1. Overview Of TradeStation

When it comes to online trading, the choice of platform can significantly impact the effectiveness and efficiency of your trading strategies. One such platform, TradeStation, stands out for its robust technical analysis tools and customization options. Known for catering to experienced traders, TradeStation offers a range of features designed to enhance trading tactics through advanced charting, back-testing, and automation capabilities.

Despite its strengths, some traders explore alternatives due to TradeStation’s pricing structure, the complexity of its platform, or a desire for features that better suit their specific trading needs. Whether you are a novice trader looking for a more user-friendly interface or an experienced trader seeking specific analytical tools, understanding the variety of platforms available is crucial.

| Feature | Description |

|---|---|

| Platform | TradeStation |

| Strengths | Advanced technical analysis, high customizability |

| Considerations | Pricing, platform complexity |

| Ideal for | Experienced traders who require advanced analytical capabilities |

2. Top 5 Alternatives Of TradeStation

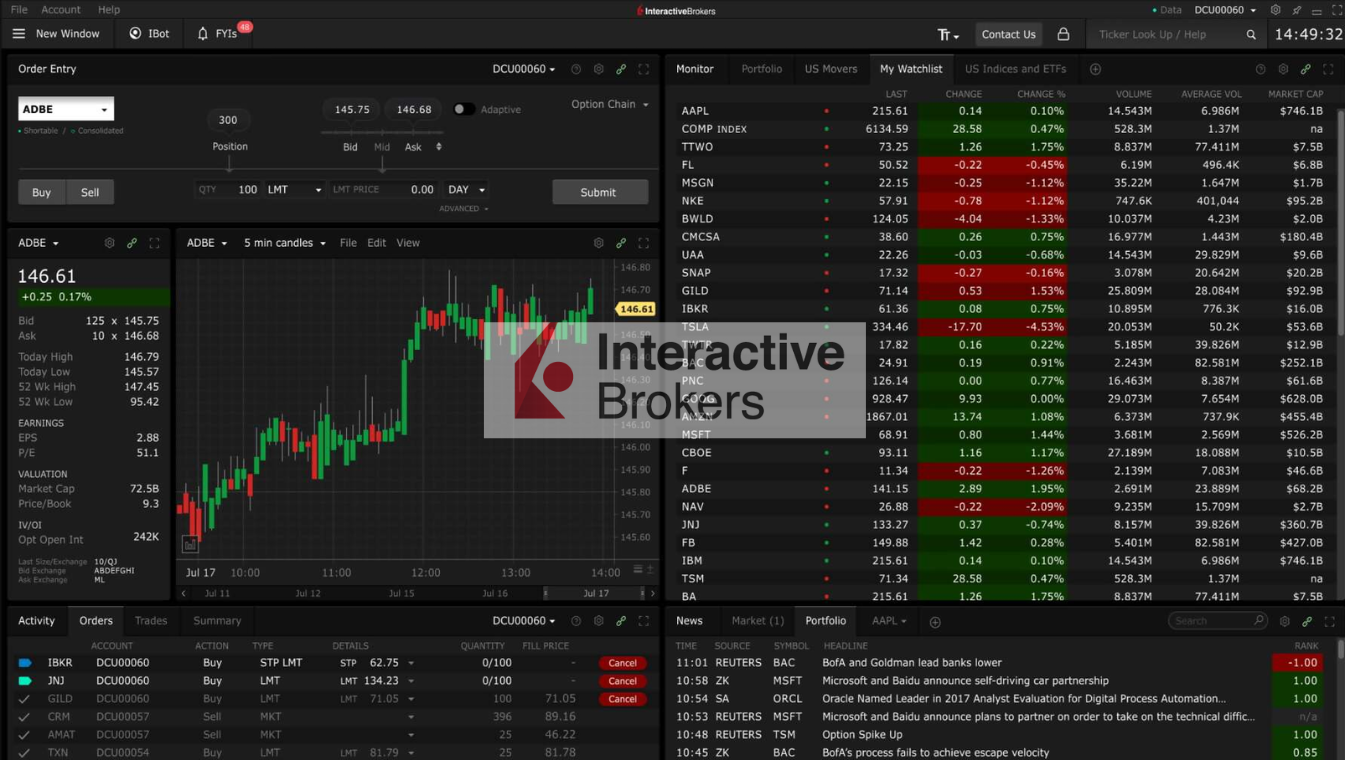

2.1. Interactive Brokers TWS

Interactive Brokers (IBKR) is renowned for its international reach and sophisticated trading capabilities, catering primarily to experienced traders and investors. Established in 1977, this platform offers access to over 135 markets across 33 countries, making it a global powerhouse for financial trading.

