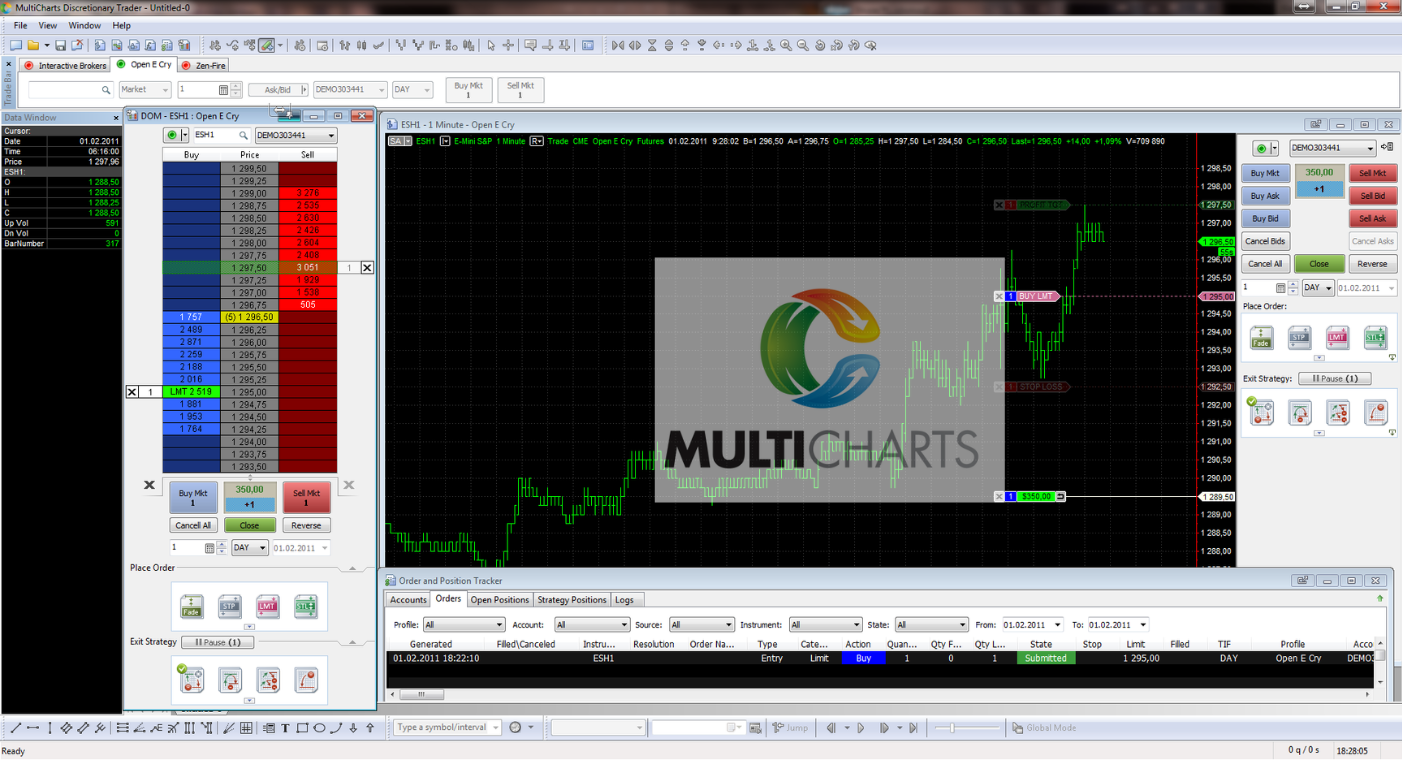

1. Overview Of MultiCharts

MultiCharts is a sophisticated trading platform known for its powerful analytical capabilities and advanced charting tools. It supports various types of market analysis, including volume analysis, system backtesting, and deep historical data analysis.

MultiCharts is favored for its high-level customization, allowing users to set up their trading environment according to personal preferences with scripts, indicators, and strategies. It integrates with multiple data feeds and brokers, offering traders flexibility in executing trades directly from charts. This platform is particularly popular among professional traders who require robust technical analysis and precise trade execution tools.

