1. What Is the Hull Moving Average?

The Hull Moving Average (HMA) is a technical indicator created by Alan Hull to improve upon the lag and responsiveness issues found in traditional moving averages. Unlike simple or exponential moving averages, the HMA employs a unique calculation that combines the weighted moving average (WMA) with the concept of smoothing to produce a faster and cleaner signal.

Traders favor the HMA because it can capture quick market trends and allows for early detection of potential reversals. The smoother curve of the HMA minimizes false signals that are often present in other types of moving averages, making it a preferred choice for those looking to minimize noise in fast-moving markets.

The HMA is versatile, applicable to any time frame, and can be used in various markets, including stocks, forex, and commodities. Traders often use it with other indicators to confirm trends and generate buy or sell signals. Its main advantage lies in the combination of speed and smoothness, providing a balance that can enhance trading strategies.

2. How to Calculate the Hull Moving Average?

Calculating the Hull Moving Average (HMA) involves a specific sequence of weighted moving averages and a set of mathematical operations to reduce lag. The first step is to determine the Weighted Moving Average (WMA) over a period that is half the length of the HMA. For example, if you’re calculating a 16-period HMA, you start with the 8-period WMA of the price.

- Choose your window size:

This is the number of periods used in the calculations. A common default is 20, but it’s up to you and your analysis timeframe.

- Calculate the first WMA (WMA1):

- For each data point (i), sum up the prices (P) from the beginning of the series to that point.

- Divide the sum by the number of prices included (i + 1).

WMA1 = (P_0 + P_1 + … + P_(i-1)) / (i + 1)

- Calculate the second WMA (WMA2):

- Divide the window size by 2 and round to the nearest whole number (e.g., 20 / 2 = 10 rounded to 10).

- For each data point (i), sum up the prices (P) from the beginning of the series to that point, but only go back half the window size (e.g., for i = 5, sum P_0 to P_2).

- Divide the sum by the half-window size.

WMA2 = (P_0 + P_1 + … + P_(i-(window/2))) / (window/2)

- Calculate the raw HMA:

- Multiply the second WMA (WMA2) by 2.

- Subtract the first WMA (WMA1) from the result.

Raw HMA = 2 * WMA2 – WMA1

- Smooth the raw HMA:

- Take the square root of the window size and round to the nearest whole number (e.g., sqrt(20) = 4.5 rounded to 5).

- Calculate a third WMA (WMA3) using the raw HMA and the square root as the new window size.

HMA = WMA3(Raw HMA, sqrt(window))

This final WMA3 gives you the smooth Hull Moving Average for that data point. Repeat steps 2-5 to complete the HMA series for all data points.

The implementation of this formula requires intermediate calculations and can be facilitated by spreadsheet software or trading platforms with built-in HMA capabilities. Traders must input accurate data and select appropriate HMA periods that align with their trading strategies and market conditions.

2.1. Understanding the Hull Moving Average Formula

Grasping the Nuances of the HMA Calculation

The HMA formula stands out for its recursive application of the weighted moving average (WMA). The initial step, involving the WMA over half the intended HMA period, is a preparatory stage for subsequent calculations. It’s pivotal to understand that this stage is not merely about averaging prices; it’s about emphasizing recent price data, hence the term ‘weighted’.

In the second step, the inventive aspect of the HMA formula comes into play. By applying the WMA again, this time over the square root of the intended HMA period, the formula takes the concept of smoothing to a higher level. This recursive smoothing is what allows the HMA to stay closer to current prices, thereby reducing lag more effectively than other moving averages.

The final step of the HMA calculation is where the magic happens. By doubling the WMA of the smoothed data (WMA2) and then subtracting the initial WMA (WMA1), the formula achieves a counterbalancing effect. This is akin to adding an adjustment factor that offsets the inherent delay typical in moving averages.

The crux of the HMA lies in its final iteration, where the previous result is subjected to yet another WMA over the square root of the HMA period. This step is crucial as it fine-tunes the balance between lag reduction and curve smoothness, effectively honing the HMA’s responsiveness to price movements.

Understanding each component of the HMA calculation is essential for traders who aim to customize the HMA to their specific trading style. By tweaking the length of the HMA period, traders can adjust the sensitivity of the HMA to align with their risk tolerance and the volatility of the market they are trading in. The formula’s parameters can be modified to suit short-term scalping strategies, medium-term swing trading, or long-term position trading, making the HMA a truly adaptable tool for various trading approaches.