2.1.1. Key Features

- Global Market Access: Access to over 135 markets in 33 countries.

- Low Cost: Competitive commissions with no account minimums.

- Superior Research and Data: Over 200 news and research providers available, many at no additional cost.

- Sophisticated Trading Tools: Includes real-time trade confirmations, portfolio analysis, and trading technologies.

2.1.2. Pros:

- Global Market Access: Trade a wide range of asset classes including stocks, options, futures, forex, and even cryptocurrencies across global markets.

- Low Cost: Competitive pricing with low commissions, no ticket charges, or account minimums for active traders.

- Superior Research and Data: Access to over 200 news and research providers, many available at no additional cost.

2.1.3. Cons:

- Complexity: The array of platforms and advanced features can be overwhelming for beginners or less active investors.

- Account Setup: The registration and verification process can be time-consuming, involving detailed documentation and a waiting period for account activation.

2.1.4. Best for:

Experienced traders and institutional investors who require a robust trading environment with advanced tools and broad market access.

Comparison Table Against TradeStation

| Feature | Interactive Brokers | TradeStation |

|---|---|---|

| Market Access | 135+ markets in 33 countries | Extensive, but fewer international options |

| User Interface | Complex, with multiple platform options | Highly customizable but complex |

| Fees | Low commissions, no minimums | Variable fees, potential for higher costs |

| Special Features | Advanced trading tools, superior execution | Powerful technical analysis tools |

| Best Suited For | Professional and institutional traders | Advanced traders who focus on technical analysis |

2.2. TC2000

TC2000 is widely recognized for its powerful charting and screening capabilities, tailored primarily for stock and options traders. Developed by Worden Brothers, it’s celebrated for its practical blend of technical analysis tools and user-friendly interface, particularly favored by chart-focused technical traders.

2.2.1. Key Features

- Advanced Charting Software: Allows for applying multiple technical strategies on charts.

- Real-Time Scanning: Known as EasyScan for efficient market scanning.

- Virtual Trading Environment: Robust simulation for practice and strategy testing.

- Customizable Features: Extensive options for personalization.

2.2.2. Pros:

- Comprehensive Charting Tools: Extensive customization options, including the ability to overlay multiple strategies on a single chart.

- Real-Time Scanning: The EasyScan feature allows users to filter and scan stocks and options efficiently.

- Educational Resources: Provides a wealth of educational materials and live seminars to enhance trading knowledge.

2.2.3. Cons:

- Limited Asset Classes: Primarily supports stocks and ETFs; not suitable for forex, futures, or crypto trading.

- Complexity for Beginners: While it offers robust features, the platform’s complexity can be daunting for new traders.

2.2.4. Best for:

Chart-focused technical traders who require detailed and customizable charting capabilities along with efficient market scanning tools.

Comparison Table Against TradeStation

| Feature | TC2000 | TradeStation |

|---|---|---|

| Asset Classes | Stocks, ETFs, Options | Stocks, ETFs, Options, Futures, Forex |

| Charting Tools | Highly advanced, customizable | Advanced, slightly less customizable |

| User Interface | Complex, suitable for experienced users | Complex, customizable for various skill levels |

| Educational Resources | Extensive, with live seminars and webinars | Available, but less extensive than TC2000 |

| Best Suited For | Technical traders who focus on stocks and options | Traders looking for a broader range of asset classes and trading tools |

2.3. Thinkorswim (TD Ameritrade):

Thinkorswim, now integrated with Charles Schwab, stands out as a high-caliber trading platform designed for advanced traders looking for robust trading tools and deep analytical capabilities. It is particularly well-regarded for its extensive range of tradable securities, including stocks, options, futures, forex, ETFs, and mutual funds.

2.3.1. Key Features

- Comprehensive Toolset: Includes scanners, heat maps, and fundamental analysis tools.

- Multiple Platforms: Desktop, web, and mobile platforms available.

- Rich Educational Content: Offers trading simulations and educational resources.

- Sophisticated Analytical Tools: Over 400 technical studies and advanced charting.

2.3.2. Pros:

- Comprehensive Toolset: Includes scanners, heat maps, fundamental and technical analysis tools, and real-time data streaming.

- Multiple Platforms: Accessible via desktop, web, and mobile, each offering unique tools and functionalities.

- Educational Resources: Rich educational content and trading simulations to enhance trading skills.

2.3.3. Cons:

- Complex Interface: New users may find the platform overwhelming due to its complexity and the vast array of tools available.

- Cost for High-Volume Options Trading: Thinkorswim charges $0.65 per options contract, which can accumulate for active traders.

