1. Overview Of TradingView

TradingView has become a staple for traders worldwide, appreciated for its comprehensive charting capabilities and user-friendly interface. However, various factors might prompt users to explore alternatives. Some traders may find TradingView’s subscription costs prohibitive or may be seeking specialized features that better fit their trading style. Others might look for platforms that offer more advanced tools for technical analysis or different kinds of financial instruments.

Given these needs, it’s valuable to recognize that there are several excellent platforms beyond TradingView that cater to a wide array of trading preferences and requirements.

| Key Points | Details |

|---|---|

| Strengths of TradingView | Comprehensive charting, user-friendly |

| Reasons for seeking alternatives | Cost, need for specialized features, different instrument focus |

| Concept Introduction | Existence of various capable platforms beyond TradingView |

2. Best Overall TradingView Alternatives

2.1. MetaTrader 4/5

Popular Forex & CFD Trading Choice

MetaTrader, specifically versions 4 and 5, remains a dominant force in the world of Forex and CFD trading. Designed to cater to the needs of sophisticated traders, MetaTrader offers a robust environment for trading with a focus on automation and customization.

Strengths of MetaTrader include its highly customizable interface and advanced trading operations. It supports extensive use of trading robots (Expert Advisors) and a plethora of technical indicators that can cater to the most demanding strategies. Its ability to integrate algorithmic trading methods makes it a powerhouse for those looking to automate their trading processes. The platform also boasts an extensive community, providing a vast resource for sharing trading strategies and tools.

Weaknesses involve a steeper learning curve compared to some newer platforms. New traders might find the interface and feature set overwhelming. Additionally, while it excels in Forex and CFDs, it’s not as comprehensive in areas like stock charting, where TradingView tends to have an edge due to its broader market focus and simpler usability.