2.2. Step-by-Step Hull Moving Average Calculation

Practical Application of the HMA Calculation

Embarking on the HMA calculation, the first practical step is gathering the selected period’s price data. This data is the foundation for the initial WMA, where recent prices are given more weight. Use a spreadsheet or trading software to calculate the WMA, typically multiplying each price by a weighting factor and summing the results.

Once WMA1 is in hand, proceed with the calculation of WMA2. Here, the square root of the HMA period plays a significant role, as it dictates the span of the second WMA. The recursive application of WMA ensures that the most recent data is smoothed yet remains sensitive to market changes.

The subtlety of the HMA formula is most evident in the final calculation. Doubling WMA2 and subtracting WMA1 is a deliberate move to neutralize the lag that usually plagues moving averages. This step is not merely a mathematical formality; it’s a strategic maneuver to enhance the indicator’s timeliness.

To finalize the HMA, apply the WMA one last time using the square root of the intended period to the value obtained in the previous step. This final smoothing is the key to the HMA’s superior responsiveness. This last iteration refines the moving average, allowing it to mirror price action with minimal delay.

Adopting the HMA in your trading strategy requires consistency in calculation and an understanding of the purpose of each step. The HMA’s accuracy is contingent upon correctly executing these calculations and applying them within the context of market conditions and individual trading goals.

| Calculation Step | Purpose | Key Notes |

| Gather Price Data | Foundation for initial WMA | Ensure data accuracy for reliable calculations |

| Calculate WMA1 | Emphasize recent price data | Use half the intended HMA period |

| Calculate WMA2 | Recursive smoothing | Apply full HMA period to the first WMA |

| Final HMA Calculation | Neutralize lag, enhance response | Double WMA2, subtract WMA1, apply final WMA |

Each calculation step plays a crucial role in achieving the HMA’s objective to provide traders with a quick yet smooth representation of market trends.

2.3. Implementing Hull Moving Average in Excel

Implementing Hull Moving Average in Excel

Excel offers a practical platform for traders to compute the Hull Moving Average (HMA) without the need for advanced programming skills. To implement the HMA, traders can create a spreadsheet that structures the calculation into a series of columns, each representing a step in the process.

Begin by inserting the price data into one column. Adjacent to this, calculate the initial Weighted Moving Average (WMA1) for half the HMA period. This involves assigning weights to each price point, with the most recent prices receiving higher weights. The SUMPRODUCT and SUM functions in Excel are helpful here, allowing you to multiply each price by its weight and then divide by the sum of the weights.

Next, create a column for the second WMA (WMA2), which is the WMA of the first WMA over the square root of the HMA period. This can be computed using the same SUMPRODUCT and SUM functions but applied to the range of cells containing WMA1 values.

For the final HMA calculation, you’ll need to operate doubling WMA2 and subtracting WMA1 from it. This can be achieved by simply creating another column where each cell contains a formula that multiplies the corresponding WMA2 cell by two and then subtracts the WMA1 value.

Lastly, apply the WMA one more time to the result of the previous step to obtain the HMA. This involves the same SUMPRODUCT and SUM functions but is now applied to the range of cells resulting from the double WMA2 minus WMA1 calculation over the square root of the HMA period.

To streamline the process, Excel allows for the creation of named ranges and relative cell references, making it easier to copy formulas across rows. Conditional formatting can highlight the HMA line, helping traders to visually discern the trend direction and potential buy/sell signals.

| Excel Column | Calculation | Excel Function |

| Price Data | – | – |

| WMA1 | Weighted average for half the HMA period | SUMPRODUCT, SUM |

| WMA2 | Weighted average of WMA1 over square root of HMA period | SUMPRODUCT, SUM |

| HMA Step 3 | 2 × WMA2 – WMA1 | Simple arithmetic operation |

| Final HMA | Weighted average of HMA Step 3 over square root of HMA | SUMPRODUCT, SUM |

3. What Are the Hull Moving Average Strategies?

Trend Identification Strategy

The HMA can be utilized for trend identification by plotting it on the price chart. When the HMA rises, it indicates an uptrend, suggesting a potential buy signal. Conversely, a falling HMA signifies a downtrend, potentially triggering a sell signal. Traders often look for the point where the HMA changes direction as a signal for entering or exiting trades.