2. Notable MultiCharts Alternatives

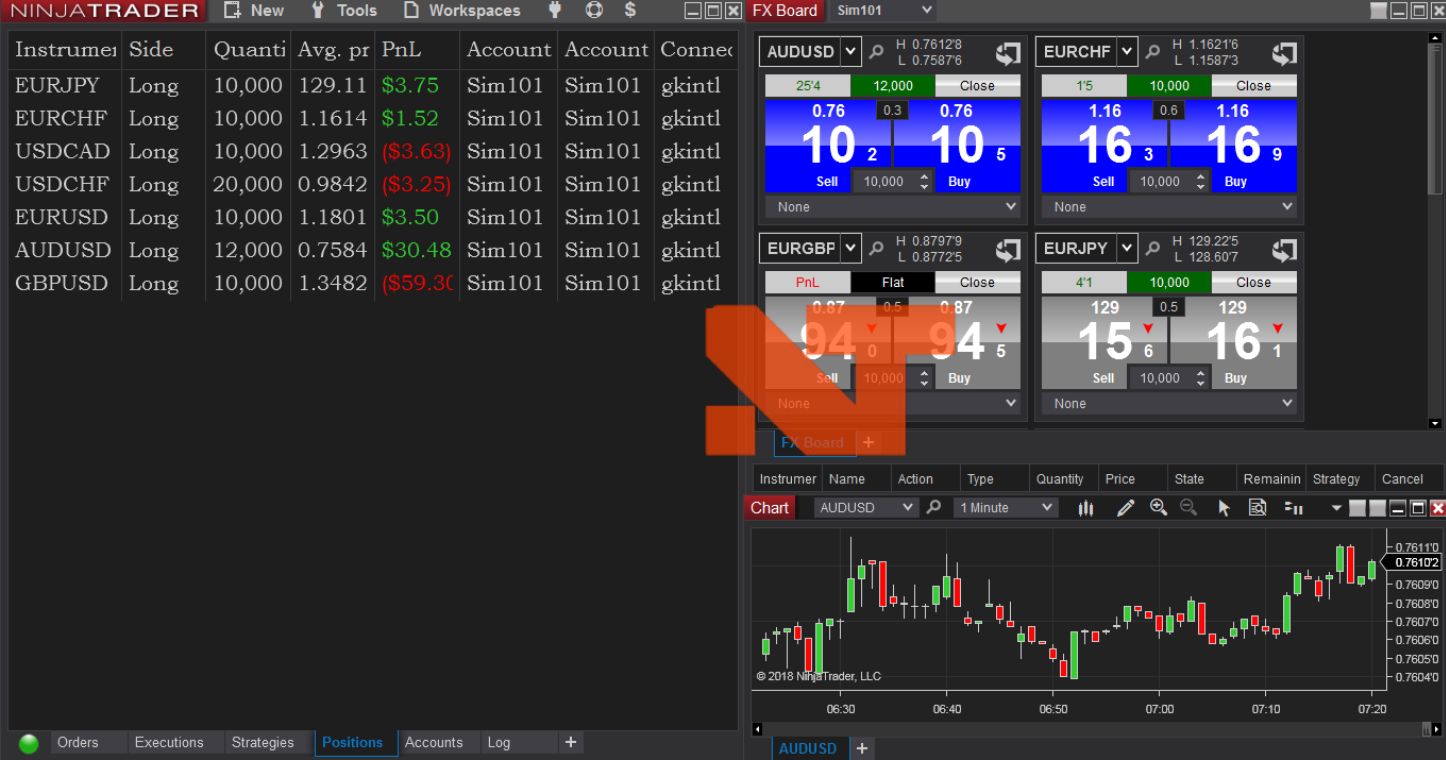

2.1. NinjaTrader

2.1.1. Overview of Key Features

NinjaTrader is a robust trading platform designed for active traders who require advanced charting, trading strategy automation, and futures trading. The platform’s notable features include a comprehensive charting suite, a customizable interface, and extensive backtesting capabilities. It stands out with its integration of machine learning for trade strategy automation, offering a unique edge in trading strategy development.

