1. Overview Of Sierra Charts

Sierra Charts is widely recognized as a robust and efficient charting platform, particularly favored by advanced traders who demand high-level functionalities and precision. However, despite its strengths, various traders explore alternatives due to concerns over aspects like pricing, features, and software compatibility. This search for alternatives is driven by the unique needs and preferences of individual traders, who may require different functionalities or find the cost-prohibitive aspects of Sierra Charts a significant barrier.

The purpose of this article is to dive into the top alternatives to Sierra Charts, providing traders with comprehensive insights into other options available in the market. We will examine each alternative’s key features, benefits, and drawbacks, and discuss the ideal user profiles for each. This guide aims to assist traders in making informed decisions by comparing these platforms directly against Sierra Charts, focusing on how well they serve different trading needs and preferences.

| Aspect | Details |

|---|---|

| Focus | Sierra Charts Alternatives |

| Reason for Seeking Alternatives | Pricing issues, varying feature needs, software compatibility |

| Objective | To explore top alternatives, comparing their features, benefits, and ideal user types |

2. Top 5 Sierra Charts Alternatives

2.1. TradingView

TradingView stands out as a leading platform in the financial markets for its comprehensive charting and analysis capabilities. Here’s an in-depth look at what makes TradingView a noteworthy alternative to Sierra Charts:

TradingView is celebrated for its user-friendly interface and extensive charting tools, catering to a global community of 20 million traders. It’s a cloud-based platform that integrates charts, indicators, screening, and backtesting seamlessly.

2.1.1. Key Features

- Advanced Charting: Real-time data with numerous chart types.

- Technical Analysis: Extensive indicators and drawing tools.

- Social Trading: Large community for sharing and discussing trade ideas.

- Multi-platform Support: Accessible via web, desktop, and mobile applications, ensuring flexibility and mobility.

2.1.2. Key Benefits

- Extensive Charting Tools: Offers a variety of chart styles and technical indicators.

- Massive User Community: Enables interaction with a large network of traders.

- Social Elements: Includes features like chat, news, and the ability to follow other traders.

- Free Plan Available: Provides basic functionalities at no cost.

2.1.3. Drawbacks

- Higher Tiers Can Be Expensive: Premium features come at a higher cost.

- Learning Curve: Some users may find the array of tools and options daunting at first.

2.1.4. Ideal For

TradingView is ideal for traders who value community interaction and extensive technical analysis capabilities, including day traders and swing traders who require detailed charting and real-time data.

TradingView vs. Sierra Charts

| Feature | TradingView | Sierra Charts |

|---|---|---|

| Charting Capabilities | Extensive with multiple chart types | Advanced, with high customization |

| User Community | Very large and active | Smaller, professional-focused |

| Pricing | Free tier available; premium plans start at $14.95/month | Subscription only |

| Platform Access | Web, desktop, and mobile | Mainly desktop |

| Technical Analysis | Superior with social trading aspects | Focused on deep technical analysis |