Crossover Strategy

A common HMA strategy involves observing crossovers with the price. When the price crosses above the HMA, it may be interpreted as a bullish signal. If the price crosses below the HMA, it might be considered bearish. Some traders enhance this strategy by employing two HMAs with different periods, such as a 9-period and a 16-period HMA. A crossover of the two HMAs can signify a stronger trend confirmation.

Pullback and Reversal Strategy

Traders may use the HMA to identify pullbacks within a trend for entry points. During an uptrend, a temporary dip in price that brings it closer to the HMA could be seen as a buying opportunity, assuming the longer-term uptrend will resume. The same concept applies in a downtrend, where a brief price rise towards the HMA might be a selling opportunity.

Breakout Strategy

The HMA can also aid in spotting breakouts. A price that moves sharply away from the HMA, especially after a period of consolidation, might indicate a beginning of a new trend. Traders could use this as a signal to enter a trade in the direction of the breakout.

| Strategy | Signal for Entry | Signal for Exit |

| Trend Identification | HMA direction change | Opposite HMA direction change |

| Crossover | Price/HMA or HMA/HMA crossover | Opposite crossover |

| Pullback and Reversal | Price approaches HMA during trend | Price moves away from HMA or trend weakens |

| Breakout | Price moves sharply from HMA | Falling momentum or return to HMA |

Each strategy requires monitoring the HMA about price action or other HMAs to capitalize on the indicator’s strengths. It’s imperative for traders to manage risk with stop-loss orders and to consider other market factors and indicators before making trade decisions.

3.1. Identifying Trend Reversals with HMA

Slope Changes in HMA

The slope of the HMA line itself is a primary indicator of a trend reversal. A change from an upward to a downward slope can signal a shift from a bullish to a bearish trend. Conversely, a slope that turns from downward to upward suggests a transition from bearish to bullish momentum. These slope changes can be more readily observed with the HMA due to its smoothness, which filters out the minor fluctuations that might obscure the true trend direction.

HMA and Price Interaction

A trend reversal may also be indicated by how the price interacts with the HMA. If the price action begins to consistently stay on one side of the HMA and then crosses to the other side, it could be a precursor to a trend change. For instance, if prices that were predominantly above the HMA start to close below it, traders may interpret this as a potential reversal from an uptrend to a downtrend.

Momentum Oscillators Confluence

Incorporating momentum oscillators like the Relative Strength Index (RSI) or the MACD can provide additional confirmation of a reversal signaled by the HMA. For instance, if the HMA indicates a potential bullish reversal and the RSI moves above 30 (out of the oversold region), it adds credence to the reversal signal. Similarly, a bearish reversal signal from the HMA coupled with a MACD crossover below the signal line can reinforce the validity of the trend change.

Volume as a Confirmation Tool

Volume can act as a confirmation tool when identifying reversals with the HMA. An increase in trading volume coinciding with a price crossing the HMA can affirm the strength of the reversal. Higher volume during such crossings suggests a stronger consensus among traders about the change in trend direction.

| Reversal Indicator | Bullish Signal | Bearish Signal |

| HMA Slope | Upward slope to downward slope change | Downward slope to upward slope change |

| Price and HMA Cross | Price crosses from below to above HMA | Price crosses from above to below HMA |

| Momentum Oscillator | RSI above 30, MACD crosses above signal | RSI below 70, MACD crosses below signal |

| Volume | Increase in volume as price crosses HMA | Increase in volume as price crosses HMA |

Traders should be cognizant of these signals and consider waiting for multiple indicators to align before acting on a reversal signal, as this can help mitigate the risk of false positives.

3.2. Combining Hull Moving Average with Other Indicators

Enhancing HMA Signals with RSI and MACD

Combining the Hull Moving Average (HMA) with oscillators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can create a robust trading system that filters signals for higher probability trades. The RSI, a momentum oscillator that measures the speed and change of price movements, complements the HMA’s trend identification capability. When the HMA indicates a trend but the RSI is overbought (>70) or oversold (<30), it warns traders of potential trend exhaustion and the possibility of a reversal.