2.3.4. Best for:

Investors and traders looking for a sophisticated platform that offers a blend of powerful analytical tools, educational resources, and multi-platform accessibility.

Comparison Table Against TradeStation

| Feature | Thinkorswim (TD Ameritrade) | TradeStation |

|---|---|---|

| Platforms | Desktop, Web, Mobile | Desktop, Web, Mobile |

| Asset Classes | Stocks, Options, Futures, Forex, ETFs, Mutual Funds | Stocks, Options, Futures, Forex, ETFs |

| Tools | Advanced charting, 400+ technical studies, trade simulator | Advanced charting, technical analysis tools |

| User Interface | Complex, with a steep learning curve | Customizable but complex |

| Fees | $0.65 per options contract, no fee for stocks | Variable fees, potentially higher for certain trades |

| Best Suited For | Advanced traders needing comprehensive tools and resources | Traders looking for powerful technical analysis capabilities |

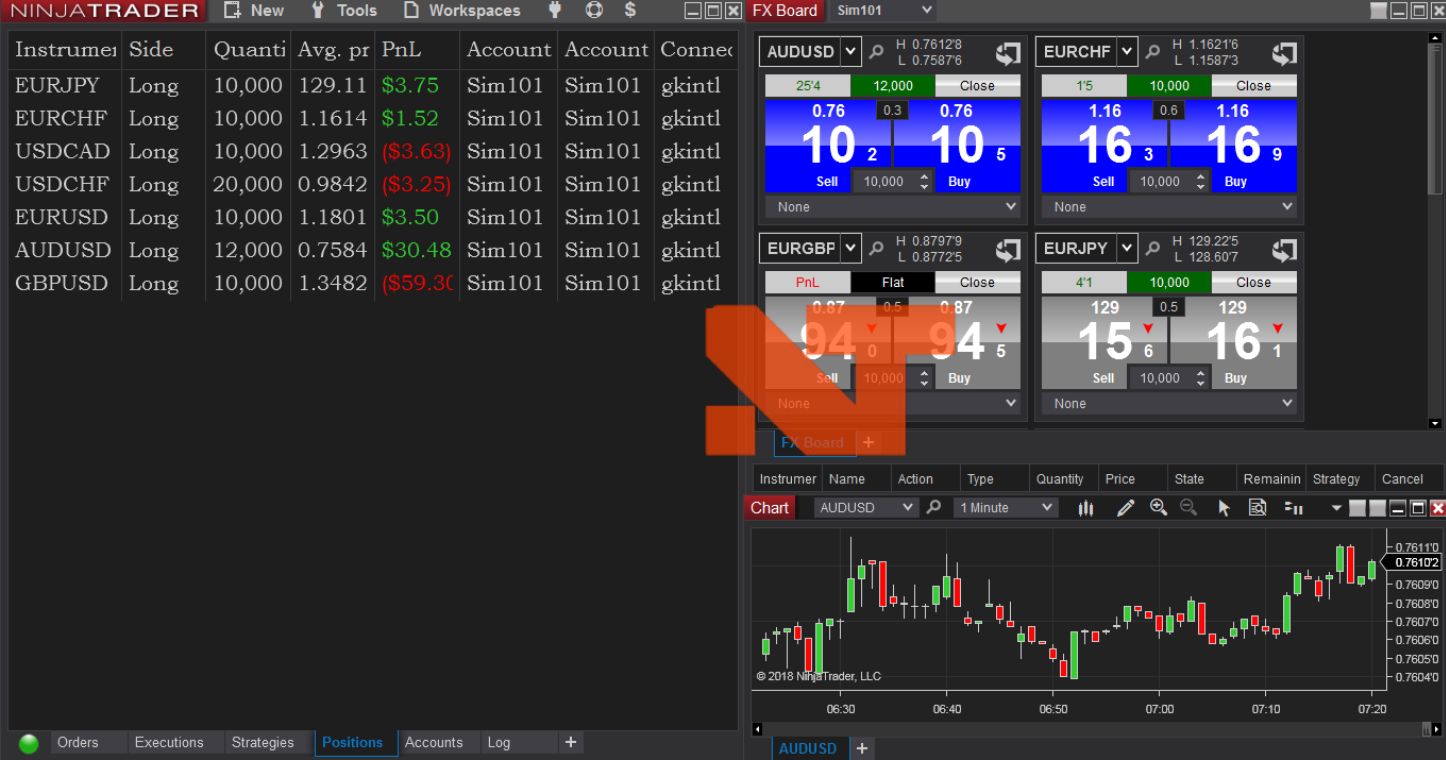

2.4. NinjaTrader

NinjaTrader is a powerful trading platform known for its advanced technical capabilities, particularly appealing to those interested in futures and forex markets. With its rich array of tools and a focus on automation, NinjaTrader is especially suitable for traders who rely on technical analysis and automated trading strategies.