2.1.2. Key Features

- Advanced Charting: Substantial improvements in chart visualization.

- Automation: Allows the automation of trading strategies with NinjaScript.

- Market Replay: Enables downloading and replaying historical market data tick-by-tick.

- Data Feeds: Uses CGC Continuum as its primary data provider; also supports Rithmic for diverse trading needs.

- Community and Customization: Supports a vast array of third-party apps and add-ons through the NinjaTrader Ecosystem.

2.1.3. Pros

- Advanced Charting and Automation Tools: Offers powerful tools for charting and automating trading strategies, ideal for technical analysts and algorithmic traders.

- Large User Community: Over 800,000 users and a supportive community, providing a rich resource for learning and sharing.

- Free Simulation: Provides a free simulation for practice and strategy testing.

2.1.4. Cons

- Potential Complexity: Can be complex for beginners due to its extensive features and customization options.

- Licensing Model: While the platform is free for advanced charting and simulation, live trading and additional features require a paid license.

2.1.5. Ideal For

NinjaTrader is ideal for experienced traders who need sophisticated charting tools, desire the ability to automate their trading strategies, and focus primarily on futures and forex markets.

Comparison Table against MultiCharts

| Feature | NinjaTrader | MultiCharts |

|---|---|---|

| Charting | Advanced with customization options | Advanced with professional tools |

| Automation | Comprehensive through NinjaScript | Supports multiple scripting languages |

| User Community | Large and active with over 800,000 users | Extensive, though slightly smaller in comparison |

| Market Replay | Available for backtesting and strategy testing | Supports backtesting with historical data |

| Pricing | Free for simulation, paid for live trading | Subscription-based with various tiers |

2.2. TradeStation

2.2.1. Overview of Features

TradeStation is a powerful trading platform known for its robust trading tools and advanced technology. It caters to both novice and seasoned traders with its wide array of features that include direct-market access, comprehensive charting, and extensive backtesting capabilities.

2.2.2. Key Features

- OptionsStation Pro: A tool for visualizing and trading options effectively.

- Simulated Trading: Allows practice without financial risk using virtual trading.

- Customizable Dashboard: Enables traders to tailor their trading environment extensively.

- Advanced Trading Tools: Includes real-time scanning of over 1,000 stocks, programming of custom trading strategies, and advanced options analysis tools.

2.2.3. Pros

- Extensive Analytics and Powerful Backtesting: The platform is equipped with robust analytical tools and allows for detailed historical backtesting.

- Integrated with Brokerage: Direct brokerage integration streamlines trading activities.

- No Minimum Account Requirements: Flexible for all types of traders with no minimum deposit required for basic account setups.

2.2.4. Cons

- Steeper Learning Curve: The wealth of features and customization options might overwhelm new traders.

- Subscription-Based Model: Access to premium features often requires a subscription, especially if certain account or trading minimums are not met.

2.2.5. Ideal For

TradeStation is ideal for active traders who require a range of trading instruments and those who prioritize extensive analytics and the ability to execute complex trading strategies.

Comparison Table against MultiCharts

| Feature | TradeStation | MultiCharts |

|---|---|---|

| Charting | Extensive with options for customization | Advanced with professional tools |

| User Interface | Customizable but complex for beginners | Streamlined and user-friendly |

| Integration | Direct brokerage integration | Requires external broker setup |

| Account Minimum | $0 for basic setups | Varies based on license type |

| Backtesting | Powerful backtesting capabilities | Strong with historical data access |

| Pricing | No commission for stocks/ETFs, fees for other trades | Subscription-based with various tiers |

2.3. MetaTrader 4/5 (MT4/MT5)

2.3.1. Overview of Its Popularity, Especially in Forex

MetaTrader 4 and MetaTrader 5 (MT4/MT5) are widely recognized platforms in the trading community, especially noted for their strong presence in the Forex market. MT4, established as a reliable platform since its inception in 2005, along with its successor MT5, offers extensive tools and a user-friendly interface that caters to traders at all levels.