The MACD, on the other hand, tracks the relationship between two moving averages of a security’s price. By using the MACD in conjunction with the HMA, traders can detect changes in momentum and confirm trend directions. A bullish signal is reinforced when the HMA is trending upwards and the MACD line crosses above the signal line. Conversely, a bearish confirmation is seen when the HMA trends downward while the MACD line crosses below the signal line.

Combining HMA with Bollinger Bands

Bollinger Bands provide a measure of market volatility relative to the moving average. When used with the HMA, Bollinger Bands can help traders identify periods of low volatility that often precede strong breakouts. An HMA that moves outside the Bollinger Bands could signal a continuation of the trend, whereas an HMA that converges within the bands might indicate a slowing momentum or a potential reversal.

Synergy with Stochastic Oscillator

The Stochastic Oscillator is another useful tool that can be paired with the HMA. It compares the closing price of an asset to its price range over a certain period. This indicator can be particularly helpful when the HMA shows a clear trend, but the market is in a state of overbought or oversold conditions. For example, in an uptrend identified by the HMA, a stochastic reading below 20 indicates oversold conditions, presenting a potential buying opportunity.

| Indicator | Bullish Signal | Bearish Signal |

| RSI | HMA up and RSI moves above 30 | HMA down and RSI moves below 70 |

| MACD | HMA up and MACD line crosses above signal line | HMA down and MACD line crosses below signal line |

| Bollinger Bands | HMA moves outside upper band | HMA moves outside lower band |

| Stochastic | HMA up and Stochastic below 20 (oversold) | HMA down and Stochastic above 80 (overbought) |

3.3. Hull Moving Average Crossover Strategy

Hull Moving Average Crossover Strategy

The Hull Moving Average Crossover Strategy leverages the reduced lag characteristic of the HMA to pinpoint potential entry and exit points. This strategy typically involves using two HMAs with different lengths; a shorter period HMA for more responsive signals and a longer period HMA to gauge the prevailing trend.

Traders implement this strategy by observing the crossover points. A buy signal is generated when the shorter HMA crosses above the longer HMA, suggesting an emerging uptrend. Conversely, a sell signal occurs when the shorter HMA crosses below, indicating a potential downtrend. This dual-HMA system aims to capture significant trends while avoiding minor price fluctuations that could lead to false signals.

The effectiveness of the crossover strategy can be enhanced by adjusting the lengths of the HMA periods based on the asset’s volatility and the trader’s time horizon. For instance, a highly volatile market might require a shorter HMA to be more reactive, whereas a less volatile market or a longer-term trading approach might benefit from a longer HMA to filter out market noise.

Optimal HMA Lengths

| Market Condition | Shorter HMA Period | Longer HMA Period |

| High Volatility | Shorter for reactivity | Moderate to filter noise |

| Low Volatility | Moderate to avoid whipsaws | Longer for trend confirmation |

| Short-Term Trading | Very Short to capture quick trends | Short to medium for context |

| Long-Term Trading | Medium for less noise | Long for strong trend confirmation |

It’s crucial to note that while the HMA Crossover Strategy is powerful, it’s not infallible. False signals can occur, particularly in sideways markets where crossovers might be frequent and misleading. To mitigate this, traders often combine the crossover strategy with technical analysis tools such as volume indicators, support and resistance levels, or additional momentum oscillators to validate signals. This multifaceted approach can provide a more comprehensive view of the market, leading to more informed trading decisions.

4. How to Trade the Hull Moving Average?

Trading with the Hull Moving Average

Trading the Hull Moving Average (HMA) effectively hinges on recognizing trend shifts and momentum changes in market prices. To capitalize on the HMA’s benefits, traders should first establish the appropriate timeframe and HMA period that aligns with their trading style. A shorter HMA period captures price movements quickly, suitable for day traders, while a longer period smooths out volatility, favoring swing traders or investors.

When the HMA slope changes direction, it indicates a potential trend reversal. Traders can enter a position as the HMA starts to rise, signaling an upward trend, and exit or go short when the HMA begins to decline. This method relies on the HMA’s ability to reduce lag and respond rapidly to price changes, providing timely signals compared to traditional moving averages.

Trade Entries and Exits

| HMA Trend | Trade Action |

| Upward Slope | Consider long positions or closing shorts |

| Downward Slope | Consider short positions or closing longs |

To refine entry and exit points, traders can apply the HMA in conjunction with price action. A breakout above the HMA may offer a buying opportunity, while a breakdown below the HMA could suggest an exit or short-selling opportunity. Monitoring the HMA’s interaction with price provides an additional layer of confirmation, reducing the likelihood of false signals.

