1. Overview of the Median Indicator

The Median Indicator is a statistical measure used in financial analysis to identify the middle value in a data set. When arranged in ascending or descending order, the median represents the central value that divides the data set into two equal halves. Unlike the mean (average), which sums up all the values and divides them by the total number, the median is less affected by outliers and extreme values, making it a more reliable measure for skewed distributions.

In the context of finance, the median is often used to analyze and interpret a range of data, such as stock prices, trading volumes, and economic indicators. It provides a more accurate representation of the ‘typical’ value, especially in scenarios where data is unevenly distributed. For instance, when assessing the typical performance of a stock over a certain period, the median can offer a clearer picture than the average if there are extreme spikes or drops in the stock’s price.

Understanding the median is crucial for both beginners and advanced traders, as it forms the basis for more complex financial indicators and strategies. For example, median-based indicators like the Median Price Indicator or the Moving Median are commonly used in technical analysis to smooth out price data and identify trends.

1.1 Advantages of the Median Indicator

- Resistance to Outliers: The median is not influenced by extreme values, making it more stable in the presence of outliers compared to the mean.

- Representative of Typical Value: It provides a more accurate reflection of the central tendency in a skewed distribution.

- Simple and Intuitive: The concept of the median is straightforward, making it easily understandable and applicable.

1.2 Limitations of the Median Indicator

- Not Sensitive to All Data Points: The median only considers the middle value, ignoring the actual distribution and magnitude of other data points.

- Limited Use in Predictive Analysis: Unlike some other statistical measures, the median does not incorporate all data characteristics, which can limit its utility in forecasting.

- Can Be Misleading in Small Data Sets: In smaller data sets, the median might not accurately reflect the distribution’s tendencies.

| Aspect | Details |

| Definition | Statistical measure identifying the middle value in a data set. |

| Importance | Offers a more reliable measure for skewed distributions in financial data. |

| Advantages | Resistant to outliers, represents typical value, simple and intuitive. |

| Limitations | Not sensitive to all data points, limited use in predictive analysis, can be misleading in small data sets. |

2. Calculation Process of the Median Indicator

Calculating the median in a financial context involves a series of straightforward steps. Understanding this process is crucial for traders and analysts to accurately interpret the data they are analyzing. Here’s how it is typically done:

2.1 Step-by-Step Calculation

- Organizing the Data: Arrange the data set (e.g., stock prices, trading volumes) in ascending or descending order.

- Determining the Data Set Size: Count the number of data points in the set.

- Finding the Median:

- If the number of data points is odd, the median is the middle value.

- If the number of data points is even, the median is the average of the two middle values.

2.2 Example of Calculation

Consider a set of closing prices for a stock over five consecutive days: $10, $12, $15, $17, $20. Here, the number of data points is 5, which is odd. So, the median price is the third value when arranged in ascending order, which is $15.

In a case where the number of data points is even, for example, six days with closing prices of $10, $12, $14, $16, $18, $20, the median would be the average of the third and fourth values, ($14 + $16) / 2 = $15.

| Step | Details |

| Organizing the Data | Arrange data in ascending or descending order. |

| Determining the Data Set Size | Count the number of data points. |

| Finding the Median | For odd data points: middle value; for even data points: average of two middle values. |

3. Optimal Values for Setup in Different Timeframes

The effectiveness of the Median Indicator can vary significantly depending on the timeframe being analyzed. Adjusting its parameters according to the trading strategy – whether short-term, medium-term, or long-term – is essential for accurate analysis. Here’s a guide to setting up the Median Indicator for different trading timeframes:

3.1 Short-Term Trading

For short-term traders, such as day traders or scalpers, the focus is typically on minute-to-minute or hour-to-hour fluctuations. In these cases, a smaller dataset for calculating the median can be more effective. This provides a quick reflection of the market’s central tendency, allowing for fast decision-making.

- Recommended Data Set Size: 5 to 15 data points.

- Advantages: Quick reflection of current market conditions, responsive to market changes.

- Limitations: Higher susceptibility to random market noise, less reliable for identifying longer-term trends.

3.2 Medium-Term Trading

Medium-term traders, like swing traders, typically focus on days to weeks. A moderately sized data set for the median calculation can balance responsiveness and stability. This timeframe offers a blend of short-term reactivity and long-term trend analysis.

- Recommended Data Set Size: 20 to 50 data points.

- Advantages: Balances between reactivity and trend stability, less affected by short-term volatility.

- Limitations: May lag behind rapid market changes, moderate susceptibility to market noise.