2.2. NinjaTrader

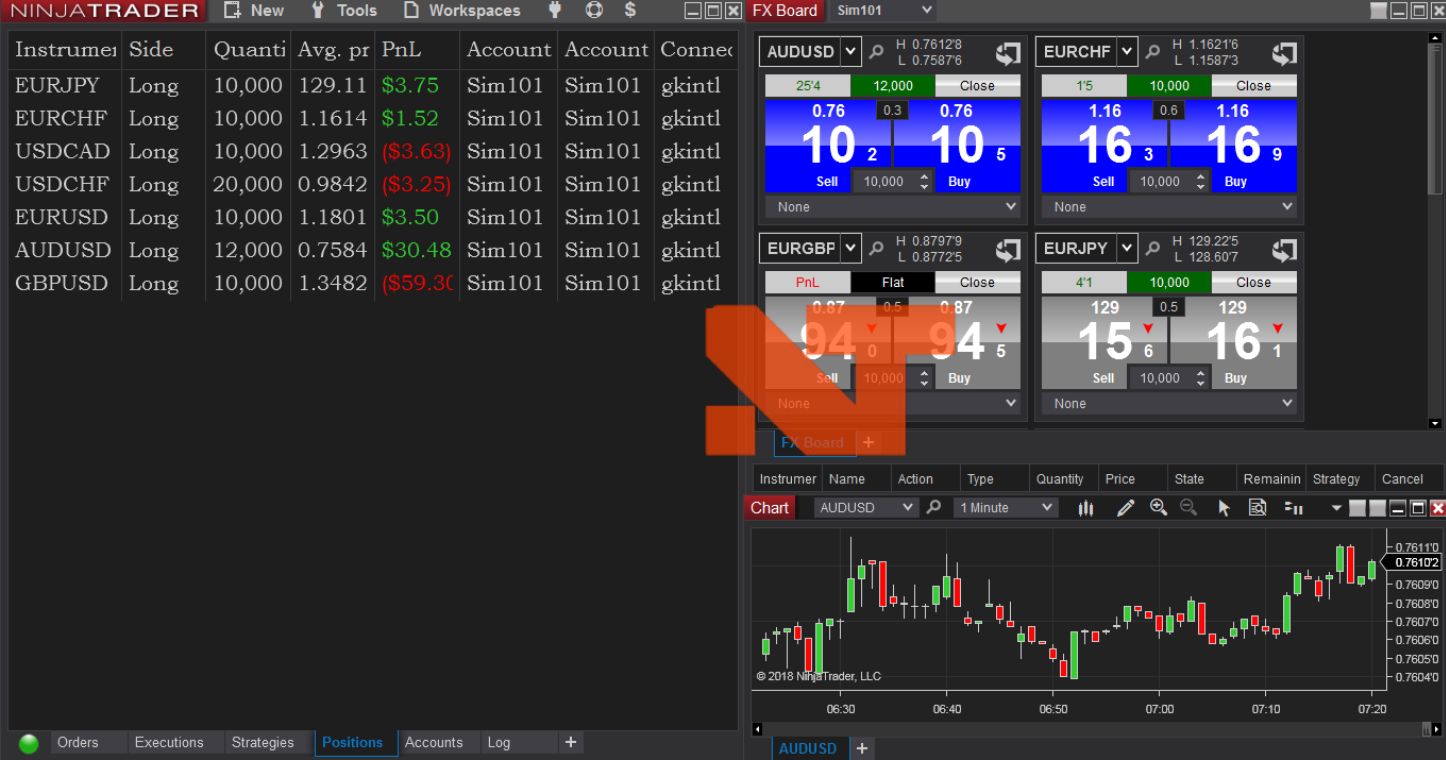

NinjaTrader is recognized for its robust and customizable trading tools, making it a strong contender for those seeking alternatives to Sierra Charts.

NinjaTrader offers a comprehensive platform mainly used for trading futures and forex. It is well-regarded for its advanced charting, trading, and automation capabilities, and is particularly favored by those interested in serious trading strategy development and backtesting.

2.2.1. Key Features

- Advanced Charting: High-quality charting with options for extensive customization.

- Market Analysis Tools: Includes numerous technical indicators and tools for comprehensive market analysis.

- Automation: Supports automated trading strategies through NinjaScript.

- Extensive Add-Ons: Access to thousands of third-party apps and add-ons to enhance trading functionality.

2.2.2. Key Benefits

- Customizable Interface: Highly customizable for individual trading preferences.

- Backtesting Capabilities: Strong backtesting features allowing traders to test strategies with historical data.

- Low Trading Costs: Competitive pricing structure, including low commissions and access to futures trading with low margins.

2.2.3. Drawbacks

- Complexity in Setup and Learning: The platform’s robust features can be complex to set up and require a steep learning curve for new users.

- Limited Mobile Support: As of the latest updates, NinjaTrader does not offer a native mobile trading application, which may be a limitation for traders seeking mobility.

2.2.4. Ideal For

NinjaTrader is ideal for active traders who need advanced charting, detailed analysis, and the ability to engage in automated trading. It is particularly suitable for those trading futures and forex but also supports stocks and options through integration with external brokers.