Incorporating volume analysis with the HMA enhances trade validation. An increase in volume on a trend change or breakout confirms market commitment to the new direction. Conversely, a trend change on low volume might be less reliable, indicating a need for caution before entering a trade.

Volume Confirmation

| HMA Signal | Volume Indicator | Trade Validity |

| Trend Change | High Volume | More Reliable |

| Breakout | Increasing Volume | Strengthened Signal |

Lastly, the use of stop-loss orders is crucial when trading with the HMA to manage risk effectively. Setting a stop-loss just below the HMA in an uptrend, or above it in a downtrend, can help protect against significant losses in the event of a sudden market reversal. Adjusting the stop-loss order as the trend progresses and the HMA moves can lock in profits and limit downside exposure.

Stop-Loss Placement

| Market Trend | Stop-Loss Position |

| Uptrend | Just below the HMA |

| Downtrend | Just above the HMA |

Trading with the HMA revolves around its swift response to price changes, providing a clear framework for trend-based strategies. By combining the HMA with other technical tools and sound risk management practices, traders can seek to improve the precision of their trades and potential profitability.

4.1. Setting Up Hull Moving Average on MT4

Setting Up Hull Moving Average on MT4

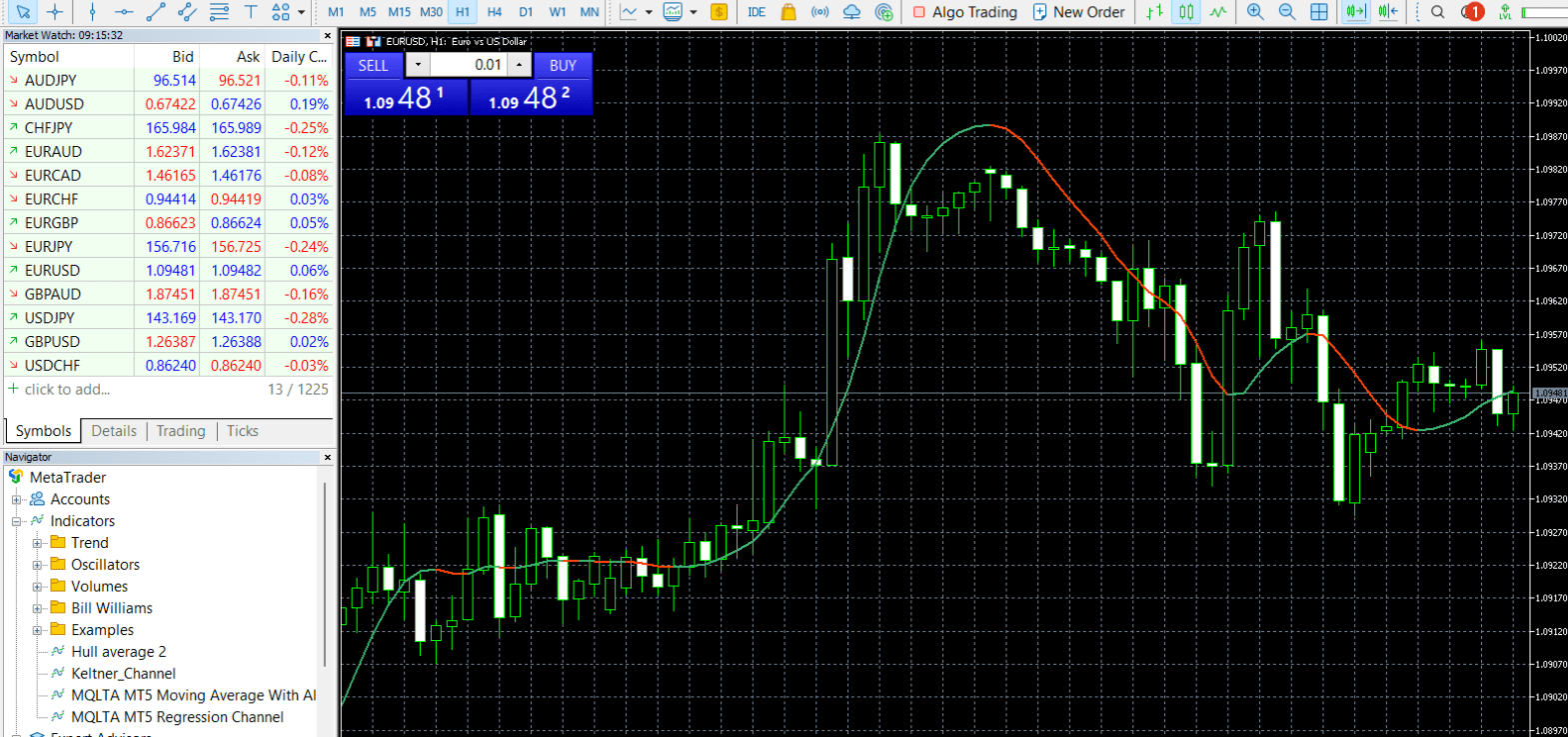

To integrate the Hull Moving Average (HMA) into the MetaTrader 4 (MT4) platform, traders must first download the HMA indicator file, which is usually available in .mq4 or .ex4 format. Access the MT4 terminal and click on “File” in the top menu, then select “Open Data Folder.” Within the opened directory, navigate to the “MQL4” folder, followed by the “Indicators” folder. Drag and drop the downloaded HMA indicator file into this location.

Restart the MT4 platform to refresh the list of available indicators. The HMA should now appear in the “Custom Indicators” section of the “Navigator” panel. To apply it to a chart, simply drag the HMA from the “Navigator” to the desired chart or right-click the indicator and select “Attach to a chart.”

Customization is key when setting up the HMA. Double-click the HMA in the “Navigator” panel or right-click on the HMA already applied to a chart and select “Properties” to adjust its parameters. The most critical parameter is the period length, which should be chosen based on the trader’s specific strategy and the asset’s volatility. Users can also change the color and thickness of the HMA line for better visual clarity.

Sample HMA Settings for MT4