MetaTrader (MT4/5) vs Tradingview

| Feature | MetaTrader | TradingView |

|---|---|---|

| Market Focus | Forex, CFDs | Multiple, including stocks and cryptocurrencies |

| Customization | High | Moderate |

| User Interface | Complex | User-friendly |

| Community Resources | Extensive | Large but more diverse in market focus |

| Algorithmic Trading | Strong support | Limited support |

| Learning Curve | Steep | Gentle |

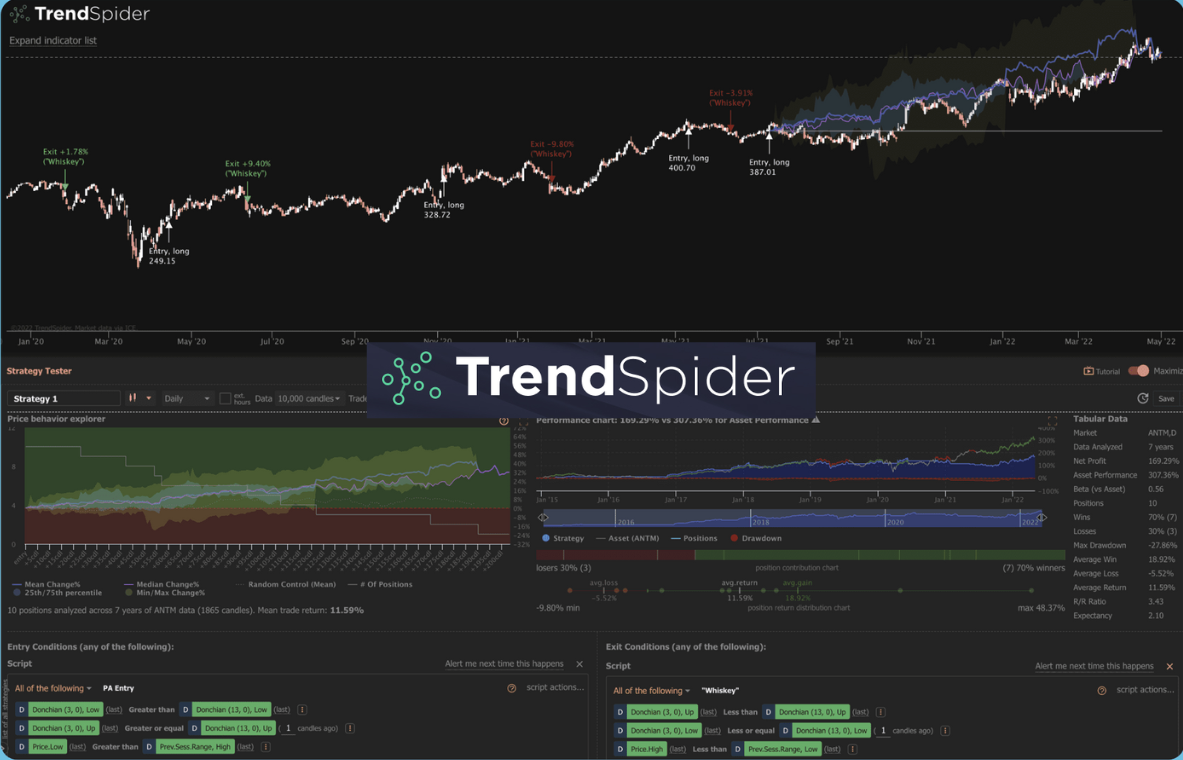

2.2. TrendSpider

Automated Technical Analysis Powerhouse

TrendSpider is designed as a modern technical analysis platform that leverages AI-driven tools to enhance the efficiency and accuracy of chart analysis. It specializes in automating the grunt work often associated with technical trading such as pattern recognition and drawing trend lines, making it highly valuable for traders focused on technical indicators.

Strengths of TrendSpider include its innovative features like automated technical analysis, dynamic price alerts, and backtesting capabilities that allow users to validate their trading strategies against historical data. These tools are designed to save time and improve the precision of technical trading. The platform also offers some unique features like raindrop charts and multi-timeframe analysis, enhancing its utility for in-depth technical analysis.

Weaknesses reflect its niche focus. Compared to broader platforms like TradingView, TrendSpider has less community support, which can be a downside for traders looking to engage with a large community for ideas and strategies. Additionally, its higher price point might deter those who are new to trading or looking for a more cost-effective solution.

TrendSpider vs Tradingview

| Feature | TrendSpider | TradingView |

|---|---|---|

| Focus | Automated technical analysis | General charting and analysis |

| Unique Features | Raindrop charts, automated analysis | Broad market tools, social trading |

| Price Point | Higher | Variable, with free tier available |

| Community Support | Less | Extensive and diverse |

| User Interface | Streamlined for technical analysis | Intuitive, suitable for all users |

| Tool Efficiency | High for technical analysis | Broadly efficient across various analysis types |

2.3. Power ETrade

Broker-integrated Platform, Ideal for Active Traders

Power ETrade is a platform that stands out for those who already have or are considering an E*Trade brokerage account. It offers a powerful combination of trading tools integrated directly with ETrade’s brokerage services, making it highly effective for active traders.

Strengths include its direct access to real-time data, extensive research resources, and the ability to execute trades quickly and efficiently directly from the platform. The integration with E*Trade’s services provides a seamless trading experience, with comprehensive tools for stock, options, and futures trading. Users benefit from advanced charting, streaming market data, and a plethora of analytical tools, making it a solid choice for those looking to trade actively and manage their investments in one place.

Weaknesses of Power ETrade involve its dependency on having an ETrade account, which might not be ideal for traders looking for a standalone trading platform. Additionally, it is less customizable than platforms like MetaTrader, which can be a drawback for traders who need highly tailored trading environments.

Power ETrade vs Tradingview

| Feature | ETrade Power ETrade | TradingView |

|---|---|---|

| Integration | Direct with E*Trade services | None, platform-independent |

| Customization | Limited | Moderate to high |

| Market Tools | Comprehensive for active trading | Broad, includes social features |

| Account Requirement | E*Trade account required | No account required for basic features |

| User Base | Active traders | Diverse, from beginners to professionals |

| Accessibility | Restricted to E*Trade customers | Open to all users |

2.4. MotiveWave

Advanced Features for Experienced Traders

MotiveWave is a comprehensive trading platform geared towards experienced traders who require detailed technical analysis. It excels in delivering tools for advanced technical methodologies like Elliott Wave, Fibonacci, Gann, and ratio analysis, which are essential for precision in trading decisions.

Strengths of MotiveWave include its specialized tools that cater to in-depth analysis, making it particularly valuable for traders who rely heavily on technical trading methods. The platform offers a rich set of features that can handle complex pattern recognition, backtesting, and strategy development. MotiveWave also supports a robust community of users, providing resources and support for traders to share and enhance their strategies.