2.4.1. Key Features

- Customization and Automation: Supports automated trading strategies through its NinjaScript.

- Advanced Charting and Analysis Tools: Offers complex analysis and trading tools.

- Low Trading Costs: Competitive pricing for active traders.

- Simulated Trading: Provides a free trial with a simulated trading experience.

2.4.2. Pros:

- Low Trading Costs: NinjaTrader is recognized for its competitive commission rates and low margins, making it cost-effective for active traders.

- Advanced Trading Tools: Offers comprehensive tools for detailed technical analysis and the ability to execute complex trading strategies.

- Customization and Automation: Highly customizable interface and supports automated trading strategies through its proprietary NinjaScript programming language.

2.4.3. Cons:

- Complexity for Beginners: The wealth of features and customization options might overwhelm new traders.

- Limited Mobile Support: Currently lacks a dedicated mobile trading application, which can be a downside for traders who prefer to manage their trades on the go.

2.4.4.Best for:

Algorithmic traders and those who need advanced technical analysis capabilities. It’s particularly well-suited for those trading futures and forex, looking to implement sophisticated strategies.

Comparison Table Against TradeStation

| Feature | NinjaTrader | TradeStation |

|---|---|---|

| Market Access | Futures, Forex, Options, CFDs, Stocks | Stocks, ETFs, Options, Futures, Forex |

| Key Tools | Advanced charting, automation with NinjaScript, SuperDOM | Advanced charting, technical analysis tools |

| User Interface | Highly customizable, complex for beginners | Highly customizable but complex |

| Mobile Trading | No dedicated app, limited mobile functionality | Full mobile app support |

| Best Suited For | Experienced traders focusing on automation and technical analysis | Traders looking for a robust all-around platform with strong technical analysis capabilities |

2.5. eToro

eToro is a distinctive trading platform known primarily for its social investing and copy trading features, making it an ideal choice for traders interested in harnessing the collective insights of a vibrant trading community. Founded in 2007, eToro has expanded globally, serving over 25 million users across 140 countries. The platform offers trading in stocks, ETFs, cryptocurrencies, and more, with a strong emphasis on social trading mechanisms.

2.5.1. Key Features

- Social Trading: eToro’s standout feature is its social trading platform, where traders can copy the trades of other successful traders, essentially replicating their positions in real-time. This feature is supported by a robust community and user-friendly interfaces on both web and mobile platforms.

- Virtual Trading: New users can benefit from a $100,000 virtual account to practice trading strategies without any financial risk, providing a safe environment to learn and experiment.

- Diverse Asset Offering: eToro offers a broad range of trading assets including stocks, cryptocurrencies, ETFs, and commodities like energy and agricultural products.

2.5.2. Pros:

- User-Friendly: Both the web and mobile platforms are designed for ease of use, featuring intuitive navigation and a responsive design that aligns well with the needs of casual traders.

- Commission-Free Stocks and ETFs: Trading stocks and ETFs on eToro does not incur commission fees, though other costs like spreads and conversion fees may apply.

- Innovative Mobile Experience: The mobile apps provide comprehensive functionality, mirroring the features of the web platform with additional conveniences like mobile alerts and synced watchlists.

2.5.3. Cons:

- Complex Fee Structure: While eToro promotes transparency in its fee structure, the costs can be higher compared to other platforms, especially due to the spreads and a 1% fee for buying and selling cryptocurrencies.

- Limited Advanced Charting Tools: More experienced traders might find the charting tools somewhat basic, which could be a limitation for those relying heavily on technical analysis.

2.5.4. Best for:

Casual investors and traders looking for a blend of traditional trading with the innovative features of social and copy trading. It’s particularly well-suited for those new to trading who can benefit from watching and learning from seasoned traders.

Comparison Table Against TradeStation

| Feature | eToro | TradeStation |

|---|---|---|

| Trading Style | Social and copy trading | Technical and algorithmic trading |

| User Interface | User-friendly, suitable for beginners | Complex, customizable |

| Fees | No commission on stocks/ETFs, fees on spreads and crypto | Variable fees, complex structure |

| Mobile App | High functionality, intuitive | Robust, full-featured |

| Best Suited For | Beginners and social traders | Experienced technical traders |

3. Factors to Consider When Choosing a Trading Platform

When selecting a trading platform, there are several critical factors to consider to ensure the platform meets your trading needs and preferences:

- Investment Style: Your trading style significantly influences the type of platform you need. For example, day traders require platforms with real-time data and advanced charting capabilities, while long-term investors might prefer platforms with robust research tools and portfolio management features.

