solid GBP/AUD trading plan can be the difference between sustained trading success and occasional, erratic profits.

4. Choosing a Reliable Broker for GBP/AUD Trading

Choosing a reliable broker to trade GBP/AUD can significantly impact your trading success. It’s crucial to look for brokers who offer competitive spreads and high liquidity. Spreads should be low, as they are the cost of trading. Tightly packed spreads mean the market doesn’t have to move as much in your favor to begin making a profit.

The broker should be regulated by reliable financial authorities. This will help to ensure your funds are secure and that you’re protected from fraudulent practices. Agencies such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the South African Financial Services Board (FSB) are reliable regulatory bodies. A broker regulated by these bodies can be considered safe and trustworthy.

Evaluate the broker’s platform and ensure it is user-friendly and equipped with advanced analytical tools. You want a platform that reduces the chance of mechanical errors, enhances your ability to analyse markets swiftly, and manages trades and risk effectively. A platform with a seamless, intuitive interface is a boon, especially if you are a novice trader.

Determining the broker’s customer service quality is also important. Reliable brokers have an efficient customer service team that can respond quickly to any issues or queries. They should be able to provide support in a timely manner when problems arise, such as platform glitches, account issues, or pressingly, in executing trades.

Opting for a broker who offers a demo account is advisable. This allows you to test the platform, your trading strategies, and get a feel for the broker without risking real money. A broker that provides educational resources can help you understand trading dynamics and sharpen your skills in trading GBP/AUD.

In summary, choosing a broker who offers competitive spreads, is regulated, user-friendly with helpful customer service, and education support, can contribute to a more confident, efficient, and hopefully, profitable GBP/AUD trading experience.

4.1. Factors to Consider in Choosing a Broker

Choosing a broker is undeniably one of the most crucial decisions for a trader. While the charm of trading the GBP/AUD often lies in its volatility and significant trend changes, traders need a reliable broker to facilitate these transactions. There are several factors that shouldn’t be overlooked when selecting a broker.

Regulation: Stringent regulation is an assurance of the legitimacy and reliability of a broker. In the unfortunate event of disputes, regulatory authorities act as an arbitrator, protecting the interests of the trader.

Execution Speed: In the world of forex trading, time is money. A broker that can execute trades rapidly could potentially offer an edge, especially in a highly volatile pair like GBP/AUD.

Trading Platform: A straightforward and user-friendly trading platform is integral for smooth trading operations. Features such as real-time charts, technical and fundamental analysis tools, and customizability should be offered.

Spreads and Commissions: In a bid to maximize profits, traders should opt for brokers that offer low spreads on GBP/AUD trades. Moreover, any commissions levied should also be reasonable.

Customer Support: Even the most experienced traders may, at times, require assistance. A broker that offers robust customer support, ideally 24/7, can be invaluable.

While these factors are highly important, they’re not exhaustive. Each trader may have their unique requirements, and therefore, it’s essential that broker selection is tailored to individual needs.

4.2. Features of a Good Trading Platform

The selection of a suitable trading platform can make a significant difference in the profitability of your trading activities. Secure Trading Environment is one of the key features of an excellent trading platform. A trading environment that is secure against cyber threats is crucial, allowing traders to focus purely on their trading decisions without the additional stress of potential cybersecurity threats.

Another critical characteristic of a good trading platform is its User-Friendly Interface. Even the most powerful trading tools are of little use if they are not intuitively designed. Traders should be able to navigate around the platform easily, access necessary tools, and execute trades without any hassle.

The Availability of a Variety of Trading Tools is a top-notch feature that a trading platform should offer. Tools for charting, analysis, trade execution, and risk management can significantly enhance traders’ ability to make informed decisions and manage their risks effectively.

Lastly, a reliable trading platform should offer Fast Execution Speeds. In a fast-paced trading environment, delays in trade executions could potentially lead to missed opportunities or diminished profits. Fast and efficient order execution is foundational for assertive and profitable trading.

For the GBP/AUD traders, it becomes imperative to look for a platform that comes integrated with Real-Time Market News feature. As both the GBP and AUD are influenced by economic news releases, having access to real-time market news could potentially offer traders a competitive edge. This helps traders stay one step ahead and gives them the ability to react more quickly to market-moving news.

Another desirable feature is having a Demo Account option. It allows traders to familiarize themselves with the platform’s interface and features, as well as refine their strategies using virtual money before jumping into the real trading world. Moreover, a platform’s ability to allow Customisation reflects adaptability to individual trading styles and strategies, which could be a true game-changer for GBP/AUD traders.