Weaknesses involve its complexity and cost. MotiveWave is not beginner-friendly, requiring a good understanding of technical analysis and trading principles to be used effectively. Additionally, the cost can be on the higher end, especially for the more advanced features, which might be a significant barrier for new or casual traders.

MotiveWave vs Tradingview

| Feature | MotiveWave | TradingView |

|---|---|---|

| Technical Tools | Advanced (Elliott Wave, Fibonacci) | Basic to advanced, less specialized |

| User Friendliness | Complex, steep learning curve | User-friendly, intuitive interface |

| Community | Active, focused on advanced techniques | Large, diverse in interests and skill levels |

| Price Point | Higher, particularly for advanced features | Free tier available, premium options vary |

| Suitability | Experienced technical traders | Beginners to professionals, broad appeal |

2.5. ChartIQ

White-label Solution for Developers

ChartIQ is renowned for its flexibility and power as a white-label solution, primarily serving financial institutions and trading websites. It offers extensive customization options, allowing developers to integrate advanced charting capabilities into their applications seamlessly.

Strengths of ChartIQ include its high degree of customizability and strong focus on interactive charting. It is designed to be embedded into existing platforms, making it an ideal choice for businesses that want to offer sophisticated charting tools without developing them from scratch. Its charting capabilities are robust, supporting a wide range of data visualizations and user interactions, which can be tailored to the specific needs of a business.

Weaknesses are primarily related to its focus; as a white-label product, ChartIQ is less suited for individual traders looking for a standalone trading platform. It requires a significant amount of technical skill to implement effectively, which may put it out of reach for those without development resources.

ChartIQ vs Tradingview

| Feature | ChartIQ | TradingView |

|---|---|---|

| Target Audience | Developers, financial institutions | Individual traders, trading communities |

| Customization Level | Very high, tailored solutions | Moderate, with some customizable features |

| Implementation | Requires development work | Ready to use off-the-shelf |

| Charting Capabilities | Advanced, specialized for integration | Broad, versatile for various markets |

| Accessibility | Requires developer skills, not for general user | User-friendly, accessible to general public |

3. Finding the Right TradingView Alternative for You

Choosing the right alternative to TradingView depends on several factors that align with your personal trading style and requirements. Here’s a recap of the strengths of each platform we discussed, followed by key considerations to help you make an informed choice.

3.1. Recap of Platform Strengths

- MetaTrader 4/5: Best for Forex and CFD traders who need robust algorithmic trading capabilities and extensive customization.

- TrendSpider: Ideal for traders who rely on automated technical analysis to save time and enhance accuracy.

- ETrade Power ETrade: Perfect for active traders who want a comprehensive, integrated trading experience with their brokerage.

- MotiveWave: Suitable for experienced traders focusing on advanced technical analysis like Elliott Wave and Fibonacci.

- ChartIQ: Excellent for developers and financial institutions needing a customizable, white-label solution for integrating advanced charting into their platforms.

3.2. Key Considerations

Trading Style

- Technical vs. Fundamental Analysis: Choose a platform that aligns with your analysis style. For instance, TrendSpider and MotiveWave are superior for technical analysis, while E*Trade offers strong fundamental resources.

- Asset Classes: Consider what markets you are trading in. MetaTrader is favored for Forex, while TradingView and others provide more variety in asset classes.

Budget

- Free vs. Premium Options: Determine your budget. If cost is a concern, look for platforms that offer free tiers or are cost-effective, like some features in E*Trade or the basic service in TradingView.

Ease of Use

- Learning Curves Matter: Consider how much time and effort you are willing to invest in learning the platform. Platforms like MetaTrader and MotiveWave require a steep learning curve compared to the more user-friendly TradingView.

| Consideration | Details |

|---|---|

| Trading Style | Choose based on whether you prefer technical or fundamental analysis. |

| Asset Classes | Select platforms that support the markets you trade in. |

| Budget | Consider if you need a free platform or can invest in premium features. |

| Ease of Use | Assess your willingness to tackle steep learning curves. |

Conclusion

While TradingView is a versatile and widely used platform, there are many great alternatives available that cater to different trading needs and preferences. Each alternative offers unique strengths, whether it’s specialized technical analysis tools, integration with brokerage services, or customizable solutions for developers. The key is to assess your specific requirements in terms of trading style, asset focus, budget, and ease of use.

Remember, there is no single “best” platform; rather, there are various options that can serve as excellent TradingView alternatives depending on your individual trading goals. Explore these options to find a robust solution that extends beyond what TradingView offers.