| Parameter | Description | Default Setting | Customization Tip |

| Period | Number of bars used to calculate the HMA | 14 | Adjust based on trading style and volatility |

| Method | Mathematical method for averaging prices | Linear Weighted | Typically left as default |

| Apply to | Price data used in calculations | Close | Can be set to Open, High, Low, or Close |

| Style | Visual style of the HMA line | Solid | Set to preference for clarity |

| Color | Color of the HMA line | Red | Choose contrasting color for visibility |

Once set up, monitor the indicator for potential trading signals as outlined in the strategies previously discussed. Remember that the HMA on MT4 is a tool to aid decision-making, and its effectiveness is enhanced when used in conjunction with other technical analysis methods.

4.2. Entry and Exit Signals Using HMA

Entry Signals with HMA

The Hull Moving Average (HMA) provides entry signals when the price action and the HMA align to suggest a new trend. For a long entry, the signal is a price closing above the HMA, ideally following an uptrend signal from the HMA slope turning upward. A short entry is indicated by the price closing below the HMA during a downtrend, confirmed by a downward turn in the HMA slope. Traders should look for these signals in conjunction with high volume, which corroborates the strength of the trend.

Trade Entry Confirmation

| Position Type | Price Action | HMA Slope | Volume |

| Long Entry | Close above HMA | Upward | High Volume |

| Short Entry | Close below HMA | Downward | High Volume |

Exit Signals with HMA

Exiting a trade using the HMA involves observing the loss of momentum or a change in direction of the HMA line. For exiting long positions, a trader should consider closing the trade when the HMA begins to flatten after an uptrend or turns downward. Conversely, an exit signal for a short position might be when the HMA stops declining and starts to rise, indicating a potential reversal. To further validate exit signals, traders may monitor decreasing volume, which often precedes a reversal in trend.

Trade Exit Confirmation

| Position Type | HMA Signal | Volume |

| Long Exit | HMA slope flattens or turns downward | Decreasing Volume |

| Short Exit | HMA slope flattens or turns upward | Decreasing Volume |

Traders using the HMA can enhance their decision-making by combining these signals with other technical tools such as candlestick patterns, support and resistance levels, or momentum oscillators. This multi-layered approach helps to filter out false signals and allows for more precise timing in entering and exiting trades.