- User Interface: A user-friendly interface is crucial for a seamless trading experience. It should offer intuitive navigation, customizable layouts, and easy access to frequently used tools and features. An overly complicated interface can hinder your trading efficiency and increase the risk of errors.

- Available Tools and Features: Depending on your trading approach, you might need specific tools like advanced charting, technical indicators, economic calendars, or options for automated trading. Some platforms also provide unique features like backtesting capabilities and access to third-party plugins.

- Costs and Fees: Understand the fee structure of the platform, which can include commissions, spreads, subscription fees, and other charges like inactivity fees. These fees can significantly impact your overall profitability, especially if you trade frequently.

- Security and Reliability: Ensure the platform has strong security measures in place, such as encryption, two-factor authentication, and compliance with regulatory standards to protect your data and funds. The platform’s reliability, indicated by uptime and performance during high-volume periods, is also vital to avoid costly disruptions.

- Customer Support: Reliable customer support is essential, especially if technical issues or questions arise. The quality of support can often be gauged through reviews and should include multiple channels such as phone, email, and live chat, ideally available 24/7.

- Mobile Trading Options: If you prefer trading on the go, consider whether the platform offers a robust mobile app that mirrors the functionality of the desktop version, ensuring you can trade effectively from anywhere.

- Asset Variety: The platform should support a wide range of assets you’re interested in trading, like stocks, forex, commodities, and cryptocurrencies. This variety allows you to diversify your investments and take advantage of various market opportunities.

- Educational and Research Resources: Especially important for beginners, these resources can help you learn and develop as a trader. Look for platforms that offer tutorials, webinars, and real-time market analysis.

- Regulatory Compliance: Trading with a platform that adheres to regulatory standards is crucial for the security of your investments. Ensure the platform is authorized by relevant financial authorities.

| Factor | Description | Importance |

|---|---|---|

| Investment Style | Tailor the platform choice based on whether you are a day trader, swing trader, or long-term investor. | High |

| User Interface | An intuitive, easy-to-navigate, and customizable interface enhances trading efficiency and reduces errors. | High |

| Tools and Features | Essential tools include advanced charting, technical indicators, and possibly automated trading capabilities. | High |

| Costs and Fees | Understand all associated costs such as commissions, spreads, and any other fees to ensure they align with your trading volume. | High |

| Security | Look for robust security measures like encryption and two-factor authentication to protect funds and personal data. | Critical |

| Reliability | The platform should perform well during all trading conditions, with minimal downtime and fast execution. | High |

| Customer Support | Accessible support via multiple channels and responsive assistance for resolving issues promptly. | High |

| Mobile Trading | Mobile app availability that offers full functionality for trading on the go. | Moderate |

| Asset Variety | A wide range of tradable assets allows diversification and the ability to capitalize on different markets. | High |

| Educational Resources | Resources like tutorials, webinars, and market analysis for ongoing learning and trading decision support. | Moderate |

| Regulatory Compliance | Ensuring the platform complies with financial regulations to secure your trading activities. | Critical |

Conclusion

When concluding our exploration of various trading platforms, it’s crucial to summarize the key strengths each alternative offers compared to TradeStation. This allows traders to make well-informed decisions based on their specific needs and trading styles.

- Interactive Brokers stands out for its exceptional market access and low costs, making it ideal for experienced traders who require a broad range of international markets and advanced trading tools.

- TC2000 is highly regarded for its superior charting tools and real-time scanning capabilities, catering to technical traders who focus on U.S. markets.

- Thinkorswim (TD Ameritrade) offers a balance of powerful trading tools and educational resources, suitable for both casual investors and serious traders who appreciate a mix of deep analysis and user-friendly features.

- NinjaTrader is noted for its specialized automation tools and advanced charting capabilities, perfect for traders who engage in automated and algorithmic trading.

- eToro excels in social trading and ease of use, appealing to traders new to the market or those who prefer to leverage the knowledge of a community.

Each platform has its distinctive advantages and may be the “best” choice depending on individual trading needs and preferences. There is no one-size-fits-all answer when it comes to choosing a trading platform. Each trader must consider what features are most critical for their personal trading strategy, whether it’s low fees, advanced technical tools, educational resources, or access to international markets.

Finally, it is always recommended for traders to explore each platform through demos or free trials. This hands-on approach helps to ensure that the platform’s interface, tools, and overall trading environment align well with their trading habits and goals, thus making a more informed decision possible.