3.3 Long-Term Trading

For long-term traders, such as position traders, the focus is on the broader market trend over months or years. A larger data set for the median calculation can smooth out short-term fluctuations and highlight longer-term trends.

- Recommended Data Set Size: 50 to 100 data points or more.

- Advantages: Provides a clear view of long-term trends, less affected by short-term market fluctuations.

- Limitations: Less responsive to recent market changes, may miss short-term trading opportunities.

| Trading Timeframe | Recommended Data Set Size | Advantages | Limitations |

| Short-Term Trading | 5 to 15 data points | Quick reflection of market, responsive | Susceptible to market noise, less reliable for long-term trends |

| Medium-Term Trading | 20 to 50 data points | Balance between reactivity and stability | Moderate susceptibility to market noise |

| Long-Term Trading | 50 to 100 data points or more | Clear view of long-term trends | Less responsive to recent changes, may miss short-term opportunities |

4. Interpretation of the Median Indicator

Interpreting the Median Indicator correctly is key to leveraging it effectively in trading. The median provides a central reference point that can be used to assess market conditions and make informed trading decisions. Here’s how traders can interpret the Median Indicator in various scenarios:

4.1 Identifying Market Trends

The median can serve as a benchmark to identify the general direction of the market. If the current market price is above the median, it may indicate an upward trend, and conversely, a price below the median can signal a downward trend.

4.2 Assessing Market Volatility

Comparing short-term median values with longer-term medians can provide insights into market volatility. A wide divergence between these values often signals increased volatility, whereas similarity indicates a more stable market.

4.3 Gauging Market Sentiment

The position of recent prices in relation to the median can offer clues about market sentiment. A consistently higher or lower positioning compared to the median might suggest bullish or bearish sentiment, respectively.

4.4 Decision-Making in Trading

Traders can use the median as a part of their decision-making process. For example, buying when the price is near or below the median in an uptrend or selling when the price is near or above the median in a downtrend. However, it’s important to use the median in conjunction with other indicators for more comprehensive analysis.

| Interpretation Aspect | Details |

| Identifying Market Trends | Use median as a benchmark for trend direction. |

| Assessing Market Volatility | Compare short-term and long-term medians to gauge volatility. |

| Gauging Market Sentiment | Analyze recent prices’ position relative to the median for sentiment insights. |

| Decision Making in Trading | Use the median to inform buy/sell decisions, in combination with other indicators. |

5. Combining the Median Indicator with Other Indicators

While the Median Indicator is powerful on its own, combining it with other financial indicators can provide a more comprehensive view of the market. This holistic approach helps in validating signals and refining trading strategies. Below are some effective combinations:

5.1 Median and Moving Averages

Pairing the Median with moving averages, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA), can help identify trends more clearly. The median can pinpoint the market’s central tendency, while moving averages can indicate the trend direction and strength.

5.2 Median and Bollinger Bands

Bollinger Bands, which consist of an SMA and standard deviation lines, used in conjunction with the median, can offer insights into market volatility. The median provides a baseline, while the bands indicate how far the market is straying from the norm.