2.3.2. Key Features

- Comprehensive Analysis Tools: MT5 includes over 80 technical indicators and more than 40 graphical tools.

- Flexibility in Trading: Supports all order types, with two accounting systems: netting and hedging.

- Automated Trading: Enhanced with a powerful scripting language, MQL5, which allows for comprehensive automated trading solutions and strategy testing.

- Market Depth and Economic Calendar: Provides insights into market prices and forex market events.

2.3.3. Pros

- Huge Marketplace for Indicators and Expert Advisors (EAs): MT4 and MT5 host a large selection of trading robots and technical indicators in the MetaTrader Market.

- Community and Support: Offers access to a vast community of traders and free trading robots.

- Suitability for Forex Trading: Extensive tools and detailed analysis specifically designed for forex trading, with support for other asset classes as well.

2.3.4. Cons

- MQL Programming Language: While powerful, MQL5 might be less intuitive for traders without programming background.

- Complexity in Transition: Some users find the transition from MT4 to MT5 challenging due to interface and feature differences.

2.3.5. Ideal For

MetaTrader 4/5 is highly suited for forex traders looking for a robust and feature-rich platform that supports a high degree of customization and automated trading.

Comparison Table against MultiCharts

| Feature | MetaTrader 4/5 | MultiCharts |

|---|---|---|

| User Base | Extremely large, especially in forex trading | Strong but more varied in assets |

| Automation | Advanced with MQL5 for MT5 | Supports multiple scripting languages |

| Customization | High, with a massive range of EAs and indicators | High, but with different toolsets |

| Market Focus | Forex primarily, but also stocks and futures | Broad, including stocks, futures, and forex |

| Ease of Use | Steep learning curve due to advanced features | User-friendly with complex capabilities |

2.4. Sierra Chart

2.4.1. Overview of Its Capabilities

Sierra Chart is a robust trading and charting platform known for its stable, efficient, and highly customizable design, which makes it suitable for advanced traders who demand precision and performance in their trading tools. The platform supports a wide range of markets including stocks, futures, and forex.

2.4.2. Key Features

- Advanced Custom Study Interface and Language (ASCIL): Allows users to create custom studies and indicators using C++, offering extensive customization possibilities.

- High-Performance Design: Known for its speed and reliability in executing trades and generating real-time data.

- Market Depth Historical Graph: Displays historical market depth data directly on charts, enhancing market analysis.

- Integrated Trading and Data Service: Provides direct connectivity to major exchanges for trading and data without third-party services.

2.4.3. Pros

- Customization and Advanced Analysis: Offers advanced technical analysis tools with over 300 built-in studies and the ability to create custom solutions.

- Depth of Market Analysis: Features include ChartDOM which integrates depth of market data directly into the chart.

- Comprehensive Documentation and Support: Well-documented features and responsive customer support enhance user experience.

2.4.4. Cons

- Complexity: The platform’s advanced features may present a steep learning curve.

- Desktop-Only: Lacks a cloud-based or web version, limiting access to desktop installations.

2.4.5. Ideal For

Sierra Chart is ideal for professional traders who require a powerful and highly customizable platform capable of detailed market analysis and complex strategy implementation.

Comparison Table against MultiCharts

| Feature | Sierra Chart | MultiCharts |

|---|---|---|

| Customization | High, with extensive use of C++ for custom studies | High, but different scripting options |

| User Interface | Complex, designed for professional users | More intuitive for general users |

| Data Integration | Direct integration with major exchanges | Requires external data providers |

| Performance | High performance and stability | Strong performance with a focus on user-friendliness |

| Market Data Handling | Real-time and historical data with advanced charting | Comprehensive market data analysis tools |

2.5. MotiveWave

2.5.1. Overview of Features with a Focus on Elliott Wave Analysis

MotiveWave is a comprehensive trading platform that excels in advanced technical analysis, particularly in Elliott Wave analysis. It offers a rich array of charting capabilities, technical indicators, and trading tools designed for both novice and professional traders.