NinjaTrader vs. Sierra Charts

| Feature | NinjaTrader | Sierra Charts |

|---|---|---|

| Charting Capabilities | Advanced with high customization | Highly customizable with technical depth |

| User Community | Active, with access to many third-party tools | Smaller, more professional-focused |

| Pricing | Free core features, low-cost options for advanced features | Subscription-based, generally higher cost |

| Platform Access | Desktop primarily, limited mobile access | Desktop-centric |

| Technical Analysis | Extensive tools, including automated options | Advanced, with a focus on manual strategies |

2.3. MultiCharts

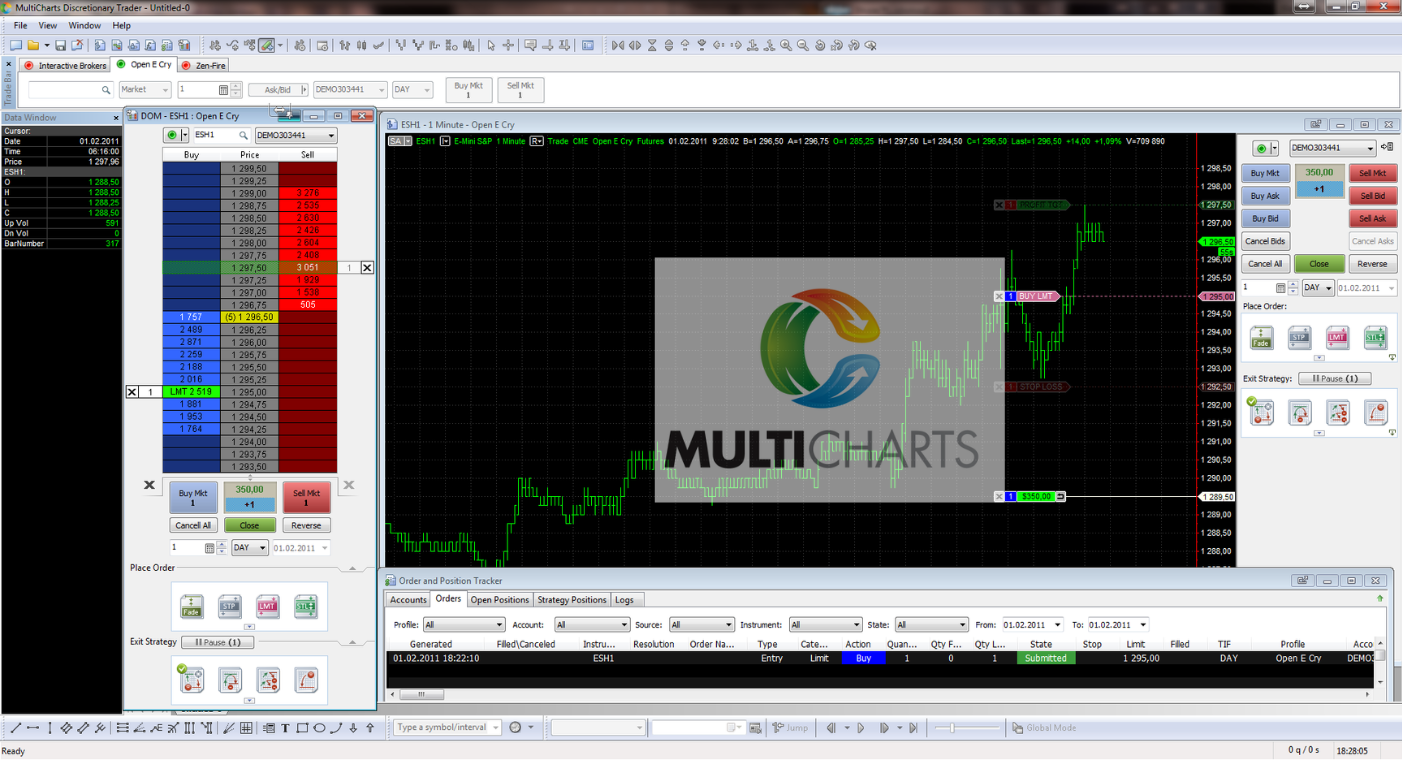

MultiCharts is a powerful trading platform that offers extensive tools for charting, backtesting, and automated trading. Here’s a comprehensive look at MultiCharts as a viable alternative to Sierra Charts:

MultiCharts is designed for traders looking for advanced analytical tools and the ability to execute trades across various financial markets. It’s recognized for its sophisticated charting capabilities and support for EasyLanguage, making it a strong option for both novice and experienced traders.

2.3.1. Key Features

- Comprehensive Charting: Offers over 300 pre-installed indicators and the ability for users to add their own.

- Dynamic Portfolio Backtesting: Ability to test strategies across multiple symbols and accounts simultaneously.