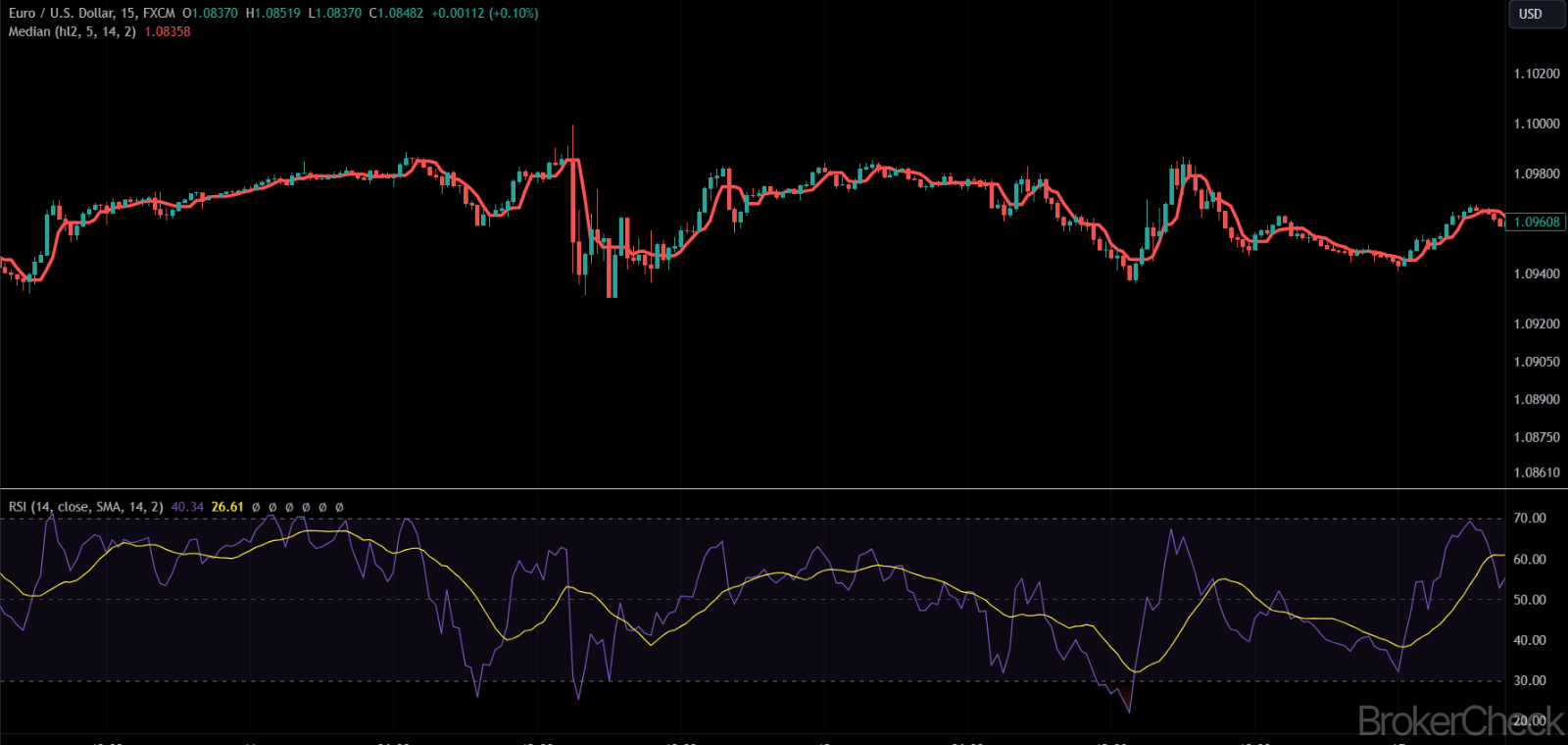

5.3 Median and Relative Strength Index (RSI)

The RSI, a momentum oscillator, combined with the Median Indicator, can be useful in identifying potential overbought or oversold conditions. The median establishes a market baseline, while the RSI measures the speed and change of price movements.

5.4 Median and Volume Indicators

Volume indicators, like the On-Balance Volume (OBV), when used with the median, can validate the strength of market trends. A rising median alongside increasing volume can confirm a strong trend, and vice versa.

| Combination | Function | Benefits |

| Median and Moving Averages | Trend Identification | Enhances trend clarity by combining central tendency with trend direction. |

| Median and Bollinger Bands | Volatility Analysis | Offers a comprehensive view of market volatility and price extremities. |

| Median and RSI | Momentum Analysis | Useful in spotting overbought or oversold conditions with a market baseline. |

| Median and Volume Indicators | Trend Confirmation | Confirms trend strength by aligning price movement with volume. |

6. Risk Management Strategies with the Median Indicator

Effective risk management is essential in trading, especially when utilizing indicators like the Median. While the Median Indicator provides valuable insights, traders must also consider risk management strategies to protect their investments. Here are key strategies to consider:

6.1 Setting Stop-Loss and Take-Profit Points

Using the median as a reference, traders can set stop-loss and take-profit points. A stop-loss can be placed just below the median for long positions, or above it for short positions, to limit potential losses. Similarly, take-profit points can be set to ensure gains are realized before market reversals.

6.2 Position Sizing

Adjusting position sizes based on the strength of the median signal can help manage risk. Stronger signals (e.g., when price significantly deviates from the median) might warrant larger positions, while weaker signals could call for smaller ones.

6.3 Diversification

While the median can guide individual trading decisions, diversifying across different assets and sectors can spread risk. This helps in mitigating the impact of any single market movement.

6.4 Combining with Other Risk Management Tools

Integrating the Median Indicator with other risk management tools like volatility indicators and correlation analysis can provide a more robust risk assessment framework.

| Risk Management Strategy | Application | Benefits |

| Stop-Loss and Take-Profit Points | Using median for setting exit points. | Limits potential losses and secures profits. |

| Position Sizing | Adjust sizes based on median signal strength. | Balances risk according to signal confidence. |

| Diversification | Spread investments across assets/sectors. | Reduces impact of adverse movements in any single market. |

| Combining with Other Tools | Use alongside other risk management indicators. | Provides a comprehensive risk assessment. |