4.3. Risk Management with Hull Moving Average

Risk Management with Hull Moving Average

Effective risk management with the Hull Moving Average (HMA) involves using its sensitivity to price movements to set dynamic stop-loss orders. Given the HMA’s propensity to reduce lag, it can help traders to adjust stop-loss levels in real-time, ensuring they’re in sync with current market conditions. A stop-loss order could be placed a certain number of pips away from the HMA line or adjusted according to a percentage of the asset’s volatility.

Additionally, the HMA can assist in position sizing. By determining the distance between the entry point and the stop-loss level, traders can calculate the appropriate trade size. This helps to manage the risk by ensuring that only a small percentage of the total capital is risked on any single trade.

Dynamic Stop-Loss Adjustment

| Market Trend | Stop-Loss Placement |

| Uptrend | Stop-loss below HMA |

| Downtrend | Stop-loss above HMA |

Furthermore, the HMA’s ability to identify trend reversals can serve as an exit strategy for trades that have moved against the trader’s position. Exiting a trade when the HMA changes direction minimizes losses and preserves capital for future trades.

Position Sizing Based on HMA

| Entry Point | Stop-Loss Level | Position Size |

| Above/Below HMA | HMA +/- Set Pips | Calculated Risk % |

Incorporating the HMA with trailing stop-loss orders can help in capturing profits while still providing downside protection. As a trade becomes profitable, a trailing stop can be set at a predefined distance from the HMA, allowing the trade to remain open as long as the trend continues favorably but automatically closing if the market moves against the position.

Lastly, the HMA can be used to identify risk-reward ratios for potential trades. Comparing the distance from entry to the stop-loss level versus the distance from entry to the profit target gives traders an insight into whether a trade is worth taking. A favorable risk-reward ratio, such as 1:2 or higher, ensures that potential profits outweigh the risks.

Risk-Reward Ratio Calculation

| Entry Point | Stop-Loss Level | Profit Target | Risk-Reward Ratio |

| Above/Below HMA | HMA +/- Set Pips | Predetermined Level | 1:2, 1:3, etc. |

5. What Are the Pros and Cons of Using Hull Moving Average?

Pros of Using Hull Moving Average

The Hull Moving Average (HMA) stands out for its speed and accuracy in identifying market trends. Its primary advantage is the reduced lag compared to traditional moving averages, which enables traders to react quicker to changes in price action. This can be particularly beneficial in fast-moving markets where timely entries and exits are crucial.

The HMA’s responsiveness also makes it a versatile tool for various trading styles, from day trading to long-term investing. Traders can adjust the period length to suit their individual strategies, making it a flexible indicator for different time frames and market conditions.

Another significant pro is the HMA’s smoothness, which helps in filtering out market noise. This smoothing effect provides a clearer picture of the underlying trend without the distractions of minor price fluctuations that may affect other types of moving averages.

Pros at a Glance

| Advantage | Description |

| Reduced Lag | Quick to reflect price changes, offering timely signals. |

| Flexibility | Adjustable period lengths cater to different trading styles. |

| Smoothness | Filters out market noise, enabling clearer trend recognition. |

Cons of Using Hull Moving Average

Despite its advantages, the HMA is not without drawbacks. A notable con is the risk of false signals, particularly in sideways or choppy markets where the HMA’s sensitivity can lead to premature entries or exits. Traders might experience whipsaws, which are false trend indications that can result in losses if not managed correctly.

The HMA’s quick reaction to price movements, while mostly positive, can also be a double-edged sword. In highly volatile markets, the HMA might generate signals too frequently, complicating the decision-making process and potentially leading to overtrading.

Moreover, the HMA is just one tool in a trader’s arsenal and should not be relied upon exclusively. It does not provide information on market volume or sentiment, which are crucial aspects of comprehensive market analysis. Therefore, it’s essential to use the HMA in conjunction with other indicators and analysis techniques for a more robust trading strategy.

Cons at a Glance

| Disadvantage | Description |

| Risk of False Signals | Prone to generating misleading signals in non-trending markets. |

| Overreaction | May respond too quickly in volatile conditions, leading to confusion. |

| Lack of Depth | Doesn’t account for volume or sentiment, requiring supplemental analysis. |

5.1. Advantages of HMA in Trading

Enhanced Trend Detection

The HMA’s advanced calculation method substantially reduces the delay typically found in standard moving averages. This prompt trend detection characteristic is vital for traders who aim to capitalize on the early stages of a trend. The HMA’s formula, which incorporates the weighted moving average (WMA) and roots of the period, ensures that traders receive signals closer to the price action, enabling them to make swift and informed decisions.