- Market Scanner: Helps in identifying trading opportunities by scanning across thousands of instruments.

- Automated Trading: Supports scripting in EasyLanguage, allowing traders to automate their strategies effectively.

2.3.2. Key Benefits

- Flexibility: Integrates with over 20 data feeds and 10 brokers, providing traders with several options to suit their needs.

- Advanced Analysis Tools: Includes genetic optimization and performance reporting to enhance trading strategies.

- User-Friendly Interface: Known for its intuitive drag-and-drop interface which simplifies complex trading operations.

2.3.3. Drawbacks

- Complex Features: Some features might be too complex for beginners.

- Pricing: While it offers a powerful suite of tools, the cost might be a barrier for traders who are just starting out or those with limited capital.

2.3.4. Ideal For

MultiCharts is best suited for professional traders and financial advisors who require robust charting and automated trading capabilities. It’s also well-suited for those who appreciate having a variety of data feeds and brokerage options at their disposal.

MultiCharts vs. Sierra Charts

| Feature | MultiCharts | Sierra Charts |

|---|---|---|

| Charting Capabilities | Extensive with over 300 indicators available | Highly detailed with strong customization options |

| User Community | Supports a global user base | Focused more on professional traders |

| Pricing | Free demo available, subscription for advanced features | Subscription-based with no free version |

| Platform Access | Supports multiple brokers and data feeds | Primarily desktop with limited broker support |

| Technical Analysis | Advanced tools, including genetic optimization | Strong, but less focus on automated options |

2.4. MotiveWave

MotiveWave is a versatile trading platform that offers an array of advanced features tailored for in-depth market analysis, particularly known for its Elliott Wave and other sophisticated trading methodologies.

MotiveWave excels with its comprehensive suite of tools that cater to both novice and experienced traders. It’s particularly favored for its robust technical analysis capabilities, including Elliott Wave analysis tools that automate and simplify complex wave pattern recognition. This platform is compatible with Windows, macOS, and Linux, making it accessible across various operating systems.

2.4.1. Key Features

- Elliott Wave Analysis: Automated tools for recognizing and labeling wave patterns.

- Advanced Charting: Over 300 studies and numerous chart types to support diverse trading strategies.

- Customizable Interface: Highly adaptable to user preferences with extensive customization options.

- Multi-Timeframe Analysis: Allows users to view and analyze multiple timeframes simultaneously.

- Direct Trading from Charts: Enables quick and efficient trade execution directly from the charts.

2.4.2. Key Benefits

- Integration with Multiple Brokers: Supports seamless integration with a wide range of brokers.

- Strategy Testing and Optimization: Robust backtesting tools to refine trading strategies.

- Educational Resources: Offers a wealth of information to help traders understand and utilize Elliott Wave theory effectively.

2.4.3. Drawbacks

- Complexity for New Users: The breadth of features and depth of analysis tools can be overwhelming for beginners.

- Cost: While it offers a free trial, the full suite of features comes at a higher cost compared to some alternatives, which might be a consideration for traders on a budget.

2.4.4. Ideal For

MotiveWave is ideal for advanced and professional traders who need a powerful platform that supports extensive charting, analysis, and trading strategy development. It’s particularly beneficial for those who use Elliott Wave theory as a core part of their trading strategy.

MotiveWave vs. Sierra Charts

| Feature | MotiveWave | Sierra Charts |

|---|---|---|

| Technical Analysis | Extensive with Elliott Wave tools | Advanced with a focus on precision |

| Charting Capabilities | Over 300 studies, customizable charts | Highly detailed and customizable |

| User Interface | Highly customizable | More traditional, less flexible |

| Broker Integration | Supports multiple brokers | Limited broker integration |

| Pricing | Higher cost with free trial available | Subscription-based, no free version |

2.5. MetaStock

MetaStock is a renowned platform in the market analysis software landscape, celebrated for its advanced charting, technical analysis tools, and comprehensive data services.

MetaStock has been a staple in the trading community for over 30 years, providing tools that cater to various levels of traders, from day traders to long-term investors. It stands out with its integration of Refinitiv’s Xenith for real-time news and data, offering powerful screening and forecasting tools that are especially valuable for active traders.

2.5.1. Key Features

- Advanced Charting: Offers over 300 chart types and indicators, supporting detailed technical analysis.

- Expert Advisors: Automated trading signals, trend analysis, and commentary on market conditions.