2.5.2. Key Features

- Elliott Wave Tools: Automatic plotting and labeling of Elliott Wave patterns.

- Advanced Charting: Includes over 300 studies and strategies, with options for custom bar sizes and advanced Fibonacci tools.

- Trading from Charts: Directly execute and manage trades from the charts.

- Customization: Highly customizable workspace and chart appearance, supporting multiple monitors.

2.5.3. Pros

- Specialized Tools for Technical Analysis: MotiveWave is particularly renowned for its detailed Elliott Wave and Gann analysis tools.

- Integration with Multiple Brokers and Data Feeds: Compatible with over 30 brokers and data services, enhancing its flexibility.

- Customizable Indicators and Alerts: Allows traders to set detailed conditions for trading alerts.

2.5.4. Cons

- Complexity: The depth of features may overwhelm new users.

- Pricing: While there is a range of pricing options, the more advanced features can become quite expensive.

2.5.5. Ideal For

MotiveWave is ideal for traders who are focused on technical analysis and require detailed charting and analysis tools, especially those using Elliott Wave theory in their trading strategy.

Comparison Table against MultiCharts

| Feature | MotiveWave | MultiCharts |

|---|---|---|

| Specialization | Elliott Wave and Gann analysis | Broad technical analysis |

| Broker Integration | Extensive, over 30 supported brokers and services | Limited to specific brokers |

| User Interface | Highly customizable, complex | User-friendly, intuitive |

| Pricing | Range from basic to very expensive | Subscription-based with various tiers |

| Technical Tools | Over 300 studies, with advanced options for customization | Comprehensive, but less focused on Elliott Wave |

3. Factors to Consider When Choosing an Alternative to MultiCharts

When selecting a trading platform alternative to MultiCharts, it’s crucial to consider various factors that align with your trading needs, preferences, and goals. Here are the key factors to consider:

3.1. Trading Style

Different platforms cater to different trading styles such as scalping, day trading, swing trading, and position trading. Each style has specific needs in terms of execution speed, data accuracy, and analytical tools.

3.2. Asset Classes

Consider which asset classes you plan to trade—stocks, forex, futures, options, or cryptocurrencies. Some platforms specialize in certain assets and provide optimized tools and data for those markets.

3.3. Technical Analysis Tools

The availability and sophistication of charting tools, technical indicators, and graphical objects can significantly impact your analysis. Platforms vary widely in the types of analysis tools they offer and how customizable these tools are.

3.4. Automation and Backtesting

For traders who rely on automated trading strategies, it’s essential to evaluate the robustness of the platform’s automation capabilities, including the ease of strategy development and backtesting facilities.

3.5. Cost

Cost considerations include not only the initial licensing fees or subscriptions but also ongoing costs for data feeds, additional features, and transaction fees. Platforms may also differ in their pricing structure (flat rate vs. per-trade charges).

3.6. Ease of Use

The user interface should be intuitive and align with your level of expertise. Some platforms may offer more customization options but at the cost of a steeper learning curve.

3.7. Community and Resources

A vibrant community can provide support, shared knowledge, and even custom trading tools. Platforms with active forums, educational resources, and regular updates are often more adaptable to changing market conditions.

3.8. Data Feeds and Speed

Quality and speed of data feeds are crucial for timely decisions, especially for day traders and scalpers. Assess the reliability and latency of the data, as well as the cost of premium data feeds.

3.9. Brokerage Integration

Ease of integration with various brokers and the ability to execute trades efficiently directly from the platform can be a significant advantage.