Adaptability Across Timeframes

Versatility across various timeframes stands out as a significant advantage of the HMA. Whether it’s a fast-paced scalper or a strategic long-term investor, the HMA’s period length can be fine-tuned to serve distinct trading styles. This adaptability allows the HMA to be an effective tool for multiple trading strategies, ensuring that it remains relevant and valuable irrespective of market changes or personal trading approach.

Effective in Trend Confirmation

The smoothing mechanism of the HMA not only reduces lag but also helps in delineating actual trends from market noise. By doing so, it provides traders with clearer trend confirmation, which is critical for executing trades that align with the market’s direction. The HMA’s smooth curve assists in identifying sustainable trends, which is beneficial for strategic entry and exit points.

Trend Confirmation Attributes

| Attribute | Benefit to Traders |

| Reduced Noise | Provides a cleaner analysis of the market trend. |

| Smooth Curve | Offers a visual aid for easier trend identification. |

| Timely Confirmation | Enables entry into trades at optimal moments. |

Superior to Traditional MAs

Compared to traditional moving averages like the Simple Moving Average (SMA) or the Exponential Moving Average (EMA), the HMA provides a unique combination of lag reduction and smoothing. While EMAs give more weight to recent prices, they still lag behind the HMA regarding responsiveness. The HMA’s formula addresses this by averaging the average, which effectively doubles the weight of recent prices, thereby enhancing reaction speed to market changes.

Risk Management Enhancement

For traders, managing risk is as crucial as identifying trade opportunities. The HMA’s quick response to price changes allows for dynamic stop-loss placement, which can be crucial in protecting profits and limiting losses. By aligning stop-loss orders with the HMA’s current level, traders can ensure their risk management strategy is as current and responsive as their trade signals.

Dynamic Risk Management with HMA

| Risk Management Tool | HMA Advantage |

| Stop-Loss Orders | Allows for real-time adjustments with market moves. |

| Trailing Stops | Secures profits while providing downside protection. |

In trading, where the ability to swiftly adapt to market conditions can be the difference between profit and loss, the HMA’s advantages provide a competitive edge. Its quick trend detection, adaptability, and risk management enhancements are key reasons for its popularity among traders.

5.2. Limitations and Considerations When Using HMA

Interpretation Nuances

While the HMA’s speed in trend detection is commendable, it’s essential to recognize the potential for overfitting in certain market conditions. Traders should be cautious of the HMA’s tendency to fit too closely to historical data, which may not always be indicative of future movements. This can lead to a false sense of security in the strength of a signal, prompting ill-timed entries or exits.

Market Context and HMA Sensitivity

The market context plays a crucial role when employing the HMA. In markets characterized by high volatility, the HMA’s sensitivity can result in rapid changes in direction, which may be misinterpreted as trend reversals. It’s vital for traders to consider the broader market environment and apply the HMA within the context of overall price action and market structure.

HMA and Divergence

Divergence between the HMA and price may occur, signaling a potential reversal or weakening of the trend. However, reliance on divergence alone can be misleading without confirmation from other technical indicators or analysis. Traders should use divergence as a component of a more comprehensive strategy, rather than as a standalone signal.

Parameter Selection

Choosing the appropriate HMA period is a balancing act. A shorter period may lead to increased sensitivity and noise, while a longer period could lag excessively in fast markets. Traders need to fine-tune the HMA settings to match their trading horizon and the volatility characteristics of the instrument being traded.

Supplemental Indicators

Finally, the HMA should not be used in isolation. Pairing it with volume indicators, oscillators, or price patterns can provide a more three-dimensional view of the market. This combination approach mitigates the limitations of the HMA and enables a more holistic market analysis.

| Consideration | Purpose |

| Market Context | Ensures HMA signals are interpreted within broader market conditions. |

| Parameter Fine-Tuning | Optimizes HMA responsiveness to align with trading strategy. |

| Supplemental Indicators | Provide additional validation for HMA-generated signals. |

After acknowledging these limitations and considerations, traders can better integrate the HMA into their trading practice, ensuring that they harness the indicator’s strengths while remaining aware of its potential