- Powerful Scanning and Screening: Utilizes the “Explorer” tool to scan and filter through thousands of stocks using predefined or custom criteria.

- Robust Backtesting: Includes the “System Tester” which allows traders to simulate and analyze the performance of trading strategies over historical data.

2.5.2. Key Benefits

- Comprehensive Data Coverage: Includes historical data and real-time updates through Refinitiv Xenith, covering a wide range of global markets and instruments.

- Extensive Customization: Allows users to customize indicators, system tests, and workflows to suit their trading style.

- Educational Resources: Provides a wealth of learning materials including tutorials, webinars, and a supportive user community which can help new users get up to speed.

2.5.3. Drawbacks

- Complex Interface: Some users may find the interface outdated and overwhelming due to the depth of features offered.

- Cost: The pricing can be a barrier for some traders, especially those just starting out or those who do not require intensive technical analysis tools.

2.5.4. Ideal For

MetaStock is particularly suited for intermediate to advanced traders who need detailed analytical tools and real-time data. It appeals to those who rely heavily on technical analysis, including day traders and those involved in systematic trading.

MetaStock vs. Sierra Charts

| Feature | MetaStock | Sierra Charts |

|---|---|---|

| Technical Analysis | Extensive, with 300+ charts and indicators | Advanced, with a focus on precision |

| Data Services | Integrated with Refinitiv Xenith for real-time | Limited to specific broker or data services |

| User Interface | Customizable but complex | More straightforward, less customizable |

| Pricing | Subscription-based, higher cost | Subscription-based, generally lower cost |

| User Education | Extensive resources and community support | More limited tutorials and community support |

3. Factors to Consider When Choosing a Trading Platform

Selecting the right trading platform is crucial for a trader’s success. Here are some of the key factors to consider, segmented by different trader types, asset classes, technical analysis needs, and additional features.

3.1. Trader Type:

- Day Traders: Need platforms that offer exceptional speed, real-time data, and Level 2 order book visibility. Day traders require platforms that can handle the rapid execution of trades and provide extensive market data to make quick decisions.

- Swing Traders: Look for platforms that offer a comprehensive range of charting tools and technical indicators. Flexibility in trading strategies and the ability to hold positions for several days to weeks is crucial.

- Long-Term Investors: Need platforms that prioritize fundamental analysis tools, integration with news sources, and less emphasis on real-time execution speed. Long-term planning tools and robust historical data are also important.

3.2. Asset Classes Traded:

- Stocks: Ensure the platform supports direct access to the desired stock exchanges and offers comprehensive stock market data.

- Futures: Require platforms that provide specific data feeds for futures markets, along with advanced order types that can handle the complexities of futures trading.

- Forex: Look for platforms specializing in forex trading that offer a wide range of currency pairs and leverage trading options, as well as tools specifically designed for forex market analysis.

3.3. Technical Analysis Needs:

- Breadth of Indicators: Some traders need built-in indicators, while others may require the ability to implement custom indicators depending on their trading strategies.

- Charting Styles: Availability of various charting styles like Candlestick, Heikin Ashi, Renko, etc., can be crucial for the analysis preferences of different traders.

- Drawing Tools: Essential tools include trendlines, Fibonacci retracement levels, and other annotation tools that help in detailed market analysis.

3.4. Automation Capabilities:

- Strategy Development Language: The platform should support a flexible and powerful scripting language for traders who prefer to write their own automated trading strategies.

- Backtesting and Optimization: Platforms should provide robust backtesting tools that allow traders to test and refine their strategies using historical data.

- Community Support and Social Trading Features: Some platforms offer a community where traders can share and discuss strategies, which can be particularly beneficial for new traders.

3.5. Cost:

- Subscription vs. Purchase Models: Some platforms charge a monthly fee, while others may require a one-time purchase or offer tiered pricing depending on the features.

- Data Feed Costs: Additional costs for real-time or premium data feeds can be a significant factor for active traders who rely on timely and accurate data.

- Third-party Indicators or Add-ons: The costs associated with purchasing or subscribing to third-party tools or data that integrate with the platform can add up and should be considered.

Conclusion

In conclusion, choosing the right trading platform depends heavily on the specific needs and strategies of the trader. By carefully considering the factors outlined above, traders can select a platform that best fits their trading style and enhances their chances for success in the markets.