3.10. Customer Support

Good customer support can be vital, especially when dealing with technical issues or financial queries. Look for platforms that offer quick and helpful support.

| Factor | Description |

|---|---|

| Trading Style | The platform should match the specific needs of your trading style. |

| Asset Classes | Ensure the platform supports all asset classes you intend to trade. |

| Technical Analysis | Check for advanced charting tools and indicators suitable for your analysis needs. |

| Automation | Evaluate the automation capabilities and ease of strategy testing. |

| Cost | Consider all associated costs, including data fees and transaction charges. |

| Ease of Use | Look for a user-friendly interface suitable for your expertise level. |

| Community | A strong community can provide additional support and resources. |

| Data Feeds | Assess the quality, speed, and cost of the data feeds available. |

| Broker Integration | Seamless integration with brokers can streamline the trading process. |

| Customer Support | Effective support is crucial for resolving technical and account issues. |

4. Additional Considerations When Choosing a Trading Platform

In addition to the primary factors discussed earlier, several other considerations can impact your choice of a trading platform. These considerations often deal with the operational aspects and additional functionalities that can enhance your trading efficiency.

4.1. Brokerage Integration

A platform’s ability to offer seamless order execution with your chosen broker can significantly affect your trading operations. Platforms that offer direct integration with a wide range of brokers provide more flexibility and typically ensure faster and more reliable trade execution.

4.2. Customer Support

The level and quality of customer support offered by the platform provider can be a deciding factor, especially for new traders. Platforms with comprehensive support, including live chat, email, and phone support, can provide crucial assistance and peace of mind.

4.3. Security

The security measures in place to protect your data and financial assets are paramount. Look for platforms that offer robust security features such as two-factor authentication, encryption, and regular security audits.

4.4. Mobile Access

For traders who need to operate on the go, the availability of a functional and full-featured mobile app is essential. The app should provide a range of functionalities similar to the desktop version, including order placement, chart analysis, and account management.

4.5. Educational Resources

For beginners and experienced traders looking to enhance their knowledge, platforms that provide educational resources such as webinars, tutorials, and articles can be beneficial.

4.6. Scalability

The platform’s ability to scale according to your growing needs, including handling increased trade volume or more complex strategies, is crucial for long-term engagement.

4.7. Customization

The ability to customize the trading environment to suit personal preferences for trading dashboards, chart settings, and even automated strategies can enhance user experience and effectiveness.

4.8. API Access

For advanced users who want to build custom solutions or integrate with other software, API access is a critical feature. It allows for the expansion of the platform’s capabilities and integration with third-party tools and systems.

4.9. Regulatory Compliance

Ensure that the trading platform complies with the regulatory requirements of the jurisdictions in which it operates. This can protect you from potential legal issues related to trading activities.

| Consideration | Description |

|---|---|

| Data Feeds | Compatibility and cost of data feeds. |

| Brokerage Integration | Integration capabilities with diverse brokers for seamless execution. |

| Customer Support | Quality of support available for troubleshooting and guidance. |

| Security | Measures in place to protect user data and funds. |

| Mobile Access | Availability of a comprehensive mobile app. |

| Educational Resources | Resources provided for learning and strategy development. |

| Scalability | Ability to accommodate growing trading activities and complexities. |

| Customization | Customization options for personalizing the trading environment. |

| API Access | Availability of API for custom integrations and enhancements. |

| Regulatory Compliance | Compliance with legal standards and regulations in operational regions. |

Conclusion

Exploring alternatives to MultiCharts reveals a range of trading platforms each tailored to specific trader needs—from advanced analytical tools in platforms like MotiveWave, known for its Elliott Wave analysis, to robust automation capabilities in NinjaTrader. The choice of a trading platform depends on various factors including trading style, asset classes, cost considerations, and the need for advanced technical analysis tools.

It’s essential to recognize that there is no “one-size-fits-all” solution in trading software. Each platform has its strengths and might appeal differently to novice traders versus seasoned professionals. By considering the detailed factors such as ease of use, customization, brokerage integration, and customer support, traders can select a platform that not only fits their immediate trading needs but also supports their growth and adapts to evolving strategies.

To ensure the best fit, traders are encouraged to utilize trial versions where available, engage with community forums for firsthand user feedback, and continuously assess their platform’s performance against their trading requirements and goals.